Professional Documents

Culture Documents

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Uploaded by

Shyam SunderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Uploaded by

Shyam SunderCopyright:

Available Formats

&UnfEWERPRISES LTD,

Manufacturers & Global Exporf~rsof

All @ades of Castor QII and Derivatives

-

P F I ~ I - ~ E W ~ W1

T,

--

W r V ~ 1W-Wm

I(EL/SE/2016-17/P13

Date: 1 3 August,

~ ~ 2016

ro,

The Manager, Listing,

BSE h t e d

Phiroze Jeejeebhoy Towers,

Dalal Street, IGla Ghoda, Fort,

Mumbai-400 001

Dear Sir,

Sub: Submission of Unaudited Standalone Financial Results of the company for the

quarter ended June 30,2016.

Ref: Company Code; BSE: 533790

With regard to above and in accordance with the provision of Regulatio~i33 oE SIiHI (Listing

Obligations and Disclosure Kequiretnents) Regulations, 2015, please find cnclosed herewith copy of

the unauhted standalone financial results of the company for the quarter ended Junc 30, 3016 along

with limited review report.

I'leasc talie note of it.

Thanking You,

Faithfullv Yours,

FOR KGN ENTERPRISES LIMITED

AU

Encl: 11s Stated

Regd. Office: 23. Vaswani Mansion, 4th Floor, Dinshaw, Vaccha Road, Dpp. K. C. College, Church Gate. Mumbai - 400 02

Tel: +91 - 22 - 6654 1 1 0 1 1 Tel: +91 - 22 - 6 7 2 5 6547

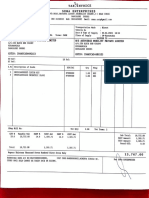

KGN ENTERPRISES LIMITED

Regd. Office : 23, Vaswani Mention, 4th Floor, Dinshaw, Vaccha Road, Opp. K.C. College,

Church Gate, Mumbai - 400020

Corporate Office : B-15 Hirnen Shopping Centre co.op.hsg. Soc. Ltd, Near CITY Centre,

S.V.Road, Goregaon(w), Mumbai-400062

Ph. : +91-22-67256547

Email : info@kgnenterprises.com

CIN No : L45201MH1994PLC204203

Part l

( f. In Lakhs )

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED ON JUNE 30,2016

Sr

Particulars

No

30.06.2016

(Unaudited)

I lncome from operations

(a) lncome from Operations

(Net of excise duty)

(b) Other Operating Income

Total Income from operations (net)

2 Expenses

(a) Cost of material consumed

(b) Purchase of stock-in-trade

(c) Changes in inventories

of finished goods, work-in-progress and stock in trade

(d) Employee benefit expense

(e) Depreciation and amortisation expense

(f) Other expenses

Total Expenses

3 Profit from Operations before

Other Income, finance costs

and Exceptional ltems (1-2)

4 Other income

5 Profit from ordinary activities

6 Finance costs

7 Profit from ordinary activities

after finance costs but before

Exceptional ltems (5-6)

8 Exceptional Items

9 Profit from ordinary activities before tax (728)

10 Tax expenses

- Current Tax (including tax adjustment

of earlier years)

- Deferred Tax

II

12

13

14

Net Profit from ordinary activities after tax (9210)

Extraordinary Items

Net Profit for the period ( I If12)

Paid up Equity Share Capital

(Face value: Rs.101- per Share)

15 Reserves excluding Revaluation

Reserves as per balance sheet of previous

accounting year

Quarter ended on

31.03.201 6

30.06.2015

(Audited)

(Unaudited)

Year ended on

31.03.201 6

Audited

0.00

34.76

30.80

91.39

0.00

0.00

0.00

34.76

0.00

30.80

6.94

98.33

0.00

0.00

0.00

0.00

0.00

30.76

0.00

0.00

26.67

0.00

0.00

. 82.96

0.53

0.00

1.16

1.69

0.64

0.00

1.85

33.25

1 07

0.00

3.39

31.I3

2.58

0.00

8.33

93.87

-1.69

1.51

-0.33

4.46

2.60

0.91

0.00

0.04

1.55

0.00

1.85

1.52

0.00

1.88

6.34

0.00

0.91

1.55

1.52

6.34

0.00

0.91

0.00

1.55

000

1.52

0.00

6.34

0.28

0.48

0.37

1.93

0.00

0.63

0.00

0.63

0.00

1.07

0.00

1.07

0.00

1.15

000

1.15

0.00

4.41

0.00

4.41

2047

2047

2047

2047

'

