Professional Documents

Culture Documents

Managerial Econometrics

Uploaded by

anon_660102059Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managerial Econometrics

Uploaded by

anon_660102059Copyright:

Available Formats

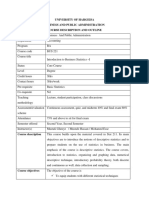

Managerial Econometrics (MM)

Elective for PGP and PGP (ABM)

Instructors: Sanket Mohapatra (SM) and Abhiman Das (AD)

Course Overview

Econometric applications have become an integral part of training in modern

economics and business management. Modern managers in a number of sectors are

increasingly incorporating econometric applications into their businesses to establish sound

economic strategies, to develop insight, create value, and outperform competition.

Econometric applications provide organisations with a potent set of tools to unlock the power

of information and in effective decision making. Therefore, it is imperative that management

students have basic grounding on Econometric analysis before handling real life problems.

In PGP 1, under Quantitative Methods (Part 1 and 2), students are introduced to the

basic concepts of probability and its applications, notions of sampling, point and interval

estimation, testing of hypotheses, analysis of variance, basic framework of regression, etc.

Building over this foundation, the main objective of the course is to introduce Econometrics

as a decision making tool purely from application point of view. Towards this, the course

aims at developing adequate understanding of regression methodology and showcases various

applications to real life problems. Beginning with the very nature of Econometrics and

economic data, we highlight some important real life problems upfront so as to ignite the

problem solving ability of young managers through Econometrics. Following two sessions

(Module 1) aim at recapitulating some of the basics concepts of regression from a more

applied context. Subsequent sessions take regression methodology forward by questioning

some of the fundamental assumptions, without going into the detailed technical stuff of

regression methodology. What happens when basic assumptions like linearity, homoscedastic

errors, causality, etc., are violated and what are the various tweaks to the data that enable us

to overcome such issues forms the crux of Modules 2 and 3. Again all these issues are

covered through various examples. The discussion in Modules 1 3 is typically restricted to

cross-sectional data and an introduction to regression is not complete without discussing time

series data in a greater detail. Time series data comes with additional issues like stationarity,

trend, seasonality, cyclicality, etc. Module 4 is aimed at providing greater understanding of

how to deal with such data. We conclude in Module 5 by discussing panel data where the

data is both cross-sectional as well as time series in nature.

In the process of teaching, we will introduce various data sets. The primary idea is to

understand the power of data analysis and to demonstrate some of the concepts which are

covered in the class. They will cover wide range of topics including finance, marketing,

politics, policy evaluation and HR. On top of that, we shall encourage students to come up

with examples of application of regression in areas of their interest. There is a software

component to this course. We will use Excel as well as more advanced statistical software

like STATA and EViews for the course. So students will have benefit to learn the basics of

STATA and EViews as well. Prerequisite for this course is the understanding of basic

statistics. However, the desire to learn a technical tool which is increasingly used in todays

world to address real life problems is essential.

Pedagogy Lectures, Econometric case studies discussions, project presentations

Managerial Econometrics (MM)

Elective for PGP and PGP (ABM)

Textbooks

The main textbook for the course is:

Introductory Econometrics - A Modern Approach, by Jeffrey Wooldridge, 5th Edition, 2015

(W).

Econometrics for Dummies, by Roberto Predace, June 2013 (P).

Other useful books:

Basic Econometrics, by Damodar Gujarati and Sangeetha, TMH, 2007 (DG)

Mostly Harmless Econometrics: An Empiricists Companion, by J. Angrist and J. Prischke,

Princeton University Press, 2009.

Additional readings:

Card, David and Alan Krueger (1994). Minimum Wages and Employment: A Case Study of

the Fast-Food Industry in New Jersey and Pennsylvania, American Economic Review, 84(4),

772-793.

Chintagunta, P. K., T. Erdem, P. Rossi, M. Wedel. (2006). Structural modeling in marketing:

Review and assessment. Marketing Science, 25(6) 604616.

Mazzeo, M. J. (2002). Product choice and oligopoly market structure. Rand Journal of

Economics, 33(2) 221242.

