Professional Documents

Culture Documents

Continental Casualty Co. v. Barbara F. Adamo, 326 F.3d 1181, 11th Cir. (2003)

Uploaded by

Scribd Government DocsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Continental Casualty Co. v. Barbara F. Adamo, 326 F.3d 1181, 11th Cir. (2003)

Uploaded by

Scribd Government DocsCopyright:

Available Formats

326 F.

3d 1181

CONTINENTAL CASUALTY COMPANY, Plaintiff-Appellee,

v.

Barbara F. ADAMO, Individually and in her capacity as

Administrator of the Estate of Shana Slakman, Sherwin Glass,

Defendants-Appellees,

Barry S. Slakman, Defendant-Appellant.

No. 02-15448. Non-Argument Calendar.

United States Court of Appeals, Eleventh Circuit.

April 2, 2003.

Charles E. Rogers, Webb, Carlock, Copeland, Semler & Stair, Robert C.

Port, Hassett, Cohen, Goldstein & Port, LP, Atlanta, GA, for Appellees.

Barry S. Slakman, Hardwick, GA, pro se.

Appeal from the United States District Court for the Northern District of

Georgia (No. 98-02373-CV-ODE); Orinda D. Evans, Judge.

Before ANDERSON, BLACK and WILSON, Circuit Judges.

PER CURIAM:

Barry S. Slakman, proceeding pro se, appeals the district court's grant of

summary judgment in favor of Barbara F. Adamo, Sherwin Glass, and

Continental Casualty Co. in Continental's interpleader action. The district court

found that Slakman was prohibited from recovering life insurance benefits

under section 33-25-13 of the Code of Georgia, because he was convicted of

murdering his wife, the insured. Slakman, however, asserts that section 33-2513 does not prohibit recovery until his conviction becomes "final" under state

law. As this case turns on an important question of state law for which there is

no controlling precedent, we certify the question to the Georgia Supreme Court

for resolution.

Shana Slakman, Slakman's wife and Adamo and Glass's daughter, was insured

under a life insurance policy issued to Slakman by Continental, under which

Slakman was the beneficiary. After Slakman was indicted for the murder of his

wife, Continental initiated this interpleader action in the district court to resolve

conflicting claims to the benefits under that policy.

3

Slakman initially was convicted of murdering his wife in 1994. Shortly

thereafter, the district court granted summary judgment in favor of Continental,

Adamo, and Glass, finding that section 33-25-13 barred Slakman's recovery of

benefits under the policy. We, however, reversed the district court's grant of

summary judgment, because, during the pendency of the appeal, Slakman's

conviction was vacated. See Cont'l Cas. Co. v. Adamo, 11th Cir. 2000 (No. 0010594, Aug. 29, 2000). On remand, the district court stayed the case pending

Slakman's retrial for the murder, and, after Slakman was retried and

reconvicted, the parties renewed their motion for summary judgment. The

district court, agreeing that Slakman forfeited all rights under the policy,

granted the motion. This appeal followed.

"In diversity cases, a federal court applies the law of the forum in which it sits."

LaTorre v. Conn. Mut. Life Ins. Co., 38 F.3d 538, 540 (11th Cir.1994).

"Where[, however,] there is any doubt as to the application of state law, a

federal court should certify the question to the state supreme court to avoid

making unnecessary Erie guesses and to offer the state court the opportunity to

interpret or change existing law." Keener v. Convergys Corp., 312 F.3d 1236,

1241 (11th Cir. 2002) (per curiam) (internal quotation marks omitted).

Section 33-25-13 provides,

No person who commits murder or voluntary manslaughter or who conspires...

to commit murder shall receive any benefits from any insurance policy on the

life of the deceased, even though the person so killing or conspiring be named

beneficiary in the insurance policy. A plea of guilty or a judicial finding of guilt

not reversed or otherwise set aside as to any of such crimes shall be prima facie

evidence of guilt in determining rights under this Code section. All right,

interest, estate, and proceeds in such an insurance policy shall go to the other

heirs of the deceased who may be entitled thereto by the laws of descent and

distribution of this state, unless secondary beneficiaries be named in the policy,

in which event such secondary beneficiaries shall take.

