Professional Documents

Culture Documents

Statutory Construction Case Digest 1

Uploaded by

kenneth escamillaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statutory Construction Case Digest 1

Uploaded by

kenneth escamillaCopyright:

Available Formats

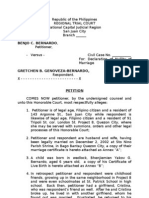

Statutory Construction JD-1-1 Case Digest 1

1. ALMORADIE, MA. CARIZA L.

COMMISSIONER OF CUSTOMS vs CTA 224 SCRA 665 July 21, 1993

FACTS: LITONJUA SHIPPING COMPANY with GRANEXPORT as sub-agent (Hereinafter referred

to as private respondent for brevity) has used the berthing facilities of ILIGAN BAY

EXPRESS CORPORATION, a private corporation which exclusively operates and maintains

said facilities, at Kiwalan, Iligan City for the following vessels which are engaged in foreign

trade: 1) MS Chozan Maru; 2) MS Samuel S; 3) MS Ero; 4) MS Messinia; 4) MS Pavel

Rybin; 5) MS Caledonia and MS Leonidas. For the use of said berthing facilities on

various occasions, the COLLECTOR OF CUSTOMS assessed berthing charges for each vessel,

amounting to a total of PhP 40, 551, which were paid by private respondent under protest.

Private respondent then filed cases before the BUREAU OF CUSTOMS through the

COLLECTOR OF CUSTOMS for the refund of berthing fees under protest, but it did not

prosper. This matter was then elevated at the COMMISSIONER OF CUSTOMS, but of no avail.

On July 28, 1978, the COURT OF TAX APPEALS reversed the decision of COMMISSIONER OF

CUSTOMS, rendering that the private respondent is entitled to a refund, amounting to PhP

40, 551.

The COMMISSIONER OF CUSTOMS contends that the government has the authority to

impose and collect berthing fees whether a vessel berths at a private pier or at a national

port. It is also of the belief that KIWALAN is a national port, for it is within the jurisdiction of

the collection district and territorial limits of the national port of Iligan.

On the other hand, private respondent countered that the right of the government to impose

berthing fees is limited only to national ports; further, KIWALAN is not a national port,

considering that it is operated by a private corporation.

ISSUE: Whether or not a vessel engaged in foreign trade which berths at a privately owned

wharf or pier is liable for the payment of berthing charges under Sec. 2901 of the Tariff and

Customs Code, as amended by PD No. 34?

HELD: NO, the Supreme Court ruled that the subject vessels, not having berth at a national

port, but at the port of KIWALAN which was constructed by a private corporation, are not

subject to berthing fees. Private respondent are further entitled to receive the refund for the

berthing fees it previously paid.

KIWALAN was not accorded the status of a national port as per Customs

Memorandum Circular No. 33-73 or in Executive Order No. 72. It was neither included in the

list of national ports specified on said orders, nor there was a showing that it was converted

as a national port. It is a settled rule in Statutory Construction that the express mention of

one person, thing, act or consequence excludes all others. This rule is expressed in the

maxim, expressio unius est exclusio alterius. Where a statute, by its terms, is expressly

limited to certain matters, it may not, by interpretation or construction be extended to

others. It further lies on the premise that the legislature would not have made specified

enumerations in a statute had the intention been not to restrict its meaning and to confine

its terms to those expressly mentioned.

Moreover, Sec. 2901 of the Tariff and Customs Code, as amended by PD No. 34,

expressly provided that only the national ports are subject to berthing fees, to wit:

Definition Berthing charge is the amount assessed a vessel for mooring or

berthing at a pier, wharf, bulkhead-wharf, river or channel marginal wharf at any national

port in the Philippines; for mooring or making fast to a vessel so berthed; or for coming

Page 1 of 35

Statutory Construction JD-1-1 Case Digest 1

or mooring within any slip, channel, basin, river, or canal under the jurisdiction of any

national port of the Philippines; Provided, however that in the last instance, the charge

shall be fifty (50%) per cent of rates provided for in cases of piers without cargo shed in the

succeeding sections.

Said amendment, in comparison with the provision it superseded, included the word

national before the word port, thus, indicating that a change from the former one has

been made, rendering the court to give and apply the legislative meaning and intent of the

amendment.

2. Conte v COA 264 SCRA 19 - Nov. 4, 1996

Ericson M. Alo

Digested

by:

John

FACTS: Petitioners Avelina B. Conte and Leticia Boiser-Palma were former employees of the

Social Security System (SSS) who retired from government service on May 9, 1990 and

September 13, 1992, respectively. They availed of compulsory retirement benefits under

Republic Act No. 660.

In addition to retirement benefits provided under R.A. 660, petitioners also claimed SSS

financial assistance benefits granted under SSS Resolution No. 56, series of 1971. Res. 56

provides financial incentive and inducement to SSS employees qualified to retire to avail of

retirement benefits under RA 660 as amended, rather than the retirement benefits under RA

1616 as amended, by giving them financial assistance equivalent in amount to the

difference between what a retiree would have received under RA 1616, less what he was

entitled to under RA 660

Respondent Commission on Audit (COA) issued a ruling, disallowing in audit all such claims

for financial assistance under SSS Resolution No. 56, for the reason that results in the

increase of benefits beyond what is allowed under existing retirement laws

Accordingly, all such claims for financial assistance under SSS Resolution No. 56

dated January 21, 1971 should be disallowed in audit.

RA 4968 (The Teves Retirement Law) Sec. 28 (b) of the act read as follows:

(b) Hereafter, no insurance or retirement plan for officers or employees shall be created by

employer. All supplementary retirement or pension plans heretofore in force in any

government office, agency or instrumentality or corporation owned or controlled by the

government, are hereby declared inoperative or abolished; Provided, That the rights of those

who are already eligible to retire thereunder shall not be affected. (underscoring supplied)

ISSUE: 1) WON Res. 56 constitutes a supplementary retirement plan.

2) WON SSS Res. No. 56 has conflict with the statute proscribed by Sec. 28 (b) of CA 186 as

amended by RA 4968.

HELD: 1) Yes. SSS Res. 56 are not supported by law and it constitutes a supplementary

retirement plan. The Court Held that Res. 56 constitutes a supplementary retirement plan.

Resolution No. 56 came about upon observation that qualified SSS employees have

invariably opted to retire under RA 1616 instead of RA 660 because the total benefit under

Page 2 of 35

Statutory Construction JD-1-1 Case Digest 1

the former is much greater than the 5-year lump sum under the latter. As a consequence,

the SSS usually ended up virtually paying the entire retirement benefit, instead of GSIS

which is the main insurance carrier for government employees. Hence, the situation has

become so expensive for SSS that a study of the problem became inevitable.

2) Yes. The court held affirmative. Said Sec. 28 (b) as amended by RA 4968 in no uncertain

terms bars the creation of any insurance or retirement plan -- other than the GSIS -- for

government officers and employees, in order to prevent the undue and inequitous

proliferation of such plans. It is beyond cavil that Res. 56 contravenes the said provision of

law and is therefore invalid, void and of no effect. To ignore this and rule otherwise would be

tantamount to permitting every other government office or agency to put up its own

supplementary retirement benefit plan under the guise of such financial assistance.

WHEREFORE, the petition is hereby DISMISSED for lack of merit, there having been no

grave abuse of discretion on the part of respondent Commission. The assailed Decision of

public respondent is AFFIRMED, and SSS Resolution No. 56 is hereby declared ILLEGAL, VOID

AND OF NO EFFECT. The SSS is hereby urged to assist petitioners and facilitate their

applications under RA 1616, and to advance to them, unless barred by existing regulations,

the corresponding amounts representing the difference between the two benefits

programs. No costs.

3. ASTIBE, Maria Jennifer C.

DIU V COURT OF APPEALS 251 SCRA 472, December 19, 1995

Facts: Wilson and Dorcita Diu appeal by certiorari from the judgment of the CA setting aside

the decision of the RTC, without prejudice to the refiling of the case by them after due

compliance with the provisions of Presidential Decree No. 1508, otherwise known as the

"Katarungang Pambarangay Law."

