Professional Documents

Culture Documents

South Indian Bank Equity Research

Uploaded by

JcoveCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

South Indian Bank Equity Research

Uploaded by

JcoveCopyright:

Available Formats

India Equity Institutional Research | BFSI

South Indian Bank

Sales Note

INR 19

A turnaround story

Margin expansion stands imminent: Steady business growth and anticipated

decline in policy rate would lead to speedier re-pricing of liabilities leading to margin

expansion. However, the new base rate methodology based off marginal cost of

funding should not have material impact on margins with Management expecting

mere 20 bps dent. That said, improving low-cost deposit base (CASA ratio at 22.8%),

benefits accruing from higher investment grade, declining costs and change in asset

mix should continue to aid margins enhancement; expect 2.9% NIMs by FY17E.

Market Info:

24492

SENSEX

7437

NIFTY

Share Price Performance

100

80

Sensex

Jan-16

Nov-15

Sep-15

60

Jul-15

Renewed business focus leading to accelerated credit growth: Post complete

liquidation of pawn business and curtailing stressed corporate exposures, SIB today

boasts of a diversified loan book. Replacing big ticket loans with working capital

financing to SMEs, SIB has strategically adopted cautious approach. De-focusing from

beleaguered power and infra sectors, the bank has tilted loan book towards retail

(auto, housing, gold, LAP), SME and agriculture loans. SIB has identified 150 branches

that are credit oriented for growing retail and SME vertical. As at the end of Q3FY16,

the corporate book stood 40.9% of total loans, retail (ex-gold) at 19.5%, SME at

22.4%, agri 13.7% and gold at 3.6%. Against this backdrop, we believe SIB is set to

clock 17% loan growth during FY16-18E.

1350

1350

25045

28/17

4616

1

SIB IN

Shares outs (Mn)

Equity Cap (Mn)

Mkt Cap (INR Mn)

52 Wk H/L (INR)

Avg Vol(3M avg K)

Face Value (INR)

Bloomberg Code

May-15

Benefits emerging from favorable geographic location and niche positioning:

Historically, SIB has focused its business operations in southern India; with dominant

presence in Kerala. With >80% of the network located in Southern India and almost

54% in Kerala, SIB generates almost 45% of the loans from the home turf and 33%

from the southern India. By virtue of the banks favorable geographic location and

healthy relationship with the locals, SIB derives benefits in terms of increased NRI

business (NRI deposits form 25% of total deposit base-Q3FY16) and gold loan

business (gold loans form 15.5% of total loans); maintaining its market share.

However, going forward SIB aims to focus largely on moving out of home turf and

increasing its pan-India footprint (aims to add 50 branches/extension counters every

year) by focusing on high growth geographies (Tier I and Tier II), opening cluster

branches and smaller branches in the vicinity of one big unit and improving branch

profitability. This should enable the bank to reduce dependence on home state paving

the way for growth and scalability.

Market Data

Mar-15

with portfolio mix comprising of corporate banking, personal banking, NRI banking, third

party products and now diversification into retail and SME franchise. Post the top

Management change at helms with Mr. Mathew taking over from Dr. VA Joseph (back in

2014), the bank has been recalibrating business re-engineering exercise. With the right

business strategy in place, SIB is treading the path of structural metamorphosis which should

prove value accretive in a two to three year time frame.

Not Rated

Jan-15

We interacted with Mr. C. P. Gireesh, Chief Financial Officer (CFO), South Indian Bank

Limited (SIB) to understand business dynamics, current financial position and business

strategy ahead. Headquartered at Thrissur City in Kerala, India, SIB is a private sector bank

South Indian Bank Ltd.

Share Holding pattern (%)

Particulars

Dec15

Sep15

Jun15

Promoters

FIIs

17.80

19.34

28.16

DIIs

23.22

12.59

12.89

Others

58.98

68.07

58.95

100

100

100

Total

Shweta Daptardar

shweta.daptardar@krchoksey.com

91-22-6696 5574

www.krchoksey.com

Asset quality improvement on the anvil; troubled sector exposures curtailed:

Historically, the bank has demonstrated improving book quality by successfully

clearing the bad assets with gross NPAs declining 493 bps from as high as 6.64% in

FY05 to 1.71% in FY15. However, the turbulent period of FY15 was marked by higher

slippages from infra, steel and tyre sectors. Given the macro challenges, the bank

continued to observe stress with gross NPAs at 2.75% (51 bps spike Y-o-Y-Q3FY16)

and net NPAs at 1.80% primarily due to fresh slippages from pharma and road sectors

during the quarter gone by. The restructured book stood at INR 22.4 bn during

Q3FY16; down Q-o-Q from INR 23 bn (Q2FY16). While stressed sector exposures such

as power discoms at 46%, construction EPC at 33%, these assets fall under standard

restructure category.

