Professional Documents

Culture Documents

MBF14e Chap02 Monetary System Pbms

Uploaded by

KarlCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBF14e Chap02 Monetary System Pbms

Uploaded by

KarlCopyright:

Available Formats

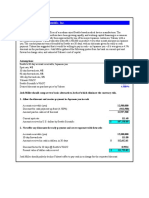

Problem 2.

1 Albert's Trip to Canada

Albert visits Toronto and buys 1.74 Canadian dollars (CAD) for one British

pound (GBP). When he returns home to the U.K., he converts CAD1 into

GBP0.59. Is the new exchange rate favorable or unfavorable?

Assumptions

Values

Buy Canadian dollars for (CAD/)

Which is equivalent, the reciprocal (/CAD)

1.7400

0.5747

Buy back pounds for (/CAD)

Which is equivalent, the reciprocal (CAD/)

0.5900

1.6949

It is better to convert back his remaining Canadian dollars to GBP when he

reaches back home.

Problem 2.2 Lottery Winner

Aisha lives in Melbourne, Australia. She wins 150 in an online lottery on

Thursday and wishes to convert the amount into Australian dollars (AUD). If the

exchange rate is 0.5988 euros per AUD, how many AUDs does she get, and what

is the value date of the AUD payment?

Assumptions

Cross rate (euros/AUD)

Prize amount in euros

What is the amount in AUD?

(the euro amount divided by the cross exchange rate)

Values

0.5988

150.00

AUD 250.50

Cross exchange rate transactions are settled in two business days, so in this case,

Monday.

Problem 2.3 Gilded Question

In 1923, one ounce of gold cost 380 French francs (FRF). If, at the same time one ounce

of gold could be purchased in Britain for GBP4.50, what was the exchange rate between

the French franc and the British pound?

Assumptions

Price of an ounce of gold in French frans (FRF/oz)

Price of an ounce of gold in Sterling Pounds (GBP/oz)

What is the implied GBP/FRF rate?

(GBP price of an ounce / FRF price of an ounce)

. Or if expressed as FRF/GBP

Values

FRF 380.00

4.50

0.01

FRF 84.4444

Problem 2.4 Brent Oil

In 2015 one barrel of Brent oil traded for GBP 42.5 and South Africa rands (ZAR) 790. What is

the exchange rate between the pound and the rand? How would the exchange rate change if the oil

price jumps to GBP 50/barrel (assume no change in the price in S. Africa)?

Assumptions

Price of an ounce of gold in GBP (/barrel)

Price of an ounce of gold in S. African rands (ZAR/barrel)

What is the implied /ZAR exchange rate?

(GBP price of an ounce / ZAR price of an ounce)

Brent Oil

Values

42.50

ZAR 790.00

What If

50.00

ZAR 790.00

0.0538

0.0633

Problem 2.5 Toyota Exports to the United Kingdom

Toyota manufactures most of the vehicles it sells in the United Kingdom in Japan.

The base platform for the Toyota Tundra truck line is 1,650,000. The spot rate of the

Japanese yen against the British pound has recently moved from 197/ to 190/.

How does this change the price of the Tundra to Toyota's British subsidiary in British

pounds?

Assumptions

Original spot rate, Japanese yen/British pound

New spot rate, Japanese yen/British pound

Export price of Toyota Tunda truck, Japanese yen

Original Import Price in British pounds

Values

197.00

190.00

1,650,000

8,375.63

Export price in yen / Original spot rate in yen/pound

New Import Price in British pounds

8,684.21

Export price in yen / New spot rate in yen/pound

Percentage change in the price of the imported truck

3.68%

New price / Old price - 1

Because the price of the truck itself did not change, the percentage change in the

import price as expressed in British pounds is the same percentage change in the

value of the Japanese yen against the British pound itself.

Problem 2.6 Online Shopping

Tamara lives in Egypt and has placed a bundle of items in her Amazon.co.uk account

basket. She has the choice to pay in Egyptian pounds (EGP 1844) or in GBP

(151.17). What is the exchange rate between both currencies? In which currency

should she pay?

Assumptions

Egyptian pound price of basket (EGP)

British pound price of basket (GBP)

Values

1,844.00

151.17

Implied exchange rate (EGP/)

12.1982

Many emerging markets that suffer from foreign exchange shortages have more than

one exchange rate . The official exchange rate is the one officially transacted by the

banking system. However, there is usually a parallel foreign exchange market where

the foreign currency is usually cheaper. Tamara should weigh both of these rates

before making her decision.

