Professional Documents

Culture Documents

Economics Project Abstract

Uploaded by

Rahul Kumar0 ratings0% found this document useful (0 votes)

296 views3 pagesFDI in India synopsis

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFDI in India synopsis

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

296 views3 pagesEconomics Project Abstract

Uploaded by

Rahul KumarFDI in India synopsis

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

BA.

LLB (Hons)/First Trimester-July 2016

Revised Abstract

ECONOMICS-I

FOREIGN DIRECT INVESTMENT IN INDIA

Submitted By:

Rahul Kumar

BA.LLB (Hons.) 1st year

School of Law, NMIMS (Deemed to be University)

Submitted To:

Mitali Gupta

Asst. Professor (Economics)

School of Law, NMIMS (Deemed to be University)

INTRODUCTION

Foreign Direct Investment or FDI as its known is a controlling ownership in a business

enterprise in one country by an entity based in another country. Broadly, foreign direct

investment includes "mergers and acquisitions, building new facilities, reinvesting profits

earned from overseas operations and intra company loans". In a narrow sense, foreign

direct investment refers to building new facility, a lasting management interest (10

percent or more of voting stock) in an enterprise operating in an economy other than that

of the investor. FDI is major source of economic development in India. Foreign

companies invest directly in fast growing private Indian businesses to take benefits of

cheaper wages and changing business environment of India. Economic

liberalization started in India in wake of the 1991 economic crisis and since then FDI has

steadily increased in India. It were Manmohan Singh and P.V Narasimha Rao who

brought FDI in India under Foreign Exchange Management Act (FEMA ), which

subsequently generated more than one crore jobs. According to the Financial Times, in

2015 India overtook China and the US as the top destination for the Foreign Direct

Investment. In first half of the 2015, India attracted investment of $31 billion compared

to $28 billion and $27 billion of China and the US respectively.

India has changed a lot since the inception of FDI since 1991.

FACED with rising inflation and a balance of payment crisis in mid-1991, India's new

(minority) government introduced a fairly comprehensive, orthodox, policy reform

package - with currency devaluation as its centerpiece. The reforms did away with the

License Raj, reduced tariffs and interest rates and ended many public monopolies,

allowing automatic approval of foreign direct investment in many sectors.

This topic is of utmost importance as it introduced a new phase in the economic history

of India. It was adopted at the time when India was in serious economic crisis. The

government was close to default, its central bank had refused new credit and FOREX

reserves had reduced to the point that India could barely finance three weeks worth of

imports. Thus this topic is and always will be a thought-provoking subject for economists

in India.

Foreign direct investment (FDI) in India has played an important role in the development

of the Indian economy. FDI in India has in a lot of ways enabled India to achieve a

certain degree of financial stability, growth and development. This money has allowed

India to focus on the areas that needed a boost and economic attention, and address the

various problems that continue to challenge the country.

STATEMENT OF PROBLEM

India has allowed FDI in many sectors like infrastructure,

Automotive, Pharmaceuticals, service, railways, chemicals, textile,

and airlines. Thus FDI has affected every aspect of lives of

common Indians. This makes the study and analysis of FDIs

impact on Indian economy more important. Questions like Has

India been benefited by FDI,

Should 100% FDI be allowed in retail sector? FDI has many

advantages like economic growth, improvement in supply chain,

benefits for the farmers and disadvantages like losses of jobs,

monopoly of giant companies, worker exploitation and so on. Thus

we need to analyze the impact of FDI critically and come to a

definite conclusion.

You might also like

- Business Success in India: A Complete Guide to Build a Successful Business Knot with Indian FirmsFrom EverandBusiness Success in India: A Complete Guide to Build a Successful Business Knot with Indian FirmsNo ratings yet

- Role of FIIDocument5 pagesRole of FIIkrishanNo ratings yet

- Project 1Document20 pagesProject 1pandurang parkarNo ratings yet

- Advantages & Disadvantages of FDI in India: INCON - X 2015 E-ISSN-2320-0065Document10 pagesAdvantages & Disadvantages of FDI in India: INCON - X 2015 E-ISSN-2320-0065Anonymous 9XYG68vqNo ratings yet

- Impact of FDI in Indian EconomyDocument7 pagesImpact of FDI in Indian EconomyDEVARAJ KGNo ratings yet

- A Study On Foreign Direct Investment Specialization (Repaired)Document65 pagesA Study On Foreign Direct Investment Specialization (Repaired)yatinNo ratings yet

