Professional Documents

Culture Documents

14 202

Uploaded by

Filozófus ÖnjelöltOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

14 202

Uploaded by

Filozófus ÖnjelöltCopyright:

Available Formats

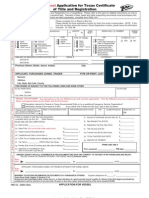

14-202

(Rev.10-15/18)

Texas Claim for Refund of Motor Vehicle Tax,

Diesel Motor Vehicle Surcharge and/or

Commercial Vehicle Registration Surcharge

0 F

Before submitting, see instructions on back.

58900

a. T code

*1420200F051517*

CLEAR FORM

PRINT FORM

*1420200F051517*

b.

c. Claimants number (See instructions.)

d. Motor vehicle identification number shown on Tax Collectors receipt

e. Claimants name and mailing address

f. Blacken this box if your

address has changed.............................

g. For Comptroller Use Only

INV

2

Email address

A tax receipt and signed buyers order or

purchase invoice must be submitted with

all claims for refund. Please allow 6-8 weeks

for processing.

k. County Tax Collectors tax receipt number

h. Tax receipt month

date

day

year

SP

3

i. Reason code for refund

claim (See code list

in instructions.)

FM

1

ACID

SS

4

For Comptroller Use Only

j.

l. Document number from title application receipt

m. PM

Section I - Motor Vehicle Tax and/or Diesel Motor Vehicle Surcharge

n.

Motor Vehicle Tax Diesel MV Surcharge

Column A

Column B

14

o.

17

1. Amount of motor vehicle tax / penalty paid to Texas in Column A and

Diesel Motor Vehicle Surcharge, if applicable, in Column B.................................... 1a. _

2. Motor vehicle sales price......................................................................................... 2a. _

3. Trade-in and/or rebate............................................................................................. 3a.

4. Taxable value (Item 2a minus Item 3a) . ................................................................. 4a. _

5a. Motor vehicle tax due (See instructions.) ............................................................... 5a. _

5b. Diesel motor vehicle surcharge due (For model years prior to 1997, multiply Item 1b by 2.5%.

For model years 1997 and after, multiply Item 1b by 1%.) ...................................................................................5b.

6. Tax paid to another state......................................................................................... 6a. _

7. Amount of tax due (Item 5a minus Item 6a) or surcharge due ............................... 7a.

8. Amount of penalty if due (See instructions, Item i, Reason Code I.) ...................... 8a. _

9. Total amount due (Item 7a plus Item 8a, and Item 7b plus Item 8b) ...................... 9a.

10. Amount of refund requested (Item 1a minus Item 9a and Item 1b minus Item 9b)... 10a. _

11. Total REFUND FOR SECTION I - (Item 10a plus Item 10b) . ...........................................................................11.

Section II - Commercial Vehicle Registration Surcharge

p.

12. Amount of commercial vehicle registration surcharge refund requested

(See instructions, Reason Codes R, S, T, and U.)................................................................................................12.

Complete the claim and mail to

Comptroller of Public Accounts

111 E. 17th St.

Austin, TX 78774-0100

I

21

_______________

AffidAviT: i declare that the information in this document and any attachments is true and correct to the best

of my knowledge and belief.

sign

here

Purchaser

sign

here

Seller

Business phone / Daytime phone

(Area code and number)

Business phone / Daytime phone

(Area code and number)

Instructions for Filing Texas Claim for Refund of Motor Vehicle Tax,

Diesel Motor Vehicle Surcharge and/or Commercial Vehicle Registration Surcharge

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited exceptions in accordance with

Ch. 552, Government Code. To request information for review or to request error correction, contact us at the address or phone number listed on this form.

Instructions for Refund Requests

Who Can File - The person that paid the tax qualifies to request a refund claim of motor vehicle sales or use tax paid on motor vehicles according to Comptrollers Rule 3.75, Refunds,

Payments Under Protest, Payment instruments and dishonored Payments.

When to File - Claims for refund of Motor vehicle Tax must be postmarked within four years of the date tax was due. Tax is due on the 30th calendar day after the day the vehicle is

delivered to the purchaser or brought into Texas for use.

Documentation Required for All Refund Requests (Send a copy of each of the following.):

1.

2.

3.

4.

5.

