Professional Documents

Culture Documents

1

Uploaded by

Swapnil KhobragadeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1

Uploaded by

Swapnil KhobragadeCopyright:

Available Formats

International Journal of scientific research and management (IJSRM)

||Volume||3||Issue||1||Pages|| 2029-2033||2015||

Website: www.ijsrm.in ISSN (e): 2321-3418

Impact of FDI on Employment Generation in India

Pakanati Someshu,

PhD Research Scholar, Dept of Economics,

Yogi Vemana University, Kadapa. A.P.

pakanatisomesh@gmail.com

Abstract

Job creation is one of the main challenges for developing countries. Many people believe that FDI

can generate many benefits to help solve the capital shortage problem in developing countries. But in

terms of job creation, the effects seem more complicated. It has direct and indirect effect on employment.

The effect of the FDI on employment is one the most direct expressions of FDI. A substantial amount of

development has been observed in the inflows of Foreign Direct Investment (FDI) in India over the last

two decades. The extraordinary growth of FDI in 1990 around the world has made it an essential

constituent of development strategy for both, developed and developing countries. However, the most

profound effect has been observed in developing nations. Macroeconomists have performed various

studies in order to prove that FDI plays an important role in generating employment and improving the

economic development.

Keywords: Foreign Direct Investment, Employment, Growth and Development.

India labour is cheap source and available in

1. Introduction: Employment

The following are four different effects of FDI on

Job creation:

1-Employment Creation: It means the FDI brings

new production capacity and new jobs. Meanwhile it

can improve the development of relevant industries.

2- Employment Crowding-out: It means the inflow

of the FDI makes the competition more intensive. So

some domestic enterprises have had to reduce

employment to improve their competitiveness.

3- Employment Shift: It means the cooperation

between foreign and domestic companies will create

joint ventures. That will make workers transfer to

new enterprises.

4- Employment Loss: It means the foreign-invested

enterprise have their own management methods.

Those who have not efficiency or are not suitable for

this corporate environment will lose their jobs.

abundant. Therefore, FDI provides employment to

all the section of the people. They contribute a good

proportionate of the total employment. Normally

Greenfields generates employment when they start

a project or firm but mergers and acquisitions do not

generate employment at the time of entry but over

the period it creates employment and also develops

trade linkages in the long run. One of the objectives

of development of special economic zones is

generation of employment. More than two-fifth of

the market capitalization originates in Class-3 cities.

FDI-enabled firms in manufacturing sectors provide

employment to about 15.6 lakhs persons, accounting

There is direct and positive relationship

for about 4 to 5% of the total employment in the

between FDI and employment. As firms are operated

organized sector. Class-3 cities provide employment

in India they require skilled and unskilled labour. In

to about 7.9 lakhs workers (more than 50% of the

Pakanati Someshu, IJSRM volume 3 issue 1 January, 2015 [www.ijsrm.in]

Page 2029

total). Sectors providing a relatively high share of

the United States at number three. India displaced

employment in Class-3 cities include transport

the United States in 2005 to gain the second

equipment; growing and processing of crops;

position, which it has held since then. FDI inflows in

construction parts; textiles; and non-metallic mineral

2006 touched $19.6 billion and in 2007, total FDI

products.

inflows.

FDI has played an important role in the

FDI in India and Its Growth Linkages: in India

process of globalization during the past two decades.

stood at $23 billion, showing a growth rate of 43.2

The rapid expansion of FDI by multinational

per cent over 2006. In 2008, total FDI inflows into

enterprises (MNEs1) since the mid-eighties may be

India stood at $33 billion. One of the most important

attributed to significant changes in technologies,

and sensitive areas for developing countries is

liberalization of trade and investment regimes, and

foreign direct investment (FDI). It is now defined as

deregulation and privatization of markets in many

not only a simple transfer of money, but as a mixture

countries including developing countries like India.

