Professional Documents

Culture Documents

9MPS Brochure - PROPERTY MARKET OUTLOOK FOR 2016 PDF

Uploaded by

Janeang33Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

9MPS Brochure - PROPERTY MARKET OUTLOOK FOR 2016 PDF

Uploaded by

Janeang33Copyright:

Available Formats

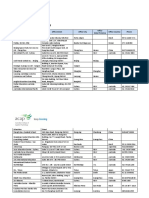

PROGRAMME

TIME

08:00 am 09:00 am

(1 hour)

Supported by:

PROGRAMME

SPEAKERS

REGISTRATION

PROPERTY MARKET OUTLOOK FOR 2016

09:00 am 09:10 am

(10 min)

Opening Remarks by Organising Chairman

James Wong Kwong Onn

09:10 am 09:50 am

(40 min)

Overview of the Malaysian Property Market

Faizan bin Abdul Rahman

09:50 am 10:20 am

(30 min)

Navigating Malaysia Through The Headwinds

Lee Heng Guie

10:20 am 10:50 am

(30 min)

COFFEE BREAK / PRESS CONFERENCE

10:50 am 11:20 am

(30 min)

Landed Residential Market Performance and Outlook

Foo Gee Jen

11:20 am 11:50 pm

(30 min)

Non-Landed Residential Market Performance and Outlook

Tang Chee Meng

11:50 pm 12:25 pm

(35 min)

Office Market Performance and Outlook

Sarky Subramaniam

12:25 pm 01:00 pm

(35 min))

Retail Market Performance and Outlook

Allan Soo

01:00 pm 02:00 pm

(1 hour)

LUNCH

02:00pm 02:30pm

(30 min)

Hotels & Resorts Market Performance & Outlook

Dennis Tan

02:30 pm 03:00 pm

(30 min)

REITS Market Performance & Outlook

YBhg Dato George Stewart Labrooy

03:00pm 03:40pm

(40 min)

Regional Market Performance & Outlook Northern Region

Dr. Jason Teoh

03:40 pm 04:10 pm

(30 min)

COFFEE BREAK

04:10 pm 04:50 pm

(40 min)

Regional Market Performance & Outlook Southern Region

Samuel Tan

04:50 pm 05:30 pm

(40 min)

Regional Market Performance & Outlook East Malaysia

YBhg Datuk Kenneth Yen

05:30 pm 05:40 pm

(10 min)

Closing Remarks by President of PEPS

YBhg Datuk Siders Sittampalam

WHO SHOULD ATTEND

Bankers Real Estate Developers Builders Real Estate Analysts Real Estate Investors Corporate Leaders

Investment Advisors Fund Managers Property Consultants Valuers REIT Players

Retail Consultants Asset Managers and others

Persatuan Penilai, Pengurus Harta, Ejen Harta & Perunding Harta Swasta Malaysia

(Association of Valuers, Property Managers, Estate Agents and Property Consultants in the Private Sector, Malaysia)

P-2-7, Block P, Plaza Damas, No. 60 Jalan Sri Hartamas 1, Sri Hartamas, 50480 Kuala Lumpur

Tel: +603 6201 8200 | Fax: +603 6201 8300 | Email: secretariat@peps.org.my

INTRODUCTION

This

year 2015 might go down as

a historic year in the sense

that the Governments actions had affected

the property market directly. The volume of

transactions decreased from 289,537 in

the first 9 months of 2014 to 275,725 in the

first 9 months of 2015, registering a drop of

4.77%. In tandem with this drop, the value

of transactions also decreased from 124.4

billion to 114.1 billion showing a decrease

of 8.26% during the corresponding period.

The tightening measures put in place by the

Government through increased Real Property

Gains Tax and stringent lending measures

appeared to have had some effect on the

property market. For the first three quarters

of 2015, the residential sector showed a

drop of 11.83% in terms of value against a

drop of 4.47% in volume. This was matched

by the commercial sector registering drops

of 12.88% and 6.94% in terms of value and

volume of transactions.

