Professional Documents

Culture Documents

RMC Income Tax

Uploaded by

HarryCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RMC Income Tax

Uploaded by

HarryCopyright:

Available Formats

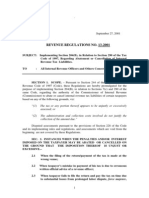

No.

of Issuance

RMC No. 16-2010

RMC No. 28-2010

RMC No. 32-2010

RMC No. 33-2010

RMC No. 47-2010

RMC No. 49-2010

RMC No. 70-2010

RMC No. 81-2010

RMC No. 82-2010

RMC No. 85-2010

RMC No. 91-2010

RMC No. 18-2011

RMC No. 23-2011

RMC No. 35-2011

Subject Matter

Requires taxpayers to disclose their election to

use the Optional Standard Deduction for taxable

year 2009.

Circularizes the full text of Republic Act No.

10026 entitled An Act Granting Income Tax

Exemption to Local Water Districts by

Amending Section 27(C) of the National

Internal Revenue Code (NIRC) of 1997, as

Amended, and Adding Section 289-A to the

Code, for the Purpose

Prescribes the policies relative to the acceptance

of "Out-of-District" Income Tax Returns

Prescribes the policies in securing certified true

copies of Income Tax Returns and Audited

Financial Statements

Circularizes Section 14 of Republic Act No.

10028, An Act Expanding the Promotion of

Breastfeeding, Amending for the Purpose

Republic Act No. 7600, otherwise known as An

Act Providing Incentives to All Government and

Private Health Institutions with Rooming-In and

Breastfeeding Practices, and for Other Purposes

Further amends certain portions of RMC No. 302008, as amended by RMC No. 59-2008 relative

to the taxability of insurance companies for

Minimum Corporate Income Tax, Business Tax

and Documentary Stamp Tax purposes

Circularizes the revocation of BIR Ruling Nos.

DA-413-04 and DA-436-04 and clarifies the

basis in computing depreciation of property,

plant and equipment

Clarifies the documentary requirements for the

application for Certificate of Tax Exemption for

Cooperatives (BIR Form No. 1945)

Provides basic questions and answers to clarify

issues relative to the filing of BIR Form No.

1947

Announces the grace period in the filing of BIR

Form No. 1947

Provides basic questions and answers to

clarify the increase in the Statutory Minimum

Wage and other concerns in relation to the

Income Tax Exemption given to Minimum Wage

Earner

Clarifies the Income Tax exemption of interest

income earnings from long-term deposits or

investment certificates

Publishes the full text of Wage Order No. NCR16, Providing a Cost of Living Allowance in

