Professional Documents

Culture Documents

Bazazallianze

Uploaded by

Rahul YadavOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bazazallianze

Uploaded by

Rahul YadavCopyright:

Available Formats

zzzzzzzzz

PROJECT REPORT

ON

COMPARISON OF PENSION PLAN OF

BAJAJ ALLIANZ

WITH OTHER COMPETITORS

UNDERGONE AT

BAJAJ ALLIANZ LIFE INSURANCE

In partial fulfillment of the requirement for the

Degree of

MASTER OF BUSSINESS ADMINISTRATION

SESSION (2006-2008)

SUBMITTED TO

INVERTIS INSTITUTE OF MANAGEMENT & STUDIES,

BAREILLY

AFFILIATED TO

U.P. TECHNICAL UNIVERSITY, LUCKNOW

Prepared By:NITESH CHANDRA OJHA

MBA 2nd YEAR

ROLL NO. 0701570059

zzzzzzzzz

PREFACE

THE PRESENT REPORT IS ON THE COMPARISON OF WHOLE LIFE

PLAN OF THE COMPANY BAJAJ ALLIANZ LIFE INSURENCE WITH

OTHER MAJOR INSURANCE PLAYERS. IN ADDITION, THE REPORT

STUDIES THE COMPARATIVE ANALYSIS OF THE VARIOUS INSURANCE

PLAYERS. THE AIM OF THE STUDY IS TO GAIN INSIGHT INTO THE WHOLE

GAMUT OF WHOLE LIFE INSURANCE BUSINESS IN BAREILLY.

IN THIS REPORT, THE BASIC FEATURES AND BENEFITS OFFERED BY

BAJAJ ALLIANZ LIFE INSURANCES PENSION PLAN OVER OTHER

COMPANIES HAVE BEEN ANALYZED. IT ALSO ANALYSES THE BENEFITS

OR UNIQUE SELLING PROPOSITION OF THE COMPANYS PENSION PLAN,

WHICH GIVES IT A COMPETITIVE EDGE OVER OTHER INSURANCE

COMPANIES.

THE

REPORT ALSO

UNDERTAKES

A SURVEY

REGARDING

THE

AWARENESS ABOUT THE INSURANCE AS A MODE OF INVESTMENT FOR A

PRUDENT INVESTOR. IT ATTEMPTS TO GAIN INSIGHT ABOUT THE

CONSUMER BEHAVIOR REGARDING THE PURCHASE OF PENSION PLAN

AS

A MODE

OF

SAFETY AND

SECURITY FOR

THEIR

FAMILY

ANDTHEMSELVES.

zzzzzzzzz

Acknowledgements

Any accomplishment requires the effort of many people and this work is no

different. I thank Bajaj Allianz Life Insurance and its entire staff, whose

support was instrumental in accomplishing the task. I would also like to

express my sincere gratitude to Bajaj Allianz Life Insurance Company Ltd. for

giving me this wonderful opportunity to work and get to know more about the

insurance industry and life insurance market in general. It was a great

experience to work with so talented and committed people.

I would also like to express my sincere regards to MR.S.K. ROI (FACULTY

IIMS) for extending her valuable guidance. He has been a source of inspiration

and motivation incidental to the completion of my project.

Many data of my findings are the result of a collection from various sources,

such as magazines and many insurance companies. Regardless of the source, I

wish to express my gratitude to those who may have contributed to this work,

even though anonymously.

zzzzzzzzz

BAJAJ ALLIANZ LIFE INSURANCE

MISSION PENSION

With inflation eating away at buying power... taxes eroding the interest earned

on savings... and the possibility of spending more than two decades in

retirement, it's clear that a plan is needed to secure your retirement dreams.

And, as the Life insurance rates are based primarily on age, the younger you

are when you make this decision, the lower your premium will be. Make a

decision today and ensure a more enjoyable, less tension filled tomorrow . . .

zzzzzzzzz

CONTENTS

1. EXECUTIVE SUMMARY

2. INTRODUCTION

COMPANY PROFILE (6-11)

PRODUCTS OFFERED BY THE COMPANY (12-17)

RETIREMENT (18-34)

RETIREMENT PLANNING (35-39)

3. PROJECT OBJECTIVE (40-45)

4. APPENDICES-PENSION PLAN

BAJAJ ALLIANZ LIFE INSURANCE (46-54)

ICICI PRUDENTIAL LIFE INSURANCE (55-60)

HDFC STANDARD LIFE INSURANCE (61-65)

OM KOTAK MAHINDRA LIFE INSURANCE (66-68)

MAX NEW YORK LIFE INSURANCE (69-71)

ING VYSYA LIFE INSURANCE (72-75)

TATA AIG LIFE INSURANCE (76-77)

LIFE INSURANCE CORPORATION (78-79)

STATE BANK OF INDIA (84-85)

AVIVA LIFE INSURANCE (86-88)

5. RESEARCH METHEDOLOGY (89)

6. ANALYSIS AND INTERPRETATION (90-93)

7. SWOT ANALYSIS (94-96)

8. CONCLUSION (97-98)

9. RECOMMENDATION (99)

10. LIMITATIONS (100)

11. BIBLOGRAPHY (101)

zzzzzzzzz

COMPANY PROFILE

BAJAJ GROUP

Bajaj Auto Ltd, the flagship company of the Rs. 8000 crore Bajaj group is the

largest manufacturer of two-wheelers and three-wheelers in India and one of the

largest in the world. .A household name in India, Bajaj Auto has a strong brand

image & brand loyalty synonymous with quality & customer focus.