The corrections in the residential and

commercial sectors come in after several

years of increasing prices and in some

instances is seen as welcome, so that

the property market does not become

overheated and cause concern for an asset

bubble to be formed. The cooling measures

have brought about some changes;

speculation is down and more thought

is being given to affordable housing and

addressing the needs of people who are

yet to buy a house. The Budget this year

addresses some of these concerns through

greater provision of affordable housing and

encouraging the Youth Programme for those

who are young and still without a house. A

number of incentives have been provided for

first time buyers of housing.

The economy has generally been felt to

have slowdown. Expected Gross Domestic

Product is seen to dip below 5%. The Ringgit

has worsened against the currencies like

USD, SGD and Indian Rupees. The economy

and the currency problems are topmost in

everyones mind. More foreign properties are

being sold in Malaysia on fear that the Ringgit

will slacken further.

In April 2015, the Government implemented

the Goods and Services Tax or GST. The

Government has decided that residential

property will be exempted from GST

presumably not to cause an extra financial

burden to the buyers who are already reeling

from high property prices. The real concern

was will the prices of houses increase

when GST is implemented. In addition, the

Government has also declared that fuel

subsidy will be reduced or removed. This

also has given rise to fears that house prices

will be spiralling upwards. Added to that, the

eternal fear of rising material costs, labour

costs and land costs was causing concern

not only to consumers but developers. In

reality, it will appear that the GST had not had

any impact in increasing prices for houses

or commercial properties. The full impact

will only be known after a full year of GST

implementation.

What directions will the property market take

in 2016 given the drop in prices and volume

of transactions in 2015? How will developers

react to the present scenario? What will the

impact of the falling Ringgit be? Are our

fundamentals strong as it is being claimed

by some quarters? What will be the market

trend in 2016? Will we see an increase in

foreign buyers of Malaysian real estate in

2016 with the falling Ringgit? What needs to

be done to revive the ailing property market?

Our speakers will address some of the ills

affecting the market. This will be bolstered

by data and information from the real experts

in the real estate industry. Hear the experts

discuss.

The market is waiting to hear what the impact

of the GST and fuel subsidy removal will have

on the housing sector. Pundits and Property

Gurus have been expounding their versions;

listen to professionals who are trained in the

area of property market analysis share their

expert knowledge. Facts and figures do not

lie.

Also dealing in detail on the commercial

office and retail markets are experts who

use their very exhaustive data banks and

research departments to analyse and

provide a framework for easy understanding

and careful decision making.

These are some of the areas that will be

discussed in depth at the 9th Malaysian

Property Summit this January 2016.

For these reasons it will remain one of

the most anticipated events each year.

Analysts, developers, bankers, Government

organizations have always been keen

supporters of this event.

This is the Summit of the property market, for

the property world, by the property people

put together by the very industry and people,

to whom property people turn to when they

need advice, consultation, research and

analysis, testimony, professional opinion,

expert witness and evidence, support and

prognostication on the property market.

The Association of Valuers, Property

Managers, Estate Agents & Property

Consultants in the Private Sector Malaysia

(PEPS), the body that represents the

reputable

and

established

private

valuation and consultation practices, has

come together to provide the Malaysian

Property World with the width and depth

Speakers

of its accumulated research and analysis,

prognosticate for this coming year, 2016, the

expectations of movements, fluctuations and

changes that can be expected to happen in

the property market, and the reasons for it.

The objective of this Summit, as in previous

years, is to present to the Malaysian Property

industry and players an authoritative view

of the state of the real estate industry.

As valuers, land economists, property

consultants, real estate investment analysts,

and, by and large, the only people trained

and paid to judge the market and the

outcomes, and the only people who have

an in-depth knowledge of what is happening

in the market, the speakers would be able

to tell the world at large exactly what has

been happening, and how the market is to

behave and perform. The databases of the

major property consultants will be thoroughly

examined and in-depth research built into

the prognostications that will be presented

by the industrys key idea-men.

