Professional Documents

Culture Documents

10 Kannan

Uploaded by

Anonymous CwJeBCAXpCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

10 Kannan

Uploaded by

Anonymous CwJeBCAXpCopyright:

Available Formats

SRJIS/BIMONTHLY/ DR. V.S.

KANNAN KAMALANATHAN (2449-2457)

WOMEN EMPOWERMENT AND MICROFINANCE - A STUDY ON SELF HELP

GROUPS IN THANE DISTRICT OF MAHARASHTRA

V.S. Kannan Kamalanathan, Ph. D.

Vice Principal, HOD & Research Guide, KES Shroff College of Arts and Commerce

Mumbai-67

Abstract

Women empowerment in the context of womens development is a way of defining, challenging and

overcoming barriers in a womens life through which she increases her ability to shape her life and

environment. It is an active multidimensional process, which should enable women to realize their full

identity and power in all spheres of life. India envisions a future in which Indian women are

independent and self reliant. It is unfortunate that because of centuries of inertia, ignorance and

conservatism, the actual and potential role of women in the society has been ignored, preventing them

from making their rightful contribution to social progress. Women entrepreneurship development is

an essential part of human resource development. Entrepreneurship amongst women has been a

recent concern. Women have become aware of their existence their rights and their work situation.

However, women of middle class are not too eager to alter their role in fear of social backlash. The

progress is more visible among upper class families in urban cities. However it is observed the

development of women entrepreneurship is very low in India, especially in the rural areas. The

present paper is based on primary and secondary data collected from different sources and specially

focus on women entrepreneurship. The collected data has been analyzed through statistical

techniques i.e. SPSS, EXCEL and conclusion were drawn

Key Words: Women Empowerment, micro finance, entrepreneurship, social progress

Scholarly Research Journal's is licensed Based on a work at www.srjis.com

Introduction:

The research plan on Women empowerment and Micro Finance a study on Self Help

Groups in Thane District of Maharashtra presents the background and broad framework for

the research work proposed to be carried out on the above topic. The finding of the study is

useful for the Micro Finance Institutions (MFIs) of the country. This study will represent the

marketing practices which are being used by the Micro Financing Institutions to achieve the

goal of financial inclusion. The study will also help to the small organizations as well as

weaker section of the society

JULY-AUG 2016, VOL-4/25

www.srjis.com

Page 2449

SRJIS/BIMONTHLY/ DR. V.S. KANNAN KAMALANATHAN (2449-2457)

Self Help Group

Self Help Group is defined as a small economically homogeneous and affinity group of rural

poor voluntarily formed, to save and mutually agree upon a collective decision. The

common fund, established through individual contribution by way of savings will be lent to

its members as per group decision. The concept of SHG serves to underline the principle of

for the poor, by the poor, of the poor. Self-help group mechanism has been widely accepted

as an integral part of micro credit. Several directives and guidelines from the RBI and

NABARD to the commercial banks have clearly mentioned the needs to recognize the selfhelp group as a potential tool of micro credit. The RBI has launched the programme of

linking self-help group with lending institutions like commercial banks so that the credit

requirements of self-help groups can be properly attended to, by the commercial banks.

Along with the self-help group, NGOs also play a pivotal role in obtaining the micro credit

for the rural poor.

Among the various districts of Maharashtra, Thane District occupies a predominant position

in the starting of the SHGs. In Thane District the urban centers have more rural bias and the

economic activities are more agro-based. Hence, the SHGs have been formed for meeting the

needs of industrial and agricultural activities.

Micro Finance:Microfinance is the provision of financial services to low-income clients or solidarity lending

groups including consumers and the self-employed, who traditionally lack access to banking

and related services. More broadly, it is a movement whose object is "a world in which as

many poor and near-poor households as possible have permanent access to an appropriate

range of high quality financial services, including not just credit but also savings, insurance,

and fund transfers." Those who promote microfinance generally believe that such access will

help poor people out of poverty. Micro finance in the recent past has emerged as a potential

instrument for poverty alleviation and women empowerment. Microfinance is a broad

category of services, which includes microcredit. Microcredit is provision of credit services

to poor clients.

The word micro financing today has its roots in 1970s when some organizations started to

engage actively in giving microloans to some pre-qualified people. One of the prominent

organizations that institutionalized the word microfinance

was Grameen Bank of

Bangladesh grounded by the man we called microfinance pioneer, Muhammad Yunus.

