Professional Documents

Culture Documents

D400

Uploaded by

Sceptic GrannyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

D400

Uploaded by

Sceptic GrannyCopyright:

Available Formats

June 3, 2016

North Carolinas Reference to the Internal Revenue Code Updated - Impact

on 2015 North Carolina Corporate and Individual income Tax Returns

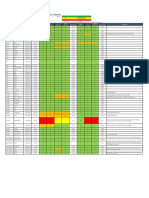

Governor McCrory signed into law Session Law 2016-6 (Senate Bill 726) on June 1, 2016. The

legislation updated North Carolinas reference to the Internal Revenue Code to the Code as enacted as of

January 1, 2016. As a result, North Carolina corporate and individual income tax laws generally follow

the Protecting Americans From Tax Hikes Act of 2015 (PATH), which extended, and in some cases

made permanent, several provisions in federal law that had sunset at the end of 2014. The law decouples

from (does not follow) PATH in six instances. The table below identifies those instances and describes

each difference and which lines on the tax returns are impacted.

Federal Provision

State Provision for 2015

NC C Corporate

Return

NC Individual

Return

Bonus depreciation is

extended to property

placed in service in 2015,

2016 and 2017.

Addition required for 85%

of bonus depreciation

deducted on federal return.

Include on Form

CD-405, Schedule

H, Line 1.g.

Include on Form

D-400 Schedule S,

Part A, Line 3.

Code section 179 dollar

and investment

limitations of $500,000

and $2,000,000,

respectively, extended to

2015. These amounts

will increase for inflation

beginning with tax year

2016.

NC dollar and investment

Include on Form

limitations of $25,000 and

CD-405, Schedule

$200,000, respectively,

H, Line 1.g.

extended to 2015 and made

permanent. Addition

required for 85% of the

difference between the

deduction using federal

limitations and the deduction

using NC limitations.

Include on Form

D-400 Schedule S,

Part A, Line 3.

The treatment of

mortgage insurance

premiums as qualified

residence interest is

extended for 2015 and

2016.

Mortgage insurance

premiums are not treated as

qualified residence interest.

Exclude from

Form D-400

Schedule S, Part

C, Line 13.

Income Tax Division

Page 1 of 2

Not applicable

June 3, 2016

The exclusion from gross

income for cancellation

of qualified principal

residence debt is

extended for 2015 and

2016.

Cancellation of qualified

principal residence debt is

not excluded from gross

income.

Not applicable

Include on Form

D-400 Schedule S,

Part A, Line 3.

The exclusion from gross

income for qualified

charitable distributions

from an IRA by a person

who has attained age 70

is extended for 2015

and 2016.

Qualified charitable

distributions from an IRA by

a person who has attained

age 70 are not excluded

from gross income. The

distributions are allowable

as a charitable contribution.

Not applicable

Include addition

on Form D-400

Schedule S, Part

A, Line 3.

The deduction for

qualified tuition and

related expenses is

extended for 2015 and

2016.

Qualified tuition and related

expenses are not deductible.

Not applicable

Deduct

contribution on

Form D-400

Schedule S, Part

C, Line 18 if

itemizing

Include addition

on Form D-400

Schedule S, Part

A, Line 3.

Any person who has already filed a 2015 North Carolina income tax return and whose federal taxable

income (C corporation) or federal adjusted gross income (individual) is impacted by the amendments to

federal law included in PATH or by the provisions of PATH from which North Carolina has decoupled

must file an amended North Carolina return. If the amended return reflects additional tax due, the

taxpayer will avoid a late-payment penalty if the additional tax reflected on the amended return is paid

when the amended return is filed. If the amended return reflects additional tax due, interest is due on the

additional tax from the date the tax was due (April 15, 2016 for calendar year taxpayers; the fifteenth day

of the fourth month after the end of the tax year for fiscal year taxpayers) until the additional tax is paid.

The interest rate is 5% per year through December 31, 2016. For the interest rate in effect after December

31, 2016, see www.dornc.com/taxes/rate.html on or after December 1, 2016.

