Professional Documents

Culture Documents

Chapter 2 Dissolution and Liquadation of Partnersip

Uploaded by

Tekaling NegashOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 2 Dissolution and Liquadation of Partnersip

Uploaded by

Tekaling NegashCopyright:

Available Formats

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Furra College

Chapter Two: Partnership Dissolution and Liquidation

Conditions for Dissolution and Liquidation

Dissolution is a term used to describe events ranging from a minor change of ownership interest

not affecting operations of the partnership to a decision by the partners to terminate a

partnership.

Conditions for dissolution of a partnership may, therefore, be:

Bankruptcy of the firm or any partner

The expiration of the time period stated in the partnership contract

Mutual agreement of the partners to end their association

Accountants are concerned with the economic substance of a transaction than its legal form and

evaluate all the circumstances of the individual case and determine how the change should be

recorded.

Changes in Personnel\Changes in Ownership

Most changes in ownership of partnerships are accomplished without interruption of its

operations and there is usually no significant change in the finances or operating routines of the

partnership. However, from a legal view point a partnership is dissolved by the retirement or

death of a partner or by the admission of a new partner.

Admission of a New Partner

Adjustment of the partnership accounting records may be necessary to restate the carrying

amounts of assets and liabilities to current fair value before a new partner is admitted. As an

alternative to revaluation of the existing partnership assets, it may be preferable to evaluate any

discrepancies between the carrying amounts and current fair values and adjust the terms of

admission of a new partner. In this way, the amount invested by the incoming partner may be set

at a level that reflects the current fair value of the partnership, even though the carrying amounts

of existing partnership assets remain unchanged in the accounting records.

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Furra College

The admission of new partner to a partnership may be effected either by an acquisition of all or

part of the interest of one or more of the existing partners or by an investment of assets by the

new partner with a resultant increase in the net assets of the partnership.

Acquisition of an Interest by Direct Payment to One or More Partners

If a new partner acquires an interest from one or more of the existing partners, the event is

recorded by establishing a capital account for the new partner and decreasing the capital account

balances of the selling partners by the same amount. No assets are received by the partnership;

the transfer ownership is a personal transaction between the partners.

Illustration: L and M are partners of L&M Partnership sharing earnings equally and each has a

capital account balance of 60,000. Partner N (with the consent of M) acquires one half of Ls

interest in the partnership. The journal entry to record this change would be:

L, Capital (1/2of 60,000)

30,000

N, Capital

30,000

To record transfer of one-half of Ls capital to N

This transfer has caused no change in the assets, liabilities or total partners capital.

The price paid for a partnership interest by a new partner to an existing partner does not

provide sufficient evidence to support changes in the carrying amounts of the

partnerships assets.

Investment in Partnership by a New Partner

A new partner may gain admission by investing assets in the partnership, thus increasing the total

assets and partners capital of the partnership.

Assume that X and Y, partners of the X&Y Partnership, share net income or net loss equally and

that each has a capital account balance of Br. 60,000. Assume also that the carrying amounts of

the partnership assets are approximately equal to current fair values and that Z owns land that

could be used for expansion of partnership operations. X and Y agree to admit Z to the

partnership by investment of the land; net income and loss of the new firm are to be shared

equally. The land had cost Z Br. 50, 000, but has a current fair value of 80,000. The admission of

Z to the partnership is recorded as follows:

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Land

Furra College

80,000

Z, Capital

80,000

To record admission of Z to partnership.

Z has 80,000 capital account balances and owns 40% interest in the firm.

Bonus Allowed to Existing Partners

In a profitable well-established firm, the partners may insist that a portion of the investment by a

new partner be allocated to them as bonus or that goodwill be recorded and credited to existing

partners.

Bonus to Existing Partners

In the C&D Partnership, C and D share net income or losses equally and have capital account

balances of Br. 45,000 each. The carrying amounts of the partnership net assets approximate

current fair values. The partners agree to admit E to a one third in capital and a one third interest

in earnings for a cash investment of Br. 60,000. The total capital of the new firm amounts to Br.

150,000 (45,000+45,000+60,000) and one third of that is Br. 50,000 resulting in bonus of 10,000

to the existing partners. Hence, the following entry:

Cash

60,000

C, Capital (10,000*1/2)

5,000

D, Capital (10,000*1/2)

5,000

E, Capital (150,000*1/3)

50,000

To record investment by E for one third interest in capital, with bonus of 10,000 divided equally

between C and D.

Bonus Allowed to New Partner

The present firm may offer a new partner a larger equity in net assets than the amount invested

by the new partner in recognition of the new partners skill and business contacts or its cash

needs.

Bonus to New Partner

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Furra College

F and G, who share net income and losses equally and have capital account balances of Br.

35,000 each, offer H a one-third interest in net assets and a one-third share of net income or

losses for an investment of Br. 20,000 cash. The investment by H when added to the existing

capital of Br. 70,000 brings the total capital to Br. 90,000 and Hs interest there in is Br. 30,000

(90,000*1/3). The difference between Hs investment and interest in capital (30,000-20,000 =

10,000) represents bonus allowed to H by F and G. the journal entry to record admission of H to

the partnership would be:

Cash

20,000

F, Capital (10,000*1/2)

5,000

H, Capital (10,000*1/2)

5,000

H, Capital

30,000

To record admission of H, with bonus of Br.10,000 from F and G.

