Professional Documents

Culture Documents

Astmisc169 Research Annual Report Abudhabi

Uploaded by

ahmedh_98Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Astmisc169 Research Annual Report Abudhabi

Uploaded by

ahmedh_98Copyright:

Available Formats

Property Review

Special Edition:

Abu Dhabi

Historic Review 2008-2014

and 2015 Outlook

All sectors of the Abu Dhabi

real estate market performed

positively in 2014, we expect this

trend to continue during 2015.

UAE ANNUAL REPORT 2014

UAE ANNUAL REPORT 2014

Abu Dhabi

Abu Dhabi 2014

Highlights

RESIDENTIAL

KEY TRENDS

Sales

Leasing

Sales rates increased by 15% because

of a shortage of quality stock for sale

on the secondary market.

The sales market performed strongly

during the first half of the year with

purchasers committed to increased

sales prices.

Sales price growth and volumes

slowed significantly in the second half

of 2014.

Some of the newly launched off-plan

projects recorded high sales levels in

the primary market such as Al Hadeel,

Ansam and Mamsha Al Saadiyat.

There was limited transaction activity

on the secondary market for existing

quality developments.

Popular master-planned developments for sale included Saadiyat Island and Al Raha Beach (Al Bandar

and Al Muneera).

Reem Island proved to be an attractive area providing more mid-market

units.

In terms of leasing, popular areas were

quality driven. Investments areas and

non freehold areas inside Abu Dhabi

City and on the Mainland attracted a

high demand for good quality properties with buildings close to full occupancy in selected developments.

Sales for the office market remained

restricted due to a lack of buildings

offering office space for sale; the only

ones that were available included Infinity Tower and Sky Tower on Reem

Island, and the upcoming ADDAX Tower at City of Lights.

The office market remained relatively

stable with high vacancy rates ranging from 35% to 40% throughout Abu

Dhabi.

Low quality office buildings continued

to see a decrease in rental rates as

companies upgraded to better quality

space.

TRANSACTION

ACTIVITY

Growing confidence and improved sentiment

in the Abu Dhabi market, together with a shortage of quality residential supply resulted in

a significant growth in sales and rental rates,

particularly for new mid to high quality developments.

Premium units in all Investment Areas recorded strong demand with full occupancy for most

of the prime and high-end developments.

POPULAR

DEVELOPMENTS

/ AREAS

OFFICES

Several new off-plan projects launched in

2014 including Al Hadeel and Ansam (Aldar),

Mamsha Al Saadiyat (TDIC), The Waves (Aabar),

Maryah Plaza (Farglory) and Al Reef 2 (Manazel).

Rental rates for premium and highend units increased across all residential types, and in particular for new

developments in Investment Areas.

The largest increases were recorded

on Saadiyat Island and Marina Square

on Reem Island.

Rental rates for lower quality units remained relatively stable, despite the

removal of the rent cap.

There remained a good level of transaction activity as tenants continued to

upgrade to better quality units.

Recently handed over high-end projects achieved high occupancy levels

leading to an increase in rental rates.

+15% APARTMENTS

SALES PRICES

Annual Growth in 2014

Abu Dhabi

Apartment sales

prices up by

15% compared

with Q4 2013.

2

2

Asteco Property Management, 2015

Rents:

+10%

Apartments

Sales:

Villas

+15%

Apartments

Supply Delivered In 2014:

+12%

Apartments: 4,000 Units

0%

Grade A-Offices

+16%

Villas

Villas: 1,500 Units

Offices: 55,000 m2 GLA

Asteco Property Management, 2015

UAE ANNUAL REPORT 2014

Abu Dhabi 2015

Outlook

Since 2013, the Abu Dhabi real estate market

has continued to strengthen, with investors being rewarded with sustained rental and capital

appreciation. Our forecasts indicate that this

pattern will continue throughout 2015, with

stability or growth across all sectors.

Asteco expects market conditions will remain

positive throughout the UAE in the next few

years with an encouraging investment climate

particularly in Abu Dhabi.

