Professional Documents

Culture Documents

Audit Summary Chapter 1

Uploaded by

saniastariOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Summary Chapter 1

Uploaded by

saniastariCopyright:

Available Formats

AUDITING

CHAPTER 1

The Demand for Audit and Other Assurance Services

Created by : Group 2

Dwi Astutik

F0311042

Lynda Mason

F0311070

Meitia Faridha

F0311076

Susani Astari .A.

F0311106

Yoga Priya .A.

F0311121

Lecturer : M. Agung Prabowo, Drs., M.Si., Ph.D., Ak.

ECONOMIC FACULTY

SEBELAS MARET UNIVERSITY

SURAKARTA

2013

Auditing is the accumulation and evaluation of evidence about information to determine and

report on the degree of correspondence between the information and established criteria.

To do an audit, there must be information in a verifiable form and some standards (criteria)

by which the auditor can evaluate the information.

The ciretria for evaluating information also vary depending on the information being audit.

Typically, audtors and the entities being audited agree on the criteria well before the audit

starts.

Evidence is any information used by the auditor to determine whether the information being

audited is stated in accordance with the established criteria. Evidence takes many different

forms, including:

Electronic and documentary data about transactions

Written communication with outsiders

Observations by the auditor

Oral testimony of the auditee (client)

Auditing should be done by a competent and independent mental person.

Independent auditors needed to maintain a high level of independence to keep the

confidence of users relying on their reports.

The final stage in the auditing process is preparing the audit report, which communicates

the auditors findings to users, including the degree of correspondence between the

information audited and established criteria.

Distinction between auditing and accounting

Accounting is the recording, classifying, and summarizing of economic events in a logical

manner for the purpose of providing financial information for decision making.

Auditors focus on determining whether recorded information properly reflects the economic

events that occurred during the accounting period.

Auditing is needed because there is a possibility of information risk, information upon

which the business risk decision was made was innacurrate.

Causes of information risk :

1 Remoteness of information

Decision maker may received information not from firsthand knowledge, but from

another parties, that increase the likelihood of being intentionally or unintentinally

misstated.

2 Biases and motives of the provider

If information is provided by someone whose goals are inconsistent with those of the

decision maker, the information may be biased in favor of the provider.

3 Voluminous Data

The larger the organization, the larger volume of exchange transaction, that increase the

likelihood of improperly recorded information.

4 Complex Exchange Transactions

Exchange transactions between organizations have become increasingly complex and

therefore more difficult to record properly.

Three main ways to reduce information risk:

1 User Verifies Information

1

The user may go to the business premises to examine records and obtain information

about the reliability of the statements.

2 User Shares Information Risk with Management

A difficulty with sharing information risk with management is that users may not be

able to collect on losses.

3 Audited Financial Statements Are Provided.

Management of a private company or the audit committee for a public company engages

the auditor to provide assurance to users that the financial statements are reliable.

Assurance services is an independent proffesional service that improves the quality of

information for decision makers.Assurance services can be done by CPAs or by variety of

other professionals.

Attestation services is one category of services provided by CPAs attestation services.

Attestation services is a type of assurance sevice in which the CPA firm issues a report about

the reliability of an assertion that is made by another party.

Five categories of attestation services :

1 Audit of historical financial statements

Management asserts that the statement are fairly stated in accordance with applicable US

or international accounting standards.

2 Audit of internal control over fiancial reporting

Management asserts that internal controls have been developed and implemented

following well established criteria.

3 Review of historical financial statements

Management asserts that the statements are fairly stated in accordance with accounting

standards, the same as for audits.

4 Attestation services on information technology

Management makes various assertions about the reliability and security of electronic

information. Examples : WebTrust and SysTrust

5 Other attestation services that may be applied to a broad range of subject matter

Corntrols over and risk related to investments, including policies related to derivatives,

mystry shopping, fraud and illegal acts risk assessment.

CPA perform numerous other services that generally fall outside the scope of assurance

services(nonassurance services). Three examples are accounting and bookkeeping services,

tax services, and management consulting services.

Relationship among assurance services, attestation services, and nonassrance services.

Audits, reviews, reports on the effectiveness of internal control over financial reporting,

attestation services on information technology, and other attestation services are all examples

of attestation services, which fall under the scope of assurance services. Some assurance

services, such as WebTrust and SysTrust, also meet the criteria of attestation services.