Patricia Pagba owed spouses Diu a debt worth P7, 862.55 incurred in 1988 by purchasing on

credit various articles of merchandise from petitioners' store at Naval, Biliran. Due to the

private respondents failure to pay despite repeated demands, the petitioners brought the

matter before the Barangay Chairman of Naval and the latter set the case for hearing, but

private respondents failed to appear. When the case was again set for hearing, the parties

appeared

but

they

failed

to

reach

an

amicable

settlement.

Accordingly,

the barangay chairman issued a Certification to File Action.

Issue: Whether or not the confrontations before the barangay chairman satisfied the

requirement in Presidential Decree No. 1508

Held: Yes, the confrontations satisfied the requirement of Presidential Decree No 1508

through substantial compliance. Even though there was a failure to constitute a pangkat

should the barangay chairman, by himself fail to resolve the parties differences still is not

denied that the parties met the office of the barangay chairman for possible settlement. The

efforts of the barangay chairman however, proved futile as no agreement was reached.

Although no pangkat was formed, the Supreme Court believes that there was substantial

compliance with the law.

Page 3 of 35

Statutory Construction JD-1-1 Case Digest 1

It must be noted that Presidential Decree No. 1508 has been repealed by codification in the

Local Government Code of 1991 which took effect on January 1, 1992 It is noteworthy that

under Section 412 of the Local Government Code aforequoted, the confrontation before

the lupon chairman OR the pangkat is sufficient compliance with the pre-condition for filing

the case in court. To indulge private respondents in their stratagem will not only result in a

circuitous procedure but will necessarily entail undue and further delay and

injustice. However, from the very start of this action, private respondents failed to show or

evince any honest indication that they were willing to settle their obligations with

petitioners, notwithstanding the efforts of the latter to submit the matter to conciliation. It is,

therefore, quite obvious that their insistence on technical compliance with the requirements

of the barangay conciliation process is a dilatory maneuver. This is an evident and inevitable

conclusion since the main argument of respondents in this petition is only the supposed

failure of petitioners to comply with the barangay conciliatory procedure and not the denial

or repudiation of their indebtedness.

ACCORDINGLY, the instant petition is GRANTED.

4. BARANGTAY, CARLO NIEL P.

Erectors, Inc., v. National Labor Relations Commission, 256 SCRA 629

Facts:

Erectors, Inc., petitioner, recruited Florencio Burgos to work as a contract driver at Saudi

Arabia for twelve (12) months with a salary of US$165.00, an allowance of US$165.00 and

shall be entitled to a bonus of US$1,000.00 if he opts to extend and renew his contract

without availing of his vacation or home leave. The contract for the said position was

approved by the Ministry of Labor and Employment but was not implemented for the reason

that the position was no longer available. The petitioner executed another contract but with

a different position and a lower compensation, US$105.00 and US$105.00, salary and

allowance, respectively. The second contract was consummated and when Burgos returned

to the Philippines, he invoked his first employment contract by demanding the difference

between his salary and allowance as indicated in the contract and the amount actually paid

to him, plus the contractual bonus for not availing his vacation or home leave credits. The

Labor Arbiter. Burgos then filed a complaint to the Labor Arbiter. The Labor Arbiter rendered

a decision by ordering the petitioner to pay the complainant the difference between the

allowance as a service driver as against the helper/ laborer and the contractual bonus. The

NLRC, after the appeal made by the petitioner appealed their case, dismissed the same and

upheld the Labor Arbiters jurisdiction.

Issues:

1

WON, the language of E.O. 797 has the intention to give it retroactive effect.

Held:

1

No, the rule is that jurisdiction over subject matter is determined by the law in force

at the time of the commencement of the actions. E.O. 707, the creation of the POEA

(Philippines Overseas Employment Agency), did not divest the authority to hear and

decide the case at bar prior to its effectivity. Law should only be applied prospectively

unless the legislative intent to give them retroactive effect is expressly declared or is

necessarily implied from the language used (Article 4 of the New Civil Code, Gallardo

v. Borromeo, 161 SCRA 500, 1988). E.O. 707 is not a curative statute, thus it was

Page 4 of 35

Statutory Construction JD-1-1 Case Digest 1

never intended to remedy any defect in the law and therefore be applied

prospectively and should not affect jurisdiction over cases filed prior to its effectivity.

The Supreme Court dismissed the petition for certiorari.

5. Bondad, Jan Danielle R.

Frivaldo Vs. COMELEC - 257 Scra 727 - June 28 1996

FACTS: In the national elections held on May 8, 1995, Juan G. Frivaldo, gubernatorial

candidate of Sorsogon, won for the third time. His rival, Raul R. Lee, questioned his

citizenship since it was a fact that he gave up his Filipino citizenship during the Marcos

regime which was also the reason why, although he got the majority of votes in the last two

elections, he was disqualified. He filed a petition for repatriation under Presidential Decree

No. 725 which stated that (1) Filipino women who had been married to aliens shall retain

their Filipino citizenship and, (2) other natural born Filipinos who lost their Philippine

nationality but now desire to retrieve Philippine citizenship through an easier process which

was repatriation instead of naturalization. Since the Court already decided that he cannot be

proclaimed as winner due to the issue of citizenship, Lee was already proclaimed as

Governor of Sorsogon. Frivaldo, on the other hand, was able to take his oath of allegiance as

a Philippine citizen and obtained repatriation to the Philippines on the same day. He

contested that since his repatriation has been granted, no legal hindrance may come up

regarding his proclamation as Governor. However, Lee contested that Frivaldos repatriation

should not be given retroactive effect because P.D. No. 725 does not provide it.

ISSUE: Whether or not Presidential Decree No. 725 granted retroactive effect on the

repatriation of Frivaldo.

HELD: YES. The Supreme Court pronounced that retroactivity was provided by P.D. No. 725.

The curative nature of the decree provided that the repatriation of the petitioner retroacted

to the filing date of his reacquisition of citizenship on August 1, 1994. P.D. No. 725

established a new right and, as established, laws which create new rights are

given retroactive effect. The decree provided the steps to reacquire Philippine Citizenship by

repatriation under Presidential Decree No. 725 which are: (1) filing the application; (2) action

by the committee; and (3) taking of the oath of allegiance if the application is permitted. As

expressly stated, it is only upon taking the oath of allegiance that the applicant is deemed

ipso jure (operation of the law) to have reacquired Philippine citizenship. If the decree had

intended the oath taking to retroact on the filing date of the application, then it should not

have explicitly provided otherwise. Hence, he is qualified to be proclaimed governor of

Sorsogon.

6. BORJA, MIA MARIEL KATHLEEN Z

GLORIA V. COURT OF APPEALS 306 SCRA 287 APRIL 21, 1999

FACTS: Private respondents are public school teachers. During the strike they did not report

for work. The investigation was concluded before the 90 days suspension and private

respondents were found guilty as charged. Respondent Nicanor Margallo was ordered

dismissed from the service. While, respondents Amparo Abad, Virgilia Bandigas and

Elizabeth Somebang were ordered suspended for six (6) months effective. Private

respondents moved for a reconsideration, contending that they should be exonerated of all

charges against them and they be paid salaries during suspension. Private respondents were

exonarated of all charges against thrm for acts connected with the teachers strike. Although

they were absent from work, it was not because of the strike.

Page 5 of 35

Statutory Construction JD-1-1 Case Digest 1

ISSUE: WON The private respondents is entitled for a compensation during their suspension

HELD: The Court of Appeals is hereby AFFIRMED with the MODIFICATION that the award of

salaries to private respondents shall be computed from the time of their

dismissal/suspension by the Department of Education, Culture, and Sports until their actual

reinstatement for a period not exceeding five (5) years. In this case, The private respondents

were entitled to back salaries although found guilty of violation of office rules and

regulations in the reason that they were absent from work without filling a leave and in

addition to that is, the absence was not because of the strike.

7. Carlos, Paolo Gerardo L.

IBP v Zamora 338 SCRA 81 August 15, 2000

Facts:

President Joseph Ejercito Estrada commanded the Philippine Marines to join the Philippine

National Police in the visibility patrols around Metro Manila, due to the increase of violent

crimes i.e. robberies, kidnappings and carnappings perpetrated not only by ordinary

criminals but also by syndicates membered by former and active police/military personnel.