The Abu Dhabi rental market is expected to

prove particularly strong with rental increases

likely to exceed 5% per annum. However, the

sales market is expected to remain relatively

stable with new projects anticipated for handover in both Investment Areas and on the island.

The City of Lights development on Reem Island

contains the lions share of new supply including Hydra Avenue (residential) and ADDAX

Tower (commercial).

Two towers (C21 & C22) by Aabar are expected

to be handed over by mid 2015 in the Saraya

masterplan, providing additional prime supply

to the market.

Changes to utility charges will come in to effect

in 2015. This may curtail a rise in villa prices

due to potentially significant increases to running costs.

4

4

Asteco Property Management, 2015

UAE ANNUAL REPORT 2014

Abu Dhabi

APARTMENTS

Sales

Leasing

Market activity is expected to remain

relatively stable throughout 2015.

Prices will become more competitive

as new projects are handed over.

VILLAS

The villa sales market will remain relatively flat, with limited prime and highend units available for sale in the primary and secondary markets.

OFFICES

The office sales market is expected to

remain unchanged in 2015, with limited transaction activity.

Rental rates are expected to record

modest increases in 2015 due to a

prevailing flight to quality scenario,

which will put pressure on older and

lower quality properties.

Quality projects in Investment Zones

will continue to be sought after and

therefore occupancy rates are expected to remain high.

Villa rental rates are expected to increase slightly due to a shortage in

quality villa units. However, increased

utility costs could slow potential rental

increases.

Occupancy rates will remain high and

transaction activity will also be strong.

Office rents in strata-owned space

could come under pressure as owners of the soon to-be-handed-over

ADDAX Tower compete to secure tenants.

Total Supply Delivery Anticipated in 2015

APARTMENTS

VILLAS

OFFICES

4,700 Units

500 Units

340,000 m2 GLA

Major Projects Due For Handover 2015

HYDRA AVENUE CITY OF LIGHTS, REEM ISLAND

ADDAX TOWER CITY OF LIGHTS, REEM ISLAND

ADIB HQ AIRPORT ROAD

AABAR PROJECT - SARAYA

Asteco Property Management, 2015

UAE ANNUAL REPORT 2014

UAE ANNUAL REPORT 2014

Abu Dhabi

Abu Dhabi

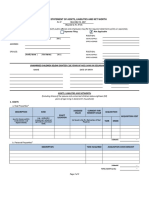

Rental Rates

2008 to 2014

Apartments

TYPICAL 2BR APARTMENT RENT EVOLUTION

2008 TO 2014

2BR

0%

The table below shows the average rental rates for the fourth quarter of each

year since 2008 to 2014 for a selection of apartment areas. The bar chart opposite represents the average rental rates for a 2-bedroom apartment for all areas

in Abu Dhabi.

AED 000s pa

As shown, the rental market peaked in 2008 and began to decrease in 2009 due

to the global financial crisis. Rates bottomed out in 2011 and recovery of the

rental market began in 2012.

2008

0%

135

136

2009

2010

2BR Apartment Rental Rate

Apartment rental rates increased by an average of 18% per year since 2011 but

were still 41% lower than in 2008 at the end of 2014. However, rents were 9%

higher, on average, compared with 2013.

Average Apartments Rental Rates

as at Q4 (AED 000s pa)

