Professional Documents

Culture Documents

Statcon30 39

Uploaded by

mjoimynbyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statcon30 39

Uploaded by

mjoimynbyCopyright:

Available Formats

F.

Particular Latin Rules

(1) MENS LEGISLATORIS

[G.R. No. L-28771. March 31, 1971.]

CORNELIA MATABUENA, Plaintiff-Appellant, v.

PETRONILA CERVANTES, Defendant-Appellee.

Alegre, Roces, Salazar & Saez, for PlaintiffAppellant.

Fernando Gerona, Jr., for Defendant-Appellee.

SYLLABUS

1. CIVIL LAW; PROPERTY RELATIONS BETWEEN

HUSBAND AND WIFE; DONATIONS BY REASON OF

MARRIAGE;

PROHIBITION

AGAINST

DONATION

BETWEEN SPOUSES DURING MARRIAGE; APPLICABLE

TO COMMON LAW RELATIONSHIP. While Art. 133 of

the Civil Code considers as void a "donation between

the

spouses

during

the

marriage",

policy

considerations of the most exigent character as well

as the dictates of morality require that the same

prohibition

should

apply

to

a common-law

relationship. A 1954 Court of Appeals decision

Buenaventura v. Bautista, (50 O.G. 3679) interpreting

a similar provision of the old Civil Code speaks

unequivocally. If the policy of the law is, in the

language of the opinion of the then Justice J.B.L.

Reyes of that Court, "to prohibit donations in favor of

the other consort and his descendants because of

fear of undue and improper pressure and influence

upon the donor, a prejudice deeply rooted in our

ancient law; porque no se engaen despojandose el

uno al otro por amor que han de consuno,

[according to] the Partidas (Part. IV, Tit. Xl, LAW IV),

reiterating the rationale Ne mutuato amore invicem

spoliarentur of the Pandects (Bk 24, Tit. I, De donat,

inter virum et uxorem); then there is every reason to

apply the same prohibitive policy to persons living

together as husband and wife without benefit of

nuptials. For it is not to be doubted that assent to

such irregular connection for thirty years bespeaks

greater influence of one party over the other, so that

the danger that the law seeks to avoid is

correspondingly increased. Moreover, as already

pointed out by Ulpian (in his lib. 32 ad Sabinum, fr.

1), it would not be just that such donations should

subsist lest the condition of those who incurred guilt

should turn out to be better. So long as marriage

remains the cornerstone of our family law, reason

and morality alike demand that the disabilities

attached to marriage should likewise attach to

concubinage.

2. ID.; SUCCESSION; INTESTATE SUCCESSION;

SURVIVING SPOUSE; RULE WHERE A SISTER

SURVIVES WITH THE WIDOW. The lack of validity of

the donation made b~ the deceased to defendant

Petronila Cervantes does not necessarily result in

plaintiff having exclusive right to the disputed

property. Prior to the death of Felix Matabuena, the

relationship between him and the defendant was

legitimated by their marriage on March 28. 1962. She

is therefore his widow. As provided in the Civil Code,

she is entitled to one-half of the inheritance and the

plaintiff, as the surviving sister to the other half.

DECISION

FERNANDO, J.:

A question of first impression is before this Court in

this litigation. We are called upon to decide whether

the ban on a donation between the spouses during a

marriage applies to a common-law relationship. 1

The plaintiff, now appellant Cornelia Matabuena, a

sister to the deceased Felix Matabuena, maintains

that a donation made while he was living maritally

without benefit of marriage to defendant, now

appellee Petronila Cervantes, was void. Defendant

would uphold its validity. The lower court, after

noting that it was made at a time before defendant

was married to the donor, sustained the latters

stand. Hence this appeal. The question, as noted, is

novel in character, this Court not having had as yet

the opportunity of ruling on it. A 1954 decision of the

Court of Appeals, Buenaventura v. Bautista, 2 by the

then Justice J. B. L. Reyes, who was appointed to this

Court later that year, is indicative of the appropriate

response that should be given. The conclusion

reached therein is that a donation between commonlaw spouses falls within the prohibition and is "null

and void as contrary to public policy." 3 Such a view

merits fully the acceptance of this Court. The

decision

must

be

reversed.

In the decision of November 23, 1965, the lower

court, after stating that in plaintiffs complaint

alleging absolute ownership of the parcel of land in

question, she specifically raised the question that the

donation made by Felix Matabuena to defendant

Petronila Cervantes was null and void under the

aforesaid article of the Civil Code and that defendant

on the other hand did assert ownership precisely

because such a donation was made in 1956 and her

marriage to the deceased did not take place until

1962, noted that when the case was called for trial

on November 19, 1965, there was stipulation of facts

which it quoted. 4 Thus: "The plaintiff and the

defendant assisted by their respective counsels,

jointly agree and stipulate: (1) That the deceased

Felix Matabuena owned the property in question; (2)

That said Felix Matabuena executed a Deed of

Donation inter vivos in favor of Defendant, Petronila

Cervantes over the parcel of land in question on

February 20, 1956, which same donation was

accepted by defendant; (3) That the donation of the

land to the defendant which took effect immediately

was made during the common law relationship as

husband and wife between the defendant-done and

the now deceased donor and later said donor and

done were married on March 28, 1962; (4) That the

deceased Felix Matabuena died intestate on

September 13, 1962; (5) That the plaintiff claims the

property by reason of being the only sister and

nearest collateral relative of the deceased by virtue

of an affidavit of self-adjudication executed by her in

1962 and had the land declared in her name and

paid the estate and inheritance taxes thereon" 5

The judgment of the lower court on the above facts

was adverse to plaintiff. It reasoned out thus: "A

donation under the terms of Article 133 of the Civil

Code is void if made between the spouses during the

marriage. When the donation was made by Felix

Matabuena in favor of the defendant on February 20,

1956, Petronila Cervantes and Felix Matabuena were

not yet married. At that time they were not spouses.

They became spouses only when they married on

March 28, 1962, six years after the deed of donation

had

been

executed."

6

We reach a different conclusion. While Art. 133 of the

Civil Code considers as void a "donation between the

spouses during the marriage," policy considerations

of the most exigent character as well as the dictates

of morality require that the same prohibition should

apply to a common-law relationship. We reverse.

1. As announced at the outset of this opinion, a 1954

Court of Appeals decision, Buenaventura v. Bautista,

7 interpreting a similar provision of the old Civil Code

8 speaks unequivocally. If the policy of the law is, in

the language of the opinion of the then Justice J.B.L.

Reyes of that Court, "to prohibit donations in favor of

the other consort and his descendants because of

fear of undue and improper pressure and influence

upon the donor, a prejudice deeply rooted in our

ancient law; porque no se engaen despojandose el

uno al otro por amor que han de consuno [according

to] the Partidas (Part IV, Tit. XI, LAW IV), reiterating

the

rationale

Ne

mutuato

amore

invicem

spoliarentur of the Pandects (Bk. 24, Tit. 1, De donat,

inter virum et uxorem); then there is every reason to

apply the same prohibitive policy to persons living

together as husband and wife without the benefit of

nuptials. For it is not to be doubted that assent to

such irregular connection for thirty years bespeaks

greater influence of one party over the other, so that

the danger that the law seeks to avoid is

correspondingly increased. Moreover, as already

pointed out by Ulpian (in his lib. 32 ad Sabinum, fr.

1), it would not be just that such donations should

subsist, lest the condition of those who incurred guilt

should turn out to be better. So long as marriage

remains the cornerstone of our family law, reason

and morality alike demand that the disabilities

attached to marriage should likewise attach to

concubinage."