The Integrated Bar of the Philippines questioned the constitutionality of the joint venture of

the local police force and the marines arguing that there is no emergency situation that

would justify the deployment, the act constitute an insidious incursion by the military in a

civilian function of government which may result to relying on the military to perform civilian

function of government.

Issues:

Whether or not the President committed a grave abuse of discretion in calling out the

marines.

Held:

The Court held that President did not commit grave abuse of discretion amounting to the

lack or excess of jurisdiction in calling out of the marines. It is stated in Section 18 Article VII

of the 1987 Constitution, the President as the Commander-in-Chief of the all armed forces of

the Philippines whenever it becomes necessary, he may call out such armed forces to

prevent or suppress lawless violence, invasion, or rebellionwhen public safety requires it. .

Based on the rule of statutory construction Expressio unius est exclusion alterius, where the

term is expressly limited to certain matters, it may not, by interpretation or construction, be

extended to other matters the intent of the constitution is exactly what its letter.

The President as Commander-in-Chief has a vast intelligence network to gather

informationhighly confidential or [can be] affecting [to] the state. [The] decision may be

imperatively necessary in emergency situations to avert great loss of human lives and mass

destruction of property. Therefore it is the intent of the Constitution to vest upon the

President, as Commander-in-Chief of the armed forces, full discretion to call fort the military

to prevent and suppress lawless violence, invasion or rebellion.

Wherefore the Supreme Court held that petition has no merit therefore dismissed.

8. Cayetano, Kristine S.

Ajero v CA 236 SCRA 488 (September 15, 1994)

Facts:

The instrument submitted for probate is the holographic will of the late Annie

Sand, who died on November 25, 1982. Petitioners instituted a special proceeding for

Page 6 of 35

Statutory Construction JD-1-1 Case Digest 1

allowance of decedent's holographic will and alleged that at the time of its execution, she

was of sound and disposing mind, not acting under duress, fraud or undue influence. Private

respondent opposed the petition on the grounds that the will contained alterations and

corrections which were not duly signed by decedent.

The trial court admitted the decedents holographic will to probate. On appeal, the

CA reversed the said Decision and the petition for probate of decedents will was dismissed.

The CA found that the holographic failed to meet the requirements for its validty. It held that

the decedent did not comply with Articles 813 and 814 of the New Civil Code (NCC). It

alluded to certain dispositions in the will which were either unsigned and undated, or signed

but not dated. It also found that the erasures, alterations and cancellations made had not

been authenticated by decedent.

Issues:

Whether or not the CA erred in dismissing the petition for probate of

decedents will in view of non-compliance with Articles 813 and 814 of the NCC

Held: YES. A reading of Art. 813 shows that its requirement affects the validity of

the dispositions contained in the holographic will, but not its probate. If the testator fails

to sign and date some of the dispositions, the result is that these dispositions cannot be

effectuated. Such failure, however, does not render the whole testament void.

Likewise,

a holographic will

can

still

be

admitted

to

probate

notwithstanding non-compliance with the provisions of Art. 814. Thus, unless the

unauthenticated alterations, cancellations or insertions were made on the date of

the holographic will or on testators signature, their presence does not invalidate the will

itself. The lack of authentication will only result in disallowance of such changes.

It is also proper to note that the requirements of authentication of changes and

signing and dating of dispositions appear in provisions (Art. 813 and 814) separate from that

which provides for the necessary conditions for the validity of the holographic will (Art. 810).

This separation and distinction adds support to the interpretation that only the

requirements of Art. 810 of the NCC and not those found in Art. 813 and 814 of

the same Code are essential to the probate of a holographic will.

Moreover, Section 9, Rule 76 of the Rules of Court and Art. 839 of the NCC enumerate

the grounds for disallowance of wills. These lists are exclusive; no other grounds can

serve to disallow a will.

9. Dayanghirang, Anna Marie

Amatan v Aujero 248 SCRA 511 - September 27, 1995

FACTS: The undersigned Assistant Provincial Fiscal of Leyte accused Rodrigo Umpad alias

"Meon" of the crime of Homicide committed as follows: That on or about the 14th day of

September 1987, in the Island of Dawahon, Municipality of Bato, Province of Leyte,

Philippines and within the preliminary jurisdiction of this Honorable Court, the above-named

accused, with deliberate intent, with intent to kill did then and there willfully, unlawfully and

feloniously shot one GENARO TAGSIP, with a revolver .38 Cal. Snub Nose Smith and Wesson

(Paltik) which the accused had provided himself for the purpose, thereby causing and

inflicting upon the victim fatal gunshot wound on his head which was the direct and

immediate cause of the death of Genaro Tagsip.

Page 7 of 35

Statutory Construction JD-1-1 Case Digest 1

Upon arraignment, however, the parties, with the acquiescence of the Public Prosecutor and

the consent of the offended party, entered into plea bargaining where it was agreed that the

accused would plead guilty to the lesser offense of Attempted Homicide instead of homicide

as originally charged in the information, and would incur the penalty of "four (4)years, two

(2) months and one (1) day of prision correccional as minimum to six (6) year of prision

correccional maximumas maximum."

Consequently, in his decision promulgated on the 27th of June 1990, respondent judge found

the accused, Rodrigo Umpad, guilty beyond reasonable doubt of the lesser crime of

Attempted Homicide and sentenced him to suffer imprisonment of four years, two months

and one day of prision correccional maximum, as minimum to six years of prision

correccional maximum, as the maximum period, exactly in accordance with the plea

bargaining agreement.

A letter-complaint addressed to the Chief Justice and signed by Pedro S. Amatan, a brotherin-law of the deceased, accused Judge Vicente Aujero of gross incompetence, gross

ignorance of the law and gross misconduct, relative to his disposition of Crim. Case No. H223 entitled People v. Rodrigo Umpad alias "Meon."

In said letter-complaint, complainant contends that the sentence of respondent judge finding

the accused guilty beyond reasonable doubt of the lesser offense of Attempted Homicide

and not Homicide as charged is proof indicative, "on its face, of gross incompetence, gross

ignorance of the law or gross misconduct. Responding to the complaint, respondent Judge

asserts that he relied on Sec. 2, Rule 116 of the 1985 Revised Rules of Criminal Procedure,

as amended, which allows an accused individual with the consent of the offended party to

plead guilty to a lesser offense, regardless of whether or not such offense is necessarily

included in the crime charged, or is cognizable by a court of lesser jurisdiction. He explains

that during the May 3, 1990 hearing, accused and his counsel, with the acquiescence and in

the presence of the prosecutor, informed the Court of the defendant's desire to plea bargain

pursuant to the afforested rule.

ISSUE: Whether or not Judge Vicente Aujerio is liable of gross ignorance of the law.

HELD: YES. Judge Vicente Aujero is liable of gross ignorance of the law. In the case at

bench, the fact of the victim's death, a clear negation of frustrated or attempted homicide,

ought to have alerted the judge not only to a possibly inconsistent result but to an injustice.

The failure to recognize such principles so cardinal to our body of laws amounts to ignorance

of the law and reflects respondent judge's lack of prudence, if not competence, in the

performance of his duties. The death of an identified individual cannot and should not be

ignored in favor of a more expedient plea of either attempted or frustrated homicide. Finally,

every judge must be the embodiment of competence, integrity and independence.

ACCORDINGLY, we are constrained to find the respondent judge GUILTY of gross ignorance

of the law for which he is hereby REPRIMANDED FINED ONE THOUSAND (P1,000.00) PESOS.

Let this decision appear in respondent's record of service.

10. Delmoro, Mel Loise M.

Bautista v SB 332 SCRA 126

Facts: An anonymous letter-complaint was filed with the Office of the Ombudsman of

Mindanao charging petitioner Franklin P. Bautista, Mayor of Malita, Davao del Sur, for

violation of RA 3019 or the Anti-Graft and Corrupt Practices Act. The complaint alleged that

Page 8 of 35

Statutory Construction JD-1-1 Case Digest 1

petitioner hired 192 casual employees in the municipal government for political

consideration and that their salaries were charged to the peace and order fund despite the

meagre savings of the municipality. The Ombudsman filed against the petitioner before the

Sandiganbayan. Petitioner Bautista filed a motion to quash but it was denied.