We have identified experts who specialises

in a particular property sector to provide the

participants the best answers to questions

asked, or lurking in the minds of bankers,

developers, analysts, investors, decision

makers, institutional agents, fund managers

and others.

For each sector, each speaker will do the

following:

Outline the historical background with

data and analysis;

Geographical spread and classifications;

Relative importance to the industry;

Relationship to the economy and market;

Highlight the last three years activities;

Give an opinion on what has happened

including an analysis of the drivers

affecting it;

Outline the key drivers that will drive the

market in the future;

State his opinion on what direction the

market will take based on his analysis.

The 9th Malaysian Property Summit 2016 is

a Property Conference not to be missed and

we look forward to your attendance.

FAIZAN BIN ABDUL RAHMAN is the Director General, Valuation and Property Services Department in the Ministry of

Finance Malaysia. He started his career as a Valuation Officer in April 1979 after graduating from the University of

Technology Malaysia. Tuan Haji Faizan also has a Master of Science in Facilities Management and Asset Maintenance

which he obtained from Heriot-Watt University, Scotland in 1996.

Throughout his career with the Government, he has served in many places and was steadily promoted to his current

position. Tuan Haji Faizan has also received commendations for Excellent Service Awards in 1987/88 and 2001 and the

Bintang Ahli Mahkota Perak by HRH Sultan of Perak in April 1992 as well as the Bintang Kesatria Mangku Negara

by HRH Seri Paduka Baginda Yang Di Pertuan Agong in June 2006. Tuan Haji Faizan is also the President of the Board

of Valuers, Appraisers & Estate Agents Malaysia (BOVAEA).

LEE HENG GUIE had 30 years of professional experience as an economist, with almost 12 years in Bank Negara

Malaysia and 18 years in financial services. Since 2002, he was the Head of Economics Research with CIMB Investment

Bank Berhad before retiring in May 2014. He supervised a team of five economists covering global and regional

economies, with particular emphasis on Malaysia, Indonesia, Singapore and Thailand.

Mr. Lee is the recipient of many awards: He was voted Best Economist in The Edge Polls twice and ranked top 3

four times from 2000-2008; Best Economist by the Asset Magazine Hong Kong - Local Currency Bond Market of

Malaysia in 2007. He also led CIMB Macroeconomic Research to be ranked among top 3 for nine consecutive years

(2005-13) in the Asiamoney Polls.

Mr. Lee hold a BA (Hons) majoring in Economics from University of Malaya, Malaysia and a Masters Degree in

Development Economics from Williams College, USA. He is currently a columnist at Focus Malaysia.

FOO GEE JEN is the Managing Director of C H Williams Talhar & Wong Sdn Bhd. Foos experience stems from

numerous corporate consultancy exercises including the pre-privatisation exercise of TNB, Kumpulan Guthrie and the

initial development of KLCC and TRX. Foo has also successfully brokered multi-million property deals involving MNCs.

In his recent involvement in Agency & Transactional Services, Foo was involved in tender exercises for Guthrie Medicare,

Gateway 2000 & Bandar Malaysia. Other assignments have been handled notably for Infineon Technologies, TEAC

Electronic Japan, Shell Trading, ExxonMobil, Hewlett Packard, Tradewinds Berhad and Manipal University.

Foo is currently the Vice President of PEPS, Fellow of RISM , Board Member of BOVAEA, member of RICS and

served as National Committee Member of FIABCI Malaysia (2010-2014). Foo was also the Honorary Advisor (Property

Consultant) to REHDA (Malacca branch) between 1996-2008.