9

2. It is hardly necessary to add that even in the

absence of the above pronouncement, any other

conclusion cannot stand the test of scrutiny. It would

be to indict the framers of the Civil Code for a failure

to apply a laudable rule to a situation which in its

essentials cannot be distinguished. Moreover, if it is

at all to be differentiated, the policy of the law which

embodies a deeply-rooted notion of what is just and

what is right would be nullified if such irregular

relationship instead of being visited with disabilities

would be attended with benefits. Certainly a legal

norm should not be susceptible to such a reproach. If

there is ever any occasion where the principle of

statutory construction that what is within the spirit of

the law is as much a part of it as what is written, this

is it. Otherwise the basic purpose discernible in such

codal provision would not be attained. Whatever

omission may be apparent in an interpretation purely

literal of the language used must be remedied by an

adherence to its avowed objective. In the language of

Justice Pablo: "El espiritu que informa la ley debe ser

la luz que ha de guiar a los tribunales en la aplicacin

de

sus

disposiciones.

10

civil case was based was culled from a tape recording

of the confrontation made by petitioner. 2 The

transcript reads as follows:

3. The lack of validity of the donation made by the

deceased to defendant Petronila Cervantes does not

necessarily result in plaintiff having exclusive right to

the disputed property. Prior to the death of Felix

Matabuena, the relationship between him and the

defendant was legitimated by their marriage on

March 28, 1962. She is therefore his widow. As

provided for in the Civil Code, she is entitled to onehalf of the inheritance and the plaintiff, as the

surviving

sister,

to

the

other

half.

11

Plaintiff Soccoro D. Ramirez (Chuchi) Good

Afternoon M'am.

Defendant Ester S. Garcia (ESG) Ano ba ang

nangyari sa 'yo, nakalimot ka na kung paano ka

napunta rito, porke member ka na, magsumbong ka

kung ano ang gagawin ko sa 'yo.

CHUCHI Kasi, naka duty ako noon.

ESG Tapos iniwan no. (Sic)

CHUCHI Hindi m'am, pero ilan beses na nila akong

binalikan, sabing ganoon

ESG Ito and (sic) masasabi ko sa 'yo, ayaw kung

(sic) mag explain ka, kasi hanggang 10:00 p.m.,

kinabukasan hindi ka na pumasok. Ngayon ako ang

babalik sa 'yo, nag-aaply ka sa States, nag-aaply ka

sa review mo, kung kakailanganin ang certification

mo, kalimutan mo na kasi hindi ka sa akin

makakahingi.

CHUCHI Hindi M'am. Kasi ang ano ko talaga noon icocontinue ko up to 10:00 p.m.

ESG Bastos ka, nakalimutan mo na kung paano ka

pumasok dito sa hotel. Magsumbong ka sa Union

kung gusto mo. Nakalimutan mo na kung paano ka

nakapasok dito "Do you think that on your own

makakapasok ka kung hindi ako. Panunumbyoyan na

kita (Sinusumbatan na kita).

CHUCHI Itutuloy ko na M'am sana ang duty ko.

ESG Kaso ilang beses na akong binabalikan doon

ng mga no (sic) ko.

ESG Nakalimutan mo na ba kung paano ka

pumasok sa hotel, kung on your own merit alam ko

naman kung gaano ka "ka bobo" mo. Marami ang

nag-aaply alam kong hindi ka papasa.

CHUCHI Kumuha kami ng exam noon.

ESG Oo, pero hindi ka papasa.

CHUCHI Eh, bakit ako ang nakuha ni Dr. Tamayo

ESG Kukunin ka kasi ako.

CHUCHI Eh, di sana

ESG Huwag mong ipagmalaki na may utak ka

kasi wala kang utak. Akala mo ba makukuha ka dito

kung hindi ako.

CHUCHI Mag-eexplain ako.

ESG Huwag na, hindi ako mag-papa-explain sa 'yo,

makaalala ka kung paano ka puma-rito. "Putang-ina"

sasabi-sabihin mo kamag-anak ng nanay at tatay mo

ang mga magulang ko.

ESG Wala na akong pakialam, dahil nandito ka sa

loob, nasa labas ka puwede ka ng hindi pumasok,

okey yan nasaloob ka umalis ka doon.

WHEREFORE, the lower court decision of November

23, 1965 dismissing the complaint with costs is

reversed. The questioned donation is declared void,

with the rights of plaintiff and defendant as pro

indiviso heirs to the property in question recognized.

The case is remanded to the lower court for its

appropriate disposition in accordance with the above

opinion. Without pronouncement as to costs

(2) UBI LEX NON DISTINGUIT, NEC NOC

DISTINGUERE DEBERMUS

SOCORRO D. RAMIREZ, petitioner,

vs.

HONORABLE COURT OF APPEALS, and ESTER S.

GARCIA, respondents.

KAPUNAN, J.:

A civil case damages was filed by petitioner Socorro

D. Ramirez in the Regional Trial Court of Quezon City

alleging that the private respondent, Ester S. Garcia,

in a confrontation in the latter's office, allegedly

vexed, insulted and humiliated her in a "hostile and

furious mood" and in a manner offensive to

petitioner's dignity and personality," contrary to

morals, good customs and public policy." 1

In support of her claim, petitioner produced a

verbatim transcript of the event and sought moral

damages, attorney's fees and other expenses of

litigation in the amount of P610,000.00, in addition to

costs, interests and other reliefs awardable at the

trial court's discretion. The transcript on which the

CHUCHI Kasi M'am, binbalikan ako ng mga taga

Union.

ESG Nandiyan na rin ako, pero huwag mong

kalimutan na hindi ka makakapasok kung hindi ako.

Kung hindi mo kinikilala yan okey lang sa akin, dahil

tapos ka na.

CHUCHI Ina-ano ko m'am na utang na loob.

ESG Huwag na lang, hindi mo utang na loob, kasi

kung baga sa no, nilapastangan mo ako.

CHUCHI Paano kita nilapastanganan?

ESG Mabuti pa lumabas ka na. Hindi na ako

makikipagusap sa 'yo. Lumabas ka na. Magsumbong

ka. 3

As a result of petitioner's recording of the event and

alleging that the said act of secretly taping the

confrontation was illegal, private respondent filed a

criminal case before the Regional Trial Court of Pasay

City for violation of Republic Act 4200, entitled "An

Act to prohibit and penalize wire tapping and other

related violations of private communication, and

other purposes." An information charging petitioner

of violation of the said Act, dated October 6, 1988 is

quoted herewith:

INFORMATION

The Undersigned Assistant City Fiscal Accusses

Socorro D. Ramirez of Violation of Republic Act No.

4200, committed as follows:

That on or about the 22nd day of February, 1988, in

Pasay City Metro Manila, Philippines, and within the

jurisdiction of this honorable court, the above-named

accused, Socorro D. Ramirez not being authorized by

Ester S. Garcia to record the latter's conversation

with said accused, did then and there willfully,

unlawfully and feloniously, with the use of a tape

recorder secretly record the said conversation and

thereafter communicate in writing the contents of

the said recording to other person.

Contrary to law.

Pasay City, Metro Manila, September 16, 1988.

MARIANO

Asst. City Fiscal

M.

CUNETA

Upon arraignment, in lieu of a plea, petitioner filed a

Motion to Quash the Information on the ground that

the facts charged do not constitute an offense,

particularly a violation of R.A. 4200. In an order May

3, 1989, the trial court granted the Motion to Quash,

agreeing with petitioner that 1) the facts charged do

not constitute an offense under R.A. 4200; and that

2) the violation punished by R.A. 4200 refers to a the

taping of a communication by a personother than a

participant to the communication. 4

From the trial court's Order, the private respondent

filed a Petition for Review on Certiorari with this

Court, which forthwith referred the case to the Court

of Appeals in a Resolution (by the First Division) of

June 19, 1989.