There are also some claims attributed to Akhtar Hameed Khan who promoted participatory

rural development in Pakistan.

JULY-AUG 2016, VOL-4/25

www.srjis.com

Page 2450

SRJIS/BIMONTHLY/ DR. V.S. KANNAN KAMALANATHAN (2449-2457)

Marketing Practices which are following by Micro Financial Institutions (MFIs) or can be say

Microfinance lending models:- Peer pressure, Associations(SHGs), Bank guarantees,

Community banking, Co-operatives, Credit unions, Grameen banks, Groups, Individual,

Intermediaries NGOs, ROSCA, Small business and Village bank

Different Legal forms of the MFIs in India

1.

NGO MFIs: Societies Registration Act, 1860, (this was enacted under the British Raj

in India to provide registration of literary, scientific and charitable societies. These societies

are formed by a memorandum of association by any seven people associated for any literary,

scientific and charitable purpose.) or Similar Provincial Acts/ Indian Trust Act, 1882. (This

act defines and amends the law relating to private trusts and trustees.)

2. The Non-profit companies: Section 25 of the Companies Act, 1956. (Section 25 of this

act deals with legal forms of non-profit organizations and due to better laws section 25

companies have the most reliable organizational structure and these companies are formed for

the sole purpose of promoting commerce, arts, science, culture etc.)

3. Cooperative MFIs: Cooperative Societies Acts of the State & Central Governments.

(Cooperative society is a society which has as its object the promotion of economic interest

of its members in accordance with the cooperative principles and the society may be

registered with or without limited liability)

4. Non-Banking Financial Companies (NBFCs): Indian Companies Act, 1956 (This is an

act to consolidate and amend the laws relating to companies and certain other associations.)

Reserve Bank of India Act, 1934. (This act constitutes the central bank of India which deals

with other bank issues and looks after the monetary policy of the country

Review of Literature

Dr. K. Ravichandran, Dr. Khalid Alkhathalan in their study financial inclusion is a path in

which Indias future economic growth found that country growth rate is 9%, still the growth

is not inclusive with the economic condition of the people in rural areas worsening further.

Basic reason of poverty is the financial exclusion. In India 40% people could not avail the

financial services such as credit, insurance etc. So the financial inclusion not only for

bankable clients but also for non-bankable clients..

Roberto More Visconti (2009) observed that the global recession which started in 2008 after

the subprime crisis and the unprecedented default or re-sue of many financial institutions has

strongly affected the credibility of the international banking system, damaging also the real

economy Intrinsic characteristics of microfinance, such as closeness to the borrowers,

JULY-AUG 2016, VOL-4/25

www.srjis.com

Page 2451

SRJIS/BIMONTHLY/ DR. V.S. KANNAN KAMALANATHAN (2449-2457)

limited risk and exposure and little if any correlation with international markets have an anticyclical effect. In hard and confused times, it pays to be little, flexible and simple.

Narayanan Memorial Lecture by Dr. Subir Gokarn, Deputy Governor, Reserve Bank of India

at Sastra University, Kumbakonam Financial Inclusion: A Consumer Centric View on

March 21, 2011 stated that basic premise of this lecture was that we need to take fully into

account various behavioral and motivational attributes of potential consumers for a financial

inclusion strategy to succeed.

Objectives of Study

1. To understand the nature and scope of micro-finance and its significance from economic

point of view.

2. To compare the impact of micro finance on the socio economic conditions of the

members of SHGs before and after the formation of SHGs

Scope of Study

The Reserve Bank of India identified large gap in the demand and supply of credit to the poor

and suggests the urgent need to widen the scope, outreach and scale of financial services to

cover the un-reached populace. The study will try to find out the reasons behind it. Another

strong reason to study that in the time of recession when banks are moving toward

bankruptcy whereas micro finance institutions are recovering 100% loan without having any

NPAs even without any collateral security. The present study addressed itself to the basic

research theme of contribution of microfinance institutions in social development and

appraisal the contribution of Micro Financing to achieve the goal of Financial Inclusion.

