Professional Documents

Culture Documents

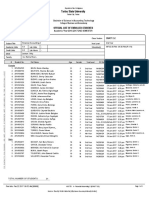

Formation of DD and EE partnership

Uploaded by

miss independentOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Formation of DD and EE partnership

Uploaded by

miss independentCopyright:

Available Formats

1.

On December 1, 2015, DD and EE formed a partnership with each contributing the following assets

at fair market values:

DD

EE

Cash

Machinery and Equipment

Land

Building

Office Furniture

P 9,000

P 18,000

13,500

90,000

27,000

13,500

The land and building are subject to a mortgage loan of P54,000 that the partnership will assume. The

partnership agreement provides that DD and EE share profits and losses 40% and 60%, respectively.

Partners agreed to bring their capital balances in proportion to the profit and loss ratio and using the

capital balance of EE as the basis. The additional cash investment made by DD should be:

2.

JJ and KK are joining their separate business to form a partnership. Cash and non-cash assets are to

be contributed for a total capital of P300,000. The non-cash assets to be contributed and liabilities to be

assumed are:

JJ

KK

Book Value

Fair Value

Book Value

Fair Value

Accounts receivable P22,500

P22,500

Inventories

22,500

33,750

60,000

67,500

Equipment

37,500

30,000

67,500

71,250

Accounts payable

11,250

11,250

7,500

7,500

The partners capital accounts are to be equal after all contributions of assets and assumptions of

liabilities.

Determine:

a. The total assets of the partnership.

b. The amount of cash that each partner must contribute?

3.

On July 1,2016, AA and BB decided to form a partnership. The firm is to take over business assets

and assume liabilities, and capitals are to be based on net assets transferred after the following

adjustments:

a. AA and BBs inventory is to be valued at P31,000 and P22,000, respectively.

b. Accounts receivable of P2,000 in AAs books and P1,000 in BBs books are uncollectible.

c. Accrued salaries of P4,000 for AA and P5,000 for BB are still to be recognized in the books.

d. Unused office supplies of AA amounted to P5,000, while that of BB amounted to P1,500.

e. Prepaid rent of P7,000 and P4,500 are to be recognized in the books AA and BB, respectively.

f. AA is to invest or withdrew cash necessary to have a 40% interest in the firm.

Balance sheets for AA and BB on July 1 before adjustments are given below:

AA

BB

Cash

31,000

50,000

Accounts receivable

26,000

20,000

Inventory

32,000

24,000

Office supplies

5,000

Equipment

20,000

24,000

Accumulated depreciation equipment

(9,000)

(3,000)

Total assets

100,000

Accounts payable

Capitals

Total liabilities and capital

Determine:

a.

b.

c.

d.

e.

f.

g.

4.

The

The

The

The

The

The

The

28,000

72,000

100,000

120,000

20,000

100,000

120,000

net adjustments capital in the books of AA and BB.

adjusted capital of AA and BB in their respective books.

additional investment (withdrawal) made by AA.

total assets of the partnership after formation.

total liabilities of the partnership after formation.

total capital of the partnership after formation.

capital balances of AA and BB in the combined balance sheet.

Bonnie and Clyde entered into a partnership agreement in which Bonnie is to have 55% interest in

the partnership and 35% in the profit and loss and Clyde will have 45% interest in the partnership and 65%

in the profit and loss.

Bonnie contributed the following:

Building

Equipment

Land

235,000

168,000

500,000

255,000

156,000

525,000

The building and the equipment had a mortgage of P50,000 and P35,000, respectively. Clyde is to

contribute P150,000 cash and an equipment. The partners agreed that only the building mortgage will be

assumed by the partnership.

a. What is the fair value of the equipment which Clyde contributed?

b. What is the amount of total assets of the partnership upon formation?

5.

Conrad and Pedro agreed to form a partnership. Conrad is to contribute P135,000 cash and an

equipment with a carrying amount of P135,000 and a fair value of P115,000.

The equipment however has a mortgage attached to it and it is agreed that the partners will assume the

mortgage.

On the other hand, Pedro contributed P240,000 cash.

The partners share profit and loss in the ratio 4:5. Furthermore, part of the agreement is to bring initial

capital in conformity with the profit and loss ratio.

What is the amount of mortgage on the equipment?

6.