Title Application Receipt issued by the Tax Assessor-Collector (TAC).

Web dealer final Tax Receipt with barcode and document number.

signed buyers order or purchase invoice.

documentation required under the specific refund reasons listed below.

Additional documentation can be requested.

Specific Instructions

Items b, g, j & m - leave blank (For Comptroller Use Only).

Item c - enter the 11-digit taxpayer number assigned by the Comptrollers office. if you

do not have a number previously assigned by the state, use the following:

social security number* if you are an individual recipient or sole owner of a

business.

federal employer identification number if set up as a corporation, partnership or other

entity.

Ag/timber number, if qualified.

* Disclosure of your Social Security number (SSN) is required and authorized under 42

U.S.C. Sec. 405(c)(2)(C)(i) and Tex. Govt. Code. Secs. 403.011.403.015, and 403.176.

The number will be used for tax administration and identification of any individual affected

by the law. The number may also be used to assist in the administration of laws relating

to child support enforcement and the identification of individuals who may be indebted

to or owe delinquent taxes to this state. Release of information on this form in response

to a public information request will be governed by the Public Information Act, Chapter 552,

Government Code.

Item d - enter the vehicle identification number indicated on the Tax Assessor-Collectors

Receipt for vehicle Tax.

Items h, k & l - enter the number shown at the top left of the long form Tax Collectors

Receipt (Item l) or top right of the short form Tax Collectors Receipt. enter the date

shown on either the long form or short form TAC receipts.

Item i - select the refund reason code from the list below that best describes the reason

for your refund request.

A - Failure of Sale (unwound deal): claimant must show proof the sale was never

completed, and ALL money has been returned to the purchaser. Proof may be shown by

sending copies of refund checks issued to purchaser (front/back) or lien holder (lH) payoff

(front/back) or lH letter stating no payments received and/or deal never funded.

B - Tax Collector Correction: claimant must provide a statement (on letterhead) issued

from the TAC, confirming/explaining why tax should be refunded.

C - Sales or Use Tax Paid In Error: if the claimant paid sales or use tax when the New

Resident Use Tax, Gift Tax or Even Trade Tax was due.

New Residents: must show proof the vehicle was registered previously in the new

residents name in other state or foreign country (e.g., copy of Texas motor vehicle

inspection report).

Gift: recipient or donor must submit, in person at a Comptroller field office, a notorized

form 14-317, Affidavit of Motor Vehicle Gift Transfer.

Even Trade Tax: see Reason Code B, Tax Collector Correction.

D - Stolen Vehicle: claimant must include a copy of the police report showing it was

reported stolen prior to purchase.

E - Tax Paid on Incorrect Sales Price or Taxable Value: if the claimant paid sales

or use tax on the incorrect sales price or tax should have been calculated based on

standard Presumptive value (sPv) or Certified Apprised value:

Incorrect Sales Price: claimant must send a copy of the original bill of sale, signed

by both seller and purchaser.

SPV: if the TAC calculated tax based on the incorrect sPv, see Reason Code B, Tax

Collector Correction.

Certified Apprised Value: claimant must provide form 14-128, Used Motor Vehicle

Certified Appraisal Form. Appraisal must be obtained within 30 calendar days of

purchase. (See instructions on Form 14-128.)

F - Credit Not Given For Tax Paid Out of State: claimant must show proof tax was paid

to another state (e.g., out-of-state tax receipt, out-of-state buyers order).

G - Vehicle assigned / transferred in error: include incorrect/correct tax receipts and

incorrect/correct purchaser signed bills of sale.

H - Tax Paid On An Exempt Vehicle: tax was paid, but vehicle qualified (at time of

purchase) for one of the following exemptions as provided by Tax Code Chapter 152:

Church or Religious Society: claimant must show proof they purchased a vehicle

designed to carry more than six passengers and provide a signed statement describing

how the vehicle will be used primarily (at least 80% of the time) to provide transportation to and from church or religious services or meetings.

Foreign NATO Military Personnel: claimant must provide a copy of military nATo

travel orders, nATo visA and a copy of foreign nATo military id.

Farm/Timber Use: claimant must provide a statement from the farmer, rancher or

timber operator describing the operation and how the vehicle will be used primarily (at

least 80% of the time) for an exempt use. The statement must include the ag/timber

number and expiration date. form 14-319 can be used in lieu of the statement.