-45%

-11%

-5%

13%

8%

246

1BR

121

115

2011

2012

141

130

2013

2014

% Annual Change

2BR

3BR

% Change

2008

2009

2010

2011

2012

2013

2014

2008

2009

2010

2011

2012

2013

2014

2008

2009

2010

2011

2012

2013

2014

20132014

20082014

Abu Dhabi Island

125

125

125

156

165

175

230

235

265

na

Investment Areas

120

130

130

140

165

165

165

180

220

250

255

255

na

Central Abu Dhabi

165

110

90

80

85

85

90

250

140

140

130

110

135

145

290

175

175

160

130

165

175

-42

Corniche

185

135

120

95

85

105

120

280

160

160

155

125

135

150

365

240

240

225

180

225

245

11

-38

Khalidiya / Bateen

185

135

120

90

85

105

120

280

160

160

140

125

155

160

365

230

230

190

155

210

215

-40

Al Raha Beach

110

110

100

100

110

155

145

140

150

155

205

200

185

190

200

na

Marina Square

80

85

100

110

130

140

140

170

175

na

Saadiyat Beach

110

120

150

175

190

210

12

na

Shams

95

95

110

115

130

130

150

155

165

165

170

195

na

Central Abu Dhabi

145

85

70

60

55

70

75

215

120

100

80

100

100

105

265

145

145

110

90

140

145

-48

Corniche

155

120

95

80

70

80

80

225

145

145

120

100

105

120

325

175

175

155

130

155

170

-48

Khalidiya / Bateen

155

120

100

75

65

80

80

225

130

130

95

90

110

120

325

170

170

125

110

135

170

14

-48

Prime Properties

High End Properties

Abu Dhabi Island

Investment Areas

Mid & Low End Properties

Abu Dhabi Island

Investment Areas

Reef Downtown

60

70

80

75

85

100

90

100

130

22

na

Off Island

MBZ & Khalifa City

75

55

40

40

60

65

90

60

45

45

85

90

115

80

70

65

110

120

na

Asteco Property Management, 2015

Asteco Property Management, 2015

UAE ANNUAL REPORT 2014

UAE ANNUAL REPORT 2014

Abu Dhabi

Abu Dhabi

Rental Rates

2008 to 2014

The tables on this page represent the average rental rates for the fourth quarter of each year

since 2008 for offices and villas.

TYPICAL 4BR VILLA RENT EVOLUTION

2008 TO 2014

4BR

0%

Villas

Villa rates at the end of 2014 increased by approximately 20% since their lowest point in

2011, and were 43% lower than at their peak rates in 2008. Villa rental rates for all of Abu

Dhabi have increased by 4% since last year.

On average, a four-bedroom villa in Abu Dhabi could be leased for AED 239,000 per annum in Q4 2014, whereas the average in 2011 was AED 203,000 and AED 433,000 in 2008

as shown in the adjacent bar chart.

Offices

2008

-14%

235

2009

2010

4BR Villa Rental Rate

In the last five years office rental rates have decreased by 46%, on average. However,

marginal growth was witnessed since last year.

Average Villa Rental Rates

as at Q4 (AED 000s pa)

-8%

257

AED 000s pa

-41%

2%

3%

12%

433

3BR

203

208

2011

2012

214

239

2013

2014

% Annual Change

4BR

5BR

% Change

2008

2009

2010

2011

2012

2013

2014

2008

2009

2010

2011

2012

2013

2014

2008

2009

2010

2011

2012

2013

2014

20132014

20082014

Khalidiya / Bateen

395

275

235

210

190

185

195

460

290

310

225

230

240

285

530

325

330

280

255

280

245

-48

Mushrif / Karama / Manaseer

390

235

220

180

170

195

205

455

270

260

230

210

190

230

535

315

345

260

240

240

265

12

-49

Khalifa A & B

360

190

155

125

100

130

135

400

205

180

150

135

170

150

445

255

220

180

170

185

180

-4

-61

Al Raha Gardens

380

205

185

175

165

175

190

420

230

210

210

200

210

243

475

240

260

270

270

285

290

-43

Golf Gardens

265

240

190

210

225

200

285

260

255

260

345

335

340

325

325

na

Al Reef

115

130

105

120

135

140

155

125

150

160

165

175

150

170

190

10

na

Saadiyat Beach Villas (Standard)

275

295

295

305

295

330

400

400

400

na

Al Raha Beach

220

250

250

300

255

255

320

320

na

Average Office Rental Rates

as at Q4 (AED / sq ft / pa)

% Change

2009

2010

2011

2012

2013

2014

20132014

20092014

Prime Fitted

260

195

177

149

153

153

-41

Prime Shell & Core

210

167

130

116

116

116

-45

Recent Build

Older Stock

Good

200

140

111

98

93

93

-54

Typical Building

160

111

70

70

70

74

-54

Low Quality Building

110

74

60

56

56

65

16

-41

Asteco Property Management, 2015

Asteco Property Management, 2015

UAE ANNUAL REPORT 2014

UAE ANNUAL REPORT 2014

Abu Dhabi

Abu Dhabi Sales Prices

2008 to 2014

Villas prices in Q4 2014 increased by 16%, on average, compared with the previous year; this

was driven by a lack of available stock to all nationalities.

