Professional Documents

Culture Documents

Keynes On Investment

Uploaded by

Cha-am JamalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Keynes On Investment

Uploaded by

Cha-am JamalCopyright:

Available Formats

Keynes on Investment

Jamal Munshi, Sonoma State University, 1995

All rights reserved

In chapters 12 and 13 of “The general theory of employment, interest,

and money”, John Maynard Keynes lays out his theory of the

determinants of returns from holding risky assets (stock) and those of

holding debt (bonds) and vents his disgust for speculative trading in

financial assets.

To a rational investor, asset valuation should be based only on the present

value of the best projections of the future cash flows, adjusted for risk,

that the investor believes will be generated by the asset. As such, capital

investment is a long term decision based on long term projections and

goals.

However, by allowing the stock market to value the stock of the firm,

this ideal goes wrong, says Keynes, because most investors are from the

"ignorant masses" and they tend to buy stock only for short term capital

gains rather than for long term income.

Keynes eschews "playing the market" which he likens to a "feeding

frenzy". He despises what he calls the "animal instincts" of stock market

investors to gamble. He feels that investors are simply trying to out-

guess and out-wit each other rather than attempting to project and

compute the cold mathematics of future cash flows and associated risks.

He says that the valuation of capital assets thus established is "absurd"

because the stock market has become a forum for speculation rather

than one of enterprise; although he admits in passing that the liquidity

and the outlet for our animal instincts provided by the market are

necessary for capital formation.

He homes in on speculation as the problem. Speculation is evil according

to Keynes. He says that speculation causes undue and irrational

fluctuations in both the stock market and the bond market and these

fluctuations do not reflect real changes in economic variables.

The speculation and excess volatility syndrome of the stock market thus

also affects the debt market as they are turned into casino-like venues

for speculators instead of being the rational arenas of the economic man

who through his liquidity preference, propensity to consume, and

propensity to save, would make all of his equations come out right.

Mankind apparently is too stupid to follow his prescribed behavior and

investors too dumb to make his equations work. It is likely that he saw

himself not simply as an observer of economic behavior but as a physician

who is required to prescribe economic behavior.

Although our view of capital markets has changed since 1935, Keynes was,

of course, a giant in his time and his wisdom still influences economic and

financial thought. However, it helps to understand that his work was

largely part of the overall response of economists to the 1929 crash and

the ensuing depression.

It must have seemed at the time that the system of free enterprise that

we inherited from the Dutch and the British Dissenters and their

Industrial Revolution may not be viable; that capitalism had failed; just as

it seemed after the fall of the Soviet Union that communism has failed.

And it was Keynes' work more than any other ideology that delivered us

from at least the psychological depression of the times. In the midst of

all the wringing of hands and gnashing of teeth, he stood tall and said

that capitalism had not failed and prescribed a cure for the depression.

It was a very uplifting piece of work.

Although Keynes' discussion of market mechanism was not necessary to

his general theory he felt compelled to write about it anyway because no

economic work of his time was deemed complete without an 'explanation'

for the crash. Chapters 12 and 13 should be read in this light.

The legacy of the crash was to make the market into the whipping boy

explaining away the depression as an artifact of market structure that

can be fixed and therefore not a fundamental failure of capitalist

economics. Keynes' strong language in this regard can be forgiven on this

score. We believe today that the market is, on the aggregate, rational

and an efficient aggregator of information and provider of liquidity going

so far as to provide additional mechanisms for speculators to provide

information and liquidity to markets. We do not question market valuation

and investor behavior. We only seek to understand them.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Will Global Warming Wipe Out Tibet's Glaciers?Document3 pagesWill Global Warming Wipe Out Tibet's Glaciers?Cha-am JamalNo ratings yet

- Deep Hot Biosphere - DR Thomas Gold-PNASDocument5 pagesDeep Hot Biosphere - DR Thomas Gold-PNASzaroia100% (1)

