Professional Documents

Culture Documents

Risk Management Outline

Uploaded by

TrentKuntscherCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Risk Management Outline

Uploaded by

TrentKuntscherCopyright:

Available Formats

RMI 357e / URB 351 Fall 2016

McClellan

Lecture Outline

(Join Young Risk Manage YRP)

1st consideration in risk management is to gain an understanding

of the base concepts and terminology.

I.

What is Risk?

A.

Uncertainty Concept No universal definition.

1.

Majority of insurance authors define risk as

uncertainty

2.

Risk and probability-if the probability of an

event occurring is either zero or one, there is

no risk since there is no uncertainty.

2. Objective Risk

1.

Defined as the relative variation of actual loss

from expected loss

2.

Declines as the number of exposure units

increases

3.

Is measurable by using the standard

deviation or coefficient of variation

RMI 357e / URB 351 Fall 2016

McClellan

3. Subjective Risk

II.

1.

Defined as uncertainty based on ones

mental condition or state of mind

2.

Difficult to measure

Chance of Loss

A.

Objective Probability

1.

A priori-by logical deduction such as in games

of chance

2.

Empirically-by induction, through analysis of

data

B.

Subjective Probability a personal estimate of

the chance of loss. It need not coincide with

objective probability and is influenced by a variety

of factors including age, sex, intelligence,

education, and personality.

C.

Chance of Loss Distinguished from Risk

although chance of loss may be the same for two

RMI 357e / URB 351 Fall 2016

McClellan

groups, the relative variation of actual loss from

expected loss may be quite different.

III.

IV.

Peril and Hazard

A.

Peril defined as the cause of loss

B.

Hazard

1.

Physical hazard physical condition that

increases the chance of loss. Examples are

icy streets, poor designed intersections, and

dimly lit stairways.

2.

Moral hazard dishonesty or characteristics

of an individual that increase the chance of

loss

3.

Moral hazard carelessness or indifference to

a loss because of the existence of insurance

Basic Categories of Risk

A.

Pure and Speculative Risk

RMI 357e / URB 351 Fall 2016

McClellan

V.

1.

Pure risk a situation where there are only

the possibilities of loss or no loss

2.

Speculative risk a situation where either

profit or loss is possible

3.

Why the distinction is important

B.

Diversifiable and Non-Diversifiable Risks

C.

Enterprise Risk

Types of Pure Risks

A.

Personal Risks

1.

Basic personal risks are premature death, old

age, poor health, and unemployment.

2.

Types of losses are loss of earned income,

extra expenses, and depletion of financial

assets.

RMI 357e / URB 351 Fall 2016

McClellan

B.

C.

D.

Property Risks

1.

Types of losses include direct physical

damage losses, theft losses, indirect or

consequential losses, and extra expenses.

2.

Perils include natural disasters, dishonesty,

and the failure of others.

Liability Risks

1.

The loss is legal liability for damages arising

out of bodily injury or property damage to

another party.

2.

Perils include negligence, breach of warranty,

and absolute liability.

Commercial Risks

1.

Property risks

2.

Liability Risks

3.

Loss of Business Income

RMI 357e / URB 351 Fall 2016

McClellan

4.

Other Risks Crime / Human Resources /

Foreign

Loss Exposures / Intangible

Property Exposures /

Government

Exposures

6. Burden of Risk on Society

A.

Need for a Larger Emergency Fund

B.

Loss of Needed Goods and Services

C.

Fear and Worry

VII. Methods of Handling Risk

A. Avoidance:

Move your factory out of an unstable country

B.

Retention

1.

Active (desirable) is the deliberate choice to

assume part or all of a loss exposure.

2.

Passive (dangerous) often results from

ignorance or inertia.

RMI 357e / URB 351 Fall 2016

McClellan

C.

D.

Noninsurance Transfers

1.

Contracts

2.

Hedging

3.

Incorporation

Loss Control

1.

Loss Prevention (pre-loss)

Bars on door

2.

Loss reduction (Post Loss)

Having a protocol that mitigates the damages of a

risk

E.

Insurance (worth 4.7 Trillion)

RMI 357e / URB 351 Fall 2016

McClellan

Meaning of Risk Management

Definition of Risk Management - process that identifies loss

exposures face by an organization and elects the appropriate

technique to handle them.

Risk Management and Insurance Management - Insurance

management is simply a sub-set of risk management

Status of Risk Management

Today - Importance is

increasing. Business

philosophy is changing from REACTIVE to

PROACTIVE

Present in most large corporations (either formal or

informal) - but

obviously can be very different across

industries.

Example - use of chemicals - printing industry differs

from dry

cleaners differs from manufacturing

silicon chips

Increasingly regarded as a management specialty field businesses

have become aware that a risk to

enterprise increase so does the

business risk

premium - decreasing available cash for operations investment for future - expansion, etc.

Objectives of Risk Management

Primary Objective - Minimize Pure Risk.

RMI 357e / URB 351 Fall 2016

McClellan

Pre-Loss Objectives

1.

Economy goal - Businesses desire to prepare for loss in the

most

economical means available - so one must consider all

available methods

AVOIDANCE / RETENTION / TRANSFER TO 3RD PARTY /

LOSS CONTROL / INSURANCE

Note as cost to transfer to 3rd parties increases, businesses must

consider use of Avoidance and Retention (Active) often require the

greatest effort but typically lead to the greatest ultimate savings.

2.

Reduction of anxiety - As mentioned last class - this is

certainly a societal goal but also a goal within an enterprise or

business - old Adage = A happy

worker is a productive

worker.

3.

Meet externally imposed obligations

4.

Creditors - For obvious reasons - creditors may conduct risk

analysis of

borrowers - can range from simple credit check to

a full blown on-site investigation.

5.

Legally imposed - Examples - building codes / workers

compensation

6.

Contractually Imposed - Example - termination clause.

Post-Loss Objectives

1.

Survival of the firm - clearly the primary objective - what

seem like small

exposures can bring catastrophic impact to

the business.

RMI 357e / URB 351 Fall 2016

McClellan

2.

Continued operations - differs from industry to industry and

within a given industry from business to business. Example utilities/medical/ energy /transportation - auto vs. perishable

goods.

3.

Stability of earnings - risk redress shareholder value as more

resources are used to handle the risk rather than for expansion

or dividends.

4.

Continued growth - must consider how loss could impact

future growth thus a business might choose to pay a high

risk cost by purchasing insurance rather than returning the risk

(and with it the chance that the risk

forecast is wrong)

5.

Social responsibility - As mentioned before - particularly

acute in small communities with dominate employer but can

clearly affect larger enterprises - recent example - BP Gulf of

Mexico disaster - huge PR

campaign geared to demonstrate

the positive attributes of BP.