TANG CHEE MENG is the Chief Operating Officer of Henry Butcher Real Estate Sdn Bhd, as well as the Chief

Operating Officer (Central Region) of Henry Butcher Asset Auctioneers Sdn Bhd. A Business Management graduate,

Chee Meng has more than thirty years of experience in the property industry. The first twelve years of his career were

spent in the property development sector with leading property developers such as Island & Peninsular Berhad and the

Palmco Group. During this period, Chee Meng gained wide exposure in handling project planning, marketing planning,

sales and sales administration for housing schemes as well as large township developments. Over the next twenty two

years, he was involved in the real estate consultancy sector where he has handled a diverse range of market research

and feasibility studies as well as project marketing assignments.

At Henry Butcher, Chee Meng has successfully overseen the marketing of a wide range of high end residential, resort,

service apartment and commercial projects. He has also been involved in marketing Malaysian property projects

internationally as well as the marketing of foreign projects in Malaysia.

Speakers

ALLAN SOO is the Managing Director of Savills (Malaysia) Sdn Bhd and has been in general practice for over 30 years

in the region and in the UK.

He has provided advice and consultancy to global and corporate clients and has extensive involvement and experience

in the areas of retail investment, research, design development, leasing, marketing and management. His inherent

understanding of the market has enabled him to provide country and industry advice to retailers such as Sephora,

Carrefour, AEON, Parkson, and in introducing new entries to Malaysia such as H & M, Johnny Rockets, Sacoor

Brothers and Hamleys. Allan is now involved in setting up Malaysias second premium outlet mall in Penang.

DENNIS TAN is the Managing Director of Everly Group with a M.Sc. in Industrial Engineering.

After successfully managing the turnaround of Park Avenue Hotel his first hotel, he formed Everly Group in 1990. He

introduced manufacturing quality methods to hotels which proved to be extremely successful as six out of their seven

hotels were winners/finalists for Service Excellence in Malaysia in the last ten years. Having completed more than

150 hotels site and design evaluation and built eleven hotels, he is often consulted by investors and sought out for

speaking engagements on various aspects of design and management of hotels. By re-engineering all aspects of a

hotel and creating a multi tasking work environment he managed to lower the break-even level of a hotel to below 30%

occupancy. He has managed the turnaround of eleven hotels (including a golf course), the latest was Qliq Hotel (4 star

boutique hotel) in Damansara Perdana which he turned around in the first full month of operation. He guarantees a

turnaround of a hotel within six months.

Y BHG DATO GEORGE STEWART LABROOY is the Executive Chairman of AREA Management Sdn. Bhd. a

subsidiary of AREA Advisors Pte Ltd (AREA) an appointment he has taken since his retirement as CEO and Executive

Director of Axis REIT Managers Bhd (ARMB) on 31 December 2015. With a career spanning over 40 years in the

industrial space, he has spent well over a decade since 2005 in heading Axis REIT and establishing REITs as an

important component of the capital markets. He will continue with his involvement with ARMB as a Non-Executive

Board Member effective 1 January 2016.

Dato George Stewart Labrooy is a Member of the Institute of Engineers Malaysia, Board Member of the Asia Pacific

Real Estate Association (APREA) and was the founding Chairman of the Malaysian REIT Managers Association (MRMA).

He is a prominent speaker on the subject of conventional and Islamic REITs in the region and also contributes articles

on the subject of REITs and industrial development for publication in the media. He is a director of a number of private

companies involved in property advisory, property development and property investment.

DR. JASON TEOH is a Director of Henry Butcher Malaysia Penang who holds an MBA from Heriot Watt University, a

Doctorate from the University of South Australia and a post graduate certificate in Real Estate Finance from the National

University of Singapore (NUS). He is also a member of the New York based Urban Land Institute and FIABCI. Jason is

a Registered Valuer with BOVAEA, a Fellow of RICS and RISM and a Member of The Chartered Institute of Marketing

(UK).

Jason has more than 27 years of experience in property consultancy including asset valuation, research,

investments and management and also a High Court appointed assessor and expert witness in land acquisition

matters. He was a former Adjunct Professor in the Department of Real Estate Management, Faculty of Built

Environment, Universiti Malaya. He has presented papers at national and international forums and conferences.