- SudarshanKashyap IB Assignmnt 2 ArticleDocument2 pagesSudarshanKashyap IB Assignmnt 2 ArticleSudarshan KashyapNo ratings yet

- Macroeconomics Research ProjectDocument14 pagesMacroeconomics Research ProjectAmit SinghNo ratings yet

- Fdi 12Document70 pagesFdi 12cityNo ratings yet

- Modified FDI & FII in India - A Comparative AnalysisDocument90 pagesModified FDI & FII in India - A Comparative AnalysisKewal JaganiNo ratings yet

- Impact of FDI in INDIADocument2 pagesImpact of FDI in INDIAsweetartNo ratings yet

- Nbibin ProjectDocument31 pagesNbibin ProjectJaspal KhalsaNo ratings yet

- Gjbmitv4n1 03Document8 pagesGjbmitv4n1 03satish kumar jhaNo ratings yet

- Viva Project FileDocument25 pagesViva Project FileGyany KiddaNo ratings yet

- Impact of FDI On Indian Entrepreneurship: Presented byDocument23 pagesImpact of FDI On Indian Entrepreneurship: Presented byAbhishek guptaNo ratings yet

- What Were The Reasons Behind The 1991 Economic Reforms in IndiaDocument6 pagesWhat Were The Reasons Behind The 1991 Economic Reforms in Indiaadeol5012No ratings yet

- Research Paper On FdiDocument6 pagesResearch Paper On FdiShweta ShrivastavaNo ratings yet

- Meaning of Foreign Capital FinalllllllllllllllllllllllllDocument15 pagesMeaning of Foreign Capital FinalllllllllllllllllllllllllManan ParikhNo ratings yet

- Impact of Foreign Direct Investment (FDI) On The Growth of The Indian EconomyDocument5 pagesImpact of Foreign Direct Investment (FDI) On The Growth of The Indian EconomyDylan WilcoxNo ratings yet

- FDI in India..RM AssignmentDocument8 pagesFDI in India..RM AssignmentTanisha MukherjeeNo ratings yet

- Foreign Direct InvestmentDocument5 pagesForeign Direct InvestmentFasih SenduNo ratings yet

- Foreign Direct InvestmentDocument12 pagesForeign Direct InvestmentRomeo RobinNo ratings yet

- Impact of Fdi On Indian EconomyDocument11 pagesImpact of Fdi On Indian Economyprahalad.rNo ratings yet

- Fdi in India Literature ReviewDocument5 pagesFdi in India Literature Reviewgvyns594100% (1)

- Program & Batch: Group No. Project Title Name of The Academic Guide/ Faculty: Subject: Group Coordinator: Contact No. Email IdDocument19 pagesProgram & Batch: Group No. Project Title Name of The Academic Guide/ Faculty: Subject: Group Coordinator: Contact No. Email IdRahul GuptaNo ratings yet

- Fdi in IndiaDocument8 pagesFdi in IndiamoniluckNo ratings yet

- Presented By:-1.bijayananda Sahoo 2.jibesh Kumar Mohapatra 3.naresh Kumar Sahoo 4.soumya Surajit BiswalDocument37 pagesPresented By:-1.bijayananda Sahoo 2.jibesh Kumar Mohapatra 3.naresh Kumar Sahoo 4.soumya Surajit BiswaljibeshmNo ratings yet

- BE Presentation KVDocument12 pagesBE Presentation KVVaikundraj NadarNo ratings yet

- Impact of Fdi in India - Annai MathammalDocument7 pagesImpact of Fdi in India - Annai MathammalSubakarthi KarthiNo ratings yet

- Globalization in IndiaDocument4 pagesGlobalization in IndianitishNo ratings yet

- Fdi in IndiaDocument15 pagesFdi in IndiaChandra ShekarNo ratings yet

- Economic Reforms INDIADocument7 pagesEconomic Reforms INDIArockydarkNo ratings yet

- Fdi Eco Project (Quillbot)Document4 pagesFdi Eco Project (Quillbot)ANANDA PADMANABAN SURESHNo ratings yet

- An Overview of Foreign Direct Investment in IndiaDocument15 pagesAn Overview of Foreign Direct Investment in IndiaParmila JhajhriaNo ratings yet

- India On MoveDocument6 pagesIndia On MoveN MNo ratings yet

- Impact of Fdi On Indian EconomyDocument11 pagesImpact of Fdi On Indian EconomyAshok SubramaniamNo ratings yet

- Fdi Inflow Merge DocumentDocument16 pagesFdi Inflow Merge DocumentSherlyNo ratings yet