A STRONG INDIAN BRAND- HAMARA BAJAJ

21 million+ vehicles, one of the largest 2 & 3 wheeler manufacturers in the

world on the roads across the globe.

Managing funds of over Rs 4000 cr.

Bajaj Auto finance one of the largest auto finance Cos. in India.

Rs. 4,744 Cr. Turnover & Profits of 538 Cr. in 2002-03.

It has joined hands with Allianz to provide the Indian consumers with a distinct option

in terms of life insurance products

zzzzzzzzz

ALLIANZ GROUP

Allianz Group is one of the world's leading insurers and financial

services providers.

Founded in 1890 in Berlin, Allianz is now present in over 70 countries with almost

174,000 employees. At the top of the international group is the holding company,

Allianz AG, with its head office in Munich.

Allianz Group provides its more than 60 million customers worldwide with a

comprehensive range of services in the areas of:

Property and Casualty Insurance,

Life and Health Insurance,

Asset Management and Banking.

ALLIANZ AS- A GLOBAL FINANCIAL POWERHOUSE

Worldwide 2nd by Gross Written Premiums - Rs.4, 46,654 cr.

3rd largest Assets Under Management (AUM) & largest amongst Insurance

cos. - AUM of Rs.51, 96,959 cr.

12th largest corporation in the world

49.8 % of global business from Life Insurance

Established in 1890, 110 yrs of Insurance expertise

70 countries, 173,750 employees worldwide

zzzzzzzzz

SHARED VISION

A household name in India teams up with a global

conglomerate...

Bajaj Auto Ltd, the flagship company of the Rs. 8000 crore Bajaj group is

the largest manufacturer of two-wheelers and three-wheelers in India and one of

the largest in the world.

A household name in India, Bajaj Auto has a strong brand image & brand loyalty

synonymous with quality & customer focus. With over 15,000 employees, the

company is a Rs. 4000 crore auto giant, is the largest 2/3-wheeler manufacturer in

India and the 4th largest in the world. AAA rated by Crisil, Bajaj Auto has been in

operation for over 55 years. It has joined hands with Allianz to provide the Indian

consumers with a distinct option in terms of life Insurance products

As a promoter of Bajaj Allianz Life Insurance Co. Ltd., Bajaj Auto has the following

to offer

Financial strength and stability to support the Insurance Business.

A strong brand-equity.

A good market reputation as a world-class organization.

An extensive distribution network.

Adequate experience of running a large organization.

A 10 million strong base of retail customers using Bajaj products.

Advanced Information Technology in extensive use.

Experience in the financial services industry through Bajaj Auto Finance

Ltd

zzzzzzzzz

INDIAN OPERATIONS

Growing at a breakneck pace with a strong pan Indian presence Bajaj

Allianz has emerged as a strong player in India...

Bajaj Allianz Life Insurance Company Limited is a joint venture between two leading

conglomerates Allianz AG and Bajaj Auto Limited.

Characterized by global presence with a local focus and driven by customer

orientation to establish high earnings potential and financial strength, Bajaj Allianz

Life Insurance Co. Ltd. was incorporated on 12th March 2001. The company received

the Insurance Regulatory and Development Authority (IRDA) certificate of

Registration (R3) No 116 on 3rd August 2001 to conduct Life Insurance business in

India.

Bajaj Allianz- THE PRESENT

Product tailored to suit your needs

Decentralized organization structure for faster response

Wide reach to serve you better a nationwide network of 700 + branches

Specialized departments for Banc assurance, Corporate Agency and Group

Business

Well networked Customer Care Centers (CCCs) with state of art IT systems

Highest standard of customer service & simplified claims process in the

industry

9

zzzzzzzzz

10

Website to provide all assistance and information on products and services,

online buying and online renewals.

strong tele-marketing and Direct marketing team

Swift and easy claim settlement process

Tie Ups with Banks

Pioneers of Banc assurance in India...Having pioneered the phenomenon,

Banc assurance is one our core business strategies. Two of our strong Banc assurance

tie-ups are:

Standard Chartered Bank

Syndicate Bank

Company has developed a range of life insurance products exclusively for our Banc

assurance partners. Also, our products are customized to suit specific needs of banks.

FOCUSSED SALES NETWORK

10

zzzzzzzzz

11

WHY BAJAJ ALLIANZ

Bajaj Allianz Life Insurance Company Limited is a union between Allianz

SE, the worlds leading insurer and Bajaj Auto, one of Indias most respected names.

Allianz SE is a leading insurance conglomerate globally and one of the largest

asset managers in the world, managing assets worth over a Trillion Euros (over

Rs. 55,00,000 crores). At Bajaj Allianz, we realize that customer seek an insurer he

can trust his hard earned money with. Allianz SE has more than 110 years of

financial experience in over 70 countries and Bajaj Auto, trusted for over 55 years in

the Indian market, are committed to offering people financial solutions that

provide all the security customer need for his family and himself.

