Professional Documents

Culture Documents

Survey Paper

Uploaded by

Ainur IssinaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Survey Paper

Uploaded by

Ainur IssinaCopyright:

Available Formats

Bitcoin and Cryptocurrency Technology:A Survey

Assel Ramazanova

Department of Computer Science

School of Science and Technology

Nazarbayev University

Astana, Kazakhstan

E-mail: assel.ramazanova@nu.edu.kz

AbstractBitcoin is a new kind of cryptocurrency that has

attracted million people in recent years, providing reliability of

security and free transaction operations . The main purpose of

the Bitcoin is to serve as independent digital currency, where

money are managed by users in direct way instead of financial

institutions such a bank. This invention has become the research

area of interest for significant scientists and we can witness

technical improvements in Bitcoin mechanics annually. In this

survey, I start

by introducing fundamental concepts,

classification of Bitcoin and review the main features of Bitcoin

foundation. Besides, I also provide benefits gaining from the

digital currency and disadvantages which we might face with.

For this purpose, I compare data from all possible researchers

that have already done and analyse the mentioned problems. This

survey involves both the technical and economical points of view.

Keywords Cryptocurrency; Bitcoin technology; mining;

cryptography;

I.

INTRODUCTION

Since a few decades ago the humanity have witnessed

numerous technological advancements, in which the most

significant change came with the internet. Today, almost

everyone has his or her virtual world due to the social networks

or on-line game communities. Thus, there was necessity of

virtual money in order to buy and exchange virtual goods and

services as in real life.For this purpose, the first digital money

was created in 1996 called E-gold and has the same properties

as real money.[33] Although there are distinct between virtual

currency and cryptocurrency, both of them are types of digital

currency.These currencies can be categorized in different way

based on their implementation, the usage area or the interaction

Fig. 1. Types of virtual currency schemes (ECB 2012) [22]

with real world economy. The most reasonable classification

was done by anon in 2012 as presented in [22] figure 1.

The first type is mostly used in on-line game communities and

explained as a closed scheme. Game players usually can make

payments for subscription or to move on the next level during

the game or to order other services via this type of money. This

kind of currency is closed scheme as it can be earned and

wasted only virtually. Regarding the second type of virtual

currency, it is possible to buy them via real money but after

that, they cannot be exchanged back to real money. This kind

of money mostly popular in social networks . The third type

[20] is used in the same way as any real world currency and

exchanged in a bidirectional flow. Of course,all of these three

types of currencies have some advantages and disadvantages.

However, there is the only type that can compete with real

money and the best example for this is a Bitcoin. This

classification of currencies is not on which this survey will

based on.

Here is a technology-wise way to categorised the

currencies[21], where one type of electronic money works with

a client-server model and the second is a distributed currency

that uses peer-to-peer model as in Bitcoin case. In this survey,

I will deeply examine Bitcoin system structure providing the

technical background and the cases of security and privacy

risks. Besides, I will also provide an economical point of view,

highlighting the role of Bitcoin in economy.

II.

BITCOIN OVERVIEW

A. A Brief History

Bitcoin was first created in the world on 31 October 2008

by Satoshi Nakamoto[1], who introduced the invention in his

article named as "Bitcoin: A Peer-to-Peer Electronic Cash

System.Satoshi Nakamoto is known as Bitcoin founder and he

created the first Original Bitcoin client. Nobody know what

exactly considered under Satoshi Nakamoto pseudonym. It

might be one person or group of people. The one thing we can

be convinced in is that he is a Japanese. It can be observed

from P2P profile where he said about it. He has been working

on his project for almost 3 years. In 2010 he disappeared and

stopped involving any improvements . The latest message from

him indicated that Satoshi Nakamoto is "gone for good[8].

His implementation was available in January 2009 as open

source code. Despite the fact that there were other

cryptocurrencies before Bitcoin has created,it is often known as

the first cryptocurrency in the world. To be more precisely,

Bitcoin is the first decentralised digital currency. The main

objective of Bitcoin was to create unusual type of digital

currency which would be independent of financial institutions

[ 22] . All operations between participants would be performed

via internet and directly.