of

Fresh investments, as well as mergers and

technologies, managerial capabilities, marketing

acquisitions, (M&A) play an important role in the

skills and other assets. There is a major debate in the

cross-country movement of FDI While the quantity

literature regarding the impact of FDI on economic

of FDI is important, equally important is the quality

growth. The traditional argument states that an

of FDI. The major factors that might provide growth

inflow of FDI improves economic growth and

impetus to the host economy include the extent of

thereby enhances employment opportunities. Most

localization of the output of the foreign firm's plant,

studies (Hill and Athukorala 1998 have shown that

its export orientation, the vintage of technology

FDI's social and distributional impact on the host

used, the research and development (R&D) best

country has been generally favourable in developing

suited

employment

countries of various regions. Apart from bringing in

generation, inclusion of the poor and rural

a package of highly productive resources into the

population in the resulting benefits, and productivity

host economy there have been a visible positive

enhancement.

impact on the creation of jobs not only in those

Investment Outlook

sectors attracting FDI inflows but also in the

A number of studies in the recent past have

supportive domestic industries. Foreign Direct

highlighted the growing attractiveness of India as an

Investment (FDI) is often seen as a driver for

investment destination. According to Goldman

economic development as it may bring capital,

Sachs (2003), the Indian economy is expected to

technology, management know-how, jobs and access

continue growing at the rate of 5 per cent or more

to new markets. Policy-makers have, therefore,

until 2005.According to the A.T. Kearney (2007),

tended to emphasize the benefits that FDI can bring

India continues to rank as the second most attractive

to host economies, particularly in developing

FDI destination, between China at number one and

countries. Accordingly, many governments have

for

the

host

economy,

financial

Pakanati Someshu, IJSRM volume 3 issue 1 January, 2015 [www.ijsrm.in]

and

intangible

assets

such

as

Page 2030

developed policies to encourage inward FDI. While

Note: + RBI has included the amount of US$ 92 million for the month of

April 2007.

FDI and multinational enterprises (MNEs) are often

perceived to be beneficial for local development,

they have also aroused much controversy and social

concerns. For example, MNEs have often been

accused of taking unfair advantage of low wages and

weak labour standards in developing countries.

MNEs also have been accused of violating human

and labour rights in countries where governments

fail to enforce such rights effectively

Trends in FDI inflows into India:

FDI inflows grew steadily through the first half of

the 90s but stagnated between 1996-97 and 2003-04

(Table 1.1). The year-on-year fluctuations until

2003-04 make it difficult to identify a clear trend;

however, inflows have been increasing continuously

since 2004-05. During 2008-09, India registered FDI

inflows of $33.6 billion and total cumulative inflows

from August 1991 to March 2009 have been to the

tune of $155 billion. FDI equity inflows rise 24% to

$22.43 bn in Jan-Sep 2015. The government in

August has allowed FDI up to 49 percent on

approval route in defence sector with certain

conditions.

Current Scenario of Employment

FDI to India has increased significantly in the last

decade. However, the growth in FDI flows has been

accompanied by strong regional concentration. The

findings of the study reveal that market size,

agglomeration effects and size of manufacturing and

services base in a state have significant positive

impact on the regional distribution of FDI flows in

India. The impact of taxation and cost of labour is

negative. While the impact of quality of labour is

ambiguous, infrastructure, however, has a significant

positive impact on FDI flows. Mining has a positive

influence on FDI flows, but lacks statistical

significance.

The presence of strong agglomeration effect

indicates that the states already rich in FDI flows

tend to receive more of them which make it more

difficult for the other states to attract fresh

investments. In view of this difficulty, a conscious

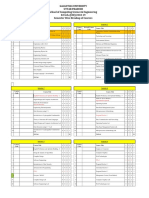

Table 1.1 FDI Inflows (August 1991 -Sep2014)

Year

1991-92

1992-93

1993-94

1994-95

1995-96

1996-97

1997-98

1998-99

1999-2k

2000-01

2001-02

2002-03

2003-04

2004-05

2005-06

2006-07

2007-08(P)+

2008-09(P)+

2009-10

2010-11

2011-12

2012-13

2013-2014

2015(jansep)