On march 1, 2016, II and JJ formed a partnership with each contributing the following assets:

Cash

P300,000

Machinery and equipment 250,000

Building

-

P700,000

750,000

2,250,000

Furniture and Fixtures

100,000

The building is subject to mortgage loan of P800,000, which is to be assumed by the partnership

agreement provides that II and JJ share profits and losses 30% and 70%, respectively. On March 1,2016

the balance in JJs capital account should be:

7.

CC admits DD as a partner in business. Accounts in the ledger for CC on November 30,2015, just

before the admission of DD, show the following balances:

Cash

P6,800

Accounts receivable

14,200

Merchandise inventory

20,000

Accounts payable

8,000

CC, capital

33,000

It is agreed that for purposes of establishing CCs interest, the following adjustments shall be made:

a. An allowance for doubtful accounts of 3% of accounts receivable is to be established.

b. The merchandise inventory is to be valued at P23,000.

c. Prepaid salary expenses of P600 and accrued rent expense of P800 are to be recognized.

DD is to invest sufficient cash to obtain a 1/3 interest in the partnership.

Compute for:

a. CCs adjusted capital before the admission of DD.

b. The amount of cash investment by DD.

You might also like

- Partnership DissolutionDocument7 pagesPartnership DissolutionAngel Frolen B. RacinezNo ratings yet

- Partnership Formation Activity 1 January 28 2023Document12 pagesPartnership Formation Activity 1 January 28 2023Jerlyn SaynoNo ratings yet

- Chapter 1 Partnership Basic Considerations and FormationDocument20 pagesChapter 1 Partnership Basic Considerations and FormationMIKASANo ratings yet

- Partnership LiquidationDocument9 pagesPartnership LiquidationJeasa LapizNo ratings yet

- Accounting For Special TransactionsDocument43 pagesAccounting For Special TransactionsNezer VergaraNo ratings yet

- Distribution of Partnership ProfitsDocument20 pagesDistribution of Partnership ProfitsJOANNA ROSE MANALONo ratings yet

- AdjustmentDocument5 pagesAdjustmentBeta TesterNo ratings yet

- PRACTICAL ACCOUNTING 1 Part 2Document9 pagesPRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagNo ratings yet

- Partnership 2021 - Long ProblemsDocument5 pagesPartnership 2021 - Long ProblemsMichael MagdaogNo ratings yet

- LiquidationDocument2 pagesLiquidationMikelle Justin RaizNo ratings yet

- PAS and PFRSDocument3 pagesPAS and PFRSNicoleNo ratings yet

- PrelimsDocument24 pagesPrelimsRhea BadanaNo ratings yet

- Partnership Formation QuizDocument5 pagesPartnership Formation QuizMJ NuarinNo ratings yet

- Partnership Liquidation: Assets Liabilities & EquityDocument2 pagesPartnership Liquidation: Assets Liabilities & EquityIvy BautistaNo ratings yet

- Quiz On Partnership FormationDocument2 pagesQuiz On Partnership FormationVher Christopher DucayNo ratings yet

- Midterm Exam Parcor 2020Document1 pageMidterm Exam Parcor 2020John Alfred CastinoNo ratings yet

- Ifrs - 9Document6 pagesIfrs - 9Sajoy P.B.No ratings yet

- 4 - Lecture Notes - Partnership DissolutionDocument18 pages4 - Lecture Notes - Partnership DissolutionNikko Bowie PascualNo ratings yet

- CFAS PrelimsDocument12 pagesCFAS PrelimsnamelessNo ratings yet

- Assets: Pedro Castro Statement of Financial Position October 1, 2016Document2 pagesAssets: Pedro Castro Statement of Financial Position October 1, 2016Mandy Bloom0% (1)

- Accounting Chapter 9Document7 pagesAccounting Chapter 9Angelica Faye DuroNo ratings yet

- Maliksi Accounting Services Financial StatementsDocument8 pagesMaliksi Accounting Services Financial StatementsJohn Carldel VivoNo ratings yet

- Acco 30103 Partnership Formation and Operations 04-2022Document3 pagesAcco 30103 Partnership Formation and Operations 04-2022Zyrille Corrine GironNo ratings yet

- Why a Statement of Cash Flows is Critical for Business SuccessDocument5 pagesWhy a Statement of Cash Flows is Critical for Business SuccesskajsdkjqwelNo ratings yet

- Accounting For Partnership FormationDocument28 pagesAccounting For Partnership FormationKrislyn Audrey Chan CresciniNo ratings yet