Issue: Whether or Not the Sandiganbayan erred in denying the petitioners Motion to Quash

HELD: No. The Court affirmed the resolution of Sandiganbayan. Bautista assailed that there

was no legal basis for the conduct of preliminary investigation as the Ombudsman failed to

reduce their evidence into affidavits before requiring him to submit his counter affidavit.

However, the court observed that the petitioner had already filed his counter-affidavit and

only questioned the Ombudsmans noncompliance with the affidavit requirement after the

preliminary investigation had ended and a case was already filed before the Sandiganbayan.

The issue therefore has become moot and academic.

Petitioner also raised that violation of Sec. 3, par. (e), RA 3019 provides as one of its

elements that the public officer should have acted by causing any undue injury to any party,

including the government, or by giving any private party unwarranted benefits, advantage

or preference in the discharge of his functions. He argued that each constitutes 2 distinct

offenses that should be charged in separate criminal complaints. The court did not agree as

the disjunctive term "or" connotes that either act qualifies as a violation. This does not

indicate that each mode constitutes a distinct offense, but rather, that an accused may be

charged under either mode or under both.

Petitioner lastly claimed exception in the term "private party" and argued that the casuals

he allegedly appointed could not qualify as private parties since they are in actuality public

officers. The court responded that the term "private party" may be used to refer to persons

other than those holding public office. The reckoning period is before the casual employees'

incumbency when they were still private individuals, hence, their current positions do not

affect the sufficiency of the case.

11. Dimaano, Joielyn D.

CATUBAY v NLRC, 330 SCRA 440, April 12, 2000

FACTS: Petitioners filed a complaint against Fishwealth Canning Corporation and its owner,

Lapaz Ngo, for payment of salary differentials and separation pay against private

respondents before the arbitration branch of the National Labor Relations Commission

(NLRC). The Labor Arbiter decided in favor of the petitioners.

On February 14, 1994, private respondents filed an appeal memorandum. Meanwhile, on

March 16, 1994, petitioners moved for execution of the judgment. Private respondents were

notified of a conference but failed to appear. Thus, on April 12, 1994, the labor arbiter issued

a writ of execution.

On April 14, 1994, private respondents filed a motion to quash the writ of execution

alleging that it was premature considering that private respondents had filed their appeal

memorandum within the ten-day reglementary period and that there was still a pending

motion to admit the appeal fee but the labor arbiter denied. He noted that although an

appeal memorandum had been filed, the records show receipt only of the appeal fee. There

was nothing to show that private respondents posted the required cash or surety bond

pursuant to Sections 3 (a) and 6 of the New Rules of Procedure of the NLRC and Article 223

of the Labor Code.

Page 9 of 35

Statutory Construction JD-1-1 Case Digest 1

Private respondents posted their surety bond on April 22, 1994. On the same day, the

Labor Arbiter issued that the respondents have posted the surety bond beyond the

reglementary period under the provision of the Labor Code.

On August 9, 1994, private respondents filed a Supplemental Memorandum of Appeal

before the NLRC, alleging denial of due process that the labor arbiter decided the case

without giving them the opportunity to present counter evidence. NLRC decided in favor of

private respondents

Petitioners motion for reconsideration of the aforequoted decision was denied by public

respondent NLRC.

ISSUE: Whether or not the private respondents appeal was perfected.

HELD: The appeal was not perfected. No justifiable reason was put forth by the private

respondents for their late filing of the required bond. The bond is sine qua non to the

perfection of appeal from the labor arbiter's monetary award. The intention of the lawmakers

to make the bond an indispensable requisite for the perfection of an appeal by the employer

is underscored by the provision that an appeal by the employer may be perfected only upon

the posting of a cash or surety bond; the word "only" makes it perfectly clear, that the

lawmakers intended the posting of a cash or surety bond by the employer to be the

exclusive means by which an employer's appeal may be perfected.

12. Escamilla, Kenneth

Claudio vs Comelec 331 SCRA 388 May 4, 2000

Facts:

This is a petition for certiorari and prohibition, seeking the nullification of the

resolution of the COMELEC giving due course to the petition for the recall of petitioner Jovito

O. Claudio as mayor of Pasay City

Jovito O. Claudio, petitioner was the duly elected mayor of Pasay City in the May 11, 1998

elections. He assumed office on July 1, 1998

Sometime during the second week of May 1999, the chairs of several barangays in Pasay

City gathered to discuss the possibility of filing a petition for recall against Mayor Claudio for

loss of confidence . They formed an ad hoc committee for the purpose of convening the PRA

(Preparatory Recall Assembly)

On May 29, 1999, 1,073 members of the PRA composed of barangay chairs, kagawads, and

sangguniang kabataan chairs of Pasay City, adopted Resolution entitled RESOLUTION TO

INITIATE THE RECALL OF JOVITO O. CLAUDIO AS MAYOR OF PASAY CITY FOR LOSS OF

CONFIDENCE

In a letter dated June 29, 1999, Advincula, as chair of the PRA, invited the Mayor, ViceMayor, Station Commander, and thirteen (13) Councilors of Pasay City to witness the formal

submission to the Office of the Election Officer on July 2, 1999 of the petition for recall.

The bone of contention in this case is 74 of the Local Government Code

(LCG) 4 which provides:

Limitations on Recall. (a) Any elective local official may be the subject of a recall election

only once during his term of office for loss of confidence.

Page 10 of 35

Statutory Construction JD-1-1 Case Digest 1

(b) No recall shall take place within one (1) year from the date of the

official's assumption to office or one (1) year immediately preceding a

regular local election.

Both petitioner Claudio and the COMELEC thus agree that the term "recall" as used in 74

refers to a process. They disagree only as to when the process starts for purposes of the

one-year limitation in paragraph (b) of 74.

Petitioner contends that the term "recall" in 74(b) refers to a process, in contrast to the

term "recall election" found in 74(a), which obviously refers to an election. He claims that

"when several barangay chairmen met and convened on May 19, 1999 and unanimously

resolved to initiate the recall, followed by the taking of votes by the PRA on May 29, 1999 for

the purpose of adopting a resolution "to initiate the recall of Jovito Claudio as Mayor of Pasay

City for loss of confidence," the process of recall began" and, since May 29, 1999 was

less than a year after he had assumed office, the PRA was illegally convened and all

proceedings held thereafter, including the filing of the recall petition on July 2, 1999, were

null and void.

Petitioner contends, however, that the date set by the COMELEC for the recall election is

within the second period of prohibition in paragraph (b). He argues that the phrase "regular

local elections" in paragraph (b) does not only mean "the day of the regular local election"

which, for the year 2001 is May 14, but the election period as well, which is normally at least

forty five (45) days immediately before the day of the election. Hence, he contends that

beginning March 30, 2000, no recall election may be held

Issue: 1.) WON the petition filed for election recall were null and void?

2.) WON COMELEC set the recall election notwithstanding the second period of

prohibition in LGC 74 paragraph (b).

Held: 1.) No, the process of recall starts with the filing of the petition for recall and not

from the time of initiation of recall (May 19 & 29,1999) and ends with the conduct of the

recall election, and that, since the petition for recall in this case was filed on July 2, 1999,

exactly one year and a day after petitioner's assumption of office(July 1, 1998), the

recall was validly initiated outside the one-year prohibited period.

2.) No, the law is unambiguous in providing that "no recall shall take place within . . .

one (1) year immediately preceding a regular local election." The COMELEC set the recall

election on April 15, 2000 outside one year second of the second period of prohibition in

LGC 74 paragraph (b) in prior to the next regular local election which is on May 14, 2001.

13. Felipe, Patricia Anne Q.

Carceller v. CA and State Investment Houses, Inc., 302 SCRA 718 (1999)

Facts: State Investment Houses, Inc. (SIHI) is the registered owner of two (2) parcels of land

located at Bulacao, Cebu City. Carceller and SIHI entered into a lease contract with option to

purchase over said two parcels of land, for a period of eighteen (18) months, beginning on

August 1, 1984 until January 30, 1986.