On February 9, 1990, respondent Court of Appeals

promulgated its assailed Decision declaring the trial

court's order of May 3, 1989 null and void, and

holding that:

[T]he allegations sufficiently constitute an offense

punishable under Section 1 of R.A. 4200. In thus

quashing the information based on the ground that

the facts alleged do not constitute an offense, the

respondent judge acted in grave abuse of discretion

correctible by certiorari. 5

Consequently, on February 21, 1990, petitioner filed

a Motion for Reconsideration which respondent Court

of Appeals denied in its Resolution 6 dated June 19,

1990. Hence, the instant petition.

Petitioner vigorously argues, as her "main and

principal issue" 7 that the applicable provision of

Republic Act 4200 does not apply to the taping of a

private conversation by one of the parties to the

conversation. She contends that the provision merely

refers to the unauthorized taping of a private

conversation by a party other than those involved in

the communication. 8 In relation to this, petitioner

avers that the substance or content of the

conversation must be alleged in the Information,

otherwise the facts charged would not constitute a

violation of R.A. 4200. 9 Finally, petitioner agues that

R.A. 4200 penalizes the taping of a "private

communication," not a "private conversation" and

that consequently, her act of secretly taping her

conversation with private respondent was not illegal

under the said act. 10

We disagree.

First, legislative intent is determined principally from

the language of a statute. Where the language of a

statute is clear and unambiguous, the law is applied

according to its express terms, and interpretation

would be resorted to only where a literal

interpretation would be either impossible 11 or absurb

or would lead to an injustice. 12

Section 1 of R.A. 4200 entitled, " An Act to Prohibit

and Penalized Wire Tapping and Other Related

Violations of Private Communication and Other

Purposes," provides:

Sec. 1. It shall be unlawfull for any person, not being

authorized by all the parties to any private

communication or spoken word, to tap any wire or

cable, or by using any other device or arrangement,

to secretly overhear, intercept, or record such

communication or spoken word by using a device

commonly known as a dictaphone or dictagraph or

detectaphone or walkie-talkie or tape recorder, or

however otherwise described.

The aforestated provision clearly and unequivocally

makes it illegal for any person, not authorized by all

the parties to any private communication to secretly

record such communication by means of a tape

recorder. The law makes no distinction as to whether

the party sought to be penalized by the statute ought

to be a party other than or different from those

involved in the private communication. The statute's

intent to penalize all persons unauthorized to make

such recording is underscored by the use of the

qualifier "any". Consequently, as respondent Court of

Appeals correctly concluded, "even a (person) privy

to a communication who records his private

conversation with another without the knowledge of

the latter (will) qualify as a violator" 13 under this

provision of R.A. 4200.

A perusal of the Senate Congressional Records,

moreover,

supports

the

respondent

court's

conclusion that in enacting R.A. 4200 our lawmakers

indeed contemplated to make illegal, unauthorized

tape

recording

of private conversations

or

communications taken either by

themselves or by third persons. Thus:

the

parties

xxx xxx xxx

Senator Taada: That qualified only "overhear".

Senator Padilla: So that when it is intercepted or

recorded, the element of secrecy would not appear to

be material. Now, suppose, Your Honor, the recording

is not made by all the parties but by some parties

and involved not criminal cases that would be

mentioned under section 3 but would cover, for

example civil cases or special proceedings whereby a

recording is made not necessarily by all the parties

but perhaps by some in an effort to show the intent

of the parties because the actuation of the parties

prior, simultaneous even subsequent to the contract

or the act may be indicative of their intention.

Suppose there is such a recording, would you say,

Your Honor, that the intention is to cover it within the

purview of this bill or outside?

Senator Taada: That is covered by the purview of

this bill, Your Honor.

Senator Padilla: Even if the record should be used not

in the prosecution of offense but as evidence to be

used in Civil Cases or special proceedings?

Senator Taada: That is right. This is a complete ban

on tape recorded conversations taken without the

authorization of all the parties.

Senator Padilla: Now, would that be reasonable, your

Honor?

Senator Taada: I believe it is reasonable because it

is not sporting to record the observation of one

without his knowing it and then using it against

him. It is not fair, it is not sportsmanlike. If the

purpose; Your honor, is to record the intention of the

parties. I believe that all the parties should know that

the observations are being recorded.

Senator Padilla: This might reduce the utility of

recorders.

Senator Taada: Well no. For example, I was to say

that in meetings of the board of directors where a

tape recording is taken, there is no objection to this if

all the parties know. It is but fair that the people

whose remarks and observations are being made

should know that the observations are being

recorded.

Senator Padilla: Now, I can understand.

Senator Taada: That is why when we take

statements of persons, we say: "Please be informed

that whatever you say here may be used against

you." That is fairness and that is what we demand.

Now, in spite of that warning, he makes damaging

statements against his own interest, well, he cannot

complain any more. But if you are going to take a

recording of the observations and remarks of a

person without him knowing that it is being taped or

recorded, without him knowing that what is being

recorded may be used against him, I think it is unfair.

xxx xxx xxx

(Congression Record, Vol. III, No. 31, p. 584, March

12, 1964)

Senator Diokno: Do you understand, Mr. Senator, that

under Section 1 of the bill as now worded, if a party

secretly records a public speech, he would be

penalized under Section 1? Because the speech is

public, but the recording is done secretly.

Senator Taada: Well, that particular aspect is not

contemplated by the bill. It is the communication

between one person and another person not

between a speaker and a public.

xxx xxx xxx

(Congressional Record, Vol. III, No. 33, p. 626, March

12, 1964)

xxx xxx xxx

The unambiguity of the

provision, taken together

deliberations from the

therefore plainly supports

express words of the

with the above-quoted

Congressional Record,

the view held by the

respondent court that the provision seeks to penalize

even those privy to the private communications.

Where the law makes no distinctions, one does not

distinguish.

Second, the nature of the conversations is immaterial

to a violation of the statute. The substance of the

same need not be specifically alleged in the

information. What R.A. 4200 penalizes are the acts of

secretly overhearing,

intercepting

or

recording private communications by means of the

devices enumerated therein. The mere allegation

that an individual made a secret recording of a

private communication by means of a tape recorder

would suffice to constitute an offense under Section

1 of R.A. 4200. As the Solicitor General pointed out in

his COMMENT before the respondent court: "Nowhere

(in the said law) is it required that before one can be

regarded as a violator, the nature of the

conversation, as well as its communication to a third

person should be professed."14

Finally, petitioner's contention that the phrase

"private communication" in Section 1 of R.A. 4200

does not include "private conversations" narrows the

ordinary meaning of the word "communication" to a

point of absurdity. The word communicate comes

from the latin word communicare, meaning "to share

or to impart." In its ordinary signification,

communication connotes the act of sharing or

imparting signification, communication connotes the

act of sharing or imparting, as in a conversation, 15 or

signifies the "process by which meanings or thoughts

are shared between individuals through a common

system of symbols (as language signs or

gestures)" 16 These definitions are broad enough to

include verbal or non-verbal, written or expressive

communications of "meanings or thoughts" which are

likely to include the emotionally-charged exchange,

on February 22, 1988, between petitioner and private

respondent, in the privacy of the latter's office. Any

doubts about the legislative body's meaning of the

phrase "private communication" are, furthermore,

put to rest by the fact that the terms "conversation"

and "communication" were interchangeably used by

Senator Taada in his Explanatory Note to the bill

quoted below:

It has been said that innocent people have nothing to

fear from their conversations being overheard. But

this

statement

ignores

the

usual

nature

of conversations as well the undeniable fact that

most, if not all, civilized people have some aspects of

their lives they do not wish to expose.

