Professional Documents

Culture Documents

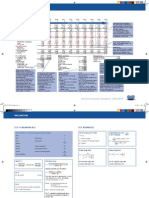

BFD (Past Paper Analysis)

Uploaded by

Muhammad Ubaid KhosaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BFD (Past Paper Analysis)

Uploaded by

Muhammad Ubaid KhosaCopyright:

Available Formats

Attempt

Q#

WACC & Capital

Structures

Summer 2012

Summer 2011

Winter 2010

Summer 2010

Summer 2009

Winter 2008

Summer 2008

1

6

5

3

5

6

2

WACC + Adjusted WACC

Debt Equity ratio working

Interest cover + MM

APV

For different Capital Structures

WACC + MM

Market price and WACC

Summer 2011

Winter 2010

Winter 2009

Winter 2008

Summer 2008

2

3

1

7

1

Involvement of sharp ratio

Alpha Values

Apha Values and Revised Beta

Beta calculations for different projects

Returns and Weighted Beta

Summer 2012

Winter 2011

Winter 2011

Summer 2011

Summer 2011

Winter 2010

Summer 2010

Winter 2009

Winter 2009

Summer 2009

Summer 2009

Winter 2008

Winter 2008

Summer 2008

5

6

3

4

4

4

2

3

1

2

4

5 (a)

4

NPV + Discounted Payback + IRR + MIRR

(Different Currencies)

International + Taxation issues

NPV (2 alternatives)

Lease vs Buy

NPV

International + Tax treaty working

Leasing calculations

NPV

NPV

TFC + Other Floating rates

Asset Replacement option

NPV (Leasing & IRR)

NPV

Leasing calculations

Winter 2011

Summer 2010

Winter 2009

Summer 2008

1

5

5

3

Dividend irrelevance theory

Right issue and effect on price

Right issue and effect on price

Right shares and Capital Structure

Summer 2012

Winter 2011

5

4

Winter 2010

Winter 2009

Summer 2009

Summer 2008

3

6

All methods (Futures,Hedge,Options)

Hedging through forward cover and money

market + multilateral netting

Hedging through forward cover and money

market + interest rate risk

Hedging through forward cover and money

market

Call and Put Options

Hedging through forward cover

Summer 2012

Summer 2011

Summer 2010

1

1

Winter 2008

Winter 2008

Winter 2008

2

5 (b)

Valuation

Risk

Analysis

Misc

Foreign Excahnge

Dividends

& Right

Issue

Investment Appraisal

Topic

CAPM +

Portfolio

BFD Question Bank (Topic Wise) - Summer 2008 to Summer 2012

Short Description

Investment mix of Mutually exclusive &

mutually dependent projects

Leverage Ratios

Projected cash flow and divident payout

policy

Injection of fresh equity + shareholding

calculations

Forcasting and Debt/Equity Ratio

Sensitivity Analysis

Winter 2011

Summer 2009

Winter 2008

2

6

3

Decision Tree + NPV

Probabilities and Expected Values

Interest rate swaps

Summer 2012

Winter 2011

Summer 2011

Winter 2010

3

5

1

Summer 2010

Winter 2009

Summer 2009

Summer 2008

2

4

4

5

Free Cash Flows + Optimum sales level +

Cash Flow Management

Free cash flows + impact of acquisition

Calculating purchase consideration

Shares as purchase consideration EPS /

Discount Rate (+ Theory)

Free cash flows + impact of SYNERGY

MBO

Working for mergers

Surplus Value on Demerger

Marks

Page (Q)

Page (A)

19

17

23

16

15

13

12

115

15

13

20

12

18

78

17

1

27

39

48

73

82

91

5

33

45

53

78

88

96

24

37

58

83

91

29

42

63

89

95

15

16

24

25

38

49

59

59

70

70

81

82

92

21

22

30

31

43

54

64

65

74

76

86

87

98

13

50

61

92

17

56

67

97

4

15

11

20

20

37

41

12

61

68

12

17

89

20

71

94

77

102

15

22

23

47

28

51

13

80

84

14

10

94

14

15

10

39

30

80

82

85

87

13

73

81

18

79

85

20

25

20

14

26

36

19

31

40

25

24

21

20

185

48

60

72

93

52

65

77

100

20

17

12

16

24

20

14

13

20

17

18

10

18

236

15

17

17

15

64

14

14

13%

9%

26%

7%

10%

10%

4%

21%

BFD Question Bank (Attempt Wise) - Summer 2008 to Summer 2012

Summer 2008

Winter 2008

Summer 2009

Winter 2009

Summer 2010

Winter 2010

Summer 2011

Winter 2011

Summer 2012

Attempt

Q#

Topic

Short Description

Marks

Page (Q)