Problem 2.7 Israeli Shekel Changes Value

One British Pound (GBP) traded against Israeli Shekels (ILS) 5.82 in 2013,

but the exchange rate rose to 6.78 in late 2014. What is the percentage

change of the ILS? Has the shekel depreciated or appreciated?

Calculation of Percentage Change in Value

Initial exchange rate (ILS/)

New exchange rate (ILS/)

Percentage change in shekel value

(ending rate - beginning rate) / (beginning rate)

As the exchange rate rises, the British pound is able to

buy more shekels. Thus, the shekel has depreciated by

16.49%.

Values

5.82

6.78

16.49%

Problem 2.8 Hong Kong Dollar and the Chinese Yuan

The Hong Kong dollar has long been pegged to the U.S. dollar at HK$7.80/$. When

the Chinese yuan was revalued in July 2005 against the U.S. dollar from Yuan8.28/$

to Yuan8.11/$, how did the value of the Hong Kong dollar change against the yuan?

Assumptions

Original Chinese yuan peg to the dollar, yuan/$

Revalued Chinese yuan to the dollar, yuan/$

Hong Kong dollar peg to the US dollar, HK$/$

Values

8.28

8.11

7.80

Original HK$/Yuan cross rate

HK$/Yuan = (HK$/$) x ($/Yuan)

0.9420

New HK$/Yuan cross rate

HK$/Yuan = (HK$/$) x ($/Yuan)

0.9618

As a result of the revaluation of the Chinese yuan, the Hong Kong dollar has fallen in

value against the Chinese yuan.

Problem 2.9 Chinese Yuan Revaluation

Many experts believe that the Chinese currency should not only be revalued

against the U.S. dollar as it was in July 2005, but also be revalued by 20% or

30%. What would be the new exchange rate value if the yuan was revalued

an additional 20% or 30% from its initial post-revaluation rate of Yuan

8.11/$?

Calculation of Percentage Change in Value

Initial exchange rate, post official revaluation (Yuan/$)

Percentage revaluation against the US dollar

Revalued exchange rate (Yuan/$)

Values

8.11

20.00%

6.76

Initial exchange rate, post official revaluation (Yuan/$)

Percentage revaluation against the US dollar

Revalued exchange rate (Yuan/$)

8.11

30.00%

6.24

As painfully obvious, it is clear why so many critics of the Chinese yuan

policy were not particularly happy with the revaluation of only 2.1%.

Problem 2.10 TEXPAK (Pakistan) in the UK

TEXPAK is a Pakistani-based textile firm that is facing increasing competition from other

manufacturers in emerging markets selling in Europe. All garments are produced in

Pakistan, with costs and pricing initially stated in Pakistani rupees (PKR), but converted to

British pounds (GBP) for distribution and sale in the United Kingdom. In 2014, one suit

was priced at PKR 11,000 with a British pound price set at GBP95. In 2015, the GBP

appreciated in value versus the PKR, averaging PKR120/GBP. In order to preserve the

GBP price and product profit margin in rupees, what should the new rupee price be set at?

Assumptions

Original (2014) unit price, rupees (PKR)

Original (2014) British pound price for sale and distribution

Average spot rate for 2015, rupees per pound

Values

11,000.00

95.00

120.00

First, the implied spot exchange rate for the previous year, 2014 must be found by dividing

the PKR price by the GBP price selected for distribution and sale.

Implied original spot rate, PKR/GBP

115.79

Assuming that TEXPAK wishes to preserve the British price for competitiveness, the same

Britsh pound price must be converted back into Pakistani rupees with the new spot

exchange rate in rupees per GBP:

Recalcualted Pakistani rupee price of product

(Original GBP price x Avg spot rate for 2015)

11,400.00

Because the Pakistani rupee depreciated in value against the GBP, the implied PKR price is

actually HIGHER than it was the previous year. This means that TEXPAK would keep the

same British pound price and either enjoy a much larger profit margin in PKR, or

potentially keep the PKR price the same as the previous year and actually reduce the GBP

price.