Income Tax Division

Page 2 of 2

June 3, 2016

D-400

Individual Income

Tax Return 2015

Staple All Pages of Your Return Here.

Web

10-15

AMENDED RETURN

Fill in circle. (See instructions.)

IMPORTANT: Do not send a photocopy of this form.

For calendar year 2015, or fiscal year beginning

15

(MM-DD)

Your Social Security Number

and ending

(MM-DD-YY)

Spouses Social Security Number

You must enter your

social security number(s).

Your First Name(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

M.I.

Your Last Name

If a Joint Return, Spouses First Name

M.I.

Spouses Last Name

Mailing Address

Apartment Number

City

State

Zip Code

County (Enter first five letters)

Country (If not U.S.)

N.C. Education Endowment Fund: You may contribute to the N.C. Education Endowment Fund by making a contribution or designating some or all

of your overpayment to the Fund. To make a contribution, enclose Form NC-EDU and your payment of $ ___________________________________.

To designate your overpayment to the Fund, enter the amount of your designation on Page 2, Line 31. See instructions for information about the Fund.

Fill in circle if you or your spouse were out of the country on April 15 and a U.S. citizen or resident.

Enter date of death of deceased taxpayer or deceased spouse.

Deceased Taxpayer Information

Fill in circle if return is filed and signed by Executor,

Administrator or Court-Appointed Personal Representative.

Residency Status

Taxpayer

Spouse

(MM-DD-YY)

(MM-DD-YY)

Were you a resident of N.C. for the entire year of 2015?

Was your spouse a resident for the entire year?

Filing Status

Did you claim the standard deduction on your 2015 federal return?

1.

Single

2.

Married Filing Jointly

3.

Married Filing Separately

4.

Head of Household

5.

Qualifying Widow(er) with Dependent Child

6. Adjusted gross income from your federal return

(If negative, see instructions.)

7. Additions to federal adjusted gross income

(From Line 4 of Form D-400 Schedule S, Part A)

8. Add Lines 6 and 7.

Staple W-2s Here.

No

Yes

No

SSN

(Year spouse died:

If amount on

Line 6, 8, 10,

12, or 14 is

negative, fill in

circle.

Example:

6.

7.

8.

9.

10.

OR

If No, complete Lines 1 through 12. Then go to

Part D of Schedule S. Fill in residency information

and complete Lines 21 through 23.

Name

9. Deductions from federal adjusted gross income

(From Line 12 of Form D-400 Schedule S, Part B)

10. Subtract Line 9 from Line 8.

11.

N.C. standard deduction

No

Yes

Print in Black or Blue Ink Only. No Pencil or Red Ink.

Fill in one circle only. (See instructions.)

(Enter your spouses

full name and Social

Security Number.)

Yes

N.C. itemized deductions

Fill in one circle only. (If itemizing, complete Part C of Form D-400

Schedule S, and enter the amount from Line 20.)

11.

12. Subtract Line 11 from Line 10.

12.

13. Part-year residents and nonresidents

(From Line 23 of Form D-400 Schedule S, Part D)

13.

14. North Carolina Taxable Income

Full-year residents enter the amount from Line 12.

Part-year residents and nonresidents multiply amount on Line 12 by the

decimal amount on Line 13.

15. North Carolina Income Tax

To calculate your tax, multiply Line 14 by 5.75% (0.0575). If Line 14 is

negative, enter -0- on Line 15.

14.

15.

Enter Whole U.S. Dollars Only

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

.00

.00

.00

.00

.00

.00

.00

,

,

.00

.00

Page 2

Last Name (First 10 Characters)

Tax Year

Your Social Security Number

2015

D-400 Web

10-15

Be sure to sign and date your return below.

16. Tax Credits (From Form D-400TC, Part 3, Line 19 - You must attach

Form D-400TC if you enter an amount on this line.)

16.

17. Subtract Line 16 from Line 15.

17.

If you certify that no Consumer

Use Tax is due, fill in circle.

18. Consumer Use Tax (See instructions.)

18.

19.

19. Add Lines 17 and 18.

20. North Carolina

Income Tax Withheld

a.