Research Methodology

The present study is based on primary as well as secondary data. The personal interview

method has been adopted to collect primary data. For this, a well designed and a pre-tested

interview schedule was prepared to collect the information relating to the study. With a view

to identify the growth of micro credit scheme, the researcher had an in depth review of

previous studies undertaken, relating to the topic of the present study. Further, the researcher

had preliminary discussion with the officials of the Mahila Scheme and few NGOs registered

in Mahila scheme, Thane District. The secondary data were collected from books, journals,

RBI Bulletins, NABARD, annual reports and reports of the project implementation unit,

Thane district.

Sample Size:In India, various financial institutes are engaged in providing micro finance. These

institutions are both from the public sector and private sectors. The population are the

JULY-AUG 2016, VOL-4/25

www.srjis.com

Page 2452

SRJIS/BIMONTHLY/ DR. V.S. KANNAN KAMALANATHAN (2449-2457)

universe for the study is Self Help Groups in Thane District. The size of the sample collected

was 622 members from Self Help Groups. The samples have been selected on random basis.

Technique of the study:The data collected will be analyzed and interpreted by applying need based statistical

tools and techniques. The same will be presented in the form of graphic, tables, charts and

through running materials for interpretation by various interested group

Hypotheses

Ho1- Self Help groups do not require Micro finance for the development of its members.

Ho2-There is no impact of micro financial institution initiative on SHGs members.

Analysis and Interpretation of Data

Nnature and scope of micro-finance

To understand the nature and scope of micro-finance and its significance from economic

point of view, We consider tabulated data of demographic variables Taluka, Age,

Occupation along with economic variables namely Personal Income, Amount of savings,

before and after the membership of SHG (per month) were studied

The -economic profile of the sample Self Help Group members such as, household income,

expenditure, savings in SHGs, standard of living of the respondents and their economic

contribution to their family, average annual income, average contribution to the family

income, savings pattern before joining SHGs members after joining SHG, progress of

income and savings per month is seen on the table-1.

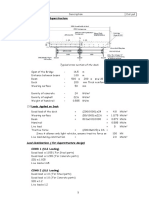

Table-1 Taluka-wise Details of Personal Income before the membership of SHG (per

month)

Personal Income before the membership of SHG (per month)

Below

Rs 2001- Rs. 3001 Rs 4001- Above

Rs.2000 3000

4000

5000

Rs. 5000 Total

Sahapur

52

34

14

8

5

113

Wada

38

20

14

3

2

77

Palghar

24

16

08

3

1

52

Vasai

56

27

16

9

2

110

Murbad

49

17

12

5

2

85

Kalyan

31

14

07

2

1

55

Bhiwandi

53

14

05

1

2

75

Ulhasnagar

28

16

06

3

2

55

Total

331

158

82

84

17

622

Taluka

Personal Income after the membership of SHG

From the table-2 it is been observed that taluka wise detailed personal income after

becoming the membership of SHG per month is been analysed. It is observed that among the

JULY-AUG 2016, VOL-4/25

www.srjis.com

Page 2453

SRJIS/BIMONTHLY/ DR. V.S. KANNAN KAMALANATHAN (2449-2457)

earning per month after become members of SHGs has increased tremendously in every

taluka.

Table no.2 Taluka-wise Details of Personal Income after the membership of SHG (per

month)

Personal Income after the membership of SHG (per month)

Rs

Rs.

Below

40016001 Rs.8001- Above

Rs. 4000 6000

8000

10000

Rs.10000 Total

Sahapur

46

32

18

11

6

113

Wada

35

23

11

06

2

77

Palghar

27

14

07

04

0

52

Vasai (E)

52

24

17

12

5

110

Murbad

45

18

12

06

4

85

Kalyan

28

14

07

04

2

55

Bhiwandi

43

18

08

05

1

75

Ulhasnagar 29

14

07

04

1

55

Total

305

157

87

52

21

622

Taluka

Testing of Hypotheses

Hypothesis 1:

H0- Self Help group members does not require Micro finance for the development of its

members

H1- Self Help group members require Micro finance for the development of its members.

To test above hypothesis Beneficiaries perception about social empowerment are considered

on five point agreement scale with following code. Strongly agree, Agree, Neither agree nor

disagree, disagree and strongly disagree. For testing above hypotheses we compare mean

rating scores with score 2 (which gives positive agreement opinion rating score). For testing

purpose we rewrite above hypotheses as below

Null Hypothesis: Mean rating scores for social development is greater than 2.

