Professional Documents

Culture Documents

Model Based Testing Workbench For Global Payplus

Uploaded by

Kal_COriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Model Based Testing Workbench For Global Payplus

Uploaded by

Kal_CCopyright:

Available Formats

Cards & Payments the way we do it

Model Based Testing Workbench for

Global PAYplus

Improve test

coverage and

reduce time to

market using

Capgeminis

test suite

A global payment

platform for high value,

mass payments and

immediate payments

Fundtechs Global PAYplus (GPP) is a domestic and international payment

processing platform which provides a highly scalable global payments engine to

support multi-bank and multi-currency. Using rules technology, GPP lets you improve

straight through processing with advanced error detection and repair functionality.

It enables banks to generate incremental fee income through more tailored services

and greater pricing flexibility. Global PAYplus provides many features including direct

payment initiation; payment routing and transit based on local and global rules and

configuration; interfaces to international clearing and domestic RTGS systems; funds

availability tracking; and more.

Since payments systems are complex with many integration points, its important

to test new releases and functionality thoroughly. How can your bank ensure high

quality without incurring high testing costs?

Model Based Testing: A clear advantage

for testing complex payments systems

Capgeminis Model Based Testing Workbench is a methodology and toolset designed

to accelerate the creation of test scripts. Users first define the system under test using

process models. These models are then used to automatically generate test scripts.

With model based testing, experienced testing professionals with payments knowledge

can reduce test preparation time for commercial software by as much as 30%.

With model based

testing, the amount

of effort needed

in the preparation

phase of a project

can be reduced by

as much as 30%.

An intuitive alternative to test-script design, model based testing uses a visual and nonlinear approach. A model is used to capture and depict the behavior of the system under

various functional and data scenarios. When used in conjunction with a compatible tool,

the model can be used to:

Significantly reduce preparation phase effort through an accelerated, accurate test

script design process

Derive a bi-directional traceability for better requirements management and track

test coverage

Simulate functionality or process flows in the application to speed up the

review process

Detect ambiguities and defects in requirements at an early stage

Increase test coverage through a more complete and accurate description of the

system under test

Global PAYplus Model Based Testing Workbench lets banks jump start testing efforts and:

Decrease time to market and costs

Manage and reduce risk

Improve operational efficiency

Enhance customer service

Support faster and more informed decision making

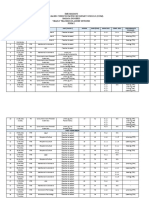

QA Analyst

Automation

Test Engineer

Manual Test

Cases Execution

Application

Under Test

Reports /

Dashboards

Scenario

Repository

PMO

Business

Analyst / SME

QA Analyst

Capgeminis Model Based Testing Framework for Test Repository Creation

Use / Compare

Model Based

Testing Tool

Test

Cases

Test

Management

Tool

Regression

Test Cases

Capgemini

Automation

Framework

(CAFE)

Extensible

Library of

Functions

Leverage force multipliers across the different phases of STLC

Payments the way we do it

Global PAYplus Functional Coverage

GPP Static Data

Office Data Setup

Office Data Attributes

User Entitlement

Setup

MOP Profile

Country Info DS

Rate Usage Profile

Profile Generic DS

Fee Exchange

Exchange Rate DS

Party

Fee Formula DS

DR CR Processing

Rate Usage DS

System Data Setup

Office Data Setup

Office Data Attributes

Currency

Our Proven Approach

Ensures Quality Testing

and Results

Benchmark the test maturity of

your organization against industry

standards using our Quality Blueprint

benchmarking data. Capgemini can

help you define a roadmap for success

to deliver actionable plans that focus

effort and value on business priorities.

Leveraging industry best practice

accelerators and our Innovation Labs

tools, we can help you reduce costs

and improve productivity.

Improved Test Coverage and Quality

Capgemini follows a rigorous, systematic approach to testing which helps improve

test coverage and quality. Standard proprietary methodologies like TMap and TPI

provide guidelines for test management and process improvement that help to ensure

every Capgemini testing engagement results in improved outcomes. Our model

based approach provides improved test coverage over traditional testing methods.

Tailored for Global PAYplus

Our Model Based Testing Workbench for Global PAYplus includes proprietary

accelerators built specifically for the application. Capgemini has over 700 GPP static

data test cases and more than 4,700 transaction processing flow test cases. We

identify and prioritize test cases and models to support the complexities of testing

GPP. The Workbench:

Covers most essential and critical business functions involved in

payment processing

Reduces turnaround time for testing

Enhances functional coverage of business functions

Global PAYplus Business Coverage

GPP Transaction Processing Business Coverage

Payment Initiation

Payment Message

Receipt

Set Basic Properties

Assess Business rule

Base Currency

Conversion

STP Validation

Compliance Check

Account Lookup

Repair and

Enrichment

Duplicate Check

Analysis

Debit Party

Processing

Debit Authorization

Credit/Debit Currency

conversion

Credit Party

Processing

IBAN Validation

MOP Selection and

Validation

PI-SN matching

Date Handling and

Cutoff

Decision

Advices calculation

Applying Fees

Posting Restriction

Balance Inquiry

Mandate/e-Mandate

Date Range

Verification

Delivery

Final Cut-off

Validation

Completion

Message Completion

Reports Generation

www.capgemini.com/payments

Capgeminis Financial Services testing practice has a

proven track record of delivering mid- to large-scale testing

engagements across banking, payments, insurance and capital

markets domains. Our global testing team is one of the largest

dedicated testing practices in the world and includes:

