Professional Documents

Culture Documents

CIR vs Reyes Tax Assessment

Uploaded by

Evangelyn EgusquizaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIR vs Reyes Tax Assessment

Uploaded by

Evangelyn EgusquizaCopyright:

Available Formats

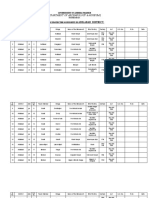

Commissioner of Internal Revenue vs Azucena Reyes

Taxation Contents of a Formal Assessment Notice

FACTS:

In 1993, Maria Tancino died leaving behind an estate worth P32 million. In

1997, a tax audit was conducted on the estate. Meanwhile, the National

Internal Revenue Code (NIRC) of 1997 was passed. Eventually in 1998, the

estate was issued a final assessment notice (FAN) demanding the estate

to pay P14.9 million in taxes inclusive of surcharge and interest; the

estates liability was based on Section 229 of the [old] Tax Code. Azucena

Reyes, one of the heirs, protested the FAN. The Commissioner of Internal

Revenue (CIR) nevertheless issued a warrant of distraint and/or levy.

Reyes again protested the warrant but in March 1999, she offered a

compromise and was willing to pay P1 million in taxes. Her offer was

denied. She continued to work on another compromise but was eventually

denied. The case reached the Court of Tax Appeals where Reyes was also

denied. In the Court of Appeals, Reyes received a favorable judgment.

ISSUE:

Whether or not the formal assessment notice is valid.

HELD:

No. The NIRC of 1997 was already in effect when the FAN was issued.

Under Section 228 of the NIRC, taxpayers shall be informed in writing

of the law and the facts on which the assessment is made:

otherwise, the assessment shall be void. In the case at bar, the FAN

merely stated the amount of liability to be shouldered by the estate and

the law upon which such liability is based. However, the estate was not

informed in writing of the facts on which the assessment of estate taxes

had been made. The estate was merely informed of the findings of the

CIR. Section 228 of the NIRC being remedial in nature can be applied

retroactively even though the tax investigation was conducted prior to the

laws passage. Consequently, the invalid FAN cannot be a basis of a

compromise, any proceeding emanating from the invalid FAN is void

including the issuance of the warrant of distraint and/or levy.

You might also like

- CIR vs Reyes Estate Tax AssessmentDocument2 pagesCIR vs Reyes Estate Tax AssessmentFilRepubliqNo ratings yet

- Week 3Document8 pagesWeek 3kaylah bautistaNo ratings yet

- CIR V Reyes - DigestDocument1 pageCIR V Reyes - DigestVillar John EzraNo ratings yet

- Commissioner of Internal Revenue vs. Azucena T. Reyes The FactsDocument2 pagesCommissioner of Internal Revenue vs. Azucena T. Reyes The FactsHartel Buyuccan100% (1)

- CD - 41. CIR v. ReyesDocument2 pagesCD - 41. CIR v. ReyesCzarina CidNo ratings yet

- Tax Digest Compilation III IVDocument11 pagesTax Digest Compilation III IVkaiaceegeesNo ratings yet

- CIR vs. FAR EAST BANKDocument5 pagesCIR vs. FAR EAST BANKDessa Ruth ReyesNo ratings yet

- Hilado Vs CADocument36 pagesHilado Vs CARegion 6 MTCC Branch 3 Roxas City, CapizNo ratings yet

- Reyes Vs CommissionerDocument2 pagesReyes Vs CommissionerLisa Garcia100% (1)

- CIR V Far East BankDocument7 pagesCIR V Far East BankChristiane Marie BajadaNo ratings yet

- Alhambra Cigar and Cigarette Manufacturing Company Vs Cir (1967)Document11 pagesAlhambra Cigar and Cigarette Manufacturing Company Vs Cir (1967)malcolveNo ratings yet

- Tax Rev Cases 1Document169 pagesTax Rev Cases 1arvindominicNo ratings yet

- Part Ii Income Taxation Case DigestsDocument119 pagesPart Ii Income Taxation Case DigestsJoshua CustodioNo ratings yet

- CIR vs. Baier-NickelDocument10 pagesCIR vs. Baier-NickelCrystal Kate AgotNo ratings yet

- Philippines Supreme Court upholds VAT exemption for healthcare providersDocument7 pagesPhilippines Supreme Court upholds VAT exemption for healthcare providersChrissy Anne del RosarioNo ratings yet

- Tax Digest Estate To VatDocument28 pagesTax Digest Estate To Vatada mae santonia100% (1)