At Bajaj Allianz, customer delight is our guiding principle. Ensuring world class

solutions by offering them customized products with transparent benefits supported

by the best technology is their business philosophy.

11

zzzzzzzzz

12

PRODUCTS

Individual plans

Protector

A mortgage reducing term plan

This is the perfect plan to protect the family from the repayment liability of

outstanding loans, in the unfortunate case of death of the loanee. There is also an

option to cover the co- applicant of the loan at a very nominal cost under this plan...

Child gain

Childrens policy

Right from providing for your child's education to securing a bright future, this plan is

tailor- made to suit your child's needs...

Cash gain

Money Back Plan

This is the only money back plan that offers quadruple protection, going upto 4 times

the basic sum assured, and a family income benefit...

Swarna Vishranti

Retirement plan

In addition to life insurance and attractive tax benefits, this plan enables you to make

adequate provisions for your years after retirement as well...

Invest gain

An Endowment Plan

This savings plan combines high protection (up to quadruple cover) with a unique

family income benefit...

Term Plan With Return -Of-Premium

12

zzzzzzzzz

13

An economic way of providing life cover, this plan also ensures the return of all

premiums at the time of maturity...

Life Time Care

Whole Life Plan

This whole life plan provides survival benefits at the age of 80 thereby making sure

you are financially secure at the time when you need it the most

Keyman Insurance

A Promising Business Opportunity

Keyman Insurance provides you with the unique opportunity to protect your business

against the unfortunate loss of key people, while giving you valuable tax advantage

and a lovely tool to help employee loyalty too...

New Unit Gain Plus

The thumb rule for buying insurance is that your insurance needs are minimal in your

early earning years, increase with added responsibilities (Marriage, children, loans

etc.) and taper off by the time you retire. It is difficult to find a single insurance plan

that can take care of all your changing requirements in life additional protection,

more money to invest, sudden requirement of cash or a steady post-retirement

income...

Additional Rider Benefits For Unit Linked Product

Bajaj Allianz Additional Benefits Additional protection for you and your family

available with Unit Gain Plus ...

New Unit Gain Easy Pension Plan

Unit Linked Retirement Plan Without Life Cover

Bajaj Allianz New UnitGain Easy Pension Plus, is a plan that helps you take control

of your future and ensure a retirement you can look forward to. This is a regular

premium investment linked deferred annuity policy. Available as: New UnitGain Easy

Pension Regular Premium & New UnitGain Easy Pension Single Premium.

13

zzzzzzzzz

14

Swarna Raksha I

A fixed annuity for life will be payable, and on death of the annuitant, the nominee

will be entitled to receive an amount that is equal to the lumpsum used to purchase the

annuity.

Mahila Gain Rider

The unique plan that takes care of you and your loved ones and provides benefits like

Critical Illness Benefit

Reconstructive Surgery Benefit for Breast(s) due to Breast Cancer

Congenital Disability Benefit

Complications of Pregnancy Benefit.

Health Care

This is a three-year health insurance plan, providing comprehensive health cover with

life insurance benefit. You can choose the amount of cover for each benefit separately

in multiples of the minimum cover amount, subject to a maximum multiple of 10.

New Unit Gain Premier SP

Upfront Allocation of 105% of single premium on day 1

Flexi maturity after 6years

New Unit Gain Super

High Allocation

Guaranteed life cover

New Family Gain

The only Unitlinked insurance plan with ethical equity fund.

Suits religious investment guidelines as well.

Save Care Economy-SP

14

zzzzzzzzz

15

An ideal plan for a one-time lump sum investment that provides for savings with

high risk-cover.

An investment that provides financial security and liquidity.

An ideal plan for a one-time lump sum investment that provides for savings with high

risk-cover. This Single Premium investment plan for 10 years is also participates in

the profits of the company.

New Unit Gain Plus SP

A single premium plan with maxx allocations

Choice of 4 investment funds and 3 free switches allowed each year

Partial and Full withdrawls after 3 years

Samraksha

Single premium Term Assurance

Convenient terms of 5 & 10 years

Sum Assured options of Rs. 5000 and Rs. 10,000

Minimum & maximum entry age is 18 & 45 respectively

Surrender Value None & Maturity Value None

15

zzzzzzzzz

16

Capital Unit Gain

Big Boss of all ULIPS

Capital UnitGain is a unit linked endowment regular premium plan that is deisgned

to suit all your insurance & investment needs.

Unit Gain Guarantee SP

High Allocation

Full or partial withdrawals are allowed anytime after 3 years

New Risk Cover

"Insure your Today with us to Ensure your family Smiles Tomorrow."

A non-participating traditional Term Assurance plan.

Higher insurance coverage at Low premium.

Regular/Single Premium payment options.

Additional Benefits For Traditional Product

Redesign your life insurance coverage to suit your nedds, providing total protection.

Bajaj Allianz Care First

Guaranteed renewals upto age 65 without medicals

Finest treatment in leading hospitals

Generous hospital cover upto 7Lacs.

Same premium for 3 years.