O.C.G.A. 33-25-13 (emphasis added). Under that statute, it is unclear

whether an individual must be given the opportunity to challenge his

conviction on direct appeal or by collaterally attacking his sentence before he is

barred from recovering life insurance benefits. Moreover, a review of Georgia

case law indicates that this issue has not been addressed directly by the courts.

8

As this case presents an important issue of Georgia law that has not been

addressed by the Georgia Supreme Court, we certify the following question to

the Georgia Supreme Court: WHETHER SECTION 33-25-13 OF THE CODE

OF GEORGIA BARS AN INDIVIDUAL FROM RECEIVING BENEFITS

UNDER A MURDER VICTIM'S LIFE INSURANCE POLICY BEFORE HIS

CONVICTION AND SENTENCE BECOME "FINAL" UNDER STATE

LAW. In so doing, we do not intend to restrict the court's consideration of the

issue presented. "This latitude extends to the Supreme Court's restatement of

the issue or issues and the manner in which the answers are given." Washburn

v. Rabun, 755 F.2d 1404, 1406 (11th Cir.1985). To assist the court in

considering this question, the record in this case and the parties' briefs shall be

transmitted to the court.

QUESTION CERTIFIED.

You might also like

- United States Court of Appeals, Fourth CircuitDocument4 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Bradford v. Bruno's Inc., 41 F.3d 625, 11th Cir. (1995)Document3 pagesBradford v. Bruno's Inc., 41 F.3d 625, 11th Cir. (1995)Scribd Government DocsNo ratings yet

- United States Court of Appeals Seventh Circuit.: No. 11778. No. 11779Document5 pagesUnited States Court of Appeals Seventh Circuit.: No. 11778. No. 11779Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument22 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Citizens Potawatomi v. Freeman, Et - Al., 10th Cir. (1997)Document4 pagesCitizens Potawatomi v. Freeman, Et - Al., 10th Cir. (1997)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument8 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- United States v. Salome, 10th Cir. (2007)Document7 pagesUnited States v. Salome, 10th Cir. (2007)Scribd Government DocsNo ratings yet

- Sullivan v. Little Hunting Park, Inc., 396 U.S. 229 (1969)Document21 pagesSullivan v. Little Hunting Park, Inc., 396 U.S. 229 (1969)Scribd Government DocsNo ratings yet

- Photostat Corporation and Lloyd Randall Ward, Jr. v. Harold E. Ball, 338 F.2d 783, 10th Cir. (1964)Document5 pagesPhotostat Corporation and Lloyd Randall Ward, Jr. v. Harold E. Ball, 338 F.2d 783, 10th Cir. (1964)Scribd Government DocsNo ratings yet

- Court Use OnlyDocument9 pagesCourt Use OnlyBrownBananaNo ratings yet

- Reply To GA Power Defendants 1:08-cv-1971-WSDDocument17 pagesReply To GA Power Defendants 1:08-cv-1971-WSDJanet and JamesNo ratings yet

- Brief For Judgment As A Matter of LawDocument11 pagesBrief For Judgment As A Matter of LawJanet and James100% (8)

- Armstrong v. Boulden, 10th Cir. (2004)Document5 pagesArmstrong v. Boulden, 10th Cir. (2004)Scribd Government DocsNo ratings yet

- Glassman Construction Company, Inc., and Home Indemnity Company v. The United States of America For The Use and Benefit of Clark-Fontana Paint Company, Inc., 421 F.2d 212, 4th Cir. (1970)Document5 pagesGlassman Construction Company, Inc., and Home Indemnity Company v. The United States of America For The Use and Benefit of Clark-Fontana Paint Company, Inc., 421 F.2d 212, 4th Cir. (1970)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument4 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument3 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Lowell Palmer v. United States of America, United States of America, Third-Party v. Donald Paul Fisher, Third-Party, 652 F.2d 893, 3rd Cir. (1981)Document5 pagesLowell Palmer v. United States of America, United States of America, Third-Party v. Donald Paul Fisher, Third-Party, 652 F.2d 893, 3rd Cir. (1981)Scribd Government DocsNo ratings yet