Page (A)

WACC + Adjusted WACC

Investment mix of Mutually exclusive &

mutually dependent projects

NPV + Discounted Payback + IRR + MIRR

(Different Currencies)

Free Cash Flows + Optimum sales level +

Cash Flow Management

All methods (Futures,Hedge,Options)

19

20

1

2

5

6

17

30

14

11

15

14

20

14

13

13

14

15

17

18

19

20

20

17

15

16

21

22

1

2

WACC & Capital Structures

Misc

Investment Appraisal

Valuation

Foreign Excahnge

1

2

3

4

Dividends & Right Issue

Risk Analysis

Valuation

Foreign Excahnge

5

6

Investment Appraisal

Investment Appraisal

Dividend irrelevance theory

Decision Tree + NPV

Free cash flows + impact of acquisition

Hedging through forward cover and money

market + multilateral netting

International + Taxation issues

NPV (2 alternatives)

1

2

3

4

5

6

Misc

CAPM + Portfolio

Investment Appraisal

Investment Appraisal

Valuation

WACC & Capital Structures

Leverage Ratios

Involvement of sharp ratio

Lease vs Buy

NPV

Calculating purchase consideration

Debt Equity ratio working

15

15

12

16

25

17

23

24

24

25

26

27

28

29

30

31

31

33

Valuation

20

36

40

Foreign Excahnge

20

37

41

3

4

5

CAPM + Portfolio

Investment Appraisal

WACC & Capital Structures

Shares as purchase consideration EPS /

Discount Rate (+ Theory)

Hedging through forward cover and money

market + interest rate risk

Alpha Values

International + Tax treaty working

Interest cover + MM

13

24

23

37

38

39

42

43

45

Misc

22

47

51

2

3

4

5

Valuation

WACC & Capital Structures

Investment Appraisal

Dividends & Right Issue

25

16

20

17

48

48

49

50

52

53

54

56

1

2

3

4

5

6

CAPM + Portfolio

Investment Appraisal

Investment Appraisal

Valuation

Dividends & Right Issue

Foreign Excahnge

Apha Values and Revised Beta

NPV

NPV

MBO

Right issue and effect on price

Hedging through forward cover and money

market

20

14

13

24

17

12

58

59

59

60

61

61

63

64

65

65

67

68

1

2

3

4

5

6

Investment Appraisal

Investment Appraisal

Foreign Excahnge

Valuation

WACC & Capital Structures

Risk Analysis

TFC + Other Floating rates

Asset Replacement option

Call and Put Options

Working for mergers

For different Capital Structures

Probabilities and Expected Values

20

17

12

21

15

15

70

70

71

72

73

73

74

76

77

77

78

79

Misc

13

80

84

14

10

18

10

10

13

12

80

81

81

82

82

82

83

85

85

86

87

87

88

89

18

12

15

18

20

17

91

91

92

92

93

94

95

96

97

98

100

102

Projected cash flow and divident payout

policy

Free cash flows + impact of SYNERGY

APV

Leasing calculations

Right issue and effect on price

2

3

4

5 (a)

5 (b)

6

7

Misc

Risk Analysis

Investment Appraisal

Investment Appraisal

Misc

WACC & Capital Structures

CAPM + Portfolio

Injection of fresh equity + shareholding

calculations

Forcasting and Debt/Equity Ratio

Interest rate swaps

NPV (Leasing & IRR)