91-22-6696 5555

91-22-6691 9569

January 28, 2016

South Indian Bank

That said, the banks new strategy of laying thrust on small ticket advances and high-rated corporate advances, de-focusing

from stressed power and infra sectors and formation of credit monitoring cells should arrest major delinquencies ahead. For

instance, the bank has categorically refrained from lending to large corporates since past two years. Moreover, around onefifth of agri, MSME and retail loans are collateralized by gold. As per the Management, the stressed assets have already been

cleansed and the bank continues to provide aggressively with no meaningful delinquencies expected to emerge ahead.

Therefore, with significant worries overdone and no major negative surprises lying ahead, we reckon SIB should restore its

better asset quality numbers sooner than later.

Valuation & Outlook: Post the consolidation of business (FY15) and realigning its balance sheet, SIB today stands poised to

tread on a growth path. The structural metamorphosis of business with loan mix tilting towards higher yielding retail and SME

products should aid bank to mitigate incremental stress, resulting in lower provisions and lower interest reversals.

Furthermore, reducing corporate exposure, collateral based retail/SME lending, expected robust loan CAGR, thrust on highvalue NRE deposits, should translate into healthy return ratios; expected RoA at 0.9% and RoE at 12%+ (FY17E). This in

turn reinforces our belief in the banks earnings enhancement going forward and we maintain our positive outlook stance on

SIB. The stock is currently trading at compelling valuations of 0.7x P/BV FY17E; with turnaround in business strategy and

anticipated earnings improvement we reckon 1.0x P/BV is what SIB deserves.

Key Financials:

Particulars (INR mn)

FY13

FY14

FY15

FY16E

FY17E

12,810

13,990

13,660

3,718

4,369

8490

8840

8160

966

1,188

PAT

5020

5080

3070

679

771

EPS

4.03

3.78

2.28

58

65.9

22.44

25.06

26.59

25.99

27.19

3.21

3.02

2.70

18.25

17.64

Net Interest Income

Operating Profit

BVPS

NIM (%)

SIBs business mix

Asset mix- Q3FY16

Liability mix - Q3FY16

4%

14%

15%

4%

41%

20%

19%

62%

22%

Corporate

SME

Agriculture

Gold

Retail Ex gold

Term

Savings

Current

Others

Source: Company, KR Choksey Research

KRChoksey-Institutional Research

South Indian Bank

BUSINESS OVERVIEW

Company Brief

Business Model

South Indian Bank Limited (SIB) is a

private sector bank headquartered at

Thrissur

City

in Kerala,

India

incorporated in 1928 South Indian

Bank was one of the earliest banks in

South India. SIB was the first private

sector bank in Kerala to become a

Schedule Commercial bank in 1946

under the RBI Act. Spearheaded by

Mr. V.G. Mathew (MD and CEO), the

banks portfolio mix comprises of

corporate banking, personal banking,

NRI banking, third party products and

now diversification into retail and SME

franchise.

The Bank had been successful in

widening its network pan India with

831

branches

(grown

~2x

duirngFY05-FY15) and 1260 ATMs

(increased ~10x FY05-FY15).

While South Indian Bank has gained renewed focus on

building up a robust liability franchise (current CASA:

22.8%) while maintaining asset quality and improve

margins, it aims to expand its retail business strengthen

SME relationships. With corporate loan book witnessing

stress, SIB strategically has planned to diversify into retail

segment (through home, auto, MSME and LAP) capitalizing

upon the existing set of customer base and strengthen MSE

relationships. As part of boosting retail growth strategy,

SIB aims to lay greater thrust on low-cost housing loans

through centralized processing and faster approvals. For

accentuating SME vertical growth, the bank has created

MSE hubs that possess expertise to serve the SME

clientele.

