Professional Documents

Culture Documents

Form 16

Uploaded by

anon_825378560Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 16

Uploaded by

anon_825378560Copyright:

Available Formats

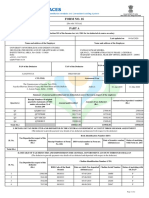

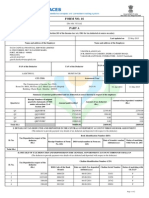

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. JQERPOJ

Last updated on

Name and address of the Employer

19-May-2016

Name and address of the Employee

KOTAK SECURITIES LIMITED

27 BKC,G BLOCK, PLOT NO. C27, BANDRA EAST,

MUMBAI BANDRA EAST - 400051

Maharashtra

+(91)22-66056211

VIVEK.N.JAIN@KOTAK.COM

SHAILENDRA SINGH

I F 17, CHANDRA SHEKHAR AZAD NAGA, BHILWARA - 311001

Rajasthan

PAN of the Deductor

TAN of the Deductor

AAACK3436F

MUMK05839B

PAN of the Employee

Employee Reference No.

provided by the Employer

(If available)

BNKPS8405H

CIT (TDS)

Assessment Year

The Commissioner of Income Tax (TDS)

Room No. 900A, 9th Floor, K.G. Mittal Ayurvedic Hospital

Building, Charni Road , Mumbai - 400002

2016-17

Period with the Employer

From

To

01-Apr-2015

31-Mar-2016

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Q3

QRPRZKQE

133154.00

1073.00

1073.00

Q4

QRUPZCND

157431.00

1073.00

1073.00

290585.00

2146.00

2146.00

Total (Rs.)

Amount of tax deposited / remitted

(Rs.)

Amount of tax deducted

(Rs.)

Amount paid/credited

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Tax Deposited in respect of the

deductee

(Rs.)

Sl. No.

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher Status of matching

(dd/mm/yyyy)

with Form no. 24G

Total (Rs.)

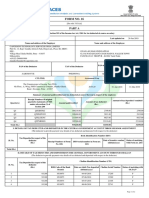

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

0.00

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

04-12-2015

1073.00

0510075

07-01-2016

16638

1073.00

0510075

05-02-2016

26854

0.00

04-03-2016

0.00

29-04-2016

Total (Rs.)

2146.00

Page 1 of 6

Page 1 of 2

This file is signed using Digital Signature.

Certificate Number: JQERPOJ

TAN of Employer: MUMK05839B

PAN of Employee: BNKPS8405H

Assessment Year: 2016-17

Verification

I, VIVEK JAIN, son / daughter of NARESH CHAND JAIN working in the capacity of SENIOR VICE PRESIDENT (designation) do hereby certify that a sum of

Rs. 2146.00 [Rs. Two Thousand One Hundred and Fourty Six Only (in words)] has been deducted and a sum of Rs. 2146.00 [Rs. Two Thousand One Hundred and

Fourty Six Only] has been deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is

based on the books of account, documents, TDS statements, TDS deposited and other available records.

Place

MUMBAI

Date

30-May-2016

Designation: SENIOR VICE PRESIDENT

(Signature of person responsible for deduction of Tax)

Full Name:VIVEK JAIN

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend

Description

Definition

Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Signature Not Verified

Signed by : JAIN VIVEK NARESHCHAND

(KOTAK SECURITIES LIMITED)

Date : 30/May/2016 10:00:00

Location : Mumbai

Page 2 of 2

Reason : Form16

Page 2 of 6

This file is signed using Digital Signature.

Employee Code: KS16095

Employer TAN: MUMK05839B

Employee PAN: BNKPS8405H

AY: 2016-2017

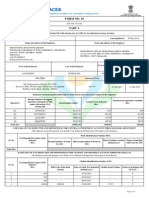

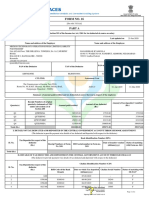

FORM NO.16

[See rule 31(1)(a)]

PART B (Annexure)

Certificate under Section 203 of the Income-tax Act,1961 for tax deducted at source on Salary

Name and address of the Employer

Name and designation of the Employee

KOTAK SECURITIES LIMITED

27 BKC,G BLOCK, PLOT NO. C27, BANDRA EAST,

MUMBAI BANDRA EAST - 400051

Maharashtra

Shailendra Singh

Associate Vice President

PAN of the Deductor

TAN of the Deductor

PAN of the Employee

Employee Reference No.

