Professional Documents

Culture Documents

Collector Vs Bautista

Uploaded by

Hannah Barrantes0 ratings0% found this document useful (0 votes)

736 views3 pageshj

Original Title

Collector vs Bautista

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenthj

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

736 views3 pagesCollector Vs Bautista

Uploaded by

Hannah Barranteshj

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

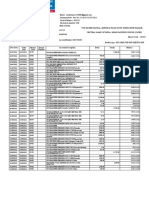

8/14/2016

PHILIPPINE REPORTS ANNOTATED VOLUME 105

[Nos. L12250 and L12259. May 27, 1959]

THE COLLECTOR OF INTERNAL REVENUE, petitioner,

vs. PEDRO B. BAUTISTA and DATIVA CORRALES TAN,

respondents. PEDRO B. BAUTISTA and DATIVA

CORRALES TAN, petitioners, vs. THE COLLECTOR OF

INTERNAL REVENUE.

Appeal from a decision of the Court of Tax Appeals.

Spouses Pedro B. Bautista and Dativa Corrales Tan

each filed a separate income tax return for 1947. The

husband reported an income of P2,300 and paid an

income tax of P9.00, after claiming personal exemptions

of P2,500 as head of family and P500 for a minor child.

The wife reported in her return an income of P9,999.90

derived from the sale of her share in a lot and building

at Tabora street, Manila, paying an income tax of P490.

She also claimed personal exemptions of P2,500 for

being a married person or head of family and P500 for

the same minor child. Under investigation by the

Bureau of Internal Revenue, the returns were

consolidated and a deficiency was assessed against them

in the sum of P15,564.54. The deficiency assessment was

the result mainly of the alleged

1327

underdeclaration of the proceeds of the sale of the wife's

share in the Tabora property and the overvaluation of the

cost thereof. The spouses contested the assessment on the

grounds that the amount actually received by them from

the sale was P49,999.00 and not P66,606.66; that they

failed to claim deduction for losses sustained as a result of

the fire which destroyed their house; that the Tabora

property was a capital asset and only 50% of the gain was

taxable; and that the right to assess the deficiency income

tax had prescribed. On appeal, the Court of Tax Appeals

rendered the decision appealed, ordering the spouses to pay

the deficiency income tax of P10,376.38, plus 50%

surcharge, and surcharge of 5% and 1% monthly interest

http://www.central.com.ph/sfsreader/session/0000015686ea8062020d690f003600fb002c009e/t/?o=False

1/3

8/14/2016

PHILIPPINE REPORTS ANNOTATED VOLUME 105

on the deficiency tax of P10,376.38. The Bautistas

maintain, in this appeal, that the lower court erred (1) in

overruling their defense of prescription; (2) in not allowing

deductions on account of the loss suffered by them; and (3)

in holding that the Tabora property was an ordinary asset.

The Government has appealed from the decision insofar as

it imposes the 5% surcharge and 1% monthly interest on

the deficiency tax only. Held: With respect to prescription,

the income tax returns of the Bautistas for 1947 are

deemed filed as of March 1, 1948. Section 331 of the Tax

Code provides that the deficiency assessment must be

made within five years after the return was filed, and the

assessment is deemed made when the notice to this effect is

released, mailed or sent by the Collector to the taxpayer,

for the purpose of giving effect to said assessment. Said

section does not require that the notice be received by the

taxpayer within the said period of five years. In the case at

bar, the Collector assessed the deficiency tax on January

21, 1953 and notice to this effect was sent or given due

course prior to March 1, 1953, for it was received in the

Office of the City Treasurer of Quezon City, on February

13, 1953, and, hence, before the expiration of said period.

As to the alleged fire losses disallowed by the court, suffice

it to say that the question whether the findings are correct

or not depends upon the degree of credence attached to the

testimonial evidence introduced by the taxpayers, which

the lower court was in a better position to decide. Finally,

the contention that the property was a capital asset, is

untenable, in view of the findings of the lower court that

said property was primarily held by them for rent, and that

they never occupied the same as their residence. On the

other hand, the claim of the Government has already been

rejected in Collector of Internal Revenue vs. University of

Sto. Tomas, G. R. No. L11274 and L11280, November 28,

1958. The

1328

surcharge of 5% and the interest of 1% a month referred to

in Section 51 (e) of the Tax Code, are imposed upon the "tax

unpaid."