Freeconversations are

often

characterized

by

exaggerations, obscenity, agreeable falsehoods, and

the expression of anti-social desires of views not

intended to be taken seriously. The right to

the privacy of communication, among others, has

expressly been assured by our Constitution. Needless

to state here, the framers of our Constitution must

have

recognized

the

nature

of conversations between

individuals

and

the

significance of man's spiritual nature, of his feelings

and of his intellect. They must have known that part

of the pleasures and satisfactions of life are to be

found in the unaudited, and free exchange

of communication between individuals free from

every unjustifiable intrusion by whatever means. 17

In Gaanan vs. Intermediate Appellate Court, 18 a case

which dealt with the issue of telephone wiretapping,

we held that the use of a telephone extension for the

purpose of overhearing a private conversation

without authorization did not violate R.A. 4200

because a telephone extension devise was neither

among

those

"device(s)

or

arrangement(s)"

enumerated therein, 19 following the principle that

"penal statutes must be construed strictly in favor of

the accused." 20 The instant case turns on a different

note, because the applicable facts and circumstances

pointing to a violation of R.A. 4200 suffer from no

ambiguity, and the statute itself explicitly mentions

the

unauthorized

"recording"

of

private

communications with the use of tape-recorders as

among the acts punishable.

WHEREFORE, because the law, as applied to the case

at bench is clear and unambiguous and leaves us

with no discretion, the instant petition is hereby

DENIED. The decision appealed from is AFFIRMED.

Costs against petitioner.

SO ORDERED.

(3) EJUSDEM GENERIS When do we apply

this rule?

AMELITO R. MUTUC, petitioner,

vs.

COMMISSION ON ELECTIONS, respondent.

Amelito R. Mutuc in his own behalf.

Romulo C. Felizmena for respondent.

FERNANDO, J.:

The invocation of his right to free speech by

petitioner Amelito Mutuc, then a candidate for

delegate to the Constitutional Convention, in this

special civil action for prohibition to assail the validity

of a ruling of respondent Commission on Elections

enjoining the use of a taped jingle for campaign

purposes, was not in vain. Nor could it be considering

the conceded absence of any express power granted

to respondent by the Constitutional Convention Act

to so require and the bar to any such implication

arising from any provision found therein, if deference

be paid to the principle that a statute is to be

construed consistently with the fundamental law,

which accords the utmost priority to freedom of

expression, much more so when utilized for electoral

purposes. On November 3, 1970, the very same day

the case was orally argued, five days after its filing,

with the election barely a week away, we issued a

minute resolution granting the writ of prohibition

prayed for. This opinion is intended to explain more

fully our decision.

In this special civil action for prohibition filed on

October 29, 1970, petitioner, after setting forth his

being a resident of Arayat, Pampanga, and his

candidacy for the position of delegate to the

Constitutional Convention, alleged that respondent

Commission on Elections, by a telegram sent to him

five days previously, informed him that his certificate

of candidacy was given due course but prohibited

him from using jingles in his mobile units equipped

with sound systems and loud speakers, an order

which, according to him, is "violative of [his]

constitutional right ... to freedom of speech." 1 There

being no plain, speedy and adequate remedy,

according to petitioner, he would seek a writ of

prohibition, at the same time praying for a

preliminary injunction. On the very next day, this

Court adopted a resolution requiring respondent

Commission on Elections to file an answer not later

than November 2, 1970, at the same time setting the

case for hearing for Tuesday November 3, 1970. No

preliminary injunction was issued. There was no

denial in the answer filed by respondent on

November 2, 1970, of the factual allegations set forth

in the petition, but the justification for the prohibition

was premised on a provision of the Constitutional

Convention Act, 2which made it unlawful for

candidates "to purchase, produce, request or

distribute sample ballots, or electoral propaganda

gadgets such as pens, lighters, fans (of whatever

nature), flashlights, athletic goods or materials,

wallets, bandanas, shirts, hats, matches, cigarettes,

and the like, whether of domestic or foreign

origin." 3It was its contention that the jingle proposed

to be used by petitioner is the recorded or taped

voice of a singer and therefore a tangible

propaganda material, under the above statute

subject to confiscation. It prayed that the petition be

denied for lack of merit. The case was argued, on

November 3, 1970, with petitioner appearing in his

behalf and Attorney Romulo C. Felizmena arguing in

behalf of respondent.

This Court, after deliberation and taking into account

the need for urgency, the election being barely a

week away, issued on the afternoon of the same day,

a minute resolution granting the writ of prohibition,

setting forth the absence of statutory authority on

the part of respondent to impose such a ban in the

light of the doctrine ofejusdem generis as well as the

principle that the construction placed on the statute

by respondent Commission on Elections would raise

serious doubts about its validity, considering the

infringement of the right of free speech of petitioner.

Its concluding portion was worded thus: "Accordingly,

as prayed for, respondent Commission on Elections is

permanently

restrained

and

prohibited

from

enforcing or implementing or demanding compliance

with its aforesaid order banning the use of political

jingles by candidates. This resolution is immediately

executory." 4

1. As made clear in our resolution of November 3,

1970, the question before us was one of power.

Respondent Commission on Elections was called

upon to justify such a prohibition imposed on

petitioner. To repeat, no such authority was granted

by the Constitutional Convention Act. It did contend,

however, that one of its provisions referred to above

makes unlawful the distribution of electoral

propaganda gadgets, mention being made of pens,

lighters, fans, flashlights, athletic goods or materials,

wallets, bandanas, shirts, hats, matches, and

cigarettes, and concluding with the words "and the

like." 5 For respondent Commission, the last three

words sufficed to justify such an order. We view the

matter differently. What was done cannot merit our

approval under the well-known principle of ejusdem

generis,

the

general

words

following

any

enumeration being applicable only to things of the

same kind or class as those specifically referred

to. 6 It is quite apparent that what was contemplated

in the Act was the distribution of gadgets of the kind

referred to as a means of inducement to obtain a

favorable vote for the candidate responsible for its

distribution.

directed. Nor could respondent Commission justify its

action by the assertion that petitioner, if he would

not resort to taped jingle, would be free, either by

himself or through others, to use his mobile

loudspeakers. Precisely, the constitutional guarantee

is not to be emasculated by confining it to a speaker

having his say, but not perpetuating what is uttered

by him through tape or other mechanical

contrivances. If this Court were to sustain respondent

Commission, then the effect would hardly be

distinguishable from a previous restraint. That cannot

be validly done. It would negate indirectly what the

Constitution in express terms assures. 10

The more serious objection, however, to the ruling of

respondent Commission was its failure to manifest

fealty to a cardinal principle of construction that a

statute should be interpreted to assure its being in

consonance with, rather than repugnant to, any

constitutional command or prescription. 7 Thus,

certain Administrative Code provisions were given a

"construction which should be more in harmony with

the tenets of the fundamental law." 8 The desirability

of removing in that fashion the taint of constitutional

infirmity from legislative enactments has always

commended itself. The judiciary may even strain the

ordinary meaning of words to avert any collision

between what a statute provides and what the

Constitution requires. The objective is to reach an

interpretation rendering it free from constitutional

defects. To paraphrase Justice Cardozo, if at all

possible, the conclusion reached must avoid not only

that it is unconstitutional, but also grave doubts upon

that score. 9

3. Nor is this all. The concept of the Constitution as

the fundamental law, setting forth the criterion for

the validity of any public act whether proceeding

from the highest official or the lowest functionary, is

a postulate of our system of government. That is to

manifest fealty to the rule of law, with priority

accorded to that which occupies the topmost rung in

the legal hierarchy. The three departments of

government in the discharge of the functions with

which it is entrusted have no choice but to yield

obedience to its commands. Whatever limits it

imposes must be observed. Congress in the

enactment of statutes must ever be on guard lest the

restrictions on its authority, whether substantive or

formal, be transcended. The Presidency in the

execution of the laws cannot ignore or disregard

what it ordains. In its task of applying the law to the

facts as found in deciding cases, the judiciary is

called upon to maintain inviolate what is decreed by

the fundamental law. Even its power of judicial

review to pass upon the validity of the acts of the

coordinate branches in the course of adjudication is a

logical corollary of this basic principle that the

Constitution is paramount. It overrides any

governmental measure that fails to live up to its

mandates. Thereby there is a recognition of its being

the supreme law.