Rs. Crore

375

1051

2041

4241

7317

10170

13317

10550

9409

18404

29269

24681

19830

27234

39730

103037

137935*

159354^

123120

997320

165148

121970

113401

182724

Amount of FDI inflows

US$ million

Annual Growth $ Value

129

315

144.2

586

86.0

1314

124.2

2144

63.2

2821

31.6

3557

26.1

2462

-12.5

2462

-30.8

4029

87.0

6130

52.1

5035

-17.9

4322

-14.2

6051

40

8961

48.1

22826

154.7

34362

50.5

33613

-2.2

25834

21283

35121

22423

18149

22.43

24

Source: Secretariat for Industrial Assistance, various FDI Fact Sheets.

and coordinated effort at the national and the state

government levels would be essential to make the

laggard states more attractive to FDI flows. The

direct method to achieve this objective may be to

design the national FDI policy in such a way that a

sizable portion of FDI flows to India move into the

laggard states. The indirect way is to provide a boost

to the overall economy of the less advanced states,

with special thrust on the manufacturing, services

and the infrastructure sectors so that they themselves

become attractive to foreign investors.

First, the Chinese government was to raise the entry

requirements for FDI into coastal belt designed to

secure high value investments, while encouraging

Pakanati Someshu, IJSRM volume 3 issue 1 January, 2015 [www.ijsrm.in]

Page 2031

labour

intensive

investments

in

the

interior.

the manufacturing industries. Therefore, apart from

Accordingly, since the late 1990s, most MNEs in

providing a boost to the manufacturing sector, it is

China have made fundamental changes to their

equally important to provide a boost to the services

business strategies and operational policies to adjust

sector, which spans the value chain from low-end

to changes in policy, market conditions and the

localized services to the most sophisticated globally-

regulatory environment. In view of the Chinese

competitive intellectual property based services.

experience, similar set of policies may be considered

Accordingly, the manufacturing policy in India

in the Indian context to direct part of the FDI flows

needs to be complemented by a compatible services

to the states, which are not receiving much of FDI

policy.

flows at present.

Fourth, the impact of the mining sector on FDI

Second, as regards the indirect method, it has been

flows was found to be less important in the study.

observed that size of the manufacturing sector has a

FDI in mining in the recent period has confronted

significant positive impact on FDI flows. This

with a number of socio-economic problems. The

implies foreign investors preference for states with

operations of two of the mega FDI steel projects -

a strong industrial base. Therefore, it is essential for

POSCO India and Arcelor Mittal have been delayed

the less industrially developed states to catch up

due to seemingly intractable problems, mostly

with the developed ones to attract larger share of

surrounding socio-economic issues like acquisition

FDI flows. The National Manufacturing Policy

of

(NMP), recently announced by the Government of

rehabilitation and resettlement of the project affected

India is a welcome step and may help in this

people,

direction if properly implemented. The equity and

Jharkhand, Orissa and West Bengal, non-allocation

distributive justice would be best fulfilled if under

of adequate captive mines, and supply of raw

the NMP, the Government gives top priority to the

materials. Given the large potential for FDI in

states with lower industrial base to give them a

mining due to the Central Governments thrust

chance of catching up with the others.

towards development of the infrastructure sector,

Third, the services sector has attracted a large

share of FDI flows to India in the recent period. The

econometric analysis also reveals that services sector

has a significant positive impact on FDI flows. In

addition, growth of the services sector can create

more employment for skilled, semi-skilled and

unskilled people. It has been observed that in the

recent period, it is the IT/BPO services which has

created the largest job opportunity in India and not

land,

forest

Naxalite

and

environment

movements

in

clearances,

Chhattisgarh,

and with a number of large FDI projects in mining in

the pipeline (POSCO India steel projects in Orissa

and Karnataka, Arcelor Mittal steel projects in

Orissa, Jharkhand and Karnataka, BP-Reliance oil

and gas project in Andhra Pradesh, Lafarge cement

project in Himachal Pradesh etc.), it is essential for

the central and the state governments to take

coordinated policy efforts towards creating a more

favourable policy environment by simplifying the

Pakanati Someshu, IJSRM volume 3 issue 1 January, 2015 [www.ijsrm.in]