the National Capital Region and clarifying its

tax implications to Minimum Wage Earners

exempt from Income Tax

Clarifies issues concerning the imposition of

Date of Issue

March 1, 2010

Page

12

March 23, 2010

36

April 12, 2010

April 21, 2010

89

June 2, 2010

10 11

June 7, 2010

12 15

August 24, 2010

16 17

November 5, 2010

18

November 5, 2010

19 24

November 18, 2010

25

December 2, 2010

26 29

April 12, 2011

30 31

June 8, 2011

32 - 37

August 17, 2011

38 40

RMC No. 40-2011

RMC No. 47-2011

RMC No. 49-2011

RMC No. 57-2011

RMC No. 2-2012

RMC No. 3-2012

RMC No. 8-2012

RMC No. 10-2012

RMC No. 15-2012

RMC No. 35-2012

RMC No. 43-2012

RMC No. 65-2012

RMC No. 67-2012

Improperly Accumulated Earnings Tax pursuant

to Section 29 of the Tax Code of 1997, in

relation to RR No. 2-2001

Notifies the use of new Income Tax forms

Clarifies the taxability of interest from savings

and time deposits of cooperatives members

Further clarifies RMC No. 38-2011 on

Expanded Withholding Tax obligation of

Philippine Health Insurance Corporation

(PHIC), including the Income Tax withholding

obligation of hospitals/clinics on case rates of

PHIC and the matter of 5% Final Withholding

VAT for government money payments

Further amends BIR Form Nos. 1700, 1701 and

1702

Reiterates the existing rules and policies on the

acceptance of payments of internal revenue

taxes by RCOs during specified deadlines and

issuance of RORs in accepting tax payments, in

cash or in checks over the P20,000.00 threshold

Clarifies the tax implications of General

Professional Partnership

Circularizes relevant excerpts from the En Banc

Supreme Court Decision in GR No. 172087

concerning the liability of PAGCOR to

corporate Income Tax and the revocation

of pertinent provisions of RR No. 16-2005

relative to the imposition of 10% VAT on

PAGCOR

Prescribes the transition procedures for all eFPS

filers in using the Enhanced Income Tax Returns

Prescribes the additional guidelines in the filing,

receiving and processing of Taxable Year 2011

Income Tax Returns and their attachments

prescribed under RR No. 19-2011

Clarifies the taxability of clubs organized and

operated exclusively for pleasure, recreation and

other non-profit purposes

Announces to all eFPS filers the availability in

the eFPS facility of the Enhanced Annual

Income Tax Return (BIR Form No. 1702)

prescribed under RR No. 19-2011

Clarifies the taxability of association dues,

membership fees and other assessments/charges

collected by condominium corporations

Circularizes the pertinent portions of the

Supreme Court Decision in G.R. Nos. 195909

and 195960 entitled Commissioner of Internal

Revenue vs- St. Lukes Medical Center, Inc.,

on the Income Tax treatment of proprietary nonprofit hospitals and on the 1998 deficiency

Income Tax liability of St. Lukes Medical

Center, Inc. on the revenues it derived from

services to paying patients and their tax

September 5, 2011

October 5, 2011

41 57

58 59

October 11, 2011

60 62

November 25, 2011

63 79

January 3, 2012

80 81

January 12, 2012

82 83

February 29, 2012

84 86

March 19, 2012

87 90

April 4, 2012

91 92

August 6, 2012

93 95

August 10, 2012

96 99

October 31, 2012

100 102

October 31, 2012

103 - 107

RMC No. 77-2012

RMC No. 81-2012

RMC No. 84-2012

RMC No. 89-2012

RMC No. 2-2013

RMC No. 4-2013

RMC No. 9-2013

RMC No. 17-2013

RMC No. 21-2013

RMC No. 26-2013

RMC No. 27-2013

RMC No. 31-2013

RMC No. 33-2013

RMC No. 40-2013

implications and implementation thereof

Clarifies certain provisions of RR No. 14-2012

on the proper tax treatment of interest income

earnings on financial instruments and other

related transactions

Clarifies certain provisions of RR No. 14-2012

on the proper tax treatment of interest income

earnings on financial instruments and other

related transactions

Clarifies the tax treatment of interest income

earnings on loans that are not securitized,

assigned or participated out

Clarifies the tax implications and recording of

deposits/advances made by clients of General

Professional Partnerships for expenses

Clarifies certain provisions of RR No. 12-2012

on the deductibility of depreciation expenses as

it relates to purchase of vehicles and other

expenses related thereto and the input taxes

allowed therefor

Requires tax-exempt hospitals to secure

revalidated tax exemption rulings/certificates

Clarifies the taxability of association dues,

membership fees and other assessments/charges

collected by homeowners associations

Clarifies the taxes due from Financial or

Technical Assistance Agreement (FTAA)

Contractors during Recovery Periods

Amends RMC No. 57-2011, entitled Revised

Forms No. 1700, 1701 and 1702

Disseminates the Primer on BIR Form No. 1701

(Annual Income Tax Return for Self-Employed

Individuals, Estates and Trusts, including those

with both business and compensation income)