Vehicle Taken Out Of State: claimant must send a copy of bill of lading from the steam

liner, copy of motor vehicle transport carrier bill of lading and copy of completed form

14-312, Texas Motor Vehicle Sales Tax Exemption Certificate, presented to dealer. if the

vehicle was registered in Texas claimant must prove vehicle was not used in Texas.

Vehicle Sold or Leased To A Public Agency: claimant must show the vehicle was

sold or leased to a federal organization; or a state agency or volunteer fire department

and the vehicle is operated with exempt plates.

I - Refund of Tax Penalty Paid: claimant must send a written explanation for the refund

request for penalty paid and documentation, if available, to support refund request.

J - Interstate Use (IRP) Exemption: claimant must send copies of cab card(s) that proves

the unit was operated continuously for 12 months for interstate use from the date of sale

in Texas or the date first brought into Texas for use on Texas roads.

K - Orthopedically Handicapped Exemption: vehicle must be operated 80% of time

by an orthopedically handicapped driver or used 80% of the operating time to transport

an orthopedically handicapped person. Claimant must submit form 14-318, Texas Motor

Vehicle Orthopedically Handicapped Exemption Certificate, signed by a physician on or

before the sale date, and the following documentation:

For Driver Exemption: copy of a Texas driver license issued to the qualified orthopedically handicapped person(s) on or before the sale date, recording restriction codes

U, v or Z; copy of medical documentation/statement signed by a practitioner of the

healing arts describing drivers orthopedic handicap and date orthopedic handicap

occurred; and documentation (e.g., modification invoice), that the vehicle has been

modified by altering acceleration, steering or braking systems.

For Transportation Exemption: copy of medical documentation/statement signed by

a practitioner of the healing arts describing passengers orthopedic handicap and date

orthopedic handicap occurred; and documentation (e.g., modification invoice) that the

vehicle has been modified by installing a wheelchair lift, hoist, raised roof, attached

ramp, wheelchair hold-down clamps or special seat restraints other than conventional

seat belts to allow for the transportation of an orthopedically handicapped person in

a reasonable manner.

M - Lemon Law: claimant must send a copy of the cancellation worksheet, settlement

agreement, refund check, lien holder payoff check and assignment of right to refund if

claimant is not the original purchaser.

N - Child Care Facilities Exemption: claimant must send a copy of license issued by

the Texas department of Protective and Regulatory services for 24-hour residential care

for children with emotional disorders who do not require specialized services or treatment

and are permitted to live in a single residential group.

O - Off-Road Vehicles: claimant must provide an MCo showing the vehicle is designed

for off-road use only.

P - Fair Market Value Deduction (FMVD): claimant must send a copy of the title history

obtained from www.TXdMv.gov for each vehicle being claimed as a tax credit/fMvd,

lessee signed lease agreement, and fMv tax credit certificate.

Q - Other: claimant must provide a signed statement detailing the reason for the refund

request and documentation, if any, to support refund claim.

Item 5 - Column A - Multiply the amount in item 4 by the tax rate of 0.0625.

For Reason Codes A, D, G, H, J, K or M, enter zero.

Item 8 - enter penalty shown on the tax collector receipt.

Item 11 - Refer to Commercial vehicles and Truck Tractor registration surcharge refund

Reason Codes R, S, T and U.

Instructions for Section II

R - IRP Registration Refunds: claimant must include a copy of the cab card and a

copy of the iRP Refund detail sheet provided by Texas department of Motor vehicles

(TxdMv).

S - Combination Registration Refunds: claimant must include a copy of a validated

Registration Renewal Receipt and the Registration fee Refund Request/Authorization

form, vTR-304, provided by TxdMv.

T - Forestry Registration Refunds: claimant must include a copy of the cab card and

a copy of the forestry iRP Refund supplement sheet provided by TxdMv.