The bank aims to enhance branch profitability by focusing

on both geographies outside Kerala and the home turf

(currently, South India: 83%, Kerala: 54%) aided by

formation of branch clusters. Not just that, the bank has

identified 150 branches that will lay major thrust on retail

and SME portfolios.

Strategic Positioning

High market share in both advances and deposits amongst

the old generation small private banks.

60% of the total branch network is located in semi-urban

and rural areas.

Competitive Edge

SIB happens to be the first Kerala-based bank to

implement core banking system.

81% of its lending is to investment grade; this largely

guards on asset quality.

71% of liabilities will be re-priced within one year;

boosting its pricing power.

17% of the agri and SME loans are backed by

additional security by way of gold.

Young workforce (average age of employees 34

years); has aided cost efficiencies.

Financial Structure

SIB continues to lay major thrust on branch profitability.

SIB has raised INR 3 bn Tier II bonds to strengthen capital

base and pursue growth.

During FY15, Management took the strategic decision to

exit the pawn broking business that impacted the gold loan

portfolio growth and also resulted into higher slippages in

turn hampering the profitability of the bank.

The bank has shifted focus from large corporate to SMEs

and de-focusing from power and infra sectors. Slippage to

advances ratio has stood lower across retail, SME and agri

portfolios.

Key Competitors

DCB Bank, Federal Bank, City Union Bank, Karur Vysya

Bank, ING Vysya Bank, Jammu Kashmir Bank.

Strategy

ahead/Focus areas

Expansion in Retail business: (a) Focus on retail loans.

(b) Improvement of branches for faster TAT.

Strengthening SME base: (a) Cluster based approach in

industry hubs. (b) Aims to be sole banker to SMEs.

CASA improvisation: (a) Strategy to increase CASA base.

(b) Centralized processes allowing branches to focus on

garnering low cost of funds.

Enhancement of asset quality: (a) Granularity in loan

portfolio to minimize risks. (b) Cautious strategy on

corporate lending. (c) Special recovery cell for monitoring

NPAs and restructured assets.

Boosting other income: (a) Focus on increasing banking

services for MSEs, retail and NRI clients.

(b) Enhancing treasury capabilities. (c) Expansion of PoS

and ATM network.

Source: KR Choksey Research

KRChoksey-Institutional Research

South Indian Bank

Key Q3FY16 Earnings Highlights

Q3FY16 earnings performance stood mixed bag for SIB. While NII and PAT stood strong recording 27.1% and 15.6% Y-o-Y

growth respectively, the gross NPAs spiked 51 bps Y-o-Y to 2.75%.

The Management maintains focus on retail loans; have stayed away from large corporate books for two years now. The loan

growth for the quarter was predominantly driven by retail loans; viz, MSME and agri that grew robust 21% Y-o-Y, home

loans by staunch 31% and sturdy show by auto loans that grew 40% Y-o-Y. The strategic focus on retail loan book

expansion should continue to boost NII traction going forward.

NIMs have jumped almost 42 bps Y-o-Y to 2.92% on the back of reduced costs and healthy CASA augmentation.

CASA ratio stood at 23% primarily supported by traction in SA balances which grew 18% Y-o-Y and CA growing 17% Y-o-Y.

NRI deposits stood strong; reporting 26% Y-o-Y growth.

Sustained traction in transaction fees and profit on sale of investments drove the sequential other income growth for the

quarter; y-o-Y it stood down.

The asset quality pressures have emerged from the corporate loan book; however, Management has already tilted focus

towards retail assets. Moreover, the bank continues to focus on early identification of bad assets and timely provisions for

the same.

The slippages stood at INR 2150 mn during the quarter. While few trading and contractor accounts have slipped during the

quarter, these stand highly collateralized as cited by the Management. While the corporate slippages stood higher at 1.8%

as against 0.77% a year ago, the agri slippages were down to 0.02% in Q3FY16 from 0.04% a year ago. Retail slippages

stood tad higher at 0.15% in Q3FY16 v/s 0.14% in Q3FY15.

The restructured assets stood nil during Q3FY16. The restructured book, overall, stands at INR 22.4 bn; o/w INR 3.06 bn

stand as NPAs. 50% of the remaining pertains to 3 discoms which are expected to get resolved through UDAY schemes.