Alternative hypothesis: Mean rating scores for social development is less than or equal to 2.

For testing above null hypothesis we use one samples test with hypothesized mean value 2.

The details of which are tabulated as follows.

Observation:

From table-3, it is observed that t value for null hypothesis is -12.960 which is less than 2.326. Also p value is 0.000 which is less than 0.01. Hence the null hypothesis cannot be

rejected at 5% & 1% level of significance.

JULY-AUG 2016, VOL-4/25

www.srjis.com

Page 2454

SRJIS/BIMONTHLY/ DR. V.S. KANNAN KAMALANATHAN (2449-2457)

Table No.3 One samplet test of mean vs. hypothesized score 2 for requirement of

microfinance Self Help group members

Mean

score

Sample

size

Degree of

freedom

Calculated

t value

(one tailed,

upper )

Significant

P value

Hypothesized

mean

scores for requirement

0 = 2

of microfinance Self

Help group members

n= 623

d.f.= 622 t = -12.960

Observed Mean rating

p =0.000

scores for requirement 1=

of microfinance Self 1.718

Help group members.

Critical t values:

1. At 5% level of significance the corresponding value t with d.f. 622 is 1.645

2. At 1% level of significance the corresponding t value with d.f. 622 is 2.326

Interpretation:

On the basis of above data it can be inferred Mean rating scores for requirement of

microfinance Self Help group members is less than or equal to 2

Findings:

Self Help group members require Micro finance for the development of its members.

Hypothesis 2:

Ho: There is no impact of micro financial institution initiative/support/encouragement (any

one) on SHG members

H1: There is impact of micro financial institution initiative/support/encouragement (any one)

on SHG members.

To test above hypothesis Beneficiaries perception about impact of micro financial institution

initiative are considered on five point agreement scale with following code. Strongly agree,

Agree, Neither agree nor disagree, Disagree and strongly disagree. For testing above

hypotheses we compare mean rating scores with score 2 (which gives positive agreement

opinion rating score). For testing purpose we rewrite above hypotheses as below

Null Hypothesis: Mean rating scores for impact of micro financial institution initiative on

SHG members is greater than 2.

Alternative hypothesis: Mean rating scores for impact of micro financial institution

initiative on SHG members is less than or equal to 2.

JULY-AUG 2016, VOL-4/25

www.srjis.com

Page 2455

SRJIS/BIMONTHLY/ DR. V.S. KANNAN KAMALANATHAN (2449-2457)

Table No.4 One sample t test of mean vs hypothesized score 2 for impact of micro

financial institution initiative on SHG members.

Mean

score

Sample

size

Degree of Calculated Significant

freedom

t value

P value

(one

tailed,

upper )

Hypothesized

mean

scores for impact of

micro

financial 0 = 2

institution initiative on

SHG members.

d.f.= 622

p =0.000

Observed Mean rating

scores for impact of

n= 623

t

=

1=

micro

financial

30.205

1.718

institution initiative on

SHG members.

Critical t values:

1. At 5% level of significance the corresponding value t with d.f. 622 is 1.645

2. At 1% level of significance the corresponding t value with d.f. 622 is 2.326

For testing above null hypothesis we use one samplet test with hypothesized mean value 2.

The details of which are tabulated in table -4.

Observation:

From the table-4, it is observed that t value for null hypothesis is -30.205 which is less than

-2.326. Also p value is 0.000 which is less than 0.01. Hence the null hypothesis cannot be

rejected at 5% & 1% level of significance.

Interpretation:

On the basis of above data it can be inferred Mean rating scores for impact of micro financial

institution initiative on SHG members on is less than or equal to 2

Findings:

There is impact of micro financial institution initiative on SHG members.

Conclusion:

Savings and credit are two basic elements in any developmental stgrategy.

People

irrespective of their position, should be encouraged to save and must be given safe and

profitable options to save. Similarly they must be given sufficient and protected access to

credit. Time is now ripe that the policy makers and practioners swing into action so that they

do not miss the opportunity.