Alp Nivesh Yojana

Life cover and Maturity benefit equal to sum assured + vested bonus

Guaranteed Surrender Value

Avail additional benefits including Accidental Death Benefit & Accidental

Permanent Total / Partial Disability Benefit

16

zzzzzzzzz

17

Bima Kavach Yojana

Return of premium on maturity

Guaranteed Surrender Value

Avail additional benefits including Accidental Death Benefit & Accidental

Permanent Total / Partial Disability Benefit

Jana Vikas Yojana

Life Cover

Maturity Benefit of 125%of the single premium payable on survival till the end of

the policy term

Guaranteed Surrender Value

Group plans

Group Credit Shield

Available for Employer - Employee Groups

and Non Employer-Employee Groups

Group Term Life

Available for Employer - Employee Groups

and Non Employer-Employee Groups

Group Term Life Scheme

in lieu of EDLI (Employees Deposit Linked

Insurance)

New Group Super Annuation Scheme

Assure your Employees a financially secured, stable and independent post retirement

life.

17

zzzzzzzzz

18

INTRODUCTION

PLANNING FOR RETIREMENT

After spending years working hard, setting up your home and raising a family,

retirement should be one of the most rewarding chapters of your life. It should be the

time to enjoy your independence. Spending time with children and grandchildren,

traveling, pursuing a hobby, embarking on a new vocation.

However, for too many people, the uncertainty of their retirement income clouds this

sunny picture. Even though you have planned ahead and saved, will it be enough to

last a lifetime? Is there some way your savings could provide a constant source of

income that would ensure peace of mind?

Today, thanks to a healthier life style and advances in medicine, the average Indian

lives longer. A person, who is 60 plus today, can hope to live at least till the age of 75.

A person who is 40 plus today can hope to live at least till the age of 80. That means

that we need to plan for at least 20 to 30 years of retired life.

NEED OF INSURANCE AFTER RETIREMENT

Retirement does not necessarily mean the end to your need for life insurance. It only

implies a change in the type of insurance plan you need.

Naturally, you'd want to ensure the continuation of the same lifestyle for you and your

spouse. However, as with any other major life stage change, you should re-evaluate

your coverage to ensure its adequacy.

If you are married, it is best for you to select a "Joint and Survivor option" annuity

which pays benefits as long as either you or your spouse is alive. However if you are

single, a "single life option" annuity is best for you. In the case of a "Single Life"

option, benefits continue for as long as the benefit recipient lives, whether the

recipient lives to age 68 or 108. Finally, if you want to leave behind something for

your beneficiaries, you could choose a "Return of Premium" option in an annuity.

18

zzzzzzzzz

19

MONEY TO BE SET ASIDE FOR RETIREMENT

You, and you, alone know how much retirement income you will need, to live

comfortably. To gain a better understanding of the need to plan ahead, you could start

by assessing all aspects of your current and anticipated financial needs.

Begin by answering the following questions:

How long do you have to save that amount before retirement?

Where can you invest your retirement money?

How much risk are you willing to take on your investments?

Do pay special attention to the first question. Many people who are currently

employed, assume the answer to that question is zero, because their retirement

money will come from the employer's pension plan. Unfortunately, this

monetary stream may not provide a sufficient retirement income.

To ensure a comfortable retired life, you would be wise to invest money into

additional avenues - like life insurance. To calculate your likely monetary

requirements during retirement, use our Retirement Calculator that will give you an

intelligent estimate.

However, as you get closer to retirement, you will need to re-evaluate your needs and

adjust accordingly to meet your goals.

ANNUITIES

An annuity gives you a fixed sum of money, at periodic intervals, for the rest of your

life. Adding a tax deferred investment, like an annuity, to your retirement plan may

help you realize your retirement dreams. Besides giving your savings the power of tax

deferred compounding (in case of deferred annuity), you are also in control of when

you begin receiving payments. They also provide a number of benefits that other

instruments don't. Some of these include:

Lifetime Income:

If outliving your savings is a concern, an Annuity could be the solution. You can

arrange to receive a steady stream of periodic payments, for the rest of your life. Only

Annuities provide the retirement income options that can protect you from outliving

your assets.

19

zzzzzzzzz

20

Competitive Interest Rates:

Annuities can offer competitive interest rates, as well as investment flexibility. With

some Annuities, you can "lock-in" a guaranteed interest rate for a specified period of

time. To maintain your purchasing power, your assets need to grow equal to or faster

than, the inflation rate. Even if inflation averages just 3% per year, your purchasing

power may be cut in half in almost 20 years.

Leverage the Power of Tax Deferral:

A Deferred Annuity allows you to accumulate money for retirement on a tax-deferred

basis. You put money in, and over time it earns interest and multiplies. Deferred refers

to the postponement of the payout - the steady payments to you start later, usually at

retirement. With deferred annuities, there are no taxes on earnings as well. Invest in

an annuity now and defer the income receipts till you retire - an effective retirement

strategy.

Guaranteed Death Benefit:

Level Term Assurance.

TAX BENEFITS

Premiums paid under this Plan will be eligible for If you were to die prematurely,

would your spouse have enough money to continue the lifestyle that he/she has

become accustomed to? Annuities offer Joint or Survivor Option, which ensures that

the same income stream continues for your spouse. Will your heirs be able to meet the

final expenses? Planning to provide for the needs of the family after your death is

essential? Annuities offer the option of a guaranteed death benefit, which passes to

your named beneficiary.