Decision affirmed. Concepcin, J., ponente

http://www.central.com.ph/sfsreader/session/0000015686ea8062020d690f003600fb002c009e/t/?o=False

2/3

8/14/2016

PHILIPPINE REPORTS ANNOTATED VOLUME 105

Copyright 2016 Central Book Supply, Inc. All rights reserved.

http://www.central.com.ph/sfsreader/session/0000015686ea8062020d690f003600fb002c009e/t/?o=False

3/3

You might also like

- Bank of America v. CA and CIR DigestDocument2 pagesBank of America v. CA and CIR DigestNichole Lanuza50% (2)

- Pansacola v. CIRDocument3 pagesPansacola v. CIRSean GalvezNo ratings yet

- List PDFDocument4 pagesList PDFPam Welch HeuleNo ratings yet

- CIR Vs Phil Aluminum WheelsDocument6 pagesCIR Vs Phil Aluminum WheelsCherry Jean RomanoNo ratings yet

- Case #26 CIR v. CTA and Smith Kline (1984) (Digest)Document4 pagesCase #26 CIR v. CTA and Smith Kline (1984) (Digest)Leslie Joy PantorgoNo ratings yet

- Republic of The Philippines Metropolitan Trial Court National Capital Judicial Region Branch 2, Quezon CityDocument6 pagesRepublic of The Philippines Metropolitan Trial Court National Capital Judicial Region Branch 2, Quezon CityHannah BarrantesNo ratings yet

- CD - 81. Allied Banking v. Quezon CityDocument2 pagesCD - 81. Allied Banking v. Quezon CityCzarina CidNo ratings yet

- 05 Aznar vs. CIRDocument2 pages05 Aznar vs. CIRAlec Ventura100% (1)

- Liquigaz Philippines Corp. Vs CIR, CTA EB Nos. 1117 and 1119Document3 pagesLiquigaz Philippines Corp. Vs CIR, CTA EB Nos. 1117 and 1119brendamanganaanNo ratings yet

- CIR Vs Transitions Optical PhilippinesDocument2 pagesCIR Vs Transitions Optical PhilippinesJuls Rxs100% (1)

- Sps. Tan V BanteguiDocument4 pagesSps. Tan V Banteguinazh100% (1)

- NKMen 13 90 Arbitration Hidden Secret of Indian Index and How ToDocument21 pagesNKMen 13 90 Arbitration Hidden Secret of Indian Index and How ToMohammed Asif Ali RizvanNo ratings yet

- RR 10-98Document2 pagesRR 10-98matinikkiNo ratings yet

- CIR Vs Benipayo G.R. L-13656Document1 pageCIR Vs Benipayo G.R. L-13656MACNo ratings yet

- G.R. No. 170257 September 7, 2011 Rizal Commercial Banking Corporation, vs. Commissioner of Internal RevenueDocument1 pageG.R. No. 170257 September 7, 2011 Rizal Commercial Banking Corporation, vs. Commissioner of Internal RevenueEdmerson Prix Sanchez CalpitoNo ratings yet

- Republic V RicarteDocument1 pageRepublic V RicarteReena MaNo ratings yet

- AccountStatement 3286686240 Aug04 185310 PDFDocument2 pagesAccountStatement 3286686240 Aug04 185310 PDFDarren Joseph VivekNo ratings yet

- Securities and Exchange Commission:: Business Compliance Guide Stock CorporationDocument5 pagesSecurities and Exchange Commission:: Business Compliance Guide Stock CorporationHannah BarrantesNo ratings yet

- Philippine Journalists Inc V CIR GR No 162852Document2 pagesPhilippine Journalists Inc V CIR GR No 162852crizaldedNo ratings yet

- CIR Vs Sony PhilDocument1 pageCIR Vs Sony PhilJazem Ansama100% (3)