SARKY SUBRAMANIAM is the Managing Director of Knight Frank Malaysia Sdn Bhd. He commenced his career 28

years ago in Melbourne, Australia and has been in private practice property consultancy since his return to Malaysia in

1989. Specialising in agency, investment sales development consultancy, research and valuations, Sarky is currently in

charge of Capital Market Transactions and Corporate Services.

SAMUEL TAN is the Executive Director of KGV International Property Consultants Sdn Bhd and is a Registered Valuer

and Registered Estate Agent with BOVAEA. He is a Member of RICS and RISM and served previously as the Past

Chairman of RISM, Johor Branch. He is also a licensed Auctioneer in the State of Johor since 1986. Samuel has

accumulated over 30 years of experience in the property industry. He was involved in several major investment sales in

Johor Bahru including the sale of Plaza Best World, Menara Landmark and Lot 1 Waterfront City.

Sarky was instrumental in the sales of a portfolio of buildings in London for 850 million to Permodalan Nasional

Berhad (PNB) in collaboration with Knight Frank UK. Sarky had been directly involved with the office search for Shell

and had secured their principal office space at about 340,000 sq ft in Kuala Lumpur and their shared services centre in

Cyberjaya for 320,000 sq ft. Sarky is a Fellow of the Australian Property Institute, a member of RICS (UK), PEPS, RISM,

MIPPM and MIEA. He is a Registered Valuer and Registered Estate Agent with BOVAEA.

He is also actively involved in presenting talks in property seminars. He sits as an ex-officio in Majlis Perbandaran Batu

Pahat and is in the Think Tank Committee of Iskandar Regional Development Authority to advice on property policies.

He is also an assessor in the High Court to assist the judge in land acquisition cases.

Y BHG DATUK KENNETH YEN is the Director of VPC Alliance (Malaysia) Sdn Bhd and Chairman/Director of VPC

Alliance (Sabah) Sdn Bhd. He is also Chairman of Pan Borneo Giza Sdn Bhd currently developing Kimanis Square, a

commercial development in Kimanis, an upcoming Oil & Gas Hub of Sabah. He is a practizing Property Consultant and

Valuer since 1970 with working experince not only in Sabah but Kuala Lumpur (2003 & 2004) and London (1982).

Datuk Yen is a Fellow of RICS, UK and a Board Member of RICS, Malaysia. He is also a Fellow of RISM. Datuks core

competencies are in Valuation for land compensation and dispute settlement and advice in Property Development

(development procedures and approvals, design and best use of the land and project marketing) in Sabah.

You might also like

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Pa International - News Paper 03-March-2018Document16 pagesPa International - News Paper 03-March-2018Janeang33No ratings yet

- Australia College of Applied Psychology - Acap-Agent-listDocument55 pagesAustralia College of Applied Psychology - Acap-Agent-listJaneang33No ratings yet

- MALAYSIA Useful Contact NumberDocument5 pagesMALAYSIA Useful Contact NumberJaneang33No ratings yet

- Blacklisted Developer in MalaysiaDocument23 pagesBlacklisted Developer in MalaysiaJaneang33100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Assignment 2 - Financial Statement AnalysisDocument6 pagesAssignment 2 - Financial Statement AnalysisGennia Mae MartinezNo ratings yet

- Investments. Lecture Notes 2Document34 pagesInvestments. Lecture Notes 2Oona NiallNo ratings yet

- 8 Virtual Market SpaceDocument18 pages8 Virtual Market SpaceJohn Edwinson JaraNo ratings yet

- Equity Risk Premium Review of ModelsDocument19 pagesEquity Risk Premium Review of ModelsBueno ValeNo ratings yet

- Saint Francis Academy: Poblacion, Mabini, BatangasDocument4 pagesSaint Francis Academy: Poblacion, Mabini, BatangasJowella Luistro De GuzmanNo ratings yet