The lease contract provided that to exercise the option, petitioner had to send a

letter to SIHI, manifesting his intent to exercise said option within the lease period. However,

what petitioner did was to request on January 15, 1986, for a six-month extension of the

Page 11 of 35

Statutory Construction JD-1-1 Case Digest 1

lease contract, for the alleged purpose of raising funds intended to purchase the property

subject of the option. SIHI denied and made mention of the fact that, said property was for

sale already to the general public. Few days later, petitioner notified SIHI of his desire to

exercise the option formally. SIHI denied the request, stressing that the option to purchase

agreement had already lapsed. SIHI also asked petitioner to vacate the property.

Issue:

WON petitioner should be allowed to exercise the option to purchase the

leased property, despite the alleged delay in giving the required notice to private

respondent

Held: YES. Analysis and construction should not be limited to the words used in the

contract, as they may not accurately reflect the parties true intent. The reasonableness of

the result obtained, after said analysis, ought likewise to be carefully considered.

It is well-settled in both law and jurisprudence, that contracts are the law between

the contracting parties and should be fulfilled, if their terms are clear and leave no room for

doubt as to the intention of the contracting parties. Further, it is well-settled that in

construing a written agreement, the reason behind and the circumstances surrounding its

execution are of paramount importance. Sound construction requires one to be placed

mentally in the situation occupied by the parties concerned at the time the writing was

executed. Thereby, the intention of the contracting parties could be made to prevail,

because their agreement has the force of law between them.

Moreover, to ascertain the intent of the parties in a contractual relationship, it is

imperative that the various stipulations provided for in the contract be construed together,

consistent with the parties contemporaneous and subsequent acts as regards the execution

of the contract. And once the intention of the parties has been ascertained, that element is

deemed as an integral part of the contract as though it has been originally expressed in

unequivocal terms.

In the case at bar, SIHI, prior to its negotiation with petitioner, was already beset with

financial problems. Thus, SIHI was compelled to dispose some of its assets, among which is

the subject leased property, to generate sufficient funds to augment its badly-depleted

financial resources. This then brought about the execution of the lease contract with option

to purchase between SIHI and the petitioner.

Furthermore, it is undeniable that SIHI really intended to dispose of said leased

property as evidenced by its letters reminding the petitioner of the upcoming expiration of

contract and by putting it for sale for the general public immediately upon failure of

petitioner to exercise the option.

On the other hand, petitioner indubitably intended to buy as evidenced by the

introduced permanent improvements on the leased property and by securing P8 Million loan

to pay the purchase price in one single payment. His letter earlier requesting extension was

premised, in fact, on his need for time to secure the needed financing through a bank loan.

In contractual relations, the law allows the parties reasonable leeway on the terms of

their agreement, which is the law between them. The Court believes that petitioners letter

and his formal exercise of the option were within a reasonable time-frame consistent with

periods given and the known intent of the parties to the agreement dated January 10,

1985. A contrary view would be harsh and iniquitous indeed.

Page 12 of 35

Statutory Construction JD-1-1 Case Digest 1

14. Ma. Florence R. Fuerte

Enrique v CA 229 SCRA 180 January 10, 1994

Facts:

For and in consideration of P500.00 to P1,000, accused Corazon Pacheco, Jesus Basilio,

Virgilio Valencia, Rodolfo Enrique, Rogelio Maglagui, Eduardo Garcia and Lilia Cunanan, all

employees of the Civil Service Regional Office No. 3, San Fernando, Pampanga, helped

and/or assisted some examinees in answering examination questions by assigning them to

particular rooms known as chocolate rooms.

Accused were charged by the CSC motu propio (sic) for DISHONESTY, GRAVE MISCONDUCT,

BEING NOTORIOUSLY UNDESIRABLE, RECEIVING FOR PERSONAL USE FOR A FEE, GIFT OR

OTHER VALUABLE THINGS IN THE COURSE OF OFFICIAL DUTIES, AND CONDUCT PREJUDICIAL

TO THE BEST INTEREST OF THE SERVICE

Dated March 14, 1984, preventive suspension was issued to CSC Resolution No. 84-052.

Petitioners denied the charges and moved for an immediate dismissal of the case, but the

CSC denied the request for formal hearing and resolved to precede in accordance with

Section 40 of PD 807.

Petitioners filed a motion for reconsideration alleging : (a) that Section 40 of P.D. No. 807

was not applicable to their case because of the absence of the circumstances provided

therein; and (b) that their constitutional rights would be placed in jeopardy if summary

proceedings were held in lieu of formal proceedings, since they opted for a formal

investigation.

CSC dismissed petitioners motion for reconsideration for lack of merit however, Rogelio

Maglagui and Lilia Cunanan was reduced to one year suspension

Rodolfo Enrique, Jesus Basilio, Corazon Pacheco and Virgilio Valencia appealed to the then

Intermediate Appellate Court. The resolution of the Civil Service Commission for Enrique and

Basilio is hereby AFFIRMED and is hereby REVERSED and SET ASIDE with respect to

respondents Pacheco and Valencia who are hereby ordered to be reinstated

Motion for reconsideration of Enrique and Basilio was denied for lack of merit.

Issue:

1.

Whether or not the CSC had original jurisdiction over CSC Case No. 138 against

petitioners.

2.

Whether or not petitioners were denied due process of law; and,

3.

Whether or not the dismissal of petitioners from the service through a summary

proceeding by the CSC was proper.

Held:

Great weight must be accorded to the interpretation or construction of a statute by the

government agency called upon to implement the same. As provided in Presidential Decree

No. 1409, which amended Presidential Decree No. 807, the heads of ministries and agencies,

on one hand, and the Merit Systems Board on the other, have concurrent original jurisdiction

over disciplinary and non-disciplinary cases, and where the heads of ministries and agencies

assume jurisdiction first, their decisions and determinations are appealable to Merit Systems

Page 13 of 35

Statutory Construction JD-1-1 Case Digest 1

Board. The Civil Service Commission, however, remains the final administrative body in

these matters, as provided in Section 8 of Presidential Decree No. 1409.

The commission of the acts imputed to petitioners took place on or before November 1983

or long before the repeal of Section 40 of P.D. No. 807. Hence, the operative law is still

Section 40.

Section 40. Summary Proceedings. No formal investigation is necessary and the respondent

may be immediately removed or dismissed if any of the following circumstances is present:

(a) When the charge is serious and the evidence of guilt is strong;

(b) When the respondent is a recidivist or has been repeatedly charged and there is

reasonable ground to believe that he is guilty of the present charge.

(c) When the respondent is notoriously undesirable.

Resort to summary proceedings by disciplining authority shall be done with utmost

objectivity and impartiality to the end that no injustice is committed: Provided, That removal

or dismissal except those by the President, himself, or upon his order, may be appealed to

the Commission.

Petitioners were informed of the charges levelled against them and were given reasonable

opportunity to present their defenses. As a matter of fact, petitioners admitted that they

filed their answer to the formal charges against them and submitted additional evidence

when asked to do so. Petitioners even moved for a reconsideration of the adverse CSC

decision. After the denial of their motion, petitioners appealed to the Intermediate Appellate

Court, which, in turn, considered said appeal. Hence, the supposed denial of administrative

due process has been cured.

Thus, the decision of the Court of Appeals were affirmed for the accused, Enrique and

Basilio.

15. GARCIA, DOREEN YSABELLE E.

FRANCISCO v BOISER - 332 SCRA 792 - May 31, 2000

FACTS:

Petitioner ADALIA B. FRANCISCO (hereinafter referred to as Adalia), and

three of her sisters, Ester, Elizabeth, and Adeluisa, were co-owners of four parcels of

registered lands on which stands the Ten Commandments Building at 689 Rizal Avenue

Extension, in Caloocan City. On August 1979, they sold 1/5 of their undivided share to their

mother, Adela Blas (Hereinafter referred to as Adela), for PhP 10,000, making her a coowner of the real property to that extent. Then on August 8, 1986, Adela, without the

consent of other co-owners, sold the said portion of land for PhP 10,000 to respondent

ZENAIDA F. BOISER (hereinafter referred to as Zenaida), another sister of Adalia.

