Professional Documents

Culture Documents

A Study of Working Capital Management in Small Scale Industries

Uploaded by

IAEME PublicationOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study of Working Capital Management in Small Scale Industries

Uploaded by

IAEME PublicationCopyright:

Available Formats

International Journal of Management (IJM)

Volume 7, Issue 3, March-April 2016, pp.266278, Article ID: IJM_07_03_025

Available online at

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=7&IType=3

Journal Impact Factor (2016): 8.1920 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

IAEME Publication

A STUDY OF WORKING CAPITAL

MANAGEMENT IN SMALL SCALE

INDUSTRIES

Dr. Pavan Mishra

Professor, Department of Commerce BU, Bhopal (M.P) India

Dr. Soniya Rajpoot

Assistant Professor, MBA Department SATI Vidisha (M.P) India

Neeti Sharma

Asst.Professor CRIM Barkatullah university Bhopal

ABSTRACT

Industrialization brings about social and economic changes that are

essentially important for sustainable survival and development of human

society in background of continuously increasing population size, shrinking

agricultural lands, inadequacy of various natural resources and

unemployment. Industrialization also leads to protection and development of

agrarian society being the backbone of our country . To study the working

capital management small scale industries.

Key words: Importance of Working Capital, Growth of Current Assets

Structure of working Capital, Effectiveness of Working Capital

Cite this Article: Dr. Pavan Mishra, Dr. Soniya Rajpoot and Neeti Sharma. A

study of Working Capital Management in Small scale. International Journal

of Management, 7(2), 2016, pp. 266278.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=7&IType=3

1. INTRODUCTION

The role played by small business in the economic activity of Indian history since

practically the beginning of the recorded time is significant. Out of the limited

resources of information available, the first ever known piece of writing on small

business, reflecting how banks would lend money at interest, appeared some more

than 4000 years ago. Since then, small businessmen have given countless hours in the

creation of products and services to benefit the consumer and society.

http://www.iaeme.com/IJM/index.asp

266

editor@iaeme.com

A study of Working Capital Management in Small scale

1.1. Small Scale Industries in Retrospect

The small-scale industrial sector, during the last 50 years, has made phenomenal

progress in diverse activities despite the zooming mortality rate. It is contributing

most to the Indian economy in the form of employment, contribution to national

domestic product, foreign exchange earning etc. As on March 1995, the number of

small-scale units in the country stood at 19 Lacs in the organized sector,

manufacturing about 7500 items, some of them based on local crafts, skills and raw

materials, while others were employing sophisticated technologies and turning out

products that compete even in the international markets. The total employment in the

sector is over 437 Lacs persons as in 1990-91. With regard to employment, it stands

next to the agricultural sector, which is the biggest employer in the economy.

1.2. Small Scale Industries in Post Independence Era

After independence, several entrepreneurship development programs had been started

to develop the skill, knowledge, and competence among the entrepreneur. In spite of

various entrepreneurship development programmes launched by the Govt. and nongovernment agencies, the entrepreneurs are encountering a number of problems for

establishing economically viable small-scale industries like lack of physical facilities

like, communication, transport and storage, lack of quality control measures,

selection of products, non-availability of right type of raw material, lack of

managerial competence, poor linkage with marketing bodies, lack of trained workers,

low scale of production, improper communication with other developmental agencies.

Long and complicated procedures to avail institutional help, lack of Govt. support and

incentives, lack of sufficient finance and working capital and problems in procuring

finance as well as loan from different agencies (Shehrawat, 2006).

2. LITERATURE REVIEW

Decisions relating to working capital and short term financing are referred to as

working capital management. These involve managing the relationship between a

firm's short-term assets and its short-term liabilities. The goal of working capital

management is to ensure that the firm is able to continue its operations and that it has

sufficient cash flow to satisfy both maturing short-term debt and upcoming

operational expenses (Chawla, 1987).

Moreover, working capital is the money used to make goods and attract sales. The

less working capital used to attract sales, the higher is likely to be the return on

investment. working capital management is about the commercial and financial

aspects of Inventory, credit, purchasing, marketing, and royalty and investment

policy. The higher the profit margin, the lower is likely to be the level of working

capital tied up in creating and selling titles (Hampton, 1983).

Working capital management ensures a company has sufficient cash flow in order

to meet its short-term debt obligations and operating expenses implementing an

effective working capital management system is an excellent way for many

companies to improve their earnings. The two main aspects of working capital

management are ratio analysis and management of individual components of working

capital. A few key performance ratios of a working capital management system are

the working capital ratio, inventory turnover and the collection ratio. Ratio analysis

will lead management to identify areas of focus such as inventory management, cash

management, accounts receivable and payable management (Smith, 1975; Gitman,

1976).

http://www.iaeme.com/IJM/index.asp

267

editor@iaeme.com

Dr. Pavan Mishra, Dr. Soniya Rajpoot and Neeti Sharma

Working capital management assumes greater significance in Small Scale

Industrial (SSI) Units as most of these have weak financial base and limited

accessibility to financial markets. In fact, efficient working capital management

decides the success or otherwise of a unit. The working capital practices in smallscale industries are more owners centric than professionally managed (Reddy and

Reddy, 2007)

As working capital refers to the mix of sources from which the long term funds

required in business are raised. In addition to own capital, 'bank loan' is the most

prominent source of working capital among the SSI units. The other important

sources being 'trade credit' and 'friends and relatives'. 'Indigenous banking sector' is

found to be more popular among the older units of partnership form of organization

with lower investment in plant and machinery (Chandra, 2002).

An idea of the importance of working capital can be had from the fact that the

management of current assets and current liabilities occupies the largest portion of a

financial manager's time. It is reliably estimated that the finance manager spends

between 80% and 90% of his time in day-to-day financial decisions involving short

term assets and liabilities. Although current assets vary from industry to industry, they

constitute between 50% and 60% of the total assets of manufacturing concerns

(Jones, 1978).Working capital management is particularly very important for small

firms to manage their current assets and current liabilities very carefully. A small firm

may not have much investment in fixed assets and it can minimize its investment in

fixed assets by renting or leasing plant and machinery , but there is no way it can

avoid an investment in current assets such as cash, accounts receivables and

inventories. Therefore, current assets are particularly significant for the financial

management of small firms.

Various studies on SSI in India have revealed either the inadequacy of working

capital or the inefficient management of working capital among the units of SSI

(NCAER, 1972; Sandesara,1982; Biswal and Acharya, 1987; Kulshreshta and

Jha, 1990; Prasad and Eresi, 1990; Balu, 1991; Manickavel, 1997; Kumar, 1999).

Small companies focus only on areas of working capital management where they

expect to improve marginal returns. A study in North England revealed that the

firms which claimed to use the more sophisticated discounted cash flow capital

budgeting techniques, or which had been active in terms of reducing stock levels or

the debtors' credit period, on average tended to be more active in respect of working

capital management practices (Peel and Wilson, 1996).