- Commissioner of Internal Revenue vs. Far East Bank & Trust Company (Now Bank of The Philippine Islands) G.R. No. 173854, March 15, 2010 FactsDocument3 pagesCommissioner of Internal Revenue vs. Far East Bank & Trust Company (Now Bank of The Philippine Islands) G.R. No. 173854, March 15, 2010 FactsBrent TorresNo ratings yet

- Commissioner of Internal Revenue vs. Reyes, 480 SCRA 382, January 27, 2006 #14Document2 pagesCommissioner of Internal Revenue vs. Reyes, 480 SCRA 382, January 27, 2006 #14rudilyn.palero9No ratings yet

- PCSC vs. CIRDocument15 pagesPCSC vs. CIRrobinNo ratings yet

- Supreme Court Rules on Input VAT Refund CaseDocument31 pagesSupreme Court Rules on Input VAT Refund CasejemezzNo ratings yet

- 1 Tax Case DigestDocument13 pages1 Tax Case DigestSusan FisherNo ratings yet

- Tax Remedies DigestsDocument50 pagesTax Remedies DigestsybunNo ratings yet

- Taxation II ReportDocument6 pagesTaxation II ReportKrishianne LabianoNo ratings yet

- Tax Remedies and CompromiseDocument5 pagesTax Remedies and Compromiselegine ramaylaNo ratings yet

- Tax Ii 3D 2020Document13 pagesTax Ii 3D 2020Emilio PahinaNo ratings yet

- Case 17 Cir vs. United Salvage G.R. No. 197515 July 2, 2014Document18 pagesCase 17 Cir vs. United Salvage G.R. No. 197515 July 2, 2014Christine Angelus MosquedaNo ratings yet

- Palanca Vs CirDocument5 pagesPalanca Vs Ciryelina_kuranNo ratings yet

- Digests 3 of 5Document6 pagesDigests 3 of 5Kisha Karen ArafagNo ratings yet

- Tax CasesDocument62 pagesTax CasesFrances MoscovadoNo ratings yet

- Document 4Document6 pagesDocument 4Ernie B LabradorNo ratings yet

- Tax Digest VATDocument5 pagesTax Digest VATJose Mari Angelo DionioNo ratings yet

- Marcos V CA Digest - TaxationDocument3 pagesMarcos V CA Digest - TaxationEM RGNo ratings yet

- Marcos vs. CADocument14 pagesMarcos vs. CAPhulagyn CañedoNo ratings yet

- 38 - 116790-2007-Commissioner - of - Internal - Revenue - V.20210505-12-1xlde2xDocument7 pages38 - 116790-2007-Commissioner - of - Internal - Revenue - V.20210505-12-1xlde2xliliana corpuz floresNo ratings yet

- Philippine Bank of Communications Vs CIRDocument1 pagePhilippine Bank of Communications Vs CIRLisley Gem AmoresNo ratings yet

- Tax Case DigestDocument11 pagesTax Case DigestPrincess Caroline Nichole IbarraNo ratings yet

- 1) Cir Vs Pascor (Gallo)Document5 pages1) Cir Vs Pascor (Gallo)kaiaceegeesNo ratings yet

- ING Banking vs. CIR (Digest)Document2 pagesING Banking vs. CIR (Digest)Theodore Dolar100% (1)

- Tax Assessment ValidityDocument1 pageTax Assessment ValidityMary AnneNo ratings yet

- Tax Dispute Ruling on Deficiency AssessmentsDocument10 pagesTax Dispute Ruling on Deficiency AssessmentsBernadette Luces BeldadNo ratings yet

- CTA Case No. 6191Document11 pagesCTA Case No. 6191John Kenneth JacintoNo ratings yet

- LIFEBLOODDocument47 pagesLIFEBLOODBREL GOSIMATNo ratings yet

- BIR's authority to collect estate taxes from heirsDocument9 pagesBIR's authority to collect estate taxes from heirsMariaNo ratings yet

- Part F 2 Republic vs. HizonDocument2 pagesPart F 2 Republic vs. HizonCyruz Tuppal100% (1)

- 1 CIR V Hambrecht - QuistDocument2 pages1 CIR V Hambrecht - Quistaspiringlawyer1234No ratings yet

- SC rules on tax amnesty applicabilityDocument7 pagesSC rules on tax amnesty applicabilityChristiane Marie BajadaNo ratings yet

- Estate & Donors Tax Case DigestsDocument25 pagesEstate & Donors Tax Case DigestsRonnaNo ratings yet

- 02 - BPI Savings v. CTADocument4 pages02 - BPI Savings v. CTAPhilip UyNo ratings yet

- Estate of The Late Juliana Diez Vda. de Gabriel vs. CommissionerDocument15 pagesEstate of The Late Juliana Diez Vda. de Gabriel vs. Commissionerangelsu04No ratings yet