20

zzzzzzzzz

21

ANNUITY OR NOT

Annuities are widely used to augment / add to retirement incomes. However, we

recommend that you do not blindly go for them. Annuities generally work well for

people who meet the following criteria:

You are afraid you may outlive your savings

You are investing money you will not need for the next 10-15 years. That's

about the time it will take to get the maximum benefits from tax rules (The

only exception to this rule, is if you are about to retire and want to put a chunk

of money into an immediate annuity, which will provide you with fixed,

guaranteed monthly income right away.)

You have received a windfall lately: a bonus, an inheritance or any other lump

sum that you want to invest for your future.

Annuities are an ideal way to invest large sums of money received all at once

Your current tax bracket is very high and it would reduce later due to

retirement. As the Annuity's gains are tax deferred, your entire savings work

and grow for you

You are nearing retirement age and looking for a product that will pay you a

guaranteed income for life

ANNUITY MEANING

The word annuity implies periodic payments. When you buy an annuity, the company

promises to pay you a periodic sum of money, for a specified period of time.

An Immediate Annuity starts making the income payments within the first year of its

purchase.

A Deferred Annuity will start making the payments at a pre-determined future date, as

agreed between the buyer of the Policy and the company.

Immediate Annuity

An Immediate Annuity starts making the periodic income payments within the very

first year of its purchase. The annual amount received as annuity payment from ICICI

Prudential is dependent on the purchase price of the annuity and the buyer's life

expectancy. The annual amount receivable through the annuity can be varied by

21

zzzzzzzzz

22

adjusting the purchase price of the annuity. The Joint Life, Last Survivor Annuity also

returns the purchase price of the annuity to a designated nominee.

Deferred Annuity

A Deferred Annuity is one where the payout phase begins after a stipulated number of

years. Either multiple contributions or a single lump sum contribution can be made

towards it. A Deferred Annuity has two phases: the Accumulation Phase and the

Payout Phase.

Accumulation Phase:

The amount accumulates on a compounded basis, till the Buyer decides to take

income from it. If the Buyer dies, a regular income stream is automatically provided

to the beneficiaries.

Payout Phase:

This begins when the Buyer starts making periodical withdrawals from the

accumulated sum. The Buyer may make partial withdrawals or convert the entire

accumulated sum to a stream of income payments

ANNUITY PAYOUT OPTIONS

An Annuity can pay out incomes in monthly, quarterly, semi-annual or annual

installments. You can design your Annuity to receive income of a specified amount

over a specified period of time.

The following income options are widely used -

Return of Purchase Price - Income payments are guaranteed for the life of the

Annuitant. On the demise of the Annuitant, the Beneficiary receives the original

purchase price as a lump sum.

Annuity certain for chosen period and Life Annuity thereafter - Income

payments are guaranteed for a specific number of years (5, 10 or 15 years).

Additionally, the payments continue beyond the "period certain" for as long as the

Annuitant lives.

22

zzzzzzzzz

23

Joint Life Last Survivor - This option is based on the lives of two people. The

income payments continue till the demise of both the Annuitants.

The plan can be structured so that

On the demise of one of the Annuitants, the payments continue for the same

amount or for a lesser amount.

On the demise of both the Annuitants, the original purchase price is given to

the Beneficiary as a lump sum.

THE IMPACT OF INFLATION ON YOUR RETIREMENT

SAVINGS

A hundred rupees today doesn't buy what it used to ten years back. How much less

will your money be worth when you are ready to cash out at retirement? One widely

used measurement for projecting inflation rates is the Consumer Price Index (CPI).

The CPI is the representative cost of a "basket of goods". The actual price of the

basket of goods is not that important. What is critical is the amount of change,

specifically the 12 month change, stated as a percentage. This percentage change is

known as the rate of inflation.

Determining Your Future Buying Power

To plan an adequate income stream for your retirement, we should apply the expected

annual CPI to your planned annuity income. This will determine just how much

buying power your retirement income will have. The procedure is as follows:

First, estimate how much annual income you will need to live the lifestyle you want,

in today's currency.

Second, multiply this amount by one plus the annual rate of inflation. For example, if

you think you will need Rs. 200,000 a year and the expected annual rate of inflation is

5%:

Rs.200, 000 x (1 + 0.05) = 210,000

You will actually need Rs.210, 000 to cover your expenses after a year - inclusive of

the cost of rising inflation.

23

zzzzzzzzz

24

Repeat the calculation, using your new total, for every year you plan to wait before

drawing on your savings at retirement. The results may surprise you. For example, the

effects of 10 years of inflation means you will need Rs. 255,256 (approx) to meet

those same expenses!

Thus, you need to consider the effect of inflation on your expected annuity income

when planning for retirement.

RETIREMENT PLANS

Most of you picture yourselves enjoying the fruits of labor after retirement, going on

your dream vacation, or helping your children's career take wing. But do you realize

that financing all this will most likely depend partly on your personal savings?

Because personal savings and investments represent a significant source of retirement

income for many people, you can never save too much.

Currently, you are at a stage where you are juggling many roles, as nurturing parents,

dutiful caregivers to elders, supportive life partners, while trying to maintain a career.

