Professional Documents

Culture Documents

Director VP Finance Controller FP&A Auditing in Indianapolis Resume Thomas Kaehr

Uploaded by

ThomasKaehrCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Director VP Finance Controller FP&A Auditing in Indianapolis Resume Thomas Kaehr

Uploaded by

ThomasKaehrCopyright:

Available Formats

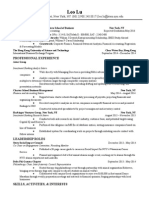

Thomas R.

Kaehr, CPA

tkaehr@indy.rr.com Carmel, IN 317-362-5205

www.linkedin.com/in/ThomasKaehr

FINANCE LEADER

Analytics Planning Risk Accounting & Reporting Acquisitions

Expertise in Corporate Finance, Accounting, FP&A, Audit, SOX, and M&A. Translates strategy into

actionable business and financial plans that propel growth, expansion, and diversification. Guided

operations and financial management for startup and established companies, in decentralized and shared

services environments. Member of senior leadership teams. Big 4 Public Accounting foundation.

EXPERIENCE

CNO Financial Group, Inc., Carmel, IN (2009 Current)

Financial services holding company for life, annuity & supplemental health insurance products;

serves 4M+ customers in U.S.; ranked 608 on Fortune 1000; $4.1B revenue

Senior Director / Vice President, Financial Planning & Analysis 2012 to Present

Promoted from General Auditor position to lead the FP&A team. Owned key financial forecasting models

plus M&A modeling including balance sheet recapitalizations. Worked closely with other senior managers

and numerous cross-functional teams

Partnered with Financial Systems Group to redesign financial planning and forecasting process that

increased efficiency 15% to accommodate acceleration of corporate closing timeline

Led cross-functional team that revamped cost/benefit analysis tool that more accurately evaluated

$50M+ in proposed corporate expenditures, most allocated to company growth initiatives

Provided key financial modeling and analytical support during major shifts in corporate structure,

including 2 recapitalizations and 2 divestitures, during a time period when stock price more than

doubled.

Most recently, lead cross-functional team responsible for parallel testing, data validation and issue

resolution on a large, critical corporate system development project

Asked to assume project leadership role in an effort to help expedite successful completion of a

struggling, multi-year, multi-million dollar compensation system development project

Established critical on-going status clarity for the first time to senior CNO leadership, expediting

project progress and allowing for establishment of a credible expected completion date

Vice President & General Auditor (2009 2012)

Restructured Audit Department functions to increase flexibility and efficiency. Oversaw staff and

operations to create and manage annual audit plan. Ensured SOX compliance and reporting. Member of

CNO Enterprise Risk Management (ERM) Committee

Served as Financial Operations Principal (FINOP, Series 27) for Broker Dealer operation. Reviewed

and approved quarterly net capital calculations, ensured broker dealer had adequate capital, and filed

FOCUS reports with FINRA

Identified and resolved operational issues, SOX deficiencies, and internal control weaknesses

resulting from merging systems and processes involving ~30 acquisitions across 2 decades

Realigned Audit and SOX groups to expand knowledge base and skill set of staff, and increase

overall work capacity by 15%

Instituted IT data mining unit to access and expertly analyze databases, files, record layouts,

systems, and processes. Quickly uncovered critical information that led to saving $.25M in

fraudulent vendor and employee payments

Added regular, systematic interactions with ERM and Compliance to share knowledge, keep

communication lines open, and improve assessment of enterprise risk

Thomas R. Kaehr, CPA tkaehr@indy.rr.com 317-362-5205

Expanded number of branch sales audits and proactively engaged Compliance Special Investigations

Unit to reveal fraud related to paying agent commissions. Saved minimum of $.5M annually

Security Benefit Corporation (SBC), Topeka, KS 2005 2009

Specialized in annuities, mutual funds, retirement plans, asset management

& business process outsourcing; $2.5B statutory revenue; $500+M GAAP revenue

VP of Finance, Controller and Treasurer, including responsibility as Interim CFO for extended period.