11,500 test professionals globally

Over 4,500 test professionals focused on Financial Services

More than 2,000 test professionals certified in ISTQB

Capgeminis Model Based

Testing Workbench is a proven,

proprietary solution that

includes testing assets, tools

and accelerators with a financial

services focus. Unlike most

testing solutions, our workbench

was created in partnership with

Capgemini clients including some

of the worlds largest financial

institutions to help solve their

real-world testing challenges. Our

solution is targeted to financial

services applications such as

Guidewire, Calypso, SWIFT and

VisionPLUS.

Govind Muthukrishnan

Vice President and Global

Financial Services Testing Leader

For more information, contact us at: payments@capgemini.com

or visit: www.capgemini.com/payments

About Capgemini

With more than 128,000 people in 44 countries, Capgemini is one of the

worlds foremost providers of consulting, technology and outsourcing

services. The Group reported 2012 global revenues of EUR 10.3 billion.

Together with its clients, Capgemini creates and delivers business and

technology solutions that fit their needs and drive the results they want.

A deeply multicultural organization, Capgemini has developed its own

way of working, the Collaborative Business Experience, and draws on

Rightshore, its worldwide delivery model.

www.capgemini.com

All products or company names mentioned in this document are trademarks or registered trademarks of their respective owners.

The information contained in this document is proprietary. 2013 Capgemini.

All rights reserved. Rightshore is a trademark belonging to Capgemini.

FS201308211013CS

Learn more about us at

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Introduction To Materials ManagementDocument50 pagesIntroduction To Materials ManagementrknanduriNo ratings yet

- MMS SyllabusDocument109 pagesMMS SyllabusVishal-Desai100% (1)

- Business PlanningDocument129 pagesBusiness PlanningAkash ShahNo ratings yet

- Taleb, Nassim - Fooled by RandomnessDocument110 pagesTaleb, Nassim - Fooled by RandomnessFAHIM MD. JALAL UDDIN100% (3)

- Introduction To Materials ManagementDocument50 pagesIntroduction To Materials ManagementrknanduriNo ratings yet

- A Case Study - Toyota Production SystemDocument58 pagesA Case Study - Toyota Production SystemKal_CNo ratings yet

- Pension PlansDocument95 pagesPension PlansKal_CNo ratings yet

- Business PlanningDocument129 pagesBusiness PlanningAkash ShahNo ratings yet

- The New Era of Expected Credit Loss ProvsioningDocument18 pagesThe New Era of Expected Credit Loss ProvsioningEmmanuelDasiNo ratings yet

- Gordon Gekko EffectDocument26 pagesGordon Gekko EffectKal_CNo ratings yet

- Bank - Capital Market NexusDocument14 pagesBank - Capital Market NexusKal_CNo ratings yet

- Big Data New Tricks For EconometricsDocument27 pagesBig Data New Tricks For EconometricsKal_CNo ratings yet

- Central Clearing and Risk TransformationDocument21 pagesCentral Clearing and Risk TransformationKal_CNo ratings yet

- Outline of FinanceDocument255 pagesOutline of FinanceKal_CNo ratings yet

- BAT Sample QuestionsDocument30 pagesBAT Sample QuestionsKunal ShahNo ratings yet

- Outline of EconomicsDocument63 pagesOutline of EconomicsKal_CNo ratings yet

- Economic Scenario of IndiaDocument8 pagesEconomic Scenario of IndiaKal_CNo ratings yet

- Factors Affecting The EconomyDocument7 pagesFactors Affecting The EconomyKal_CNo ratings yet

- How To Assemble A Desktop PCDocument90 pagesHow To Assemble A Desktop PC420100% (17)

- Assignment No 4Document12 pagesAssignment No 4Kal_CNo ratings yet

- AFM TheoryDocument18 pagesAFM TheoryKal_CNo ratings yet

- Basel 2 To Basel 3 - Proposed Changes and Required AmendmentsDocument24 pagesBasel 2 To Basel 3 - Proposed Changes and Required AmendmentsKal_CNo ratings yet

- 17Document12 pages17Chandan BugaliaNo ratings yet

- Mutual FundsDocument7 pagesMutual FundsKal_CNo ratings yet

- Commody Derivatives Sample Chapter - pdf-HLISDocument5 pagesCommody Derivatives Sample Chapter - pdf-HLISKal_CNo ratings yet

- The Equity Derivatives Market: The State of The Art: Susan Thomas Susant@igidr - Ac.in February 17, 2002Document28 pagesThe Equity Derivatives Market: The State of The Art: Susan Thomas Susant@igidr - Ac.in February 17, 2002Kal_CNo ratings yet