- Midterm exam partnership and corporation accountingDocument2 pagesMidterm exam partnership and corporation accountingJj Abad BoieNo ratings yet

- Problems: Problem 4 - 1Document4 pagesProblems: Problem 4 - 1KioNo ratings yet

- Partnership and Corporation Accounting ReviewerDocument9 pagesPartnership and Corporation Accounting ReviewerMarielle ViolandaNo ratings yet

- Partnership Dissolution and Liquidation GuideDocument15 pagesPartnership Dissolution and Liquidation GuideDarwyn MendozaNo ratings yet

- A-Standards of Ethical Conduct For Management AccountantsDocument4 pagesA-Standards of Ethical Conduct For Management AccountantsChhun Mony RathNo ratings yet

- Accounting For Special TransactionsDocument1 pageAccounting For Special TransactionsKc SevillaNo ratings yet

- Partnership OpDocument25 pagesPartnership OpNeri La LunaNo ratings yet

- AC17-602P-REGUNAYAN-End of Chapter 1 ExercisesDocument15 pagesAC17-602P-REGUNAYAN-End of Chapter 1 ExercisesMarco RegunayanNo ratings yet

- Fundamentals of PartnershipsDocument6 pagesFundamentals of PartnershipsJobelle Candace Flores AbreraNo ratings yet

- Corporate Accounting TransactionsDocument7 pagesCorporate Accounting TransactionsJohncel Tawat100% (1)

- Accounting For Partnership DissolutionDocument19 pagesAccounting For Partnership DissolutionMelanie kaye ApostolNo ratings yet

- Sec Code of Corporate Governance AnswerDocument3 pagesSec Code of Corporate Governance AnswerHechel DatinguinooNo ratings yet

- Partnership: Definition, Nature and FormationDocument19 pagesPartnership: Definition, Nature and FormationRuthchell CiriacoNo ratings yet

- Accounting For Partnership and Corporation (3 Trimester - CY 2016-2017)Document56 pagesAccounting For Partnership and Corporation (3 Trimester - CY 2016-2017)Gumafelix, Jose Eduardo S.No ratings yet

- Assignment On Partnership DissolutionDocument2 pagesAssignment On Partnership DissolutionGhillian Mae Guiang100% (1)

- Optical Clinic Financial RecordsDocument3 pagesOptical Clinic Financial RecordsJadon MejiaNo ratings yet

- Reviewer: Accounting For Manufacturing OperationsDocument16 pagesReviewer: Accounting For Manufacturing Operationsgab mNo ratings yet

- Partnership Formation QuizDocument1 pagePartnership Formation QuizMaria Carmela MoraudaNo ratings yet

- IntAcc Quiz 1 PDFDocument9 pagesIntAcc Quiz 1 PDFMyles Ninon LazoNo ratings yet

- Partnership Formation AccountingDocument6 pagesPartnership Formation AccountingHelena MontgomeryNo ratings yet

- Notes On Partnership FormationDocument11 pagesNotes On Partnership FormationSarah Mae EscutonNo ratings yet

- Partnerships Liquidation PDFDocument33 pagesPartnerships Liquidation PDFSekar Nurthilawah ManellaNo ratings yet

- Partnership Liquidation Exam AnswersDocument7 pagesPartnership Liquidation Exam AnswersAlexandriteNo ratings yet

- Partnership FormationDocument3 pagesPartnership FormationJules AguilarNo ratings yet

- ADVACCDocument3 pagesADVACCCianne AlcantaraNo ratings yet

- Quiz - Basic Corporate ConceptsDocument3 pagesQuiz - Basic Corporate ConceptsKimberly Etulle CelonaNo ratings yet

- Prefinal Review AcfarDocument8 pagesPrefinal Review AcfarBugoy CabasanNo ratings yet

- Intermediate Accounting FormulasDocument2 pagesIntermediate Accounting FormulasBlee13No ratings yet

- Jan David's Accounting Las 4Document9 pagesJan David's Accounting Las 4Cj ArquisolaNo ratings yet

- Zurita - Summary Table For PSAsDocument2 pagesZurita - Summary Table For PSAsNove Jane ZuritaNo ratings yet

- Chapter 4 Dissolution Q A Final Chapter 4 Dissolution Q A FinalDocument26 pagesChapter 4 Dissolution Q A Final Chapter 4 Dissolution Q A Finalrandom17341No ratings yet