- G.R. No. 159694 CIR Vs REYESDocument4 pagesG.R. No. 159694 CIR Vs REYESMa. Katrina Z. ManaloNo ratings yet

- Azucena Reyes v. CIR GR No. 163581 Jan. 27, 2006Document8 pagesAzucena Reyes v. CIR GR No. 163581 Jan. 27, 2006AlexandraSoledadNo ratings yet

- Presumption of regularity does not apply to tax delinquency salesDocument10 pagesPresumption of regularity does not apply to tax delinquency salesMelody Lim DayagNo ratings yet

- 276-CIR v. Reyes G.R. No. 159694 January 27, 2006Document7 pages276-CIR v. Reyes G.R. No. 159694 January 27, 2006Jopan SJNo ratings yet

- CIR vs. PascorDocument17 pagesCIR vs. PascorCarla EspinoNo ratings yet

- Ing Banking Vs Cir DigestDocument2 pagesIng Banking Vs Cir DigestJuan AntonioNo ratings yet

- Cir Vs Fitness by DesignDocument2 pagesCir Vs Fitness by DesignAnonymous 5MiN6I78I0No ratings yet

- 3-Marcos II v. Court of Appeals20210505-11-1eedgp0Document17 pages3-Marcos II v. Court of Appeals20210505-11-1eedgp0Gina RothNo ratings yet

- CIR Vs Pascor RealtyDocument8 pagesCIR Vs Pascor RealtyRosalie CastroNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- External LandmarksDocument1 pageExternal LandmarksEvangelyn EgusquizaNo ratings yet

- Respiratory RateDocument1 pageRespiratory RateEvangelyn EgusquizaNo ratings yet

- Intro To Trauma in AbdomenDocument1 pageIntro To Trauma in AbdomenEvangelyn EgusquizaNo ratings yet

- Verbal ResponseDocument1 pageVerbal ResponseEvangelyn EgusquizaNo ratings yet

- Eye OpeningDocument1 pageEye OpeningEvangelyn EgusquizaNo ratings yet

- Background Abdominal TraumaDocument1 pageBackground Abdominal TraumaEvangelyn EgusquizaNo ratings yet

- Systolic Blood PressureDocument1 pageSystolic Blood PressureEvangelyn EgusquizaNo ratings yet

- Scenario of Mass CasualtyDocument1 pageScenario of Mass CasualtyEvangelyn EgusquizaNo ratings yet

- Dictum in TraumaDocument1 pageDictum in TraumaEvangelyn EgusquizaNo ratings yet

- Hospital TriageDocument1 pageHospital TriageEvangelyn EgusquizaNo ratings yet

- Best Motor ResponseDocument1 pageBest Motor ResponseEvangelyn EgusquizaNo ratings yet

- Different Parts of Triage DecisionDocument1 pageDifferent Parts of Triage DecisionEvangelyn EgusquizaNo ratings yet

- Emergency PersonnelDocument1 pageEmergency PersonnelEvangelyn EgusquizaNo ratings yet

- Mechanism of InjuryDocument1 pageMechanism of InjuryEvangelyn EgusquizaNo ratings yet

- Different Parts of Triage DecisionDocument1 pageDifferent Parts of Triage DecisionEvangelyn EgusquizaNo ratings yet

- Clinical Manifestation Adrenal CrisisDocument1 pageClinical Manifestation Adrenal CrisisEvangelyn EgusquizaNo ratings yet

- Emergency PersonnelDocument1 pageEmergency PersonnelEvangelyn EgusquizaNo ratings yet

- Clinical Manifestation Children Renal FailureDocument1 pageClinical Manifestation Children Renal FailureEvangelyn EgusquizaNo ratings yet

- Supportive Care Status AsthmaticusDocument1 pageSupportive Care Status AsthmaticusEvangelyn EgusquizaNo ratings yet

- Acute Renal Failure Children DefinitionDocument1 pageAcute Renal Failure Children DefinitionEvangelyn EgusquizaNo ratings yet

- Acute Adrenal Defiency Maintenance TherapyDocument1 pageAcute Adrenal Defiency Maintenance TherapyEvangelyn EgusquizaNo ratings yet

- Drug Therapy Asthma AcuteDocument1 pageDrug Therapy Asthma AcuteEvangelyn EgusquizaNo ratings yet

- Criteria of Good Response in AsthmaDocument1 pageCriteria of Good Response in AsthmaEvangelyn EgusquizaNo ratings yet

- Management Acute Adrenal CrisisDocument1 pageManagement Acute Adrenal CrisisEvangelyn EgusquizaNo ratings yet

- Acute Adrenal Crisis DefinitionDocument1 pageAcute Adrenal Crisis DefinitionEvangelyn EgusquizaNo ratings yet