Microfinance has made tremendous progress in India. It has become a household name, in

view of the variety of benefits reaped by the poor from microfinance services. Self Help

groups have become the common vehicle of development process, converting all

JULY-AUG 2016, VOL-4/25

www.srjis.com

Page 2456

SRJIS/BIMONTHLY/ DR. V.S. KANNAN KAMALANATHAN (2449-2457)

developmental programmes. At present, a large number of SHGs , all the banking agencies

and Microfinance Institutions (MFIs) are pursuing this programme for upliftment of the poor.

RBI also recognized it as part of priority sector lending and normal banking business. The

programme is also the main contributor towards financial inclusion in the country. Micro

finance is a powerful tool for social and economic development. It has been recognized as an

effective strategy for the empowerment of women. It is very useful for repayment of loan of

bank, reduction in transaction cost to the poor and to the banks and to the banks, door step

savings and credit facilities to poor in rural India.

For achieving complete financial inclusion and for inclusive growth, the RBI, Government,

NABARD and the implementing agencies will have to put their minds and hearts together so

that the financial inclusion can be encouraged. There should be proper financial inclusion in

our country and the access to financial services should be made through SHGs and MFIs,

thus, financial inclusion is a big broad road which Indians needs to travel to make it

completely successful.

References

report of the committee on financial inclusion in india (Chairperson : C. Rangarajan ) (2008)

Narayanan Memorial Lecture by Dr. Subir Gokarn, Deputy Governor, Reserve Bank of India at

Sastra University, Kumbakonam - Financial Inclusion: A Consumer Centric View on March

21, 2011

Reserve Bank Of India. Webside.

Financial Inclusion in India: A case-study of West Bengal

Financial Inclusion: A Consumer Centric View - VI V. Narayanan Memorial Lecture by Dr. Subir

Gokarn, DG, RBI

Financial Inclusion in India: A case-study of West Bengal Sadhan Kumar Chattopadhyay

Ramakrishnan, R. (2007). Micro Finance Emerging Trends in Financial Management, April 17.

Available at http://www.indianmba.com/Faculty_Column/FC557/fc557.html

Khandelwala, Anil K. (2007). Microfinance Development Strategy for India, Economic and

Political Weekly, Vol. XLII, No.13, March 31-April 6, pp. 1127-35.

SSRN parer-Manisha Rajstudy Microfinance institutions in India and its legal aspects

V. Basil Hans Innovations in Microfinance Looking beyond income poverty ssrn parer

Dr. K. Ravichandran, Dr. Khalid Alkhathalan paper financial inclusion is a path in which Indias

future economic growth

Narayanan Memorial Lecture by Dr. Subir Gokarn, Deputy Governor, Reserve Bank of India at

Sastra University, Kumbakonam - Financial Inclusion: A Consumer Centric View on March

21, 2011

Jayasheela, Dinesha P.T and V. Basil Hans Financial Inclusion and Microfinance in India: An

Overview ssrn paper.

Rangarajan C. (2007), Financial Inclusion: Some Key Issues, Lecture delivered at Mangalore

University, Mangalore, and August 10, 2007

JULY-AUG 2016, VOL-4/25

www.srjis.com

Page 2457

You might also like

- 19.Dr Ibrahim Aliyu ShehuDocument29 pages19.Dr Ibrahim Aliyu ShehuAnonymous CwJeBCAXpNo ratings yet

- 13.nasir RasheedDocument9 pages13.nasir RasheedAnonymous CwJeBCAXpNo ratings yet

- 25.suresh ChenuDocument9 pages25.suresh ChenuAnonymous CwJeBCAXpNo ratings yet

- 29.yuvraj SutarDocument4 pages29.yuvraj SutarAnonymous CwJeBCAXpNo ratings yet

- Homesh RaniDocument7 pagesHomesh RaniAnonymous CwJeBCAXpNo ratings yet

- 4.Dr Gagandeep KaurDocument13 pages4.Dr Gagandeep KaurAnonymous CwJeBCAXpNo ratings yet

- Customers' Consciousness About Financial Cyber Frauds in Electronic Banking: An Indian Perspective With Special Reference To Mumbai CityDocument13 pagesCustomers' Consciousness About Financial Cyber Frauds in Electronic Banking: An Indian Perspective With Special Reference To Mumbai CityAnonymous CwJeBCAXpNo ratings yet