AAACK3436F

MUMK05839B

BNKPS8405H

KS16095

CIT (TDS)

Assessment Year

Period with the Employer

The Commissioner of Income Tax (TDS)

Room No. 900A, 9th Floor, K.G. Mittal Ayurvedic Hospital

Building, Charni Road , Mumbai - 400002

2016-2017

From

To

02-Nov-2015

31-Mar-2016

Rs.

Rs.

Details of Salary Paid And Any Other Income And Tax Deducted

Rs.

1.

Gross Salary

(a) Salary as per provisions contained in section 17(1)

347454

(b) Value of perquisites under Section 17(2) as per Form No.12BA,

wherever applicable

(c) Profits in lieu of Salary under Section 17(3) as per Form

No.12BA, wherever applicable

(d) Total

2.

0

0

347454

Less: Allowance to the extent exempt under Section 10

House Rent Allowance

42300

Medical Allowance

6621

Conveyance Allowance

7947

56868

3.

Balance (1-2)

4.

Deductions:

290586

(a) Entertainment Allowance

(b) Tax on Employment

1100

5.

Aggregate of 4(a to b)

6.

Income chargeable under the head "Salaries" (3 - 5)

7.

Add: Any other income reported by employee

8.

1100

289486

0

Less: Income /Loss from House Property

-97000

Gross total income ( 6 + 7 )

192486

Page 1

Page 3 of 6

This file is signed using Digital Signature.

Employee Code: KS16095

Employer TAN: MUMK05839B

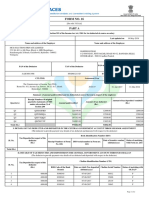

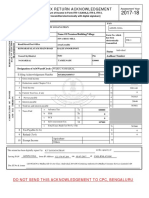

9.

Deductions under Chapter VI A

Section 80C,80CCC and 80CCD

Section 80C

Employee PAN: BNKPS8405H

Gross

Amount

Qualifying Amount

Deductible

Amount

70307

70307

70307

2235

2235

2235

Provident Fund

17880

Housing Loan Principal

32927

Children Tuition Fees

19500

Total of above

AY: 2016-2017

Other Sections (e.g. 80E, 80G, 80TTA, 80EE, 80CCD(2) etc.) Under

Chapter VI A

80D Mediclaim Insurance

72542

10.

Aggregate of deductible amounts under Chapter VI A

11.

Total Income (8 10)

12.

Tax on total Income

13.

Rebate U/s 87A (Taxable Income Below Rs. 500000/=)

14.

Tax after Section 87A Rebate (12 - 13)

15.

Surcharge

16.

Education Cess @3% on (tax computed on Sr. No 14+15)

17.

Tax payable (14 +15+16)

18.

Relief under section 89 (attach details)

19.

Tax payable (17 18)

119950

Verification

I VIVEK JAIN, son of NARESH CHAND JAIN working in the capacity of SENIOR VICE PRESIDENT do hereby certify that the information given

above is true, complete and correct based on the books of account, documents, TDS Statement, and other available records.

Place :

MUMBAI

Date :

30 May 2016

Designation : SENIOR VICE PRESIDENT

Signature of person responsible for deduction of tax

Full Name : VIVEK JAIN

Signature Not Verified

Page 2

Signed by : JAIN VIVEK NARESHCHAND

(KOTAK SECURITIES LIMITED)

Date : 30/May/2016 10:00:00

Location : Mumbai

Reason : Form16

Page 4 of 6

This file is signed using Digital Signature.

Employee Code: KS16095

Employer TAN: MUMK05839B

Employee PAN: BNKPS8405H

AY: 2016-2017

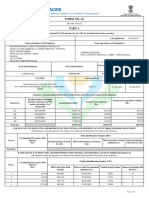

FORM NO. 12BA

[See rule 26 A(2)(b)]

Statement showing particulars of perquisites, other fringe or Amenities and profits in lieu of salary with value thereof

1.

Name and address of the Employer :

2.

TAN :

3.

TDS Assessment Range of the employer :

4.

Name, designation and PAN of the Employee:

5.

7.

Is the Employee a director or a person :

with substantial interest in the company

(where the employer is a company)

Income under the head salaries of the

employee (other than from perquisites) :

Financial Year :

8.

Valuation of Perquisites :

Nature Of Perquisite (See Rule 3)

Value Of Perquisite as

per rule (Rs.)