4925.37

16 Earnings Per Share (EPS)

Basic and diluted EPS before Extraordinary Items

Basic and diluted EPS before Extraordinary items

0.003

0.003

rr

0.005

0.005

0.006

0.006

0.002

0.002

r ll

A PARTICULARS OF SHAREHOLDING

1 Public Shareholdlng

- Number of Equlty Shares

- Percentage of Shareholding

2 Promoters and promoter group Shareholding

(a) PledgedlEncumbered

- Number of shares

- Percentage of share

(as a% of the total shareholding of promoter and

8

- ' -promoter group)

- Percentage of share

9603859.00

46.92

9603859.00

46.92

9603859 00

46 92

9603859.00

46.92

10866141.00

100.00

10866141 00

100 00

10866141.OO

100.00

10866141.00

100.00

53.08

53.08

53.08

53.08

,--. -

(as a% of the total shareholding

capital of the company)

(b) Non-encumbered

- Number of shares

- Percentage of share

(as a% of the total shareholding of promoter and

promoter group)

- Percentage of share

(as a% of the total shareholding capital of the company)

B INVESTOR COMPLAINTS

Pending at the beginning of the quarter

Recelved during the quarter

Disposedof during the quarter

Remaining unresolved at the end of the quarter

Quarter ended

30.06.2016

NIL

1

NIL

1

Notes :

1 Figures have been regrouped, reclassified and rearranged wherever necessary

2 The above financial Results have been approved and taken on record by the Board of Directors of the company at ~ t s

meetrng held on August 13, 2016

3 There are no reportable segments as specified in Accounting Standard (As-17) on "Segment reporting" which need to be

reported

4 Company had not received any compliant from shareholder during the Quarter ended as dn 30 06.2016. Further there was no

complaint pending at the beginning of the quarter and also there is no complaint pendlng as at the end of the quarter.

5 The figures of last quarter are the balancing figures between audited figures in respect of the full financial year and the

published year to date figures upto the end of third quarter of the respective financial year.

6 Earnings per share -Basic and diluted have been calculated in accordance with the Accountrng Standard -20

7 The applicable Tax under the Provisron of Income Tax Act, 1961 computed by the quarter end

Place : Mumbai

Date : 13108/2016

chartered Accountants

Review Report to:

The Board of Directors,

MIS. KGN Enterprises Limited

We have reviewed the accompanying statement of unaudited financial results of M/s. KGN

Enterprises Limited for the Quarter ended 30"' June, 2016. This statement

1s

the

responsibhty of the Company's Management and has been approved by thc Board of

Directors. Our responsibility is to issue a report on these Statements based on our rcview.

We conducted our review in accordance with the Standard on Review Engagcnlcnt (SRE)

2400, Engagements to Review Financial Statements issued by the Institute of Chartered

Accountants of India. This standard requires that we plan and perform the review to obtain

moderate assurance as to whether the financial statements are free o f rnatenal misstatement.

A review is limited primarily to inquiries of company personnel and anal! t1c;ll proccdurcs

applied to financial data and thus provides less assurance than an audit. Wt. havc not

performed an au&t and accordingly, we do not express an audit opinion.

Based on our review conducted as stated above, n o t h g has come to our attention that

causes us to believe that the accompanying statement of unaudited financral results prepared

in accordance with applicable accounting standards and other recognized accounting

practices and policies has not disclosed the informauon required to bc disclosed In terms of

Regulation 33 of SEBI (Listing Obligation and Disclosure Requirements) Regulauons, 2015

including the manner in whch it is to be disclosed, or that it contains any material

misstatement.

For, Kirit & Company

F. R. No. 132282W

Chartered Accountants

Place: Ahmedabad

Date: UTh

August, 2016

Proprietor

M. No.: 038047

- -

--

4, Nina Society, Near Shreyap Railway Crossing, Ambmmli, Ahmedabad 380 015

Phone No. Qft2411 3 3 s E- Mail :-c a k ~ 1 l ~ m a i l . c o m

-A-

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Jaihind Synthetics Limited: S BusDocument4 pagesJaihind Synthetics Limited: S BusShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document15 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Document5 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document2 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document10 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document3 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Document7 pagesStandalone & Consolidated Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderNo ratings yet

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document7 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderNo ratings yet

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderNo ratings yet

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderNo ratings yet

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderNo ratings yet

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderNo ratings yet

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderNo ratings yet

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderNo ratings yet

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderNo ratings yet

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Environmental Scan: The Global Beer IndustryDocument25 pagesEnvironmental Scan: The Global Beer Industrybradhillwig6152100% (5)

- Tax 01 Introduction To Consumption TaxesDocument3 pagesTax 01 Introduction To Consumption TaxesShiela LlenaNo ratings yet