In the above illustration it is assumed that the net assets of the partnership were valued

properly

Writing down of the assets to 40, 000 should be considered especially if trade accounts

receivable included doubtful accounts or if inventories were obsolete.

Retirement of a Partner

A partner has always the authority to withdraw, as distinguished from the right to withdraw. A

partner, who withdraws in violation of the terms of the partnership contract, and without consent

of the other partners, may be liable for damages to the other partners.

In measuring the equity of a retiring partner:

The partners capital account is the starting point. Adjustments for correction of errors or

for differences between the carrying values and current fair values of net assets may be

necessary.

The partnership contract should be referred to for provisions regarding computation of

the amount to be paid a retiring partner. The contract may require audit by independent

auditors or valuation of the partnership as a going concern.

If the partnership doesnt contain provisions for the computation of retiring partners

equity, the accountant may obtain authorization from the partners to use a specific

method to determine an equitable settlement price.

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Furra College

The equity of a retiring partner is computed on the basis of current fair values of

partnership net assets with gain or loss arising from the difference between the current

fair value and carrying value divided in the income sharing ratio.

The partners may agree to settle by payment of the computed amount or a different

amount.

Payment of Bonus to Retiring Partner

Assume that L is to retire from the J, K &L Partnership. Each partner has a capital account

balance of Br. 60,000, and net income and losses are shared equally. The partnership contract

provides that a retiring partner is to receive the balance of his\her capital account plus a share of

any goodwill. At the time of Ls retirement, goodwill in the amount of Br. 10,000 is computed to

the mutual satisfaction of the partners.

But there is no reliable evidence to record such goodwill in the accounts except estimate of the

partners. Therefore, it is not appropriate to enter this goodwill in the accounting records of the

partnership. The portion paid to the retiring partner would, however, be treated as bonus as

shown in the following journal entry.

L, Capital

60,000

J, Capital (10,000*1/2)

5,000

K, Capital (10,000*1/2)

5,000

Cash

70,000

To record payment to retiring partner L, including bonus of Br. 10,000.

Settlement with Retiring Partner for Less than Carrying Amount

A retiring partner may accept less than his\her equity on retirement due to:

Anxiety to escape from an unsatisfactory business situation

Personal problems

Consideration that the partnership assets are overvalued

Anticipation of less net income in future years

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Furra College

The preferred accounting treatment under such circumstances is to leave net asset valuation

undisturbed unless a large amount of goodwill is carried in the accounting records. The

difference between the retiring partners capital account and the amount paid in settlement

should be credited as a bonus to the continuing partners.

M, N and P share net income or losses equally, and that each has a capital account balance of Br.

60,000. N retires from the partnership and receives Br. 50,000. The journal entry to record Ns

retirement is:

N, Capital

60,000

Cash

50,000

M, Capital (10,000*1/2)

5,000

P, Capital (10,000*1/2)

5,000

To record retirement of partner N for an amount less than carrying amount of Ns equity.

The final settlement with retiring partner is often differed for some time to permit:

The accumulation of cash

Measurement of net income to date of withdrawal

Obtaining of bank loans

Or other acts needed to complete the transaction

The retirement of a partner doesnt terminate the retiring partners responsibility for general

partnership liabilities existing on the retirement date.

Death of a Partner

A partnership contract often provides:

o Partners shall acquire life insurance policies on each others lives so that cash will be

available for settlement with the estate of a deceased partner.

o A buy-sell agreement wherein the surviving partners acquire equities of the deceased

partner

o The surviving partners are given an option to buy, or right of first refusal, rather than

imposing on the partnership an obligation to acquire the deceased partners equity.

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Furra College

Accounting for Liquidation of Partnerships

Liquidation means winding up partnership activities, usually by selling assets, paying liabilities

and distributing any remaining cash to partners.

A business enterprise that has ended normal operations and is in the process of converting its

assets to cash and making settlement with its creditors is said to be in liquidation, or in the

process of being liquidated.

Another commonly used term in liquidation is realization, which means the conversion of assets

to cash.

Distribution of Loss or Gain

When the decision to liquidate the partnership is made, the accounting records of the partnership

should be adjusted and closed, and the net income or loss for the final period of operations

entered in the accounts of the partners.

The losses or gains from realization of assets are divided among the partners in the income

sharing ratio and entered in their capital accounts. The underlying theme under the circumstances

is: Divide the loss or gain from realization before distributing the cash.

The income sharing ratio used during the operation is applicable upon liquidation also unless the

partners have a different agreement.

When the net loss or gain from liquidation is divided among the partners, the final balance of the

partners capital and loan ledger accounts will be equal to the cash available for distribution.

Payments are then made in the amounts of the partners respective equities in the partnership.