Risk Management Process

Most authors identify 4 steps:

1.

Identification: To avoid passive retention

2.

Analysis (measurement)

3.

Selection of risk management techniques

4.

Implementation.

(But should also add)

10

RMI 357e / URB 351 Fall 2016

McClellan

5.

Continual Evaluation: Reevaluate the assumptions, look at

new insurance rates. Legal changes, Tunnel vision kills companies.

Revaluation is key.

Identifying Potential Losses

prevention almost

cheaper than loss. One should

consider:

A.

Cost of Risk

1.

Calculate expected cost

critical step - cost of

always

direct loss

indirect loss

extra expenses

2.

Determine possibility of loss control and cost associated with

it - such as

increased safety measures.

3.

Determine possibility of loss financing

-

4.

insurance

outsourcing activity

increased line of credit (cost of

capital)

Is Internal Risk Reduction Available?

-

diversification - geopolitical/operational/

managerial

transaction costs - employee re-training

evaluate cost/ ramifications

11

RMI 357e / URB 351 Fall 2016

McClellan

4.

Residual Uncertainty what if insurance

company fails?

AMBEST Rating agency

Note - Defense costs can be huge - even if ultimately

unsuccessful - Mattel Case 146 million dollars

B.

Cost Trade Offs risks to not necessarily operate

independently hence enterprise

(the entire company) risk.

1.

Expected Losses/Loss Control typically more spent in

loss control less risk - but

not always

Example Discuss leaking underground storage tank

2.

Loss Financing of Expected Indirect Loss door

minimizes risk of fire

spreading to other

operations

installing fire

3.

Loss Financing of Residual Uncertainty pay more to

avoid

residual uncertainty pay higher premium for

financial stronger

insurance company.

C.

Types of potential loss

1.

Physical damage to property obviously can range from

small (vandalism) to large (explosion)

12

RMI 357e / URB 351 Fall 2016

McClellan

2.

Loss of income - shut down of operations; loss to reputation;

product recall

3.

Liability lawsuits - as mentioned before - some potential

liability risk can be foreseen but sometimes a judicial decision

can come out of the blue

4.

Death or disability of key persons - Can not ignore the fact

that loss of a key person can be devastating - not just related

to founders for example

- loss of key marketing / sales

person / key scientist.

5.

Losses from job-related injuries or disease - Typical examples

- Asbestos /

Carpal Tunnel/ Coal Dust. Recently a court held

that exposure to diesel fumes harmful even if less than EPA

standards

6.

Losses from fraud, criminal acts, and employee dishonesty typically seen as issue to retail operations but what about trade

secrets (know-how)

Example involved banks

recent Wall Street Journal most fraud

and for less than $150K.

7.

Employee benefits loss exposures - besides actual injuries residual costs such as workers compensation insurance rates

are impacted for 3 years.

General Rule Business suffers $4 additional cost for

every $1

direct loss - so if $500,00 loss

- Total Loss =

$2,000,000 +

500,000 = $2,500,000 @10% profit

level - necessitates $25,000,000 in additional

sales.

13

RMI 357e / URB 351 Fall 2016

McClellan

8.

International loss exposures (political risk) - for obvious

reasons this area is becoming increasingly important - bedsides

commodity costs - must consider local regulations and

customers - just look at recently discussed

differences between

US and Europe for Google (right to be forgotten)

D. Tools for recognizing loss exposures - Always evolving /

changing

Examples -

Advent of GPS tracking devices can reduce

theft

DNA testing

1.

Physical inspection -

Scientific -

Experience

but an

overlooked in

downsizing - loss or brain

drain?

testing/sampling.

usually invaluable

element often

2.

Survey form

allows risk managers to gain

understanding of

operations. But

must be careful to ensure truthful

response

- employees can see what the expected

answer is

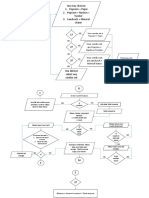

3.

Flow chart

appreciating the

of activities.

useful in understanding and

interconnectedness

14

RMI 357e / URB 351 Fall 2016

McClellan

[Will discuss in detail later in this semester especially in relation

to

supply chain risk analysis]

4.

Financial statements

how much loss can an

enterprise handle?

where is

cash? if overseas, may be cost

barriers to bringing back to U.S. (taxes)?.

5.

Past loss experience -

depend on a

or how business or

react.

history often repeats itself but as

mentioned before cannot

repeat performance

individuals

Evaluating Potential Losses

Key Concepts

Loss frequency -

how often does loss occur?

Variance as mentioned before - tells us about the likelihood

and

magnitude actual outcome will differ

from expected outcome.

Skewedness

loss possibilities are not uniform.

Correlation

another?

how do (if at all) the variables affect one

(U.S. GDP + Berlin Zoo - pink flamingos.)

Loss severity how big is the loss? for risk manager,

understanding

both frequency and severity

are critical in evaluating risk

15

RMI 357e / URB 351 Fall 2016

McClellan

Example -

increased technology may

frequency but

decrease

increase severity. By the

issue is discovered - more product

manufactured and distributed.

time

Guidelines for measuring severity

Maximum possible loss

is

this activity.

Truck

Maximum probable loss -

no chance element - simply what

largest loss possible for

Cement

what is the most likely loss?

Selecting the Appropriate Technique

1.

Avoidance - again, if possible, always the best approach.

2.

Retention use when

also

umbrella policies).

3.

critical, if used, that it is an Active Retention losses are predictible.

Marsh Mac claims - insurance deductible but

insurance policy limit (Discuss -

Noninsurance transfers

16

RMI 357e / URB 351 Fall 2016

McClellan

4.

Loss control - typically used in combination with other

methods.

5.

Insurance by a wide margin - most used technique to

transfer risk but as we will start talking about insurance is multifaceted - standard

insurers but also captive

companies/risk retention groups - offer differing

protections

Implementing the Program

Policy statement tells employees (and customers) what to

expect. Educated employees on importance of risk management

Cooperation with other departments critical that risk manager

has cooperation of other departments

Periodic review-must determine if choice = effective

Continual Evaluation of every Step especially base

assumptions text

books refer to periodic

review but needs to be

continual - so many factors

today affect enterprise's risk

exposures.

Example areas Technology changes; Legal changes just one

judicial decision can

completely upend risk

assessments and management; Regulatory

changes - new regulator / legislature.

17

RMI 357e / URB 351 Fall 2016

McClellan

The Fascinating World of Insurance

Insurance offers several advantages in handling risk:

Greater Predictability of Actual Losses due to application of

Law of Large Numbers

Transfer of Risk (of an Unknown Amount and perhaps,

Nature) to Another Party for a Sum Certain (i.e. Premium)

Specialized Approach to Analyzing, Assessing and Handling

Risk

Two Basic Premises:

1.