III.

A TECHNICAL OVERVIEW OF BITCOIN

In this part of the survey, I will explain the main aspects

of Bitcoin technology as it was introduced by Satoshi

Nakamoto in [1] Bitcoin: A peer-to-Peer Electronic Cash

System, in 2008. In order to clear understanding all basics of

Bitcoin in terms of the usage operations and the work

processes , there must be covered particular aspects such as

transactions process, peer to peer network system,

cryptography, block chain and mining. So, Bitcoin is a

complex scheme that has a well designed structure and whose

implementation involves a cryptographically methods along

with distributed algorithms. The main feature is that bitcoin is

decentralised currency. In other words, Bitcoin unlike other

cryptocurrencies does not have a central bank that would

control them. That is why, the starting point of survey will

review

how to eliminate the third party in order to

decentrilized the currency.

A. Decentralized Digital Currency

Bitcoin is a peer to peer version of cryptocurrency which is

mostly used for online payments through the Internet, whose

transactions are not controlled by financial institutions such as

bank. Instead of that, the bitcoin system is based on

cryptographic proof that allow people to transfer a coin each

other without the third party[15].Turning to the deep

examination of bitcoins structure, we have to clearly

distinguish centralised digital currency from decentralised

digital currency as it is shown in figure 3. It is known from

traditional or real money, all transfers are conducted by

consulting the third party. For example, let us assume person 1

want to send some coins to person 2. The person 1 need a

trusted source to verify their contract and issue new coins

maintaining all data with serial numbers linking them to

accounts owners. In our real life, for centralized currencies the

trust source can be considered as a bank. In this case, the

transfer process would verified by the bank, after that the

person 2 would get the ownership contract due to the sign

of person 1. Regarding the decentralised design[4], there is no

central control and people can easily to exchange the coins

directly over the blockchain without the government

observation. Now, there is the question of who or what does

take the role of a central bank. The answer is that every

participant considered as a bank and maintain a copy of the

transaction data which would be kept in a traditional bank. So,

in Bitcoin this distributed ledger replaced with Block chain

and all transactions take place there. In addition to this,

Bitcoins are not created by the government organisations[3]

but in a Bitcoin mining processing in which the mentioned

block chain is used. Thus, although there are a considerable

number of networks that can be exist, all of them distinct

based on two factors: centralised his is known as a star and

distributed or grid.

Fig. 3. Centalized, Decentralized and Distributed Networks [4]

B. Transactions

Saying about any transactions and payments we always

imagine a real money and in Bitcoins operations think of some

coins. However, in reality there are not any physical coins that

we can touch. Saying coins, in fact we say about the chain of

the transactions. In order to have a clear picture of it, we

have to turn to the structure of Bitcoin transaction process. So,

as was mentioned above, each coin is considered as a digital

signature.

In figure 4, we can observed the linked list of coin owners,

where each participant transfer the coin to the next one by

digitally signing a hash of transaction that was done before it.

The public key of the second owner must be signed too and

they are added to the and of the electronic coin[17]. The main

issue users might faced with is a double-spending. This term

means that one owner tried or tend to use one Bitcoin more

than once.

Satoshi Nakamoto illustrated the solution in his

project, that can be observed in figure 4, providing open source

code for implementation and detailed description. At first

glance, it seemed to be that the only way to avoid this attack is

to have a trust third party that would verify each transaction

Fig. 4. Simplified Chain of Ownership [1]

The term difficulty [8] in Bitcoin area used when we want

to say how it is hard to find a new hash in a given condition.

The difficulty measure can be calculated by dividing the

highest possible target on the current target.

D. Bitcoin Security: Cryptography

Because Bitcoin security and privacy relies on

cryptographic algorithms, it is wisely to review cryptographic

basics at first. It is also the main reason why Bitcoin is

refferedd as cryptocurrency.The cryptographic methods that

used in Bitcoin transaction process and were observed in [10]

are well known and implemented in other application for

protection information security. As for Bitcoin, it covers two

cryptographic schemes: digital signatures and cryptographic

hash functions[13]. Both of them have the same traditional

approaches as those which widely used to protect government

organizations security.