Duflo E. (2001). Schooling and Labor Market Consequences of School Construction in

Indonesia: Evidence from an Unusual Policy Experiment, American Economic Review,

91(4), 795-813.

Eissa, Nada and Jeffrey Liebman (1996). Labour Supply Response to the Earned Income

Tax Credit, Quarterly Journal of Economics, May, 1996

Lieberman, Marvin (1990). Exit from Declining Industries: Shakeout or Stakeout, Rand

Journal of Economics, Vol. 21, No. 4.

Iyer, Lakshmi (2010). Direct versus Indirect Colonial Rule in India: Long Term

Consequences, Review of Economics and Statistics, November.

Angrist, Joshua and Alan Krueger (1994). Why do World War II Veterans Earn More than

Non-Veterans? Journal of Labour Economics, January.

Levitt, Steven (1997). Using Electoral Cycles in Police Hiring to Estimate the Effects of

Police on Crime, American Economic Review, June.

Borenstein, Severin and Nancy Rose, Competition and Price Dispersion in the U.S. Airline

Industry, Journal of Political Economy, Vol. 102, No. 4

Managerial Econometrics (MM)

Elective for PGP and PGP (ABM)

Varian, H. and H. Choi (2011): Predicting the Present with Google Trends,

http://people.ischool.berkeley.edu/~hal/Papers/2011/ptp.pdf

Session Plan

Module 1: Introduction to Econometrics and Basic Linear Regression Methodology

Session 1:

Introduction: Nature of Econometrics and Economic Data (W, P)

What is Econometrics?

Goals of Econometric Analysis

Economic models and Econometric models

Variables: quantitative and qualitative

Various kinds of economic data sets

o Cross-sectional data

o Time series data

o Pooled cross-sectional data

o Panel/Longitudinal data

o Examples of various data

Introduction to the simple linear regression model

Practical applications in Econometrics

Readings: W (Chapter 1 and 2)

Sessions 2 and 3:

Classical multiple linear regression model

Sample vs. population estimates

Discussion of assumptions in a regression model

Ordinary least squares estimate

Degrees of freedom and hypothesis testing; standard errors

Goodness of fit R2, adjusted R2

Prediction and issues

In class exercise: Wage rate equation. Understanding a standard

software (STATA) output

Readings: W (Chapters 3 and 4 (sec. 4.1-4.4)

Additional readings: Borenstein and Rose (1994)

Sessions 4:

Further issues in classical linear regression model

Choice of functional form (logarithmic, quadratic)

Interaction terms in regression models

Testing general model restrictions

In class exercise: Pollution and housing prices

Readings: W (Chapters 4 (sec. 4.5-4.6) and 5)

Sessions 5 and 6:

Regression models with binary independent variables

Dummy variable regression: intercept and slope dummy

Dummy variables when there are more than two classifications

Managerial Econometrics (MM)

Elective for PGP and PGP (ABM)

Difference in difference estimation

In class exercise: wage rate vs. gender; municipal bonds

Readings: W (Chapter 7)

Additional readings: Eiss and Liebman (1996), Card and Krueger

(1994)

Module 2: Nonlinear regression methods

Sessions 7 and 8:

Limited dependent variable models

Basic Logit and Probit models

Multinomial logit/ probit models

Discrete choice models and application to marketing

Basics of nested logit model

Tobit regression models

In class exercise: GPA of a student, demand for cars

Readings: W (Chapter 17)

Additional readings: Lieberman (1990)

Module 3: Violation of basic assumptions of classical linear regression

Sessions 9 and 10:

Multicollinearity, heteroscedasticity and non-normality

Problems with multicollinearity, detection and some cures

Homoscedasticity vs. heteroscedasticity

Detection (BP test and White test)

Some common cures for heteroscedasticity

Issues of non-normality assumption

In class exercise: House price determinants, wage rate determinants

Readings: DG (Chapter 10), W (Chapter 8)

Sessions 11 and 12: Endogeneity, instrumental variables, simultaneous equations

Omitted variables and subsequent bias

Two way causality and issues

Demand supply paradigm and basic identification problem

Instrumental variable regression (2SLS)

Estimating structural equations

In class exercise: wage equation, crime vs. police force

Readings: W (Chapter 15)