and BIR Form No. 1702 (Annual Income Tax

Return for Corporation, Partnership and other

Non-Individual Taxpayer) November 2011

ENCS

Provides guidelines in the filing, receiving and

processing of TY 2012 Income Tax Returns and

prescribes the additional attachment of the

regular allowable itemized deductions to BIR

Form November 2011 ENCS versions

Prescribes the guidelines on the taxation of

compensation income of Philippine nationals

and alien individuals employed by foreign

governments/embassies/diplomatic missions and

international organizations situated in the

Philippines

Clarifies the Income Tax and Franchise Tax due

from PAGCOR, its contractees and licensees

Circularizes the full text of RA No. 10378

entitled An Act Recognizing the Principle of

Reciprocity as Basis for the Grant of Income

November 23, 2012

108 112

December 11, 2012

113 116

December 26, 2012

117

December 28, 2012

118 125

January 7, 2013

126 128

January 14, 2013

129 131

January 30, 2013

132 136

February 15, 2013

137 139

March 1, 2013

140 180

March 19, 2013

181 185

March 20, 2013

186 187

April 12, 2013

188 - 210

April 23, 2013

211 213

May 14, 2013

214 217

RMC No. 50-2013

RMC No. 9-2014

RMC No. 15-2014

RMC No. 20-2014

RMC No. 26-2014

RMC No. 39-2014

RMC No. 86-2014

RMC No. 2-2015

RMC No. 7-2015

RMC No. 10-2015

RMC No. 13-2015

RMC No. 14-2015

RMC No. 20-2015

RMC No. 9-2016

Tax Exemptions to International Carriers and

Rationalizing Other Taxes Imposed Thereon by

Amending Sections 28(A)(3)(A), 109, 118 and

236 of the National Internal Revenue Code

(NIRC), as Amended, and for Other Purposes

Clarifies the Tentative Annual Income Tax

Returns being filed by certain taxpayers

Further amends Revenue Memorandum Circular

No. 57-2011 entitled Revised Form Nos. 1700,

1701 and 1702

Reminds all revenue officials on the acceptance

of Out-Of-District Filing of Income Tax Returns

of certain government officials and employees

Prescribes the guidelines in the filing, receiving

and processing of Taxable Year 2013 Income

Tax Returns (BIR Form Nos. 1700, 1701, 1702RT, 1702-EX and 1702-MX, all June 2013

ENCS version) under RR No. 2-2014

Encourages the use of Computer-Generated

Forms and clarifies certain policies in filing

Income Tax Returns for Taxable Year 2013 using

BIR Form Nos. 1700, 1701, 1702-RT, 1702-EX

and 1702-MX, all June 2013 ENCS version,

including other BIR Forms

Clarifies the tax treatment of payouts by

employee pension plans

Clarifies the valuation of contributions or gifts

actually paid or made in computing taxable

income

Informs taxpayers relative to the availability of

certain Annual Income Tax and Excise Tax

Returns in Offline eBIRForms Package, which

could be submitted thru the eFPS

Reiterates the tax treatment of interest income

derived from Long-Term Deposits or Investment

Certificates as described in RR No. 14-2012 and

clarified in RMC Nos. 77-2012 and 81-2012

Prescribes the policies relative to the filing of

Income Tax Returns (BIR Form No. 1700) by

employees belonging to employers identified as

Large Taxpayers

Further amends RMC No. 57-2011, as amended

by RMC Nos. 21-2013 and 9-2014, entitled

"Revised Form Nos. 1700, 1701 and 1702"

Prescribes the guidelines in the filing, receiving

and processing of Income Tax Returns (BIR

Form Nos. 1700, 1701, 1702-RT, 1702-EX and

1702-MX, all June 2013 ENCS version) for

Taxable Year 2014 using the electronic platform

of BIR

Provides alternative modes in the filing of BIR

Form Nos. 1701Q and 1702Q with payment

using the electronic platforms of BIR

Clarifies the taxability of Non-Stock Savings

July 18, 2013

218

February 11, 2014

219

March 5, 2014

220

April 4,

2014

221 227

April 15,

2014

228 229

May 12,

2014

December 5,

2014

230 233

January 9, 2015

236

March 6, 2015

237 240

March 24, 2015

241

March 31, 2015

242

April 6, 2015

243 254

April 15, 2015

255

January 28, 2016

256 258

234 235

RMC No. 19-2016

RMC No. 64-2016

and Loan Associations for purposes of Income

Tax, Gross Receipts Tax and Documentary

Stamp Tax

Clarifies the tax treatment of the Monthly

Provisional Allowance and Officer's Allowance

given to military personnel/officers under the

recently signed Executive Order, entitled

"Modifying the Salary Schedule for Civilian

Government Personnel and Authorizing the

Grant of Additional Benefits for Both Civilian

and Military and Uniformed Personnel"