Your tax withheld

21. Other Tax Payments

a.

2015 estimated tax

c.

Partnership

,

,

,

,

,

,

.00

.00

.00

b.

Spouses tax withheld

b.

Paid with extension

d.

S Corporation

,

,

,

,

,

,

If amount on

Line 25 is

negative, fill in

circle.

Example:

24. Amended Returns Only - Previous refunds (See Amended Returns in instructions.)

26. a. Tax Due - If Line 19 is more than Line 25, subtract Line 25 from Line 19.

(If Line 25 is negative, see instructions.)

b. Penalties

.00

23.

24.

25.

25. Subtract Line 24 from Line 23.

c. Interest

.00

e. Interest on the underpayment of estimated income tax

(See instructions and enter letter in box, if applicable.)

27. Add Lines 26a, 26d, and 26e.

Pay This Amount - You can pay online. Go to

www.dornc.com and click on eServices for details.

26a.

(Add Lines 26b

and 26c and

enter the total

on Line 26d.)

26d.

26e.

Exception to

underpayment

of estimated

tax

27.

28. Overpayment - If Line 19 is less than Line 25,

subtract Line 19 from Line 25.

When filing an amended return, see instructions.

29. Amount of Line 28 to be applied to 2016 Estimated Income Tax

28.

30. Contribution to the N.C. Nongame and Endangered Wildlife Fund

30.

31. Contribution of overpayment to the N.C. Education Endowment Fund

31.

32. Add Lines 29, 30, and 31.

32.

33. Subtract Line 32 from Line 28. This is the Amount To Be Refunded.

For direct deposit, file electronically. Go to www.dornc.com and click on eServices.

33.

Sign Here

,

,

,

,

.00

.00

.00

.00

If you claim a

partnership payment

on Line 21c or S

corporation payment

on Line 21d, you must

attach a copy of the

NC K-1.

22.

22. Amended Returns Only - Previous payments (See Amended Returns in instructions.)

23. Total Payments - Add Lines 20a through 22.

.00

.00

.00

,

,

,

,

29.

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

,

I certify that, to the best of my knowledge, this return is accurate and complete.

If prepared by a person other than taxpayer, this certification is based on all

information of which the preparer has any knowledge.

Your Signature

Date

Paid Preparers Signature

Spouses Signature (If filing joint return, both must sign.)

Date

Preparers FEIN, SSN, or PTIN

Home Telephone Number (Include area code.)

If REFUND mail

return to:

N.C. DEPT. OF REVENUE

P.O. BOX R

RALEIGH, NC 27634-0001

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Date

Preparers Telephone Number (Include area code.)

FOR ORIGINAL RETURNS ONLY

If you ARE NOT due a

refund, mail return, any

payment, and D-400V to:

N.C. DEPT. OF REVENUE

P.O. BOX 25000

RALEIGH, NC 27640-0640

You might also like

- Enrollment Kits PDFDocument4 pagesEnrollment Kits PDFSceptic GrannyNo ratings yet

- Apm Terminals Operations Status Update 04072017 17h00 Cet Status Per TerminalDocument2 pagesApm Terminals Operations Status Update 04072017 17h00 Cet Status Per TerminalSceptic GrannyNo ratings yet

- 4.2 Null Spaces, Column Spaces, & Linear Transformations: M A A A A ADocument6 pages4.2 Null Spaces, Column Spaces, & Linear Transformations: M A A A A ASceptic GrannyNo ratings yet

- ReadrDocument34 pagesReadrSceptic GrannyNo ratings yet

- Company Profile Jan de Nul Group enDocument8 pagesCompany Profile Jan de Nul Group enSceptic GrannyNo ratings yet

- NullityDocument7 pagesNullitySceptic GrannyNo ratings yet

- Linear Line Voltage Halogen Under Cabinet Fixture: NUL-315 NUL-321Document1 pageLinear Line Voltage Halogen Under Cabinet Fixture: NUL-315 NUL-321Sceptic GrannyNo ratings yet