It is too easy to get carried away handling and solving the day-to-day problems to not

look into your retirement needs. It may also seem too far away to be of concern. But a

look at the issues below will make the need for some strategic planning at this stage

amply clear.

Today, thanks to a healthier lifestyle and advances in medicine, the average Indian

lives longer. This makes the challenge of accumulating enough money for retirement

even more difficult, since it may have to last longer. Also, with the falling interest rate

scenario and the rising costs of medical expenses retirement mean monetary

uncertainty for most of us. More so, because there is also the ever-persistent evil of

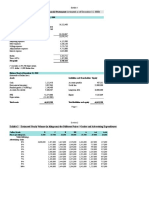

inflation, which erodes your purchasing power. The graph below illustrates how much

Rupees will 10,000/- amount to after some years:

Therefore, the message is simple - no matter whether you are 30 or 50, you should

start planning early to have a healthy retirement kitty.

As can be seen the cost of delaying is high. Situation A is when you are saving Rs

10000 annually from the age of 25 to 34 years and Situation B is when you save the

same annual amount from the age of 35 to 59 years. As can be seen in the example,

even after investing your money for a 2.5 times longer duration, the maturity value in

24

zzzzzzzzz

25

the second case is much lesser (the figures are based on a hypothetical interest rate of

10%). The longer your money is allowed to grow at a compounded rate, the more

dramatic will the difference be eventually.

Therefore, the message is simple - Put Time On Your Side and Start Early.

1

2

3

4

5

6

7

W/out Sec80CCC (1) Benefit

With Sec80CCC (1) Benefit

Details

Amount

Details

Amount

Income

300000

Income

300000

Tax Deductible Exp.

100000 Tax Deductible Exp.

110000

Taxable Income (1-2)

200000 Taxable Income (1-2)

190000

Taxes Payable

35700

Taxes Payable

32550

Investment in Sec88

20000 Investment in Sec88

20000

Tax Rebate u/s 88

4000

Tax Rebate u/s 88

4000

Net Taxes (4-6)

31700

Net Taxes (4-6)

28550

Assumption of an investment of RS10,000 u/s 80CCC(1)

As the chart indicates, the powerful combination of compound interest plus tax

deferred earnings, plus no tax on maturity proceeds, can be one of your strongest

allies, when it comes to accumulating wealth, for your retirement or other long term

financial goals.

25

zzzzzzzzz

26

POWER TO PLAN YOUR RETIREMENT, THE WAY

YOU WANT

YOUR OBJECTIVE OF RETIREMENT PLANNING:

Maximize the value of your investments to get more pensions, when you

retire.

Beat the effect of inflation over the long-term, enjoy real appreciation.

Value

of your

invest

ments

that

give

you

pensio

n

This is where you are now- invest

for your retirement kitty

Your

Objectiv

eMaximiz

e this

value

This is where you want to bePeaceful Retirement Years.

This is when you retire

Linked Pensions provide you the power to invest the way you want- so you have the

opportunity to maximize your returns.

26

zzzzzzzzz

27

Options to maximize your

returns

Why the

Market-Linked

Pension Plan is a better way

to accumulate?

Sustained

regular

investments over a long

period

of

investments,

because of the Rupee-Cost

Averaging Effect.*

Long-Term

Appreciatio

n of your

investment

Combination of

Cap.

Appreciation

with steady

returns

Reasonable

and steady

returns

OTHER INVESTMENT FLEXIBILITIES

Flexibility to Top-Up on your investments just at a cost of 1%Power in your hands to direct your windfall/Lump sum gains anytime for growing your

retirement kitty.

Flexibility to Switch Between your Investments OptionsBased on your changing Life stage, your investment priorities change. We have made

a flexibility to felicitate this change for you, so that you can change from one option

of investment to other depending on your needs.

27

zzzzzzzzz

28

POWER TO CHOOSE PROTECTION ON YOU LIFE

AND HEALTH, THE WAY YOU WANT TO

Options to plan for your

Retirement

Pure

Accumulation

purpose- No

LifeCover and

Health Riders

ZERO DEATH

BENEFIT OPTION

Protection with

Accumulation

Purpose- With

LifeCover and

Health Riders

DEATH BENEFIT

WITH RIDERS

28

zzzzzzzzz

29

POWER TO START YOUR PENSION, WHENEVER YOU

WANT TO.

What if you do not want your pension to start as opted by you originally?

-

You may find that you want to work for some more years.

You may want to accumulate in your pension for some more time.

And, above all you may want to start your pension whenever you wish, any

day, any month.

We understand your needs and hence we have the flexibility in our products that give

you the power to start your pension whenever you wish to.

You may wish to postpone it because:

You want to accumulate for some more time.

You may work for some more years.

You may wish to take any benefits from the market

movements.

Your

Original

Vesting Date

You have the flexibility of postpone the original date

and start you pension whenever you

wish

29

zzzzzzzzz

30

POWER TO GET YOUR PENSION, THE WAY YOU WANT TO

If you think how you would receive your pension, we have so many options for you,

just to fit in your requirements. We give you options such as to provide you with best

of the solutions for your retirement.

Options for Receiving

Pension

Annuity for whole of your

life.

Annuity for whole of your

life with the return of the

purchase price to the

nominee.