- Clark v. Province, 10th Cir. (2009)Document7 pagesClark v. Province, 10th Cir. (2009)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Third CircuitDocument7 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Raley v. Hyundai Motor Co., LTD., 642 F.3d 1271, 10th Cir. (2011)Document13 pagesRaley v. Hyundai Motor Co., LTD., 642 F.3d 1271, 10th Cir. (2011)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument31 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Staten v. Clarkson Constuction, 10th Cir. (2004)Document4 pagesStaten v. Clarkson Constuction, 10th Cir. (2004)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument6 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Brief in Support of Void JudgmentDocument12 pagesBrief in Support of Void JudgmentJanet and James94% (31)

- Carol Morris, Administratrix of The Estate of Linda Louis Grimes, Deceased v. Sse, Inc., 912 F.2d 1392, 11th Cir. (1990)Document7 pagesCarol Morris, Administratrix of The Estate of Linda Louis Grimes, Deceased v. Sse, Inc., 912 F.2d 1392, 11th Cir. (1990)Scribd Government DocsNo ratings yet

- Walter H. Cook, James Reid Parker and The First National Bank & Trust Company of New Canaan, Executors of The Estate of Helen E. Hokinson, Deceased v. United States, 274 F.2d 689, 1st Cir. (1960)Document7 pagesWalter H. Cook, James Reid Parker and The First National Bank & Trust Company of New Canaan, Executors of The Estate of Helen E. Hokinson, Deceased v. United States, 274 F.2d 689, 1st Cir. (1960)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument28 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument6 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Elvira de La Vega Glen v. Club Mediterranee, S.A., 450 F.3d 1251, 11th Cir. (2006)Document8 pagesElvira de La Vega Glen v. Club Mediterranee, S.A., 450 F.3d 1251, 11th Cir. (2006)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument3 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- Robert Langermann v. Samuel J. Dubbin, 11th Cir. (2015)Document12 pagesRobert Langermann v. Samuel J. Dubbin, 11th Cir. (2015)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument4 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- United States v. Williams, 10th Cir. (2006)Document3 pagesUnited States v. Williams, 10th Cir. (2006)Scribd Government DocsNo ratings yet

- Agan v. Vaughn, 119 F.3d 1538, 11th Cir. (1997)Document18 pagesAgan v. Vaughn, 119 F.3d 1538, 11th Cir. (1997)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument23 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- United States Court of Appeals, Fifth CircuitDocument2 pagesUnited States Court of Appeals, Fifth CircuitScribd Government DocsNo ratings yet

- Nnadili v. Chevron U.s.a., Inc.Document10 pagesNnadili v. Chevron U.s.a., Inc.RavenFoxNo ratings yet

- Ares Armor Motion For TRODocument9 pagesAres Armor Motion For TRONoloContendereNo ratings yet

- 1:14-cv-00208 #50Document22 pages1:14-cv-00208 #50Equality Case FilesNo ratings yet

- Miner Elec., Inc. v. Muscogee (Creek) Nation, 505 F.3d 1007, 10th Cir. (2007)Document12 pagesMiner Elec., Inc. v. Muscogee (Creek) Nation, 505 F.3d 1007, 10th Cir. (2007)Scribd Government DocsNo ratings yet

- Tanguma v. Golder, 10th Cir. (2006)Document4 pagesTanguma v. Golder, 10th Cir. (2006)Scribd Government DocsNo ratings yet

- Jacqueline Scott v. Mark F. Taylor, 405 F.3d 1251, 11th Cir. (2005)Document12 pagesJacqueline Scott v. Mark F. Taylor, 405 F.3d 1251, 11th Cir. (2005)Scribd Government DocsNo ratings yet

- SC State Ports v. FMC, 4th Cir. (2002)Document24 pagesSC State Ports v. FMC, 4th Cir. (2002)Scribd Government DocsNo ratings yet

- United States Court of Appeals Third CircuitDocument6 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- Tidal Oil Co. v. Flanagan, 263 U.S. 444 (1924)Document7 pagesTidal Oil Co. v. Flanagan, 263 U.S. 444 (1924)Scribd Government DocsNo ratings yet

