Professional Documents

Culture Documents

Financial Ratios

Uploaded by

dvagh4150Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Ratios

Uploaded by

dvagh4150Copyright:

Available Formats

No.

Ratio

Gross profit margin

Formula

(Sales - Cost of goods sold / Sales)

x 100

Norm

Interpretation

Indicates the total margin

available to cover operating

expenses and yield a profit.

Gross profit margin

A. Liquidity Ratios:

a) Liquid assets to current debt

ratios :

Current Ratio

(Current assets / Current liabilities)

Quick Ratio

Quick Assets / Current Liabilities

1:1

It is a measure of firms

short-term

solvency.

It

represents the margin of

safety for creditors. The

higher the current ratio, the

greater the margin of safety.

(Larger the amount of current

assets in relation to current

liabilities, the more the firms

ability to meet its current

obligations) It is a test of

quantity.

It indicates rigorous test of a

firms ability to serve short

team liabilities. Thus a firm

Cash Ratio

Cash / Current Liabilities

Cash to current assets ratio

Cash / Current assets.

.5:1

with high quick ratio may

face problem if it has

doubtful and slow paying

receivables. On the other

hand a firm with lower liquid

ratio may be in a position to

pay current liabilities in time

if it has been managing its

inventories efficiently.

The

most

vigorous

and

conservative test of a firms

liquidity position.

shows the proportion of cash

in total current assets. The

higher the ratio, greater the

liquidity of a concern and vice

versa. Surplus cash will not

fetch any income.

b) Liquid assets to fixed assets

ratio :

Current assets to Fixed assets

Current assets / Fixed assets

Shows the proportion of

current assets in relation to

fixed

assets.

Higher

proportion of current assets

represents greater liquidity,

does mean payment of short

team obligations in time.

Greater proportion of fixed

assets represents strength of

Quick assets to fixed assets

Quick assets / fixed assets

Cash to fixed assets

Cash / fixed assets

Working capital to fixed assets

Working capital / fixed assets

the concern but less liquidity.

This

ratio

shows

the

proportion of quick assets in

relation to fixed assets.

Higher proportion of quick

assets represents greater

liquidity.

Shows the proportion cash to

fixed assets. Cash includes

cash in hand and bank

balance.

Shows the relationship b/w

WC & FA and nature of

industry.

This

ratio

is

generally high for retail

businesses

and

low

for

manufacturing industries.

c) Liquid Assets to Total

Assets Ratios :

Current assets to total

assets

Current assets / total assets

Liquid assets to total assets

Cash to total assets

Working capital to total assets

Loan & advances to total assets

Investment to total assets

Liquid assets / total assets

cash / total assets

Working capital / total assets

Loan & advances / total assets

Investment / total assets

This ratio indicates the assets

composition of a firm. Larger

proportion of current assets

denotes more liquidity.

It shows how much

proportion (surplus funds) of

total assets has been

invested in outside

opportunities.

II

.

B. Activity Ratio:

employed

to

evaluate

the

efficiency with which the firm

manages and utilizes its assets.

Inventory turnover Ratio

Net Sales / Inventory

Debtors turnover ratio

Net Sales / Debtors

It

shows

how

rapidly

(efficiency) the inventory is

converted into sales. A high

inventory is indicative of

efficient

management

of

inventory

because

more

quickly the inventory is sold.

A low inventory turnover

implies excessive inventory

levels than warranted by

production

and

sales

activities or a slow moving or

obsolete inventory. Relatively

high inventory turnover may

be the result of a very low

level of inventory, which

results in frequent stock outs.

It indicates the no. of times

average debtors have been

converted into cash during a

year. It measures how rapidly

Creditors turnover ratio:

Purchases / Creditors

Capital employed turnover

ratio

Net Sales / Capital Employed

Capital Employed = Net fixed

assets + current assets - current

liabilities.

the firm collects debts. High

ratios

indicate

efficient

management of credit. A low

ratio implies a very liberal

and inefficient credit and

collection performance. A

very high debtor turnover

ratio may be the outcome of

a very restrictive credit and

collection policy. Such a

policy severely curtails and

reduces the profits.

Judge the requirements of

cash

for

paying

sundry

creditors. It indicates the

number of times sundry

creditors have been paid

during a year. It shows credit

terms granted by suppliers.

High Creditors turnover ratio

implies

that

Creditors

accounts are to be settled

rapidly.

Measure the efficiency or

effectiveness with which a

firm

utilizes

its

capital

employed. It is a good

indicator

of

overall

profitability of a concern.

Net working capital turnover

Net Sales / Working Capital

Total assets turnover ratio

Net Sales / Total Assets

Total Assets = Net Fixed Assets +

Current Assets.

Fixed assets turnover ratio

Net Sales / Fixed Assets

Net fixed Assets = Fixed Assets Depreciation.

Current assets turnover ratio

Net Sales / Current Assets

Higher the ratio greater the

profitability of the concern

and vice versa.