- Effect of Life Skill Training On Mental Health Among B.ed. Interns in Relation To Their Impulsive BehaviourDocument9 pagesEffect of Life Skill Training On Mental Health Among B.ed. Interns in Relation To Their Impulsive BehaviourAnonymous CwJeBCAXpNo ratings yet

- Technostress, Computer Self-Efficacy and Perceived Organizational Support Among Secondary School Teachers: Difference in Type of School, Gender and AgeDocument13 pagesTechnostress, Computer Self-Efficacy and Perceived Organizational Support Among Secondary School Teachers: Difference in Type of School, Gender and AgeAnonymous CwJeBCAXpNo ratings yet

- 1.prof. Ajay Kumar AttriDocument8 pages1.prof. Ajay Kumar AttriAnonymous CwJeBCAXpNo ratings yet

- A Study of Effect of Age and Gender On Stress of AdolescentsDocument5 pagesA Study of Effect of Age and Gender On Stress of AdolescentsAnonymous CwJeBCAXpNo ratings yet

- Aggression Among Senior Secondary School Students in Relation To Their Residential BackgroundDocument8 pagesAggression Among Senior Secondary School Students in Relation To Their Residential BackgroundAnonymous CwJeBCAXpNo ratings yet

- Historical Development of Play Schools in IndiaDocument11 pagesHistorical Development of Play Schools in IndiaAnonymous CwJeBCAXpNo ratings yet

- 29 Balwinder SinghDocument8 pages29 Balwinder SinghAnonymous CwJeBCAXpNo ratings yet

- 28 Shailaja KanwarDocument12 pages28 Shailaja KanwarAnonymous CwJeBCAXpNo ratings yet

- A Lookout at Traditional Games Played by Tribes in IndiaDocument4 pagesA Lookout at Traditional Games Played by Tribes in IndiaAnonymous CwJeBCAXpNo ratings yet

- Women Empowerment and Religion's Role in Gender Relations in KargilDocument10 pagesWomen Empowerment and Religion's Role in Gender Relations in KargilAnonymous CwJeBCAXpNo ratings yet

- 24 Adv Raj KumarDocument5 pages24 Adv Raj KumarAnonymous CwJeBCAXpNo ratings yet

- The Use of English Language During PandemicDocument7 pagesThe Use of English Language During PandemicAnonymous CwJeBCAXpNo ratings yet

- The Need of Remote Voting Machine in Indian Voting SystemDocument7 pagesThe Need of Remote Voting Machine in Indian Voting SystemAnonymous CwJeBCAXpNo ratings yet

- 31 Dr. Suman Kumari, Prof. Sudarshana Rana & Ms. Anita VermaDocument9 pages31 Dr. Suman Kumari, Prof. Sudarshana Rana & Ms. Anita VermaAnonymous CwJeBCAXpNo ratings yet

- 25 AshaDocument5 pages25 AshaAnonymous CwJeBCAXpNo ratings yet

- 23 JayalakshmiDocument9 pages23 JayalakshmiAnonymous CwJeBCAXpNo ratings yet

- 26 Dr. Reni Francis Mr. Rajendra DeshmukhDocument5 pages26 Dr. Reni Francis Mr. Rajendra DeshmukhAnonymous CwJeBCAXpNo ratings yet

- 22 Pavithra.g ArticleDocument8 pages22 Pavithra.g ArticleAnonymous CwJeBCAXpNo ratings yet

- 30 Trishala BhaskarDocument7 pages30 Trishala BhaskarAnonymous CwJeBCAXpNo ratings yet

- Suyambukani VDocument6 pagesSuyambukani VAnonymous CwJeBCAXpNo ratings yet

- Deepa AnwarDocument17 pagesDeepa AnwarAnonymous CwJeBCAXpNo ratings yet

- Payal BhatiDocument10 pagesPayal BhatiAnonymous CwJeBCAXpNo ratings yet

- 21 DR ReniDocument6 pages21 DR ReniAnonymous CwJeBCAXpNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Stop Order NoticeDocument2 pagesStop Order Noticeapi-37083620% (2)

- Problems and Constraints in Banana Cultivation: A Case Study in Bhagalpur District of Bihar, IndiaDocument9 pagesProblems and Constraints in Banana Cultivation: A Case Study in Bhagalpur District of Bihar, IndiaVasan MohanNo ratings yet

- Constitution NotePadDocument8 pagesConstitution NotePadJanet GawareNo ratings yet