- Hijo Plantation V Central BankDocument3 pagesHijo Plantation V Central BankKayee KatNo ratings yet

- 12 99Document32 pages12 99sui_generis_buddyNo ratings yet

- Forex Combo System.Document10 pagesForex Combo System.flathonNo ratings yet

- Cir v. Cebu HoldingsDocument4 pagesCir v. Cebu HoldingsAudrey50% (2)

- Collector vs. BautistaDocument1 pageCollector vs. BautistaFrancise Mae Montilla Mordeno100% (1)

- 4 Philippine Journalists, Inc. vs. CIR (Tan)Document2 pages4 Philippine Journalists, Inc. vs. CIR (Tan)Rudejane TanNo ratings yet

- RCBC Vs CIR, GR No. 168498, April 24, 2007Document1 pageRCBC Vs CIR, GR No. 168498, April 24, 2007Vel June De LeonNo ratings yet

- Oceanic Wireless v. CIRDocument2 pagesOceanic Wireless v. CIRlesterjethNo ratings yet

- Real Property Tax CasesDocument90 pagesReal Property Tax Casesvilgay25100% (1)

- Lascona Land Co., Inc. v. CIRDocument2 pagesLascona Land Co., Inc. v. CIRAron Lobo100% (1)

- Sharpe Single Index ModelDocument11 pagesSharpe Single Index ModelSai Mala100% (1)

- CIR V MINDANAO SANITARIUM AND HOSPITAL INCDocument4 pagesCIR V MINDANAO SANITARIUM AND HOSPITAL INCAlexis Anne P. ArejolaNo ratings yet

- RR 14-77Document1 pageRR 14-77cheska_abigail950No ratings yet

- Allied Banking Corporation vs. CIRDocument1 pageAllied Banking Corporation vs. CIRBobbyNo ratings yet

- Cir Vs WyethDocument1 pageCir Vs WyethHollyhock Mmgrzhfm100% (1)

- Gibbs vs. Cir and Cta - RemediesDocument2 pagesGibbs vs. Cir and Cta - RemediesIrish Asilo PinedaNo ratings yet

- Digest of Ramsay vs. CIR, CTA Case No. 8456, September 17, 2015Document2 pagesDigest of Ramsay vs. CIR, CTA Case No. 8456, September 17, 2015Michael Joseph NogoyNo ratings yet

- Tax Case DigestsDocument21 pagesTax Case Digestsannamariepagtabunan100% (3)

- Manny Pacquiao Tax Case DigestDocument3 pagesManny Pacquiao Tax Case Digestbigbird1021780% (1)

- BPI Vs CIR, 473 SCRA 205, Oct. 17, 2005Document8 pagesBPI Vs CIR, 473 SCRA 205, Oct. 17, 2005katentom-1No ratings yet

- 13.republic Vs RicarteDocument1 page13.republic Vs RicarteGyelamagne EstradaNo ratings yet

- CIR vs. FAR EAST BANKDocument5 pagesCIR vs. FAR EAST BANKDessa Ruth ReyesNo ratings yet

- CIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Document1 pageCIR v. Smith Kline / G.R. No. L-54108 / January 17, 1984Mini U. SorianoNo ratings yet

- CIR v. Hedcor Sibulan, Inc.Document2 pagesCIR v. Hedcor Sibulan, Inc.SophiaFrancescaEspinosa100% (1)

- Cir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsDocument2 pagesCir V Hantex Trading Co, Inc. G.R. NO. 136975: March 31, 2005 Callejo, SR., J.: FactsKate Garo100% (2)

- CIR vs. FMF Development Corporation 167765Document1 pageCIR vs. FMF Development Corporation 167765magenNo ratings yet

- 40 Nippon Life V CIRDocument2 pages40 Nippon Life V CIRMae SampangNo ratings yet

- 23 Cir Vs Mindanao Sanitarium and HospitalDocument5 pages23 Cir Vs Mindanao Sanitarium and HospitalSecret Secret0% (1)

- Audit of Inventories (Done)Document19 pagesAudit of Inventories (Done)Hasmin Saripada AmpatuaNo ratings yet

