Professional Documents

Culture Documents

Laws & Regulations On Setting Up Business in Japan

Uploaded by

HarryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Laws & Regulations On Setting Up Business in Japan

Uploaded by

HarryCopyright:

Available Formats

Laws & Regulations on Setting

Up Business in Japan

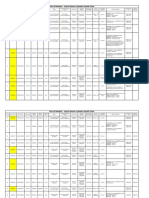

Section 3. Taxes in Japan

3.1 Overview of Japanese corporate tax system for

investment in Japan

3.1.1 Neutrality of tax system with respect to mode of business presence

(branch or subsidiary)

Corporations engaged in economic activities in Japan are subject to taxes in Japan on

the profits generated by those economic activities. Steps have been taken, however, to

ensure that the tax system does not impose unfair burdens on multinational

corporations engaged in economic activities in Japan on the basis of the mode of their

business presence in Japan. Income of corporations established in Japan is, as a rule and

with the exception of certain non-taxable and tax-exempt income, subject to taxation,

regardless of where it was generated (i.e., the source country of income), but when that

income includes profits earned in foreign countries that are taxed in the source

countries of that income, foreign taxation deductions are available whereby taxes paid

in a foreign country may within certain bounds be deducted from Japanese taxes owed

for the purpose of eliminating double taxation between the source country of income

and Japan. Regarding Japanese branches of foreign corporations, measures such as only

certain income is subject to taxation in Japan, have been implemented to avoid

international double taxation in Japan.

The scope of taxable income of Japanese branches of foreign corporations will change

significantly from the business year commencing on or after April 1, 2016. Under the

new regulation applicable from the business year commencing on or after April 1, 2016,

Japanese branches, head office, etc. shall be respectively deemed to be an

independent corporation and subject to taxation. Due to this, the income of a Japanese

branch subject to taxation will be the income attributable to the Japanese branch

(permanent establishment) which is the income earned by the Japanese branch if the

branch is deemed to be a company which is separated/independent from the head

office, etc. as well as other prescribed income. When calculating the income attributable

to the Japanese branch (permanent establishment), the profits/losses from the internal

transactions between the branch and head office, etc. are to be recognized based on

the presumption that transactions are conducted with the arm's length prices.

3.1.2 Withholding at source and self-assessment/payment

Multinational corporations engaged in activities in Japan that earn income subject to

taxation in Japan calculate and pay the taxes owed through withholding procedures or

self-assessed income tax procedures according to their form of corporation and type of

income.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- PandPofCC (8th Edition)Document629 pagesPandPofCC (8th Edition)Carlos Alberto CaicedoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 50 Years of Teaching PianoDocument122 pages50 Years of Teaching PianoMyklan100% (35)

- Photographing Shadow and Light by Joey L. - ExcerptDocument9 pagesPhotographing Shadow and Light by Joey L. - ExcerptCrown Publishing Group75% (4)

- #3011 Luindor PDFDocument38 pages#3011 Luindor PDFcdouglasmartins100% (1)

- Describing-Jobs-British-English StudentDocument3 pagesDescribing-Jobs-British-English Studentrenata pedroso100% (1)

- ISO 9001:2015 Explained, Fourth Edition GuideDocument3 pagesISO 9001:2015 Explained, Fourth Edition GuideiresendizNo ratings yet

- RR 14-01Document9 pagesRR 14-01matinikkiNo ratings yet

- 61716rmo 48-2011Document1 page61716rmo 48-2011HarryNo ratings yet

- BIR Cuts Requirements For Brokers and Importers' ClearancesDocument4 pagesBIR Cuts Requirements For Brokers and Importers' ClearancesPortCallsNo ratings yet

- 2001 RR 17 HousingDocument7 pages2001 RR 17 HousingCherry MaeNo ratings yet

- Revenue Regulations on Cooperative Tax ExemptionsDocument5 pagesRevenue Regulations on Cooperative Tax ExemptionsmatinikkiNo ratings yet

- rr01 01 PDFDocument1 pagerr01 01 PDFHarryNo ratings yet

- rr15 01Document5 pagesrr15 01HarryNo ratings yet

- rr12 01Document12 pagesrr12 01Bryant R. CanasaNo ratings yet

- RR 13-01Document5 pagesRR 13-01Peggy SalazarNo ratings yet

- rr16 01Document3 pagesrr16 01HarryNo ratings yet

- BIR Amends Agreement for Tax Collection Through BanksDocument17 pagesBIR Amends Agreement for Tax Collection Through BanksHarryNo ratings yet

- RR 18-01Document7 pagesRR 18-01JvsticeNickNo ratings yet

- BIR RMC 17 2006Document2 pagesBIR RMC 17 2006Mary Anne BantogNo ratings yet

- rr21 01Document1 pagerr21 01HarryNo ratings yet

- 1873rmc07 - 03 (Annex A)Document1 page1873rmc07 - 03 (Annex A)HarryNo ratings yet

- BIR RMC 17 2006Document2 pagesBIR RMC 17 2006Mary Anne BantogNo ratings yet

- Tax Guide Value Added TaxDocument18 pagesTax Guide Value Added TaxBuenaventura RiveraNo ratings yet

- 1903rmc09 03 PDFDocument3 pages1903rmc09 03 PDFHarryNo ratings yet

- 1859rmc06 - 03 (Annex A)Document2 pages1859rmc06 - 03 (Annex A)HarryNo ratings yet