Page 2032

land acquisition procedure and reducing the delay in

productivity and employment in some sectors

the approval mechanism.

especially in service sector. Indian service sector is

generating the proper employment options for

In Indian Service Sector: The number of service

skilled worker with high perks.

sector jobs (skill and unskilled) has increased in

References:

India, new findings have revealed. A survey

conducted

by the

country's

Labour

1. D.L. Narayana (2006) Issues of Globalisation and

Economic Reforms Serials Publications, New Delhi.

Ministry

indicated that during the last quarter, employment in

the industry rose to 15.72 million, Channel News

Asia reported. The research revealed that two sectors

have shown the strongest improvement in terms of

hiring levels; information technology and business

process. Out sourcing. Commenting on the findings,

Nimish Adani, chief executive of workosaur.com,

told Channel News Asia: "As far as employment is

concerned, there have been certain short-term

2. DIPP, Ministry of Commerce and Industry, Government of

India - Fact Sheet On FDI (April 2000 to December 2010)

3. Report of ASSOCHAM on FDI in 2008-09.

4. Discussion Paper on Foreign Direct Investment (FDI)

(2011): Multi Brand Trading in Indian venture capital and

Private Equity Association, 2 August.

5. Anil Kumar Takur and Tapan Kumar Shadily (Eds) (2008)

Foreign Direct Investment in India: Problems and

Prospectus, Deep and Deep Publications Pvt Ltd, New Delhi.

6. Siddharthan (2006), "Regional Differences in FDI Inflows:

China - India Comparison,

.7. Source WTO, Vol. 8, No. 4 Nov Dec 2006

initiatives taken by the government." There has been

8. Source: Press Trust of India, Jan 01, 2015 at 18:37 |

an infusion of stimulus packages in sectors which

9. FDI In India And Its Growth Linkages Department Of

were labour-intensive. So, there has been a marginal

Industrial Policy Promotion

improvement."Finance Services sector is growing

(ministry of commerce &Industry, Government Of India)

with rapid rate, Finance sector is the second

10 World Investment Prospects Survey2013-2014.

preferred choice of students of management post

graduation top B-Schools in India, following figures

are explaining the preference of skilled professional

in Indian service sector. For analyzing the perception

Author Profile:

Pakanati. Someshu received M.A., Economics from Yogi

Vemana University, Kadapa, A.P. Currently pursuing Ph.D in

Economics (Full- Time) in YVU, Kadapa. Area of interest in

Globalisation impact on FDI: A Study of FDI in A.P.

of skilled toward various segment of service sector.

Summary: FDI is an important stimulus for the

economic growth of India.FDI shown a tremendous

growth in second decade (2002 -2012) that is three

times then the first decade of FDI in services sector.

Banking & Insurance is first and Telecommunication

is second segment of service sector which pick the

growth in second decade of reforms.FDI create high

perks jobs for skilled employee in Indian service

sector.FDI

has

helped

to

raise

the

output,

Pakanati Someshu, IJSRM volume 3 issue 1 January, 2015 [www.ijsrm.in]