Fig .5. An example of a blockchain in the Bitcoin network [1]

before adding it to block chain. The idea is that after each

transaction operation, the coin must be mined once again

creating new coin, thus avoiding a double-spending (Fig.5).

Only those coins which were issued from mint can be proved.

However there is a problem with this solution: the quality of

this operation directly depends on the company where coins are

mined. There must be proof that previous owner did not sign

any transactions before. Therefore, we need to know all data

about all transaction have done.In order to realise this solution

without the third part, all transactions must be publicly

available. Moreover, there must be a system in which the

potential owners would perform the proof-of-work.

C. Block Chain and Bitcoin Mining

Block chain can be imagined as a digital cupboard where

each shelf is a block of information. The information in the

shelf contains all data about transactions in order from the

period when that block chain was created. Almost every 10

minutes a new blocks are created in the Bitcoins world. [6]

Block chain gives the opportunity to avoid users from double

spending. In Bitcoin, the term double spending means that

some participant attempts to use one Bitcoin more than once

intending to gain money or because of other

reasons.

However, from Satoshi Nakamoto [1] we know how avoid this

attack. I will examine it in detail in survey later. Turning back

to block chain, we need to a deeply look to its structure. When

the data is added to block chain, new block is connected with

previous block and this process looks like a linked list. It is

required in order to determine the coins ownerships[19]. The

whole number from bottom to top of that blocks or shelves

are called block height. So called block height is always

updating and increasing, as long as the mining process

works[9].From this statement, we can note one important

feature that the bigger block height the more difficult for

block to be proved and added to block chain.[3][17]

In order to be valid to block chain it must be satisfied a

proof-of-work condition.[12] It stands for that the user before

verifying the transactions must to do a certain work to prove

that they a real users. The proof-of-work scheme has been

known from other areas when it was used against to denial of

service attack.[3]

Bitcoins core protocol is available to anyone, has been

improved by thousands of security scientists from

cryptography area. When we use bitcoin, it is similar to using

other private applications in virtual world, for example social

network or internet banking. In order to log in these

communities you should have a password. [7] Likewise, these

other web services, you must access your bitcoin with a private

key to be convinced that you are the only owner of this coin.

Digital signatures

Digital signature [2] is an electronic signature whose

implementation combines cryptographic algorithms of

originator authentication and computation of conditions and a

set of parameters, in order to verify the signer identity.[5]

Briefly speaking, digital signatures allow to authenticate a

message between two participant

verifying following

aspects:

Fig.6. The process of how digital signature is applied and then verified.

Fig. 8. Three main currencies illustration

The third one is the most popular, that is Bitcoin which has

attracted research community.

Fig. 7. A calculation of Bitcoin address [13]

Authentication: the recipient can verify that the message

came from the sender;

Non-repudiation: there is no chance to return the

sending message;

Integrity: the message has not been interfere with.

The implementation of digital signatures involves public key

encryption;

In Figure 6, the process of digitally signing a message is

illustrated.

In Figure 7, a Bitcoin address is calculated by running a public

key through several hash functions as shown above. Here, It is

important to note that at first, a key is not a public but a private.

A hash function is a one-way cryptographic function that takes

an input and turns it into a cryptographic output. Saying oneway it stands for that it is impossible derive the input from the

output. It can be explained as she you encrypt something, and

the lose your key. In the hashing process, all blocks are linked

to each other in a sequence. Therefore each hash impact on the

following blocks. Because we can not know There is a

requirement to start with a group of 0s.

IV.

BITCOIN PROSPECTS

In this part, I will observe the economical role

of

cryptocurrencies, particular of Bitcoin. I will also provide the

advantages and disadvantages of Bitcoin usage, giving

examples where they are relevant. In final section, I will share

with some future expectations for Bitcoin fate.