Distribution of Cash

The Uniform Partnership Act lists the order for distribution of cash by a liquidating partnership

as:

Payment of creditors in full

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Payment of loans from partners

Payment of partners capital account credit balances

Furra College

The indicated priority of partners loan over partners capital appears to be a legal provision

which is usually nullified for practical purposes by an established legal doctrine called the right

of offset. If a partners capital account has a debit balance or even a potential debit balance

depending upon possible future realization of losses, any credit balance in the partners loan

account must be offset against the deficit or potential deficit in the capital account. However, if a

partner with a loan account receives any cash, it is debited to the loan account to the extent of the

balance of that account. Furthermore, the existence of a partners loan account will not advance

the time of payment to any partner during liquidation.

The amount of cash, if any, that a partner is entitled to receive in liquidation can not be

determined until the partners capital accounts have been adjusted for any loss or gain on the

realization of the assets.

Settlement of Partners Capital Balances

The amount each partner receives from the liquidation of a partnership will be equal to:

The capital invested, whether recorded in a capital or loan account

A share of operating net income or loss minus drawings

A share of loss or gain from realization of assets

If the negative factors are larger, the partner will have a capital deficit (a debit balance in the

capital account), and must pay the amount of such deficit. Failure to effect such payment would

mean the partner had not complied with provisions of the partnership contract for sharing net

income or loss and cause the other partners to receive less than their equity in the partnership.

Illustration follows:

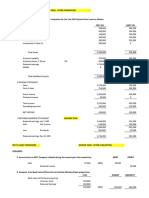

Equity of Each Partner is Sufficient to Absorb Loss from Realization

Assume that A and B, who share net income and losses equally, decide to liquidate their

partnership. A balance sheet on 30 June 1999, just prior to liquidation follows:

A & B Partnership

Balance Sheet

June 30, 1999

Assets

Cash

10,000.00

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Other assets

Total

Furra College

75,000.00

85,000.00

Liabilities and Partners Capital

Liabilities

20,000.00

Loan Payable to B

20,000.00

A, Capital

40,000.00

B, Capital

5,000.00

Total

85,000.00

Non cash assets with a carrying amount of Br. 75,000.00 realized cash of Br. 35,000.00,

with the resultant loss absorbed by A and B.

The accountant exercises the right of offset by transferring Br. 15,000.00 from Bs loan

account to his capital account.

A & B Partnership

Statement of Realization and Liquidation

July 1-15, 1999

Assets

Cash Other

Liabilities

B Loan

Balances before liquid.

10,000

75,000

40,000

5,000

Realization at a loss of40,000 35,000

(75,000)

(20,000)

(20,000)

Balances

45,000

20,000

(15,000)

Payment to Creditors

(20,000)

Balance

25,000

20,000

(15,000)

Offset Bs loan

15,000

Balance

25,000

20,000

Payments to Partners

(25,000)

(20,000)

Partners Capital

A (50%)

B (50%)

20,000

20,000

20,000

20,000

(20,000)

20,000

(15,000)

5,000

(5,000)

From the above it is apparent that partners loan account has no special significance in the

liquidation process. Therefore, in succeeding illustrations, whenever a partners loan account is

involved its balance will be combined with the partners capital account balanc

Equity of One Partner Not Sufficient to Absorb Loss From Realization

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Furra College

In this case, distribution of loss on realization of assets as per the income sharing ratio results in

debit balance in capital account of one of the partners. The partner must pay sufficient cash to the

partnership to eliminate any capital deficit. If the partner is unable to do so, the deficit must be

absorbed by the other partners as an additional loss in the same proportion as they have

previously shared net income or loss among themselves. To illustrate, assume the following

balance sheet for DEF Partnership just prior to liquidation:

D, E &F Partnership

Balance Sheet

May 20, 1999

Assets

Cash

Other assets

Total

20,000

80,000

100,000

Liabilities & Partners Capital

Liabilities

D, Capital

E, Capital

F, Capital

Total

30,000

40,000

21,000

9,000

100,000

The income sharing ratio is 20%, 40%, and 40% to D, E, and F respectively.

The other assets with carrying amount of Br. 80,000 realized Br. 50,000 cash.

D,E &F Partnership

Statement of Realization and Liquidation

May 21 to 31, 1999

Assets

Cash Other Liabilities

Balance before liquidation 20, 000

80,000 30,000

Realization

50,000 (80,000)

Balances

70,000

30,000

Payment to creditors

(30,000)

(30,000)

Balance

40,000

Cash from F

3,000

Balances

43,000

Payment to partners

(43,000)

D (20%)

40,000

( 6,000)

34,000

partners Capital

E(40%)

F(40%)

21,000

9,000

(12,000)

(12,000)

9,000

(3,000)

34,000

9,000

34,000

(34,000)

9,000

(9,000)

(3,000)

3,000

0

0

Change one condition of the following illustration by assuming that partner F was not able to pay

the 3,000 capital deficit to the partnership. If the cash available is to be distributed without delay,

the statement of realization and liquidation would appear as:

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Furra College

D, E &F Partnership

Statement of Realization and Liquidation

May 21 to 31, 1999

Assets

Cash

Other

Balance before liquidation 20,000 80,000

Realization

50,000 (80,000)

Balances

70,000

Payment to creditors

(30,000)

Balance

40,000

Payment to partners

(40,000)

Balance

Liabilities

30,000

D (20%)

40,000

(6,000)

34,000

30,000

(30,000)

Partners Capital

E(40% )

F(40%

21,000

9,000

(12,000)

(12,000)

9,000

(3,000)

34,000

9,000

(33,000) (7,000)

1,000 2,000

(3,000)

0

(3,000)

The cash payments made to D and E leaves both with a sufficient capital account balance to

share their share of the additional loss if F is unable to pay the Br. 3,000 to the partnership.