2. Petitioner's submission of his side of the

controversy, then, has in its favor obeisance to such

a cardinal precept. The view advanced by him that if

the above provision of the Constitutional Convention

Act were to lend itself to the view that the use of the

taped jingle could be prohibited, then the challenge

of unconstitutionality would be difficult to meet. For,

in unequivocal language, the Constitution prohibits

an abridgment of free speech or a free press. It has

been our constant holding that this preferred

freedom calls all the more for the utmost respect

when what may be curtailed is the dissemination of

information to make more meaningful the equally

vital right of suffrage. What respondent Commission

did, in effect, was to impose censorship on petitioner,

an evil against which this constitutional right is

To be more specific, the competence entrusted to

respondent Commission was aptly summed up by the

present Chief Justice thus: "Lastly, as the branch of

the executive department although independent

of the President to which the Constitution has

given the 'exclusive charge' of the 'enforcement and

administration of all laws relative to the conduct of

elections,' the power of decision of the Commission is

limited to purely 'administrative questions.'" 11 It has

been the constant holding of this Court, as it could

not have been

otherwise, that respondent

Commission cannot exercise any authority in conflict

with or outside of the law, and there is no higher law

than the Constitution. 12 Our decisions which liberally

construe its powers are precisely inspired by the

thought that only thus may its responsibility under

the Constitution to insure free, orderly and honest

elections be adequately fulfilled. 13 There could be no

justification then for lending approval to any ruling or

order issuing from respondent Commission, the effect

of which would be to nullify so vital a constitutional

right as free speech. Petitioner's case, as was

obvious from the time of its filing, stood on solid

footing.

WHEREFORE, as set forth in our resolution of

November 3, 1970, respondent Commission is

permanently

restrained

and

prohibited

from

enforcing or implementing or demanding compliance

with its aforesaid order banning the use of political

taped jingles. Without pronouncement as to costs.

(4) EXPRESSIO

ALTERIUS

UNIUS

EST

EXCLUSION

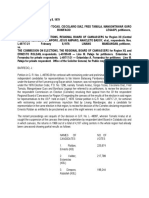

REPUBLIC OF THE PHILIPPINES and THE

DIRECTOR OF LANDS, petitioners,

vs.

HON. NUMERIANO G. ESTENZO, ETC., ET

AL., respondents.

DE CASTRO, J.:

Petitioners Republic of the Philippines and The

Director of Lands seek the review of the decision

dated July 22, 1972 of the respondent Judge in Cad.

Case No. 27, GLRO Rec. No. 1714, Lot No. 4273,

Ormoc Cadastre entitled, "The Director of Lands,

petitioner, versus Tiburcio, Florencia, Fabian and

Gonzala, all surnamed Aotes, claimants-movants",

the dispositive portion of which reads:

WHEREFORE, the decision of this Court dated

September 28, 1940, declaring Lot No. 4273 Public

Land is set aside and said Lot No. 4273 of the Ormoc

Cadastre is hereby adjudicated in favor of herein

movants in undivided interests and in equal share of

each to GONZALA AOTES, married to Victorino

Gormanes; TIBURCIO AOTES, married to Epefania

Maglasang; FLORENCIA AOTES, married to Basilio

Barabad; and FABIAN AOTES, married to Dulcisima

Barabad; all adjudicatees are Filipinos, of legal ages,

the first named is residing in Can-adiong, Ormoc City,

Philippines; and as soon as this decision shall have

become final, let the Commissioner of Land

Registration Commission, Quezon City, issue the

corresponding decree of aforesaid parcel of land in

the names of herein adjudicatees, subject to the

liability and claims of creditors, Hens, or other

persons for the full period of two (2) years after their

distribution as imposed by Section 4 of Rule 74 of the

Rules of Court. 1

The following facts are undisputed in the instant

case:

In a decision dated September 28, 1940 by the

Cadastral Court, Lot No. 4273 of the Ormoc Cadastre

was declared public land.

On February 23, 1972, private respondents Aotes

filed with the Court of First Instance of Leyte, Branch

V, Ormoc City, presided by the respondent Judge a

petition to reopen the aforesaid decision dated

September 28, 1940 under Rep. Act 931 as amended

by Rep. Act 6236 claiming to be the owners and

possessors of Lot No. 4273 of the Ormoc Cadastre by

virtue of hereditary succession but, due to their nonappearance on the date of the hearing of the

Cadastral Case because of ignorance and excusable

neglect, said land was declared public land and that

they had been in adverse, peaceful and notorious

possession of the said parcel of land since the time

immemorial, paying all the taxes, interests and

penalties. They pray that the decision of the

Cadastral Court affecting Lot No. 4273, Ormoc

Cadastre be reopened, and that they be allowed to

file their cadastral answer.

On March 16, 1972, petitioners filed an opposition to

the aforesaid petition on the ground that such

petition is barred by the expiration of the period for

reopening cadastral proceedings under Rep. Act 931

which expired on December 31, 1968 and this period

has not been extended under the provisions of Rep.

Act 6236 because the latter applies only to the

extensions of time limit for the filing of applications

for free patent and for judicial confirmation of

imperfect or incomplete titles.

Respondent Judge in its order dated May 9, 1972,

denied the opposition for lack of sufficient merit and

set the case for hearing on June 24, 1972.

On July 22, 1972, respondent judge rendered

decision setting aside the decision of the cadastral

court dated September 28, 1940 declaring Lot No.

4273 public land and adjudicating said lot in favor of

the private respondents in undivided interest in equal

share of one-fourth (1/4) each.

Dissatisfied with the decision of the lower court,

petitioners filed this instant petition assigning only

one error to writ: The trial court erred in assuming

jurisdiction over the petition for reopening of

Cadastral Proceedings.

In the Brief, 2 petitioners argue that the lower court

has no jurisdiction over the proceedings for

reopening of the cadastral case because under the

provision of Rep. Act 931, the period for reopening of

cadastral proceedings expired on December 31,

1968, and that period has not been extended by Rep.

Act 6236 which applies only to the extension of the

time limit for the filing of applications for free patent

and for judicial confirmation of imperfect or

incomplete titles and not to reopening of cadastral

proceedings.

In

the

Manifestation

and

Motion, 3 respondents Aotes claim that considering

the time limit for firing applications for free patents

and for judicial confirmation of incomplete and

imperfect titles has been extended up to December

31, 1980, the reopening of cadastral cases should

also be extended until December 31, 1980 in fairness

and justice to them.

The sole issue to be resolved, considering the above

facts, is whether or not Rep. Act 6236 which provides

for the extension of the time limit to file applications

for free patent and for judicial confirmation of

imperfect or incomplete titles to December 31, 1976

applies also to the reopening of cadastral

proceedings on certain lands which were declared

public lands.

There is merit in the petition.