A higher ratio is an indicator

of better utilization of current

assets and working capital

and vice - versa.

This ratio shows the firms

ability to generate sales from

all

financial

resources

committed to total assets.

Higher ratio indicates that the

firm is managing its assets

both

current

and

fixed

efficiently to maximize the

sales and vice versa.

This

ratio

shows

how

efficiently firm is utilizing its

fixed assets. Higher ratio is

indicative

of

efficient

utilization of fixed assets in

maximizing the sales by the

firm.

This ratio explains about the

amount of sales, which the

firm is able to generate from

every rupee invested in

current assets.

Quick assets turnover ratio

Net sales to cash ratio

Net Sales / Quick Assets Quick

Asses Current Assets Inventories.

Net sales / cash.

It shows how efficiently a firm

is utilizing its quick assets in

maximizing its sales.

It shows the relationship

between net sales and cash.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tutorial - Chapter 11 - Monetary Policy - QuestionsDocument4 pagesTutorial - Chapter 11 - Monetary Policy - QuestionsNandiieNo ratings yet

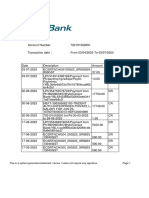

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancefriendztoall4351No ratings yet

- BKM Chapter 3 SlidesDocument41 pagesBKM Chapter 3 SlidesIshaNo ratings yet

- Philander Anver Francois-5k01014Document1 pagePhilander Anver Francois-5k01014ShaneNo ratings yet

- Suryaa Hotel Bal SheetDocument3 pagesSuryaa Hotel Bal Sheetarjun chauhan100% (1)

- Individual Corporate R2-52 R3-32Document8 pagesIndividual Corporate R2-52 R3-32Fang JiangNo ratings yet

- Marketing Strategy For IslamicDocument16 pagesMarketing Strategy For IslamicTamim Arefi100% (1)

- JUSTIN Account Statement (Feb)Document3 pagesJUSTIN Account Statement (Feb)MiguelNo ratings yet

- FirstStrike PlusDocument5 pagesFirstStrike Plusartus14No ratings yet

- Problem 1-1 To 1-3 Intermediate Accounting (Vol 1)Document8 pagesProblem 1-1 To 1-3 Intermediate Accounting (Vol 1)Margarette TumbadoNo ratings yet

- UPSA 2019 Tutorial Questions Fs WITH ANSWERSDocument14 pagesUPSA 2019 Tutorial Questions Fs WITH ANSWERSLaud ListowellNo ratings yet

- Simple and Compound InterestDocument2 pagesSimple and Compound InterestJeffrey Del MundoNo ratings yet

- Akuntansi 11Document3 pagesAkuntansi 11Zhida PratamaNo ratings yet

- Introduction To Budgets and The Master BudgetDocument33 pagesIntroduction To Budgets and The Master BudgetkunalNo ratings yet

- Deposit SlipDocument2 pagesDeposit Slipsoly2k12No ratings yet

- Emerging Areas For Articleship ExperienceDocument17 pagesEmerging Areas For Articleship ExperienceAmit JainNo ratings yet

- IDirect NCC ConvictionIdeaDocument8 pagesIDirect NCC ConvictionIdeaVivek GuptaNo ratings yet

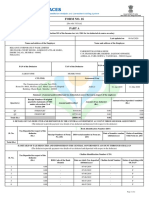

- Form No. 16: Part ADocument8 pagesForm No. 16: Part AParikshit ModiNo ratings yet

- Inflation Indexed Bonds.Document81 pagesInflation Indexed Bonds.Mythili InnconNo ratings yet

- Dunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Document2 pagesDunkin' Donuts-Student Lounge Area Projected Statement of Financial Position December 31, 2020Cath VeluzNo ratings yet

- 2011 - UOL - Monetary EconsDocument15 pages2011 - UOL - Monetary EconsAaron ChiaNo ratings yet

- Statement 1688358203630Document3 pagesStatement 1688358203630Chinmay RajNo ratings yet

- Delhi To Rudrapur: Abhibus TicketDocument2 pagesDelhi To Rudrapur: Abhibus TicketKrishan SharmaNo ratings yet

- A Study On Working CapitalDocument92 pagesA Study On Working CapitalNeehasultana ShaikNo ratings yet

- Introduction On HDFC BankDocument3 pagesIntroduction On HDFC BankAditya Batra50% (2)

- FORM24Document3 pagesFORM24Fayaz KhanNo ratings yet

- Ra 6977Document12 pagesRa 6977Kobe MambaNo ratings yet

- Credit RatingDocument24 pagesCredit RatingpsnithyaNo ratings yet

- AF1401 2020 Autumn Lecture 3Document30 pagesAF1401 2020 Autumn Lecture 3Dhan AnugrahNo ratings yet

- Anup TransactionsDocument6 pagesAnup TransactionsNirupam DewanjiNo ratings yet