Moreover, there were no slippages from

While Q3FY16 did not observe any 5/25 refinance account, till date the bank has opted for 5/25 scheme for mere one

account.

Around INR 890 mn were sold to ARCs during the quarter.

As at the end of December 2015, the branch count stood at 831, ATM network stood at 1272.

Employee headcount stood at 7048 as at the end of December quarter.

Interestingly, this quarter the RWA assets growth exceeded the overall advances growth primarily due to decline in gold

loan portfolio.

CAR stood at 11.7%, Tier I at 9.4% during the December quarter 2015.

Financial highlights

INR mn

Net Interest Income

Other Income

Profit After Tax

Total Advances

Deposits

GNPA

NNPA

NIM

CASA

Q3FY16

4067.2

1533.2

1016.3

406,010

534,410

2.75%

1.80%

2.92%

12,307

Q3FY15

3199.2

1603.4

879.3

369,980

484,590

1.80%

1.04%

2.50%

10,424

Yo-Y growth

27.13%

-4.38%

15.58%

9.74%

10.28%

95bps

76bps

42bps

18.06%

Source: Company, KR Choksey Research

KRChoksey-Institutional Research

South Indian Bank

Income Statement:

INR Mn

FY11

FY12

FY13

FY14

FY15

Net Interest Income

7910

10,220

12,810

13,990

13,660

Other Income

1970

2470

3350

3680

4970

Total Income

9880

12,690

16,160

17,670

18,630

Operating Expenses

4630

6170

7670

8830

10,470

Operating Profit

5250

6520

8490

8840

8160

800

790

1610

1550

4140

Profit Before Tax

4460

5720

6880

7290

4020

Provision for Tax

1530

1710

1540

2210

1380

Exceptional Items

317.2

-430

Profit After Tax

2930

4020

5020

5080

3070

FY11

FY12

FY13

FY14

FY15

1130

1130

1340

1340

1350

17,320

20,540

28,700

32,340

34540

297,210

365,010

442,620

474,910

519,120

Borrowings

2900

5880

12,850

27,310

22,320

Other Liabs. & Provisions

9640

11,140

12,450

13,960

13,830

328,200

403,700

497,950

549,860

591,160

18,280

15,720

16,970

22,010

24,420

6380

10,690

26,390

10,170

11,540

89,240

94,000

125,230

143,520

167,170

204,890

272,810

318,160

362,300

373,920

Fixed Assets

3570

3780

3960

4120

4790

Other Assets

5850

6710

7240

7740

9320

328,200

403,700

497,950

549,860

591,160

Provisions & Contingencies

Source: Company, KR Choksey Research

Balance sheet:

INR Mn

Capital & Liabilities

Capital

Reserves and Surplus

Deposits

Total

Assets

Cash & Balances with RBI

Balances with Banks

Investments

Advances

Total

Source: Company, KR Choksey Research

KRChoksey-Institutional Research

South Indian Bank

Key Ratios

Particulars

FY11

FY12

FY13

FY14

FY15

Net Interest Margin (%)

3.06

3.1

3.21

3.02

2.7

14.01

14

13.91

12.53

12.06

CRAR Basel II (%)

RoAA(Annualized) (%)

1.05

1.12

1.17

0.56

Provision Coverage (%)

73.94

71.36

60.33

62.71

60.63

CASA (%)

21.55

19.67

18.6

20.69

20.59

Gross NPA (%)

1.11

0.97

1.36

1.19

1.71

Net NPA (%)

0.29

0.28

0.78

0.78

0.96

Book Value per Share (INR)

16.33

19.12

22.44

25.06

26.59

Earnings per Share (INR)

2.59

3.55

4.03

3.78

2.28

Dividendper Share (INR)

0.5

0.6

0.7

0.8

0.6

Branches

-

Kerala

358

383

409

436

444

South Ex-Kerala

173

200

213

227

236

Others (Rest of India)

100

105

116

131

142

Kerala

280

382

461

552

651

South Ex-Kerala

124

184

221

293

362

Others (Rest of India)