On August 5, 1992, Adalia received summons with a copy of the Complaint in Civil

Case No. 15510, filed by Zenaida, demanding her share in the rentals being collected by

Adalia from the tenants of the building situated in the subject land. Adalia then informed

Zenaida that she was exercising her right of redemption as co-owner of the subject property,

then proceeded to deposit for that purpose the amount of PhP 10,000 with the Clerk of

Court, on August 12, 1992. The case was dismissed however after Zenaida was declared

non-suited, and Adalias counterclaim was dismissed as well.

Three years later, on September 14, 1995, Adalia instituted a complaint demanding

the redemption of the property contending that the 30-day period for redemption had not

begun to run against her or any of the other co-owners, since the vendor Adela, did not

Page 14 of 35

Statutory Construction JD-1-1 Case Digest 1

inform them about the sale, which they only came to know when Adalia received the

summons in 1992.

Zenaida, on the other hand, contended that Adalia already knew of the sale even

before she received the summons since Zenaida had informed Adalia by letter of the sale,

with a demand for her share of the rentals three months before filing of the suit. Attached to

the said letter, according to Zenaida, was a copy of the deed of sale between her and Adela.

Adalia received said letters is proved by the fact that within a week, she advised the tenants

of the building to disregard Zenaidas demand letter.

The trial court dismissed the Adalias complaint for legal redemption, holding Art.

1623 of the Civil Code does not prescribe any particular form of notifying co-owners on

appeal. The trial court considered the letter sent by Zenaida to Adalia with a copy of the

deed of sale as substantial compliance with the required written notice under Art. 1623 of

the New Civil Code.

Adalia elevated the case to the Court of Appeals, but it only affirmed the decision of

the RTC, relying on the ruling of Distrito v CA, Art. 1623 does not prescribe any particular

form of written notice, nor any distinctive method for notifying the redemptioner, and that

of De Conejero v CA & Badillo v. Ferrer, which said that furnishing the redemptioner with a

copy of the deed of sale is equivalent in giving him the written notice required by the law.

ISSUE:WON the demand letter by Zenaida to Adalia can be considered as sufficient

compliance with the notice of requirement of Art. 1623 for the purpose of legal redemption

HELD: There are two side questions on the interpretation of Art. 1623 of the CC:

1

Who should send notice?

The text of Art. 1623 clearly and expressly prescribes that the 30 days for making

the redemption shall be counted from notice in writing by the vendor. It makes

sense to require that notice be given by the vendor and nobody else, since the

vendor of an undivided interest is in the best position to know who are his coowners, who under the law, must be notified of the sale.

When do you start counting the 30-day period?

In the present case, for instance, the sale took place in 1986, but it was kept

secret until 1992, when Zenaida needed to notify Adalia about the sale to demand

1/5 of the rentals from the property sold.

Compared to serious prejudice to Adalias right of legal redemption, the only

adverse to Adela, the vendor of the property, and Zenaida, is that the sale could

not be registered. It is, therefore, unjust when the subject sale has already been

established before both lower courts and now, before this Court, to further delay

Adalias exercise of her right of legal redemption by requiring that notice be given

by Adela before Adalia can exercise her right.

For this reason, the Supreme Court ruled that the receipt by Adalia of summons in

August 1992 constitutes actual knowledge on the basis of which she may now

exercise her right of redemption within 30 days from finality of decision.

Page 15 of 35

Statutory Construction JD-1-1 Case Digest 1

The Petition is GRANTED, and the decision of the Court of Appeals and the Regional

Trial Court is REVERSED, to effect Adalia Francisco of her right of legal redemption.

16. Gargaritano, Angelo Ibaez

In Re: Valenzuela and Vallarta 298 SCRA 408 November 9, 1998

FACTS:

March 9, 1998, a meeting was held by the JBC and the issue discussed was the

constitutionality of appointments of the CA, being that the election was at hand. Provisions

of Sec. 15 of Article VII and Sec. 4(1), Article VIII of the Constitution were brought about.

Senior Associate Justice Florenz D. Regalado, Consultant of the Council, expressed that the

election ban had not application to appointments to the CA, and this hypothesis was

accepted without further discussion or study of the other JBC members. This was then

submitted to the President with the JBCs nominations for 8 vacancies in the CA.

March 30, 1998, The President signed the appointments of Hon. Mateo A. Valenzuela and

Hon. Placido B. Vallarta as Judges of the RTC of Branch 62, Bago City and Branch 24,

Cabanatuan City, respectively.

There has been an exchange of letters between the President and the Chief Justice in regard

to the issue of the constitutionality of the appointments. The Chief Justice called for a

meeting with the Chief Justice Secretary and members of the council that they might hear

the formers concerns on the issue; and after the session they decided to wait for the

Presidents reply. The President expressed that Sec. 15, of Article VII only applied to

executive appointments, the whole article being entitled EXECUTIVE DEPARTMENT.

Furthermore, he observed that appointments in the Judiciary have specific provisions as

stated by Sec. 4 and Sec. 9, of Article VIII.

May 12, 1998, the Chief Justice received from Malacanang the appointment of 2 Judges of

the RTC, Hon. Mateo A. Valenzuela and Hon. Placido B. Vallarta. The Chief Justice, troubled

that he runs the risk of acting in a manner inconsistent with the Constitution having the

obligation to transmit the appointments of the appointees so they can take their oaths,

raised the issue before the Court.

ISSUES:

Whether or not the President can make appointments to fill vacancies in the judiciary, as

mandated by Sec. 4(1) & Sec.9 of Article VIII, during the period of the ban, imposed by Sec.

15, Article VII.

HELD:

No. The appointments of Messrs. Valanzuela and Vallarta on March 30, 1998 were

unquestionably made during the period of the ban.

It was stated in the Chief Justices letter for the President, the provision of Sec.15, Article

VII, imposes a direct prohibition on the President: he shall not make appointments within

the period mentioned, and since there is no specification of which appointments are

proscribed, the same may be considered as applying to all appointments of any kind and

nature

Now, in view of the general prohibition in the first-quoted provisions, how is the

requirement of filling vacancies in the Court within ninety days to be construed? One

interpretation that immediately suggests itself is that Sec. 4(1), Article VIII is a general

provision while Sec. 15, Article VII is a particular one; that is to say, normally, there are no

Page 16 of 35

Statutory Construction JD-1-1 Case Digest 1

presidential elections which after all occur only every 6 years Sec. 4(1), Article VIII shall

apply; but when (as now) there are presidential elections, the prohibition in Sec. 15, Article

VII comes into play.

Consequently, they come within the operations of the first prohibition relating to

appointments which are considered to be for the purpose of buying votes or influencing the

election. While the filling of vacancies in the judiciary is undoubtedly in the public interest,

there is no showing in this case of any compelling reason to justify the making of the

appointments during the period of the ban.

17. Garin, Diana M.

KILOSBAYAN v. MORATO - 246 SCRA 540 - November 16, 1995

Facts:

On the first case of Kilosbayan v. Guingona, the contract of lease between the Philippine

Charity Sweepstake Office (PSCO) and Phil. Gaming Managment Corp. (PGMC) was null and

void due to the violation of the PCSO Charter.

Thereafter, PCSO and PGMC entered into another agreement, Equipment Lease

Agreement (ELA). The petitioners prayed that ELA is also invalid for the reason that it is the

same with the old lease contract under Kilosbayan vs. Guingona, for it is violative of the law

of public bidding, and not advantageous for the government.

In addition, petitioners claimed that the two new appointeed justices, regardless of the

merit of the decision in the first Kilosbayan case against the online lotto (Kilosbayan v.

Guingona) must of necessity align themselves with all the Ramos appointees who were

dissenters in the first case and constitute the new majority in the second lotto case." And

petitioners ask, "why should it be so?

PCSO and PGMC manifested that they are no longer filing a motion for reconsideration

and both are presently negotiating a new lease agreement consistent (which is the ELA) with

the authority of PCSO under its charter. Even if the parties made a "formal commitment," the

Page 17 of 35

Statutory Construction JD-1-1 Case Digest 1

justices certainly could not barred by the doctrine of stare decisis, res judicata or

conclusiveness of judgment or law of the case.