- Lect2 08web PDFDocument13 pagesLect2 08web PDFSceptic GrannyNo ratings yet

- 4.6 Null Space, Column Space, Row SpaceDocument10 pages4.6 Null Space, Column Space, Row SpaceSceptic GrannyNo ratings yet

- ReadrDocument34 pagesReadrSceptic GrannyNo ratings yet

- The Structure of Nul! Lagrangians: P Olvert and J Sivaloganathan$Document10 pagesThe Structure of Nul! Lagrangians: P Olvert and J Sivaloganathan$Sceptic Granny100% (1)

- See Sections 203A and Rule 114ADocument4 pagesSee Sections 203A and Rule 114ASceptic GrannyNo ratings yet

- Kenyon College Dana Paquin Paquind@kenyon - EduDocument3 pagesKenyon College Dana Paquin Paquind@kenyon - EduSceptic GrannyNo ratings yet

- Annals 07 03 PDFDocument10 pagesAnnals 07 03 PDFSceptic GrannyNo ratings yet

- NullityDocument7 pagesNullitySceptic GrannyNo ratings yet

- Throwers 10Document7 pagesThrowers 10pranjlNo ratings yet

- Top 10 recommendations for libraries starting research data managementDocument4 pagesTop 10 recommendations for libraries starting research data managementSceptic GrannyNo ratings yet

- Successful Public/Private Partnerships: Ten Principles ForDocument42 pagesSuccessful Public/Private Partnerships: Ten Principles ForSceptic GrannyNo ratings yet

- Throwers Ten Exercise Program: What You Will NeedDocument7 pagesThrowers Ten Exercise Program: What You Will NeedSceptic GrannyNo ratings yet

- OWASP Top 10 - 2013Document22 pagesOWASP Top 10 - 2013constantine100% (1)

- Bologna Seminar Report on Doctoral ProgrammesDocument10 pagesBologna Seminar Report on Doctoral ProgrammesSceptic GrannyNo ratings yet

- Tenx Whitepaper FinalDocument51 pagesTenx Whitepaper FinalSceptic GrannyNo ratings yet

- 10 Big Ideas For Future NSF InvestmentsDocument11 pages10 Big Ideas For Future NSF InvestmentsSceptic GrannyNo ratings yet

- Future Work Skills 2020Document19 pagesFuture Work Skills 2020Biblioteca Tracto100% (1)

- 9780822955672exr PDFDocument1 page9780822955672exr PDFSceptic GrannyNo ratings yet

- The Top Ten Myths About HomosexualityDocument26 pagesThe Top Ten Myths About HomosexualityFrancesca Padovese100% (1)

- Go TenquestionsforfakenewsfinalDocument1 pageGo Tenquestionsforfakenewsfinalapi-264692371No ratings yet

- Ten Trends To Change Your LifeDocument28 pagesTen Trends To Change Your LifejechavarNo ratings yet

- Belsorp MaxDocument6 pagesBelsorp MaxSceptic GrannyNo ratings yet

- 10year Impact Study 1325Document50 pages10year Impact Study 1325Sceptic GrannyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- JAN-21 PaperDocument17 pagesJAN-21 PaperDivyasha PathakNo ratings yet

- FTF 2024-01-19 1705691319142Document16 pagesFTF 2024-01-19 1705691319142Naty MoralesNo ratings yet

- Compilation of Works Contract Provisions Under VAT Laws oDocument615 pagesCompilation of Works Contract Provisions Under VAT Laws oSwati Agrawal100% (2)

- TARLAC STATE UNIVERSITY - COLLEGE OF BUSINESS AND ACCOUNTANCY MID-YEAR 2021 TAX 2 COURSEDocument3 pagesTARLAC STATE UNIVERSITY - COLLEGE OF BUSINESS AND ACCOUNTANCY MID-YEAR 2021 TAX 2 COURSEMark Lawrence YusiNo ratings yet

- 2 Partnership AgreementDocument31 pages2 Partnership AgreementMaria Salmiyah Cruz CruzNo ratings yet