Teamed with Head of M&A, President, and CEO to lead Finance in $775M mutual fund acquisition

Co-drafted purchase agreement, worked with investment bankers during negotiations and

process management, and directed tax and financial due diligence

Ceded $1.5B block of variable annuity business to help fund transaction. Represented company

to Kansas State Department of Insurance (SDI), and gained approval to move forward with

transaction

Led purchase price allocation process utilizing 3 party vendor, and negotiated competitive rate

for $12M corporate aircraft financing

rd

Directed Valuation Actuarial and Internal Audit while retaining responsibilities as Controller

Coordinated Audit Committee and presented to full Board on all financial matters

Participated in Board strategy meetings. Frontline contact for rating agencies

As Controller managed 70 staff members and led statutory and regulatory accounting and reporting

for multiple legal entities, corporate tax, FP&A, budgeting, forecasting, investment accounting,

corporate insurance, and financial systems

Upgraded underperforming department lacking technical and leadership skills to smoothly running

operation, and increased number of CPAs from 3 to 14

Lincoln Financial Advisors, Fort Wayne, IN 2002 2005

Distribution organization supporting sales agents handling affluent customers

VP & Controller

Managed 20 associates, and directed financial planning, budgeting, reporting, and FP&A. Served as

Financial Operations Principal (Series 27). Handled SEC FOCUS filings and reviews.

Created first-time standalone field financial statement and collective P&L report that measured

success of entire company across all operations, and assisted Collections with reducing

delinquencies related to loans to agents by more than $1M

Handpicked to recruit candidates from Notre Dame for new management development program

offered by parent company. Asked to personally mentor 2 trainees

Vector Technologies, Indianapolis, IN 2000 2002

Small IT consulting company with about 50 employees

CFO

Directed all financial affairs and provided operational guidance for this entrepreneurial enterprise.

Provided leadership, credibility, and transparency that earned the trust and loyalty of workforce, lenders

and other stakeholders

Instrumental in making strategic shift in business management and customer support

Decreased annual expenses by $1.5M and resolved funding problems by restructuring functions,

negotiating extension of credit line with bank, and initiating 20% wage cut across all operations

Page 2 of 3

Thomas R. Kaehr, CPA tkaehr@indy.rr.com 317-362-5205

Symons International Group, Indianapolis, IN 1999 2000

Insurance holding company that underwrote and marketed nonstandard private passenger automobile insurance

VP & CFO

Responsible for accounting, finance, investments, taxes, actuarial, and SEC reporting. Developed

companys first financial results and cash flow forecasting model

Lincoln National Life Insurance Company, Fort Wayne, IN 1997 1999

Retail distribution unit with approximately 2K financial planners & 3K registered representatives

Second VP & Controller

Managed financial affairs of LNCs flagship insurance subsidiary. Member of executive team. Drove

assimilation of 2 large life and annuity reinsurance transactions representing $2.5B in reserves

American States Financial Corporation, Indianapolis, IN 1994 1997

Premier property & casualty operation of Lincoln National Corporation

VP & Controller

Played key role in taking company public, then subsequently selling remaining Holding Company stake to

Safeco at sizable premium. Started SEC reporting operation after firm went public. Managed all financial

activities

Lincoln National Corporation, Fort Wayne, IN 1992 1994

Fortune 250 American holding company that operates multiple insurance and investment management business through subsidiary companies

Second VP, Corporate Planning and Development (CP&D)

Recruited by SVP and Head of CP&D based on experience in M&A, employment with Big 8 public

accounting firms and 2 years as Director of Audit for Lincoln. Performed due diligence, and interfaced

with external and internal M&A professionals.

Supported LNC Chairman and CEO and senior staff. Developed and directed capital expenditure

review and approval process

Coordinated IPO of leading small case group health carrier, and was primary liaison between

subsidiary management, corporate senior management, investment bankers, legal counsel, and other

departments throughout offering process

Helped develop and execute companys strategic planning process

Note: Earlier career included senior position in Managed Healthcare Group acquisitions, financial

operations and audit, as well as Staff and Senior Staff Auditor for two Big 4 public accounting firms,

currently doing business as KPMG and PricewaterhouseCoopers.

EDUCATION / CERTIFICATION / MEMBERSHIPS

Bachelor of Science in Business Accounting Indiana University Associate of Science in Management

Purdue University CPA (active certification) Series 27 FINOP (inactive)

Member of American Institute of Certified Public Accountants, Indiana Society of CPAs, Financial

Executives International, Financial Executives Networking Group, Institute of Internal Auditors

Page 3 of 3

You might also like

- Financial Planning Analysis Director in Dallas TX Resume Sanjay NaraDocument3 pagesFinancial Planning Analysis Director in Dallas TX Resume Sanjay NaraSanjayNaraNo ratings yet

- Finance Manager in Atlanta GA Resume Benjamin HughesDocument3 pagesFinance Manager in Atlanta GA Resume Benjamin HughesBenjaminHughesNo ratings yet

- Finance Director Resume Samples: Expert Guidance for Your CareerDocument7 pagesFinance Director Resume Samples: Expert Guidance for Your CareerArojiduhu HalawaNo ratings yet