Clarifies the nature, tax treatment, registration

and compliance requirements of corporations

and associations under Section 30 of the NIRC

of 1997, as amended

February 19, 2016

259 260

June 20, 2016

261 281

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- rr15 01Document5 pagesrr15 01HarryNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 61716rmo 48-2011Document1 page61716rmo 48-2011HarryNo ratings yet

- RR 13-01Document5 pagesRR 13-01Peggy SalazarNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- rr12 01Document12 pagesrr12 01Bryant R. CanasaNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- RR 14-01Document9 pagesRR 14-01matinikkiNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- BIR Cuts Requirements For Brokers and Importers' ClearancesDocument4 pagesBIR Cuts Requirements For Brokers and Importers' ClearancesPortCallsNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- rr01 01 PDFDocument1 pagerr01 01 PDFHarryNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- RR 18-01Document7 pagesRR 18-01JvsticeNickNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- rr16 01Document3 pagesrr16 01HarryNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- RR 20-01Document5 pagesRR 20-01matinikkiNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- rr19 01Document17 pagesrr19 01HarryNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- 02-2003 Staggered Filing of ReturnDocument4 pages02-2003 Staggered Filing of Returnapi-247793055No ratings yet

- 2001 RR 17 HousingDocument7 pages2001 RR 17 HousingCherry MaeNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- rr21 01Document1 pagerr21 01HarryNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 1845rmc05 - 03 (Annex A)Document1 page1845rmc05 - 03 (Annex A)HarryNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 1903rmc09 03 PDFDocument3 pages1903rmc09 03 PDFHarryNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- BIR RMC 17 2006Document2 pagesBIR RMC 17 2006Mary Anne BantogNo ratings yet

- 1859rmc06 - 03 (Annex A)Document2 pages1859rmc06 - 03 (Annex A)HarryNo ratings yet

- Tax Guide Value Added TaxDocument18 pagesTax Guide Value Added TaxBuenaventura RiveraNo ratings yet

- 1873rmc07 - 03 (Annex A)Document1 page1873rmc07 - 03 (Annex A)HarryNo ratings yet

- RMC 04-2003 - Gross Income On Services For MCIT PurposesDocument7 pagesRMC 04-2003 - Gross Income On Services For MCIT PurposesjtilloNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 1689rmc03 03 PDFDocument1 page1689rmc03 03 PDFHarryNo ratings yet

- 02-2003 Staggered Filing of ReturnDocument4 pages02-2003 Staggered Filing of Returnapi-247793055No ratings yet

- BIR RMC 17 2006Document2 pagesBIR RMC 17 2006Mary Anne BantogNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 1845rmc05 03 PDFDocument1 page1845rmc05 03 PDFHarryNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument6 pagesRepublic of The Philippines Department of Finance Bureau of Internal RevenueJess FernandezNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument6 pagesRepublic of The Philippines Department of Finance Bureau of Internal RevenueJess FernandezNo ratings yet

- Total Collection Goal by Major Tax Type, Cy 2004 (In Thousand Pesos) LegislativeDocument1 pageTotal Collection Goal by Major Tax Type, Cy 2004 (In Thousand Pesos) LegislativeHarryNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Collection Goal, by Implementing Office and Major Tax Type, Cy 2004Document1 pageCollection Goal, by Implementing Office and Major Tax Type, Cy 2004HarryNo ratings yet

- 1798rmo04 06tab3Document1 page1798rmo04 06tab3HarryNo ratings yet

- Inr014298 53291001Document2 pagesInr014298 53291001NARASIMHS MURTHYNo ratings yet

- Bir Ruling No. Dac168 519-08Document12 pagesBir Ruling No. Dac168 519-08Jasreel DomasingNo ratings yet