Business should purchase insurance coverage if the premium

is less than

the risk adjusted present value of the Expected

Loss.

2.

Businesses should also consider whether or not the asset for

which

insurance coverage is sought, is redundant. Many

businesses purchase

insurance on assets for which it can

better handle through one of the other means of handling risk.

Effect of Insurance

insurance is by far

means of handling risk.

As mentioned several times 0

the most prevalent

Definition of Insurance

Pooling of fortuitous losses by

transfer of such

risks to 3rd

parties - who agree to indemnify the

transferee (policy holders) for such losses to

provide certain services related to that risk.

18

RMI 357e / URB 351 Fall 2016

McClellan

Basic Characteristics of Insurance - 4 Basic Characteristics

1.

Pooling of losses

spreading of losses over many

exposures - causes

the average or

Expected Loss to become closer to

the

Actual Loss

Payment of fortuitous losses - losses that are unforeseen and

unexpected - occur as the result of chance i.e. accidental - Law of

Large Numbers depends on losses being random.

Risk transfer -

Indemnification

Requirements of an Insurable Risk

Started with shippers @ Lloyds coffee shop;

who helped cover each others ships to help

mitigate risks.

General Requirements

Large number of exposure units

19

RMI 357e / URB 351 Fall 2016

McClellan

Accidental and unintentional loss

1.

Determinable and measurable loss

2.

No catastrophe loss

3.

Calculable chance of loss

4.

Loss cant be related

5.

Economically feasible premium

Applications of Requirements

How the risk of fire to a private dwelling satisfies

the requirements

How the risk of unemployment fails to meet the

requirements

Adverse Selection and Insurance

Nature of adverse selection

20

RMI 357e / URB 351 Fall 2016

McClellan

Consequences of adverse selection

Description of Insurable and Uninsurable Risks

A. Insurable Risks

Uninsurable Risks

B.

Generally

1.

Personal

1.

Market

2.

Property

2.

Financial

3.

Liability

3.

Production

4.

Political

Insurance Distinguished from Other Transactions

How Insurance Differs from Gambling

21

RMI 357e / URB 351 Fall 2016

McClellan

Insurance eliminates a pure risk, while gambling

creates a new speculative risk.

Insurance is socially productive, while gambling is

socially unproductive.

How Insurance Differs from Hedging

Insurance transfers a pure risk, while hedging

involves the transfer of a speculative risk.

Insurance reduces objective risk, while hedging

does not.

Types of Insurance

Private Insurance

Life and health insurance

Property and liability insurance

22

RMI 357e / URB 351 Fall 2016

McClellan

Government Insurance

Social insurance

Other government insurance programs

Social Benefits and Costs of Insurance

Benefits of Insurance to Society

Indemnification for loss

Less worry and fear

Source of investment funds

Loss prevention

Enhancement of credit

23

RMI 357e / URB 351 Fall 2016

McClellan

Costs of Insurance to Society

Cost of doing business

Fraudulent claims

Inflated claims

The Changing

Management

Scope

of

Risk

A.

Financial Risk Management

B.

Enterprise Risk Management

C.

Insurance Market Dynamics

Underwriting Cycle

Consolidation in the Insurance Industry

Capital Market Risk Financing Alternatives

Loss Forecasting

24

RMI 357e / URB 351 Fall 2016

McClellan

A.

Probability Analysis

B.

Regression Analysis

C.

Forecasting with Loss Distributions

Financial Analysis in Risk Management Decision Making

A.

The Time Value of Money

[Example of choosing between Policy A and Policy B]

B.

Financial Analysis Applications

[Example of capital budgeting process]

Law of Large Numbers

[Example No. 1 discussed]

25

RMI 357e / URB 351 Fall 2016

McClellan

Basis of Legal Liability

A.

1.

Types of Legal Wrongs

Legal wrong is defined as

26

RMI 357e / URB 351 Fall 2016

McClellan

2.

B.

Types of legal wrongs include

Types of Torts

1.

2.

3.

Law of Negligence

A.

Negligence is

B.

Elements of Negligence

1.

2.

3.

4.

C.

Defenses against Negligence

27

RMI 357e / URB 351 Fall 2016

McClellan

1.

2.

3.

4.

D. Imputed Negligence

1.

2.

3.

4.

E.

Res lpsa Loquitur

Definition

Four elements must be present for it to apply:

1.

28

RMI 357e / URB 351 Fall 2016

McClellan

2.

3.

4.

Specific Applications of the Law of Negligence

A.

Ownership of Property

1.

Degree of care required for trespasser, licensee, or

invitee

2.

Attractive nuisance doctrine

B.

Ownership and Operation of Automobiles, Trucks,

Commercial Liveries, etc.

1.

The negligent owner and operator of the vehicle can be

2.

Where the owner is not the operator, the general rule is

that the owner is not liable for the negligence of the

operatorexceptions include the family purpose

doctrine, or an agency relationship exists

C.

1.

Government Liability

Government entities can be sued if

29

RMI 357e / URB 351 Fall 2016

McClellan

2.

With respect to government functions,

D.

Charitable Institutions

E.

Employer and Employee Relationships

1.

Must be an

2.

Must be acting

F.

Parents and Children

1.

Common law

2.

Today

G.

Animals

1.

Wild Animals

2.

Domestic pets

Current Tort Liability Problems

..and therefore areas in which the rules may change and

therefore your risk may change as well..

A.

Defective Tort Liability System

30

RMI 357e / URB 351 Fall 2016

McClellan

1.

2.

3.

4.

5.

6.

B.

Medical Malpractice Crisis Healthcare costs

1.

2.

C.

Corporate Fraud and Lax Corporate Governance

D. Increase in Mass Tort Liability Lawsuits e.g. Asbestos; Toyota

Braking Systems; Ford and Michelin Tires / Rollovers

31

RMI 357e / URB 351 Fall 2016

McClellan

Special Characteristics of an Insurance Contract

Insurance Is ___________________________________ Contract

Insurance Is ___________________________________ Contract

Insurance Is ___________________________________ Contract

Insurance Is ___________________________________ Contract.

Doctrines of Waiver and Estoppel

1.

Waiver

2.

Estoppel

3.

Practical significance of these legal doctrines

Basic Parts of an Insurance Contract

Declarations Page

Definitions

Insuring Agreement

32

RMI 357e / URB 351 Fall 2016

McClellan

Exclusions

Conditions

Coinsurance

Nature of Coinsurance

Purpose of Coinsurance

i.

Liability Risk

A.

Business Liability

1.

Tort / Negligence

2.

Strict Liability

3.

Product Liability

4.

Breach of Contract

Term

Defective Manufacturing

Design

Warning

Breach

33

Contractual

RMI 357e / URB 351 Fall 2016

McClellan

Representation

Warranty

5.