- Room Rental AgreementDocument3 pagesRoom Rental AgreementgrandoverallNo ratings yet

- Gazette Copy of West Bengal Real Estate Regulationand Development Rules 2021Document50 pagesGazette Copy of West Bengal Real Estate Regulationand Development Rules 2021Anwesha SenNo ratings yet

- Sectoral AnalysisDocument416 pagesSectoral AnalysisNICOLE EDRALINNo ratings yet

- Le Et Al v. ArciTerra Group, LLC - Document No. 7Document2 pagesLe Et Al v. ArciTerra Group, LLC - Document No. 7Justia.comNo ratings yet

- Marketing Research ProposalDocument42 pagesMarketing Research ProposalFahmida HaqueNo ratings yet

- Bic Sodio Tongbai Malan MSDSDocument7 pagesBic Sodio Tongbai Malan MSDSFIORELLA VANESSA MAITA MUCHANo ratings yet

- 5.11 NC AG Letter To MissionDocument3 pages5.11 NC AG Letter To MissionMitchell BlackNo ratings yet

- Geography SyllabusDocument4 pagesGeography SyllabusmvrthedocNo ratings yet

- Oh, What A Day! - Barney Wiki - FandomDocument4 pagesOh, What A Day! - Barney Wiki - FandomchefchadsmithNo ratings yet

- Kush Conquers EgyptDocument67 pagesKush Conquers EgyptLc TrinidadNo ratings yet

- Product Overview Brochure. ABB Medium Voltage Products Our One-Stop Approach For Every Medium Voltage ApplicationDocument12 pagesProduct Overview Brochure. ABB Medium Voltage Products Our One-Stop Approach For Every Medium Voltage ApplicationhafezasadNo ratings yet

- Pro Net On Amazon Web Services Guidance and Best Practices For Building and Deployment 1St Edition William Penberthy 2 Full Download ChapterDocument52 pagesPro Net On Amazon Web Services Guidance and Best Practices For Building and Deployment 1St Edition William Penberthy 2 Full Download Chapterraymond.fryar721100% (19)

- Paper Bridge CompetitionDocument5 pagesPaper Bridge Competitionzia.mudassir2No ratings yet

- The Return of "Patrimonial Capitalism": in The Twenty-First CenturyDocument16 pagesThe Return of "Patrimonial Capitalism": in The Twenty-First CenturyjlgallardoNo ratings yet

- Terra Et Aqua 153 CompleteDocument44 pagesTerra Et Aqua 153 CompleteCarlos PicalugaNo ratings yet

- Pe V RepublicDocument2 pagesPe V RepublicKen ChaseMasterNo ratings yet

- Changing Roles of The NurseDocument15 pagesChanging Roles of The NurseShibinNo ratings yet

- Mipi-Tutorial PDF CompressedDocument13 pagesMipi-Tutorial PDF CompressedGeorgeNo ratings yet

- The Factory Act 1948 ObjectivesDocument24 pagesThe Factory Act 1948 ObjectivescontactsoniNo ratings yet

- Aob - Plan of ActionDocument4 pagesAob - Plan of Action8dimensionsNo ratings yet

- Assignement Primark AnitaDocument16 pagesAssignement Primark AnitaAnita Krishnan100% (1)

- XCAT 2.0: A Component-Based Programming Model For Grid Web ServicesDocument10 pagesXCAT 2.0: A Component-Based Programming Model For Grid Web Servicesxico107No ratings yet

- Design Calculations MalidduwaDocument72 pagesDesign Calculations MalidduwaUmesg100% (1)

- Manual e Mini Wind TunnelDocument10 pagesManual e Mini Wind TunnelWilson Rodríguez CalderónNo ratings yet

- Serena Comparex DatasheetDocument4 pagesSerena Comparex DatasheetprincerajaNo ratings yet

- Final Year Project "Addressing Marketing and Growth Issues of Chattha's Pakistani Street Food" BBA-8Document143 pagesFinal Year Project "Addressing Marketing and Growth Issues of Chattha's Pakistani Street Food" BBA-8Muhammad Humayun KhanNo ratings yet

- IBM 'Selectric Composer' Fonts CatalogDocument60 pagesIBM 'Selectric Composer' Fonts CatalogAnthony M75% (4)