Despite high prices, the Saadiyat Beach villa community was in high demand from both

investors and end-users due to the developments exclusivity. The development features

a golf course, premium hotels and an extensive beach within proximity to the new Cultural

District. Prices for beach villas started from AED 5 million for a standard 4BR villa and AED 16

million for a St Regis branded 4BR unit.

Al Muneera and Al Zeina at Al Raha Beach also featured a selection of sought after villas and

townhouses, which have sea or canal views; prices started from AED 4 million for a 4BR.

Al Raha Gardens and Golf Gardens remained popular with UAE National investors, as these

communities consistently yielded attractive rental returns.

On average, apartment sale prices in Q4 2014 were 26% lower than in Q4 2008, for the areas

shown in the graph but 15% higher than the previous year.

A current shortage of residential stock for sale in high-end developments has resulted in

high asking prices on the secondary market. The achieved high sales volumes on newly

launched projects in Abu Dhabi, such as Ansam on Yas Island, Al Hadeel at Al Raha Beach

and Mamsha Al Saadiyat, proved a pent-up demand existed for the right type of product.

AVERAGE APARTMENT SALES PRICES

AVERAGE VILLA SALES PRICES

Q4 2008 TO Q4 2014

Q4 2008 TO Q4 2014

-31%

-11%

-19%

25%

17%

17%

9%

21%

-6%

-15%

13%

2000

1750

965

1350

1175

1300

1425

1425

1225

1190

1175

1100

1100

AED per ft2

AED per ft2

1000

1375

1550

1375

1025 1025

1750

975

900

925

1115

900

825

770

1020

890

860 850

730

Raha Gardens

Marina Square

Raha Beach / Al Bandar

810 770

870

Saadiyat Beach Villas (Standard)

Golf Gardens

Raha Beach / Al Muneera

-31%

2%

1550

1200

21%

-40%

13%

11%

-11%

10%

2450

1100

1175

1015

1200

825

930

900

500

Raha Beach / Al Zeina

2008

10

10

2009

Asteco Property Management, 2015

2010

1000

2012

2013

1325

1130 1050

550

Reef Downtown

2011

1250 1250

2014

1475

AED per ft2

AED per ft2

1750

950

600 560

% Change 2013-2014

745

845

600

2008

2009

660

Hydra Village

Al Reef Villas

Sun & Sky Towers

% Change 2008-2014

520

540

2010

2011

2012

2013

2014

% Change 2013-2014

% Change 2008-2014

11 Property Management, 2015

Asteco

11

UAE ANNUAL REPORT 2014

UAE ANNUAL REPORT 2014

Abu Dhabi

Abu Dhabi Area & Rent

Affordability Map

The following map highlights some of Abu Dhabis most popular

residential areas, in terms of their affordability for rent or sale.