Types of Audit:

1 Operational Audits

Evaluates the efficiency and effectiveness of any part of an organizations operating

procedures and methods.

2

At the compleetion og an operational audit, management normally expects

recommendation for improving operation.

In operational auditing, the reviews are not limited to accounting. They can include

the evaluation of organizational structure, computer operations, production methods,

marketing, and any other area in which the auditor is qualified.

2 Compliance Audits

Conducted to determine whether the auditee is following specific procedures, rules,

or regulations set by some higher authority.

Governmental units, such as school districts, are subject to considerable compliance

auditing because of extensive government regulation.

Results of compliance audits are typically reported to management, rather than

outside users, because management is the primary group concerned with the extent of

compliance with prescribed procedures and regulations.

3 Financial Statement Audits

Conducted to determine whether the financial statements (the information being

verified) are stated in accordance with specified criteria.

In determining whether financial statements are fairly stated in accordance with

accounting standards, the auditor gathers evidence to determine whether the

statements contain material errors or other misstatements.

Types of Auditors :

Certified public accounting firms, responsible for auditing the published historical

financial statements of all publicly traded companies. Auditors who express audit

opinions on financial statements must be licensed as CPAs. Often called external auditors

or independent auditors,

Government accountibility office auditor, working for the U.S. Government

Accountibility Office (GAO), reports to and is responsible solely to Congress.

Internal revenue agents, responsible for enforcing the federal tax laws as they have been

defined by Congress and interpreted by the courts, to audit taxpayers returns to

determine whether they have complied with the tax laws.

Internal auditors, emploeyd by all types of organizations to audit for management, the

responsibilities vary depending on the employer. Typically reports directly to the

president, another high executive officer, or the audit committee of the board of directors.

Certified Public Accountant (CPA) is regulated by state law through the licensing

departments of each state, which are usually differ within any state. Three requirement for

becoming CPA are

Educational requirement that are normally an undergraduate or graduate degree with a

major in accounting, including a minimum number of accounting credits.

Uniform CPA examination requirement, a computer-based examination consist of

auditing and attestation, financial accounting and reporting, regulation, business

environment and concepts.

Experience requirement, varies widely from no experience to 2 years, including auditing.

3

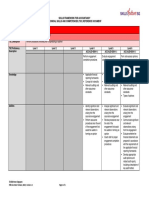

GROUP DISCUSSION RECORD

Place

: BMT Economic Faculty of UNS

Time

: Saturday, March 3, 2013 (07.30 - 10.00 am)

Points of discussion :

Definition of auditing

Information and established criteria for auditing

Competent and independent auditor

Reporting

Distinction between auditing and accounting

Importance of auditing in reducing information risk

Reducing information risk

Definition of assurance services and attestation services

Other assurance services

Relation among assurance, attestation, and non assurance services

Types of audit (Operational, Compliance, and Financial Statement Audit)

Types of auditors (CPA Firms, Government Accountibility Office Audtors, Internal Revenue

Agents, and Internal Auditors)

Requirement for becoming CPA

You might also like

- Textbook of Urgent Care Management: Chapter 38, Audits by Managed-Care Organizations and Regulatory AgenciesFrom EverandTextbook of Urgent Care Management: Chapter 38, Audits by Managed-Care Organizations and Regulatory AgenciesNo ratings yet

- CH 1Document34 pagesCH 1Ram KumarNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Audit UNIT 1Document9 pagesAudit UNIT 1Nigussie BerhanuNo ratings yet

- IS Auditor - Process of Auditing: Information Systems Auditor, #1From EverandIS Auditor - Process of Auditing: Information Systems Auditor, #1No ratings yet

- Auditing I CH I-3Document64 pagesAuditing I CH I-3mercyteshite5No ratings yet

- CHAPTER 3 Answers To Review QuestionsDocument9 pagesCHAPTER 3 Answers To Review Questionswhagan167% (3)

- The Demand For Audit and Other Assurance Services: Review Questions 1-1Document13 pagesThe Demand For Audit and Other Assurance Services: Review Questions 1-1Monique CabreraNo ratings yet

- Auditing CH 1Document20 pagesAuditing CH 1Nigussie BerhanuNo ratings yet

- Chapter - 1THE DEMAND FOR AUDIT AND OTHER ASSURANCE SERVICESDocument46 pagesChapter - 1THE DEMAND FOR AUDIT AND OTHER ASSURANCE SERVICESDina AlfawalNo ratings yet