If the Br. 3,000 is later collected from F, this amount will be divided Br. 1,000 to D and Br.

2,000 to E. However, if the 3,000 from F is uncollectible the statement of realization and

liquidation is completed with the write off of Fs capital deficit as additional loss to D and E.

Equities of Two Partners Are Not Sufficient to Absorb Their Shares of Loss From

Realization

One capital deficit, if uncollectible, may cause a second capital deficit that may or may not be

collectible. In other words, a partner may have sufficient credit balance in his capital and loan

accounts to cover losses from realization but may not have sufficient equity to absorb loss caused

by inability of the partnership to collect the deficit in another partners capital account.

Assume that J, K, L and M share net income and loss 10%, 20%, 30%, and 40% respectively.

J, K, L &M Partnership

Statement of Realization and Liquidation

August 1 to 15, 1999

M(40%)

Balance before liquidation

8,000

Realization

(32,000)

Assets

Cash

Other

20,000

200,000

120,000

(200,000)

Liab.

120,000

Partners Capital

J (10%)

K (20%) L(30%)

30,000

32,000

(8,000)

(16,000)

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

30,000

(24,000)

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Balances

(24,000)

Payment to creditors

Balance

(24,000)

Payment to partners

Balance

(24,000)

140,000

120,000

(120,000)

20,000

(120,000)

22,000

16,000

22,000

(20,000)

(16,000)

6,000

Furra College

6,000

16,000

(4,000)

12,000

6,000

6,000

J, K, L &M Partnership

Statement of Realization and Liquidation

August 1 to 15, 1999

Partners Capital

Balance before cash dist.

Additional loss to J, K, l, &M

(10: 20: 30)

Balance

Additional loss to J & K

Amount that may be paid to partners

J (10%)

K(20%)

L(30%)

M(40%)

22,000

16,000

6,000

(24,000)

(4,000)

18,000

(2,000)

16,000

( 8,000)

8,000

(4,000)

4,000

(12,000) 24,000

(6,000)

6,000

Partnership is Insolvent but Partners Are Solvent

A partnership is insolvent means it is unable to pay all outside creditors. In such cases, the total

of the capital account debit balances exceeds the total of the credit balances. If the

partner\partners with deficit pay the required cash, the partnership will be able to pay its

liabilities. However, the partnership creditors may demand payment from any solvent partner

whose actions caused the partnerships insolvency, regardless of whether the partners capital

account has a debit or a credit balance.

Any partner who makes payments to partnership creditors receives credit to his or her capital

account.

N, O, & P partnership is liquidated on May 10,1999

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Furra College

Other assets with Br. 85,000 carrying amount realize Br. 40,000 cash

Total cash available of Br. 55,000 is paid to creditors leaving unpaid balance of Br.

10,000

N, O & P LLP

Statement of Realization and Liquidation

May 11 to 31, 1999

Assets

Cash

Other

Balance before liquidation 15,000 85,000

Realization

40,000 (85,000)

Balances

55,000

Partial Pmt to creditors

(55,000)

Balance

0

Cash by O & P

13,000

Balance

13,000

Final Pmt to creditors

(10,000)

Balance

3,000

Payment to N

(3,000)

Liabilities

65,000

65,000

(55,000)

10,000

10,000

(10,000)

Partners Capital

N (1/3) O(1/3)

18,000 10,000

(15,000) (15,000)

3,000

(5,000)

3,000

(5,000)

5,000

P(1/3)

7,000

(15,000)

(8,000)

(8,000)

8,000

3,000

3,000

(3,000)

General Partnership is Insolvent and Partners Are Insolvent

In an insolvent general partnership with one or more insolvent partners, the relative right of

the following groups would be:

Assets of the general partnership are first available to partnership creditors

Assets of the partners are first available to their creditors

o After full payment to the partners creditors assets of the partner are available

to partnership creditors whether that partners capital account has a debit or a

credit balance

To illustrate, R, S & T Partnership is a general partnership whose partners share net income or

loss equally. On 30 Nov. the partners have the following assets and liabilities other than their

equities in the partnership.

Partner

R

Personal

Assets

100,000

Personal

Liabilities

25,000

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

S

T

50,000

5,000

Furra College

50,000

60,000

Realization of other assets results in Br. 60,000 loss

R, S & T PARTNERSHIP

Statement of Realization and Liquidation

December 1 to 12, 1999

Assets

Partners Capital

Cash

Other Liabilities

R (1/3) S (1/3)

Balance before liquidation 10,000

100,000 60,000

5,000

15,000

Realization

40,000

(100,000)

(20,000) (20,000

Balances

50,000

60,000

(15,000) (5,000)

Partial Pmt to creditors

(50,000)

(50,000)

Balance

0

10,000

(15,000) (5,000)

Pmt to PP creditors by R

(10,000)

10,000

Balance

Cash by R

Balances

Payment to T

Balance

Write-off of Ss Deficit

Balances

Cash by R

Balances

Payment to T

0

5,000

5,000

(5,000)

5,000

(5,000)

10,000

10,000

(5,000)

(5,000)

2,500

2,500

(2,500)

T (1/3)

30,000

(20,000)

10,000

(5,000)

(2,500)

5,000

(2,500)

2,500

10,000

(5,000)

5,000

(2,500)

2,500

2,500

(2,500)

Installment Payment to Partners

Occurs when realization of non cash assets takes longer periods and the partners want to receive

cash as it becomes available rather than waiting until all non cash assets are realized.