Annuity guaranteed for

5/10/15 years with

continuation after that till

you survive.

Annuity for you and your

spouse for the whole of life

with the return of purchase

price to the nominee.

30

zzzzzzzzz

31

INCREASING LIFE EXPECTANCY

Population in India is expected to increase by 49% between 1991(Census) and 2016;

the number of elderly people would increase by 107%. An amazing 113Mn by 2016,

which would increase to a staggering 179Mn by 2026. You may be one of them!!

A 60 year old person toady would on an average live till 75 years. 20 years from now

a person aged 60 would live till 80 years. Wouldnt we be facing the same long

retirement? Was the situation same with our grandfathers?? Perhaps not!

The yesteryears!!

Retirement Years

What is looks like today??

LESSER NUMBER OF PRODUCTIVE YEARS

How do we take care of these long years, if we do not plan from today??

31

zzzzzzzzz

32

RISING INFLATION

Wouldnt you have ridiculed on somebody who ten years age would have said Potatoes ten

years from now would cost Rs10 /kg? Today you may look back and say how correct he was!!

Look at these

10 years ago Today

1 Kg of Potato

Rs 1.50

1 Ltr. Of Petrol Rs17.00

1 Mum-Dli Train Ticket

Rs350.00

% Increase

Rs 8.00 533%

Rs31.00 182%

Rs1750.00500%

Do you spend more while at Work or

Have you provided for your retirement,

tiring Work life??

Expected Cost after 10

years

Rs43

Rs57.00

Rs8750.00

May

Look

ridiculo

us

when at Vacation- Certainly on Vacation!!

same

as that

which is nothing but your vacation after

your

person

10

years

ago

ENOUGH SAVINGS TO TAKE CARE OF THE INCREASING COSTS DURING

YOUR VACATION

I wish I had catalysts in my body that would have prepared medicines for me

whenever I wanted. (Medical Costs)

Which are the most common diseases that hit people in the old age- Arthritis, Asthma,

and Diabetes? A look at the expected cost for these, when you retire would make you

think twice.

32

zzzzzzzzz

Disease

33

No. of visits to Cost in 1992

Cost in 2002

Projected Cost

doctor

per (Rs)

(Rs)

in 2012#

Spondylitis

month cost

Once in

3 2500

8000

(Rs)

25600

Arthritis

months

Once in

2 250

850

2890

Asthma

months

Month cost45 175

600

2060

Diabetes

days

Once

750

2500

in

a 225

month

ADVANCED MEDICAL SCIENCE HAS BECOME VERY

EXPENSIVE

A simple blood test today costs anything between Rs75-Rs100. X-Ray ranges to even

more, something like Rs200-Rs300. These basic costs may quadruple in the next 20

years and would be far more expensive when you require them even more, at your old

age.

Research reveals that medical expenses are 40% of the expenses in old age, with these

increasing prices, do you have enough provision to take care of your health properly

at old age.

As if Inflation was not enough: Finally, from 2005 onwards, the government proposes

to decontrol the pricing of drugs under the deregulation of the price control regime.

Costs, which were controlled till now, will skyrocket.

In case we do not have the provision, certainly we have to wish for

the catalysts.

33

zzzzzzzzz

34

DELAY YOUR SAVINGS AND THE COST THAT YOU WOULD INCUR IS

UNIMAGINABLE(THE MAGIC OF COMPOUNDING)

If You Invest Early

If you invest late

Rs 6,78,803

Rs 11, 32,832

Rs 3,00,000

In

ve

st

m

en

ts

R

eti

re

m

en

t

Sa

vi

ng

s

When you invest Rs10, 000

annually

for

30

year

period( from age 31 to 60

years),

the

magic

of

compounding

lets

your

money grow to a larger

amount

Early investments make

smarter gains

Rs 3,00,000

The

Choice

is all

yoursBe

Smart in

your

Plannin

g or pay

the high

cost of

delay.

R

eti

re

m

en

t

Sa

vi

ng

s

When you invest Rs25,000

annually Infor a 15 year

ve

period(from

46-60),

the

st receive is far

value you

m

lower.

en

Cost of delaying

is high!!

ts

RETIREMENT PLANNING

INCREASING LIFE EXPECTANCY

SOME FACTS:

34

zzzzzzzzz

35

Populations worldwide are ageing. In India, while the total population is

expected to rise by 49% between 1991(Census) and 2016, the number of

elderly person is expected to increase by 107%, to nearly 113 Mn. In other

words, the share of the aged in the population would be 9%. It would still rise

further and would stand at 179 Mn by 2026- or 13.3% of the population.

Demographics suggest that while today in India, Males and females of 60

years of age are going to live till 75 years, a person who is 40 as of today and

would be 60 by 2022 would live for 20 years, post attaining the age of 60

years.

What these facts reflect is that with the increasing time, their old age would increase.

Not only the number of old age people would increase but also the number of years

they spend in.

The other important factor is that the number of working years is constantly reducing,

with the increased competition and the urbanization in the country.

In such a scenario, the situation looks like as this:

35

zzzzzzzzz

36

YESTERYEARS

Retirement Years

Working Years

What it looks like today?

Retirement Years

Working Years

We are increasingly getting left with lesser number of productive years to take care of a longer

and longer retirement years.