- Dealership AgreementsDocument7 pagesDealership AgreementsDebasish NathNo ratings yet

- Taxation 8-Preferential Taxation: Pre-TestDocument4 pagesTaxation 8-Preferential Taxation: Pre-TestCharles Decripito Flores100% (1)

- Unit - IDocument43 pagesUnit - ISuseela PNo ratings yet

- Business Law FinalDocument27 pagesBusiness Law FinalLeonardo MercuriNo ratings yet

- Tax Benefits To Ssi SectorDocument13 pagesTax Benefits To Ssi SectorHarshVardhan AryaNo ratings yet

- Htaimrb Form16 54079Document6 pagesHtaimrb Form16 54079Akhil AggarwalNo ratings yet

- 02 Allowable DeductionsDocument56 pages02 Allowable DeductionsHazel ChatsNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- TAX6148-Reviewer (Auto Recovered) TAX6148 - Reviewer (Auto Recovered)Document31 pagesTAX6148-Reviewer (Auto Recovered) TAX6148 - Reviewer (Auto Recovered)lizelleNo ratings yet

- Income Tax - SalaryDocument18 pagesIncome Tax - SalaryhanumanthaiahgowdaNo ratings yet

- BS FormatDocument12 pagesBS Formatsudershan90% (1)

- RMC No. 22-04 Supplement To Revenue Memorandum Circular No. 44-2002 On Accounting Methods To Be Used by Taxpayers For Internal Revenue Tax PurposesDocument2 pagesRMC No. 22-04 Supplement To Revenue Memorandum Circular No. 44-2002 On Accounting Methods To Be Used by Taxpayers For Internal Revenue Tax PurposesKriszan ManiponNo ratings yet

- Tax Tables BuTaxDocument6 pagesTax Tables BuTaxMon Ram100% (1)

- CTRL F Banggawan-Income Taxation (2021)Document743 pagesCTRL F Banggawan-Income Taxation (2021)Lyka Mae E. Mariano100% (6)

- Income and Business TaxationDocument1 pageIncome and Business TaxationTomo Euryl San JuanNo ratings yet

- Module 6 - Donor's TaxationDocument14 pagesModule 6 - Donor's TaxationLex Dela CruzNo ratings yet

- Ilovepdf MergedDocument67 pagesIlovepdf MergedShatrughna Ojha I H211O9No ratings yet

- Financial Reporting 3rd Edition - (CHAPTER 12 Income Taxes)Document52 pagesFinancial Reporting 3rd Edition - (CHAPTER 12 Income Taxes)gvfx48zc7xNo ratings yet

- Mires v. United States, 10th Cir. (2006)Document10 pagesMires v. United States, 10th Cir. (2006)Scribd Government DocsNo ratings yet

- Income From Other SourcesDocument11 pagesIncome From Other Sourcessrocky2000100% (1)

- Bir Train-Income TaxDocument34 pagesBir Train-Income TaxJemma SaponNo ratings yet

- Tax Planning With Reference To Managerial DecisionsDocument22 pagesTax Planning With Reference To Managerial DecisionsdharuvNo ratings yet

- Induction V23 PDFDocument20 pagesInduction V23 PDFNagendra KumarNo ratings yet

- Acca - f6 - Taxation Fa 2017 - CtsDocument1,003 pagesAcca - f6 - Taxation Fa 2017 - Ctsswaathho yuuiNo ratings yet

- Tax True or False Not FinalDocument3 pagesTax True or False Not FinalAdah Micah PlarisanNo ratings yet

- SCDL - PGDBA - Finance - Sem 4 - TaxationDocument23 pagesSCDL - PGDBA - Finance - Sem 4 - Taxationapi-3762419100% (2)

- Taxation Income TaxationDocument73 pagesTaxation Income TaxationB-an Javelosa0% (1)

- James Gandolfini WillDocument17 pagesJames Gandolfini WillNew York Post100% (4)

- Joint Astronomy Centre - Birthday Stars - FinalDocument2 pagesJoint Astronomy Centre - Birthday Stars - Finalhail2pigdumNo ratings yet