NPV

Sensitivity Analysis

WACC + MM

Beta calculations for different projects

1

2

3

4

5

6

CAPM + Portfolio

WACC & Capital Structures

Dividends & Right Issue

Investment Appraisal

Valuation

Foreign Excahnge

Returns and Weighted Beta

Market price and WACC

Right shares and Capital Structure

Leasing calculations

Surplus Value on Demerger

Hedging through forward cover

You might also like

- BFD Revision Kit (Question Bank With Solutions - Topicwise)Document106 pagesBFD Revision Kit (Question Bank With Solutions - Topicwise)naeem_shamsNo ratings yet

- Interest Rate Markets - Siddhartha JhaDocument6 pagesInterest Rate Markets - Siddhartha JhaNipun DuaNo ratings yet

- LBO Analysis TemplateDocument11 pagesLBO Analysis TemplateBobby Watkins75% (4)

- Financial Planning and Forecasting GuideDocument35 pagesFinancial Planning and Forecasting GuideSaidarshan RevandkarNo ratings yet

- 04 - VC Fund PerformanceDocument22 pages04 - VC Fund Performancejkkkkkkkkkretretretr100% (1)

- Financial Planning & ForecastingDocument44 pagesFinancial Planning & Forecastingnageshalways503275% (4)

- Projet PGPM RatioDocument16 pagesProjet PGPM RatioViren PatelNo ratings yet

- Business Process Master List (BPML) Introduction and SamplesDocument124 pagesBusiness Process Master List (BPML) Introduction and SamplesMillionn Gizaw100% (8)

- Slides367 Investment Mangemnt Must PrintDocument454 pagesSlides367 Investment Mangemnt Must PrintneveenNo ratings yet

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahavNo ratings yet

- Financial Statement Analysis for Semiconductor CompanyDocument19 pagesFinancial Statement Analysis for Semiconductor CompanyMohammad ShahraeeniNo ratings yet

- Hotel Ind CompsDocument11 pagesHotel Ind Compsdeepak3krNo ratings yet

- Turning The Corner, But No Material Pick-UpDocument7 pagesTurning The Corner, But No Material Pick-UpTaek-Geun KwonNo ratings yet

- Answer-Lease Vs BuyDocument2 pagesAnswer-Lease Vs BuyAshwin KumarNo ratings yet

- Business Model ManufacturerDocument92 pagesBusiness Model ManufacturerNida Mumtaz AsherNo ratings yet

- BPML Master List-ALLDocument124 pagesBPML Master List-ALLSurya Damarla100% (2)

- Asset Swap GuideDocument11 pagesAsset Swap Guideemerging11No ratings yet

- Valuation Report DCF Power CompanyDocument34 pagesValuation Report DCF Power CompanySid EliNo ratings yet

- Fin 3320 ProjectDocument13 pagesFin 3320 Projectapi-313630382No ratings yet

- Financial Planning and ForecastingDocument17 pagesFinancial Planning and Forecastinglove_a123100% (1)

- Fiscal Year Is January-December. All Values USD Millions.: AssetsDocument29 pagesFiscal Year Is January-December. All Values USD Millions.: AssetsHubert Luis Madariaga ManyaNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- FY 2011-12 Third Quarter Results: Investor PresentationDocument34 pagesFY 2011-12 Third Quarter Results: Investor PresentationshemalgNo ratings yet

- DCF ValuationDocument19 pagesDCF ValuationVIJAYARAGAVANNo ratings yet

- DMX Technologies 3Q13 results above expectations on higher salesDocument4 pagesDMX Technologies 3Q13 results above expectations on higher salesstoreroom_02No ratings yet

- Petroskills Economics of Worldwide Petroleum Production BookDocument20 pagesPetroskills Economics of Worldwide Petroleum Production BooksaadalamNo ratings yet

- Pro Forma Models - StudentsDocument9 pagesPro Forma Models - Studentsshanker23scribd100% (1)

- Descriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsDocument15 pagesDescriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsVALLIAPPAN.PNo ratings yet

- Equity Valuation Concepts and Basic Tools (CFA) CH 10Document28 pagesEquity Valuation Concepts and Basic Tools (CFA) CH 10nadeem.aftab1177No ratings yet

- Lbo W DCF Model SampleDocument43 pagesLbo W DCF Model SamplePrashantK100% (1)