Additional readings: Iyer (2010), Angrist and Krueger (1994) and

Levitt (1997)

Module 4: Time series regressions

Sessions 13 and 14:

Basic regression with time series data

Nature and scope of time series regressions

Classical assumptions and time series data

Managerial Econometrics (MM)

Elective for PGP and PGP (ABM)

Trends and seasonality

In class exercise: GDP growth rates vs. inflation in India

Readings: W (Chapter 10)

Session 15-16:

Further issues in time series data

Issues of stationarity and weakly dependent time series

Impact of these issues on estimates

Dynamically complete time series data

Differencing and time series regressions

Forecasting basic Box-Jenkins ARIMA modelling

Grangers causality

In class exercise: t-bill exercise

Readings: W (Chapter 11)

Sessions 17:

Serial correlation and heteroscedasticity

Problems with serial correlation

Testing and correcting for serial correlation

Heteroscedasticity in time series data and how to rectify the problem

In class exercise: unemployment in Puerto Rico, CAPM model

Readings: W (Chapter 12)

Module 5: Time series with cross-sectional data Basic Panel Data Models

Sessions 18-19:

Basic panel data regressions

Pooled cross-sectional data analysis

Simple fixed effects regression

Mean differencing regression

In class exercise: return to education

Readings: : W (Chapters 13 and 14)

Ten common mistakes in Applied Econometrics

Session 20:

Student project presentations

Evaluation

Class preparedness

Problem sets

Project

Final

10%

20%

30%

40%

There would be two problem sets, with equal weightage. Problem sets and projects can be

done in groups of three/four students (to be assigned by the instructors). For the project,

students are expected to identify a hypothesis, and formulate a regression model to test the

hypothesis and take it forward to interpret correctly the estimated regression coefficients.

You might also like

- Solution Manual For MicroeconometricsDocument785 pagesSolution Manual For MicroeconometricsSafis Hajjouz59% (22)

- Costing and Pricing SyllabusDocument3 pagesCosting and Pricing SyllabusMariya BhavesNo ratings yet

- Costing and Pricing SyllabusDocument3 pagesCosting and Pricing SyllabusMariya BhavesNo ratings yet

- NPV Scheduler: From Geological Model To Mine PlanDocument2 pagesNPV Scheduler: From Geological Model To Mine PlanEnrique Cruz CheccoNo ratings yet

- Introduction and The Simple Linear Regression ModelDocument35 pagesIntroduction and The Simple Linear Regression ModelNazmul H. PalashNo ratings yet

- Numerical Methods in Economics PDFDocument349 pagesNumerical Methods in Economics PDFHenry CisnerosNo ratings yet

- 708-Kaido Class NotesDocument6 pages708-Kaido Class Noteshimanshoo panwarNo ratings yet

- PML 2017 OutlineDocument6 pagesPML 2017 OutlineFotis KondNo ratings yet

- EC312 Course Outline 2015Document5 pagesEC312 Course Outline 2015Nibhrat LohiaNo ratings yet

- 895 Syllabus Fall 2012Document14 pages895 Syllabus Fall 2012bdole787No ratings yet

- Course Outline - Jan-June 2024 (Core Courses)Document14 pagesCourse Outline - Jan-June 2024 (Core Courses)ranuv8030No ratings yet

- ECON 413 - Applied MicroeconomicsDocument5 pagesECON 413 - Applied MicroeconomicsRhealyn InguitoNo ratings yet

- Syllabus Li 47757Document15 pagesSyllabus Li 47757Abhinav MauryaNo ratings yet

- Syllabus Applied MicroeconomicsDocument11 pagesSyllabus Applied Microeconomicstramnguyen.31221026352No ratings yet

- Lee2020 Article FinancialEconometricsMathematiDocument50 pagesLee2020 Article FinancialEconometricsMathematiHamish Stanley LouNo ratings yet

- Identification and Estimation of Causal Effects in Economics and Other Social SciencesDocument8 pagesIdentification and Estimation of Causal Effects in Economics and Other Social SciencesStanislao MaldonadoNo ratings yet

- Class XI Economics 2011Document159 pagesClass XI Economics 2011Ramita Udayashankar0% (1)