6.

SR

NO.

KOTAK SECURITIES LIMITED

27 BKC,G BLOCK, PLOT NO. C27, BANDRA EAST, MUMBAI

BANDRA EAST - 400051

Maharashtra

MUMK05839B

Shailendra Singh

Associate Vice President

BNKPS8405H

No

347454

2015-2016

Amount if any,

recovered from

employee

Amount of Taxable

Perquisites(Rs)

1.

Accommodation

2.

3.

4.

5.

6.

Cars/Other Automotive

Sweeper, Gardner, Watchman or attendant

Gas, Electricity, Water

Interest free or concessional loans

Holiday Expenses

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

7.

8.

Free or concessional Travels

Free Meals

0

0

0

0

0

0

9.

Free Education

10.

Gifts, Vouchers, etc.

11.

12.

National Pension Scheme Employer

Club Expenses

0

0

0

0

0

0

13.

14.

15.

Use of movable assets by employees

Transfer of assets to employees

Value of any other benefit/amenity/service/privilege

0

0

0

0

0

0

0

0

0

16.

Stock Options (non-qualified options)

0

0

0

0

0

0

0

0

0

Other benefits or amenities

17.

Total Value Of perquisites

18.

Profits in lieu of salary as per section 17(3)

19.

9. Details Of Tax :(a) Tax Deducted from salary of the employee under section 192(1):

(b) Tax by employer on behalf of the employee under section 192(1A):

(c) Total Tax Paid :

(d) Date Of Payment into Government treasury :DECLARATION BY EMPLOYER

2146

NIL

2146

As per Form 16

I VIVEK JAIN, son of NARESH CHAND JAIN working in the capacity of SENIOR VICE PRESIDENT do hereby declare on behalf of KOTAK

SECURITIES LIMITED that the information given above is based on the books of accounts, documents, and other relevant records or information

available with us and details of value of such perquisite are in accordance with section 17 and rules framed there under and that such information is

true and correct.

KOTAK SECURITIES LIMITED

Place : MUMBAI

Date : 30 May 2016

Signature of the person responsible for deduction of tax

Full Name : VIVEK JAIN

Designation : SENIOR VICE PRESIDENT

Signature Not Verified

Page 3

Signed by : JAIN VIVEK NARESHCHAND

(KOTAK SECURITIES LIMITED)

Date : 30/May/2016 10:00:00

Location : Mumbai

Reason : Form16

Page 5 of 6

This file is signed using Digital Signature.

Employee Code: KS16095

Employer TAN: MUMK05839B

Employee PAN: BNKPS8405H

AY: 2016-2017

ANNEXURE TO FORM 16

2015-2016

Company Name : KOTAK SECURITIES LIMITED

Employee Name : Shailendra Singh

SALARY AS PER PROVISIONS CONTAINED IN SECTION 17(1)

Basic

House Rent Allowance

Transport Allowance

Special Allowance

Advance Against LTA

Medical Reimbursement

TOTAL

Amount in Rs.

149000

89400

7947

82069

12417

6621

347454

Signature of the Person responsible for Deduction of Tax

Place: Mumbai

Full Name: VIVEK JAIN

Date: 30 May 2016

Designation: SENIOR VICE PRESIDENT

Signature Not Verified

Page 4

Signed by : JAIN VIVEK NARESHCHAND

(KOTAK SECURITIES LIMITED)

Date : 30/May/2016 10:00:00

Location : Mumbai

Reason : Form16

Page 6 of 6

This file is signed using Digital Signature.

You might also like

- Form 16 by Tcs PDFDocument5 pagesForm 16 by Tcs PDFAnonymous utPqL6jA3i25% (4)

- FORM 16 TAX DEDUCTION CERTIFICATEDocument5 pagesFORM 16 TAX DEDUCTION CERTIFICATEJagdeep SinghNo ratings yet

- FORM 16 TITLEDocument5 pagesFORM 16 TITLEPunitBeriNo ratings yet

- THE DOSE, Issue 1 (Tokyo)Document142 pagesTHE DOSE, Issue 1 (Tokyo)Damage85% (20)

- Form 16Document2 pagesForm 16SIVA100% (1)

- Dbkps7123e - Ay 2017 18Document5 pagesDbkps7123e - Ay 2017 18Damodar SurisettyNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Form Active Structure TypesDocument5 pagesForm Active Structure TypesShivanshu singh100% (1)