By way of background, Rep. Act 931, which was

approved on June 20, 1953, is an act to authorize the

filing in the proper court, under certain conditions, of

certain claims of title to parcels of land that have

been declared public land, by virtue of judicial

decisions rendered within the forty years next

preceding the approval of this act. Under this

aforesaid act, all persons claiming title to parcels of

land that have been the object of cadastral

proceedings, who at the time of the survey were in

actual possession of the same but for some

justifiable reason had been unable to file their claim

in the proper court during the time limit established

by law, in case such parcels of land, on account of

their failure to file such claims, have been, or are

about to be declared land of the public domain, by

virtue of judicial proceedings instituted within the

forty years next preceding the approval of this act,

are granted the right within five years after the date

on which this act shall take effect, to petition for a

reopening of the judicial proceedings under the

provisions of Act 2259. Rep. Act 2061, which took

effect on June 13, 1958, refers to an act setting a

new time limit for the filing of applications for free

patents, for the judicial confirmation of imperfect or

incomplete titles, and for the reopening of judicial

proceedings on certain lands which were declared

public lands. Under this act the time for filing

applications shall not extend beyond December 31,

1968. Rep. Act 6236, approved on June 19, 1971,

however, extended the time limit for the filing of

applications for free patents and for the judicial

confirmation of imperfect or incomplete titles not to

extend beyond December 31, 1976. In resume, Rep.

Act 931 granted a right within 5 years from June 20,

1953 to petition for a reopening of cadastral

proceedings. Rep. Act 2061 fixed a new time limit

which is up to December 31, 1968 to file applications

for free patents, for the judicial confirmation of

imperfect or incomplete titles and for the reopening

of judicial proceedings on certain lands which were

declared public land. Rep. Act 6236 extended the

time limit which is up to December 31, 1976 for the

filing of applications for free patents and for the

judicial confirmation of imperfect or incomplete titles.

Respondent Aotes filed on February 23, 1972 a

petition to reopen the decision of the Cadastral Court

under Rep. Act 931 as amended by Rep. Act 6236.

Respondents Aotes claim that since the time limit for

filing applications for free patents and applications

for judicial confirmation of incomplete and imperfect

titles have been extended up to December 31, 1980,

the reopening of cadastral cases is also extended

until December 31, 1980. Rep. Act 6236, the very law

on which respondents Aotes bases his petition to

reopen the cadastral proceedings fails to supply any

basis for respondents' contention. It will be noted

that while Rep. Act 2061 fixed the time to reopen

cadastral cases which shall not extend beyond

December 31, 1968, no similar provision is found in

Rep. Act 6236 expressly 'extending the time limit for

the reopening of cadastral proceedings on parcels of

land declared public land. As correctly pointed out by

petitioners, the extension as provided for by the Rep.

Act 6236 makes no reference to reopening of

cadastral cases as the earlier law, Rep. Act 2061,

expressly did. Under the legal maxim of statutory

construction, expressio unius

est

exclusio

alterius (Express Mention is Implied Exclusion), the

express mention of one thing in a law, as a general

rule, means the exclusion of others not expressly

mentioned. This rule, as a guide to probable

legislative intent, is based upon the rules of logic and

the natural workings of the human mind. 4 If Rep. Act

6236 had intended that the extension it provided for

applies also to reopening of cadastral cases, it would

have so provided in the same way that it provided

the extension of time to file applications for free

patent and for judicial confirmation of imperfect or

incomplete title. The intention to exclude the

reopening of cadastral proceedings or certain lands

which were declared public land in Rep. Act 6236 is

made clearer by reference to Rep. Act 2061 which

includes the reopening of cadastral cases, but not so

included in Rep. Act 6236.

We hold, therefore, that the extension provided for

by Rep. Act 6236 which is the sole basis for filing the

respondents Aotes' petition to reopen the cadastral

proceedings applies only to the filing of applications

for free patent and for judicial confirmation of

imperfect or incomplete titles and not to reopening of

cadastral proceedings like the instant case, a

proceeding entirely different from "filing an

application for a free patent or for judicial

confirmation of imperfect or incomplete titles."

Parenthetically, in setting aside the decision dated

September 28, 1940, the respondent Judge has

concluded that Rep. Act 6236 is applicable also to

reopening of cadastral proceedings, thereby, altering

Rep. Act 6236. That cannot be done by the judiciary.

That is a function that properly pertains to the

legislative branch. As was pointed out in Gonzaga vs.

Court of Appeals: 5 "It has been repeated time and

again that where the statutory norm speaks

unequivocally, there is nothing for the courts to do

except to apply it. The law, leaving no doubt as to

the scope of its operation, must be obeyed. Our

decisions

have

consistently

been

to

that

effect. 6 Likewise, it is a cardinal rule of statutory

construction that where the terms of the statute are

clear and unambiguous, no interpretation is called

for, and the law is applied as written, 7 for application

is the first duty of courts, and interpretation, only

were literal application is impossible or inadequate. 8

More importantly, the lower court has no longer

jurisdiction to entertain the petition filed by

respondents for reopening the cadastral proceedings

because the latter, as we have noted, did not file the

aforesaid petition within the period fixed by the

applicable laws to wit: Rep. Act 931 and 2061.

Consequently, the decision dated September 30,

1940 of the Cadastral Court declaring the land in

question a public land has become final and

conclusive. It has also acquired the status of res

judicata. It must be remembered that generally, the

fundamental principle of res judicata applies to all

cases and proceedings, including land registration or

cadastral

proceedings.9 The

doctrine

of res

judicata precludes parties from relitigating issues

actually litigated and determined by a prior and final

judgment. It is well-settled that a prior judgment is

conclusive in a subsequent suit between the same

parties on the subject matter, and on the same cause

of action, not only as to matters which were decided

in the first action, but also as to every other matter

which the parties could have properly set up in the

prior suit. 10 Indeed, settled is the rule that a

cadastral case is a judicial proceeding in rem, which,

as such binds the whole world. 11 The final judgment

rendered therein is deemed to have settled the

status of the land subject thereof, if not noted

thereon, like those of the petitioner, are deemed

barred under the principle of res judicata. 12 In the

case of Cano vs. De Camacho, this Court held:

Although the title of Jesus Vao over said Lot 1-B is

not as yet indefeasible, no decree having been

issued in his favor, all rights, interests or claims

existing before said date are deemed barred by said

decision, under the principle of res judicata, once the

decision become final, upon expiration of the thirtyday period to appeal therefrom. 13

By reiterating its ruling, this Court once more

stresses and emphasizes that Rep. Act 6236 does not

apply to the reopening of cadastral proceedings and

as a consequence, the respondent Judge has no

jurisdiction over the petition of the respondents

Aotes to reopen the cadastral proceedings.

WHEREFORE, judgment is hereby rendered setting

aside the decisions dated July 22, 1972 of the

respondent Judge and reiterating that of the

Cadastral Court dated September 28, 1940. No

pronouncement as to costs.

SO ORDERED.

(5) CASUS OMISSUS Casus Ominus pro

omisso habendus est (restrictive rule)

PEOPLE OF THE PHILIPPINES, plaintiff-appellant,

vs.

GUILLERMO MANANTAN, defendant-appellee.

REGALA, J.:

This is an appeal of the Solicitor General from the

order of the Court of First Instance of Pangasinan

dismissing the information against the defendant.

The records show that the statement of the case and

the facts, as recited in the brief of plaintiff-appellant,

is complete and accurate. The same is, consequently,

here adopted, to wit:

In an information filed by the Provincial Fiscal of

Pangasinan in the Court of First Instance of that

Province, defendant Guillermo Manantan was

charged with a violation Section 54 of the Revised

Election Code. A preliminary investigation conducted

by said court resulted in the finding a probable cause

that the crime charged as committed by defendant.