- 1 AuditDocument9 pages1 Auditahmed sheblNo ratings yet

- Auditing Reading MaterialDocument58 pagesAuditing Reading MaterialSnn News TubeNo ratings yet

- Auditing Ch1 by MekaDocument7 pagesAuditing Ch1 by MekaEbsa AbdiNo ratings yet

- Chapter I-The Nature of Auditing: Information CriteriaDocument10 pagesChapter I-The Nature of Auditing: Information CriteriaAngel TumamaoNo ratings yet

- Auditing I Chapter OneDocument7 pagesAuditing I Chapter OneBam FbhNo ratings yet

- Auditing Principle 1 - ch1Document7 pagesAuditing Principle 1 - ch1Duguma BejigaNo ratings yet

- Chapter 02 Overview of AuditingDocument26 pagesChapter 02 Overview of AuditingRichard de LeonNo ratings yet

- IPFM Chapter 1Document20 pagesIPFM Chapter 1Yitera SisayNo ratings yet

- Lesson Number: 02 Topic: Audits of Financial Information Learning ObjectivesDocument18 pagesLesson Number: 02 Topic: Audits of Financial Information Learning ObjectivesDavid alfonsoNo ratings yet

- Auditing Principles and PracticesDocument58 pagesAuditing Principles and PracticeskainatNo ratings yet

- Matriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreDocument12 pagesMatriculation No: Identity Card No.: Telephone No.: E-Mail: Learning CentreKen KiongNo ratings yet

- Audit Chapter 1Document3 pagesAudit Chapter 1Aitzaz UddinNo ratings yet

- Chapter 1-3 SumaaryDocument16 pagesChapter 1-3 SumaaryLovely Jane Raut CabiltoNo ratings yet

- Chapter 1audi 2015 DUDocument10 pagesChapter 1audi 2015 DUMoti BekeleNo ratings yet

- Course: Auditing (481) Semester: Spring 2021 Assignment No.1 Q. 1 Define Auditing and Describe Its Various Techniques? AnswerDocument20 pagesCourse: Auditing (481) Semester: Spring 2021 Assignment No.1 Q. 1 Define Auditing and Describe Its Various Techniques? Answergemixon120No ratings yet

- Auditing: Module 1overview of Auditing and Pre-Engagement ActivitiesDocument22 pagesAuditing: Module 1overview of Auditing and Pre-Engagement ActivitiesElla Jane Buenaventura JimenezNo ratings yet

- Adms 4551 PDFDocument50 pagesAdms 4551 PDFjorNo ratings yet

- Into To World of CPAsDocument22 pagesInto To World of CPAsKristine WaliNo ratings yet

- 2021 M2IAEF Audit Compliance MaterialsDocument53 pages2021 M2IAEF Audit Compliance MaterialsLamis ShalabiNo ratings yet

- Comp. Lesson 7Document18 pagesComp. Lesson 7Ryan Prado AndayaNo ratings yet

- Chap. 1Document2 pagesChap. 1Al Mo SaintNo ratings yet

- TrangNTH BH01145 ASM1 APDocument12 pagesTrangNTH BH01145 ASM1 APTrang NguyenNo ratings yet

- Unit 1: An Overview of AuditingDocument12 pagesUnit 1: An Overview of AuditingYonasNo ratings yet

- Week 1 Overview of Audit - ACTG411 Assurance Principles, Professional Ethics & Good GovDocument6 pagesWeek 1 Overview of Audit - ACTG411 Assurance Principles, Professional Ethics & Good GovMarilou PanisalesNo ratings yet

- Verifiable Form Criteria Quantifiable Information Subjective InformationDocument5 pagesVerifiable Form Criteria Quantifiable Information Subjective InformationAnonymous BwN1AVNo ratings yet

- Auditing I Chap 1Document14 pagesAuditing I Chap 1Yitera SisayNo ratings yet

- Auditing Assignment Task 4Document7 pagesAuditing Assignment Task 4Naushal SachaniyaNo ratings yet

- Chapter 1 Outline: The Demand For Audit and Other Assurance ServicesDocument6 pagesChapter 1 Outline: The Demand For Audit and Other Assurance Servicestjn8240100% (1)