- What Are The Factors Affecting Brand ImageDocument21 pagesWhat Are The Factors Affecting Brand ImageManisha Gurnani0% (1)

- 15 Ways To Trade Moving Averages by Mrtq13 - StockBangladesh ExcellenceDocument2 pages15 Ways To Trade Moving Averages by Mrtq13 - StockBangladesh ExcellencePratik ChhedaNo ratings yet

- Pivot Call EbookDocument103 pagesPivot Call Ebooksree100% (1)

- Chapter 9 Standard Costing - SynopsisDocument8 pagesChapter 9 Standard Costing - SynopsissajedulNo ratings yet

- Computing Down Payment Gross Balance and Current Increased BalanceDocument8 pagesComputing Down Payment Gross Balance and Current Increased BalanceDione DegamoNo ratings yet

- Chapter 5Document6 pagesChapter 5JPNo ratings yet

- Sample Research Proposal On The Influence and Impact of Advertising To Consumer Purchase MotiveDocument19 pagesSample Research Proposal On The Influence and Impact of Advertising To Consumer Purchase MotiveallanNo ratings yet

- Sampati Suddhikaran Niwaran Act 2008, 2nd Amendment 2014 NepaliGazette-newDocument16 pagesSampati Suddhikaran Niwaran Act 2008, 2nd Amendment 2014 NepaliGazette-newBaaniya Nischal0% (1)

- List of Attempted Questions and AnswersDocument28 pagesList of Attempted Questions and Answersnk20No ratings yet

- FIN358 Chapter1 Introduction To Investment StudentDocument7 pagesFIN358 Chapter1 Introduction To Investment StudentMuhammad FaizNo ratings yet

- Chap 008 - RETURN ON INVESTED CAPITAL AND PROFITABILITY ANALYSISDocument26 pagesChap 008 - RETURN ON INVESTED CAPITAL AND PROFITABILITY ANALYSIShy_saingheng_760260970% (10)

- Klaus Uhlenbruck - Hochland CaseDocument15 pagesKlaus Uhlenbruck - Hochland CaseAvogadro's ConstantNo ratings yet

- Digital Marketing RawDocument22 pagesDigital Marketing Raw1820 Sakshi.AgrawalNo ratings yet

- 502 - Service Management (MCQ)Document20 pages502 - Service Management (MCQ)Ruhul Amin PatelNo ratings yet

- CPSE ETF - FFO PresentationDocument34 pagesCPSE ETF - FFO PresentationBhanuprakashReddyDandavoluNo ratings yet

- FINAL Income Tax MatrixDocument9 pagesFINAL Income Tax MatrixFC EstoestaNo ratings yet

- Wine PresentationDocument20 pagesWine Presentationsonal k100% (6)

- Siemens Finance Case StudyDocument9 pagesSiemens Finance Case StudyJohnNo ratings yet

- Study Guide: Series 7 Top-Off Exam Preparation - Knopman Marks GuideDocument1 pageStudy Guide: Series 7 Top-Off Exam Preparation - Knopman Marks GuideCamilla TalagtagNo ratings yet

- 1 - SyllabusDocument8 pages1 - SyllabusSintayehu DemekeNo ratings yet

- DMSPT 1Document16 pagesDMSPT 1Airielle VivasNo ratings yet

- 10-K 2008.2.22 687Document473 pages10-K 2008.2.22 687Sammy TangnesNo ratings yet

- m3 How To Distinguish Good From Bad Analytics CompressedDocument99 pagesm3 How To Distinguish Good From Bad Analytics CompressedCésar Álvarez de Linera ParedesNo ratings yet

- Goni MahwashDocument27 pagesGoni MahwashChandan ChoudharyNo ratings yet

- Daftar Pustaka - 11-34 CrosbyDocument6 pagesDaftar Pustaka - 11-34 CrosbyMuhammad Sidiq ANo ratings yet