Problem 2.11 Vietnamese Coffee Coyote

Many people were surprised when Vietnam became the second largest coffee producing country in the world in recent

years, second only to Brazil. The Vietnamese dong, VND or d, is managed against the U.S. dollar but is not widely

traded. If you were a traveling coffee buyer for the wholeale market (a "coyote" by industry terminology), which of the

following currency rates and exchange commission fees would be in your best interest if traveling to Vietnam on a

buying trip?

Currency Exchange

Vietnamese bank rate

Saigon Airport exchange bureau rate

Hotel exchange bureau rate

Assuming an intial cash amount for exchange to dong of:

Assumptions

Vietnamese bank rate (dong/$)

Bank commission (%)

Saigon Airport Exchange Bureau rate (dong/$)

Airport comission (%)

Hotel Exchange Bureau rate (dong/$)

Hotel comission (%)

Rate

d19,800

d19,500

d19,400

Commission

2.50%

2.00%

1.50%

$10,000.00

Values

19,800

2.50%

19,500

2.00%

19,425

1.50%

Vietnamese

dong proceeds

193,050,000

191,100,000

191,336,250

The combined exchange rate and commission offered in the commercial banks in Vietnam is the better rate. In the case

of the Hotel Exchange Bureau rate, although its exchange rate is slightly weaker than the airport, its lower comission

makes it preferable over the combined airport rate.

Problem 2.12 Chunnel Choices

The Channel Tunnel or "Chunnel" passes underneath the English Channel between Great Britain and France, a land-link

between the Continent and the British Isles. One side is therefore an economy of British pounds, the other euros. If you

were to check the Chunnel's rail ricket Internet rates you would find that they would be denominated in U.S. dollars

(USD). For example, a first class round trip fare for a single adult from London to Paris via the Chunnel through

RailEurope may cost USD170.00. This currency neutrality, however, means that customers on both ends of the Chunnel

pay differing rates in their home currencies from day to day. What is the British pound and euro denominated prices for

the USD170.00 round trip fare in local currency if purchased on the following dates at the accompanying spot rates drawn

from the Financial Times?

Round trip RailEurope train fare

Date of Spot Rate

Monday

Tuesday

Wednesday

$170.00

British pound

Spot Rate

(/$)

0.5702

0.5712

0.5756

Euro

Spot Rate

(/$)

0.8304

0.8293

0.8340

British pound

train fare

()

96.93

97.10

97.85

Continental

train fare

()

141.17

140.98

141.78

In an attempt to be neutral or impartial in its currency of pricing, the Chunnel has actually introduced a degree of currency

risk to all customers either British or Continental, as neither group counts the U.S. dollar as its home or domestic

currency. The day-to-day fluctuations in the dollar against the pound and the euro may seem relatively small over a three

day period, but over several weeks or months in recent years, the changes could have been significant in the eyes of

potential customers.

Problem 2.13 Barcelona Exports

Oriol Dez Miguel S.R.L., a manufacturer of heavy duty machine tools near Barcelona, ships an

order to a buyer in Jordan. The purchase price is 425,000. Jordan imposes a 13% import duty on

all products purchased from the European Union. The Jordanian importer then re-exports the

product to a Saudi Arabian importer, but only after imposing their own resale fee of 28%. Given the

following spot exchange rates on April 11, 2010, what is the total cost to the Saudi Arabian

importer in Saudi Arabian riyal, and what is the U.S. dollar equivalent of that price?

Spot Rate

JD 0.96/

JD 0.711/$

SRI 3.751/$

Currency Crossrate

Jordanian dinar (JD) per euro ()

Jordanian dinar (JD) per U.S. dollar ($)

Saudi Arabian riyal (SRI) per U.S. dollar ($)

Assumptions

Purchase price, in euros ()

Spot rate of exchange, Jordanian dinar per euro (JD/)

Spot rate of exchange, Jordanian dinar per dollar (JD/$)

Spot rate, Saudi Arabian riyal per Jordanian dinar (SRI/JD)

Jordanian import duty on EU products

Jordanian resale fees

Spot rate of exchange, Saudi Arabian riyal (SRI/$)

Values

425,000

0.9600

0.7110

5.2751

13.00%

28.00%

3.751

What is the dollar price after all exchanges and fees?

