Professional Documents

Culture Documents

New CST Form Iii-E

Uploaded by

HariHara Prabhanjan ReddyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New CST Form Iii-E

Uploaded by

HariHara Prabhanjan ReddyCopyright:

Available Formats

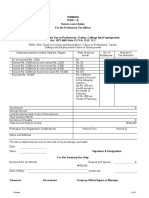

Form III (E)

Return-cum-chalan under rule 5 of the Central Sales Tax (Bombay) Rules, 1957.

I

C. S. T. R. C. No.

II Personal Name of Dealer

Information

FLAT / BLOCK

Address

Name of Premise/Building/Village

ROAD / STREET

Area/ Locality

CITY

District

Location of Sales Tax office having

jurisdiction over place of business

III

Separate Return Code

Pin code

E-mail-id of Dealer

Type of Return (Tick appropriate)

Original

Fresh

Revised

Periodicity of Return (Tick appropriate)

Monthly

Quarterly

Six-monthly

First Return ( Tick, if

applicable)

Newly registered dealers filling First return.

In Case of Cancellation of RC -for the period ending with the date of cancellation

IV

V

1

A

Period Covered by Return

From

Date

Month

Year

To

Mode of Incentives if holding Certificate of entitlement under package scheme of

incentives ( Please tick whichever is applicable)

Gross Turnover of Sales

Rs.

Less:-Turnover of Sales within the State

Rs.

Less:-Turnover of Sales of Goods outside the State

Rs.

Less:-Sales of the goods in the course of export out of India

Rs.

Less:-Sales of the goods in the course of import into India

Rs.

Rs.

A

B

Less:-Turnover of Inter_State sales on which tax is not leviable in

Maharashtra state u/s 9(1)

Less:-Value of goods transferred u/s 6A (1) of C.S.T. Act 1957

Less:- Turnover of sales of goods fully exempted from tax under

section 8(2) read with 8(4) of MVAT ACT 2002

Balance :-Inter-State sales on which tax is leviable in Maharashtra

State

Less:-Cost of freight , delivery or installation , if separately charged

Less:-Value of goods returned within six months u/s 8 A(1)(b)

Less:-Turnover of interstate sales on which no tax is payable

Rs.

D

E

3

Less:-Turnover of interstate sales u/s 6(2)

Less:-Turnover of interstate sales u/s 6(3)

Balance :-Total Taxable interstate sales ( 2- 2A-2B-2C-2D-2E)

A. Less:-Deduction u/s 8A(1)(a)

Rs.

Rs.

Rs.

Rs.

Net Taxable interstate sales ( 3- 3A)

Rs.

F

G

2

Last Return ( Tick, if

applicable)

Date

Month

Exemption

Year

Deferment

Rs.

Rs.

Rs.

Rs.

Rs.

A. Sales Taxable U/s. 8 (1)

Sr. No.

Rate

Sales Turnover (Rs.)

Tax (Rs.)

Sales Turnover (Rs.)

Tax (Rs.)

Sales Turnover (Rs.)

Tax (Rs.)

Total

B. Sales Taxable U/s. 8 (2)

Sr. No.

Rate

Total

C. Sales Taxable U/s. 8 (5)

Sr. No.

Rate

Total

Tax collected in excess of the tax payable ( 3A total tax 4( A+B+C) if positive

6

7

8

9

10

Total Amount of C.S.T Payable ( Total tax 4( A+B+C)

Amount deferred (out of Box (6)) ( under package scheme of incentives) if any

Balance Amount Payable ( Box (6)- Box (7))

Interest Payable

Total Amount Payable ( Box (8)+ Box (9))

Deduct

a)

Excess Credit brought forward from from previous return

b)

Excess MVAT refund to be adjusted against the CST liability.

c)

Amount already paid ( if any)( Details to be entered in Box 12( c) )

d)

Refund Adjustment order Amount ( Details to be entered in Box 12 (d))

11

Balance Amount Refundable / Excess credit ( if amount [10(a)+10(b)+10(c)+10(d)]

-Amount 10- is positive)

a)

Excess Credit carried forward to subsequent return

b)

Excess Credit claimed as refund( amount ( 11- 11(a))

12

Balance Amount payable ( if Amount 10- (10(a)+10(b)+10(c)+10(d))- is positive)

a)

Amount paid along with this return cum chalan

Chalan / CIN No.