- Financial Analysis of Wipro LTDDocument101 pagesFinancial Analysis of Wipro LTDashwinchaudhary89% (18)

- CS709 HandoutsDocument117 pagesCS709 HandoutsalexNo ratings yet

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556No ratings yet

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuNo ratings yet

- Form 16 TDS certificate for FY 2014-15Document2 pagesForm 16 TDS certificate for FY 2014-15RamyaMeenakshiNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarNo ratings yet

- Form 16Document2 pagesForm 16Mithun KumarNo ratings yet

- Form 16 PDFDocument3 pagesForm 16 PDFkk_mishaNo ratings yet

- Form 16 651746Document4 pagesForm 16 651746Arslan1112No ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part AHarish KumarNo ratings yet

- Form 16 1Document2 pagesForm 16 1Vijay JiíväNo ratings yet

- Form 16 TDS Certificate SummaryDocument2 pagesForm 16 TDS Certificate SummaryPravin HireNo ratings yet

- Form 16 20-21 PartaDocument2 pagesForm 16 20-21 PartaTEMPORARY TEMPNo ratings yet

- Form 16Document4 pagesForm 16Aruna Kadge JhaNo ratings yet

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADocument2 pagesAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNo ratings yet

- b5047 Form16 Fy1819 PDFDocument9 pagesb5047 Form16 Fy1819 PDFBhumika JoshiNo ratings yet

- Form 16 FY 18-19 PART - ADocument2 pagesForm 16 FY 18-19 PART - Asai venkataNo ratings yet

- Form 16 FYbilDocument8 pagesForm 16 FYbilBilalNo ratings yet

- Salary details and tax deductionsDocument3 pagesSalary details and tax deductionsBALANo ratings yet

- Form 16 Part - BDocument3 pagesForm 16 Part - BdivanshuNo ratings yet

- Form 16 TDS CertificateDocument2 pagesForm 16 TDS Certificatejatin kuashikNo ratings yet

- Form 16 CertificateDocument3 pagesForm 16 CertificateGanesh LohakareNo ratings yet

- Form 16Document2 pagesForm 16robin0903No ratings yet

- Basha Form 16Document6 pagesBasha Form 16BakiarajNo ratings yet

- Form 16Document2 pagesForm 16sowjanya0% (1)

- Form 16 Salary CertificateDocument9 pagesForm 16 Salary CertificateHarish KumarNo ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- FORM 16 DETAILSDocument2 pagesFORM 16 DETAILSKushal MalhotraNo ratings yet

- FORM16Document11 pagesFORM16ganeshPVRMNo ratings yet

- 322 PartaDocument2 pages322 Partaritik tiwariNo ratings yet

- Form16 ANNPM2039F 40000516 PDFDocument8 pagesForm16 ANNPM2039F 40000516 PDFDr. Pankaj MishraNo ratings yet

- Form 16 TDS CertificateDocument10 pagesForm 16 TDS CertificateLogeshwaranNo ratings yet

- Form No. 16: Part ADocument10 pagesForm No. 16: Part ARAJASHEKAR KYAROLLANo ratings yet

- Aekpy3088c 2019Document4 pagesAekpy3088c 2019Ajay YadavNo ratings yet

- TDS Certificate Form 16Document9 pagesTDS Certificate Form 16Aman AgrawalNo ratings yet

- Employee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeDocument2 pagesEmployee: Empno, Desig. Dev Narayan Sah, 52406419756, 2414600, Bela, Awm Pan of The EmployeeGjjnnmNo ratings yet

- Pay Slip ModelDocument1 pagePay Slip ModelAryan ShashiNo ratings yet

- Form 16 Part B 2016-17Document4 pagesForm 16 Part B 2016-17atulsharmaNo ratings yet

- Form16 - Vinoth Subramaniyan PDFDocument6 pagesForm16 - Vinoth Subramaniyan PDFi netsty BROWSING & TICKETSNo ratings yet

- Apfpm0726b 2019-20 (1527)Document2 pagesApfpm0726b 2019-20 (1527)Basant Kumar MishraNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Deve 60398Document7 pagesDeve 60398Devesh Pratap ChandNo ratings yet

- Geeta - Form 16 A 2022-23Document2 pagesGeeta - Form 16 A 2022-23Sourabh PunshiNo ratings yet