3. RESEARCH METHODOLOGY

3.1. Study Site

The present study was carried out in Vidisha district that occupies the central part of

Madhya Pradesh. Vidisha is an ancient city that historically belongs to Ashoka, the

Great. The geographical area of the District is 7371 Sq Kms. It is situated at 2320

and 2422 North latitudes and 7716 and 7818 East longitudes (Fig.1). The tropic

of cancer runs through its southern part. District Guna/Ashok Nagar in the North,

Sagar in the East, Raisen in the South and Bhopal in the West surround the district.

River Betwa is its main river, which flows through Vidisha, Basoda and Kurwai

blocks from south to north, along with its tributaries making the land fertile. River

Sindh in Lateri and River Bina in Kurwai block have small valleys of fertile land.

http://www.iaeme.com/IJM/index.asp

268

editor@iaeme.com

A study of Working Capital Management in Small scale

3.2. Objectives

To study the working capital management and finance in respect of small scale

industries.

3.3. Sampling

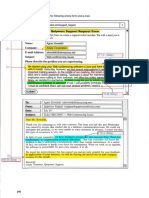

The coverage refers to the units covered and the locations of their operations. An

accurate census of the universe is the most essential requirement for satisfactory

sample enquiry. The record of SSI units maintained by DIC is based on registration of

the units in operation in Vidisha district. Most of the small industrial units are found

to be operational without registration as registration of SSI is only optional.

Appropriate information could not be obtained about the total number of such units

and their locations, hence the study remains confined mainly to those small scale

industrial units which are registered under District Industries Centre (DIC).

A sample size of 32 units was 50% of the total 64 functional units of the study

area, since 18 units are reported closed their activities. The sample units selected out

of the total appearing in the list of DIC of the district were functional for more than 5

years at the time of present investigation. The homogeneous groups and numbers of

small scale industries existing and chosen for the study are listed as under in table 1.

Table 1 Industry groups, numbers of existing and sample units in Vidisha

Sl.

No.

1.

2.

3.

4.

5.

6.

7.

8.

Industry group

Fertilizer & Pesticide

Agriculture Implements mfg, fabrication & Service

unit

Food Grain, Dal Processing & Warehousing

HDP bags

Tyre Retarding / Remolding

Re-refining of used oil

RCC Pipe

Craft paper & Others

Total No. of Units

No. of

Units

14

15

No. of

Sample units

7

7

10

05

03

03

01

13

64

5

3

2

2

1

5

32

3.4. Data Analysis

Analysis of Working capital management short term financial position was carried out

for financial analysis of different categories of SSI units working in the district

Vidisha of Madhya Pradesh chosen for the present study. A total of 32 SSI units as

samples under 8 categories were investigated for their financial performance.

4. RESULTS AND DISCUSSION

The short-term creditors of a company like suppliers of goods on credit and

commercial banks providing short-term loans, are primarily interested in knowing the

company's ability to meet its current or short-term obligations as and when these

become due. The short-term obligations of a firm can be met only when there are

sufficient liquid assets. Therefore, a firm must ensure that it does not suffer from lack

of liquidity or the capacity to pay its current obligations. If a firm fails to meet such

current obligations due to lack of good liquidity position, its goodwill in the market is

likely to be affected beyond repair. It will result in a loss of creditor's confidence in

the firm and may cause even closure of the firm. Even a very high degree of liquidity

http://www.iaeme.com/IJM/index.asp

269

editor@iaeme.com

Dr. Pavan Mishra, Dr. Soniya Rajpoot and Neeti Sharma

is not good for a firm because such a situation represents unnecessarily excessive

funds of the firm being tied-up in current assets. Therefore, it is very important to

have a proper balance in regard to the liquidity of the firm. Two types of ratios can be

calculated for measuring short-term financial position or short-term solvency of a

firm.

Table 1 depicts Current Ratio of various industries for consecutive three years.

The ratio is expected to be 1:1 by which it can be safely said that the industrial unit is

able to meet its current liabilities out of current assets. In this circumstances the

margin of safty become almost nil. However lenders generally consider 2:1 to be a

optimum current ratio. This provides a 100 percent safety margin and even if half of

the current assets are realized into cash, current obligations will be fully met. This

logic is based on the principle conservation. It is assumed that all current obligations

have to meet immediately. The current ratio of a company shows the ability to pay

short term creditors from current Assets. It represents the margin of safety, higher the

ratio higher is the margin of safety. But it is not always true higher ratios sometime

indicate the unnecessarily blockage of funds in unrealizable current assets. Thus ratio

2:1 is considered satisfactory.

Table 1 Current Ratio of various industries for consecutive three years

Category of Industry

Year

Fertilizer &

Pesticide

(A)

Agriculture

Implements mfg

fabrication &

Service unit

(B)

Food Grain Dal

Processing &

Warehousing

(C)

HDP bags

(D)

Tyre

Retarding /

Remolding

(E)

Re-refining

of used oil

(F)

RCC

Pipe

(G)

Craft

paper

& Others

(H)

1.57

1.22

1.26

3.72

1.78

1.42

1.82

1.80

II

1.38

1.18

1.30

3.75

2.14

1.78

1.82

1.35

III

1.29

1.30

1.39

1.11

2.35

1.78

1.00

1.28

This ratio indicates the short term financial position of the company. It judges

whether current assets are sufficient to meet the current liabilities. The company must

be able to meet its current obligation out of the current assets. It should not depend

upon its long term sources to pay its short term liabilities. This is expressed as the

current assets divided by the current liabilities. Current assets are those assets which

are convertible into cash with in a year. The current ratios for all three years in

category A belonging to Fertilizer & Pesticide industries are not up to the optimum

level. There is a declining trend of the ratio. The ratios for other categories obtained

for individual units have also shown more or less similar trends. This will require

strict financial discipline.

On the other hand, category B belonging to Agriculture Implements mfg

fabrication & Service units have shown the similar declining trend for first two years

and started showing improvement in third year but which is below the expected level

of 2:1, in the third year. The category C belonging to Food Grain Dal Processing &

Warehousing industry is showing a gradual improvement in its current ratio in the last

three consecutive years but below the optimum level. The category D belonging to

HDP bags industries have show a higher ratio as compared to optimum level of 2:1 in

first two consecutive years which indicate misappropriate increase in current assets as

http://www.iaeme.com/IJM/index.asp

270

editor@iaeme.com

A study of Working Capital Management in Small scale

compared to currant liabilities the ratio declined drastically in the third year due to

higher level of liabilities, the reason behind is need to be carefully examined and

appropriate management measures required to be taken for improvement of the ratio.

The category E belonging to Tyre Retarding / remolding industries have shown

consistently improving satisfactory ratio. The individual units in majority are also

performing well in this group. Whereas, category F belonging to Re-refining of

used oil industries below the desired level of 2:1 in the first year but current ratioin

subsequent two years it is showing positive trend near to the optimum level. The

category G belonging to RCC Pipe industries performed near to the expected level

of 2:1 in first two years but in third year it was just 1:1 with no margin of safety .This

was due to reduction in the amount of business of the product of this category in

Vidisha district .