- Corruption in State Owned UtilitiesDocument8 pagesCorruption in State Owned UtilitiesCha-am JamalNo ratings yet

- The Risk Return Structure of The Credit Card IndustryDocument17 pagesThe Risk Return Structure of The Credit Card IndustryCha-am JamalNo ratings yet

- History of The Global Warming Scare Chapter 5: 2000-2005Document5 pagesHistory of The Global Warming Scare Chapter 5: 2000-2005Cha-am JamalNo ratings yet

- The Arbitrage Pricing Model in FinanceDocument5 pagesThe Arbitrage Pricing Model in FinanceCha-am JamalNo ratings yet

- Employment Public Aid RenewableDocument53 pagesEmployment Public Aid RenewablethierrydebelsNo ratings yet

- Gap Management 101Document6 pagesGap Management 101Cha-am JamalNo ratings yet

- Corruption Case StudyDocument7 pagesCorruption Case StudyCha-am JamalNo ratings yet

- History of The Global Warming Scare: Chapter 4: 1995 - 2000Document6 pagesHistory of The Global Warming Scare: Chapter 4: 1995 - 2000Cha-am JamalNo ratings yet

- Portfolio Theory Lecture NotesDocument2 pagesPortfolio Theory Lecture NotesCha-am Jamal100% (1)

- The Montreal ProtocolDocument2 pagesThe Montreal ProtocolCha-am JamalNo ratings yet

- Enterprise Reform in ChinaDocument3 pagesEnterprise Reform in ChinaCha-am JamalNo ratings yet

- Dupont AnalysisDocument4 pagesDupont AnalysisCha-am JamalNo ratings yet

- Database NormalizationDocument2 pagesDatabase NormalizationCha-am JamalNo ratings yet

- History of The Global Warming Scare. Chapter 2, 1985-1990Document3 pagesHistory of The Global Warming Scare. Chapter 2, 1985-1990Cha-am JamalNo ratings yet

- History of The Global Warming Scare: Chapter 3: 1990-1995Document5 pagesHistory of The Global Warming Scare: Chapter 3: 1990-1995Cha-am Jamal100% (1)

- On The Alleged Fractal Nature of MarketsDocument5 pagesOn The Alleged Fractal Nature of MarketsCha-am JamalNo ratings yet

- Stock Exchange AutomationDocument2 pagesStock Exchange AutomationCha-am JamalNo ratings yet

- Institutional Reforms For Capital Markets in ChinaDocument9 pagesInstitutional Reforms For Capital Markets in ChinaCha-am JamalNo ratings yet

- A Method For Constructing Likert ScalesDocument12 pagesA Method For Constructing Likert ScalesCha-am JamalNo ratings yet

- The Kyoto ProtocolDocument2 pagesThe Kyoto ProtocolCha-am Jamal100% (1)

- A Framework For MIS Effectiveness ResearchDocument8 pagesA Framework For MIS Effectiveness ResearchCha-am JamalNo ratings yet

- History of The Global Warming Scare: Chapter 1: 1980 - 1985Document3 pagesHistory of The Global Warming Scare: Chapter 1: 1980 - 1985Cha-am JamalNo ratings yet

- The Re-Unification of IndiaDocument2 pagesThe Re-Unification of IndiaCha-am JamalNo ratings yet

- Village Life in BangladeshDocument3 pagesVillage Life in BangladeshCha-am Jamal0% (1)

- Moderate MuslimsDocument1 pageModerate MuslimsCha-am JamalNo ratings yet

- Ozone Hole News Archive: 1987 To 2005Document3 pagesOzone Hole News Archive: 1987 To 2005Cha-am JamalNo ratings yet

- The International Aid BusinessDocument1 pageThe International Aid BusinessCha-am JamalNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Bucksbaum SuitDocument28 pagesBucksbaum SuitChicago Tribune100% (1)

- For Mba Student Summer Assignment IfsDocument17 pagesFor Mba Student Summer Assignment IfsRajan ShrivastavaNo ratings yet