- Fast Moving Consumer Goods (FMCG) : Project By-Arpita Hirawat ROLL NO. - 946 ROOM NO. - 38Document5 pagesFast Moving Consumer Goods (FMCG) : Project By-Arpita Hirawat ROLL NO. - 946 ROOM NO. - 38arpita_hirawatNo ratings yet

- Impact of FDI On Indian Economy: Term Paper On Financial SystemDocument19 pagesImpact of FDI On Indian Economy: Term Paper On Financial SystempintuNo ratings yet

- Introduction of FdiDocument5 pagesIntroduction of Fdijalpashingala1231707No ratings yet

- Or An Investor Located Outside Its BordersDocument6 pagesOr An Investor Located Outside Its BordersIrshita TarafdarNo ratings yet

- Grant Thornton FICCI MSMEDocument76 pagesGrant Thornton FICCI MSMEIshan GuptaNo ratings yet

- FDI and FII Impact On EconomyDocument80 pagesFDI and FII Impact On EconomyAmit SinghNo ratings yet

- FDI and Indian EconomyDocument47 pagesFDI and Indian EconomyParul Gupta0% (1)

- Foreign Direct Investment Section D Group 1Document12 pagesForeign Direct Investment Section D Group 1Anonymous pQv37RTYtRNo ratings yet

- An Analysis of Investment Pattern of FDI and Its Impact On Indian EconomyDocument15 pagesAn Analysis of Investment Pattern of FDI and Its Impact On Indian EconomyRam sharmaNo ratings yet

- Impact of Fdi On Indian Economy Research PapersDocument4 pagesImpact of Fdi On Indian Economy Research PapersefdrkqkqNo ratings yet

- IJREAMV05I0149096Document12 pagesIJREAMV05I0149096Sayyed Mustafa Kalaam RazviNo ratings yet

- ProjectDocument8 pagesProjectananyaNo ratings yet

- Foreign Direct Investment in India Research PaperDocument6 pagesForeign Direct Investment in India Research Papergz8zw71w100% (1)

- Impact and Influence of Foreign Investment in India: Master of Commerce Banking & Finance Semester I (2012 - 13)Document41 pagesImpact and Influence of Foreign Investment in India: Master of Commerce Banking & Finance Semester I (2012 - 13)Viswaprem CANo ratings yet

- Class: +2 Subject: Economics Part: Indian Economic Development Chapter-5 Economic Reforms Since 1991 or New Economic Policy Assignment No. 25-31Document19 pagesClass: +2 Subject: Economics Part: Indian Economic Development Chapter-5 Economic Reforms Since 1991 or New Economic Policy Assignment No. 25-31Harniazdeep SinghNo ratings yet

- Fdi in India Research PaperDocument8 pagesFdi in India Research Paperfvj892xr100% (1)

- The Impact of FDIDocument7 pagesThe Impact of FDIArham KothariNo ratings yet

- Foreign Direct Investment (FDI) in India Foreign Direct Investment (FDI) in IndiaDocument3 pagesForeign Direct Investment (FDI) in India Foreign Direct Investment (FDI) in IndiaDhavaSMNo ratings yet

- Term Paper On FII FDIDocument25 pagesTerm Paper On FII FDINisharg ZaveriNo ratings yet

- FDI FII Comparision As Drivers of GrowthDocument8 pagesFDI FII Comparision As Drivers of Growthshreyansh naharNo ratings yet

- Foreign CapitalDocument30 pagesForeign CapitalKaushal SekhaniNo ratings yet

- Impact of Foreign Investments On Economic Growth of India: December 2018Document6 pagesImpact of Foreign Investments On Economic Growth of India: December 2018Ashish JainNo ratings yet

- Foreign Direct Investment in IndiaDocument30 pagesForeign Direct Investment in Indiadevesh bhattNo ratings yet

- MKT 3350 Quiz 1Document4 pagesMKT 3350 Quiz 1Jar TiautrakulNo ratings yet

- Assignment # 6Document9 pagesAssignment # 6Ahtsham Ilyas RajputNo ratings yet

- ps2 SolutionsDocument7 pagesps2 SolutionsGabriel LopesNo ratings yet

- Economics ISC 11Document2 pagesEconomics ISC 11Sriyaa SunkuNo ratings yet

- Promotion Management: By: Priyanka Dang Subrata Jadon Prashant Gupta Farid Ashraf Anurag PrashantDocument23 pagesPromotion Management: By: Priyanka Dang Subrata Jadon Prashant Gupta Farid Ashraf Anurag PrashantAnurag PrashantNo ratings yet