- Filed: Patrick FisherDocument19 pagesFiled: Patrick FisherScribd Government DocsNo ratings yet

- In The United States Court of Appeals For The Eleventh CircuitDocument8 pagesIn The United States Court of Appeals For The Eleventh CircuitScribd Government DocsNo ratings yet

- United States v. Brent Gundersen and Herman Graulich, 978 F.2d 580, 10th Cir. (1992)Document7 pagesUnited States v. Brent Gundersen and Herman Graulich, 978 F.2d 580, 10th Cir. (1992)Scribd Government DocsNo ratings yet

- United States v. United States Dist. Court For Southern Dist. of NY, 334 U.S. 258 (1948)Document6 pagesUnited States v. United States Dist. Court For Southern Dist. of NY, 334 U.S. 258 (1948)Scribd Government DocsNo ratings yet

- Kenneth R. Cate, Esquire, and Maher, Overchuck, Langa & Cate, A Florida Association v. Gordon G. Oldham, JR., and State of Florida, 707 F.2d 1176, 11th Cir. (1983)Document18 pagesKenneth R. Cate, Esquire, and Maher, Overchuck, Langa & Cate, A Florida Association v. Gordon G. Oldham, JR., and State of Florida, 707 F.2d 1176, 11th Cir. (1983)Scribd Government DocsNo ratings yet

- Veronica Louthian v. State Farm Mutual Insurance Company, 493 F.2d 240, 4th Cir. (1974)Document4 pagesVeronica Louthian v. State Farm Mutual Insurance Company, 493 F.2d 240, 4th Cir. (1974)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Tenth CircuitDocument4 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsNo ratings yet

- Lapides v. Board of Regents of Univ. System of Ga., 535 U.S. 613 (2002)Document10 pagesLapides v. Board of Regents of Univ. System of Ga., 535 U.S. 613 (2002)Scribd Government DocsNo ratings yet

- Zurich Insurance Co. v. Chatham County, GA, 452 F.3d 1283, 11th Cir. (2006)Document2 pagesZurich Insurance Co. v. Chatham County, GA, 452 F.3d 1283, 11th Cir. (2006)Scribd Government DocsNo ratings yet

- United States Court of Appeals, Fourth CircuitDocument4 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsNo ratings yet

- Ammond, Alene S., in Her Capacity As A Member of The Senate of New Jersey and Individually v. Joseph L. McGahn, 532 F.2d 325, 3rd Cir. (1976)Document7 pagesAmmond, Alene S., in Her Capacity As A Member of The Senate of New Jersey and Individually v. Joseph L. McGahn, 532 F.2d 325, 3rd Cir. (1976)Scribd Government DocsNo ratings yet

- International Federation v. Karen Haas, 4th Cir. (2014)Document12 pagesInternational Federation v. Karen Haas, 4th Cir. (2014)Scribd Government DocsNo ratings yet

- Petition for Certiorari: Denied Without Opinion Patent Case 93-1413From EverandPetition for Certiorari: Denied Without Opinion Patent Case 93-1413No ratings yet

- Petition for Extraordinary Writ Denied Without Opinion– Patent Case 94-1257From EverandPetition for Extraordinary Writ Denied Without Opinion– Patent Case 94-1257No ratings yet

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coyle v. Jackson, 10th Cir. (2017)Document7 pagesCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsNo ratings yet

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsNo ratings yet

- Primary Sources FinalDocument2 pagesPrimary Sources Finalapi-203215781No ratings yet

- Short Texts On MasculinityDocument6 pagesShort Texts On Masculinityapi-522679657No ratings yet

- From Gender Equality and Women S Empowerment To Global Justice Reclaiming A Transformative Agenda For Gender and DevelopmentDocument21 pagesFrom Gender Equality and Women S Empowerment To Global Justice Reclaiming A Transformative Agenda For Gender and DevelopmentLola Abrahams AbelNo ratings yet

- SONG BOK YOONG V HO KIM POUIDocument2 pagesSONG BOK YOONG V HO KIM POUIAinul Mardiah bt HasnanNo ratings yet