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Furra College

Liquidation in installment is, therefore, a process of realizing some assets, paying creditors,

paying the remaining available cash to partners, realizing additional assets, and making

additional cash payment to partners until all non cash assets are realized and all cash distributed.

General Principles Guiding Installment Payments

The only safe policy for determining cash payments to partners is assuming the worst case

scenario:

Assume a total loss on all remaining non cash assets, and provide for all possible losses,

including potential liquidation costs and unrecorded liabilities

Any partner with a potential capital deficit will be unable to pay anything;

Thus, distribute each installment of cash as if no more cash will be forthcoming.

To illustrate, assume that the partners of UVW Partnership who share net income or loss in a

4:3:2 ratio decide to liquidate the partnership and distribute cash in installments. The balance

sheet just prior to liquidation on July 5, 1999 is as follows:

UVW Partnership

Balance Sheet

July 5, 1999

Assets

Cash

Other Assets

Total

Liabilities & Partners Capital

8,000

Liabilities

192,000

U, Capital

V, Capital

W, Capital

200,000

Total

61,000

40,000

45,000

54,000

200,000

UVW Partnership

Realization of Other Assets

July 6 to September 30, 1999

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Date

Book Value

Proceed

Loss

July 31

August 31

September 30

62,000

66,000

64,000

48,500

30,000

32,500

13,500

30,000

31,500

Total

192,000

111,000

81,000

Furra College

Cash distribution is to be made monthly

UVW PARTNERSHIP

Statement of Realization and Liquidation

July 6 to September 30, 1999

Assets

Cash Other Liabilities

8,000 192,000 61,000

48,500 (62,000)

56,500 130,000 61,000

(56,500)

(56,500)

130,000 4,500

30,000 (66,000)

30,000 64,000 4,500

(4,500)

(4,500)

25,500 64,000

(25,500)

64,000

32,500 (64,000)

32,500

(32,500)

Balance before liquidation

Realization July, 31

Balances

Partial Payment to Creditors

Balances

Realization August, 31

Balances

Final Pmt to Creditors

Balances

Pay to Partners (Sch.2)

Balances

Realization

Balances

Final pmt to Partners

Partners Capital

U (4)

V (3)

40,000

45,000

(6,000)

(4,500)

34,000

40,500

W (2)

54,000

(3,000)

51,000

34,000

(16,000)

18,000

51,000

(8,000)

43,000

18,000

28,500

(900)

18,000

27,600

(14,000)

(10,500)

4,000

17,100

(4,000) (17,100)

UVW PARTNERSHIP

Schedule of Safe Payment to Partners

U (4)

V (3)

Schedule 1: July 31

Balance before cash distribution

34,000

40,500

(12,000)

28,500

43,000

(24,600)

18,400

(7,000)

11,400

(11,400)

W (2)

40,500

51,000

28,500

(21,333)

7,167

(6,267)

900

43,000

(14,222)

28,778

(4,178)

24,600

No cash distribution to partners

as creditors are not fully paid yet

Schedule 2: August 31

Balance before cash distribution 18,000

Full loss of Br. 64, 000 assets

(28,445)

Balances

(10,445)

Full absorption of Us deficit (3:2) 10,445

Balances to be distributed

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

Chapter Two: Accounting for Dissolution and Liquidation of Partnership

Furra College

Compiled By Tekalign Negash (Lecturer and M.Sc in Accounting and Finance)

4

You might also like

- Liquidity Ratios - Practice QuestionsDocument14 pagesLiquidity Ratios - Practice QuestionsOsama SaleemNo ratings yet

- Formation of DD and EE partnershipDocument3 pagesFormation of DD and EE partnershipmiss independent100% (1)

- B440 Management Representation LetterDocument2 pagesB440 Management Representation LetterTuấn Phạm Nguyễn ĐìnhNo ratings yet

- Chapter 4 Analysis of Financial StatementsDocument2 pagesChapter 4 Analysis of Financial StatementsSamantha Siau100% (1)

- Financial Ratio Analysis, Exercise and WorksheetDocument4 pagesFinancial Ratio Analysis, Exercise and Worksheetatiqahrahim90No ratings yet

- Accounting Research EssayDocument4 pagesAccounting Research EssayInsatiable LifeNo ratings yet

- Problems: Problem 4 - 1Document4 pagesProblems: Problem 4 - 1KioNo ratings yet

- Accounting Fundamentals Explained in 40 StepsDocument70 pagesAccounting Fundamentals Explained in 40 Stepsyared destaNo ratings yet