Date

b)

Balance payable ( anmount not paid )if any

c). Details of Amount Already Paid

Chalan / CIN No.

Amount (Rs.)

Total

Date of Payment

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Rs.

Bank Name

Branch Name

d). Details of RAO

RAO No.

Amount Adjusted (Rs.)

Total

Date of RAO

The Statement contained in this return in Box 1 to 12 are true to the best of my knowledge and belief.

Date of Filing of Return

Date

Name Of Authorised Person

Designation

E-mail-id

Month

Year

Place

Signature of Tax Payer or Authorised Person

Phone No

For Bank / Treasury Use.

Chalan / CIN No.

Space for Bank's / Treasury's Stamp

Date of Entry

Date

Month

Year

Treasury Accountant / Treasury Officer / Agent / Manager's

Signature

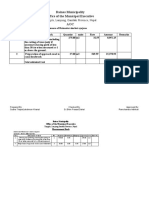

Form No III(E)

Form No III(E)

Chalan For Treasurty

Return-cum-chalan under rule 5 of the Central Sales Tax

(Bombay) Rules, 1957.

00400111-Sales Tax Receipts under C.S.T. ACT . 1957-Tax

Collection

Chalan For Treasurty

Return-cum-chalan under rule 5 of the Central Sales Tax (Bombay)

Rules, 1957.

Monthly

Quarterly

Six-monthly

Original

Fresh

Revised

Periodicity of Return

Six-monthly

Original

Fresh

Revised

CST RC NO

From

Month

Year

Date

To

Month

Year

Period

Covered By

the Return

From

Month

Date

Name Of Dealer

Address

Address

PIN

Year

Date

To

Month

Year

PIN

Tax( Rs.)

Tax( Rs.)

Interst ( Rs.)

Interst ( Rs.)

Total ( Fig)

Total ( Fig)

Total ( Words)

Total ( Words)

Lakh

Quarterly

Type of Return

MVAT RC No

Name Of

Dealer

Crore

Monthly

Periodicity of Return

Type of Return

MVAT RC No

CST RC NO

Period

Covere

Date

d By

the

Return

00400111-Sales Tax Receipts under C.S.T. ACT . 1957-Tax Collection

Thousands

Hundreds

Tens

Date

Crore

Lakh

Thousands

Hundreds

Tens

Date

Place

Signature of Depositor

Place

For Bank / Treasury Use.

Signature of Depositor

For Bank / Treasury Use.

Amount

Received( Fig)

Amount Received( Fig)

Amount

Received( Words

)

Amount

Received( Words)

Date of Entry

Date of Entry

Chalan / CIN No.

Chalan / CIN No.

Space for Bank's / Treasury's

Stamp

Signature of Treasury

Account / Treasury Officer /

Agent / Manager's

Space for Bank's / Treasury's Stamp

Signature of Treasury

Account / Treasury Officer /

Agent / Manager's

You might also like

- WiproDocument19 pagesWiproPriya ChariNo ratings yet

- WiproDocument19 pagesWiproPriya ChariNo ratings yet

- PF & Esi Calculation Sheet ExampleDocument3 pagesPF & Esi Calculation Sheet ExampleMohan RajNo ratings yet

- PtmahaDocument3 pagesPtmahaHariHara Prabhanjan ReddyNo ratings yet

- No Dues CertificateDocument1 pageNo Dues CertificateSurbhi SharmaNo ratings yet

- S.no Emplyoee Name Dept. Bank Name Bank A/c No. Basic Working DaysDocument7 pagesS.no Emplyoee Name Dept. Bank Name Bank A/c No. Basic Working DaysAnju KhasyapNo ratings yet

- Esic Online ChallanDocument26 pagesEsic Online ChallanahtradaNo ratings yet

- Competancy Mapping in HCL LTDDocument81 pagesCompetancy Mapping in HCL LTDbuviaroNo ratings yet

- Competency MappingDocument12 pagesCompetency Mappingarchana2089100% (1)

- EEDocument2 pagesEEHariHara Prabhanjan ReddyNo ratings yet

- Payment of Bonus Act, 1965 & The Rules: ChecklistDocument2 pagesPayment of Bonus Act, 1965 & The Rules: ChecklistparavindNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Rainas Municipality Office of The Municipal Executive AOC: Tinpiple, Lamjung, Gandaki Province, NepalDocument10 pagesRainas Municipality Office of The Municipal Executive AOC: Tinpiple, Lamjung, Gandaki Province, NepalLaxu KhanalNo ratings yet