86

97

118

155

187

ATMs

Source: Company, KR Choksey Research

Branch dynamics

Region

Kerala

South-Ex-Kerala

Rest of India

Total

FY05

251

117

51

419

FY15

444

236

142

822

CAGR %

6.5

8.1

12.1

7.8

Region

Kerala

South-Ex-Kerala

Rest of India

Total

FY05

58

33

30

121

FY15

651

362

187

1200

CAGR %

30.8

30.5

22.5

29.0

Distribution Network

Branch

ATMs

FY11

631

490

FY12

688

663

FY13

738

800

ATM Network

Source: Company, KR Choksey Research

KRChoksey-Institutional Research

South Indian Bank

ANALYST CERTIFICATION:

We Shweta Daptardar (BCoM, MBA) research analyst & Nikhil Kothari (B Com, CA,), research associate, author and the name subscribed to this report, hereby certify that all of the

views expressed in this research report accurately reflect my views about the subject issuer(s) or securities. I also certify that no part of our compensation was, is, or will be

directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Terms & Conditions and other disclosures:

KRChoksey Shares and Securities Pvt. Ltd (hereinafter referred to as KRCSSPL) is a registered member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and MCX Stock Exchange Limited. KRCSSPL is in the process of making an application with SEBI for registering as a Research Entity in terms of SEBI (Research Analyst)

Regulations, 2014.

We submit that no material disciplinary action has been taken on KRCSSPL and its associates by any Regulatory Authority impacting Equity Research Analysis activities.

KRCSSPL generally prohibits its analysts, persons reporting to analysts and their relatives from maintaining a financial interest in the securities or derivatives of any companies

that the analyst covers.

The information and opinions in this report have been prepared by KRCSSPL and are subject to change without any notice. The report and information contained herein is strictly

confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the

media or reproduced in any form, without prior written consent of KRCSSPL. While we would endeavor to update the information herein on a reasonable basis, KRCSSPL is not

under any obligation to update the information. Also, there may be regulatory, compliance or other reasons that may prevent KRCSSPL from doing so. Non-rated securities

indicate that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or KRCSSPL policies, in

circumstances where KRCSSPL might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or

completeness guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to

buy or sell or subscribe for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the

same time. KRCSSPL will not treat recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or

a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities di scussed and opinions expressed in this report may not

be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may

not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on

investment may vary because of changes in interest rates, foreign exchange rates or any other reason. KRCSSPL accepts no liabilities whatsoever for any loss or damage of any

kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand

the risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not

predictions and may be subject to change without notice. Our employees in sales and marketing team, dealers and other professionals may provide oral or written market

commentary or trading strategies that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make

investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all of the foregoing, among

other things, may give rise to real or potential conflicts of interest.

KRCSSPL or its associates might have received any commission/compensation from the companies mentioned in the report during the period preceding twelve months from the

date of this report for services in respect of brokerage services or specific transaction or for products and services other than brokerage services.

KRCSSPL encourages the practice of giving independent opinion in research report preparation by the analyst and thus strives to minimize the conflict in preparation of research

report. KRCSSPL or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the

research report. Accordingly, neither KRCSSPL nor Research Analysts have any material conflict of interest at the time of publication of this report.

It is confirmed that Shweta Daptardar (B Com, MBA,), research associate, of this report have not received any compensation from the companies mentioned in the report in the

preceding twelve months. Compensation of our Research Analysts is not based on any specific brokerage service transactions.

KRCSSPL or its associates collectively or its research analyst do not hold any financial interest/beneficial ownership of more than 1% (at the end of the month immediately

preceding the date of publication of the research report) in the company covered by Analyst, and has not been engaged in market making activity of the company covered by

research analyst.

Since associates of KRCSSPL are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the

subject company/companies mentioned in this report.

It is confirmed that Shweta Daptardar (B Com, MBA,), research associate, do not serve as an officer, director or employee of the companies mentioned in the report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction,

where such distribution, publication, availability or use would be contrary to law, regulation or which would subject KRCSSPL and affiliates to any registration or licensing

requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose

possession this document may come are required to inform themselves of and to observe such restriction.

Please send your feedback to research.insti@krchoksey.com

Visit us at www.krchoksey.com

Kisan Ratilal Choksey Shares and Securities Pvt. Ltd

Registered Office:

1102, Stock Exchange Tower, Dalal Street, Fort, Mumbai 400 001.

Phone: 91-22-6633 5000; Fax: 91-22-6633 8060.

Corporate Office:

ABHISHEK, 5th Floor, Link Road, Andheri (W), Mumbai 400 053.