Purchase price, converted to Jordanian dinar (JD)

Additional fees due on importation

Total cost, Jordanian dinar (JD)

408,000.00

53,040.00

461,040.00

Resale fee in Jordan

Resale price to Saudi Arabian, in JD

129,091.20

590,131.20

Price paid in Iraqi dinar, converting JD to SRI

(spot rate (SRI/JD) x Resale price to Saudi Arabian (JD) )

U.S. dollar equivalent of final price paid

3,113,004.33

830,001.69

You might also like

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX Marketskk50% (2)

- Bus 322 Tutorial 5-SolutionDocument20 pagesBus 322 Tutorial 5-Solutionbvni50% (2)

- Ch07 SSolDocument7 pagesCh07 SSolvenkeeeee100% (1)

- Foreign Exchange Markets, End of Chapter Solutions.Document27 pagesForeign Exchange Markets, End of Chapter Solutions.PankajatSIBMNo ratings yet

- Chapter 13 - Class Notes PDFDocument33 pagesChapter 13 - Class Notes PDFJilynn SeahNo ratings yet

- Chap 6 ProblemsDocument5 pagesChap 6 ProblemsCecilia Ooi Shu QingNo ratings yet

- Case StudyDocument7 pagesCase StudyTasnova Haque Trisha100% (1)

- MBF14e Chap05 FX MarketsDocument20 pagesMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- Summer 2021 FIN 6055 New Test 2Document2 pagesSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- Chapter 14 Multinational Tax Management Multiple Choice and True/False Questions 14.1 Tax PrinciplesDocument15 pagesChapter 14 Multinational Tax Management Multiple Choice and True/False Questions 14.1 Tax Principlesqueen hassaneenNo ratings yet

- UntitledDocument5 pagesUntitledsuperorbitalNo ratings yet

- Pbm7 2Document1 pagePbm7 2jordi92500No ratings yet

- Case Study ch6Document3 pagesCase Study ch6shouqNo ratings yet

- Finance - Module 7Document3 pagesFinance - Module 7luckybella100% (1)

- 2Document2 pages2akhil107043No ratings yet

- Vertical Supply Chain of Zara: Suppliers Across World ZARA Manufacturing Unit in SpainDocument1 pageVertical Supply Chain of Zara: Suppliers Across World ZARA Manufacturing Unit in SpainADITYAROOP PATHAKNo ratings yet

- Theories of Foreign ExchangeDocument19 pagesTheories of Foreign Exchangerockstarchandresh0% (1)

- Transaction Exposure Chapter 11Document57 pagesTransaction Exposure Chapter 11armando.chappell1005No ratings yet

- Multinational Business Finance 10th Edition Solution ManualDocument8 pagesMultinational Business Finance 10th Edition Solution ManualrspkamalgmailcomNo ratings yet

- Solnik Chapter 3 Solutions To Questions & Problems (6th Edition)Document6 pagesSolnik Chapter 3 Solutions To Questions & Problems (6th Edition)gilli1trNo ratings yet

- Inventory Simulation Game Student HandoutDocument3 pagesInventory Simulation Game Student HandoutRhobeMitchAilarieParelNo ratings yet

- FX II PracticeDocument10 pagesFX II PracticeFinanceman4No ratings yet

- CH 18Document4 pagesCH 18Ahmed_AbdelkariemNo ratings yet

- Tutorial 5 Exercises TemplateDocument17 pagesTutorial 5 Exercises TemplateHà VânNo ratings yet

- Blade's CaseDocument8 pagesBlade's CaseEly HarunoNo ratings yet

- PPP and exchange ratesDocument16 pagesPPP and exchange ratesNovrika DaniNo ratings yet

- Chapter 07Document3 pagesChapter 07Suzanna RamizovaNo ratings yet

- BUS322Tutorial8 SolutionDocument10 pagesBUS322Tutorial8 Solutionjacklee1918100% (1)

- Problem 11.3Document1 pageProblem 11.3SamerNo ratings yet

- Blades Case Exposure to International Flow of FundsDocument1 pageBlades Case Exposure to International Flow of FundsWulandari Pramithasari50% (2)

- Week 3 Tutorial ProblemsDocument6 pagesWeek 3 Tutorial ProblemsWOP INVESTNo ratings yet

- Chapter 16Document16 pagesChapter 16queen hassaneenNo ratings yet

- Chapter Fourteen Foreign Exchange RiskDocument14 pagesChapter Fourteen Foreign Exchange Risknmurar01No ratings yet