In Table 1, three the most popular kind of electronic

currencies are listed[14], where the earliest one is the currency

called as E-gold. The second is named as Perfect money and

we can categorize it as a currency with undirected flow. It

means this currency mostly used for online services and can be

exchanged only in one way(from real money to virtual money).

A. The Risks

Now, we have introduced with a technical background of

digital currency and can understand in what way they will

work properly. All inventions, along with their benefits have

some unsolved problems or risks[25]. Let us analyse these

features for Bitcoin.

1.The Disclosure of an anonymity. Although all transaction

processes held in open areas, there is a guarantee of anonymity

as the accounts are not attached to the personal data of users.

However, in the case of uploading the account number in social

networks, forums or somewhere else in the internet it is

possible to identify the account owner. Moreover, if there are

the increasing number of users that are known it is also

possible to remove the anonymity theoretically due to

statistical methods.[25]

2. Data loss. As traditional money, cryptocurrencies also

can be stolen or lost. As a rule all data are saved in computers

as well as files[16]. That is why there is the same risk for

cryptocurrencies as for other documents. Furthermore, they can

not be returned after that. This kind of criminal can be done

via viruses that distribute the wallet data to unauthorized

persons or even via computers with viruses which used for

mining.

B. Economical Role of the Bitcoin: Statistics

Since Bitcoin was invented, there were attractions not only

from computer scientists but also from economists. Because

bitcoin is one kind of money, it can be compete with other

world currencies[11][15]. Annually, the number of users is

increasing. For example, from the figure 8, we can see that the

use of Bitcoin has grown significantly in the period of 6 years

beginning from 2009 , reaching a peak in July, 2015 (at just a

over 192.000 transactions). It is also shown that until 2012m

there almost was not any operations. It means that Bitcoin was

contributed lots of efforts before gaining such popularity in the

Fig. 8. Daily Bitcoin Transactions (www.coindesk.com)

world[24]. For figure 9, the pattern is almost the same: the

Bitcoin amount are increasing constantly.

C. The Future Evaluation of the Bitcoin

It is very hard to evaluate the Bitcoin future because there

was not any equivalent that has ever existed before. So, the fate

of the bitcoin can go in different ways. The more people

concerning and speculating about it, the more opinions are

exist. Obviously, there are three main directions:

1. Bitcoin will be used everywhere, becoming a global

currency and there will not other world currencies;

2. Bitcoin will serve as today, facilitating our payment

operations, but not like a main currency;

3. Bitcoin will replaced by other currency, and disappear

from the world economy totally;

Of course, the listed cases only kinds of suggestions and

there can be some disputes, but every option can occur.

V.

CONCLUSION

In this survey, I have described Bitcoin technical

background covering all basic aspects relevant to mining,

transactions and cryptography methods. The main objective of

paper is to emphasise the necessity of exploring trust in Bitcoin

system. For this purpose I have studied the broad field of

Bitcoin, including its benefits and risks. It is a highly dynamic

area of research, and yet need a lot of work for future

development. To conclude, Bitcoin is a potential currency that

can replace real money.

REFERENCES

[1] S. Nakamoto, Bitcoin : A Peer-to-Peer Electronic Cash System, pp. 19,

November 2008.

[2]Kravitz, David W. "Digital signature algorithm." U.S. Patent No.

5,231,668. 27, pp-2-8 July. 1993.

[3] F. Tschorsch and B. Scheuermann, Bitcoin and Beyond : A Technical

Survey on Decentralized Digital Currencies,pp. 4-20, 2015.

[4]P. Baran, On Distributed Communications: Introduction to Distributed

Communications Networks, RAND memoranda RM-3420-PR, RAND

Distribution Services, Santa Monica, CA. p. 2, 1964.

[5]A. Badev and M. Chen, Bitcoin : Technical Background and Data

Analysis, pp. 138, 2014.

[6] D. Kraft, Difficulty Control for Blockchain-Based Consensus Systems

Bitcoin Mining and the Blockchain, pp. 119, 2015.