Phone: 91-22-6696 5555; Fax: 91-22-6691 9576.

KRChoksey-Institutional Research

You might also like

- Investment Strategy For Indian Markets Post-CovidDocument21 pagesInvestment Strategy For Indian Markets Post-CovidJcoveNo ratings yet

- Indonesia Mining in Indonesia Survey 2016Document124 pagesIndonesia Mining in Indonesia Survey 2016JcoveNo ratings yet

- 12 Ways To Be More SuccessfulDocument35 pages12 Ways To Be More SuccessfulNakul KothariNo ratings yet

- Exora Rent RollDocument36 pagesExora Rent RollJcoveNo ratings yet

- EY Ripe For Investment The Indonesian Health Care Industry Post Introduction of Universal Health CoverageDocument76 pagesEY Ripe For Investment The Indonesian Health Care Industry Post Introduction of Universal Health CoverageIka Wulan PermataNo ratings yet

- Market Outlook - Aprils-Financial-Markets-Transcend-Miserable-Economic-Data-Capital-Markets-Re... - 23apr20Document27 pagesMarket Outlook - Aprils-Financial-Markets-Transcend-Miserable-Economic-Data-Capital-Markets-Re... - 23apr20JcoveNo ratings yet

- Yahoo Peanut Butter ManifestoDocument10 pagesYahoo Peanut Butter ManifestoJcoveNo ratings yet

- Europe Greece 13 July 2011 20 SeptemberDocument21 pagesEurope Greece 13 July 2011 20 SeptemberJcoveNo ratings yet

- J.K. Cement LTD Care 01-20-2015Document3 pagesJ.K. Cement LTD Care 01-20-2015JcoveNo ratings yet

- Forwards, Futures & Swaps PDFDocument32 pagesForwards, Futures & Swaps PDFJcoveNo ratings yet

- Kim Tae Moon FullpaperDocument8 pagesKim Tae Moon FullpaperJcoveNo ratings yet

- JK Cement Corp PresentationDocument18 pagesJK Cement Corp PresentationJanani RajagopalanNo ratings yet

- IDirect JKCement Q1FY16 050815083453Document11 pagesIDirect JKCement Q1FY16 050815083453JcoveNo ratings yet

- Fortress Says Emerging Markets Bear Slump To Rival 1997Document7 pagesFortress Says Emerging Markets Bear Slump To Rival 1997JcoveNo ratings yet

- 21 Books Successful People Read To Their KidsDocument29 pages21 Books Successful People Read To Their KidsJcove100% (1)

- The Alleged Flash-Trading Mastermind Lived With His Parents and Couldn't DriveDocument5 pagesThe Alleged Flash-Trading Mastermind Lived With His Parents and Couldn't DriveJcove100% (1)

- On The Farm - Startups Put Data in Farmers' HandsDocument5 pagesOn The Farm - Startups Put Data in Farmers' HandsJcoveNo ratings yet

- Msia Aviation SU 050413 2045Document21 pagesMsia Aviation SU 050413 2045JcoveNo ratings yet

- As Funds Dry Up, Hyperlocals Tap Private Labels To Boost ProfitsDocument2 pagesAs Funds Dry Up, Hyperlocals Tap Private Labels To Boost ProfitsJcoveNo ratings yet

- India's E-Commerce Power List 2015Document44 pagesIndia's E-Commerce Power List 2015JcoveNo ratings yet

- Apexindo - Moodys Rating 2013Document14 pagesApexindo - Moodys Rating 2013JcoveNo ratings yet

- Fake Traffic SchemesDocument19 pagesFake Traffic SchemesJcove100% (1)

- Chinese Coal Quality Restrictions - A Further Headache For Bulk ImportersDocument2 pagesChinese Coal Quality Restrictions - A Further Headache For Bulk ImportersJcoveNo ratings yet

- Natural Gas Conversion Guide PDFDocument52 pagesNatural Gas Conversion Guide PDFTinuoye Folusho OmotayoNo ratings yet

- LPG in World Markets Jan 2016 PDFDocument32 pagesLPG in World Markets Jan 2016 PDFJcoveNo ratings yet

- ANALYSIS Can The Air Cargo Market Bounce BackDocument4 pagesANALYSIS Can The Air Cargo Market Bounce BackJcoveNo ratings yet