- CIMB - DaybreakDocument10 pagesCIMB - DaybreakThomas Lau100% (3)

- Contoh Print Out Neraca Saldo Jan-Feb 2018 Accurate 5Document34 pagesContoh Print Out Neraca Saldo Jan-Feb 2018 Accurate 5Mohammad Fauzi Kushardia NovanNo ratings yet

- Sharpe's Ratio - Portfolio EvaluationDocument12 pagesSharpe's Ratio - Portfolio EvaluationVaidyanathan RavichandranNo ratings yet

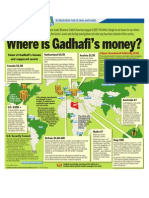

- Where Is Gadhafi's Money?Document1 pageWhere Is Gadhafi's Money?The London Free Press100% (2)

- Kavry Project MBA 2019Document87 pagesKavry Project MBA 2019Catherine Maria0% (1)

- Economics Project AbstractDocument3 pagesEconomics Project AbstractRahul KumarNo ratings yet

- Redback MiningDocument23 pagesRedback MiningOuedraogo AzouNo ratings yet

- Ugc Net EconomicsDocument17 pagesUgc Net EconomicsSachin SahooNo ratings yet

- Baupost GroupDocument7 pagesBaupost GroupValueWalk0% (1)

- Pe 3061 4Document1 pagePe 3061 4ALONSO SANCHEZ CARLOSNo ratings yet

- PEMI PSEiDocument1 pagePEMI PSEiVictor RamirezNo ratings yet

- Ias33 PDFDocument26 pagesIas33 PDFJorreyGarciaOplas100% (1)

- Financial Management MCQDocument31 pagesFinancial Management MCQR.ARULNo ratings yet

- Sample Financial Plan Arthayantra PDFDocument15 pagesSample Financial Plan Arthayantra PDFVamsi Pavan Kumar SankaNo ratings yet

- Alberta International Offices ReviewDocument20 pagesAlberta International Offices ReviewEdmonton SunNo ratings yet

- Batus - Price Will Tell (Entry)Document187 pagesBatus - Price Will Tell (Entry)Tengku DinNo ratings yet

- Candle Stick PatternDocument15 pagesCandle Stick Patterndisha_gupta_16No ratings yet

- Fera ActDocument28 pagesFera Actjuhi jainNo ratings yet

- ACY4001 Advanced Accounting 1 - Individual Assignment 2 - Ch17Document2 pagesACY4001 Advanced Accounting 1 - Individual Assignment 2 - Ch17Morris LoNo ratings yet

- Written Report in Ucsp: Title: Economic InstitutionsDocument10 pagesWritten Report in Ucsp: Title: Economic InstitutionsLizley CordovaNo ratings yet

- NGAS 2019 eBOOKDocument128 pagesNGAS 2019 eBOOKGabinu AngNo ratings yet

- Adjudication Order in Respect of Gulshan V Chopra in The Matter of M/s Niraj Cement Structurals LimitedDocument20 pagesAdjudication Order in Respect of Gulshan V Chopra in The Matter of M/s Niraj Cement Structurals LimitedShyam SunderNo ratings yet

- JPM Covered Bond Handbook 2010Document252 pagesJPM Covered Bond Handbook 2010Audrey LimNo ratings yet

- BCG MatrixDocument2 pagesBCG Matrixpallav86No ratings yet

- Tutorial Answers FDIDocument6 pagesTutorial Answers FDISong YeeNo ratings yet

- Prospectus BedmuthaIndustriesDocument380 pagesProspectus BedmuthaIndustriesMurali KrishnaNo ratings yet

- Functions of Stock ExchangeDocument2 pagesFunctions of Stock ExchangeGokulKarwaNo ratings yet

- Definedge Diwali NewsletterDocument10 pagesDefinedge Diwali NewsletterSubbarayudu PasupulaNo ratings yet