- Econ DC-1Document42 pagesEcon DC-1aleyaray1995No ratings yet

- M.A. Part I Semester I: Four Courses in Each of The Two Semesters For M.A in EconomicsDocument11 pagesM.A. Part I Semester I: Four Courses in Each of The Two Semesters For M.A in EconomicsHolly JohnsonNo ratings yet

- Dynamic Econ ProgrammeDocument2 pagesDynamic Econ Programmesimao_sabrosa7794No ratings yet

- Analysis and Evaluation of Public PoliciesDocument6 pagesAnalysis and Evaluation of Public PoliciesSikomo LewatNo ratings yet

- Experimental Economics SyllabusDocument11 pagesExperimental Economics SyllabusUttara AnanthakrishnanNo ratings yet

- Course Outline (Islamic Banking)Document3 pagesCourse Outline (Islamic Banking)Areej AslamNo ratings yet

- BT11803 Syllabus-MQA Format-Revised (SPE Standard)Document4 pagesBT11803 Syllabus-MQA Format-Revised (SPE Standard)Lala Thebunker'sNo ratings yet

- RI Mikroekonomi BIDocument9 pagesRI Mikroekonomi BImeenarojaNo ratings yet

- Econometrics CourseworkDocument7 pagesEconometrics Courseworkjlnggfajd100% (2)

- Recent Development in The Eco No Metrics of Program EvaluationDocument82 pagesRecent Development in The Eco No Metrics of Program Evaluation김태이No ratings yet

- BGPE Course Advanced Econometrics2 2017 SyllabusDocument3 pagesBGPE Course Advanced Econometrics2 2017 SyllabusDaniel SánchezNo ratings yet

- Financial Econometrics and Empirical Finance II: Professor Massimo Guidolin (With Prof. Carlo Favero)Document4 pagesFinancial Econometrics and Empirical Finance II: Professor Massimo Guidolin (With Prof. Carlo Favero)Diamante GomezNo ratings yet

- Statistical and Econometric Methods For Transportation Data AnalysisDocument2 pagesStatistical and Econometric Methods For Transportation Data AnalysisNurul HandayaniNo ratings yet

- MBA (Marketing Management) PDFDocument35 pagesMBA (Marketing Management) PDFNandha KumarNo ratings yet

- Methods for Applied Macroeconomic ResearchFrom EverandMethods for Applied Macroeconomic ResearchRating: 3.5 out of 5 stars3.5/5 (3)

- Mba (Ib)Document37 pagesMba (Ib)Divya SankrityaNo ratings yet

- ECN-720, 603 Econometric Theory Spring 2014 - OutlineDocument4 pagesECN-720, 603 Econometric Theory Spring 2014 - OutlineSumera BokhariNo ratings yet

- Course Syllabus: MBA 135 Managerial Economics 2 Credits Course DescriptionDocument3 pagesCourse Syllabus: MBA 135 Managerial Economics 2 Credits Course DescriptionMathew JoseNo ratings yet

- Economics Hindi XI 2011Document146 pagesEconomics Hindi XI 2011Ashish DiwakarNo ratings yet

- MBA (Financial Services)Document36 pagesMBA (Financial Services)Prajwal BhattNo ratings yet

- (Analisis Dan Polisi Ekonomi) : 54 66 Sub-Total 120 Hours TotalDocument3 pages(Analisis Dan Polisi Ekonomi) : 54 66 Sub-Total 120 Hours TotalAdib RedzaNo ratings yet

- Silabus Pengantar Ekonomi MikroDocument3 pagesSilabus Pengantar Ekonomi MikroSurya Adhi MNo ratings yet

- QM 1 Course Manual 1013Document40 pagesQM 1 Course Manual 1013williamhoangNo ratings yet

- Managerial Economics LOLP For PGDM 2013-15 by Pankaj KumarDocument4 pagesManagerial Economics LOLP For PGDM 2013-15 by Pankaj KumarRaja ßalaNo ratings yet

- Doku - Pub Quantitative Analysis For Management 13th Edition SolutionsDocument8 pagesDoku - Pub Quantitative Analysis For Management 13th Edition SolutionsKhayrul BasherNo ratings yet