- Chapter 3 - Shareholders' Equity BreakdownDocument17 pagesChapter 3 - Shareholders' Equity BreakdownJohn Lloyd YastoNo ratings yet

- Bus Combination 2Document8 pagesBus Combination 2Angelica AllanicNo ratings yet

- Measuring Business Income AdjustmentsDocument34 pagesMeasuring Business Income AdjustmentsFaiza ShahNo ratings yet

- PLEDGEDocument23 pagesPLEDGEmiss independentNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of Attorneymiss independentNo ratings yet

- Financial Asset at Amortized Cost BDocument2 pagesFinancial Asset at Amortized Cost Bmiss independentNo ratings yet

- Whether or Not RA 6552 Otherwise Known As Maceda Law Can Be Applied Retroactively?Document1 pageWhether or Not RA 6552 Otherwise Known As Maceda Law Can Be Applied Retroactively?miss independentNo ratings yet

- Araullo Vs AquinoDocument1 pageAraullo Vs Aquinomiss independentNo ratings yet

- Investment in AssociateDocument2 pagesInvestment in Associatemiss independentNo ratings yet

- Calculating Investment Income from AssociatesDocument2 pagesCalculating Investment Income from Associatesmiss independent100% (1)

- Investment in Equity Securities 2Document2 pagesInvestment in Equity Securities 2miss independentNo ratings yet

- Investment in Equity SecuritiesDocument3 pagesInvestment in Equity Securitiesmiss independentNo ratings yet

- Investment in Equity Securities 2Document2 pagesInvestment in Equity Securities 2miss independentNo ratings yet

- Bsact 2-2Document1 pageBsact 2-2miss independentNo ratings yet

- People Vs GonzalesDocument2 pagesPeople Vs Gonzalesmiss independentNo ratings yet

- RA 9048 allows correction of clerical errors in civil registryDocument11 pagesRA 9048 allows correction of clerical errors in civil registrymiss independentNo ratings yet

- I Love MyselfDocument1 pageI Love Myselfmiss independentNo ratings yet

- Prayer RequestDocument1 pagePrayer Requestmiss independentNo ratings yet

- Security Markets ReportsDocument10 pagesSecurity Markets Reportsmiss independentNo ratings yet

- I Love My FamilyDocument1 pageI Love My Familymiss independentNo ratings yet

- Thank You Dearest JESUSDocument1 pageThank You Dearest JESUSmiss independentNo ratings yet

- People of The Philippines vs. Jesus Retubado: FactsDocument10 pagesPeople of The Philippines vs. Jesus Retubado: FactsAnonymous fL9dwyfekNo ratings yet

- Yu Oh Vs CADocument1 pageYu Oh Vs CAmiss independentNo ratings yet

- Family Code VIIDocument15 pagesFamily Code VIImiss independentNo ratings yet

- Stars at The NightDocument1 pageStars at The Nightmiss independentNo ratings yet

- Family Code V, VI, VIDocument19 pagesFamily Code V, VI, VImiss independentNo ratings yet

- Investment Setting Measures of Historical Rates of ReturnDocument4 pagesInvestment Setting Measures of Historical Rates of Returnmiss independentNo ratings yet

- Family Code III and IVDocument22 pagesFamily Code III and IVmiss independentNo ratings yet

- Investment Setting Measures of Historical Rates of ReturnDocument4 pagesInvestment Setting Measures of Historical Rates of Returnmiss independentNo ratings yet

- Family Code I and IIDocument10 pagesFamily Code I and IImiss independentNo ratings yet

- Abando, Ann Margarette G. Legal Research LLB Tsu 1ADocument2 pagesAbando, Ann Margarette G. Legal Research LLB Tsu 1Amiss independentNo ratings yet

- Comprehensive Dangerous Act of 2002 (R.a. 9165)Document39 pagesComprehensive Dangerous Act of 2002 (R.a. 9165)Karl_Patayon_2642No ratings yet

- Groom Suits & Groomsmen StylesDocument1 pageGroom Suits & Groomsmen Stylesmiss independentNo ratings yet

- MOCK EXAMS FINALSDocument3 pagesMOCK EXAMS FINALSDANICA FLORESNo ratings yet

- CB 4 Letter To Gov. Cuomo Re Congestion PricingDocument3 pagesCB 4 Letter To Gov. Cuomo Re Congestion PricingGersh KuntzmanNo ratings yet