- World Air Cargo ForecastDocument69 pagesWorld Air Cargo ForecastJcoveNo ratings yet

- Global Coal 12 Sept 2014Document15 pagesGlobal Coal 12 Sept 2014JcoveNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- BBL 2019 IDocument4 pagesBBL 2019 Iapi-294141759No ratings yet

- Beneish M ScoreDocument6 pagesBeneish M ScoreAlex ElliottNo ratings yet

- Profits and Position Control: A Week of Dealing: ElsevierDocument19 pagesProfits and Position Control: A Week of Dealing: ElsevierTraderCat SolarisNo ratings yet

- Article Loan & Investment by CompanyDocument7 pagesArticle Loan & Investment by CompanyDivesh GoyalNo ratings yet

- Amulya Kumar Verma 26asDocument4 pagesAmulya Kumar Verma 26asSatyendra SinghNo ratings yet

- DCP Financial AccountingDocument9 pagesDCP Financial AccountingIntekhab AslamNo ratings yet

- 1 Finance-Exam-1Document22 pages1 Finance-Exam-1ashish25% (4)

- Qualifying Exam Reviewer 2017 - FARDocument18 pagesQualifying Exam Reviewer 2017 - FARAdrian FrancisNo ratings yet

- CH 1 - Cost Management and StrategyDocument35 pagesCH 1 - Cost Management and StrategySuresh SelvamNo ratings yet

- Ra 8425 Poverty Alleviation ActDocument14 pagesRa 8425 Poverty Alleviation ActZyldjyh C. Pactol-Portuguez0% (1)

- PTPP Uob 15 Mar 2022Document5 pagesPTPP Uob 15 Mar 2022Githa Adhi Pramana I GDNo ratings yet

- AmalgamationDocument46 pagesAmalgamationThe FlashNo ratings yet

- CV Yong Gyu Lee 20130701Document5 pagesCV Yong Gyu Lee 20130701Oscar BurnettNo ratings yet

- Republic of The Philippines Citibank, N.A. and Bank of America, S.T. & N.A.Document14 pagesRepublic of The Philippines Citibank, N.A. and Bank of America, S.T. & N.A.CristineNo ratings yet

- The Play's The ThingDocument56 pagesThe Play's The Thingapi-26032005No ratings yet

- Theories Chapter 1Document16 pagesTheories Chapter 1Farhana GuiandalNo ratings yet

- Unit I Theory and ProblemsDocument7 pagesUnit I Theory and Problemssandy santhoshNo ratings yet

- Fashion Fund SACDocument22 pagesFashion Fund SACKartik RamNo ratings yet

- Hybrid Financing, Preferred Stock, Leasing, Warrants and ConvertiblesDocument30 pagesHybrid Financing, Preferred Stock, Leasing, Warrants and ConvertiblesannafuentesNo ratings yet

- Management Project - Vipra PatangiaDocument61 pagesManagement Project - Vipra PatangiadilipNo ratings yet

- 5 Min Scalping FOREX StrategyDocument3 pages5 Min Scalping FOREX StrategyzooorNo ratings yet

- Futures ContractsDocument14 pagesFutures ContractsSantosh More0% (1)

- Canadian Investment Funds CourseDocument2 pagesCanadian Investment Funds CourseNancy ShenoudaNo ratings yet

- Chapter 16Document21 pagesChapter 16Aiko E. LaraNo ratings yet

- Zerodha ComDocument25 pagesZerodha ComBalakrishna BoyapatiNo ratings yet

- Idx Monthly Apr 2018Document111 pagesIdx Monthly Apr 2018nadiladlaNo ratings yet

- Ratio 4Document13 pagesRatio 4Edgar LayNo ratings yet

- Banking ReviewerDocument41 pagesBanking ReviewerCindy-chan DelfinNo ratings yet

- Tareck El Aissami and Samark Lopez Bello NetworkDocument1 pageTareck El Aissami and Samark Lopez Bello NetworkEl Informador WebNo ratings yet

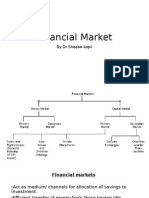

- Financial Market: by DR Sheeba KapilDocument9 pagesFinancial Market: by DR Sheeba KapilRakesh AroraNo ratings yet