- Why Do Mergers FailDocument20 pagesWhy Do Mergers FailKal_C100% (2)

- Business Etiquette in BriefDocument4 pagesBusiness Etiquette in BriefdahmailboxNo ratings yet

- Mutual FundsDocument7 pagesMutual FundsKal_CNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Writers Craft LP - Day 1Document9 pagesWriters Craft LP - Day 1api-357297274No ratings yet

- HRM7503A - 2 Individual and Reflective LearningDocument20 pagesHRM7503A - 2 Individual and Reflective LearningHafsa YousufNo ratings yet

- Course 15 Final ExamDocument3 pagesCourse 15 Final ExamSebastian Jaramillo PiedrahitaNo ratings yet

- Rice Is NiceDocument3 pagesRice Is Niceammayi100No ratings yet

- Unit 5 Sports CoachingDocument12 pagesUnit 5 Sports CoachingCHR1555100% (1)

- Tally ERP9 by Dr.P.rizwan AhmedDocument8 pagesTally ERP9 by Dr.P.rizwan AhmedRizwan Ahmed100% (1)

- Pre Interview QuestionnaireDocument2 pagesPre Interview QuestionnaireVivek Ranjan MaitreyNo ratings yet

- Personal Factors Also Influence Buyer BehaviourDocument3 pagesPersonal Factors Also Influence Buyer BehaviourJessica Estolloso GoyagoyNo ratings yet

- Form 3 Booklist - 2021 - 2022Document3 pagesForm 3 Booklist - 2021 - 2022Shamena HoseinNo ratings yet

- English Language DR Amna Saeed (Autosaved)Document18 pagesEnglish Language DR Amna Saeed (Autosaved)Javeria KafeelNo ratings yet

- Penjajaran RPT Form 2 With PBDDocument6 pagesPenjajaran RPT Form 2 With PBDSEBASTIAN BACHNo ratings yet

- Lars2 AnswersDocument14 pagesLars2 Answersyusuf ceribasNo ratings yet

- Formative 1 - Ans KeyDocument47 pagesFormative 1 - Ans KeyDhine Dhine ArguellesNo ratings yet

- Ethnographic IDEODocument5 pagesEthnographic IDEORodrigo NajjarNo ratings yet

- Problems Facing Science Teachers in PublDocument12 pagesProblems Facing Science Teachers in PublEquity KonceptsNo ratings yet

- Department of Education: Summary Report of Quarterly Average For S.Y. 2021 - 2022Document2 pagesDepartment of Education: Summary Report of Quarterly Average For S.Y. 2021 - 2022NashaNo ratings yet

- Apbd 1203 Topic 4Document42 pagesApbd 1203 Topic 4Anonymous wsqFdcNo ratings yet

- A. A Naïve Method. Year Sales ForecastDocument7 pagesA. A Naïve Method. Year Sales ForecastCAMILLE CABICONo ratings yet

- Inoue TetsujiroDocument37 pagesInoue Tetsujirojeanettelunas.babasaNo ratings yet

- Literacy Progress Units: Spelling - Pupil BookletDocument24 pagesLiteracy Progress Units: Spelling - Pupil BookletMatt GrantNo ratings yet

- Net 4003 Course Outline 2014Document4 pagesNet 4003 Course Outline 2014Robert BarrettNo ratings yet

- Dentists - General Information Assessment - 34204Document2 pagesDentists - General Information Assessment - 34204Sivam NirosanNo ratings yet

- Rancangan Pengajaran Dan Pembelajaran Harian MingguDocument7 pagesRancangan Pengajaran Dan Pembelajaran Harian MingguSha MinNo ratings yet

- Perceived Effects of Lack of Textbooks To Grade 12Document10 pagesPerceived Effects of Lack of Textbooks To Grade 12Jessabel Rosas BersabaNo ratings yet

- Short Bond Paper. (8x5 40 PTS) : I. ESSAY: Answer The Following Questions Below. Write Your Answer On Separate Sheets ofDocument1 pageShort Bond Paper. (8x5 40 PTS) : I. ESSAY: Answer The Following Questions Below. Write Your Answer On Separate Sheets ofVence Nova Flores AbsinNo ratings yet

- Toast Master - MentoringDocument14 pagesToast Master - MentoringYogeeshwaran PonnuchamyNo ratings yet

- Mba Finance CourseworkDocument7 pagesMba Finance Courseworkbcrqs9hr100% (2)

- Owens,: Valesky, 260)Document2 pagesOwens,: Valesky, 260)dahrajahNo ratings yet

- 4th Grade Science Web ResourcesDocument3 pages4th Grade Science Web Resourcesapi-235707049No ratings yet

- The Moi Formula For Improper Algebraic-Exponential IntegralDocument5 pagesThe Moi Formula For Improper Algebraic-Exponential IntegralFrank Waabu O'Brien (Dr. Francis J. O'Brien Jr.)No ratings yet