- VebitdaDocument24 pagesVebitdaAndr EiNo ratings yet

- 01 Valuation ModelsDocument24 pages01 Valuation ModelsMarinaGorobeţchiNo ratings yet

- The Little Book of Valuation: How to Value a Company, Pick a Stock, and ProfitFrom EverandThe Little Book of Valuation: How to Value a Company, Pick a Stock, and ProfitRating: 4 out of 5 stars4/5 (7)

- Year End (In Crore Rupees) 2014 2013 2012 2011 2010 Average Sources of FundsDocument6 pagesYear End (In Crore Rupees) 2014 2013 2012 2011 2010 Average Sources of FundsKamakshi KaulNo ratings yet

- UAE Real Estate Sector Update October 2008Document40 pagesUAE Real Estate Sector Update October 2008Mustafa ChaudhryNo ratings yet

- Fin439 Final Luv Aal UpdatedDocument91 pagesFin439 Final Luv Aal Updatedapi-323273427No ratings yet

- BaiduDocument29 pagesBaiduidradjatNo ratings yet

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2021 + TEST BANKRating: 5 out of 5 stars5/5 (1)

- Equity Valuation: Concepts and Basic Tools: Presenter Venue DateDocument28 pagesEquity Valuation: Concepts and Basic Tools: Presenter Venue Datenadeem.aftab1177No ratings yet

- SECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2022 + TEST BANKFrom EverandSECURITIES INDUSTRY ESSENTIALS EXAM STUDY GUIDE 2022 + TEST BANKRating: 5 out of 5 stars5/5 (4)

- Boeing Financial AnalysisDocument21 pagesBoeing Financial AnalysisMohamed Ali SalemNo ratings yet

- Fi 410 Chapter 3Document50 pagesFi 410 Chapter 3Austin Hazelrig100% (1)

- SMF DCF Training (Done) FinalDocument22 pagesSMF DCF Training (Done) FinalWayne Weixian HoNo ratings yet

- Lecture5 6 Ratio Analysis 13Document39 pagesLecture5 6 Ratio Analysis 13Cristina IonescuNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Using Bloomberg To Get The Data You NeedDocument36 pagesUsing Bloomberg To Get The Data You Needte_gantengNo ratings yet

- Figuring It Out: Sixty Years of Answering Investors' Most Important QuestionsFrom EverandFiguring It Out: Sixty Years of Answering Investors' Most Important QuestionsNo ratings yet

- Business ModelDocument111 pagesBusiness ModelShai BurnovskiNo ratings yet

- Financial Management Solved ProblemsDocument50 pagesFinancial Management Solved ProblemsAnonymous RaQiBV75% (4)

- Equity Research - Finance Modelling - NIFTY - SENSEX CompaniesDocument46 pagesEquity Research - Finance Modelling - NIFTY - SENSEX Companiesyash bajajNo ratings yet

- Assign 3 - Sem 2 11-12 - RevisedDocument5 pagesAssign 3 - Sem 2 11-12 - RevisedNaly BergNo ratings yet

- Biocon - Ratio Calc & Analysis FULLDocument13 pagesBiocon - Ratio Calc & Analysis FULLPankaj GulatiNo ratings yet

- Understanding Commercial Real Estate CDOs 9.50amDocument23 pagesUnderstanding Commercial Real Estate CDOs 9.50amKaran Malhotra100% (1)

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- Infosys Technologies: Cautious in The Realm of Rising UncertaintyDocument7 pagesInfosys Technologies: Cautious in The Realm of Rising UncertaintyAngel BrokingNo ratings yet

- CH 02 Tool KitDocument9 pagesCH 02 Tool KitDhanraj VenugopalNo ratings yet

- Short-Term Financial Planning GuideDocument23 pagesShort-Term Financial Planning GuideRao786No ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Final Inception Report With Appendices PDFDocument233 pagesFinal Inception Report With Appendices PDFAnAs Nassar100% (1)

- Pranoy Mazumdar - ResumeDocument3 pagesPranoy Mazumdar - ResumePranoy MazumdarNo ratings yet

- Accounting and Financial Close (J58 - BR) : Test Script SAP S/4HANA - 18-09-20Document114 pagesAccounting and Financial Close (J58 - BR) : Test Script SAP S/4HANA - 18-09-20MarceloNo ratings yet