Fig. 9. Total number of bitcoins in circulation

[7] J. Bonneau, A. Miller, J. Clark, A. Narayanan, J. A. Kroll, E. W. Felten,

and E. F. Foundation, SoK : Research Perspectives and Challenges for

Bitcoin and Cryptocurrencies. pp. 2-14, 2015.

[7] K. Dokic, M. R. Funaric, and K. P. Galic, The Relationship between the

Cryptocurrency Value ( Bitcoin ) and Interest for it in the Region, pp. 391

398, 2015.

[8] D. Kraft, Difficulty Control for Blockchain-Based Consensus Systems

Bitcoin Mining and the Blockchain, pp. 119, 2015.

[9] I. Eyal and G. Emin, Majority is not Enough : Bitcoin Mining is

Vulnerable. pp. 3-10, November 2013.

[10] R. Farell, An Analysis of the Cryptocurrency Industry An Analysis of

the Cryptocurrency Industry, pp. 3-10, 2015.

[11] A. Singhal and A. Rafiuddin, Role of Bitcoin on Economy, vol. II, pp.

2224, 2014.

[12] D. Kraft, Difficulty Control for Blockchain-Based Consensus Systems

Bitcoin Mining and the Blockchain, pp. 119, 2015.

[13]Bentov, Iddo, and Ranjit Kumaresan. "How to use bitcoin to design fair

protocols." Advances in CryptologyCRYPTO 2014. Springer Berlin

Heidelberg, pp.6-16, 2014.

[14] Reid F, Harrigan M. An analysis of anonymity in the bitcoin system.

Springer New York; pp-4-8, January 2013.

[15]Barber, Simon, et al. "Bitter to betterhow to make bitcoin a better

currency." , pp. 3-10, 2012.

[16]Ron, Dorit, and Adi Shamir. "Quantitative analysis of the full bitcoin

transaction graph." Financial Cryptography and Data Security. Springer Berlin

Heidelberg, 2013. 6-24.

[17]Miers, Ian, et al. "Zerocoin: Anonymous distributed e-cash from bitcoin."

Security and Privacy (SP), 2013 IEEE Symposium on. IEEE,

2013.pp-399-404.

[18]Androulaki, Elli, et al. "Evaluating user privacy in bitcoin." Financial

Cryptography and Data Security. Springer Berlin Heidelberg, 2013. 34-51.

[19]Babaioff, Moshe, et al. "On bitcoin and red balloons." Proceedings of the

13th ACM conference on electronic commerce. ACM, 2012. pp-5-9.

[20]Grinberg, Reuben. "Bitcoin: an innovative alternative digital currency."

Hastings Sci. & Tech. LJ 4 (2012): 159.

[21]Decker, Christian, and Roger Wattenhofer. "Information propagation in

the Bitcoin network." Peer-to-Peer Computing (P2P), 2013 IEEE Thirteenth

International Conference on. IEEE, 2013.

[22] Europe Central Bank, Virtual Currency Schemes, pp-16-18. 2012.

[23]Kaplanov, Nikolei. "Nerdy money: Bitcoin, the private digital currency,

and the case against its regulation." Loy. Consumer L. Rev. 25 (2012): 111.

[24]Kroll, Joshua A., Ian C. Davey, and Edward W. Felten. "The economics of

Bitcoin mining, or Bitcoin in the presence of adversaries." Proceedings of

WEIS. Vol. 2013. 2013.