Thereafter, the trial started upon defendant's plea of

not guilty, the defense moved to dismiss the

information on the ground that as justice of the

peace the defendant is one of the officers

enumerated in Section 54 of the Revised Election

Code. The lower court denied the motion to dismiss

holding that a justice of the peace is within the

purview Section 54. A second motion was filed by

defense counsel who cited in support thereof the

decision of the Court of Appeals in People vs.

Macaraeg, (CA-G.R. No. 15613-R, 54 Off. Gaz., pp.

1873-76) where it was held that a justice of the

peace is excluded from the prohibition of Section 54

of the Revised Election Code. Acting on this second

motion to dismiss, the answer of the prosecution, the

reply of the defense, and the opposition of the

prosecution, the lower court dismissed the

information against the accused upon the authority

of the ruling in the case cited by the defense.

Both parties are submitting this case upon the

determination of this single question of law: Is a

justice the peace included in the prohibition of

Section 54 of the Revised Election Code?

Section 54 of the said Code reads:

No justice, judge, fiscal, treasurer, or assessor of any

province, no officer or employee of the Army, no

member of the national, provincial, city, municipal or

rural police force and no classified civil service officer

or employee shall aid any candidate, or exert any

influence in any manner in a election or take part

therein, except to vote, if entitled thereto, or to

preserve public peace, if he is a peace officer.

Defendant-appellee argues that a justice of the

peace is not comprehended among the officers

enumerated in Section 54 of the Revised Election

Code. He submits the aforecited section was taken

from Section 449 of the Revised Administrative Code,

which provided the following:

SEC. 449. Persons prohibited from influencing

elections. No judge of the First Instance, justice of

the peace, or treasurer, fiscal or assessor of any

province and no officer or employee of the Philippine

Constabulary, or any Bureau or employee of the

classified civil service, shall aid any candidate or

exert influence in any manner in any election or take

part therein otherwise than exercising the right to

vote.

When, therefore, section 54 of the Revised Election

Code omitted the words "justice of the peace," the

omission revealed the intention of the Legislature to

exclude justices of the peace from its operation.

The above argument overlooks one fundamental

fact. It is to be noted that under Section 449 of the

Revised Administrative Code, the word "judge" was

modified or qualified by the phrase "of First

instance", while under Section 54 of the Revised

Election Code, no such modification exists. In other

words, justices of the peace were expressly included

in Section 449 of the Revised Administrative Code

because the kinds of judges therein were specified,

i.e., judge of the First Instance and justice of the

peace. In Section 54, however, there was no

necessity therefore to include justices of the peace in

the enumeration because the legislature had availed

itself of the more generic and broader term, "judge."

It was a term not modified by any word or phrase and

was intended to comprehend all kinds of judges, like

judges of the courts of First Instance, Judges of the

courts of Agrarian Relations, judges of the courts of

Industrial Relations, and justices of the peace.

It is a well known fact that a justice of the peace is

sometimes addressed as "judge" in this jurisdiction. It

is because a justice of the peace is indeed a judge. A

"judge" is a public officer, who, by virtue of his office,

is clothed with judicial authority (U.S. v. Clark, 25

Fed. Cas. 441, 422). According to Bouvier Law

Dictionary, "a judge is a public officer lawfully

appointed to decide litigated questions according to

law. In its most extensive sense the term includes all

officers appointed to decide litigated questions while

acting in that capacity, including justices of the

peace, and even jurors, it is said, who are judges of

facts."

A review of the history of the Revised Election Code

will help to justify and clarify the above conclusion.

The first election law in the Philippines was Act 1582

enacted by the Philippine Commission in 1907, and

which was later amended by Act. Nos. 1669, 1709,

1726 and 1768. (Of these 4 amendments, however,

only Act No. 1709 has a relation to the discussion of

the instant case as shall be shown later.) Act No.

1582, with its subsequent 4 amendments were later

on incorporated Chapter 18 of the Administrative

Code. Under the Philippine Legislature, several

amendments were made through the passage of Acts

Nos. 2310, 3336 and 3387. (Again, of these last 3

amendments, only Act No. 3587 has pertinent to the

case at bar as shall be seen later.) During the time of

the Commonwealth, the National Assembly passed

Commonwealth Act No. 23 and later on enacted

Commonwealth Act No. 357, which was the law

enforced until June 1947, when the Revised Election

Code was approved. Included as its basic provisions

are the provisions of Commonwealth Acts Nos. 233,

357, 605, 666, 657. The present Code was further

amended by Republic Acts Nos. 599, 867, 2242 and

again, during the session of Congress in 1960,

amended by Rep. Acts Nos. 3036 and 3038. In the

history of our election law, the following should be

noted:

Under Act 1582, Section 29, it was provided:

No public officer shall offer himself as a candidate for

elections, nor shall he be eligible during the time that

he holds said public office to election at any

municipal, provincial or Assembly election, except for

reelection to the position which he may be holding,

and no judge of the First Instance, justice of the

peace, provincial fiscal, or officer or employee of the

Philippine Constabulary or of the Bureau of Education

shall aid any candidate or influence in any manner or

take part in any municipal, provincial, or Assembly

election under the penalty of being deprived of his

office and being disqualified to hold any public office

whatsoever for a term of 5 year: Provide, however,

That the foregoing provisions shall not be construe to

deprive any person otherwise qualified of the right to

vote it any election." (Enacted January 9, 1907; Took

effect on January 15, 1907.)

Then, in Act 1709, Sec. 6, it was likewise provided:

. . . No judge of the First Instance, Justice of the

peace provincial fiscal or officer or employee of the

Bureau of Constabulary or of the Bureau of Education

shall aid any candidate or influence in any manner to

take part in any municipal provincial or Assembly

election. Any person violating the provisions of this

section shall be deprived of his office or employment

and shall be disqualified to hold any public office or

employment whatever for a term of 5 years,

Provided, however, that the foregoing provisions shall

not be construed to deprive any person otherwise

qualified of the right to vote at any election. (Enacted

on August 31, 1907; Took effect on September 15,

1907.)

Subsequently, however, Commonwealth Act No. 357

was enacted on August 22, 1938. This law provided

in Section 48:

Again, when the existing election laws were

incorporated in the Administrative Code on March 10,

1917, the provisions in question read:

This last law was the legislation from which Section

54 of the Revised Election Code was taken.

SEC. 449. Persons prohibited from influencing

elections. No judge of the First Instance, justice of

the peace, or treasurer, fiscal or assessor of any

province and no officer or employee of the Philippine

Constabulary or any Bureau or employee of the

classified civil service, shall aid any candidate or

exert influence in any manner in any election or take

part therein otherwise than exercising the right to

vote. (Emphasis supplied)

After the Administrative Code, the next pertinent

legislation was Act No. 3387. This Act reads:

SEC. 2636. Officers and employees meddling with

the election. Any judge of the First Instance,

justice of the peace, treasurer, fiscal or assessor of

any province, any officer or employee of the

Philippine Constabulary or of the police of any

municipality, or any officer or employee of any

Bureau of the classified civil service, who aids any

candidate or violated in any manner the provisions of

this section or takes part in any election otherwise by

exercising the right to vote, shall be punished by a

fine of not less than P100.00 nor more than

P2,000.00, or by imprisonment for not less than 2

months nor more than 2 years, and in all cases by

disqualification from public office and deprivation of

the right of suffrage for a period of 5 years.

(Approved December 3, 1927.) (Emphasis supplied.)

SEC. 48. Active Interventation of Public Officers and

Employees. No justice, judge, fiscal, treasurer or

assessor of any province, no officer or employee of

the Army, the Constabulary of the national,

provincial, municipal or rural police, and no classified

civil service officer or employee shall aid any

candidate, nor exert influence in any manner in any

election nor take part therein, except to vote, if

entitled thereto, or to preserve public peace, if he is

a peace officer.