- CFO VP Director Finance in Houston TX Resume Michelle BakerDocument3 pagesCFO VP Director Finance in Houston TX Resume Michelle BakerMichelleBakerNo ratings yet

- Director Finance Planning Analysis in New York City Resume Kevin BayneDocument2 pagesDirector Finance Planning Analysis in New York City Resume Kevin BayneKevinBayneNo ratings yet

- CFO Chief Financial Officer in New York NY Resume David RaineyDocument4 pagesCFO Chief Financial Officer in New York NY Resume David RaineyDavid RaineyNo ratings yet

- CFO VP Finance Controller in Austin TX USA Resume Penny LozanoDocument3 pagesCFO VP Finance Controller in Austin TX USA Resume Penny LozanoPennyLozanoNo ratings yet

- Director Financial Planning Analysis in Philadelphia PA Resume Tracy BondDocument3 pagesDirector Financial Planning Analysis in Philadelphia PA Resume Tracy BondTracyBondNo ratings yet

- Senior Finance Manager FP&A in Williamsburg, VA ResumeDocument2 pagesSenior Finance Manager FP&A in Williamsburg, VA ResumeRCTBLPONo ratings yet

- Global Strategic CFO Manufacturing in Burlington VT Resume Kent RosenthalDocument3 pagesGlobal Strategic CFO Manufacturing in Burlington VT Resume Kent RosenthalKent RosenthalNo ratings yet

- Jaime Cooper Consulting (Business Development Resume)Document2 pagesJaime Cooper Consulting (Business Development Resume)jcooper_bostonNo ratings yet

- Director Financial Planning Analysis in New York NY Resume Howard SchierDocument2 pagesDirector Financial Planning Analysis in New York NY Resume Howard SchierHowardSchierNo ratings yet

- Director Finance FP&A Operations in New York City Resume James WhitneyDocument2 pagesDirector Finance FP&A Operations in New York City Resume James WhitneyJamesWhitneyNo ratings yet

- Sample CEO ResumeDocument2 pagesSample CEO ResumeAnonymous gf7D0nNo ratings yet

- Chief Executive Officer CEO COO in North America Resume Christopher MoritzDocument2 pagesChief Executive Officer CEO COO in North America Resume Christopher MoritzChristopherMoritzNo ratings yet

- Rob Brown, PHD, Cfa 5054 Evanwood AvenueDocument4 pagesRob Brown, PHD, Cfa 5054 Evanwood Avenuekurtis_workmanNo ratings yet

- Director Investment Banking in NYC NY Resume Pascal KabembaDocument2 pagesDirector Investment Banking in NYC NY Resume Pascal KabembaPascalKabemba100% (1)

- VP Strategy Strategic Planning Resume Columbus OH Gerald NanningaDocument3 pagesVP Strategy Strategic Planning Resume Columbus OH Gerald NanningaGerald NanningaNo ratings yet

- Senior Investment Strategist Portfolio Manager in Detroit MI Resume Clarence LewisDocument2 pagesSenior Investment Strategist Portfolio Manager in Detroit MI Resume Clarence LewisClarenceLewisNo ratings yet

- Sample Ceo Resume 2 PDFDocument2 pagesSample Ceo Resume 2 PDFfahdlyNo ratings yet

- Finance VP Director FP&A in Los Angeles CA Resume Dean DunaierDocument2 pagesFinance VP Director FP&A in Los Angeles CA Resume Dean DunaierDeanDunaier2No ratings yet

- VP Strategic Business Development in USA Resume Manlio HuacujaDocument2 pagesVP Strategic Business Development in USA Resume Manlio HuacujaManlioHuacujaNo ratings yet

- Financial Analyst Resume PDFDocument1 pageFinancial Analyst Resume PDFjayeshrane2107100% (1)

- The 80-20 CFODocument72 pagesThe 80-20 CFOAbdinour100% (1)

- Senior Accountant Staff Accountant Assistant Controller in New Jersey Resume Magaly VanderbergDocument2 pagesSenior Accountant Staff Accountant Assistant Controller in New Jersey Resume Magaly VanderbergMagaly VanderbergNo ratings yet

- CIO VP Director IT in Detroit MI Resume Remi DiesbourgDocument2 pagesCIO VP Director IT in Detroit MI Resume Remi DiesbourgRemi DiesbourgNo ratings yet

- VP Corporate Finance CFO in Dallas Fort Worth TX Resume Joe RenfroeDocument2 pagesVP Corporate Finance CFO in Dallas Fort Worth TX Resume Joe RenfroeJoeRenfroeNo ratings yet