Failure to Perform / Complete -

6.

Breach of Fiduciary Duty -

7.

Regulatory

B.

Additional Concepts

1.

Dispute Resolution -

Mediation -

Contractual

Judicial

Regulatory

Arbitration

-

Binding

Non-binding

3.

Appraisal Clauses

II.

Types of Insurers

Violation Law

Regulation

Order

34

RMI 357e / URB 351 Fall 2016

McClellan

A.

Types of Private Insurers

Stock Insurance

1.

Ownership

and

stockholders

governance

2.

Status of the

nonassessable

3.

Dominant in the property and liability industry

policyowner

owned

by

contracts

are

Mutual Insurers

1.

Ownership

and

policyowners

governance

owned

by

2.

Dominant in the field of life insurance

3.

Types include assessment, advance premium, and

fraternal

Changing corporate structure of mutual insurers because of

mergers, demutualization, and formation of mutual holding

companies

Reciprocal Exchange

1.

Defined as an unincorporated mutual

35

RMI 357e / URB 351 Fall 2016

McClellan

2.

Managed by an attorney-in-fact, which may be a

corporation

Risk Retention Groups

Risk Purchasing Groups

Captives

Lloyds Associations

1.

Lloyds of London

a.

Provides a meeting place

syndicates do the insuring.

b.

Has great financial strength

b.

Major lines of business are ocean marine,

reinsurance, and surplus lines.

36

individual

RMI 357e / URB 351 Fall 2016

McClellan

2.

American Lloyds differ from Lloyds of London in

that they are smaller, less prestigious, and not as

financially strong.

Health Maintenance Organizations (HMOs)

III.

Distribution Systems - Agents and Brokers

A.

Legal Status of an Agent

B.

1.

Authorized agent can bind the principal to a

contract.

2.

Sources of authority -

Brokers

1.

Represent insureds

37

express

implied

apparent

RMI 357e / URB 351 Fall 2016

McClellan

IV.

2.

Marketing Systems - provide services such as risk

management, loss control, and knowledge where

insurance can be best placed

3.

Are important in the surplus lines market

Claim Settlement

A.

B.

Basic Objectives

1.

Verification that a covered loss has occurred

2.

Fair and prompt payment of claims

3.

Providing personal assistance to the insured

Texas Unfair Claims Settlement Act -- Brief Discussion

Reinsurance

Key Definitions

Reinsurance shifting of part or all of the insurance to another

insurer

Ceding company insurer that initially writes the business

Reinsurer firm that accepts insurance from the ceding insurer

Net retention the amount of insurance kept by the ceding

company

Retrocession reinsurer obtains reinsurance

38

RMI 357e / URB 351 Fall 2016

McClellan

Reasons for Reinsurance

To increase underwriting capacity

To stabilize profits

To reduce drain on surplus because of the unearned

premium reserve

To protect against a catastrophic loss

Types of Reinsurance

Facultative reinsurance

Treaty reinsurance

Advantages

Types of automatic treaties

Quota share

Surplus share

Excess of loss

39

RMI 357e / URB 351 Fall 2016

McClellan

Reinsurance pool

Other Approaches to Catastrophe Losses

Catastrophe bonds

Catastrophe insurance options

Reasons for Insurance Regulation

Maintaining Insurer Solvency

Contract for future delivery

Possible financial insecurity if insurers fail

Inadequate Consumer Knowledge

Complex product

Difficult to compare and determine monetary value

Protection needed against unethical agents

40

RMI 357e / URB 351 Fall 2016

McClellan

Ensuring Reasonable Rates

Making Insurance Available

Historical Development of Insurance Regulation

Early Efforts

State-chartered companies

State insurance commissions

Paul v. Virginia

Ruled that insurance was not commerce

Defeated a challenge to state regulation

South-Eastern Underwriters Association Case

Reversed the Paul decision court ruled that insurance

was interstate commerce when conducted across state

lines and was subject to federal regulation

Cast doubt on the legality of private rating bureaus and

powers of the state to regulate and tax the insurance

industry

41

RMI 357e / URB 351 Fall 2016

McClellan

Public Law 15 McCarran-Ferguson Act

Reaffirmed states responsibility to regulate and tax the

insurance industry

Conditionally exempted the insurance industry from

federal antitrust laws

Methods for Regulating Insurers

Legislation

State laws:

Federal laws;

Courts

Constitutionally of state insurance laws

42

RMI 357e / URB 351 Fall 2016

McClellan

Interpretation of policy clauses and provisions

Legality of administrative actions by state departments

State Insurance Departments

Areas That Are Regulated

Formation and Licensing of Insurers

Financial Regulation

Rate Regulation

Policy Forms

Sales Practices and Consumer Protection

State versus Federal Regulation

43

RMI 357e / URB 351 Fall 2016

McClellan

Advantages of Federal Regulation

Advantages of State Regulation

Shortcomings of State Regulation

D.

Repeal of the McCarran-Ferguson Act

Current Issues in Insurance Regulation

Convergence of Financial Services

Increase in Mergers and Acquisitions

Growth of the Internet and E-Commerce

Insolvency of Insurers

Quality of Insurance Regulation

Deregulation of Commercial Lines

Texas Unfair Claims Settlement Act

Texas Prompt Payment of Claims Requirements

44

RMI 357e / URB 351 Fall 2016

McClellan

Property and Casualty Insurance Companies

A.

Balance Sheet

B.

Income and Expense Statement

C.

Measuring Profit or Loss

Rate Making in Property and Casualty Insurance

A.

Objectives in Rate Making

B.

Basic Rate Making Definitions

C.

Rate Making Methods

45

RMI 357e / URB 351 Fall 2016

McClellan

An overview of the most commonly used insurance coverage for

the typical risks faced by a commercial enterprise.

Commercial Package Policy

--

--

Overview of Commercial Package Policy

Building and Personal Property Coverage Form

A. Covered Property

1.Building

2.Building personal property

3.Personal property of others

4.Additional coverages (debris removal, preservation of

property, fire department service charge, pollutant

cleanup and removal, increased cost of construction, and

electronic data)

5.Extensions of coverage (________________property,

personal effects and property of others, valuable papers

and records, property off the premises and outdoor

property)

Business Income Insurance

A. Business Income (and Extra Expense) Coverage Form

1.The form covers

2.Extra expenses incurred as

3.Additional coverages include

4.Coinsurance

46

RMI 357e / URB 351 Fall 2016

McClellan

5.Optional coverage

B. Extra Expense Coverage Form

1.The form covers

2. ___________ are not covered since the firm is still

operating.

C. Business Income from Dependent Properties

1.

2.

3.

4.