- 2023-09-14 Proposed (DCKT 496 - 0)Document3 pages2023-09-14 Proposed (DCKT 496 - 0)TélamNo ratings yet

- Syariah Subordinate CourtDocument1 pageSyariah Subordinate CourtIrah ZinirahNo ratings yet

- IRI Report Understand Me Dont Define MeDocument25 pagesIRI Report Understand Me Dont Define Međạt QuốcNo ratings yet

- Canon 10 Case DigestsDocument5 pagesCanon 10 Case DigestsRywelle BravoNo ratings yet

- NPFL - Rules - Professional - Players and Clubs in Nigeria Must Know - LawyardDocument10 pagesNPFL - Rules - Professional - Players and Clubs in Nigeria Must Know - LawyardOtito KoroNo ratings yet

- Chapter 3 PDFDocument27 pagesChapter 3 PDFMaritoni MedallaNo ratings yet

- Rime AW: Crimes Criminals Crime Verbs Crime CollocationsDocument5 pagesRime AW: Crimes Criminals Crime Verbs Crime CollocationsDanielNo ratings yet

- Cabrera V Isaac 8Document3 pagesCabrera V Isaac 8Michael MartinNo ratings yet

- The Little Book of Restorative JusticeDocument7 pagesThe Little Book of Restorative JusticeAml MeetuNo ratings yet

- Advocates For Truth v. BSP (2013)Document3 pagesAdvocates For Truth v. BSP (2013)Imee CallaoNo ratings yet

- Cold War and VUCA No VidDocument14 pagesCold War and VUCA No VidWedy Lorence L. CalabriaNo ratings yet

- Laporan Penerimaan Peserta Didik Baru (PPDB) Raudlatul Athfal (Ra) Kantor Kementerian Agama Kab. Tegal TAHUN PELAJARAN 2018/2019Document47 pagesLaporan Penerimaan Peserta Didik Baru (PPDB) Raudlatul Athfal (Ra) Kantor Kementerian Agama Kab. Tegal TAHUN PELAJARAN 2018/2019Yenni VitaNo ratings yet

- 11 Matthews vs. TaylorDocument11 pages11 Matthews vs. TaylorRenceNo ratings yet

- Data Privacy ActDocument3 pagesData Privacy ActsofiaqueenNo ratings yet

- Michael Wetherbee Resignation AgreementDocument7 pagesMichael Wetherbee Resignation AgreementThe Livingston County NewsNo ratings yet

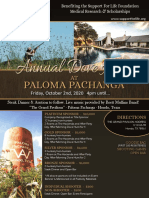

- 2020 Annual Dove HuntDocument2 pages2020 Annual Dove HuntMaritza NunezNo ratings yet

- CHAPTER 1: Concept and Measurement of Development: Economic Growth Vs Economic DevelopmentDocument20 pagesCHAPTER 1: Concept and Measurement of Development: Economic Growth Vs Economic DevelopmentAaron Justin Panganiban ArellanoNo ratings yet

- Sample Trust Deed - PDFDocument18 pagesSample Trust Deed - PDFJayarma Parlikad100% (3)

- Martinez Vs CADocument1 pageMartinez Vs CAShiela PilarNo ratings yet

- Tarlac - San Antonio - Business Permit - NewDocument2 pagesTarlac - San Antonio - Business Permit - Newarjhay llave100% (1)

- Annex A Application Form - P3Document37 pagesAnnex A Application Form - P3Dorina TicuNo ratings yet

- Abello vs. CIRDocument2 pagesAbello vs. CIRluis capulongNo ratings yet

- Govt. T.R.S. College Rewa (M.P.) : Papers (Write Papers in Blank) Test 1 Test 2 Test 3 Assignment SeminarDocument2 pagesGovt. T.R.S. College Rewa (M.P.) : Papers (Write Papers in Blank) Test 1 Test 2 Test 3 Assignment Seminarsauravv7No ratings yet

- SSRN Id1957588Document30 pagesSSRN Id1957588uvyNo ratings yet

- Media ResearchDocument53 pagesMedia Researchdeepak kumarNo ratings yet

- Centre State RelationsDocument7 pagesCentre State RelationsSubscriptions NikhilNo ratings yet