- Helpful WSO PostsDocument23 pagesHelpful WSO PostsalbertNo ratings yet

- Fast Standards For Financial ModelingDocument34 pagesFast Standards For Financial Modelingsonthaliarahul5561100% (1)

- Finance ResumesDocument9 pagesFinance ResumesMJ BajaNo ratings yet

- Business Consultant MBA CV Resume TemplateDocument2 pagesBusiness Consultant MBA CV Resume TemplateMike Kelley100% (1)

- Succeeding in An Investment Banking Interview by Jared HaftelDocument1 pageSucceeding in An Investment Banking Interview by Jared HafteljaflorentineNo ratings yet

- Financial PL Anning & Analysis Technical Mastery Program: Where Strategy and Analysis MeetDocument3 pagesFinancial PL Anning & Analysis Technical Mastery Program: Where Strategy and Analysis MeetAarnaaNo ratings yet

- Finance Director in Boston MA Resume James ReynoldsDocument2 pagesFinance Director in Boston MA Resume James ReynoldsJamesReynolds2No ratings yet

- Get CFO-Level Support from Experienced Finance ProfessionalsDocument12 pagesGet CFO-Level Support from Experienced Finance ProfessionalsMuhammad Ahmed MirzaNo ratings yet

- Job Interview Questions For Financial AnalystsDocument5 pagesJob Interview Questions For Financial AnalystsPabitha MonishaNo ratings yet

- COO Financial Services CFO in New York City Resume Clyvan BelleDocument2 pagesCOO Financial Services CFO in New York City Resume Clyvan BelleClyvanBelleNo ratings yet

- Role of CFODocument3 pagesRole of CFOTara GilaniNo ratings yet

- Lu Leo ResumeDocument2 pagesLu Leo ResumeLeo LuNo ratings yet

- Innovative CFO VP Finance Controller in Houston TX Resume Thornton StewartDocument2 pagesInnovative CFO VP Finance Controller in Houston TX Resume Thornton StewartThorntonStewartNo ratings yet

- Complete Financial Modeling Guide - Step by Step Best PracticesDocument14 pagesComplete Financial Modeling Guide - Step by Step Best PracticesPAK & CANADA TRADING LLC.100% (1)

- Financial Modelling in Power SectorDocument5 pagesFinancial Modelling in Power SectorngozinwaneriNo ratings yet

- 13 Structure of The Investment IndustryDocument19 pages13 Structure of The Investment Industryfryuo pilanNo ratings yet

- 3 Biggest Lies About Landing a Job in BankingDocument19 pages3 Biggest Lies About Landing a Job in BankingSwapnil KumarNo ratings yet

- Katie Rogers ResumeDocument3 pagesKatie Rogers ResumeDave RogersNo ratings yet

- MBA Investment Banking Resume TemplateDocument2 pagesMBA Investment Banking Resume TemplatesensibledeveshNo ratings yet

- HR Manager Generalist in San Francisco Bay CA Resume Laura BurgessDocument2 pagesHR Manager Generalist in San Francisco Bay CA Resume Laura BurgessLauraBurgess2No ratings yet

- CFO Controller VP Finance in Denver CO Resume Jon ZimbeckDocument4 pagesCFO Controller VP Finance in Denver CO Resume Jon ZimbeckJonZimbeckNo ratings yet

- Chief Financial Officer CFO in Midwest USA Resume David LindstaedtDocument4 pagesChief Financial Officer CFO in Midwest USA Resume David LindstaedtDavidLindstaedtNo ratings yet

- CFO Finance Director Controller in Los Angeles CA Resume Keith RowlandDocument2 pagesCFO Finance Director Controller in Los Angeles CA Resume Keith RowlandKeithRowlandNo ratings yet

- VP Corporate Development M&A in San Francisco Bay CA Resume Kostas KatsohirakisDocument2 pagesVP Corporate Development M&A in San Francisco Bay CA Resume Kostas KatsohirakisKostasKatsohirakis100% (1)

- Cover Letter For Stanford - Mutemi-1Document1 pageCover Letter For Stanford - Mutemi-1Sitche ZisoNo ratings yet

- CFO Director Finance Controller in Toronto ON Canada Resume Yvonne QuDocument3 pagesCFO Director Finance Controller in Toronto ON Canada Resume Yvonne QuYvonneQuNo ratings yet

- Dardenresume PEDocument36 pagesDardenresume PEkk235197No ratings yet

- Global Controller Finance Director in NYC Resume Sanjeev ParabDocument2 pagesGlobal Controller Finance Director in NYC Resume Sanjeev ParabSanjeevParabNo ratings yet