Issue:

Whether or not the decision of the first case has already settled the second case

Held:

No, the decision of the first case has not yet settled the second case.

Stare Decisis. Since ELA is a different contract from the prior case, the previous decision

does not preclude determination of the petitioners standing. It must be noted that ELA was

amended consistent with the PCSO Charter.

Law in the case Doctrine. Petitioners insist on the ruling in the previous case that the

PCSO cannot hold and conduct charity sweepstakes, lotteries and other similar activities in

collaboration, association or joint venture with any other party. Petitioners contend that the

ruling of the first case is the law of this case because the parties are the same and the case

involves the same issue, i.e., the meaning of this statutory provision.The "law of the case"

doctrine is inapplicable, because this case is not a continuation of the first.

Conclusiveness of judgment. Petitioners also say that inquiry into the same question as

to the meaning of the statutory provision is barred by the doctrine of res judicata. The

general rule on the "conclusiveness of judgment," however, is subject to the exception that

a question may be reopened if it is a legal question and the two actions involve substantially

different claims. Indeed, the questions raised in this case are legal questions and the claims

involved are substantially different from those involved in the prior case between the

parties. As already stated, the ELA is substantially different from the Contract of Lease

declared void in the first case.

Therefore, the second case will prosper with regard to its merits.

18. JALALON, Jeanine Vanessa R.

LLDA v Court of Appeals - 251 SCRA 42 December 7, 1995

Page 18 of 35

Statutory Construction JD-1-1 Case Digest 1

Facts: Towards environmental protection and ecology, navigational safety, and sustainable

development, Republic Act No. 4850 created the "Laguna Lake Development Authority."

Presidential Decree 813 of former President Marcos amended certain sections of R.A. 4850

because of the rapid deterioration of the Laguna Lake, thereby giving the LLDA special

powers on the pertinent issues such as: that the LLDA shall exercise exclusive jurisdiction

over the lake with regards to the issuance of permits, projects or activities that affects the

said lake, including its navigation. To more effectively perform the role of the Authority, the

late President issued Executive Order 927 to further define and enlarge the functions and

powers of the Authority and named and enumerated the towns, cities and provinces

encompassed by the term "Laguna de Bay Region". E.O. 927 gave the Authority exclusive

jurisdiction to issue permit for the use of all surface water for any projects or activities in or

affecting the said region including navigation, construction, and operation of fishpens, fish

enclosures, fish corrals and the like.

When R.A. 7160 or the Local Government Code of 1991 was enacted, the municipalities in

the Laguna Lake Region interpreted the provisions of this law to mean that the newly passed

law gave municipal governments the exclusive jurisdiction to issue fishing privileges within

their municipal waters because R.A. 7160 provides: the municipality shall have exclusive

jurisdiction over the municipal waters and impose fees in accordance to the provision. The

Municipal then took over the authority to issue fishing privileges and fishpen permits.

Because of this, it worsened the environmental problems and ecological state of Laguna

Lake.

The Authority served notice to the general public that: all the fishpens, fishcages, and aquaculture structures not registered within LLDA are illegal, and will be subject to demolition;

that they will be criminally charged for their non-observance of the notice; and that they

only have one month on or before 27 October 1993 to show case/reason as to why their

fishpens, fishcages and the likes should not be demolished. One month thereafter, they

issued a notice that all the structures made in Laguna Lake will be demolished after 10 days.

The fishpen owners filed a case to the LLDA. The Authority moved for the Dismissal of the

case. On June 29, 1995, the Court of Appeals dismissed the Authoritys consolidated

petitions on the ground that the provisions of the LLDA charter insofar as fishing privileges in

Laguna de Bay are concerned had been repealed by the Local Government Code of 1991.

The Authority appealed stating that: THE HONORABLE COURT OF APPEALS COMMITTED

SERIOUS ERROR WHEN IT RULED THAT R.A. 4850 AS AMENDED BY P.D. 813 AND E.O. 927

SERIES OF 1983 HAS BEEN REPEALED BY REPUBLIC ACT 7160. THE SAID RULING IS

CONTRARY TO ESTABLISHED PRINCIPLES AND JURISPRUDENCE OF STATUTORY

CONSTRUCTION.

Issue: WON the Laguna Lake Authority has exclusive jurisdiction over the Laguna Lake.

Ruling: Yes. It has to be conceded that the charter of the Laguna Lake Development

Authority constitutes a special law. Republic Act No. 7160, the Local Government Code of

1991, is a general law. It is basic in statutory construction that the enactment of a later

legislation which is a general law cannot be construed to have repealed a special law. It is a

well-settled rule in this jurisdiction that "a special statute, provided for a particular case or

class of cases, is not repealed by a subsequent statute, general in its terms, provisions and

application, unless the intent to repeal or alter is manifest, although the terms of the general

law are broad enough to include the cases embraced in the special law."

Where there is a conflict between a general law and a special statute, the special statute

should prevail since it evinces the legislative intent more clearly that the general statute.

Page 19 of 35

Statutory Construction JD-1-1 Case Digest 1

The special law is to be taken as an exception to the general law in the absence of special

circumstances forcing a contrary conclusion. This is because implied repeals are not favored

and as much as possible, given to all enactments of the legislature. A special law cannot be

repealed, amended or altered by a subsequent general law by mere implication.

19. LAYOS, ALEXANDER II B.

LAND BANK v CA - 249 SCRA 19 - October 6, 1995

FACTS: Private respondents are landowners (Pedro L. Yap, Heirs of Emiliano Santiago,

AMADCOR) whose holdings were acquired by Department of Agrarian Reform and subjected

to transfer schemes to qualified beneficiaries under RA 6657. Aggrieved by the alleged

lapses by Department of Agrarian Reform and Land Bank of the Philippines with respect to

the valuation and payment of compensation for their land; private respondents filed a

petition questioning the validity of DAR AO Nos. 6 and 9. They sought to compel DAR to

deposit in cash and bonds the amounts respectively, earmarked, reserved

and deposited in trust accounts for private respondents and allow them to withdraw the

same. Land Bank (petitioner) assail the decision of the Court of Appeals promulgated on

October 20, 1994, which granted private respondents' Petition for Certiorari and Mandamus

ISSUE: Whether or not DAR overstepped the limits of its power when it issue AO No. 9

HELD: Section 16(e) of RA 6657 provides as follows:

Sec.16. Procedure for Acquisition of Private Lands

(e) Upon receipt by the landowner of the corresponding payment or, in case of

rejection or no response from the landowner, upon the deposit with an

accessible bank designated by the DAR of the compensation in cash or in LBP

bonds in accordance with this Act, the DAR shall take immediate possession of

the land and shall request the proper Register of Deeds to issue a Transfer

Certificate of Title (TCT) in the name of the Republic of the Philippines. . . .

The DAR clearly overstepped the limits of its power to enact rules and regulations when it

issued Administrative Circular No. 9. There is no basis in allowing the opening of a trust

account in behalf of the landowner as compensation for his property because, as heretofore

discussed, Section 16(e) of RA 6657 is very specific that the deposit must be made only in

"cash" or in "LBP bonds". In the same vein, petitioners cannot invoke LRA Circular Nos. 29,

29-A and 54 because these implementing regulations cannot outweigh the clear provision of

the law. Respondent court therefore did not commit any error in striking down Administrative

Circular No. 9 for being null and void.

WHEREFORE, the foregoing premises considered, the petition is hereby DENIED for lack of

merit and the appealed decision is AFFIRMED in toto.

20. Legaspi, Gianne Claudette P.

Melendres vs. COMELEC - 319 SCRA 262 - November 25, 1999

Facts: Miguel Melendres filed a case against Ruperto Concepcion contesting the result of

the election. During the preliminary hearing it was shown that no filing fee was paid by the

Melendres, in which payment is required in the COMELEC Rules of Procedure, Rule 37, Sec. 6.

Concepcion moved to dismiss the case on the ground of failure to comply with the said

requirements, but the Metropolitan Trial Court, denied the motion to dismiss on the ground

Page 20 of 35

Statutory Construction JD-1-1 Case Digest 1

that the requirement of payment of filing or docket fee is merely an administrative

procedure and not jurisdictional.