U - IRP Audits: claimant must include a copy of the iRP Billing notice validated by

TxdMv.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- PWD 143Document2 pagesPWD 143Alex SemNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Tax Due Diligence Checklist KurtzCPADocument5 pagesTax Due Diligence Checklist KurtzCPAarya1808100% (3)

- SMChap 023Document35 pagesSMChap 023testbank100% (2)

- Test Bank For Taxation For Decision Makers, 2016 Edition by Shirley Dennis Escoffier, Karen Fortin 9781119089087Document29 pagesTest Bank For Taxation For Decision Makers, 2016 Edition by Shirley Dennis Escoffier, Karen Fortin 9781119089087NitinNo ratings yet

- Epicor Tax Connect Configuration Epicor ERP 10Document14 pagesEpicor Tax Connect Configuration Epicor ERP 10nerz8830No ratings yet

- State and Local Tax Outline, Fall 2011Document98 pagesState and Local Tax Outline, Fall 2011wrzmstr2100% (1)

- TTLREG100 - Registration and Title Application - Fillable - 0Document2 pagesTTLREG100 - Registration and Title Application - Fillable - 0Will SmithNo ratings yet

- Bloomsbury Photographs 239-241Document218 pagesBloomsbury Photographs 239-241Norka Korda100% (1)

- Introduction To DeterminationDocument147 pagesIntroduction To Determinationdivu_dhawan12100% (1)

- Fag Bearings FundamentalsDocument55 pagesFag Bearings Fundamentals19031954100% (1)

- UK FUI VE Power Relay Series DSDocument7 pagesUK FUI VE Power Relay Series DSFilozófus ÖnjelöltNo ratings yet

- VA3288Document2 pagesVA3288Filozófus ÖnjelöltNo ratings yet

- Campus Map HighresDocument2 pagesCampus Map HighreskanesmallNo ratings yet

- Va40 10007 PDFDocument2 pagesVa40 10007 PDFAlan StancliffNo ratings yet

- Vha 10 10ezr FillDocument4 pagesVha 10 10ezr FillFilozófus ÖnjelöltNo ratings yet

- 400-Ahadith of Moula Ali (A.s.)Document0 pages400-Ahadith of Moula Ali (A.s.)Nafisa ZamanNo ratings yet

- 1010EZ FillableDocument5 pages1010EZ FillableFilozófus ÖnjelöltNo ratings yet

- 2006 McKelvey (06) - Comment On Van de Ven and Johnson Paper-AMRDocument9 pages2006 McKelvey (06) - Comment On Van de Ven and Johnson Paper-AMRFilozófus ÖnjelöltNo ratings yet

- Sana Dispatch1 FN FalDocument8 pagesSana Dispatch1 FN FalFilozófus ÖnjelöltNo ratings yet

- 0764453e2eff080ab826cacd0ebb9e77Document15 pages0764453e2eff080ab826cacd0ebb9e77Filozófus ÖnjelöltNo ratings yet

- SAS Weapons Rifles FN FALDocument1 pageSAS Weapons Rifles FN FALFilozófus ÖnjelöltNo ratings yet

- AKDocument10 pagesAKFilozófus ÖnjelöltNo ratings yet

- Prtunjuk Penggunaaan PDFDocument8 pagesPrtunjuk Penggunaaan PDFDave GaoNo ratings yet

- Instructions For Report of Medical Examination and Vaccination RecordDocument12 pagesInstructions For Report of Medical Examination and Vaccination RecordFilozófus ÖnjelöltNo ratings yet

- IRS Pub. 501 (2016)Document30 pagesIRS Pub. 501 (2016)Daniel LevineNo ratings yet

- A Simple PDFDocument2 pagesA Simple PDFJaheer MakalNo ratings yet

- TestDocument1 pageTestjkwascomNo ratings yet

- Howto fillinTIRCarnet PDFDocument20 pagesHowto fillinTIRCarnet PDFFilozófus ÖnjelöltNo ratings yet

- The Benefits and Risks of The Pdf/A-3 File Format For Archival InstitutionsDocument25 pagesThe Benefits and Risks of The Pdf/A-3 File Format For Archival InstitutionsFilozófus ÖnjelöltNo ratings yet

- Meddelelse 2 Af 2017-02-16 - ENGELSK Samlet FilDocument33 pagesMeddelelse 2 Af 2017-02-16 - ENGELSK Samlet FilFilozófus ÖnjelöltNo ratings yet

- BI 4 DefinitionsGoldBarsDocument3 pagesBI 4 DefinitionsGoldBarsFilozófus ÖnjelöltNo ratings yet