Other Commercial Property Coverage

A. Builders Risk Insurance

B. Equipment Breakdown Insurance -- fka Boiler and

Machinery Coverage

C. Difference in Conditions (DIC) Insurance

Transportation Insurance

A. Ocean Marine Insurance

1.Interests insured:

2.Implied warranties

47

RMI 357e / URB 351 Fall 2016

McClellan

3.Perils covered: fire,

Policies may also be written on an ___________ basis

4.Exclusionslosses due to

B. Inland Marine Insurance

Businessowners Policy (BOP)

A. Eligible Firms

B. BOP Coverages

1.Buildings

2.Business personal property

3.Covered causes of loss

4.Business liability insurance

General Liability Loss Exposures

A. Premises and Operations

1.Liability because of

2.Liability because of

B. Products Liability

C. Completed Operations

48

RMI 357e / URB 351 Fall 2016

McClellan

1.Typical insureds:

2.Provides coverage for losses that occur

D. Contractual Liability

E. Contingent Liability

F. Other Liability Exposures

1.Liability arising out of ownership or use of autos, aircraft

or watercraft

2.Occupational injury or disease to employees

3.Suits by employees alleging 4.Professional liability

5.Directors and officers liability

Commercial General Liability (CGL) Policy

A. Overview of the CGL Occurrence Policy

Section ICoverages

1.Coverage Abodily injury and property damage liability

2.Coverage Bpersonal and advertising injury liability

3.Coverage Cmedical payments

4.Supplementary paymentscoverages A and B

49

RMI 357e / URB 351 Fall 2016

McClellan

B. Overview of CGL Claims-Made Policy

Meaning of Claims Made

Rationale for Claims-Made Policies (___________ problem)

Retroactive Date

Extended Reporting Periods

Employment-Related Practices Liability Insurance

A. Insuring Agreement

B. Co-payment provision

C. Legal Defense

D. Exclusions

Workers Compensation and Employers Liability Insurance

A. Part oneworkers compensation insurance

B. Part twoemployers liability insurance

C. Part threeother states insurance

D. Voluntary Compensation Coverage

Commercial Auto Insurance

50

RMI 357e / URB 351 Fall 2016

McClellan

Aircraft Insurance

Commercial Umbrella Policy

A. Basic Features

1.Excess liability insurance

2.Required underlying coverages are

3.Liability coverages: bodily injury and property damage

liability; personal injury and advertising injury

4.Self-insured retention (SIR) for losses not covered

by any underlying insurance but is covered by the

umbrella policy

Liability InsuranceBusinessowners Policy

A. Basic Coverages

B. Amount of Insurance

C. Legal Defense Costs

D. Exclusions

Professional Liability Insurance

A. Physicians, Surgeons, and Dentists Professional Liability

Insurance

51

RMI 357e / URB 351 Fall 2016

McClellan

B. Errors and Omissions Insurance

Directors and Officers Liability Insurance

52

RMI 357e / URB 351 Fall 2016

McClellan

Commercial General Liability (CGL) Policy

Overview of the CGL Occurrence Policy

Occurrence

-

Section ICoverages

- Coverage Abodily injury and property damage liability

- Coverage Bpersonal and advertising injury liability -

- Coverage Cmedical payments - Supplementary paymentscoverages A and B - Overview of CGL Claims-Made Policy

-

Meaning of Claims Made

Rationale for Claims-Made Policies (long-tail problem)

-

Retroactive Date

53

RMI 357e / URB 351 Fall 2016

McClellan

Extended Reporting Periods -

Employment-Related Practices Liability Insurance

-

Insuring Agreement

Co-payment provision

Legal Defense

Exclusions

Workers Compensation and Employers Liability Insurance

One of the principal areas of liability for a business is that arising

from its employees.

This liability regarding employees is

Employee injuries account for in excess of

= cost to businesses.

54

RMI 357e / URB 351 Fall 2016

McClellan

When we discussed Automobile Liability the risk arises from

action by an insured.

You hit another vehicle

Same with Commercial Auto Your employee hits another vehicle.

Employers Liability typically arises from the employers inaction

=>

Key =

Therefore issue is what is a safe workplace under the given

circumstances => i.e. whats required to have a safe coffee shop

is different than what it takes to make a safe metal shop.

4. Brief History

Courts dramatically changed the legal relationship and therefore

the legal responsibility of employers.

8.

9. 3 Basic Rules Protected Employers

1.

2.

55

RMI 357e / URB 351 Fall 2016

McClellan

3.

Eventually, society realized that the pendulum had swung

too far.

Courts and legislatures acted:

10.

WORKERS COMPENSATION LAWS

Earnest workers compensation laws date back to essentially to

mid 1800s; 1846

56

RMI 357e / URB 351 Fall 2016

McClellan

That evolution was very evident with the changes in the Texas

Workers Compensation Law.

Talk about L.S. Mitchell

Business began opting out of the workers compensation system

and taking their chances at the courthouse.

Talk about East Texas Memorial Medical Center

57

RMI 357e / URB 351 Fall 2016

McClellan

Remember -

The TX Legislature had 2 options:

Part oneworkers compensation insurance

Part twoemployers liability insurance

Part threeother states insurance

- Voluntary Compensation Coverage

Commercial Auto Insurance

Aircraft Insurance

58

; or

RMI 357e / URB 351 Fall 2016

McClellan

- Aviation Insurers (written by a relatively small number of

aviation pools)

- Aviation Insurance for Private Business and Pleasure

Aircraft

- Physical damage coverage (can be written on an

basis; or

; or

)

- Liability coverage

Commercial Umbrella Policy

- Basic Features

- Excess liability insurance

- Required underlying coverages

- Liability coverages: bodily injury and property damage

liability; personal injury and advertising injury

- ________________________(____) for losses not covered by any

underlying insurance but is covered by the umbrella policy

- Exclusions

Liability InsuranceBusinessowners Policy

- Basic Coverages

59

RMI 357e / URB 351 Fall 2016

McClellan

- Business Liability coverage

- Medical expenses coverage

- Amount of Insurance

- Legal Defense Costs

- Exclusions

Professional Liability Insurance

- Physicians, Surgeons, and Dentists Professional Liability

Insurance

- There are two insuring agreements.

- Liability is not restricted to

physician or surgeon.

the

- Current forms permit the insurer to

.

- Professional liability insurance is ______ a substitute for

general liability insurance.