It will thus be observed from the foregoing narration

of the legislative development or history of Section

54 of the Revised Election Code that the first

omission of the word "justice of the peace" was

effected in Section 48 of Commonwealth Act No. 357

and not in the present code as averred by defendantappellee. Note carefully, however, that in the two

instances when the words "justice of the peace" were

omitted (in Com. Act No. 357 and Rep. Act No. 180),

the word "judge" which preceded in the enumeration

did not carry the qualification "of the First Instance."

In other words, whenever the word "judge" was

qualified by the phrase "of the First Instance", the

words "justice of the peace" would follow; however, if

the law simply said "judge," the words "justice of the

peace" were omitted.

The above-mentioned pattern of congressional

phraseology would seem to justify the conclusion

that when the legislature omitted the words "justice

of the peace" in Rep. Act No. 180, it did not intend to

exempt the said officer from its operation. Rather, it

had considered the said officer as already

comprehended in the broader term "judge".

It is unfortunate and regrettable that the last World

War had destroyed congressional records which

might have offered some explanation of the

discussion of Com. Act No. 357 which legislation, as

indicated above, has eliminated for the first time the

words "justice of the peace." Having been completely

10

destroyed, all efforts to seek deeper and additional

clarifications from these records proved futile.

Nevertheless, the conclusions drawn from the

historical background of Rep. Act No. 180 is

sufficiently borne out by reason hid equity.

Defendant further argues that he cannot possibly be

among the officers enumerated in Section 54

inasmuch as under that said section, the word

"judge" is modified or qualified by the phrase "of any

province." The last mentioned phrase, defendant

submits, cannot then refer to a justice of the peace

since the latter is not an officer of a province but of a

municipality.

Defendant's argument in that respect is too strained.

If it is true that the phrase "of any province"

necessarily removes justices of the peace from the

enumeration for the reason that they are municipal

and not provincial officials, then the same thing may

be said of the Justices of the Supreme Court and of

the Court of Appeals. They are national officials. Yet,

can there be any doubt that Justices of the Supreme

Court and of the Court of Appeals are not included in

the prohibition? The more sensible and logical

interpretation of the said phrase is that it qualifies

fiscals, treasurers and assessors who are generally

known as provincial officers.

The rule of "casus omisus pro omisso habendus est"

is likewise invoked by the defendant-appellee. Under

the said rule, a person, object or thing omitted from

an enumeration must be held to have been omitted

intentionally. If that rule is applicable to the present,

then indeed, justices of the peace must be held to

have been intentionally and deliberately exempted

from the operation of Section 54 of the Revised

Election Code.

The rule has no applicability to the case at bar. The

maxim "casus omisus" can operate and apply only if

and when the omission has been clearly established.

In the case under consideration, it has already been

shown that the legislature did not exclude or omit

justices of the peace from the enumeration of officers

precluded from engaging in partisan political

activities. Rather, they were merely called by another

term. In the new law, or Section 54 of the Revised

Election Code, justices of the peace were just called

"judges."

In insisting on the application of the rule of "casus

omisus" to this case, defendant-appellee cites

authorities to the effect that the said rule, being

restrictive in nature, has more particular application

to statutes that should be strictly construed. It is

pointed out that Section 54 must be strictly

construed against the government since proceedings

under it are criminal in nature and the jurisprudence

is settled that penal statutes should be strictly

interpreted against the state.

Amplifying on the above argument regarding strict

interpretation of penal statutes, defendant asserts

that the spirit of fair play and due process demand

such strict construction in order to give "fair warning

of what the law intends to do, if a certain line is

passed, in language that the common world will

understand." (Justice Holmes, in McBoyle v. U.S., 283

U.S. 25, L. Ed. 816).

The application of the rule of "casus omisus" does

not proceed from the mere fact that a case is

criminal in nature, but rather from a reasonable

certainty that a particular person, object or thing has

been omitted from a legislative enumeration. In the

present case, and for reasons already mentioned,

there has been no such omission. There has only

been a substitution of terms.

The rule that penal statutes are given a strict

construction is not the only factor controlling the

interpretation of such laws; instead, the rule merely

serves as an additional, single factor to be

considered as an aid in determining the meaning of

penal laws. This has been recognized time and again

by decisions of various courts. (3 Sutherland,

Statutory Construction, p. 56.) Thus, cases will

frequently be found enunciating the principle that the

intent of the legislature will govern (U.S. vs. Corbet,

215 U.S. 233). It is to be noted that a strict

construction should not be permitted to defeat the

policy and purposes of the statute (Ash Sheep Co. v.

U.S., 252 U.S. 159). The court may consider the spirit

and reason of a statute, as in this particular instance,

where a literal meaning would lead to absurdity,

contradiction, injustice, or would defeat the clear

purpose of the law makers (Crawford, Interpretation

of Laws, Sec. 78, p. 294). A Federal District court in

the U.S. has well said:

The strict construction of a criminal statute does not

mean such construction of it as to deprive it of the

meaning intended. Penal statutes must be construed

in the sense which best harmonizes with their intent

and purpose. (U.S. v. Betteridge 43 F. Supp. 53, 56,

cited in 3 Sutherland Statutory Construction 56.)

As well stated by the Supreme Court of the United

States, the language of criminal statutes, frequently,

has been narrowed where the letter includes

situations inconsistent with the legislative plan (U.S.

v. Katz, 271 U.S. 354; See also Ernest Brunchen,

Interpretation of the Written Law (1915) 25 Yale L.J.

129.)

Another reason in support of the conclusion reached

herein is the fact that the purpose of the statute is to

enlarge the officers within its purview. Justices of the

Supreme Court, the Court of Appeals, and various

judges, such as the judges of the Court of Industrial

Relations, judges of the Court of Agrarian Relations,

etc., who were not included in the prohibition under

the old statute, are now within its encompass. If such

were the evident purpose, can the legislature intend

to eliminate the justice of the peace within its orbit?

Certainly not. This point is fully explained in the brief

of the Solicitor General, to wit:

On the other hand, when the legislature eliminated

the phrases "Judge of First Instance" and justice of

the peace", found in Section 449 of the Revised

Administrative Code, and used "judge" in lieu

thereof, the obvious intention was to include in the

scope of the term not just one class of judges but all

judges, whether of first Instance justices of the peace

or special courts, such as judges of the Court of

Industrial Relations. . . . .

The weakest link in our judicial system is the justice

of the peace court, and to so construe the law as to

allow a judge thereof to engage in partisan political

activities would weaken rather than strengthen the

judiciary. On the other hand, there are cogent

reasons found in the Revised Election Code itself why

justices of the peace should be prohibited from

11

electioneering. Along with Justices of the appellate

courts and judges of the Court of First Instance, they

are given authority and jurisdiction over certain

election cases (See Secs. 103, 104, 117-123).

Justices of the peace are authorized to hear and

decided inclusion and exclusion cases, and if they are

permitted to campaign for candidates for an elective

office the impartiality of their decisions in election

cases would be open to serious doubt. We do not

believe that the legislature had, in Section 54 of the

Revised Election Code, intended to create such an

unfortunate situation. (pp. 708, Appellant's Brief.)

Another factor which fortifies the conclusion reached

herein is the fact that the administrative or executive

department has regarded justices of the peace within

the purview of Section 54 of the Revised Election

Code.

In Tranquilino O. Calo, Jr. v. The Executive Secretary,

the Secretary of Justice, etc. (G.R. No. L-12601), this

Court did not give due course to the petition for

certiorari and prohibition with preliminary injunction

against the respondents, for not setting aside, among

others, Administrative Order No. 237, dated March

31, 1957, of the President of the Philippines,

dismissing the petitioner as justice of the peace of