- ER Ch06 Solution ManualDocument16 pagesER Ch06 Solution ManualAbhay Singh ChandelNo ratings yet

- Sallie Schnudel speculates on Singapore dollar appreciationDocument25 pagesSallie Schnudel speculates on Singapore dollar appreciationveronika100% (1)

- Part 1 2nd AttemptDocument16 pagesPart 1 2nd AttemptCuitlahuac TogoNo ratings yet

- SM Multinational Financial Management ch09Document5 pagesSM Multinational Financial Management ch09ariftanur100% (1)

- As An Employee of The Foreign Exchange Department For A LargeDocument1 pageAs An Employee of The Foreign Exchange Department For A Largetrilocksp SinghNo ratings yet

- Assignment #2 Exchange Rate BehaviorDocument7 pagesAssignment #2 Exchange Rate BehaviorjosephblinkNo ratings yet

- Ch8 Practice ProblemsDocument5 pagesCh8 Practice Problemsvandung19No ratings yet

- Examples WACC Project RiskDocument4 pagesExamples WACC Project Risk979044775No ratings yet

- MBF13e Chap20 Pbms - FinalDocument11 pagesMBF13e Chap20 Pbms - FinalAnonymous 8ooQmMoNs1100% (3)

- Chapter 2 - Part 2 - Problems - AnswersDocument3 pagesChapter 2 - Part 2 - Problems - Answersyenlth940% (2)

- Practice Questions: Problem 1.1Document6 pagesPractice Questions: Problem 1.1Chekralla HannaNo ratings yet

- Global Investments PPT PresentationDocument48 pagesGlobal Investments PPT Presentationgilli1trNo ratings yet

- Chapter 11Document2 pagesChapter 11atuanaini0% (1)

- BFC5935 - Tutorial 9 SolutionsDocument6 pagesBFC5935 - Tutorial 9 SolutionsXue XuNo ratings yet

- International Financial Management - Geert Bekaert Robert Hodrick - Chap 02 - SolutionDocument4 pagesInternational Financial Management - Geert Bekaert Robert Hodrick - Chap 02 - SolutionFagbola Oluwatobi OmolajaNo ratings yet

- International Financial ManagementDocument23 pagesInternational Financial Managementsureshmooha100% (1)

- Problem 8.1 Peregrine Funds - JakartaDocument5 pagesProblem 8.1 Peregrine Funds - JakartaAlexisNo ratings yet

- TB Chapter 20Document14 pagesTB Chapter 20Mon LuffyNo ratings yet

- Chapter 4Document14 pagesChapter 4Selena JungNo ratings yet

- Week 2 Tutorial QuestionsDocument4 pagesWeek 2 Tutorial QuestionsWOP INVESTNo ratings yet

- Currency Bid Rate Ask/Offer Rate: 1. 2. 3. 4. How Much CAD Received When Selling CHF10, 000,000? 5Document4 pagesCurrency Bid Rate Ask/Offer Rate: 1. 2. 3. 4. How Much CAD Received When Selling CHF10, 000,000? 5Dinhphung Le100% (1)

- MNC S Exposure To Exchange Rate FluctuationsDocument34 pagesMNC S Exposure To Exchange Rate FluctuationsanshuldceNo ratings yet

- Chap03 Pbms MBF12eDocument15 pagesChap03 Pbms MBF12eRoopak Rewari100% (2)

- MBF12 CH3 Question BankDocument15 pagesMBF12 CH3 Question BankwertyuoiuNo ratings yet

- FINA3020 Question Bank Solutions PDFDocument27 pagesFINA3020 Question Bank Solutions PDFTrinh Phan Thị NgọcNo ratings yet

- Module#2: ProblemsDocument17 pagesModule#2: ProblemsAbdallah ClNo ratings yet

- MBF14e Chap06 Parity Condition PbmsDocument23 pagesMBF14e Chap06 Parity Condition PbmsKarl100% (18)

- MBF14e Chap02 Monetary System PbmsDocument13 pagesMBF14e Chap02 Monetary System PbmsKarlNo ratings yet

- MBF14e Chap04 Governance PbmsDocument16 pagesMBF14e Chap04 Governance PbmsKarl60% (5)

- MBF14e Chap01 Introduction PbmsDocument14 pagesMBF14e Chap01 Introduction PbmsKarl67% (3)