Page 2033

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- 4th Sept - Marathon Series Lecture 8 - General AwarenessDocument208 pages4th Sept - Marathon Series Lecture 8 - General AwarenessManbir ArinNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Chapter 13 CarbohydratesDocument15 pagesChapter 13 CarbohydratesShanna Sophia PelicanoNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 220245-MSBTE-22412-Java (Unit 1)Document40 pages220245-MSBTE-22412-Java (Unit 1)Nomaan ShaikhNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Debate ReportDocument15 pagesDebate Reportapi-435309716No ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- IR2153 Parte6Document1 pageIR2153 Parte6FRANK NIELE DE OLIVEIRANo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- UNIT 5-8 PrintingDocument17 pagesUNIT 5-8 PrintingNOODNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Generation III Sonic Feeder Control System Manual 20576Document32 pagesGeneration III Sonic Feeder Control System Manual 20576julianmataNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- SEILDocument4 pagesSEILGopal RamalingamNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Galgotias University Uttar Pradesh School of Computing Science & Engineering B.Tech. (CSE) 2018-19 Semester Wise Breakup of CoursesDocument2 pagesGalgotias University Uttar Pradesh School of Computing Science & Engineering B.Tech. (CSE) 2018-19 Semester Wise Breakup of CoursesRohit Singh BhatiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Lodge at The Ancient City Information Kit / Great ZimbabweDocument37 pagesLodge at The Ancient City Information Kit / Great ZimbabwecitysolutionsNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- DB Lecture Note All in ONEDocument85 pagesDB Lecture Note All in ONEyonasante2121No ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- DIR-819 A1 Manual v1.02WW PDFDocument172 pagesDIR-819 A1 Manual v1.02WW PDFSerginho Jaafa ReggaeNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Test Physics Chapter# 12,13,14 (2 Year) NameDocument1 pageTest Physics Chapter# 12,13,14 (2 Year) NameStay FocusedNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- RCA LCD26V6SY Service Manual 1.0 PDFDocument33 pagesRCA LCD26V6SY Service Manual 1.0 PDFPocho Pochito100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- 2nd Term Project 4º Eso Beauty Canons 2015-16 DefinitivoDocument2 pages2nd Term Project 4º Eso Beauty Canons 2015-16 DefinitivopasferacosNo ratings yet

- PDFDocument40 pagesPDFAndi NursinarNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- SubaruDocument7 pagesSubaruclaude terizlaNo ratings yet

- The Effect of Co-Op Approach in Improving Visual Motor Integration Skills in Children With Learning DisabilityDocument7 pagesThe Effect of Co-Op Approach in Improving Visual Motor Integration Skills in Children With Learning DisabilityIJAR JOURNALNo ratings yet

- Pubb-0589-L-Rock-mass Hydrojacking Risk Related To Pressurized Water TunnelsDocument10 pagesPubb-0589-L-Rock-mass Hydrojacking Risk Related To Pressurized Water Tunnelsinge ocNo ratings yet

- ..Product CatalogueDocument56 pages..Product Catalogue950 911No ratings yet

- The Mooring Pattern Study For Q-Flex Type LNG Carriers Scheduled For Berthing at Ege Gaz Aliaga LNG TerminalDocument6 pagesThe Mooring Pattern Study For Q-Flex Type LNG Carriers Scheduled For Berthing at Ege Gaz Aliaga LNG TerminalMahad Abdi100% (1)

- XII CS Material Chap7 2012 13Document21 pagesXII CS Material Chap7 2012 13Ashis PradhanNo ratings yet

- DCS800ServiceManual RevADocument96 pagesDCS800ServiceManual RevAElinplastNo ratings yet

- Subject OrientationDocument15 pagesSubject OrientationPearl OgayonNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Gis Data Creation in Bih: Digital Topographic Maps For Bosnia and HerzegovinaDocument9 pagesGis Data Creation in Bih: Digital Topographic Maps For Bosnia and HerzegovinaGrantNo ratings yet

- Alfa Week 1Document13 pagesAlfa Week 1Cikgu kannaNo ratings yet

- 7Document6 pages7Joenetha Ann Aparici100% (1)

- PDFDocument27 pagesPDFER Saurabh KatariyaNo ratings yet

- European Asphalt Standards DatasheetDocument1 pageEuropean Asphalt Standards DatasheetmandraktreceNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Carnegie Mellon Thesis RepositoryDocument4 pagesCarnegie Mellon Thesis Repositoryalisonreedphoenix100% (2)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)