- 1845rmc05 03 PDFDocument1 page1845rmc05 03 PDFHarryNo ratings yet

- 02-2003 Staggered Filing of ReturnDocument4 pages02-2003 Staggered Filing of Returnapi-247793055No ratings yet

- 1845rmc05 - 03 (Annex A)Document1 page1845rmc05 - 03 (Annex A)HarryNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument6 pagesRepublic of The Philippines Department of Finance Bureau of Internal RevenueJess FernandezNo ratings yet

- MCIT clarification on gross receipts and costs for servicesDocument7 pagesMCIT clarification on gross receipts and costs for servicesjtilloNo ratings yet

- 02-2003 Staggered Filing of ReturnDocument4 pages02-2003 Staggered Filing of Returnapi-247793055No ratings yet

- Tax Collection Goals by Type 2004Document1 pageTax Collection Goals by Type 2004HarryNo ratings yet

- 1689rmc03 03 PDFDocument1 page1689rmc03 03 PDFHarryNo ratings yet

- Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument6 pagesRepublic of The Philippines Department of Finance Bureau of Internal RevenueJess FernandezNo ratings yet

- Collection Goal, by Implementing Office and Major Tax Type, Cy 2004Document1 pageCollection Goal, by Implementing Office and Major Tax Type, Cy 2004HarryNo ratings yet

- 1798rmo04 06tab3Document1 page1798rmo04 06tab3HarryNo ratings yet

- Propiedades Grado 50 A572Document2 pagesPropiedades Grado 50 A572daniel moreno jassoNo ratings yet

- NAT Order of Operations 82Document39 pagesNAT Order of Operations 82Kike PadillaNo ratings yet

- Journal Entries & Ledgers ExplainedDocument14 pagesJournal Entries & Ledgers ExplainedColleen GuimbalNo ratings yet

- Reflection Homophone 2Document3 pagesReflection Homophone 2api-356065858No ratings yet

- Hyper-Threading Technology Architecture and Microarchitecture - SummaryDocument4 pagesHyper-Threading Technology Architecture and Microarchitecture - SummaryMuhammad UsmanNo ratings yet

- Olympics Notes by Yousuf Jalal - PDF Version 1Document13 pagesOlympics Notes by Yousuf Jalal - PDF Version 1saad jahangirNo ratings yet

- Tigo Pesa Account StatementDocument7 pagesTigo Pesa Account StatementPeter Ngicur Carthemi100% (1)

- Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) Digital Literacy Programme For Rural CitizensDocument2 pagesPradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA) Digital Literacy Programme For Rural Citizenssairam namakkalNo ratings yet

- Impact of IT On LIS & Changing Role of LibrarianDocument15 pagesImpact of IT On LIS & Changing Role of LibrarianshantashriNo ratings yet

- DELcraFT Works CleanEra ProjectDocument31 pagesDELcraFT Works CleanEra Projectenrico_britaiNo ratings yet

- 1.2 - Venn Diagram and Complement of A SetDocument6 pages1.2 - Venn Diagram and Complement of A SetKaden YeoNo ratings yet

- CMC Ready ReckonerxlsxDocument3 pagesCMC Ready ReckonerxlsxShalaniNo ratings yet

- Unit-1: Introduction: Question BankDocument12 pagesUnit-1: Introduction: Question BankAmit BharadwajNo ratings yet

- 20 Ua412s en 2.0 V1.16 EagDocument122 pages20 Ua412s en 2.0 V1.16 Eagxie samNo ratings yet

- Striedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsDocument22 pagesStriedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsOsny SillasNo ratings yet

- AgentScope: A Flexible Yet Robust Multi-Agent PlatformDocument24 pagesAgentScope: A Flexible Yet Robust Multi-Agent PlatformRijalNo ratings yet

- SEO-Optimized Title for Python Code Output QuestionsDocument2 pagesSEO-Optimized Title for Python Code Output QuestionsTaru GoelNo ratings yet

- 15 - 5 - IoT Based Smart HomeDocument6 pages15 - 5 - IoT Based Smart HomeBhaskar Rao PNo ratings yet

- Log File Records Startup Sequence and Rendering CallsDocument334 pagesLog File Records Startup Sequence and Rendering CallsKossay BelkhammarNo ratings yet

- Passenger E-Ticket: Booking DetailsDocument1 pagePassenger E-Ticket: Booking Detailsvarun.agarwalNo ratings yet

- Motor Master 20000 SeriesDocument56 pagesMotor Master 20000 SeriesArnulfo Lavares100% (1)

- Sewage Pumping StationDocument35 pagesSewage Pumping StationOrchie DavidNo ratings yet

- Algorithms For Image Processing and Computer Vision: J.R. ParkerDocument8 pagesAlgorithms For Image Processing and Computer Vision: J.R. ParkerJiaqian NingNo ratings yet

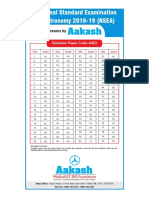

- National Standard Examination in Astronomy 2018-19 (NSEA) : Question Paper Code: A423Document1 pageNational Standard Examination in Astronomy 2018-19 (NSEA) : Question Paper Code: A423VASU JAINNo ratings yet