- Chapter 3 Partnership Liquidation and IncorporationDocument73 pagesChapter 3 Partnership Liquidation and IncorporationHarry J Gartlan100% (1)

- Acctg 15 - Midterm ExamDocument6 pagesAcctg 15 - Midterm ExamAngelo LabiosNo ratings yet

- Human Behavior in OrganizationDocument22 pagesHuman Behavior in Organizationmirmo tokiNo ratings yet

- Chapter 2Document12 pagesChapter 2Cassandra KarolinaNo ratings yet

- Income Tax Part 1Document16 pagesIncome Tax Part 1mary jhoyNo ratings yet

- PRACTICAL ACCOUNTING 1 Part 2Document9 pagesPRACTICAL ACCOUNTING 1 Part 2Sophia Christina BalagNo ratings yet

- LiquidationDocument2 pagesLiquidationMikelle Justin RaizNo ratings yet

- Cash and Cash EquivalentDocument50 pagesCash and Cash EquivalentAurcus JumskieNo ratings yet

- Accounting Systems Principles and DevelopmentDocument7 pagesAccounting Systems Principles and DevelopmentjaysonNo ratings yet

- Quiz 2 Case StudyDocument3 pagesQuiz 2 Case StudyChristian Mark ParasNo ratings yet

- Quiz 2Document19 pagesQuiz 2Quendrick SurbanNo ratings yet

- Partnership Dissolution and Liquidation GuideDocument15 pagesPartnership Dissolution and Liquidation GuideDarwyn MendozaNo ratings yet

- AIS Chapter 7Document2 pagesAIS Chapter 7Rosana CabuslayNo ratings yet

- Top 40 Accounting Research Paper Topic IdeasDocument7 pagesTop 40 Accounting Research Paper Topic Ideasjm syNo ratings yet

- Administrative Office ManagementDocument44 pagesAdministrative Office ManagementLea VenturozoNo ratings yet

- It 800 PrefinalDocument3 pagesIt 800 PrefinalRovern Keith Oro CuencaNo ratings yet

- Advanced Accounting Multiple Choice ProblemsDocument15 pagesAdvanced Accounting Multiple Choice ProblemsKryscel ManansalaNo ratings yet

- Different Strokes . Political and Economic Systems Around The GlobeDocument22 pagesDifferent Strokes . Political and Economic Systems Around The GlobeMarjon DimafilisNo ratings yet

- Responsibility AccountingDocument3 pagesResponsibility AccountinglulughoshNo ratings yet

- AdjustmentDocument5 pagesAdjustmentBeta TesterNo ratings yet

- Consolidated Statement of Financial Position - Date of Acquisition AnalysisDocument2 pagesConsolidated Statement of Financial Position - Date of Acquisition AnalysisKharen Valdez0% (1)

- A4 PalacioDocument3 pagesA4 PalacioPinky DaisiesNo ratings yet

- CHAPTER I and IIDocument13 pagesCHAPTER I and IIPritz Marc Bautista MorataNo ratings yet

- Ais Chapter 15 Rea ModelDocument138 pagesAis Chapter 15 Rea ModelJanelleNo ratings yet

- Business Combination-Acquisition of Net AssetsDocument2 pagesBusiness Combination-Acquisition of Net AssetsMelodyLongakitBacatanNo ratings yet

- What Is The Significance of Annual Objectives in Strategy ImplementationDocument1 pageWhat Is The Significance of Annual Objectives in Strategy Implementationbhupesh_kushwahaNo ratings yet

- Module 2Document8 pagesModule 2ysa tolosaNo ratings yet

- Auditing in CIS Environment - Auditing Operating Systems and Networks (Final)Document44 pagesAuditing in CIS Environment - Auditing Operating Systems and Networks (Final)Luisito100% (2)

- Chapter 4 DCFDocument107 pagesChapter 4 DCFVienne MaceNo ratings yet

- Auditing Chapter 1Document7 pagesAuditing Chapter 1Sigei LeonardNo ratings yet

- Partnership Formation NotesDocument3 pagesPartnership Formation NotesApril GumiranNo ratings yet

- BDO Unibank 2020 Annual Report Financial SupplementsDocument236 pagesBDO Unibank 2020 Annual Report Financial SupplementsDanNo ratings yet

- Week 10 Control Self AssessmentDocument24 pagesWeek 10 Control Self AssessmentMark Angelo BustosNo ratings yet

- Module 3 - Home Office Brancg Acctg Part 1Document13 pagesModule 3 - Home Office Brancg Acctg Part 1May P. Huit100% (1)

- ACTPACO Lecture NotesDocument68 pagesACTPACO Lecture NotesJohan Lourens100% (3)

- Globe Reflection aCyFaR1 AWItDocument9 pagesGlobe Reflection aCyFaR1 AWIt123r12f1No ratings yet

- PFRS 3, Business CombinationsDocument39 pagesPFRS 3, Business Combinationsjulia4razoNo ratings yet

- Ict 2 Finals Quiz 1Document2 pagesIct 2 Finals Quiz 1Dmzjmb SaadNo ratings yet

- ADVACCDocument3 pagesADVACCCianne AlcantaraNo ratings yet

- Construction Contracts GuideDocument3 pagesConstruction Contracts GuideJamie RamosNo ratings yet