- Sequence Alignment/Map Format SpecificationDocument16 pagesSequence Alignment/Map Format SpecificationFilozófus ÖnjelöltNo ratings yet

- Tir Lens Guide-Web PDFDocument8 pagesTir Lens Guide-Web PDFFilozófus ÖnjelöltNo ratings yet

- Zespoly Lozyskowe Do Wentylatorow Serii VRE3Document22 pagesZespoly Lozyskowe Do Wentylatorow Serii VRE3Filozófus ÖnjelöltNo ratings yet

- Tpi 253 de enDocument20 pagesTpi 253 de enFilozófus ÖnjelöltNo ratings yet

- designPatternsP1 PDFDocument21 pagesdesignPatternsP1 PDFFilozófus ÖnjelöltNo ratings yet

- GF Rules enDocument6 pagesGF Rules enFilozófus ÖnjelöltNo ratings yet

- Intro GalDocument15 pagesIntro GalFilozófus ÖnjelöltNo ratings yet

- Customers Resale Certificate 2022Document1 pageCustomers Resale Certificate 2022John MorrisonNo ratings yet

- Sap Fi 4.6 Exercises Financial Accounting - Chapter 29 Appendix 1. Sales & Use TaxDocument3 pagesSap Fi 4.6 Exercises Financial Accounting - Chapter 29 Appendix 1. Sales & Use TaxVaibhavNo ratings yet

- PIO-101 Illinois Use Tax MatrixDocument19 pagesPIO-101 Illinois Use Tax MatrixPaige TortorelliNo ratings yet

- Audit Procedures For Vessels: August 2017Document22 pagesAudit Procedures For Vessels: August 2017bridelNo ratings yet

- Instructions 2022Document52 pagesInstructions 2022Shonga CatsNo ratings yet

- 2008 Spring Audit State Developments 2Document285 pages2008 Spring Audit State Developments 2rashidsfNo ratings yet

- Record KeepingDocument11 pagesRecord Keepingr.jeyashankar9550No ratings yet

- What Is Discretionary Sales Surtax?Document3 pagesWhat Is Discretionary Sales Surtax?MavNo ratings yet

- st124 Fill inDocument2 pagesst124 Fill inABODE PVT LIMITEDNo ratings yet

- Capital Improvement FormDocument2 pagesCapital Improvement Formnyc_guyNo ratings yet

- Form St-12 Exempt Use Certificate: Apu MccrayDocument4 pagesForm St-12 Exempt Use Certificate: Apu MccraynareshkumharNo ratings yet

- St121 Fill inDocument4 pagesSt121 Fill inDavid EscobarNo ratings yet

- Municipal and Law Enforcement Title and Registration PacketDocument10 pagesMunicipal and Law Enforcement Title and Registration PacketMusicDramaMamaNo ratings yet

- Solutions Manual: An Introduction To TaxDocument21 pagesSolutions Manual: An Introduction To Taxyea okayNo ratings yet

- Nathan Deal Media Report: Emails Reveal Controversial Business Deal Influenced by Governor's StaffDocument54 pagesNathan Deal Media Report: Emails Reveal Controversial Business Deal Influenced by Governor's StaffbettergeorgiaNo ratings yet

- Outside Resale Certificate-OhioDocument8 pagesOutside Resale Certificate-OhioS S AliNo ratings yet

- BOE Letter To Taxpayers Informing Them of Use TaxDocument1 pageBOE Letter To Taxpayers Informing Them of Use TaxDavid DuranNo ratings yet

- Student Name: - : Question DetailsDocument105 pagesStudent Name: - : Question Detailsyea okayNo ratings yet

- TX Tax Exempt FormDocument1 pageTX Tax Exempt FormDemo CreditManagerNo ratings yet

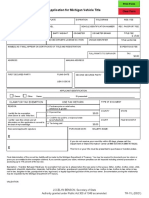

- Application For Michigan Vehicle Title: Use Tax Return Claim For Tax ExemptionDocument1 pageApplication For Michigan Vehicle Title: Use Tax Return Claim For Tax ExemptionNancyNo ratings yet

- One Ohio Now - Top Ten LoopholesDocument1 pageOne Ohio Now - Top Ten LoopholesoneohionowNo ratings yet