- Ristvet 2014 Ritual Performance and Politics in The Ancient Near East Final DraftDocument434 pagesRistvet 2014 Ritual Performance and Politics in The Ancient Near East Final Draftflanders_ned_No ratings yet

- Print: A4 Size Paper & Set The Page Orientation To PortraitDocument1 pagePrint: A4 Size Paper & Set The Page Orientation To Portraitnitik baisoya100% (2)

- E - Sugam Notification For KarnatakaDocument8 pagesE - Sugam Notification For KarnatakaHitesh BansalNo ratings yet

- NSO Layered Service Architecture: Americas HeadquartersDocument34 pagesNSO Layered Service Architecture: Americas HeadquartersAla JebnounNo ratings yet

- Sotto vs. TevesDocument10 pagesSotto vs. TevesFranzMordenoNo ratings yet

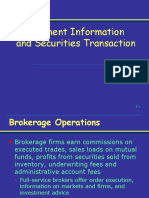

- 3-Investment Information and Securities TransactionDocument59 pages3-Investment Information and Securities TransactionAqil RidzwanNo ratings yet

- Onga 735Document12 pagesOnga 735review20No ratings yet

- ADR R.A. 9285 CasesDocument9 pagesADR R.A. 9285 CasesAure ReidNo ratings yet

- Deuteronomy SBJT 18.3 Fall Complete v2Document160 pagesDeuteronomy SBJT 18.3 Fall Complete v2James ShafferNo ratings yet

- Qualifications approved for direct entry to MRICSDocument7 pagesQualifications approved for direct entry to MRICSJohn BernalteNo ratings yet

- Comprehension and Essay Writing Junior Judicial Assistant Delhi High Court 2012Document2 pagesComprehension and Essay Writing Junior Judicial Assistant Delhi High Court 2012varaki786No ratings yet

- Compromise AgreementDocument2 pagesCompromise AgreementPevi Mae JalipaNo ratings yet

- Organizational ManagementDocument7 pagesOrganizational ManagementMacqueenNo ratings yet

- I. True or FalseDocument5 pagesI. True or FalseDianne S. GarciaNo ratings yet

- EksmudDocument44 pagesEksmudKodo KawaNo ratings yet

- Lumbini Grade 9 Test 2 PhysDocument8 pagesLumbini Grade 9 Test 2 PhysSnow WhiteNo ratings yet

- Project Management of World Bank ProjectsDocument25 pagesProject Management of World Bank ProjectsDenisa PopescuNo ratings yet

- Lighting Users GuideDocument70 pagesLighting Users GuideАлександр МоскалевNo ratings yet

- CS201 Assignment 2 Matrix Addition SolutionDocument8 pagesCS201 Assignment 2 Matrix Addition SolutionTauqeer AwanNo ratings yet

- Eriodic Ransaction Eport: Hon. Judy Chu MemberDocument9 pagesEriodic Ransaction Eport: Hon. Judy Chu MemberZerohedgeNo ratings yet

- Assessing Police Community Relations in Pasadena CaliforniaDocument125 pagesAssessing Police Community Relations in Pasadena CaliforniaArturo ArangoNo ratings yet

- PayGate PayWebv2 v1.15Document23 pagesPayGate PayWebv2 v1.15gmk0% (1)

- Magnitude of Magnetic Field Inside Hydrogen Atom ModelDocument6 pagesMagnitude of Magnetic Field Inside Hydrogen Atom ModelChristopher ThaiNo ratings yet

- Sample Business Plans - UK Guildford Dry CleaningDocument36 pagesSample Business Plans - UK Guildford Dry CleaningPalo Alto Software100% (14)

- Define Ngo, Types of Ngo, Difference Between National Ngo and International NgoDocument8 pagesDefine Ngo, Types of Ngo, Difference Between National Ngo and International NgoPRIYANKANo ratings yet

- DPB50123 HR Case Study 1Document7 pagesDPB50123 HR Case Study 1Muhd AzriNo ratings yet

- Navajo Silversmiths.: IllustrationsDocument18 pagesNavajo Silversmiths.: IllustrationsGutenberg.orgNo ratings yet

- Assignment Title: Professional Issues in ITDocument11 pagesAssignment Title: Professional Issues in IThemacrcNo ratings yet