-

Errors and Omissions Insurance

Directors and Officers Liability Insurance

-

Insuring Agreement

Exclusions

60

RMI 357e / URB 351 Fall 2016

McClellan

Supply Chain Risk Management

-

(SCRM)

increasing reliance on other entities for Companys success

historically businesses expend ____ of budget on goods and

services from outside vendors (3rd parties)

today many companies spend over _____ of their budget on

outside goods and services

-

due to efficiency advantages -

(1)

(2)

(3)

-

additional regulatory compliance both

increased levels of economic uncertainty

shorter ____________ / rapid technological change

demanding customers

supply side capacity constraints think of

consolidation of operations to gain economies of scale

Result

ever

Supply Chain Risk

Supply Chains are more ______ than

before

Need to handle that

increased risk

defined as

61

RMI 357e / URB 351 Fall 2016

McClellan

from sources of

Identify Internal and External Environments

-

Note -

that

Where to Start ?

typically good starting point is

as with all risk management it is important to

Effective team would include members from areas within the

business focused on:

-

finance

logistics

manufacturing

quality control

senior management -

best if members are

responsible for

results in better buy in to

process

62

RMI 357e / URB 351 Fall 2016

McClellan

Must be ____________ in the company culture to be effective

should meet regularly

discuss risks - changes in

environment - effects on contingency plans - conduct

simulations / tests

Example -

Remember

Effective SCRM -

(1)

(2)

(3)

Example -

Nokia vs. Erikson case

[ GO TO NOTIONAL SUPPLY CHAIN PROCESS FLOW ]

Terms Used therein

Major Categories:

63

RMI 357e / URB 351 Fall 2016

McClellan

Upstream Inputs

Distribution

Manufacture

Downstream Outputs

Sub-Categories:

Infrastructure

Utilities

Raw -

Converted

Process Functions

People

64

RMI 357e / URB 351 Fall 2016

McClellan

Obvious that these sub-categories affect the Suppliers and

Production / Manufacturing, but why do we consider the

Customers?

1.

2.

3.

Remember

that the process flow stops with your

customer but what

if

Answer

Having identified potential risks, what is next?

and

Analysis.

need to analyze each risk and determine the likelihood

consequence i.e.

Many methods of analysis

Bow-Tie Risk Analysis Method

[ GO TO BOW TIE RISK ANALYSIS METHOD ]

Bow-Tie Method looks at any

(1)

65

___________ - risk in absence of

treatment (i.e. loss control)

RMI 357e / URB 351 Fall 2016

McClellan

(2)

___________ - risk remaining after

treatment

Remember 5 ways to handle risk

-

Avoidance

Retention (active / passive)

Non-Insurance transfer to 3rd

party

Loss control (pre and post

Insurance

loss)

In evaluating risks one must consider the businesss

_______________.

Risk Tolerance Graph

High

Buffer

Eliminate /Avoid Risk

Likelihood

of Event

(________)

Acceptable Risk Frontier

Low

Minor

Major

Consequence of Event (_________)

66

RMI 357e / URB 351 Fall 2016

McClellan

concept allows prioritization of risks

may

-

other risks may warrant -

if low, business

decide to take no further

action - i.e._____________.

(1) some type of buffering

__________- use of multiple

suppliers for example, or

building inventory.

(2)

___________________.

Once business understands its supply chain, it can address how

best to handle or treat those risks.

3 Basic Elements of Supply Chain Risk Management Program:

1.

2.

3.

Protecting and Securing the Supply Chain

-

essential because

(2)

(1)

Example use of corporate jet and

shipment of gold

(1)

Physical Security

67

RMI 357e / URB 351 Fall 2016

McClellan

(2)

Access Control -

(3)

Personal Security

(4)

Education and Training

(5)

Procedural Security -

(6)

IT Security

(7)

Business Partner Security

(8)

Conveyance Security

Responding to Events

-

obviously with the best pans, unexpected events occur

Cement Trucks are Real

Definition of a Crisis

(i)

(ii)

(iii)

(iv)

68

RMI 357e / URB 351 Fall 2016

McClellan

So Crisis Management

is the overall strategy and tactical

responses of business to (i) recognize; and (ii) respond

effectively, efficiently and comprehensively

to actualized threats.

recognition therefore includes pro-active

measures to detect events

As with all corporate hierarchies, Crisis Management teams

operate at all levels of the business.

Executive Crisis

Management Team

T

ECMT

__________ Crisis Team

_____ Crisis MT

_______ Incidents

affecting Business

__________ Crisis MT

Site & Functional Teams

__________ Crisis Team

Personnel __________

response

__________ Response Team

69

RMI 357e / URB 351 Fall 2016

McClellan

Each level will have specific Trigger Points events that cause the

team to be activated

need to consider triggers very carefully otherwise senior

management may appear uninterested / uncaring think of BP

Gulf disaster / Head of Bears Stern playing in bridge tournament

as firm was collapsing

Important not to base all trigger points on dollars e.g.

trigger may be when the frequency reaches a pre-determined

level.

Important to avoid organizational reluctance to report

incidents avoid compensation schemes that penalize reporting

Ideal Crisis Response Process should include the following steps

1.

2.

3.

Risk Assessment

4.

5.

Communication to Stakeholders

6.

Event Control and Resolution

7.

70

RMI 357e / URB 351 Fall 2016

McClellan

8.

Plan maintenance, training and preparation

Continuity of Operations

Business Continuity Plansthose activities, programs, system

developed and implemented prior to an incident used to

mitigate, respond to and cover supply chain disruptions, disasters

and emergencies

After addressing immediate concerns / needs rescue / medical

attention / shelter / protection (think international events or

looters), ________________________________ is key to resuming

operations

Continual Monitoring of Risks and their Treatment

Critical that business implement a monitoring program evaluating

plans, procedures and capabilities through

(i)

(ii)

(iii)

Testing and Adjustment of Plans

goals should be:

(1)

Determining whether or not crisis response process works

and how it can be improved

(2)

Testing capacity (e.g.______________________)

(3)

Reducing time to accomplish a process (e.g.

__________________)

71

RMI 357e / URB 351 Fall 2016

McClellan

(4)

Increasing awareness and knowledge among employees

about risk management plan

(5)

Incorporating lessons learned from previous tests and actual

incidents

Discuss Examples

Nokia vs. Erikson

Boeing

Toyota

Ford

Steps to Take:

(1)

Improve demand planning

work with customers to

avoid being blindsided by changes in demand again Ford

Example

(2)

Work with suppliers to create ________________

(3)

Diversify sourcing

chain failure

(4)

Extend insurance coverages when possible

reduces risk of catastrophic supply

72

e.g.

RMI 357e / URB 351 Fall 2016

McClellan

(5)

Use large 3rd party logistics provider

typically larger

organizations have greater up to date knowledge of

conditions e.g. which ports are closed or are experiencing

delays which might cause need to divert shipments to

another port and then transported to manufacturing plant

(6)

Model and optimize inventories on a disaggregated basis

i.e.

(7)

Increase product component standardization think of Apollo

13 carbon dioxide problem square and round filters

Note -

(8)

Create centralized product data management system

(9)

Raise visibility along extended supply chain

(10) Monitor specific warning signs e.g.