- True Copy of ThesisDocument15 pagesTrue Copy of ThesisCrizza Mae Mamador-Ancho NoayNo ratings yet

- Audit Exam QuestionnaireDocument12 pagesAudit Exam QuestionnaireKathleenNo ratings yet

- Horizontal AnalysisDocument6 pagesHorizontal AnalysisJames Torniado AgboNo ratings yet

- Consignment Sales AnswersDocument4 pagesConsignment Sales AnswersLovelyNo ratings yet

- Global BusinessDocument2 pagesGlobal BusinessJerica DacanayNo ratings yet

- Financial Statements ExplainedDocument9 pagesFinancial Statements ExplainedTokie TokiNo ratings yet

- Fa 3 Chapter 2 Statement of Financial PositionDocument22 pagesFa 3 Chapter 2 Statement of Financial PositionKristine Florence TolentinoNo ratings yet

- BA10 Chap 8 P12Document8 pagesBA10 Chap 8 P12Liz CNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- LLP Organization and Partnership AgreementsDocument6 pagesLLP Organization and Partnership AgreementsAhmad Al-Tarifi Abu JozephNo ratings yet

- Partnership - DissolutionDocument51 pagesPartnership - DissolutionJulius B. OpriasaNo ratings yet

- CMPC 131 3-Partnership-DissltnDocument13 pagesCMPC 131 3-Partnership-DissltnGab IgnacioNo ratings yet

- Figure For Flow of Inventory and CostsDocument1 pageFigure For Flow of Inventory and CostsTekaling NegashNo ratings yet

- Master Budget and Responsibility Accounting Chapter Cost Accounting Horngreen DatarDocument45 pagesMaster Budget and Responsibility Accounting Chapter Cost Accounting Horngreen Datarshipra_kNo ratings yet

- Guide: Reduce Your Costs WithDocument80 pagesGuide: Reduce Your Costs WithTekaling NegashNo ratings yet

- Iso 14001 Certification and Financial Performance of CompaniesDocument21 pagesIso 14001 Certification and Financial Performance of CompaniesTekaling NegashNo ratings yet

- Bank ServiceDocument11 pagesBank ServiceTekaling NegashNo ratings yet

- 18Document6 pages18Tekaling NegashNo ratings yet

- Environmental Management Accounting - : Overview and Main ApproachesDocument23 pagesEnvironmental Management Accounting - : Overview and Main ApproachesTekaling Negash100% (1)

- Ma1 Mod6 Handout1 PDFDocument14 pagesMa1 Mod6 Handout1 PDFTekaling NegashNo ratings yet

- Environmental Management Accounting (EMA), Management Accounting Including Environmental Management - A Literature ReviewDocument53 pagesEnvironmental Management Accounting (EMA), Management Accounting Including Environmental Management - A Literature ReviewTekaling NegashNo ratings yet

- The Role of Environmental Cost Accounting in Environmental Sustainability in NigeriaDocument13 pagesThe Role of Environmental Cost Accounting in Environmental Sustainability in NigeriaTekaling NegashNo ratings yet

- Uses of Financial Reporting Accountability and Interperiod EquityDocument4 pagesUses of Financial Reporting Accountability and Interperiod EquityTekaling NegashNo ratings yet

- Example 1 On CVPDocument1 pageExample 1 On CVPTekaling NegashNo ratings yet

- Managerial Accounting and Environmental Performance of Bakery CompaniesDocument9 pagesManagerial Accounting and Environmental Performance of Bakery CompaniesTekaling NegashNo ratings yet

- GuidelinesDocument4 pagesGuidelinesAkopohxi JuvyNo ratings yet

- 18Document6 pages18Tekaling NegashNo ratings yet

- Comparison of Financial Reporting Objectives State and Local Governments Federal Government and Not-for-Profit OrganizationsDocument1 pageComparison of Financial Reporting Objectives State and Local Governments Federal Government and Not-for-Profit OrganizationsTekaling NegashNo ratings yet

- Master Budget and ResponisbiltiyDocument68 pagesMaster Budget and ResponisbiltiyTekaling Negash100% (1)

- Comparison of Financial Reporting Objectives State and Local Governments Federal Government and Not-for-Profit OrganizationsDocument1 pageComparison of Financial Reporting Objectives State and Local Governments Federal Government and Not-for-Profit OrganizationsTekaling NegashNo ratings yet

- Master Budget BestDocument10 pagesMaster Budget BestTekaling NegashNo ratings yet

- Chapter Two Consolidated Financial Statement On Date of AcqusitionsDocument30 pagesChapter Two Consolidated Financial Statement On Date of AcqusitionsTekaling NegashNo ratings yet

- Types of Business CombinationsDocument1 pageTypes of Business CombinationsTekaling NegashNo ratings yet

- Cash BudgetDocument2 pagesCash BudgetTekaling NegashNo ratings yet

- Windows QWERTY Keyboard Keys ExplainedDocument12 pagesWindows QWERTY Keyboard Keys ExplainedTekaling NegashNo ratings yet