The category H belonging to Craft paper & Others industries the ratio was just

near to the satisfactory level in the first year in the next two subsequent years IInd &

III rd year the performance has declined to 1.35 and 1.28 respectively. It indicates that

the margin of safety is gradually reducing in this industry. This category of industry is

a labour oriented one which generates employment to the maximum extent .In the

recent past years the cost of raw material and labour has also increased substantially.

This factor also affected the cost of production and product cost. As a result of which

the items related to the current ratio have also effected badly. Now the units have to

concentrate on efforts for improvement of current ratio in the following years.

Table 2 Quick Ratio of various industries for consecutive three years

Category of Industry

Year

Fertilizer &

Pesticide

(A)

Agriculture

Implements

mfg fabrication

& Service unit

(B)

Food Grain Dal

Processing &

Warehousing

(c)

HDP bags

(D)

Tyre

Retarding /

Remolding

(E)

Re-refining of

used oil

(F)

RCC Pipe

(G)

Craft

paper &

Others

(H)

0.91

0.49

0.74

0.44

0.05

0.28

1.37

0.72

II

0.63

0.40

0.68

0.32

0.02

0.35

1.37

0.67

III

0.62

0.46

0.81

0.22

0.29

0.26

0.71

0.62

Table 2 depicts Quick Ratio of various industries for consecutive three years.

Quick ratio involves only those current assets, which liquidate immediately, ratio of

1:1 is ideal but 0.7 to 1 is considered satisfactory. This indicates the extent to which

current liabilities can be paid without relying on the sale of inventory. Quick ratio is

also known as acid test ratio or liquid ratio, quick ratio is the ready means of assessing

a firms liquidity position in the real sense. It shows very short term liquidity or

capacity of the business to meet its obligation at short notice. Liquid assets are current

assets less stock and prepaid expenses. These assets are called liquid because they can

be converted into cash very shortly. It is expressed as the liquid assets divided by the

current liabilities. Quick ratio assess the ability of the business to meet the current

liabilities without having wait for the manufacturing cycle to be completed and safe to

take place for inflow of cash.

The quick ratio in category A belonging to Fertilizer & Pesticide industries

were satisfactory in first year as compared to second and third year. The liquidity

position of the SSI units of this category had declined in the following two financial

years. The group of this industry needs to revise the policies so as to reach the desired

http://www.iaeme.com/IJM/index.asp

271

editor@iaeme.com

Dr. Pavan Mishra, Dr. Soniya Rajpoot and Neeti Sharma

state of 1:1 by investing the appropriate amount in marketable security in different

forms. It is reasonable to say that most small scale industries in the region dominated

by agrarian rural society who suffer from shortage of funds and therefore, of the

become reason for slow business cycle. Category B belonging to Agriculture

Implements mfg fabrication & Service unit has not reached to the desired level for all

the three years. This appears unseasonable since the region being dominated by the

agrarian society. It is therefore expected that the industrys performance as a whole

should be up to the extent of desired level however it is also observed from the

performance of individual unit in the industry that the same is also for below the

optimum level the reason for this need further investigation. Category C belonging

Food Grain Dal Processing & Warehousing industries has shown satisfactory quick

ratio for all the three years whereas in category D the quick ratio is unsatisfactory.

The declining trend of the ratio has been observed in this industry in all the category

in general. The ratios obtained for individual units have also shown more or less

similar trends.

In category E belonging to Tyre Retarding / Remolding is far below the desired

level, need careful examination of reason behind it. category F belonging to Rerefining of used oil have shown lesser

quick ratios which require taking of

corrective steps in strict financial discipline whereas category G belonging to RCC

Pipe industries has shown satisfactory quick ratios. In category H belonging to Craft

paper & others industries the quick ratios of first year is satisfactory but the following

two years it is gradually showing a downword trend. The causes of which required to

be ascertained and recitation financial steps needed to be taken for its improvement.

Table 3 Working Capital Turnover Ratio of various industries for consecutive three years

Category of Industry

Year

Fertilizer &

Pesticide

Agriculture

Implements

mfg

fabrication &

Service unit

3.24

4.31

16.25

0.11

5.20

3.52

8.34

2.06

II

2.79

6.83

15.13

0.09

4.23

2.55

7.59

4.53

III

3.81

4.79

9.27

0.37

3.74

2.65

534.16

4.68

Food Grain Dal

Processing &

Warehousing

HDP

bags

Tyre

Retarding /

Remolding

Rerefining

of used oil

RCC

Pipe

Craft

paper &

Others

Table 3 Show the Working capital Turnover ratios which employed to evaluate the efficiency

with which the firm manages and utilizes its assets. They indicate the speed with which assets

are converted into sales. A measure of the number of times a companys inventory is replaced

during a given period. Turnover ratio is calculated as cost of goods sold/ turnover divided by

average inventory / working capital during the time period. A high turnover ratio is a sign that

the company is producing and selling its goods or services very quickly.

This ratio tells how often a business inventory turnover during the course of the

year. Because inventories are the least liquid form of assets, a high inventory turnover

ratio is generally positive. On the other hand, an unusually high ratio compared to the

average for the industry could means a business is losing sales because of in adequate

stock on hand. The turnover ratios in category A belonging to

Fertilizer &

Pesticide industries were apparently looking not satisfactory. The some situation may

reflect in almost all other categories B,C,E,F of we analyze the trend .

http://www.iaeme.com/IJM/index.asp

272

editor@iaeme.com

A study of Working Capital Management in Small scale

We see a common fact that there industries are mostly argobased and being the

agrobased industry there sales are of seasonal nature. Since Vidisha district is having

a limited irrigation facilities and is having a single cropping pattern, the speed with

which the assets are converted in to sale, is either slow or moderate. We can therefore

safely consider these ratios as acceptable except in category D. The ratios for

category D belonging to HDP bags industries are very poor in all the three years and

show the gradual decrease in sales. Category G belonging to RCC Pipe industries

indicate satisfactory ratios in first and second year but in third year the ratio obtained

was quit unrealistic and high. Category H belonging to Craft paper & others

industries the ratio is low in the first year whereas in subsequent years the ratio noted

improvement to the satisfactory levels.

We see a common fact that there industries are mostly argobased and being the

agrobased industry there sales are of seasonal nature. Since Vidisha district is having

a limited irrigation facilities and is having a single cropping pattern, the speed with

which the assets are converted in to sale, is either slow or moderate. We can therefore

safely consider these ratios as acceptable except in category D. The ratios for

category D belonging to HDP bags industries are very poor in all the three years and

show the gradual decrease in sales. Category G belonging to RCC Pipe industries

indicate satisfactory ratios in first and second year but in third year the ratio obtained

was quit unrealistic and high. Category H belonging to Craft paper & others

industries the ratio is low in the first year whereas in subsequent years the ratio noted

improvement to the satisfactory levels.