- DTB Orientation (PIT & CIT) FINALDocument37 pagesDTB Orientation (PIT & CIT) FINALCourt NanquilNo ratings yet

- IT1 (5th) May2019Document3 pagesIT1 (5th) May2019suman0% (1)

- 11 Deductions From Gross Income (Expenses in General, Interest Expense and Taxes)Document18 pages11 Deductions From Gross Income (Expenses in General, Interest Expense and Taxes)Clarisse PelayoNo ratings yet

- Tax Law Sumary NotesDocument72 pagesTax Law Sumary Notesannpurna pathakNo ratings yet

- KEY WORDS Income Taxation BAR Q'sDocument14 pagesKEY WORDS Income Taxation BAR Q'sAndrew Mercado NavarreteNo ratings yet

- Tax Planning and Managerial DecisionDocument163 pagesTax Planning and Managerial DecisionDr Linda Mary Simon100% (2)

- Payroll Records and Tax Computations for Lex Daniel QuequeganDocument11 pagesPayroll Records and Tax Computations for Lex Daniel Quequegankate trishaNo ratings yet

- 13 PCC Income Tax SectionsDocument8 pages13 PCC Income Tax SectionsVelayudham ThiyagarajanNo ratings yet

- Republic of the Philippines Batangas State University Taxation and Land Reform ExamDocument5 pagesRepublic of the Philippines Batangas State University Taxation and Land Reform ExamMeynard MagsinoNo ratings yet

- Full Download Intermediate Accounting Volume 2 Canadian 10th Edition Kieso Test BankDocument35 pagesFull Download Intermediate Accounting Volume 2 Canadian 10th Edition Kieso Test Banklofsteadkaroluks100% (38)

- FBR Preparation Notes 1Document86 pagesFBR Preparation Notes 1Jąhąnząib Khąn KąkąrNo ratings yet

- TAXN7321 - Semester PlanDocument4 pagesTAXN7321 - Semester Plansadz3690No ratings yet

- Publication 590 Appendix C, Individual Retirement Arrangements (IRAs)Document10 pagesPublication 590 Appendix C, Individual Retirement Arrangements (IRAs)Michael TaylorNo ratings yet

- Auqaf Property Abbottabad Audit NoteDocument31 pagesAuqaf Property Abbottabad Audit NoteAbdul Salam Kuki KhelNo ratings yet

- Accounting for Income Tax DifferencesDocument42 pagesAccounting for Income Tax DifferencesAngela Miles DizonNo ratings yet

- CorporationDocument23 pagesCorporationLiyana Chua50% (2)

- Tax Due DiligenceDocument29 pagesTax Due Diligencearya1808100% (1)

- First National Bank of Omaha and Katherine D. Clark, Trustees of The Margaret H. Doorly Family Trusts v. United States, 565 F.2d 507, 1st Cir. (1977)Document17 pagesFirst National Bank of Omaha and Katherine D. Clark, Trustees of The Margaret H. Doorly Family Trusts v. United States, 565 F.2d 507, 1st Cir. (1977)Scribd Government DocsNo ratings yet

- 04 - Intermountain Lumber v. CIRDocument2 pages04 - Intermountain Lumber v. CIRTrek Alojado100% (1)

- Monthly Income 15th 30th Source of Income Amounts (Estimated) TotalDocument3 pagesMonthly Income 15th 30th Source of Income Amounts (Estimated) TotalMyles Ninon LazoNo ratings yet

- PICPA Income Tax Pas Tax2Document175 pagesPICPA Income Tax Pas Tax2jennyMBNo ratings yet

- ACCT 3326 Tax II Cengage CH 2 199ADocument6 pagesACCT 3326 Tax II Cengage CH 2 199Abarlie3824No ratings yet

- Computation of Income Tax LiabilityDocument6 pagesComputation of Income Tax LiabilityAbdullah QureshiNo ratings yet

- Business Organization and TaxesDocument22 pagesBusiness Organization and TaxesChieMae Benson QuintoNo ratings yet

- Ind - Chapter 10vvDocument27 pagesInd - Chapter 10vvMbadilishaji DuniaNo ratings yet