- Notes To Financial Statement (Sample) (All Amounts in Philippine Peso Unless Otherwise Stated)Document42 pagesNotes To Financial Statement (Sample) (All Amounts in Philippine Peso Unless Otherwise Stated)aliahNo ratings yet

- Goldman Sachs Pitchbook Airvana Why Goldman Pitch 7-14-2009Document35 pagesGoldman Sachs Pitchbook Airvana Why Goldman Pitch 7-14-2009JNo ratings yet

- SSRN Id4429586Document14 pagesSSRN Id4429586Sibasish PandaNo ratings yet

- Coronavirus Impact On Stock Prices and Growth ExpectationsDocument27 pagesCoronavirus Impact On Stock Prices and Growth ExpectationsSouheil LahmerNo ratings yet

- DCF Valuation Methods ExplainedDocument12 pagesDCF Valuation Methods ExplainedChristina ZhangNo ratings yet

- Y Combinator Guide To Seed FundraisingDocument12 pagesY Combinator Guide To Seed FundraisingOluwasegun OluwaletiNo ratings yet

- Graham and Doddsville Spring 2013 PDFDocument60 pagesGraham and Doddsville Spring 2013 PDFAbdullah18No ratings yet

- 11 TarasoffDocument39 pages11 Tarasoffdiademny09No ratings yet

- CH 5 SolutionsDocument24 pagesCH 5 SolutionsJeniffer WangNo ratings yet

- Corporate Restructuring Part 1Document145 pagesCorporate Restructuring Part 1Vibha SharmaNo ratings yet

- Objective of The StudyDocument68 pagesObjective of The StudyArchie SrivastavaNo ratings yet

- Prudential Regulations For Banks: Banking Supervision DepartmentDocument39 pagesPrudential Regulations For Banks: Banking Supervision DepartmentscoutaliNo ratings yet

- Lecture 1 Effecient Market HypothesisDocument10 pagesLecture 1 Effecient Market HypothesisInformation should be FREENo ratings yet

- Definition of WACCDocument6 pagesDefinition of WACCMMNo ratings yet

- Pitchbook US TemplateDocument26 pagesPitchbook US TemplateBrian Heiligenthal100% (1)

- Solution Manual For Strategic Human Resource Management 5th Edition by MelloDocument11 pagesSolution Manual For Strategic Human Resource Management 5th Edition by MelloBlanca Denton100% (35)

- Chilean Equity Yearbook 2021Document87 pagesChilean Equity Yearbook 2021Yi Chun LinNo ratings yet

- CFA Level 2 Equity Valuation Study ExamplesDocument6 pagesCFA Level 2 Equity Valuation Study ExamplessaurabhNo ratings yet

- ACCA Study Text Book F9 Financial Management Exam 4 Focused LearningDocument128 pagesACCA Study Text Book F9 Financial Management Exam 4 Focused LearningTichaona Makwara100% (1)

- Where's The Bar - Introducing Market-Expected Return On InvestmentDocument17 pagesWhere's The Bar - Introducing Market-Expected Return On Investmentpjs15No ratings yet

- Inventory Management - MIDAS SafetyDocument22 pagesInventory Management - MIDAS Safetysupplier13No ratings yet

- The Karnataka Stamp Act, 1957Document83 pagesThe Karnataka Stamp Act, 1957Sridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್No ratings yet

- 2017 UBS Investment Banking Challenge Heat Round Case StudyDocument31 pages2017 UBS Investment Banking Challenge Heat Round Case StudyFay ManaziNo ratings yet

- Chap 09 Prospective AnalysisDocument35 pagesChap 09 Prospective AnalysisHiếu Nhi TrịnhNo ratings yet

- Assumptions: DCF ModelDocument3 pagesAssumptions: DCF Modelniraj kumarNo ratings yet

- SAP FICO Expert With 7+ Years ExperienceDocument4 pagesSAP FICO Expert With 7+ Years Experiencesateesh konatamNo ratings yet

- Session 10 - Simulation QuestionsDocument6 pagesSession 10 - Simulation QuestionsChetan Duddagi75% (4)