Most Expensive

Expensive

Mid Priced

Affordable

1 Al Bandar Raha Beach

2 Al Bateen Wharf

3 Al Gurm

4 Al Maqtaa

5 Al Muneera Al Raha Beach

6 Al Nahyan Camp

7 Al Raha Gardens

8 Al Rayanna

9 Al Reef

10 Al Zeina Al Raha Beach

11 Baniyas

12 Bateen Airport Area

13 Bateen Area

14 Bawabat Al Sharq

15 Capital District (ADNEC)

16 CBD / Tourist Club Area

17 Corniche

18 Danet Abu Dhabi

19 Eastern Mangroves

20 Golf Gardens

21 Hydra Village

22 Khalidia / Al Hosn / Al Manhal

23 Khalifa City A

24 Khalifa City B

25 Maryah Island

26 MBZ City

27 Mina

28 Mushrif / Karama / Manaseer / Muroor

29 Officers City

30 Rawdhat Abu Dhabi

31 Reem Island - Marina Square

32 Reem Island Najmat Abu Dhabi

33 Reem Island rest of Shams Abu Dhabi

34 Reem Island The Gate District

35 Rihan Heights

36 Saadiyat Beach District

37 The Hills

11

36

21

27

33

25

34

31

16

32

17

22

6

1

10

5

13

19

28

7

18

12

20

15

35

30

33

23

8

4

37

29

24

26

22

11

Note: Area classification by affordability is provided for indicative purposes only as most areas in Abu

Dhabi offer various types of residential units, from affordable to high

end. As such, the map colour coding

takes into account the most prevalent type of product and exceptions

14

11

of a lower and / or higher price could

be available.

12

Asteco Property Management, 2015

Asteco Property Management, 2015

13

UAE ANNUAL REPORT Q4

2014

2014

Al Ain 2014

Highlights &

Outlook

UAE ANNUAL REPORT 2014

Al Ain

KEY TRENDS

2014 Highlights

2015 Outlook

Rental rates in Al Ains residential market increased by an average of 16%

for villas and more than 4% for apartments.

Retail rental rates remained stable in

the last three years, with an average

rate of AED 2,225 per sqm per annum

for major malls in Al Ain.

Rental transaction activity was relatively high in 2014 especially in the

residential sector.

The highest transaction activity recorded was in mid 2014.

Transaction activity is expected to increase for residential and office sectors.

The most popular areas in Al Ain are

Al Jimi and Al Manaseer for residential,

and Town Centre for offices.

Asharej, will be one of the most sought

after areas, as new quality residential

supply will be handed over by mid

2015.

The Town Centre will remain the business centre of Al Ain.

TRANSACTION

ACTIVITY

POPULAR

DEVELOPMENTS

/ AREAS

Al Ains residential market recorded some

growth during 2014, with over 16% rental increase for the villa market and circa 4% for

apartments.

OFFICES

The office market remained stable across all

locations, with the exception of lower quality

space where rental rates declined marginally.

The office market remained stable

across all locations, with the exception of lower quality space, where

rental rates declined marginally.

Al Ains residential market is expected to witness further rental increases

during the first half of 2015, and stabilisation during the second half of the

year.

The retail market is expected to remain stable throughout 2015.

Asteco expects a slight increase in

rental rates for quality office space,

especially for the Town Centre and its

surrounding area.

In the last three years, the retail sector remained stable and the highest recorded rental

rates were predominantly retail shops in the

major malls.

Annual Growth in 2014

Rents:

+8%

Apartments

14

14

Asteco Property Management, 2015

+16%

Villas

0%

Offices

Asteco Property Management, 2015

15

UAE ANNUAL REPORT 2014

UAE ANNUAL REPORT 2014

Al Ain

Al Ain

Rental Rates

2008 to 2014

AVERAGE OFFICE RENTAL RATES

Q4 2008 TO Q4 2014

The Al Ain residential apartment market followed a similar trend to the one witnessed in

Abu Dhabi, with rental rates declining till 2012 and never fully recovering to 2008 levels.

In comparison, villa rents however recovered beyond 2008 levels, with 18% increases witnessed within older units whereas new units are only 7% lower than in Q4 2008.

AED per ft2

1150

1050

1BR

2008

2009

2010

2011

0%

0%

0%

0%

-11%

-11%

-38%

1125

1100

975

850

950

850 850

1000

1150

1075

1100

975

950 950

925 850 850

850 850

800 800

900 900

550

Khalifa Street

2008

Average Apartments Rental Rates

as at Q4 (AED 000s pa)