- Machine Learning Methods in Finance: Recent Applications and ProspectsDocument81 pagesMachine Learning Methods in Finance: Recent Applications and ProspectsMilad Ebrahimi DastgerdiNo ratings yet

- SS 100-Economics Course Outline - EconomicsDocument6 pagesSS 100-Economics Course Outline - EconomicsSamama ZafarNo ratings yet

- MIT Joint Program On The Science and Policy of Global ChangeDocument50 pagesMIT Joint Program On The Science and Policy of Global ChangehumbertorcNo ratings yet

- Introduction To Engineering Statistics and Six SigmaDocument531 pagesIntroduction To Engineering Statistics and Six Sigmae-learning HLNo ratings yet

- Lecture Note On Basic Business Statistics - I Mustafe Jiheeye-1Document81 pagesLecture Note On Basic Business Statistics - I Mustafe Jiheeye-1Nagiib Haibe Ibrahim Awale 6107No ratings yet

- Department of Industrial Engineering: Prerequisite For Masters in Engineering ManagementDocument2 pagesDepartment of Industrial Engineering: Prerequisite For Masters in Engineering ManagementRashadafanehNo ratings yet

- Research Method WorkbookDocument86 pagesResearch Method WorkbookYameen Lazim AhmadNo ratings yet

- Ma Economics SyllabusDocument36 pagesMa Economics SyllabusParmit KourNo ratings yet

- Statistical Analysis For Social Science ResearchDocument7 pagesStatistical Analysis For Social Science ResearcharslanshaniNo ratings yet

- Eco No MetricsDocument6 pagesEco No MetricsSirElwoodNo ratings yet

- Eco 121Document6 pagesEco 121Sahil VermaNo ratings yet

- Literature Review EconometricsDocument5 pagesLiterature Review Econometricsafmaadalrefplh100% (1)

- Intro To Economics With Statistics (1st Edition)Document586 pagesIntro To Economics With Statistics (1st Edition)mjholianNo ratings yet

- Area: Operations Tem 1: Post-Graduate Diploma in Management (PGDM)Document6 pagesArea: Operations Tem 1: Post-Graduate Diploma in Management (PGDM)rakeshNo ratings yet

- Public Finance: Daeyong@phbs - Pku.edu - CNDocument6 pagesPublic Finance: Daeyong@phbs - Pku.edu - CNSprasadNo ratings yet

- DSGEDocument10 pagesDSGEsimbiroNo ratings yet

- Course Outline Mfs 7104 QT For FinanceDocument2 pagesCourse Outline Mfs 7104 QT For FinanceDavid KNo ratings yet

- Management Statistics: A Provisional Research Programme For Workpackage 7 of The Pro-ENBIS Thematic NetworkDocument10 pagesManagement Statistics: A Provisional Research Programme For Workpackage 7 of The Pro-ENBIS Thematic NetworkreemarrNo ratings yet

- MBA-Executive (Working Professionals) : Syllabus - First SemesterDocument10 pagesMBA-Executive (Working Professionals) : Syllabus - First SemesterRachnaNo ratings yet

- Farmer, J. D., & Foley, D. (2009) - The Economy Needs Agent-Based Modelling. Nature, 460 (7256), 685-686.Document2 pagesFarmer, J. D., & Foley, D. (2009) - The Economy Needs Agent-Based Modelling. Nature, 460 (7256), 685-686.lcr89No ratings yet

- ACFrOgD-4M1vDNC6XVEVNPe3JcUCSXK2K7z1wX JTUj2rytquTiYXVeA6tDvmlDjnXn8XCFc Msy-kg8q4AMZ7wSi3l6Qp5yaMfG-q9gNKBmLd0lP Ce1AHNikECnKkDocument52 pagesACFrOgD-4M1vDNC6XVEVNPe3JcUCSXK2K7z1wX JTUj2rytquTiYXVeA6tDvmlDjnXn8XCFc Msy-kg8q4AMZ7wSi3l6Qp5yaMfG-q9gNKBmLd0lP Ce1AHNikECnKkMohiminul KhanNo ratings yet