- Strategic Management: Mini Case StudyDocument4 pagesStrategic Management: Mini Case StudyMuhammad AbdullahNo ratings yet

- 34 48 48 39 66 64 46 24 53 64 54 56 83 31 Total Result 442 268 710 38%Document89 pages34 48 48 39 66 64 46 24 53 64 54 56 83 31 Total Result 442 268 710 38%Agus MaulanaNo ratings yet

- BBMP1103 OUM Mathematics For Management September 2023Document9 pagesBBMP1103 OUM Mathematics For Management September 2023KogiNo ratings yet

- Use The Line Drawing Tool To Draw The Engel Curve For DonutsDocument1 pageUse The Line Drawing Tool To Draw The Engel Curve For DonutsChoo Wei shengNo ratings yet

- Engineering Economics OutlineDocument6 pagesEngineering Economics Outlineali ghalibNo ratings yet

- Claudio Lucarelli CV-2018Document5 pagesClaudio Lucarelli CV-2018ignacioillanesNo ratings yet

- 1.8 - An Introductory Note On The Environmental Economics of The Circular EconomyDocument9 pages1.8 - An Introductory Note On The Environmental Economics of The Circular EconomyKaroline Brito Coutinho FerreiraNo ratings yet

- McqsDocument22 pagesMcqsChandra Sai KumarNo ratings yet

- Wage Determination Under Free Market ForcesDocument5 pagesWage Determination Under Free Market ForcesKrishna Das ShresthaNo ratings yet

- Journal of Retailing and Consumer Services: Ajay Kumar, Justin Paul, Slađana Star Cevi CDocument12 pagesJournal of Retailing and Consumer Services: Ajay Kumar, Justin Paul, Slađana Star Cevi CVarinder Pal SinghNo ratings yet

- Exchange Rates JBDocument9 pagesExchange Rates JBboss9921No ratings yet

- Prof. SARPV Chaturvedi - Business Management ProfileDocument8 pagesProf. SARPV Chaturvedi - Business Management Profileलक्षमी नृसिहंन् वेन्कटपतिNo ratings yet

- Analyzing Common StockDocument47 pagesAnalyzing Common StockBang Topa50% (2)

- Results & Discussion: Table - 1 Gross Profit Ratio Year Gross Profit Net Sales 100 RatioDocument9 pagesResults & Discussion: Table - 1 Gross Profit Ratio Year Gross Profit Net Sales 100 RatioeswariNo ratings yet

- MicroDocument9 pagesMicroRomero, Rose Ann N.No ratings yet

- The Future of ContentDocument124 pagesThe Future of ContentFuturist Gerd Leonhard100% (1)

- Chapter 13 - The Costs of Production: Profit MaximizationDocument28 pagesChapter 13 - The Costs of Production: Profit MaximizationTường HuyNo ratings yet

- Chapter 31 - Open-Economy Macroeconomics - Basic Concepts - StudentsDocument25 pagesChapter 31 - Open-Economy Macroeconomics - Basic Concepts - StudentsPham Thi Phuong Anh (K16 HCM)No ratings yet

- Operations Management: Customer-Focused PrinciplesDocument13 pagesOperations Management: Customer-Focused PrinciplesYusranNo ratings yet

- Assignments 3 & 4 Questions MEDocument10 pagesAssignments 3 & 4 Questions MEAjinkya BinwadeNo ratings yet

- 9707 Business Studies: MARK SCHEME For The May/June 2013 SeriesDocument8 pages9707 Business Studies: MARK SCHEME For The May/June 2013 Series8jnmvbvqvwNo ratings yet

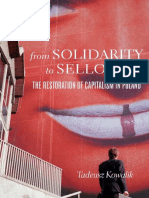

- 13 Kowalik, From Solidarity To Sellout PDFDocument367 pages13 Kowalik, From Solidarity To Sellout PDFporterszucsNo ratings yet

- The Greeks FinanceDocument49 pagesThe Greeks FinanceGerardo Rafael GonzalezNo ratings yet

- Problem AnalysisDocument2 pagesProblem AnalysisAriel FernandezNo ratings yet

- Running Head: Critical Analysis of Usa Global Financial Crisis 2007-2008 1Document10 pagesRunning Head: Critical Analysis of Usa Global Financial Crisis 2007-2008 1Sanjeevan SivapaleswararajahNo ratings yet