Issue: Whether or not the payment of the filing fee in an election protest is a jurisdictional

requirement.

Held: No. Nothing extant in the COMELEC Rules either expressly or by implication requires

the payment of the filing fee for purposes of conferment upon or acquisition by the Court of

jurisdiction over the case. The Rule speaks only of giving due course to the protest upon the

payment of the filing fee. Therefore, the payment of the filing fee is an administrative

procedural matter, proceeding as it does from an administrative body.

21. MARIN, ELJOHN C.

NPC v Province, 264 SCRA 271, November 19, 1996

FACTS:

Petitioner National Power Corporation (NPC) was assessed real estate taxes

amounting to P154,114,854.82 by the respondents Province of Lanao del Sur; its

governor, Saidamen B. Pangarungan; and its provincial treasurer, Hadji Macmod L.

Dalidig, for its Agus II Hydroelectric Power Plant Complex covering June 14, 1984 to

December 31, 1989, allegedly because NPCs exemption from realty taxes had been

withdrawn.

According to petitioner, it has never been effectively deprived of its tax and duty

exemption privilege granted under Commonwealth Act (CA) 120, as amended and

Republic Act (RA) 6395, as amended. Said statutes created the petitioner a non-profit

public corporation wholly owned by the Government of the Republic of the Philippines

and exempting it from the payment of all forms of taxes, among others. Although the

privileges were temporarily withdrawn, they contended that it were just as quickly

restored, such that at no time did it lose its tax-exempt status.

On the other hand, respondents position was that the petitioners exemption from

payment of realty taxes had been withdrawn or revoked by virtue of Presidential

Decree (PD) 1931 which withdrew all tax exemption privileges to government-owned

or controlled corporations. Contrary to the petitioners claim, the respondents argued

that the tax exemption privilege of NPC was not restored by the Fiscal Incentives

Review Board (FIRB), a body created by PD 776 tasked to determine what subsidies

and tax exemptions should be modified, withdrawn, revoked or suspended. The

respondents questioned the power of FIRB because of its authority to revoke taxes,

which under the constitution, only the legislature may do.

ISSUE:

WON petitioner has ceased to enjoy its exemption from payment of real

property taxes.

HELD: No. The FIRB is authorized to restore tax and / or duty exemptions withdrawn. Since

Hon. Virata fully restored the tax exemption of the petitioner as of July 1, 1985 in his

dual capacity as Minister of Finance and Chairman of the FIRB and, after being

withdrawn again by Executive Order 93, was likewise restored by De Roda, Jr. as of

March 10, 1987 in his dual capacity as Acting Secretary of Finance and as Chairman

of the FIRB, confirmed by the authority of the President, it is clear that petitioners

Page 21 of 35

Statutory Construction JD-1-1 Case Digest 1

tax exemption for the period in question (1984-1989) had effectively been preserved

intact by virtue of their restoration through these FIRB resolutions.

Regarding the respondents question for the FIRBs power to revoke taxes which

according to them, only the legislature may do, the court ruled that specialization in

legislation has become necessary. To many of the problems attendant upon present

day undertakings, the legislature may not have the competence, let alone the

interest and the time, to provide the required direct and efficacious, not to say

specific solutions.

22. Maurin, Nio Jay M.

Pahilan v Tabalba - 230 SCRA 205 - February 21, 1994

Facts:

Petitioner Roleto A. Pahilan and private respondent Rudy A. Tabalba were candidates for

Mayor of Guinsiliban, Camiguin. The Municipal board of Canvassers proclaimed Tabalba as

the duly elected Mayor of Guinsiiliban Camiguin over Pahilan. The Petitioner filed an election

protest thru registered email addressing to the Clerk of Court of the Regional Trial Court of

Mambajao, Camiguin, attached the P200.00 in cash as payment for docket fees. However,

The OIC Clerk of Court of the Regional Trial Court of Mambajao, Camiguin informed the

petitioner the correct docket fees that supposed to be paid amounting to P620.00.

Accordingly, his petition would not be entered in the court docket and summons if he would

not paid the balance of P420.00.

Subsequently, the petitioner paid the required balance in the total amount of P470.00. But,

the clerk of court dismissed the election protest due to non-payment on time of the docket

fees for filing an initiatory pleading.

Within 5 day period to appeal, the petitioner filed a verified appeal brief. But, the court of

appeal informed the petitioner that they did not received any notice of appeal. Due to that,

the Pahilans verified appeal brief dismissed by the court for failure to appeal within the

prescribed period.

Issue(s):

1 Whether or not the respondent trial judge validly dismissed the petition of protest of

petitioner for non-payment on time of the required fee.

2 Whether or not respondent Commission validly dismissed the verified "Appeal" of

petitioner which contains all the elements of a "notice of appeal" and more

expressive of the intent to elevate the case for review by said appellate body, and

furnishing copies thereof to the respondent trial judge and counsel for the adverse

party, aside from the incomplete payment of the appeal fee.

Held:

No The docket fee was paid although insufficient. Statutes providing for election contests

are to be liberally construed that the will of the people in the choice of public officers may

not be defeated by mere technical objections.

No The petitioner filed the verified appeal brief within the required period of filing of an

appeal. Although the court of appeal claimed that he had not received any notice of appeal

from the petitioner. It is to be assumed that the verified appeal brief was received in the

regular course of the mail, filed as of the date of mailing.

Thus, the Order of the Commission on Elections dated January 19, 1993, as well as its

Resolution promulgated on May 6, 1993, both in EAC No. 24-92; and the Order of the

Page 22 of 35

Statutory Construction JD-1-1 Case Digest 1

Regional Trial court of Mambajao, Camiguin, dated October 2, 1992, in Election Case No.

3(92) are hereby REVERSED and SET ASIDE, and the records of this case are hereby ordered

REMANDED to the court a quo for the expeditious continuation of the proceedings in and the

adjudication of the election protest pending therein as early as practicable.

23. MORALES, KATRINA G.

EVANGELISTA vs. PEOPLE - 337 SCRA 671 (August 14, 2000)

FACTS:

On September 17, 1987, Tanduay Distillery, Inc. filed with the Bureau of Internal Revenue

application for tax credit in the amount of P180,701,682.00 for allegedly erroneous

payments of ad valorem taxes from January 1, 1986 to August 31, 1987. The Revenue

Administrative Section (RAS) which was under the Revenue Accounting Division (RAD)

headed by petitioner released a certification in the form of 1st Endorsement. The document

signed by petitioner states that Tanduay made tax payments classified under Tax Numeric

Code (TNC) 3011-0001 totalling P102,519,100.00 and TNC 0000-0000 totalling

P78,182582.00. Teodoro Pareo (head of the Tax and Alcohol Division) certified to Justino

Galban, Jr. (head of the Compounders, Rectifiers and Repackers Section) that Tanduay was a

rectifier not liable for ad valorem tax. Pareo recommended to Aquilino Larin of the Specific

Tax Office that the application for tax credit be given due course. Hence, Larin

recommended that Tanduays claim be approved. Based on this recommendation Deputy

Commisioner Eufracio Santos signed Tax Credit Memo No. 5177 in the amount of

P180,701,682.00.

Ruperto Lim wrote to BIR Commisioner Bienvenido Tan, Jr. that Tax Memo No. 5177 was

anomalous. Larin, Pareo, Galban and Evangelista (petitioner) were charged before the

Sandiganbayan with violation of Section 268 (4) of the National Internal Revenue Code and

of Section 3 (e) of R.A. 3019, the Anti-Graft and Corrupt Practices Act. After a review of the

Supreme Court, petitioner was acquitted of the first charge but the SC affirmed the decision

of conviction on the second violation (Section 3 (e) of R.A. 3019, the Anti-Graft and Corrupt

Practices Act).

ISSUE:

Whether petitioners actions, issuing the certification without identifying the kinds of tax for

which the TNCs stand and without indicating whether Tanduay was entitled to tax credit or

not (that became basis for conviction), fall under acts violating Section 3 (e) of R.A. 3019,

the Anti-Graft and Corrupt Practices Act?

HELD:

NO. The certification made by petitioner was not favorable to Tanduays application for tax