0%

2009

Aud Al Touba Street

2010

2011

2012

Senaya Street

Main Street

2013

% Change 2008-2014

% Change 2013-2014

2014

500 500

% Change

2012

2013

2014

20132014

20082014

AVERAGE RETAIL RENTAL RATES

Q4 2008 TO Q4 2014

Mature Units

50

35

25

23

23

29

33

14

-34

2BR

70

55

45

43

35

39

43

10

-39

3BR

90

75

60

53

48

51

53

-41

New Units

1BR

60

50

38

28

28

32

38

19

-37

2BR

75

65

58

45

45

45

48

-36

3BR

95

85

73

55

58

63

65

-32

1500

70%

50%

0%

0%

0%

1700 1650

1825 1825 1825

1700 1650

78%

0%

1350

975

1000

Khalifa Street

1BR

1825 1825 1825

1075

2008

Average Villas Rental Rates

as at Q4 (AED 000s pa)

87%

2250 2250 2225 2225 2225

AED per ft2

1BR

2009

Main Street

2010

2011

2012

1200

1350 1300

1550

1500 1500 1500

1250

Major Malls

Senaya Street

2013

% Change 2013-2014

% Change 2008-2014

2014

2BR

3BR

% Change

2008

2009

2010

2011

2012

2013

2014

2008

2009

2010

2011

2012

2013

2014

2008

2009

2010

2011

2012

2013

2014

20132014

20082014

Town Centre

70

60

60

55

50

65

85

95

80

75

70

65

75

95

95

90

90

85

85

105

125

24

17

Others *

70

60

60

55

50

65

85

85

75

75

70

65

75

95

95

90

90

85

85

105

130

27

24

Zaker

65

55

55

50

45

65

75

75

70

70

65

60

75

75

85

75

85

80

80

105

105

13

Al Towaya

75

65

65

60

50

70

80

85

80

80

80

65

85

95

100

95

95

95

85

110

125

13

15

Al Jimi

70

60

60

55

50

65

85

85

75

75

70

65

75

95

95

90

90

85

85

105

125

24

22

Town Centre

115

95

80

65

65

75

90

125

115

100

90

85

100

110

140

135

125

110

105

130

155

16

-7

Others *

115

95

80

65

65

75

80

120

115

100

90

85

100

115

140

135

125

110

105

130

160

16

-5

Zaker

105

85

65

55

50

75

80

115

95

90

85

75

100

100

135

100

115

105

90

130

130

-13

Al Towaya

110

105

85

70

65

80

95

130

125

105

100

85

105

110

140

135

130

120

105

135

160

14

-4

Al Jimi

120

95

80

65

65

75

90

120

115

100

90

85

100

110

140

135

125

110

105

130

155

16

-7

Mature Units

New Units

* Includes Al Khabisi, Al Muwaiji, Al Manasir , Al Masoudi Areas and prime compounds

16

Asteco Property Management, 2015

Asteco Property Management, 2015

17

UAE ANNUAL REPORT 2014

Al Ain

Area Map

VALUATION & ADVISORY

Our professional advisory services are conducted by suitably qualified personnel all of whom

have had extensive real estate experience

within the Middle East and internationally.

Our valuations are carried out in accordance

with the Royal Institution of Chartered Surveyors

(RICS) and International Valuation Standards (IVS)

and are undertaken by appropriately qualified valuers with extensive local experience.

The Professional Services Asteco conducts throughout the region include:

Consultancy and Advisory Services

Market Research

Valuation Services

SALES

Asteco has established a large regional property sales division with representatives based

in the UAE, Qatar and Jordan. Our sales

teams have extensive experience in the negotiation and sale of a variety of assets.

LEASING

Asteco has been instrumental in the leasing of

many high-profile developments across the GCC.

ASSET MANAGEMENT

Asteco provides comprehensive asset management services to all property owners, whether a

single unit (IPM) or a regional mixed use portfolio.

Our focus is on maximising value for our Clients.

OWNERS ASSOCIATION

Asteco has the experience, systems, procedures and manuals in place to provide

streamlined comprehensive Association

Management and Consultancy Services to

residential, commercial and mixed use communities throughout the GCC Region.

SALES MANAGEMENT

Our Sales Management services are comprehensive and encompass everything required for the successful completion and

handover of units to individual unit owners.