- Discharge Instruction Status AsthmaticusDocument1 pageDischarge Instruction Status AsthmaticusEvangelyn EgusquizaNo ratings yet

- Disposition Acute AsthmaDocument1 pageDisposition Acute AsthmaEvangelyn EgusquizaNo ratings yet

- Adrenergic Agonist For AsthmaDocument1 pageAdrenergic Agonist For AsthmaEvangelyn EgusquizaNo ratings yet

- Theophylline in AsthmaDocument1 pageTheophylline in AsthmaEvangelyn EgusquizaNo ratings yet

- Status Asthmaticus ManagementDocument1 pageStatus Asthmaticus ManagementEvangelyn EgusquizaNo ratings yet

- Cooperative by LawsDocument24 pagesCooperative by LawsMambuay G. MaruhomNo ratings yet

- Classical Dances of India Everything You Need To Know AboutDocument18 pagesClassical Dances of India Everything You Need To Know AboutmohammadjakeerpashaNo ratings yet

- Shot List Farm To FridgeDocument3 pagesShot List Farm To Fridgeapi-704594167No ratings yet

- Day1 S2 Gravity IntroDocument21 pagesDay1 S2 Gravity IntroPedro Hortua SeguraNo ratings yet

- Bibliography of the Butterworth TrialDocument3 pagesBibliography of the Butterworth TrialmercurymomNo ratings yet

- 17.06 Planned Task ObservationsDocument1 page17.06 Planned Task Observationsgrant100% (1)

- SSS LAwDocument14 pagesSSS LAwbebs CachoNo ratings yet

- Education Secretaries 10Document6 pagesEducation Secretaries 10Patrick AdamsNo ratings yet

- XCVBNMK, 54134Document49 pagesXCVBNMK, 54134fakersamNo ratings yet

- Operational Auditing Internal Control ProcessesDocument18 pagesOperational Auditing Internal Control ProcessesKlaryz D. MirandillaNo ratings yet

- Lec 2Document10 pagesLec 2amitava deyNo ratings yet

- Tiket Kemahasiswaan Makasar1Document4 pagesTiket Kemahasiswaan Makasar1BLU UnramNo ratings yet

- The First Charm of MakingDocument8 pagesThe First Charm of Makingapi-26210871100% (1)

- InvoiceDocument1 pageInvoiceDp PandeyNo ratings yet

- Trial of Warrant Cases by MagistrateDocument15 pagesTrial of Warrant Cases by MagistrateSaurav KumarNo ratings yet

- General Math Second Quarter Exam ReviewDocument5 pagesGeneral Math Second Quarter Exam ReviewAgnes Ramo100% (1)

- Texas Commerce Tower Cited for Ground Level FeaturesDocument1 pageTexas Commerce Tower Cited for Ground Level FeatureskasugagNo ratings yet

- AutoCompute SF2Document84 pagesAutoCompute SF2Ronan SibbalucaNo ratings yet

- A Reply - Lee Epstein, Gary KingDocument19 pagesA Reply - Lee Epstein, Gary KingAdam PeaseNo ratings yet

- BP Code of ConductDocument112 pagesBP Code of ConductLuis ZequeraNo ratings yet

- Audit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaDocument15 pagesAudit Independence and Audit Quality Likelihood: Empirical Evidence From Listed Commercial Banks in NigeriaIdorenyin Okon100% (1)

- Return To The Source Selected Speeches of Amilcar CabralDocument112 pagesReturn To The Source Selected Speeches of Amilcar Cabraldjazzy456No ratings yet

- Amazon InvoiceDocument1 pageAmazon InvoiceChandra BhushanNo ratings yet

- 3+Minute+Sales+Multiplier - PDF Jho Benson TopppDocument6 pages3+Minute+Sales+Multiplier - PDF Jho Benson TopppAndressa Nunes BatistaNo ratings yet

- Nathaly - Work Shop 3Document3 pagesNathaly - Work Shop 3Laurita Artunduaga OtavoNo ratings yet

- Symphonological Bioethical Theory: Gladys L. Husted and James H. HustedDocument13 pagesSymphonological Bioethical Theory: Gladys L. Husted and James H. HustedYuvi Rociandel Luardo100% (1)

- Debate Motions SparringDocument45 pagesDebate Motions SparringJayden Christian BudimanNo ratings yet

- Axis Priority SalaryDocument5 pagesAxis Priority SalarymanojNo ratings yet

- Criminal Investigation 11th Edition Swanson Test BankDocument11 pagesCriminal Investigation 11th Edition Swanson Test BankChristopherWaltonnbqyf100% (14)

- Protected Monument ListDocument65 pagesProtected Monument ListJose PerezNo ratings yet