Table 4 Inventory turnover Ratio of various industries for consecutive three years

Category of Industry

Year

Fertilizer &

Pesticide

Agriculture

Implements

mfg

fabrication &

Service unit

Food Grain Dal

Processing &

Warehousing

HDP

bags

Tyre

Retarding /

Remolding

Rerefining

of used oil

RCC

Pipe

Craft

paper &

Others

2.04

1.52

9.06

0.06

2.13

1.34

18.38

1.67

II

1.45

1.74

7.48

0.05

2.45

1.56

7.25

2.25

III

1.86

1.75

5.92

0.08

2.57

1.44

8.73

2.21

Table 4 depicts Inventory Turnover Ratio that shows the efficiency of the firm in

selling the product. It indicates the speed with which the stock is rotated into sales or

the number of times the stock is turn into sales during the year. The higher the ratio,

the better it is, since it indicates that stock is selling quickly. In a business where stock

turnover ratio is high goods can be sold at a long margin of profit and even then the

profitability may be quite high.

This ratio indicates the efficiency of the firm in selling its product, i.e. it indicates

the number of times the inventory has been given the shape of final sales during the

year. It is calculated by dividing the cost of goods by the average inventory. The

turnover ratios of category C belonging to Food Grain Dal Processing &

Warehousing industries and category G belonging RCC Pipe industries were found

to be satisfactory. Ratios in other categories are low

http://www.iaeme.com/IJM/index.asp

273

editor@iaeme.com

Dr. Pavan Mishra, Dr. Soniya Rajpoot and Neeti Sharma

Table 5 Debtors Turnover Ratio of various industries for consecutive three year

Year

Fertilize

r&

Pesticid

e

Agriculture

Implements mfg

fabrication &

Service unit

Food Grain Dal

Processing &

Warehousing

HDP bags

2.66

3.23

7.19

1.82

II

2.08

4.67

9.80

1.80

III

2.13

5.21

6.62

2.98

Tyre

Retarding

/

Remolding

Nil

Nil

Nil

Re-refining

of used oil

RCC Pipe

Craft paper

& Others

7.77

Nil

3.52

9.81

Nil

3.69

12.93

5.95

3.29

Table 5 depicts Debtors Turnover Ratio measures the number of times accounts

receivable was collected during the year. This is also a measure of how well the

company collects sales on credit from its customers, just as average collection period

measures this in days.

This ratio is calculated by dividing sales by average debtors. A high debtor

turnover ratio indicates a tight credit policy. Showing the company is successfully

executing its credit policies and quickly turning its accounts receivables into cash.

A low or declining debtor turnover ratio indicates a collection problem, part of

which may be due to bad debts. A possible negative aspect to an increasing accounts

receivable turnover is the company may be too strict in its credit policies and missing

out on potential sales.

Category A belonging to Fertilizer & Pesticide industries, category B

belonging Agriculture Implements mfg fabrication & Service unit industries, category

C Food Grain Dal Processing & Warehousing industries, category F belonging Rerefining of used oil industries and category H belonging to Craft paper & Others

industries have shown that the credit policy of the SSI units of industries belonging to

these categories are satisfactory whereas, the category E belonging to Tyre

Retarding / Remolding industries indicated lack of credit attitude. Category F

belonging to RCC Pipe industries demonstrated lack of credit attitude in first and

second year whereas in the third year, the ratio was noted to be satisfactory.

Table 6 Creditors turnover Ratio of various industries for consecutive three years

Category of Industry

HDP

bags

Tyre

Retarding

/

Remoldin

g

Re-refining of

used oil

RCC Pipe

Craft

paper &

Others

Year

Fertilizer &

Pesticide

Agriculture

Implements mfg

fabrication &

Service unit

1.84

1.44

6.14

0.81

6.07

14.47

8.97

3.63

II

1.36

1.94

14.85

0.94

8.94

16.13

7.01

2.38

III

1.41

2.19

10.00

0.85

8.18

11.92

116.15

1.98

Food Grain Dal

Processing &

Warehousing

http://www.iaeme.com/IJM/index.asp

274

editor@iaeme.com

A study of Working Capital Management in Small scale

Table 6 depicts Creditors turnover ratio of net credit purchases to average trade

creditors. It is also known as payables turnover ratio. It is on the pattern of debtors

turnover ratio. It indicates the speed with which the payments are made to the trade

creditors. It establishes relationship between net credit annual purchases and average

accounts payables. Accounts payables include trade creditors and bills payables.

Average means opening plus closing balance divided by two. In this case also

accounts payables' figure should be considered at gross value i.e. before deducting

provision for discount on creditors (if any).

Shorter average payment period or higher payable turnover ratio may indicate less

period of credit enjoyed by the business or business credit rating among suppliers is

not good and therefore they do not allow reasonable period of credit. Category A, B

and H have shown that their credit rating among suppliers were not good whereas

category D indicated better liquidity position leading to better credit standing in the

market. Categories C, E, F and G have also shown satisfactory credit turnover ratio.

5. CONCLUSION

Fertilizer & Pesticide, Food Grain, Dal Processing, Tyre Retarding / Remolding, Rerefining of used oil, RCC Pipe, Craft paper & Others are Optimum level. But

Agriculture Implements mfg , fabrication & Service unit, and ,HDP bags firm fails to

meet such current obligations due to lack of good liquidity position, its goodwill in

the market is likely to be affected beyond repair. It will result in a loss of creditor's

confidence in the firm and may cause even closure of the firm. Even a very high

degree of liquidity is not good for a firm because such a situation represents

unnecessarily excessive funds of the firm being tied-up in current assets. Therefore, it

is very important to have a proper balance in regard to the liquidity of the firm. Two

types of ratios calculated for measuring short-term financial position or short-term

solvency of a firm. Liquidity refers to the ability of a concern to meet its current

obligations as and when these become due.

The short-term obligations are met by realising amounts from current, floating or

circulating assets. The current assets should either be liquid or near liquidity. These

should be convertible into cash for paying obligations of short-term nature. The

sufficiency or insufficiency of current assets should be assessed by comparing them

with short-term (current) liabilities. If current assets can pay off current liabilities,

then liquidity position will be satisfactory. On the other hand, if current liabilities may

not be easily met out of current assets then liquidity position will be bad. The bankers,

suppliers of goods and other short-term creditors are interested in the liquidity of the

concern. Funds are invested in various assets in business to make sales and earn

profits. The efficiency with which assets are managed directly affect the volume of

sales. The better the management of assets, the larger is the amount of sales and the

profits. Activity ratios measure the efficiency or effectiveness with which a firm

manages its resources or assets. These ratios are also called turnover ratios because

they indicate the speed with which assets are converted or turned over into sales. For

example, inventory turnover ratio indicates the rate at which the funds invested in

inventories are converted into sale. Depending upon the purpose, a number of

turnover ratios can be calculated, as debtors turnover, stock turnover, capital turnover,

etc.

http://www.iaeme.com/IJM/index.asp

275

editor@iaeme.com

Dr. Pavan Mishra, Dr. Soniya Rajpoot and Neeti Sharma

REFERENCES

[1]

[2]

[3]

[4]

[5]

[6]

[7]

[8]

[9]

[10]

[11]

[12]

[13]

[14]

[15]

[16]

[17]

[18]

[19]

[20]

[21]

Annual Report (2003-2004), Ministry of Small Scale Industries, Govt. of India,

New Delhi.