18

Asteco Property Management, 2015

Asteco Property Management, 2015

19

UAE Property Review

Special Edition:

Historic Review

2008-2014

and 2015 Outlook

John Allen, BSc MRICS

Director, Valuation & Advisory

+971 600 54 7773

JohnA@Asteco.com

John Stevens, BSc MRICS

Managing Director/Director, Asset Services

+971 600 54 7773

JohnS@Asteco.com

Jeremy Oates, BSc FRICS

General Manager, Abu Dhabi

+971 2 626 2660

JerryO@asteco.com

James Joughin, BSc (Hons) MRICS

Head of Valuations, Abu Dhabi

+971 2 626 2660

JamesJ@Asteco.com

Ghada Amhaz, MBA

Research & Consultancy Manager, Abu Dhabi

+971 2 626 2660

GhadaA@asteco.com

Julia Knibbs, MSc

Research & Consultancy Manager, UAE

+971 600 54 7773

JuliaK@Asteco.com

Tamer Ibrahim Chaaban

Branch Manager, Al Ain

+971 3 7666097

TamerI@asteco.com

Bassam Rizk

Head Of Sales & Leasing

+971 2 626 2660

BassamR@asteco.com

DISCLAIMER: The information contained in this report has been obtained from and is based upon sources that Asteco Property Management believes to be

reliable, however, no warranty or representation, expressed or implied, is made to the accuracy or completeness of the information contained herein, and same

is submitted subject to errors, omissions, change of price, rental or other conditions, withdrawal without notice, and to any special listing conditions imposed

by our principals. Asteco Property Management will not be held responsible for any third-party contributions. All opinions and estimates included in this report

constitute Asteco Property Managements judgment, as of the date of this report and are subject to change without notice. Figures contained in this report

are derived from a basket of locations highlighted in this report and therefore represent a snapshot of the Dubai market. Due care and attention has been used

in the preparation of forecast information. However, actual results may vary from forecasts and any variation may be materially positive or negative. Forecasts,

by their very nature, involve risk and uncertainty because they relate to future events and circumstances which are beyond Asteco Property Managements

control. For a full in-depth study of the market, please contact Asteco Property Managements research team. Asteco Property Management LLC. Commercial

Licence No. 218551. Paid-up Capital AED4,000,000.

Asteco Property Management, 2015

You might also like

- Competitive Retail MarketDocument146 pagesCompetitive Retail Marketahmedh_98No ratings yet

- TRAPSATUR Company ProfileDocument10 pagesTRAPSATUR Company Profileahmedh_98No ratings yet

- Mall Management in India & Revival Strategies For Sick MallsDocument38 pagesMall Management in India & Revival Strategies For Sick Mallspunya.trivedi2003No ratings yet

- Managing Risks Drivers PDFDocument214 pagesManaging Risks Drivers PDFahmedh_98No ratings yet

- Goat Farm Feasibility StudyDocument75 pagesGoat Farm Feasibility StudyDaniela Repta86% (7)

- Organic DairyDocument2 pagesOrganic Dairyahmedh_98No ratings yet

- Dubai Insurance Companies1Document39 pagesDubai Insurance Companies1abdulpanasiaNo ratings yet

- Business Model Version 1Document23 pagesBusiness Model Version 1ManivannancNo ratings yet

- Revenue Management Manual XotelsDocument65 pagesRevenue Management Manual XotelsElena Andreea MusatNo ratings yet

- Project Risk Assessment ExamplesDocument10 pagesProject Risk Assessment Examples1094No ratings yet

- Practical Guide To Risk Assessment (PWC 2008)Document40 pagesPractical Guide To Risk Assessment (PWC 2008)ducuh80% (5)

- Understanding The Breakeven Point When It Comes To Room RevenueDocument3 pagesUnderstanding The Breakeven Point When It Comes To Room Revenueahmedh_98No ratings yet

- Qatar Review Q1 2016 enDocument6 pagesQatar Review Q1 2016 enahmedh_98No ratings yet