- CIR V Isabela Cultural Corp, GR No. 135210Document2 pagesCIR V Isabela Cultural Corp, GR No. 135210Lilaben SacoteNo ratings yet

- RMC 48-90Document2 pagesRMC 48-90cmv mendozaNo ratings yet

- CIR v. CitytrustDocument2 pagesCIR v. Citytrustpawchan02No ratings yet

- Gutierrez V CollectorDocument3 pagesGutierrez V Collectormichee coi100% (1)

- Issues and Problems in Decentralization and Local Autonomy in The PhilippinesDocument19 pagesIssues and Problems in Decentralization and Local Autonomy in The PhilippinesHannah Barrantes0% (1)

- 269-Republic v. Patanao G.R. No. L-22356 July 21, 1967Document3 pages269-Republic v. Patanao G.R. No. L-22356 July 21, 1967Jopan SJNo ratings yet

- Republic V Ricarte, GR L-46893, November 12, 1985Document2 pagesRepublic V Ricarte, GR L-46893, November 12, 1985Diane Dee YaneeNo ratings yet

- CIR Vs Hambrecht and Quist PhilDocument2 pagesCIR Vs Hambrecht and Quist PhilElerlenne Lim100% (1)

- Samar-I Electric Coop V CIR (2014) DigestDocument2 pagesSamar-I Electric Coop V CIR (2014) Digestviktoriavillo67% (3)

- 3 Heng Tong Textiles V CIRDocument1 page3 Heng Tong Textiles V CIRJezreel Y. ChanNo ratings yet

- Borromeo v. CSCDocument1 pageBorromeo v. CSCRaymond RoqueNo ratings yet

- CIR V StanleyDocument15 pagesCIR V StanleyPatatas SayoteNo ratings yet

- CIR V FMFDocument21 pagesCIR V FMFPatatas SayoteNo ratings yet

- Sample PANDocument5 pagesSample PANArmie Lyn Simeon100% (1)

- CIR v. Tulio (Digest by Madz)Document3 pagesCIR v. Tulio (Digest by Madz)madzarellaNo ratings yet

- Gulf Air Co-Phil Branch v. CIRDocument3 pagesGulf Air Co-Phil Branch v. CIRJustine GaverzaNo ratings yet

- Soriamont Steamship v. SprintDocument2 pagesSoriamont Steamship v. Sprintd2015memberNo ratings yet

- Cir Vs San Roque 690 Scra 336Document5 pagesCir Vs San Roque 690 Scra 336Izzy Martin MaxinoNo ratings yet

- CIR Vs Perf RealtyDocument2 pagesCIR Vs Perf RealtyEnav LucuddaNo ratings yet

- Gutierrez v. CtaDocument4 pagesGutierrez v. CtaasandaloNo ratings yet

- Insurance BarqsDocument4 pagesInsurance BarqsHannah BarrantesNo ratings yet

- ActivityDocument1 pageActivityHannah BarrantesNo ratings yet

- DRF - Soul Skincare and Nude Cosmetics (April Delivery)Document6 pagesDRF - Soul Skincare and Nude Cosmetics (April Delivery)Hannah BarrantesNo ratings yet

- Unit I Local Government Concepts AND Basic Policies Underlying The Local Government CodeDocument12 pagesUnit I Local Government Concepts AND Basic Policies Underlying The Local Government CodeHannah BarrantesNo ratings yet

- Labor Law Midterms ProjectDocument10 pagesLabor Law Midterms ProjectHannah BarrantesNo ratings yet

- Budgetary Cost EstimatesssssDocument14 pagesBudgetary Cost EstimatesssssHannah BarrantesNo ratings yet

- 4th Year - Constitutional Law ReviewDocument9 pages4th Year - Constitutional Law ReviewHannah BarrantesNo ratings yet

- Batangas Chord SheetDocument28 pagesBatangas Chord SheetHannah BarrantesNo ratings yet