- Model Thinking PDFDocument1 pageModel Thinking PDFArthur ChewNo ratings yet

- Conspicuous Consumption-A Literature ReviewDocument15 pagesConspicuous Consumption-A Literature Reviewlieu_hyacinthNo ratings yet

- Chap.01.Science of Macroeconomics - GMDocument26 pagesChap.01.Science of Macroeconomics - GMSallyan DonnyNo ratings yet

- Principles of MicroeconomicsDocument442 pagesPrinciples of Microeconomicsshudhai jobe100% (5)

- Shareholder and Stakeholder Theory - After The Financial Crisis-1Document13 pagesShareholder and Stakeholder Theory - After The Financial Crisis-1Mohammed Elassad Elshazali100% (1)

- Economic Model vs. Economic TheoryDocument10 pagesEconomic Model vs. Economic TheoryAcbel RnucoNo ratings yet

- Chap 02Document12 pagesChap 02Nguyễn Quỳnh TrâmNo ratings yet

- Media and The Representation of OthersDocument18 pagesMedia and The Representation of Othersapi-58165914No ratings yet

- Developmental Economics PDFDocument39 pagesDevelopmental Economics PDFعمربٹNo ratings yet

- Econ Notes Econ 306Document3 pagesEcon Notes Econ 306Chandler SchleifsNo ratings yet

- Ch01 Introduction To EconomicsDocument44 pagesCh01 Introduction To EconomicsSarah A. HassanNo ratings yet

- (Poznañ Studies in the Philosophy of the Sciences and the Humanities 86) Martin R. Jones (Ed.), Nancy Cartwright (Ed.)-Idealization XII_ Correcting the Model_ Idealization and Abstraction in the ScienDocument305 pages(Poznañ Studies in the Philosophy of the Sciences and the Humanities 86) Martin R. Jones (Ed.), Nancy Cartwright (Ed.)-Idealization XII_ Correcting the Model_ Idealization and Abstraction in the Scienperception888No ratings yet

- Paul Romer's Assault On "Post-Real" Macroeconomics: Lars Pålsson SyllDocument12 pagesPaul Romer's Assault On "Post-Real" Macroeconomics: Lars Pålsson SyllscientometricsNo ratings yet

- D'Agata Et Al 2016 MetroeconomicaDocument25 pagesD'Agata Et Al 2016 MetroeconomicaAnonymous uQDdWutkNo ratings yet

- Chapter 2 MicroeconomicsDocument23 pagesChapter 2 Microeconomicsqvq8zvz784No ratings yet

- Topic 2-Basic Concepts of MacroeconomicsDocument9 pagesTopic 2-Basic Concepts of Macroeconomicsreuben kawongaNo ratings yet

- NUS GraduateModulesOutlineDocument19 pagesNUS GraduateModulesOutlinePua Suan Jin RobinNo ratings yet

- The Keynes Solution The Path To Global Economic Prosperity Via A Serious Monetary Theory Paul Davidson 2009Document23 pagesThe Keynes Solution The Path To Global Economic Prosperity Via A Serious Monetary Theory Paul Davidson 2009Edward MartinezNo ratings yet

- Chari Boru Bariso's Econ GuidsesDocument190 pagesChari Boru Bariso's Econ GuidsesSabboona Gujii GirjaaNo ratings yet

- Applied Economics Week 1Document10 pagesApplied Economics Week 1Asnairah Mala DaraganganNo ratings yet

- Effectiveness of Entrepreneurship Education in Developing Entrepr PDFDocument323 pagesEffectiveness of Entrepreneurship Education in Developing Entrepr PDFSmart B Connect0% (1)

- The York Pedagogy: What and Why, How and WhyDocument16 pagesThe York Pedagogy: What and Why, How and Whyyorkforum100% (1)

- Rajiv DandotiyaDocument160 pagesRajiv DandotiyaSuperunknow DesconocidoNo ratings yet

- Macro SummmaryDocument116 pagesMacro SummmaryJeevikaGoyalNo ratings yet

- 2016 Human Smart Cities BAGUSDocument263 pages2016 Human Smart Cities BAGUSshrikalaniNo ratings yet

- 1.0 Introduction To EconomicsDocument45 pages1.0 Introduction To EconomicsaygaikwadNo ratings yet