- Risk Appetite Best Practice A Complete Guide - 2020 EditionFrom EverandRisk Appetite Best Practice A Complete Guide - 2020 EditionNo ratings yet

- COBIT 2019 Design GuideDocument277 pagesCOBIT 2019 Design GuideHasti YektaNo ratings yet

- Job AnalysisDocument25 pagesJob AnalysishiraludhaniNo ratings yet

- BAFT Handbook With Registration FormDocument21 pagesBAFT Handbook With Registration FormGabriel LimNo ratings yet

- Program Corporate Social Responsibiliti CSR PTPN VDocument25 pagesProgram Corporate Social Responsibiliti CSR PTPN VauliaNo ratings yet

- The Ultimate Guide To PR in 2022Document16 pagesThe Ultimate Guide To PR in 2022CynthiaNo ratings yet

- RM GuidelinesDocument62 pagesRM GuidelinesHe BinNo ratings yet

- Syllabus For Management of Education ChangeDocument9 pagesSyllabus For Management of Education ChangeTeachers Without BordersNo ratings yet

- SafetyToolkit 5whysDocument4 pagesSafetyToolkit 5whysFaisal AbdoNo ratings yet

- 08 Critical Success Factors For FM Implementation in The Healthcare IndustryDocument15 pages08 Critical Success Factors For FM Implementation in The Healthcare IndustrydnoksNo ratings yet

- CCMv4 0AuditingGuidelinesDocument79 pagesCCMv4 0AuditingGuidelinesMousumi Utkarsh RayNo ratings yet

- (Barbara B. Moran, Robert D. Stueart) Library and PDFDocument524 pages(Barbara B. Moran, Robert D. Stueart) Library and PDFMartha IlaganNo ratings yet

- Final assessment SWOT analysisDocument15 pagesFinal assessment SWOT analysismiraj hossenNo ratings yet

- P 08 Procedure For Customer SatisfactionDocument10 pagesP 08 Procedure For Customer SatisfactionSeshadri JaganathanNo ratings yet

- Sameer Hossain, 19-41332-3, Affiliation Report, Activities of A Student Services ExecutiveDocument8 pagesSameer Hossain, 19-41332-3, Affiliation Report, Activities of A Student Services ExecutiveMunna PervezNo ratings yet

- Core Values: Timeless Guiding PrinciplesDocument10 pagesCore Values: Timeless Guiding Principlessaqib ghiasNo ratings yet

- MIS Management Tool for Strategic Decision MakingDocument144 pagesMIS Management Tool for Strategic Decision Makingpavithra srinivasanNo ratings yet

- PM Chapter 03Document59 pagesPM Chapter 03fahadneoNo ratings yet

- Eight Cs For Team BuildingDocument2 pagesEight Cs For Team Buildingmauserk98No ratings yet

- Summary of FindingsDocument3 pagesSummary of FindingsshairaNo ratings yet

- Org Week 5Document7 pagesOrg Week 5Arlyn Jane Catienza PradoNo ratings yet

- Yamashina WCM Introduzione PPT Compatibility Mode RepairedDocument85 pagesYamashina WCM Introduzione PPT Compatibility Mode RepairededuardolucosNo ratings yet

- Dissertation Ideas On PrisonsDocument8 pagesDissertation Ideas On PrisonsPaperWritingHelpOnlineMadison100% (1)

- The Agile Approach: An Overview of Agile Principles, Methods and AttributesDocument15 pagesThe Agile Approach: An Overview of Agile Principles, Methods and Attributesgabrielvera100% (1)

- Kaizen & PDCA CycleDocument20 pagesKaizen & PDCA CycleRabia JamilNo ratings yet

- Chapter 9 - Organazational CultureDocument31 pagesChapter 9 - Organazational Cultureanashj2No ratings yet

- Post Implementation ReviewDocument5 pagesPost Implementation ReviewSteveNo ratings yet

- Research-Informed Curriculum Design For A Master's-Level Program in Project ManagementDocument32 pagesResearch-Informed Curriculum Design For A Master's-Level Program in Project ManagementMariaNo ratings yet

- BCG Taking Agile Transformations Beyond The Tipping Point Aug 2018 Tcm9 199341Document4 pagesBCG Taking Agile Transformations Beyond The Tipping Point Aug 2018 Tcm9 199341Mohammad Mahdi MozaffarNo ratings yet

- What Is Inventory TurnoverDocument2 pagesWhat Is Inventory TurnoverDarlene SarcinoNo ratings yet

- Oracle Service Procurement Advisory & ConsultingDocument22 pagesOracle Service Procurement Advisory & ConsultingPrakashNo ratings yet