So we get back to fundamental process:

(1)

Understand risk environment

(2)

Identify and assess current risk

(3)

Quantify and prioritize risk

73

RMI 357e / URB 351 Fall 2016

McClellan

(4)

Develop risk handling technique

(5)

Implement plan

(6)

Continually monitor effectiveness.

Sounds like the basic risk management process .

74

You might also like

- Atkinson, A. R. (2002) - The Pathology of Building Defects A Human Error Approach.Document9 pagesAtkinson, A. R. (2002) - The Pathology of Building Defects A Human Error Approach.Luis AugustoNo ratings yet

- Risk Management AssignmentDocument15 pagesRisk Management AssignmentYee KangNo ratings yet

- W06 Lesson Plan - Safety Meeting-Concrete and MasonryDocument2 pagesW06 Lesson Plan - Safety Meeting-Concrete and MasonryHenry GutierrezNo ratings yet

- APC Pathway Guide For Building ControlDocument25 pagesAPC Pathway Guide For Building ControlMace StudyNo ratings yet

- Tender - Organics Processing FacilityDocument20 pagesTender - Organics Processing FacilitySimon McCarthyNo ratings yet

- Sustainability Research in The Hotel Industry: Past, Present, and FutureDocument46 pagesSustainability Research in The Hotel Industry: Past, Present, and Futuresinta putrianaNo ratings yet

- How To Price Swaps in Your Head An Interest Rate Swap & Asset Swap PrimerDocument96 pagesHow To Price Swaps in Your Head An Interest Rate Swap & Asset Swap Primerswinki3No ratings yet

- How To Find The Perfect Spouse..... With 101 Simple QuestionsDocument8 pagesHow To Find The Perfect Spouse..... With 101 Simple Questionstmcfadden5875No ratings yet

- Kedir Accounting ProposalDocument22 pagesKedir Accounting ProposalAhmed100% (10)

- Solutions To End of Chapter ProblemsDocument176 pagesSolutions To End of Chapter Problemsmitaleo23100% (1)

- Partnership QuaMTODocument4 pagesPartnership QuaMTOMoon BeamsNo ratings yet

- Construction Method Statement: at The Property Known As 18 Old Church Street London, Sw3 5DqDocument14 pagesConstruction Method Statement: at The Property Known As 18 Old Church Street London, Sw3 5DqRoland HarteNo ratings yet

- Asbestos Awareness: Alan ConwayDocument13 pagesAsbestos Awareness: Alan ConwayGutha BabuNo ratings yet

- Phone Myat Thaw Zin. CT. A1Document9 pagesPhone Myat Thaw Zin. CT. A1pyae sone100% (1)

- Making Anti-Terror InfrastructureDocument5 pagesMaking Anti-Terror InfrastructureLo Loss100% (1)

- Probable Maximum LossDocument4 pagesProbable Maximum LossDiana MitroiNo ratings yet

- NASC VTT TG20.13 Introduction Draft 2 1Document28 pagesNASC VTT TG20.13 Introduction Draft 2 1TRIAL SAFETY SERVICES AND CONSULTANTNo ratings yet

- Hazard Spotting Group 4 1Document11 pagesHazard Spotting Group 4 1anon ggNo ratings yet

- HSE GS6 Avoidance of Danger From Overhead Power LinesDocument15 pagesHSE GS6 Avoidance of Danger From Overhead Power LinesrjmcivorNo ratings yet

- Assessment Task 1Document15 pagesAssessment Task 1rishiNo ratings yet

- Roofing Code of Practice PDFDocument379 pagesRoofing Code of Practice PDFAlejandro Segura Pereira100% (1)

- Software Engineering Unit 7-RiskDocument27 pagesSoftware Engineering Unit 7-RiskHarshita GopuNo ratings yet

- Practical Building Defect Solutions Construction Failures To Be Avoided - Real Case Studies Selected From Malaysian BuildingsDocument6 pagesPractical Building Defect Solutions Construction Failures To Be Avoided - Real Case Studies Selected From Malaysian BuildingsWARSE Journals100% (1)

- The Evolution of E-Commerce Research A Stakeholder Perspective Article ReviewDocument3 pagesThe Evolution of E-Commerce Research A Stakeholder Perspective Article Reviewsachin024No ratings yet

- BR PDFs FiresafetyDocument42 pagesBR PDFs FiresafetyWan SyaNo ratings yet

- Domestic Lighting ReportDocument495 pagesDomestic Lighting ReportYaredNo ratings yet

- H1: Fall Protection: Technical Guidance Mobile Elevating Work Platforms (Mewps)Document2 pagesH1: Fall Protection: Technical Guidance Mobile Elevating Work Platforms (Mewps)yasirNo ratings yet

- Fraud Policy Template-Pdf-2Document13 pagesFraud Policy Template-Pdf-2Ranjeet DongreNo ratings yet

- Arboricultural Method StatementDocument13 pagesArboricultural Method StatementEngr. Zohaib Hussain KaziNo ratings yet

- Safety Instructions Manual FOR Contractors and VendorsDocument15 pagesSafety Instructions Manual FOR Contractors and VendorsAjay SharmaNo ratings yet

- Ladders & Step Ladders PDFDocument8 pagesLadders & Step Ladders PDFKevin MorrisNo ratings yet

- Airport Terminal DesignDocument9 pagesAirport Terminal DesignLaisattrooklai PhisitNo ratings yet

- Fraud Risk MNGDocument3 pagesFraud Risk MNGsmarty_200388No ratings yet

- Cap 1 - Meredith Mantel (2009) Project ManagementDocument34 pagesCap 1 - Meredith Mantel (2009) Project Managementjohn100% (1)

- Risk Assessment FundamentalsDocument26 pagesRisk Assessment FundamentalsTAHER AMMARNo ratings yet

- Can I Remove Cavity Wall Insulation - TheGreenAgeDocument23 pagesCan I Remove Cavity Wall Insulation - TheGreenAgefriska_arianiNo ratings yet

- Underpinning Solutions of Historical Constructions PDFDocument10 pagesUnderpinning Solutions of Historical Constructions PDFRose Carla GuerrierNo ratings yet

- Global Health, Safety, Security, and Crisis ManagementDocument63 pagesGlobal Health, Safety, Security, and Crisis ManagementDhanis IshwarNo ratings yet

- Example Risk Assessment For A Bricklaying Company Updated 20-11-12Document10 pagesExample Risk Assessment For A Bricklaying Company Updated 20-11-12dwayjayNo ratings yet

- CUSTOMER COMPLAINT LETTER TEMPLATE DateDocument2 pagesCUSTOMER COMPLAINT LETTER TEMPLATE DateAliNo ratings yet