[25]Karame, Ghassan O., Elli Androulaki, and Srdjan Capkun. "Doublespending fast payments in bitcoin." Proceedings of the 2012 ACM conference

on Computer and communications security. ACM, 2012.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Pi Quick GuideDocument61 pagesPi Quick GuideUdayNo ratings yet

- Key Management and DistributionDocument6 pagesKey Management and Distributiongraduation projectNo ratings yet

- Taewoo Kim Et Al. v. Jump TradingDocument44 pagesTaewoo Kim Et Al. v. Jump TradingCrainsChicagoBusiness100% (1)

- InsuranceDocument82 pagesInsuranceNikesh KothariNo ratings yet

- CISSP Study Guide On CryptographyDocument48 pagesCISSP Study Guide On CryptographyrakeshrjainsNo ratings yet

- TA4 - Cyber Security - 1688734977204Document66 pagesTA4 - Cyber Security - 1688734977204Deepak KumarNo ratings yet

- E - Commerce AssignmentDocument26 pagesE - Commerce AssignmentWA The LabelNo ratings yet

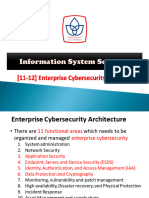

- PU Is Security - 12. Enterprise Cybersecurity ArchitectureDocument42 pagesPU Is Security - 12. Enterprise Cybersecurity ArchitecturealifaldindaNo ratings yet

- BMC ADDM ExplainedDocument28 pagesBMC ADDM ExplainedPraveen LawrenceNo ratings yet

- Ijct V3i2p3Document5 pagesIjct V3i2p3IjctJournalsNo ratings yet

- Image Authentication TechniquesDocument25 pagesImage Authentication TechniquesKamlekar Venkateshwar100% (2)

- Jiang2018 PDFDocument12 pagesJiang2018 PDFMENANI ZineddineNo ratings yet

- Apple White Paper On FileVault 2Document42 pagesApple White Paper On FileVault 2LondonguyNo ratings yet

- Diffie-Hellman Key Exchange ExplainedDocument6 pagesDiffie-Hellman Key Exchange ExplainedMilica LukicNo ratings yet

- Blind AuthenticationDocument29 pagesBlind AuthenticationRohan Abraham0% (1)

- Bitcoin-Monero Cross-Chain Atomic SwapDocument10 pagesBitcoin-Monero Cross-Chain Atomic SwapCorey Lee SquiresNo ratings yet

- MCQS - Cs 707 Paper-SolvedDocument21 pagesMCQS - Cs 707 Paper-SolvedShahid AzeemNo ratings yet

- ECMA-386 NFC PDFDocument26 pagesECMA-386 NFC PDFLazar IvanicNo ratings yet

- CloudEngine 6800 V200R005C20 Configuration Guide - IP MulticastDocument544 pagesCloudEngine 6800 V200R005C20 Configuration Guide - IP Multicastdl_maheshNo ratings yet

- Break the CodeDocument165 pagesBreak the CodeMayur ShettNo ratings yet

- Unit-Iv Hash FunctionDocument19 pagesUnit-Iv Hash Functionsriramganesh8107No ratings yet

- Training Manual SignServer-v10-20221012 - 223306Document47 pagesTraining Manual SignServer-v10-20221012 - 223306Mouhamed Lamine DiankhaNo ratings yet

- E Commerce 2017 14th Edition Laudon Test BankDocument26 pagesE Commerce 2017 14th Edition Laudon Test Bankquynhagneskrv100% (30)

- Classical Encryption TechniquesDocument44 pagesClassical Encryption TechniquesprasanthrajsNo ratings yet

- How To Configure A Service Provider - ABAP ConnectivityDocument9 pagesHow To Configure A Service Provider - ABAP ConnectivitywilliammgcNo ratings yet

- CryptDB Sosp11 PDFDocument16 pagesCryptDB Sosp11 PDFAnonymous ChASJ3eFsHNo ratings yet

- A A G G S S DES DES: Ppendix Ppendix Implified ImplifiedDocument4 pagesA A G G S S DES DES: Ppendix Ppendix Implified ImplifiedSkyline VideosNo ratings yet

- Sat 21.PDF Secure VaultDocument11 pagesSat 21.PDF Secure VaultVj KumarNo ratings yet

- Encryption Lesson Plan 22Document3 pagesEncryption Lesson Plan 22Matt DNo ratings yet

- Applied Cryptography and Network SecurityDocument390 pagesApplied Cryptography and Network Securitylarspier100% (4)