- 2007 Full SpecbookDocument1,080 pages2007 Full SpecbookGuillermo LuchinNo ratings yet

- Taxation Class 11 QP PT 3Document10 pagesTaxation Class 11 QP PT 3AKSHAY KUMAR GUPTANo ratings yet

- 6 MHRM Sem VI MCQ Module 4Document41 pages6 MHRM Sem VI MCQ Module 4Nikita KukrejaNo ratings yet

- B2B Marketing: Price: Rs600Document2 pagesB2B Marketing: Price: Rs600Sandeep KadyanNo ratings yet

- Inventory ModelsDocument9 pagesInventory ModelshavillaNo ratings yet

- Chapter 4-Identifying Attributes of Strategic ResourcesDocument21 pagesChapter 4-Identifying Attributes of Strategic ResourcesatikahNo ratings yet

- Tan PawitraDocument17 pagesTan PawitraValentina BellaNo ratings yet

- Push and Pull Production Control System: MRP and JIT Session 5-7Document84 pagesPush and Pull Production Control System: MRP and JIT Session 5-7AfifahSeptiaNo ratings yet

- An Institutional Model For Land Use and Transport IntegrationDocument23 pagesAn Institutional Model For Land Use and Transport IntegrationAnessa HasibuanNo ratings yet

- Solution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 9Document46 pagesSolution Manual, Managerial Accounting Hansen Mowen 8th Editions - CH 9jasperkennedy086% (22)

- Institutional Theory and Environmental Pressures: The Moderating Effect of Market Uncertainty On Innovation and Firm PerformanceDocument12 pagesInstitutional Theory and Environmental Pressures: The Moderating Effect of Market Uncertainty On Innovation and Firm PerformanceayuNo ratings yet

- Intraday IndicatorDocument7 pagesIntraday IndicatoremailtodeepNo ratings yet

- Tax Final TaxDocument19 pagesTax Final TaxSittie Aisah AmpatuaNo ratings yet

- The Role of HRM in The Innovation of Performance Measurement and Management Systems: A Multiple Case Study in SmesDocument18 pagesThe Role of HRM in The Innovation of Performance Measurement and Management Systems: A Multiple Case Study in SmesRahman HakimNo ratings yet

- Scalping PDF 1st Edition - Not CompleteDocument102 pagesScalping PDF 1st Edition - Not Completemacosd4450No ratings yet

- How To Measure Bank SizeDocument24 pagesHow To Measure Bank SizeAsniNo ratings yet

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- (Bọp Đã Điền) BSBHRM411 AssignmentDocument44 pages(Bọp Đã Điền) BSBHRM411 AssignmenthsifjpobNo ratings yet

- Stanford Social Innovation Review - The Myth of CSRDocument8 pagesStanford Social Innovation Review - The Myth of CSRMoniqueNo ratings yet

- 3 Capacity Development Agenda For Barangays (Annex G-2)Document68 pages3 Capacity Development Agenda For Barangays (Annex G-2)Barangay Poblacion NaawanNo ratings yet

- Edexcel Business U1 CompiledDocument104 pagesEdexcel Business U1 CompiledCasey WangNo ratings yet

- Branch Accounts Gr-II 2Document12 pagesBranch Accounts Gr-II 2Dipen AdhikariNo ratings yet

- MIL CPI IW May 2021 EDocument1 pageMIL CPI IW May 2021 EAmit BharambeNo ratings yet

- Final Report Maruti SuzukiDocument70 pagesFinal Report Maruti SuzukiVarun Abrol88% (8)

- Tally SejdaDocument143 pagesTally Sejdaapaptech96No ratings yet

- Financial Statement 2020-21Document7 pagesFinancial Statement 2020-21celiaNo ratings yet

- A Study On Digital Marketing and Its New PhaseDocument9 pagesA Study On Digital Marketing and Its New Phasekar3kNo ratings yet

- Action PlanDocument3 pagesAction PlanJulie Ann100% (1)

- Under Section 4 (1) (B) of Rti Act, 2005 APIIC - Right To Information Act, 2005Document15 pagesUnder Section 4 (1) (B) of Rti Act, 2005 APIIC - Right To Information Act, 2005Sunil PhaniNo ratings yet