- QBE Casualty Risk Management Construction Newsletter February 2010Document2 pagesQBE Casualty Risk Management Construction Newsletter February 2010QBE European Operations Risk ManagementNo ratings yet

- Building Pathology & Inspection Building Pathology & InspectionDocument41 pagesBuilding Pathology & Inspection Building Pathology & InspectionBadDaddyMood JBNo ratings yet

- Balfour BeattyDocument1 pageBalfour Beattyvijay_2k8No ratings yet

- Example Risk Assessment For A WarehouseDocument3 pagesExample Risk Assessment For A Warehousekhalid najjarNo ratings yet

- Construction Safety Planning 1Document12 pagesConstruction Safety Planning 1umer_rehmannNo ratings yet

- The Assessment of Pedestrian Slip Risk The HSE ApproachDocument9 pagesThe Assessment of Pedestrian Slip Risk The HSE ApproachRim BdidaNo ratings yet

- Leaching L0333 AGG079 003 BREDocument45 pagesLeaching L0333 AGG079 003 BREjuli_radNo ratings yet

- Case Study - The Collapse of Barings BankDocument1 pageCase Study - The Collapse of Barings BankHamna IshaqNo ratings yet

- Business PlanDocument36 pagesBusiness PlanSiare AntoneNo ratings yet

- Is 2750 Specifiction For Steel Scaffoldings R0.183134252Document29 pagesIs 2750 Specifiction For Steel Scaffoldings R0.183134252Suhas Karar0% (1)

- Rapidshare Download LinksDocument4 pagesRapidshare Download LinksyayayalNo ratings yet

- From ExperienceDocument3 pagesFrom ExperiencetcwlingleungNo ratings yet

- Highly Protected Risk PDFDocument2 pagesHighly Protected Risk PDFRanjit TalpadaNo ratings yet

- Workplace Housekeeping: Training Slides OnDocument42 pagesWorkplace Housekeeping: Training Slides OnEstefh DeriquitoNo ratings yet

- Warehouse SafetyDocument16 pagesWarehouse SafetyAbhinit SinhaNo ratings yet

- hsg47 - Avoiding Danger From Underground Services PDFDocument40 pageshsg47 - Avoiding Danger From Underground Services PDFAchilleas21No ratings yet

- Mem603 Case Study SlideDocument53 pagesMem603 Case Study SlideLoxman ZahariNo ratings yet

- Topic: Overall Maintenance Considerations For Functional and High Quality BuildingsDocument19 pagesTopic: Overall Maintenance Considerations For Functional and High Quality BuildingsTong Kin Lun100% (4)

- Risk Assessment For Civil Engineering Facilities: Critical Overview and DiscussionDocument12 pagesRisk Assessment For Civil Engineering Facilities: Critical Overview and Discussionterror_ro533No ratings yet

- New RAMS - MARC - Arbor City Hotel - LondonDocument15 pagesNew RAMS - MARC - Arbor City Hotel - LondonPaul McGahanNo ratings yet

- Me ReportingDocument66 pagesMe Reportingmaribel anubNo ratings yet

- Managing Event Risks: Damodaran/ch.10Document38 pagesManaging Event Risks: Damodaran/ch.10Abinash BiswalNo ratings yet

- RAMS (Rev 06) 04.01.2024Document48 pagesRAMS (Rev 06) 04.01.2024Ştefan Marian TamaşNo ratings yet

- Threat And Risk Assessment A Complete Guide - 2020 EditionFrom EverandThreat And Risk Assessment A Complete Guide - 2020 EditionNo ratings yet

- Reshaping the Built Environment: Ecology, Ethics, and EconomicsFrom EverandReshaping the Built Environment: Ecology, Ethics, and EconomicsNo ratings yet

- Jaen Public Market Efficiency Plan - FinalDocument126 pagesJaen Public Market Efficiency Plan - FinalBebot Bolisay100% (2)

- 20 Edp 6Document4 pages20 Edp 6coder 69No ratings yet

- MetLife Alico at A GlanceDocument10 pagesMetLife Alico at A GlanceRejul KhanNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancesatyagireeshNo ratings yet

- FlowchartDocument3 pagesFlowchartSarah SazaliNo ratings yet

- Attempts All Questions From Part I and Any Five Questions From Part IIDocument1 pageAttempts All Questions From Part I and Any Five Questions From Part IINimesh GoyalNo ratings yet

- Presented By: Abhishek Ghosh Anjali Paswan Sayanna DasDocument16 pagesPresented By: Abhishek Ghosh Anjali Paswan Sayanna DasAbhishekNo ratings yet

- Company Registration DocumentsDocument54 pagesCompany Registration Documentssara24391No ratings yet

- Variance AnalysisDocument10 pagesVariance AnalysisOchko GanbaatarNo ratings yet

- 9 Basic DerivativesDocument3 pages9 Basic DerivativesBaron MirandaNo ratings yet

- 10 Question Exam Income TaxDocument1 page10 Question Exam Income TaxLei MorteraNo ratings yet

- Allied Bank Account OpeningDocument33 pagesAllied Bank Account Openingbilal_jutttt100% (2)

- Practice: Scope of The Architect's ServicesDocument28 pagesPractice: Scope of The Architect's ServicesHenry TungNo ratings yet

- Paper PresentationDocument11 pagesPaper PresentationAmit PandeyNo ratings yet

- Course Module 1 Mathematics of InvestmentDocument18 pagesCourse Module 1 Mathematics of InvestmentAnne Maerick Jersey OteroNo ratings yet

- ViewGOPDF - list - user (21) (1) शासनादेश PDFDocument3 pagesViewGOPDF - list - user (21) (1) शासनादेश PDFMadan ChaturvediNo ratings yet

- MN - 2016 06 21Document36 pagesMN - 2016 06 21mooraboolNo ratings yet

- Revised Joint Trial ExhibitDocument54 pagesRevised Joint Trial ExhibitTeamMichaelNo ratings yet

- Monetary Policy - IndicatorsDocument4 pagesMonetary Policy - IndicatorsGJ RamNo ratings yet

- Siga-An v. VillanuevaDocument2 pagesSiga-An v. Villanuevad2015member100% (1)

- Form No. 16-ADocument1 pageForm No. 16-AJay100% (6)

- Nego CasesDocument91 pagesNego CasesBruce WayneNo ratings yet

- An Introduction To Modern Portfolio TheoryDocument38 pagesAn Introduction To Modern Portfolio Theoryhmme21No ratings yet

- VCB-ib@nking User Guide PDFDocument34 pagesVCB-ib@nking User Guide PDFThông Hà ThúcNo ratings yet

- Balatero v. Intermediate Appellate CourtDocument7 pagesBalatero v. Intermediate Appellate CourtShiela PilarNo ratings yet