Arora A.K. (2002). Financing of small Scale Industries, Deep & Deep Publishers,

New Delhi.

Bajaj, K.K, (1992). Factoring Service Make a Doubt in India, Financial Express,

August 20, 1992.

Bala M. (2006a). Institutional Framework for Small Scale Industries, Chapter-19,

pp 278- 293. University of Delhi .Retrieved from http://www.du.ac.in/course

/material/ug/ba/esb/index.html

Bala, M. (2006b). Policy Support to Small Scale Industries, Chapter-20, pp 297315.

University

of

Delhi.

Retrieved

from

http://www.du.ac.in

/course/material/ug/ba/esb/index.html

Balu, V. (1991). Financing of SSIs - A sample Survey including Notified

Backward Areas. Indian Journal of Economics, 72: 151-159.

Balu, V. (1995), Entrepreneurial development in India- Analysis of some key

factors. Shri Venkatswara Publications, Chenni.

Banerjee, P.K. (2003) Global Factoring Business: Trend and performance,

Finance India, XVII, (4), December 2003.

Biswal, D. and Acharya. G.P. (1987), Working Capital Management of Small

Scale Industries in Orissa, Indian Journal of Commerce, XL. Part 1& 2. Nos.150

& 151, Jan.-June. pp. 1-9.

Budget of India 1998-99, Government of India.

Chandra P. (2008). Financial Management Theory and Practice. Fifth Edition,

Tata McGraw-Hill Publishing Company Limited New Delhi. pp1040.

Chawla, S.K. (1987), Working Capital Management-A Practical Approach. The

Management Accountant. 575. August 1987.

Desai, V. (1989). Management of Small Scale Industry. Himalaya Publishing

House. pp. 278-279.

Desai, B M, Gupta, R, and Tripathi, B. L. (1989), Frameworkfor an Integrative

Role of Rural Financial Institutions, New Delhi: Oxford &D3H.

Dhar, P. N. (1958) Small Scale Industry in Delhi: A Study in Investment output

and Employment Aspect Bombay: Asia Publishing House.

Gitman, L.J.(1976). Principles of Managerial Finance. Harper and Row

Publishers, 148 New York.

Government of India, (GOI), (1955) Report of Small Scale Industry in India.

New Delhi; Ministry of Finance.

Gupta, M. & Sharma, K. (1996). Environmental operations management: An

opportunity for improvement. Production and Inventory Management Journal,

pp. 40-46.

Hallberg, K. (2000). A Market-Oriented Strategy for Small and Medium-Scale

Enterprises, Discussion Paper No. 40, International Finance Corporation, The

World Bank.

Hampton, J. J. (1983). Financial Decision Making-Concepts, Problems and

Cases. Prentice-Hall of India Ltd., 219 New Delhi.

Khan,R.R., Management of Small-Scale Industry,(1979), S.Chand & Company

LTD New Delhi Page No.130

http://www.iaeme.com/IJM/index.asp

276

editor@iaeme.com

A study of Working Capital Management in Small scale

[22]

[23]

[24]

[25]

[26]

[27]

[28]

[29]

[30]

[31]

[32]

[33]

[34]

[35]

[36]

[37]

[38]

[39]

[40]

[41]

[42]

[43]

Kamla, R. M (2003), Globalizations Impact on Small Scale Sector of India,

Indian Commerce Bulletin, 7(1): 34-38.

Kamla, R. M (2003), Globalizations Impact on Small Scale Sector of India,

Indian Commerce Bulletin, 7(1): 34-38.

Khan M.Y. (2003). Indian Financial System Theory & Practice, Vikash

Publishing, New Delhi

Khan, N.A. (1989) Development of Small Scale Sector in India, YOJANA,

Ministry of Information & Broadcasting, Govt. of India, New Delhi, Oct. 1-15,

pp.113-115

Khan, N.A. (2011). Plight of Small Scale Sector in India under Globalised Era.

Department of Commerce, A.M.U., Aligarh. Retriewed from Academia Edu.

Kulshreshtha, D.K. and Jha, B.K. (1990), Working Capital Management in Small

Business. Journal of Accountancy and Finance, 6(1), Spring.

Kumar, R. (1999). Financing Practices in Small Scale Industries: A Study of

Textile Industry of Punjab. Unpublished Ph.D Thesis. G. N. D. University,

Amritsar.

Longenecker, J.G; Carlos W. M; Petty, J.W. and Palich, L.E. (2008)

(Casebound). Small business management: launching and growing

entrepreneurial ventures. (14th ed.). Cengage Learning. p. 768.

Manickawal S. (1997), Inventory Management in Small Scale Industrial Units of

Tamil Nadu. Abhigyan, 15(3): 47- 52.

Mattoo, A.R., (2003). Small Scale Sector in the Context of Liberalisation, The

Business Studies, 9(2): 18-22.

Ministry of Micro, Small, Medium Enterprises, Government of India 2006. Home

Page Retrieved from http://msme.gov.in/msme_aboutus.htmt

Ministry of finance (2002) : Economic Survey 2001-2002, Government of India

New Delhi

National Commit of Applied Economic Research, (NCAER) (1959).Survey of

the Handloom Industry in Karnataka and Sholapur Bombay: Asia Publishing

House.

Nyati, K. (1988). Problems of pollution and its control in small scale industries.

New Delhi, India: Friedrich Elbert Foundation.

Parthasarthy, S. 1996. Whither small scale industry. In The Hindu Survey of

Indian Industry, M/s (pp. 14-26), Madras, India. Kasturi and Sons, National

Press.

Peel, M.J. and Wilson, N. (1996). Working Capital and Financial Management

Practices in the Small Firm Sector In North England. International Small

Business Journal, 14(2): 52-68

Prasad, B. and Eresi. K. (1990), Working Capital Management in SSI-An

Empirical Study, Journal of Accounting and finance, IV (I). spring. pp.31-41.

Rajendran. S, (2002). Institutional Support to SSI, Published by the Hindu Survey

of Indian Industry.

Ramamoorthy, V.E., Working Capital Management, Institute of Financial

Management and Research. 5 Madras: 1978.

Reddy G.S. and Reddy S. R. (2007). Working Capital in Small Scale Industry.

SCMS Journal of Indian Management.4 (2): 21-26

Reddy. V. R. (1990). Problems of Small Industries in India. Indian Management,

29 (11-12): 43-46.

Reji,M.A. (2003), Impact of Globalisation on the Small Scale Sector of India.