- 10.1007@978 3 319 90521 11Document14 pages10.1007@978 3 319 90521 11Ibtissam EljedaouyNo ratings yet

- Auditing Tutorial Answer1Document13 pagesAuditing Tutorial Answer1severinmsangiNo ratings yet

- What Are Assurance Services?Document4 pagesWhat Are Assurance Services?Sheila Mae AramanNo ratings yet

- Chapter 5 - Auditing Information Technology-Based ProcessesDocument4 pagesChapter 5 - Auditing Information Technology-Based ProcessesMichael AnibanNo ratings yet

- @audit CW1Document8 pages@audit CW1bujernest7No ratings yet

- Pre-Test: Lesson 1: Introduction To AuditingDocument3 pagesPre-Test: Lesson 1: Introduction To AuditingShaira UntalanNo ratings yet

- AUDITING PRINCIPLES I - NotesDocument69 pagesAUDITING PRINCIPLES I - Notesyebegashet100% (1)

- Chapter 1 - Assurance & Engagement (Audit Theory) 2010e - Ma. Elenita B. Cabrera - Chapter 02Document8 pagesChapter 1 - Assurance & Engagement (Audit Theory) 2010e - Ma. Elenita B. Cabrera - Chapter 02Pol AnduLanNo ratings yet

- Solutions For Chapter 1 Auditing: Integral To The Economy: Review QuestionsDocument26 pagesSolutions For Chapter 1 Auditing: Integral To The Economy: Review QuestionsStefany Mie MosendeNo ratings yet

- Chapter 3 SolutionsDocument13 pagesChapter 3 SolutionsjessicaNo ratings yet

- Understanding AuditingDocument2 pagesUnderstanding AuditingAlejandra VeneraNo ratings yet

- Auditing Principles and Practice I Chapter 1Document25 pagesAuditing Principles and Practice I Chapter 1demsashu21No ratings yet

- AUDITINGDocument13 pagesAUDITINGGrace AlolorNo ratings yet

- Introduction To Financial Statement AuditDocument63 pagesIntroduction To Financial Statement AuditRica RegorisNo ratings yet

- Chapter 03 - Answer PDFDocument8 pagesChapter 03 - Answer PDFjhienellNo ratings yet

- Mod 1Document15 pagesMod 1Marie claire Delos santosNo ratings yet

- The Role of Auditors With Their Clients and Third PartiesDocument45 pagesThe Role of Auditors With Their Clients and Third PartiesInamul HaqueNo ratings yet

- Auditing Chapter (1) First Part 2023Document26 pagesAuditing Chapter (1) First Part 2023Saleh RaoufNo ratings yet

- Audit Report PDFDocument14 pagesAudit Report PDFঅাজবমানুষNo ratings yet

- QuestionsDocument35 pagesQuestionsHeart SebNo ratings yet

- Chapter 1Document6 pagesChapter 1dejen mengstieNo ratings yet

- AAA - Assignment 2 (BEN)Document7 pagesAAA - Assignment 2 (BEN)Benson KamphaniNo ratings yet

- Audit Program-Cash FundsDocument2 pagesAudit Program-Cash FundsCristina RosalNo ratings yet

- A Review A Review of Financial Accounting Fraud Detection Based On Data Mining Techniquesof Financial Accounting Fraud Detection Based On Data Mining TechniquesDocument11 pagesA Review A Review of Financial Accounting Fraud Detection Based On Data Mining Techniquesof Financial Accounting Fraud Detection Based On Data Mining TechniqueskhuongcomputerNo ratings yet

- NGO Management Training Narrative Report - Accra, Ghana (July 2008)Document18 pagesNGO Management Training Narrative Report - Accra, Ghana (July 2008)wacsiNo ratings yet

- QAR of FS in Accordance With PSADocument169 pagesQAR of FS in Accordance With PSAMarco Fernando Lumanlan NgNo ratings yet

- 13.Privacy-Preserving Public Auditing For Secure Cloud StorageDocument3 pages13.Privacy-Preserving Public Auditing For Secure Cloud StorageprincegirishNo ratings yet

- CA. Sanjay K Agarwal: Bank Audit ManualDocument38 pagesCA. Sanjay K Agarwal: Bank Audit Manualcaabhaiagarwal1No ratings yet

- Accounting Thesis ExamplesDocument8 pagesAccounting Thesis ExamplesWriteMyMathPaperSingapore100% (2)