- Process Costing EssentialsDocument14 pagesProcess Costing EssentialsTekaling NegashNo ratings yet

- Accounting Worksheet Chapter 2 Adjusting EntriesDocument1 pageAccounting Worksheet Chapter 2 Adjusting EntriesTekaling NegashNo ratings yet

- Efficient Markets Hypothesis Andrew W. LoDocument28 pagesEfficient Markets Hypothesis Andrew W. LomalilimaNo ratings yet

- Apa 6 TheditionDocument3 pagesApa 6 TheditionTekaling NegashNo ratings yet

- CH 02Document30 pagesCH 02AhsanNo ratings yet

- Chapter 4Document4 pagesChapter 4Tekaling NegashNo ratings yet

- Project Work HarishDocument11 pagesProject Work HarishHarish Pillu.No ratings yet

- SA 540 - PresentationDocument22 pagesSA 540 - PresentationRajesh SNo ratings yet

- Proof of Payment CodeKece Creative StudioDocument1 pageProof of Payment CodeKece Creative StudioIing the m.rollesNo ratings yet

- Cash Journal - Advantages and Configuration - SAP BlogsDocument6 pagesCash Journal - Advantages and Configuration - SAP BlogsAlia del ArteNo ratings yet

- How Environmentalism Nationalism and Civil Rights Shape CorporaDocument73 pagesHow Environmentalism Nationalism and Civil Rights Shape CorporaTien PhamNo ratings yet

- Sol Man Chapter 7 Construction Contracts 2020 EditionDocument38 pagesSol Man Chapter 7 Construction Contracts 2020 EditionTricia AranillaNo ratings yet

- Forecasting: © 2007 Pearson EducationDocument58 pagesForecasting: © 2007 Pearson EducationIqbal HussainNo ratings yet

- Clay Bricks Manufactruing Kiln Zigzag Technology Rs. 33.74 Million Jun-2021Document21 pagesClay Bricks Manufactruing Kiln Zigzag Technology Rs. 33.74 Million Jun-2021ABDUL BASITNo ratings yet

- VPN-Step 2Document9 pagesVPN-Step 2Ivan OrellanosNo ratings yet

- What Is The Planning Process?: ViewsDocument2 pagesWhat Is The Planning Process?: ViewsKim Gabriel OañaNo ratings yet

- Code of Conduct & Business Principles: The AsmlDocument23 pagesCode of Conduct & Business Principles: The Asmlcheri kokNo ratings yet

- Commodity FuturesDocument25 pagesCommodity FuturesPragya JainNo ratings yet

- 569 Project ManagementDocument7 pages569 Project Managementfmr123No ratings yet

- Tugas ManPro Group 1Document2 pagesTugas ManPro Group 1Salshadina SundariNo ratings yet

- The Organization of International BusinessDocument42 pagesThe Organization of International Businesshesham meckawyNo ratings yet

- Audit and Assurance (AA) : Syllabus and Study GuideDocument19 pagesAudit and Assurance (AA) : Syllabus and Study Guidepallavi hasandasaniNo ratings yet

- Evaluation Sheet Icqcc 2022Document1 pageEvaluation Sheet Icqcc 2022deepakNo ratings yet

- 14 Acctg Ed 1 - Receivable FinancingDocument19 pages14 Acctg Ed 1 - Receivable FinancingNath BongalonNo ratings yet

- MR ProposalDocument22 pagesMR ProposalTRONG NGUYEN HA PHUOCNo ratings yet

- Internal Controls: Noelito M. Sales, CPA, MBA, CTTDocument52 pagesInternal Controls: Noelito M. Sales, CPA, MBA, CTTPrincess MalaluanNo ratings yet

- Unit 8: Marketing: Case Study: Wincote International P.80 - P.81Document53 pagesUnit 8: Marketing: Case Study: Wincote International P.80 - P.81ANH LÊ ĐỨCNo ratings yet

- PAS16 mcq1Document11 pagesPAS16 mcq1Margaux CornetaNo ratings yet

- PENA Midterm and Final ExamsDocument43 pagesPENA Midterm and Final ExamsCza PeñaNo ratings yet

- Prospectus of ZudioDocument26 pagesProspectus of Zudiosecure.kalyanjNo ratings yet

- Business Intelligence and Analytics Fundamentals - Charles NatuhamyaDocument21 pagesBusiness Intelligence and Analytics Fundamentals - Charles NatuhamyaCharles NatuhamyaNo ratings yet

- MSG Luton Managing Small and Medium Sized Enterprises 10.2.21Document19 pagesMSG Luton Managing Small and Medium Sized Enterprises 10.2.21MarianAdragaiNo ratings yet

- Social Media Marketing ProposalDocument6 pagesSocial Media Marketing ProposalAnkit SuraNo ratings yet

- Competitive Profile Worksheet: Key CompetitorsDocument11 pagesCompetitive Profile Worksheet: Key CompetitorsRod LorNo ratings yet

- Non-Disclosure Agreement TemplateDocument3 pagesNon-Disclosure Agreement TemplategiehartonoNo ratings yet

- Gravity and Low Pressure Die CastingDocument10 pagesGravity and Low Pressure Die CastingtumoyeNo ratings yet