Indian Commerce Bulletin, 7(1): 67-72.

http://www.iaeme.com/IJM/index.asp

277

editor@iaeme.com

Dr. Pavan Mishra, Dr. Soniya Rajpoot and Neeti Sharma

[44]

[45]

[46]

Reserve Bank of India (2010). Home Page Retrieved from

http://www.rbi.org.in/scripts/FAQView.aspx?Id=8

Saini, R.R., Kumar, P., Kumar, M. (2006). Sickness in small-scale industries in

India. Journal of management Accounting.

www.icwai.org/icwai

/knowledgebank/ma26.pdf

[47]

[48]

[49]

[50]

[51]

[52]

[53]

Sandesara, J. C. (1982). Incentives and their impact: Some Studies on Small

Industry. Economic and Political Weekly, 17(48): 27.

SIDBI report on small-scale industries sector, (2000). Small Industries

Development Bank of India.

SIDO. 2004. SIDO's Half Century, History of Small Industries Development,

Organisation, 1954-2004. Published 2004 by Development Commissioner, Small

Scale Industries, Ministry of Small Scale Industries, Govt. of India ,New Delhi.

Ravindra Uttamrao Kanthe, Dr.Rajesh U Kanthe. Human Resource Practices A

Study on Small Scale Industries in Miraj City. International Journal of

Management, 3(3), 2012, pp. 228234.

Arunkumar O. N and T. Radharamanan. Working Capital Management and

Profitability: an Empirical Analysis of Indian Manufacturing Firms. International

Journal of Management, 4(1), 2013, pp. 121129.

Dr. E. Muthukumar and S. Sakeerthi. Working Capital Management Based on

The Study at Sakthi Sugars, Tamilnadu. International Journal of Management,

7(2), 2016, pp. 536547.

Singh, P. (2010). Financial Inclusion through Micro Finance Institution; Social

Responsibility or a Viable Business Proposition: Empirical Study on what drives

the valuation of a MFI. Udyog Pragati: The Journal for Practising Managers.

34(4):18.

http://www.iaeme.com/IJM/index.asp

278

editor@iaeme.com

You might also like

- A Study of Financial Management in Small Scale Industries in IndiaDocument7 pagesA Study of Financial Management in Small Scale Industries in IndiaNiraj ThakurNo ratings yet

- Multi SkillDocument45 pagesMulti SkillradhaNo ratings yet

- Are MNCs devils in disguise in IndiaDocument26 pagesAre MNCs devils in disguise in IndiaMekhla MittalNo ratings yet

- What Is A BrandDocument5 pagesWhat Is A BrandHaileab TesfamariamNo ratings yet

- Impact of Advertisement of On Youth With Respect To FMCG ProductsDocument26 pagesImpact of Advertisement of On Youth With Respect To FMCG ProductsAMIT K SINGH0% (1)

- HDFC Bank's Foreign Exchange SynopsisDocument17 pagesHDFC Bank's Foreign Exchange SynopsisMohmmedKhayyumNo ratings yet

- Nisaraga ProjectDocument82 pagesNisaraga ProjectSidda SiNo ratings yet

- Pradhan Mantri MUDRA YojanaDocument3 pagesPradhan Mantri MUDRA YojanaUjjwal MishraNo ratings yet

- Impact Assessment of Self Help Groups On SHG Members in Madhya PradeshDocument5 pagesImpact Assessment of Self Help Groups On SHG Members in Madhya PradeshInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- HCL Company Analysis - Udit GurnaniDocument7 pagesHCL Company Analysis - Udit GurnaniUdit GurnaniNo ratings yet

- The Role of Commercial Banks Funding On The Development of SmallDocument11 pagesThe Role of Commercial Banks Funding On The Development of Smallbhanu matiNo ratings yet

- FDO ProjectDocument75 pagesFDO ProjectHarish.PNo ratings yet

- A Comparitive Study On Mutual FundsDocument58 pagesA Comparitive Study On Mutual Fundsarjunmba119624No ratings yet

- National Stock ExchangeDocument11 pagesNational Stock ExchangeKaustubh PatelNo ratings yet

- Impact of Global Financial Crisis (2007-2008) : ON The Indian EconomyDocument48 pagesImpact of Global Financial Crisis (2007-2008) : ON The Indian EconomyDiksha PrajapatiNo ratings yet

- Significance: Study of Fdi in IndiaDocument73 pagesSignificance: Study of Fdi in Indiatarun41100% (1)

- CAPITAL ASSET PRICING MODEL - A Study On Indian Stock MarketsDocument78 pagesCAPITAL ASSET PRICING MODEL - A Study On Indian Stock MarketsnikhinccNo ratings yet

- Bonds and DebenturesDocument24 pagesBonds and DebenturesArpita MundharaNo ratings yet

- Reliance Mutual FundDocument32 pagesReliance Mutual Fundshiva_kuttimma100% (1)

- Role of Insurance in India's Economic GrowthDocument4 pagesRole of Insurance in India's Economic Growth538Mansi ChaurasiaNo ratings yet

- HDFC Bank Core Banking Solutions, Products, and ServicesDocument23 pagesHDFC Bank Core Banking Solutions, Products, and Servicesakash_shah_42No ratings yet

- The Impact of Government Policy On The Development of Small Scale BusinessDocument35 pagesThe Impact of Government Policy On The Development of Small Scale BusinessAkpu Odinaka PreciousNo ratings yet

- ILO-ADB report: Covid-19 impact on youth employment in India and Asia-PacificDocument2 pagesILO-ADB report: Covid-19 impact on youth employment in India and Asia-PacificsurajsinghbhadauriaNo ratings yet

- Payal HappyDocument62 pagesPayal HappyAarav AroraNo ratings yet

- Service Marketing in Banks PDFDocument67 pagesService Marketing in Banks PDFRupal Rohan DalalNo ratings yet

- Modern Indian School Economics Project on Problems of Unemployment in IndiaDocument23 pagesModern Indian School Economics Project on Problems of Unemployment in IndiaManasi MaityNo ratings yet

- 01 Meaning and Importance of CommunicationDocument12 pages01 Meaning and Importance of CommunicationLakshmi Prasad CNo ratings yet

- DemonitisationDocument46 pagesDemonitisationP Kumar ReddyNo ratings yet

- Comparative Financial Analysis of Tata Steel and SAILDocument53 pagesComparative Financial Analysis of Tata Steel and SAILManu GCNo ratings yet

- Comparative Analysis of NPAs of Public and PrivateDocument14 pagesComparative Analysis of NPAs of Public and PrivateAnkit Patel100% (1)

- Math Library Methods GuideDocument68 pagesMath Library Methods Guidegayathri naiduNo ratings yet

- Detailed Study of Edelweiss Tokio Life InsuranceDocument73 pagesDetailed Study of Edelweiss Tokio Life InsuranceHardik AgarwalNo ratings yet

- Review of Working Capital PDFDocument12 pagesReview of Working Capital PDFsandhyaNo ratings yet

- Mobile Money and Payment: A Literature Review Based On Academic and Practitioner-Oriented Publications (2001-2011)Document35 pagesMobile Money and Payment: A Literature Review Based On Academic and Practitioner-Oriented Publications (2001-2011)aroniNo ratings yet