- TMP LM8DNDocument73 pagesTMP LM8DNahmedh_98No ratings yet

- Drinks Survey Under 40 CharactersDocument5 pagesDrinks Survey Under 40 Charactersahmedh_98No ratings yet

- Valuation Using Startigic OptionDocument15 pagesValuation Using Startigic Optionahmedh_98No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Philippine Accountancy ActDocument9 pagesPhilippine Accountancy ActPrince DoomedNo ratings yet

- The Revenue Cycle: Group 1Document43 pagesThe Revenue Cycle: Group 1Ratih PratiwiNo ratings yet

- DCF Model Training - 4Document10 pagesDCF Model Training - 4mohd shariqNo ratings yet

- Saln TemplateDocument6 pagesSaln TemplateAllan TomasNo ratings yet

- 7110 s11 QP 21Document20 pages7110 s11 QP 21mstudy123456No ratings yet

- Kết Quả Đăng Ký - Admin - Wina Summit 2022Document63 pagesKết Quả Đăng Ký - Admin - Wina Summit 2022tamchau nguyenngocNo ratings yet

- Talent Management StrategiesDocument16 pagesTalent Management Strategiesgauravbpit100% (12)

- CH 4Document73 pagesCH 4Ella ApeloNo ratings yet

- Project Management by Gray and Larson (13Document43 pagesProject Management by Gray and Larson (13lubnaalhassanNo ratings yet

- Hola KolaDocument24 pagesHola KolaNidhi Agarwal92% (12)

- Case Study 3 - Pepsi 2009Document6 pagesCase Study 3 - Pepsi 2009AHMAD EIZATT BIN IDLANA -No ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit Formandrewdallas948No ratings yet

- T Mobile Usa.2023Document1 pageT Mobile Usa.2023applelog100% (2)

- Improve Business ProcessesDocument14 pagesImprove Business Processessonia_soja100% (2)

- SOP For DSC ManagementDocument3 pagesSOP For DSC Managementyamuna popparthiNo ratings yet

- Alaminos PaperDocument23 pagesAlaminos PaperJennifer UrsuaNo ratings yet

- Financial Analysis Tools and Techniques GuideDocument22 pagesFinancial Analysis Tools and Techniques GuideCamille G.No ratings yet

- Marketing - Section ADocument15 pagesMarketing - Section AArchana NeppolianNo ratings yet

- Finance AccountingDocument178 pagesFinance AccountingcostinNo ratings yet

- Japanese Organizations & American OrganizationsDocument31 pagesJapanese Organizations & American OrganizationsSantosh SrikarNo ratings yet

- Human Resources Management Best PracticeDocument19 pagesHuman Resources Management Best PracticeemmanuelNo ratings yet

- Micobussa, P1, F3, T2,2023Document8 pagesMicobussa, P1, F3, T2,2023malcomNo ratings yet

- The Souk Al-Manakh CrashDocument18 pagesThe Souk Al-Manakh CrashNzugu HoffmanNo ratings yet

- Scott Corwon of IMPACTS Approves Private Transaction With UK's The AQ GroupDocument1 pageScott Corwon of IMPACTS Approves Private Transaction With UK's The AQ Grouppbrandeis100% (10)

- Cost Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesCost Accounting: The Institute of Chartered Accountants of PakistanShehrozSTNo ratings yet

- Winding up company processDocument9 pagesWinding up company processSarthak SinghNo ratings yet

- Operations Management at AmazonDocument4 pagesOperations Management at AmazonKshitij ChopraNo ratings yet

- AX2012 Approval LimitDocument5 pagesAX2012 Approval Limitsiriluck_s6826No ratings yet

- IFRS For Small and Medium-Sized Entities (IFRS PDFDocument34 pagesIFRS For Small and Medium-Sized Entities (IFRS PDFAhmed HussainNo ratings yet

- Investor Knowledge Quiz: A Helpful Guide To Learning More About InvestingDocument16 pagesInvestor Knowledge Quiz: A Helpful Guide To Learning More About InvestingWensen ChuNo ratings yet