- Form 26ASDocument3 pagesForm 26ASHarshil MehtaNo ratings yet

- Form 16 ADocument5 pagesForm 16 Anisha_khanNo ratings yet

- Form16 742768 PDFDocument6 pagesForm16 742768 PDFAtulsing thakurNo ratings yet

- Form 16Document6 pagesForm 16CSKNo ratings yet

- Itr VDocument1 pageItr VcachandhiranNo ratings yet

- LetterDocument2 pagesLetterShiv Kiran SademNo ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- Form 16 and Salary DetailsDocument22 pagesForm 16 and Salary DetailsAjay Chowdary Ajay ChowdaryNo ratings yet

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhNo ratings yet

- ADRPD2454Document2 pagesADRPD2454ravibhartia1978No ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- The Smith Generator BlueprintsDocument36 pagesThe Smith Generator BlueprintsZoran AleksicNo ratings yet

- Basic Features of The Microcredit Regulatory Authority Act, 2006Document10 pagesBasic Features of The Microcredit Regulatory Authority Act, 2006Asif Hasan DhimanNo ratings yet

- Correlation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesiDocument8 pagesCorrelation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesimuqfiNo ratings yet

- Display PDFDocument6 pagesDisplay PDFoneoceannetwork3No ratings yet

- Done - NSTP 2 SyllabusDocument9 pagesDone - NSTP 2 SyllabusJoseph MazoNo ratings yet

- Felizardo C. Lipana National High SchoolDocument3 pagesFelizardo C. Lipana National High SchoolMelody LanuzaNo ratings yet

- Lecture NotesDocument6 pagesLecture NotesRawlinsonNo ratings yet

- France Winckler Final Rev 1Document14 pagesFrance Winckler Final Rev 1Luciano Junior100% (1)

- Mil STD 2154Document44 pagesMil STD 2154Muh SubhanNo ratings yet

- Exercise-01: JEE-PhysicsDocument52 pagesExercise-01: JEE-Physicsjk rNo ratings yet

- Consumers ' Usage and Adoption of E-Pharmacy in India: Mallika SrivastavaDocument16 pagesConsumers ' Usage and Adoption of E-Pharmacy in India: Mallika SrivastavaSundaravel ElangovanNo ratings yet

- PNBONE_mPassbook_134611_6-4-2024_13-4-2024_0053XXXXXXXX00 (1) (1)Document3 pagesPNBONE_mPassbook_134611_6-4-2024_13-4-2024_0053XXXXXXXX00 (1) (1)imtiyaz726492No ratings yet

- Desana Texts and ContextsDocument601 pagesDesana Texts and ContextsdavidizanagiNo ratings yet

- Chapter 4 DeterminantsDocument3 pagesChapter 4 Determinantssraj68No ratings yet

- EC GATE 2017 Set I Key SolutionDocument21 pagesEC GATE 2017 Set I Key SolutionJeevan Sai MaddiNo ratings yet

- Technical Manual - C&C08 Digital Switching System Chapter 2 OverviewDocument19 pagesTechnical Manual - C&C08 Digital Switching System Chapter 2 OverviewSamuel100% (2)

- CBSE Class 6 Whole Numbers WorksheetDocument2 pagesCBSE Class 6 Whole Numbers WorksheetPriyaprasad PandaNo ratings yet

- PHY210 Mechanism Ii and Thermal Physics Lab Report: Faculty of Applied Sciences Uitm Pahang (Jengka Campus)Document13 pagesPHY210 Mechanism Ii and Thermal Physics Lab Report: Faculty of Applied Sciences Uitm Pahang (Jengka Campus)Arissa SyaminaNo ratings yet

- Speed Reducer GearboxDocument14 pagesSpeed Reducer Gearboxعبد للهNo ratings yet

- Evil Days of Luckless JohnDocument5 pagesEvil Days of Luckless JohnadikressNo ratings yet

- Guide To Raising Capital From Angel Investors Ebook From The Startup Garage PDFDocument20 pagesGuide To Raising Capital From Angel Investors Ebook From The Startup Garage PDFLars VonTurboNo ratings yet

- Assembly ModelingDocument222 pagesAssembly ModelingjdfdfererNo ratings yet

- Final Year Project (Product Recommendation)Document33 pagesFinal Year Project (Product Recommendation)Anurag ChakrabortyNo ratings yet

- Uses and Soxhlet Extraction of Apigenin From Parsley Petroselinum CrispumDocument6 pagesUses and Soxhlet Extraction of Apigenin From Parsley Petroselinum CrispumEditor IJTSRDNo ratings yet