- Barrantes, Hannah R. Table of Intestacy For Legitimate Children With Whom The Legitimate Children Concure and Share Extent Example/SDocument8 pagesBarrantes, Hannah R. Table of Intestacy For Legitimate Children With Whom The Legitimate Children Concure and Share Extent Example/SHannah BarrantesNo ratings yet

- People of The Philippines, Crim Case No. 12345 Aku Sado, AccusedDocument27 pagesPeople of The Philippines, Crim Case No. 12345 Aku Sado, AccusedHannah BarrantesNo ratings yet

- Feliciano On JpepaDocument44 pagesFeliciano On JpepaHannah BarrantesNo ratings yet

- Atty. Maria Concepcion NocheDocument2 pagesAtty. Maria Concepcion NocheHannah BarrantesNo ratings yet

- Public International Law - Reading List - UA&PDocument3 pagesPublic International Law - Reading List - UA&PHannah BarrantesNo ratings yet

- Lecture Note 03 - Bond Price VolatilityDocument53 pagesLecture Note 03 - Bond Price Volatilityben tenNo ratings yet

- Exercises For Corporate FinanceDocument13 pagesExercises For Corporate FinanceVioh NguyenNo ratings yet

- FAQ - Maxicare SME Online Payment FacilityDocument7 pagesFAQ - Maxicare SME Online Payment FacilityJohn Dexter SunegaNo ratings yet

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyDocument3 pagesQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- Terms and Conditions: (Receipt For The Recipient)Document1 pageTerms and Conditions: (Receipt For The Recipient)sagar aroraNo ratings yet

- Equity ReleaseDocument17 pagesEquity ReleaseEquity Release WiseNo ratings yet

- Kiwi Property Annual Report 2020 FINAL PDFDocument40 pagesKiwi Property Annual Report 2020 FINAL PDFNam PhamNo ratings yet

- (CredTrans) 85 - Mahoney V TuasonDocument3 pages(CredTrans) 85 - Mahoney V TuasonALEC NICOLE PARAFINANo ratings yet

- IMPACT of FDI IN INDIADocument17 pagesIMPACT of FDI IN INDIABharathyNo ratings yet

- Groww Nifty Total Market Index Fund KIMDocument37 pagesGroww Nifty Total Market Index Fund KIMG1 ROYALNo ratings yet

- Estate Tax-Handout 2Document4 pagesEstate Tax-Handout 2Xerez SingsonNo ratings yet

- Accountancy MSDocument13 pagesAccountancy MSJas Singh DevganNo ratings yet

- Chapter-1: Working CapitalDocument47 pagesChapter-1: Working Capitalchhita mani sorenNo ratings yet

- Mastering Financial Modelling File ListDocument1 pageMastering Financial Modelling File ListNamo Nishant M PatilNo ratings yet

- Rencana TradingDocument17 pagesRencana TradingArya PuwentaNo ratings yet

- Analisis Studi Kelayakan Bisnis Pada Kelompok UsahDocument11 pagesAnalisis Studi Kelayakan Bisnis Pada Kelompok UsahPermana Bagas SatriaNo ratings yet

- Apply For A U.SDocument1 pageApply For A U.Scm punkNo ratings yet

- 2019-04-03 Certo V BONY Mellon FL1st DCA 17-4421Document5 pages2019-04-03 Certo V BONY Mellon FL1st DCA 17-4421D. BushNo ratings yet

- Deprival Value Lecture NotesDocument7 pagesDeprival Value Lecture NotesTosin YusufNo ratings yet

- AuditingDocument99 pagesAuditingWen Xin GanNo ratings yet

- Practical Auditing - C2 and C3 Suggested AnswersDocument4 pagesPractical Auditing - C2 and C3 Suggested AnswersTammy Yeban100% (1)

- Taxation Situational ProblemsDocument32 pagesTaxation Situational ProblemsMilo MilkNo ratings yet

- NBP RateSheet 03 04 2023Document1 pageNBP RateSheet 03 04 2023Awais AslamNo ratings yet

- (Colliers) APAC Cap Rate Report Q4.2022Document6 pages(Colliers) APAC Cap Rate Report Q4.2022Khoi NguyenNo ratings yet