- Pks Consumer Behaviour Towards Shampoo in KolkataDocument41 pagesPks Consumer Behaviour Towards Shampoo in KolkataPriti BasforeNo ratings yet

- Institute of Management, Nirma University: Group Assignment-Reliance Power's IPODocument7 pagesInstitute of Management, Nirma University: Group Assignment-Reliance Power's IPOCJKNo ratings yet

- Fundamental Analysis of Indian Banking SectorDocument17 pagesFundamental Analysis of Indian Banking SectorDipesh AprajNo ratings yet

- Life Insurance Market Reforms in IndiaDocument42 pagesLife Insurance Market Reforms in Indiamldc2011No ratings yet

- A Study On Asset Liability ManagementDocument56 pagesA Study On Asset Liability ManagementMisraNo ratings yet

- Privatisation in Insurance SectorDocument20 pagesPrivatisation in Insurance Sectormokalo100% (5)

- Employee Recruitment, Selection, Training & Development Procedures Used by HDFC BankDocument57 pagesEmployee Recruitment, Selection, Training & Development Procedures Used by HDFC BankUmeshSharmaNo ratings yet

- HDFCDocument103 pagesHDFCfun_mag100% (2)

- Bandhan Case Study: Prepared By: Bakshi Satpreet Singh (10MBI1005)Document17 pagesBandhan Case Study: Prepared By: Bakshi Satpreet Singh (10MBI1005)Sachit MalikNo ratings yet

- Chapter - 1Document32 pagesChapter - 1raj tripathiNo ratings yet

- Biki Proj. InternDocument50 pagesBiki Proj. InternShlok KulkarniNo ratings yet

- India BullsDocument7 pagesIndia BullssaiyuvatechNo ratings yet

- Home Insurance-2Document56 pagesHome Insurance-2ashu100% (1)

- Career Development For Middle Level Employee in Edelweiss Tokio Life InsuranceDocument53 pagesCareer Development For Middle Level Employee in Edelweiss Tokio Life InsuranceShobiga VNo ratings yet

- Literature ReviewDocument14 pagesLiterature ReviewNamdev Upadhyay100% (1)

- ProjectDocument42 pagesProjectVenkatesh VenkyNo ratings yet

- Veeresh - DCCBank - FinalDocument80 pagesVeeresh - DCCBank - FinalSangamesh BagaliNo ratings yet

- Abstract:: A Study On Mergers and Acquisition in Banking Industry of IndiaDocument4 pagesAbstract:: A Study On Mergers and Acquisition in Banking Industry of IndiaPotlamarri SumanthNo ratings yet

- FDI in Indian Retail Sector: An AnalysisDocument144 pagesFDI in Indian Retail Sector: An AnalysisShebin Mathew0% (1)

- A Comparative Study On Service Quality of Bank of Baroda and ICICI Bank Using Servqual ModelDocument6 pagesA Comparative Study On Service Quality of Bank of Baroda and ICICI Bank Using Servqual ModelEditor IJTSRDNo ratings yet

- Amul ProjectDocument120 pagesAmul ProjectrobanabangbangNo ratings yet

- CRM On Big BazaarDocument89 pagesCRM On Big BazaarAnkit Badnikar0% (1)

- Impacts of Fintech on Commercial Banks' Tech & OpsDocument10 pagesImpacts of Fintech on Commercial Banks' Tech & OpsThanh TrúcNo ratings yet

- Part II Audit ProjecDocument36 pagesPart II Audit ProjecSagar Zine100% (1)

- The Relevance of Working Capital, Financial Literacy and Financial Inclusion On Financial Performance and Sustainability of Micro, Small and Medium-Sized Enterprises (MSMEs)Document14 pagesThe Relevance of Working Capital, Financial Literacy and Financial Inclusion On Financial Performance and Sustainability of Micro, Small and Medium-Sized Enterprises (MSMEs)AJHSSR JournalNo ratings yet

- A Study On The Reasons For Transgender To Become EntrepreneursDocument7 pagesA Study On The Reasons For Transgender To Become EntrepreneursIAEME PublicationNo ratings yet

- Determinants Affecting The User's Intention To Use Mobile Banking ApplicationsDocument8 pagesDeterminants Affecting The User's Intention To Use Mobile Banking ApplicationsIAEME PublicationNo ratings yet

- Broad Unexposed Skills of Transgender EntrepreneursDocument8 pagesBroad Unexposed Skills of Transgender EntrepreneursIAEME PublicationNo ratings yet

- Impact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesDocument10 pagesImpact of Emotional Intelligence On Human Resource Management Practices Among The Remote Working It EmployeesIAEME PublicationNo ratings yet

- Attrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesDocument15 pagesAttrition in The It Industry During Covid-19 Pandemic: Linking Emotional Intelligence and Talent Management ProcessesIAEME PublicationNo ratings yet

- Gandhi On Non-Violent PoliceDocument8 pagesGandhi On Non-Violent PoliceIAEME PublicationNo ratings yet

- Influence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiDocument16 pagesInfluence of Talent Management Practices On Organizational Performance A Study With Reference To It Sector in ChennaiIAEME PublicationNo ratings yet

- Analyse The User Predilection On Gpay and Phonepe For Digital TransactionsDocument7 pagesAnalyse The User Predilection On Gpay and Phonepe For Digital TransactionsIAEME PublicationNo ratings yet

- Modeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyDocument14 pagesModeling and Analysis of Surface Roughness and White Later Thickness in Wire-Electric Discharge Turning Process Through Response Surface MethodologyIAEME PublicationNo ratings yet

- Voice Based Atm For Visually Impaired Using ArduinoDocument7 pagesVoice Based Atm For Visually Impaired Using ArduinoIAEME PublicationNo ratings yet

- A Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiDocument16 pagesA Study On Talent Management and Its Impact On Employee Retention in Selected It Organizations in ChennaiIAEME PublicationNo ratings yet

- Role of Social Entrepreneurship in Rural Development of India - Problems and ChallengesDocument18 pagesRole of Social Entrepreneurship in Rural Development of India - Problems and ChallengesIAEME PublicationNo ratings yet

- Visualising Aging Parents & Their Close Carers Life Journey in Aging EconomyDocument4 pagesVisualising Aging Parents & Their Close Carers Life Journey in Aging EconomyIAEME PublicationNo ratings yet

- A Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaDocument9 pagesA Study of Various Types of Loans of Selected Public and Private Sector Banks With Reference To Npa in State HaryanaIAEME PublicationNo ratings yet

- A Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurDocument7 pagesA Study On The Impact of Organizational Culture On The Effectiveness of Performance Management Systems in Healthcare Organizations at ThanjavurIAEME PublicationNo ratings yet

- A Multiple - Channel Queuing Models On Fuzzy EnvironmentDocument13 pagesA Multiple - Channel Queuing Models On Fuzzy EnvironmentIAEME PublicationNo ratings yet

- Application of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDDocument19 pagesApplication of Frugal Approach For Productivity Improvement - A Case Study of Mahindra and Mahindra LTDIAEME PublicationNo ratings yet

- EXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESDocument9 pagesEXPERIMENTAL STUDY OF MECHANICAL AND TRIBOLOGICAL RELATION OF NYLON/BaSO4 POLYMER COMPOSITESIAEME PublicationNo ratings yet

- Various Fuzzy Numbers and Their Various Ranking ApproachesDocument10 pagesVarious Fuzzy Numbers and Their Various Ranking ApproachesIAEME PublicationNo ratings yet

- Analysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsDocument13 pagesAnalysis of Fuzzy Inference System Based Interline Power Flow Controller For Power System With Wind Energy Conversion System During Faulted ConditionsIAEME PublicationNo ratings yet

- Dealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsDocument8 pagesDealing With Recurrent Terminates in Orchestrated Reliable Recovery Line Accumulation Algorithms For Faulttolerant Mobile Distributed SystemsIAEME PublicationNo ratings yet

- Optimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsDocument13 pagesOptimal Reconfiguration of Power Distribution Radial Network Using Hybrid Meta-Heuristic AlgorithmsIAEME PublicationNo ratings yet

- Knowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentDocument8 pagesKnowledge Self-Efficacy and Research Collaboration Towards Knowledge Sharing: The Moderating Effect of Employee CommitmentIAEME PublicationNo ratings yet

- A Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksDocument10 pagesA Proficient Minimum-Routine Reliable Recovery Line Accumulation Scheme For Non-Deterministic Mobile Distributed FrameworksIAEME PublicationNo ratings yet

- Prediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsDocument13 pagesPrediction of Average Total Project Duration Using Artificial Neural Networks, Fuzzy Logic, and Regression ModelsIAEME PublicationNo ratings yet

- Quality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceDocument7 pagesQuality of Work-Life On Employee Retention and Job Satisfaction: The Moderating Role of Job PerformanceIAEME PublicationNo ratings yet

- Financial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelDocument9 pagesFinancial Literacy On Investment Performance: The Mediating Effect of Big-Five Personality Traits ModelIAEME PublicationNo ratings yet

- Moderating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorDocument7 pagesModerating Effect of Job Satisfaction On Turnover Intention and Stress Burnout Among Employees in The Information Technology SectorIAEME PublicationNo ratings yet

- Analysis On Machine Cell Recognition and Detaching From Neural SystemsDocument9 pagesAnalysis On Machine Cell Recognition and Detaching From Neural SystemsIAEME PublicationNo ratings yet

- A Review of Particle Swarm Optimization (Pso) AlgorithmDocument26 pagesA Review of Particle Swarm Optimization (Pso) AlgorithmIAEME PublicationNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document3 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09gary hays100% (1)

- Universiti Kuala Lumpur Intra Management System: Unikl-ImsDocument16 pagesUniversiti Kuala Lumpur Intra Management System: Unikl-ImsAfnanFadlanBinAzmiNo ratings yet

- Lembar Jawaban Siswa - Corona-2020Document23 pagesLembar Jawaban Siswa - Corona-2020Kurnia RusandiNo ratings yet

- Find Offshore JobsDocument2 pagesFind Offshore JobsWidianto Eka PramanaNo ratings yet

- I I I I I I I: Quipwerx Support Request FormDocument2 pagesI I I I I I I: Quipwerx Support Request Form08. Ngọ Thị Hồng DuyênNo ratings yet

- Pooja RasidDocument3 pagesPooja RasidRajiuNo ratings yet

- Case No. 23 - Maderada Vs MediodeaDocument3 pagesCase No. 23 - Maderada Vs MediodeaAbbyAlvarezNo ratings yet

- Recolonizing Ngugi Wa Thiongo PDFDocument20 pagesRecolonizing Ngugi Wa Thiongo PDFXolile Roy NdlovuNo ratings yet

- IGNOU Hall Ticket December 2018 Term End ExamDocument1 pageIGNOU Hall Ticket December 2018 Term End ExamZishaan KhanNo ratings yet

- Dukin DonutsDocument1 pageDukin DonutsAnantharaman KarthicNo ratings yet

- PHILIP MORRIS Vs FORTUNE TOBACCODocument2 pagesPHILIP MORRIS Vs FORTUNE TOBACCOPatricia Blanca SDVRNo ratings yet

- LRTA v. Navidad, G.R. No. 145804, 6 February 2003Document3 pagesLRTA v. Navidad, G.R. No. 145804, 6 February 2003RENGIE GALO0% (1)

- Bob Marley - SunumDocument5 pagesBob Marley - SunumNaz SakinciNo ratings yet

- JPM The Audacity of BitcoinDocument8 pagesJPM The Audacity of BitcoinZerohedge100% (3)

- People vs. Aruta Case DigestDocument3 pagesPeople vs. Aruta Case DigestRhea Razo-Samuel100% (1)

- Self Concept's Role in Buying BehaviorDocument6 pagesSelf Concept's Role in Buying BehaviorMadhavi GundabattulaNo ratings yet

- 2016 AP Micro FRQ - Consumer ChoiceDocument2 pages2016 AP Micro FRQ - Consumer ChoiceiuhdoiNo ratings yet

- SSS Presentation PDFDocument50 pagesSSS Presentation PDFEMMANUEL SSEWANKAMBO100% (2)

- DDT Use Raises Ethical IssuesDocument15 pagesDDT Use Raises Ethical IssuesNajihah JaffarNo ratings yet

- Ancient Civilizations - PACKET CondensedDocument23 pagesAncient Civilizations - PACKET CondensedDorothy SizemoreNo ratings yet

- Liberal Arts Program: Myanmar Institute of TheologyDocument6 pagesLiberal Arts Program: Myanmar Institute of TheologyNang Bu LamaNo ratings yet

- The Seven ValleysDocument17 pagesThe Seven ValleyswarnerNo ratings yet

- ELECTRONIC TICKET For 4N53LY Departure Date 27 06 2023Document3 pagesELECTRONIC TICKET For 4N53LY Departure Date 27 06 2023حسام رسميNo ratings yet

- BE1 - 1. Skripta (Kolokvij)Document5 pagesBE1 - 1. Skripta (Kolokvij)PaulaNo ratings yet

- CASES IN LOCAL and REAL PROPERTY TAXATIONDocument3 pagesCASES IN LOCAL and REAL PROPERTY TAXATIONTreblif AdarojemNo ratings yet

- Pragma c4Document4 pagesPragma c4ElenaNo ratings yet

- Hannover Messe 2011: New Marke New Con NEWDocument16 pagesHannover Messe 2011: New Marke New Con NEWsetzen724No ratings yet

- 2023 Whole Bible Reading PlanDocument2 pages2023 Whole Bible Reading PlanDenmark BulanNo ratings yet

- Pinagsanhan Elementary School Kindergarten AwardsDocument5 pagesPinagsanhan Elementary School Kindergarten AwardsFran GonzalesNo ratings yet

- English Conversation Pour FormationDocument217 pagesEnglish Conversation Pour FormationMed JabrNo ratings yet