- 2021 S C M R 437Document3 pages2021 S C M R 437Yahia MustafaNo ratings yet

- Profile t1 InstructionsDocument4 pagesProfile t1 Instructionsapi-306226330No ratings yet

- So You Wanna Be A ProducerDocument78 pagesSo You Wanna Be A ProducerRoxana Rădeanu100% (1)

- RMO NO.51-2019 (Tax Residency Certificates)Document4 pagesRMO NO.51-2019 (Tax Residency Certificates)Ray-an Francis BaybayNo ratings yet

- Tax1-June 27 SessionDocument2 pagesTax1-June 27 SessionSuiNo ratings yet

- Corporate Tax PlanningDocument16 pagesCorporate Tax PlanningRakesh KushwahaNo ratings yet

- TDS On Printing & StationeryDocument11 pagesTDS On Printing & StationeryVivek Reddy100% (1)

- Beaumont Holdings Corporation vs. Reyes, 834 SCRA 477, August 07, 2017Document30 pagesBeaumont Holdings Corporation vs. Reyes, 834 SCRA 477, August 07, 2017Christopher IgnacioNo ratings yet

- Filling, Penalties and RemediesDocument14 pagesFilling, Penalties and RemediesMichael Brian TorresNo ratings yet

- Translation Invoice Template v3Document1 pageTranslation Invoice Template v3ysNo ratings yet

- Globalization and Its Impact On EducationDocument14 pagesGlobalization and Its Impact On EducationSutrisno Spd96% (27)

- 04-17-15 EditionDocument33 pages04-17-15 EditionSan Mateo Daily JournalNo ratings yet

- Fiona Chen Empire Comparision ChartsDocument18 pagesFiona Chen Empire Comparision Chartsapi-38151138760% (5)

- District 103 DonaldDocument58 pagesDistrict 103 DonaldJeremy Cromwell MNo ratings yet

- The Customs Value of Imported Goods &: Advance Valuation RulingDocument8 pagesThe Customs Value of Imported Goods &: Advance Valuation RulingYanisa M. OscarNo ratings yet

- BFD Complete Past PapersDocument100 pagesBFD Complete Past PapersMuhammad Usama SheikhNo ratings yet

- ZACARIAS v. REVILLADocument2 pagesZACARIAS v. REVILLAEmmanuel Princess Zia Salomon100% (1)

- Career 2201: Budget Assignment: SectionDocument4 pagesCareer 2201: Budget Assignment: SectionInnocent MapaNo ratings yet

- 2017 AJ Mariano Del Castillo CasesDocument277 pages2017 AJ Mariano Del Castillo CasesJeanelle LagadonNo ratings yet

- p9 SlutsDocument1 pagep9 Slutsyonah olupauNo ratings yet

- HRM Practice of SQUARE: Square Textiles Limited - IntroductionDocument26 pagesHRM Practice of SQUARE: Square Textiles Limited - IntroductionKolpo KothaNo ratings yet

- NF Invoice Apple IphoneDocument1 pageNF Invoice Apple Iphonegustavogko01No ratings yet

- 1922 B.com B.com Batchno 43Document86 pages1922 B.com B.com Batchno 43RomitNo ratings yet

- Lesson 1 Business EthicsDocument21 pagesLesson 1 Business EthicsRiel Marc AliñaboNo ratings yet

- Adobe Scan 23 Jan 2024Document1 pageAdobe Scan 23 Jan 2024rajeshNo ratings yet

- Seminar XIIDocument67 pagesSeminar XIINeko IvanishviliNo ratings yet

- Rahul Mimani: Carrier ObjectiveDocument3 pagesRahul Mimani: Carrier ObjectiveCa Rahul MimaniNo ratings yet

- Tax1 (T31920)Document82 pagesTax1 (T31920)Charles TuazonNo ratings yet

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Bribery and Corruption Casebook: The View from Under the TableFrom EverandBribery and Corruption Casebook: The View from Under the TableNo ratings yet

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- Building a World-Class Compliance Program: Best Practices and Strategies for SuccessFrom EverandBuilding a World-Class Compliance Program: Best Practices and Strategies for SuccessNo ratings yet

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsFrom EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsNo ratings yet

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- GDPR for DevOp(Sec) - The laws, Controls and solutionsFrom EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsRating: 5 out of 5 stars5/5 (1)

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachFrom EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachRating: 4 out of 5 stars4/5 (1)

- Audit and Assurance Essentials: For Professional Accountancy ExamsFrom EverandAudit and Assurance Essentials: For Professional Accountancy ExamsNo ratings yet