- GM 1927 01 Project PlanDocument1 pageGM 1927 01 Project Planmark100% (2)

- 1.audit Excel ChecklistsDocument92 pages1.audit Excel Checklistschari50% (2)

- Test Paper - HMCL SCP Manual TrainingDocument2 pagesTest Paper - HMCL SCP Manual TrainingMukesh YadavNo ratings yet

- Interim Results June 2008Document12 pagesInterim Results June 2008Huseyin BozkinaNo ratings yet

- The Role of Judicial Accounting and Its Impact in Reducing The Phenomenon of Money LaunderingDocument14 pagesThe Role of Judicial Accounting and Its Impact in Reducing The Phenomenon of Money LaunderingIJAR JOURNALNo ratings yet

- IFRS Implementation in India Opportunities and ChallengesDocument20 pagesIFRS Implementation in India Opportunities and ChallengesMohdRAnsari0% (1)

- Chapter 2 OpaudDocument5 pagesChapter 2 OpaudMelissa Kayla ManiulitNo ratings yet

- Quiz 1Document24 pagesQuiz 1Marwin AceNo ratings yet

- ISO 27701 Privacy Information Management System - © TÜV SÜD 2013Document2 pagesISO 27701 Privacy Information Management System - © TÜV SÜD 2013Bruce ROBERTSONNo ratings yet

- Planning Guide For Maintaining School Facilities PDFDocument184 pagesPlanning Guide For Maintaining School Facilities PDFFahd Bin RiasatNo ratings yet

- Unit 6 AUDITORS' REPORTSDocument5 pagesUnit 6 AUDITORS' REPORTSzelalem kebedeNo ratings yet

- Eco ManagementDocument5 pagesEco Managementm50adjNo ratings yet

- Completano Chapter 13Document3 pagesCompletano Chapter 13Rojan CompletanoNo ratings yet

- ACCA - Advanced Audit and Assurance (AAA) - Course Exam 1 Solutions - 2019Document12 pagesACCA - Advanced Audit and Assurance (AAA) - Course Exam 1 Solutions - 2019Ruddhi JainNo ratings yet

- Engagement Completion and ReportingDocument1 pageEngagement Completion and ReportingWilbur LamNo ratings yet

- Maruti Suzuki India LimitedDocument17 pagesMaruti Suzuki India LimitedDinesh KumarNo ratings yet

- TCS Drone Warehouse Inventory Reconciliation PDFDocument4 pagesTCS Drone Warehouse Inventory Reconciliation PDFSri Lalithya MaganiNo ratings yet

- Integrated Business Management System Manual (PDFDrive)Document18 pagesIntegrated Business Management System Manual (PDFDrive)mn1938No ratings yet

- Field Finance Manual 2010Document135 pagesField Finance Manual 2010Muhammad Zaki83% (6)

- Sample Questions For Itb Modular ExamDocument4 pagesSample Questions For Itb Modular Exam_23100% (2)

- 2016 4 The Khyber Pakhtunkhwa Antiquities Act 2016Document38 pages2016 4 The Khyber Pakhtunkhwa Antiquities Act 2016Tehmash KhanNo ratings yet

- Ellerby ResumeDocument3 pagesEllerby ResumeRobEllerbyNo ratings yet

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- Amazon Interview Secrets: A Complete Guide to Help You to Learn the Secrets to Ace the Amazon Interview Questions and Land Your Dream JobFrom EverandAmazon Interview Secrets: A Complete Guide to Help You to Learn the Secrets to Ace the Amazon Interview Questions and Land Your Dream JobRating: 4.5 out of 5 stars4.5/5 (3)

- Guide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyFrom EverandGuide: SOC 2 Reporting on an Examination of Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality, or PrivacyNo ratings yet

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceFrom EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceRating: 4 out of 5 stars4/5 (1)

- Internal Controls: Guidance for Private, Government, and Nonprofit EntitiesFrom EverandInternal Controls: Guidance for Private, Government, and Nonprofit EntitiesNo ratings yet

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- Financial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsFrom EverandFinancial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsRating: 4 out of 5 stars4/5 (26)

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachFrom EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachRating: 4 out of 5 stars4/5 (1)

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- Bribery and Corruption Casebook: The View from Under the TableFrom EverandBribery and Corruption Casebook: The View from Under the TableNo ratings yet

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)