PROTECTION OF LIFESTYLES

How the Cost of Living has been increasing?

Ten years Ago

1 Kg of Potato

Rs 1.50

1 Litre of Petrol

Rs 17

1 Cinema Ticket

Rs 20

1 Mumbai-Delhi Train Rs350

Today

Rs 8. 00

Rs 31

Rs 80

Rs1750

% increase

533%

182%

400%

500%

Ticket

Looking at the above list of items which would be the one that you would not use

after you have retired. Perhaps you would use all of them. If these keep on growing at

the same rate, a 10 year hence scenario would look like this.

1 Kg of Potato

Today

Rs 8. 00

% increase

10 year hence

533%

43

36

zzzzzzzzz

1 Litre of Petrol

1 Cinema Ticket

1 Mumbai-Delhi

37

Rs 31

Rs 80

Rs1750

182%

400%

500%

57

320

8750

What we have not considered here is the medical cost, which is a major expense in the

post-retirement phase.

Isnt it frightening to imagine what would be the cost of the above items 20 years

from now??

Now, ask a person- when would he spend more money on a vacation or while at

work. More often that not you would get an answer VACATION. What is

retirement- it is this vacation after a long stint of working years. In this period one

would like to maintain the present level of lifestyle, if not better.

37

zzzzzzzzz

38

EXAMPLE OF AN AVERAGE FAMILY SPENDS OF AN INDIVIDUAL

TODAY

Household Expenses: Rs6, 000 per month.

Expenses on Children: Rs3, 000 per month.

Medical Expenses: Rs5, 00 per month.

Assuming this individual would work for the next 20 years and then retire and also

assuming that the household expenses would reduce to 60% of the present level

(because the children would be independent), the cost comparisons would like as

follows:

Expenses

Present

After 20 years*

Household

6000

9552

Children

Medical Expense

Total

3000

500

9500

0

1526

11078

Even with the household expenses reduced by 40% and no expenses on the children

post-retirement, the cost of living will increase by 15%.

Therefore it is important that we provide enough to take care of these increasing

expenses.

The costs have been worked out assuming an increase in the medical costs by

15% and an overall cost inflation of 5%

38

zzzzzzzzz

39

The Compounding Effect of Money

How many times one thinks of retirement planning at an early stage in the life. The attitude

generally exhibited is I AM TOO YOUNG TO PLAN FOR RETIREMENT.

Example, assuming a retirement age of 55 years and the amount of money required

then, to take care of the retirement is Rs10, 00, 000. Now let us see what would be the

effect of planning your retirement from the age of 25, 30 and 35 years.

One would require to invest nearly Rs 24, 000 per annum to get the same amount at

retirement, if he starts the planning at 35 years as compared to Rs 10, 600 if he

chooses to start the planning at age of 25 years of age.

A successful planning would be when we spread our responsibilities over a longer

period of time to make it less cumbersome rather than making it short and difficult.

Protection for Spouse/ Dependents

While doing a research of the needs of the people in the various life stages, one thing

that was strongly opined by people in the age group of 45 years and more was the

financial independence of them and their spouses during their retirement period.

With the breaking up of the traditional family system in the present era and people

living in nuclear families, the worry for the provision for the old age is a specific

concern.

It is important that you provide for the financial independence of you and your spouse

post your retirement

39

zzzzzzzzz

40

OBJECTIVES OF THE RESEARCH STUDY

The purpose of the project in the first place was to study the various pension

plans provided by the different insurance companies. Further to study and

compare the plans and bring out differences. Also to make a ready-reckoner of

the same for the advisors and unit managers.

The main objectives of the research study were as follows

To gain an insight into the entire gamut of the pension market.

This comparative study would help in assessing the product features of

other pension providers and their strategy towards creating customers

for the product

This study would also helped in knowing the potential market for the product

and also how to have a competitive edge over the other players in the market by

stressing on to the key areas of the product.

METHODOLOGY ADOPTED

The first step was to study all the insurance products being offered by BAJAJ

ALLIANZ LIFE INSURANCE CO. LTD.

Then data of other pension players was collected by personally visiting them and

then probing their pension plans.

The next step was to draw results from the analysis of the information collected

regarding the features of the product in the market.

A comparison was then made between the features of the product in the market

and that offered by BAJAJ ALLIANZ LIFE INSURANCE CO. LTD.

After finding out the investors details, this data was then tabulated, analyzed and

deductions were then made so as to know the investors psyche and the products

and features which a investor looks for in a product.

40

zzzzzzzzz

41

RESEARCH DESIGN

A research design is the arrangement of conditions for collection and analysis of

data in a manner that aims to combine relevance to the research purpose with

economy in procedure. The research design id the conceptual structure within

which research is conducted; it constitutes the blue print for the collection,

measurement and analysis of data.

Types of Research Design

1. Exploratory Research Design- Also called formulative research study; the main

purpose of such studies is that of formulating a problem for more precise

investigation or of developing the working hypotheses from an operational point

of view.

2. Descriptive and diagnostic Research Design- Descriptive research studies are

those studies which are concerned with describing the characteristics of a

particular individual, or of a group, whereas diagnostic research studies determine

the frequency with which something occurs or its association with something else.

3. Hypothesis-testing Research Design- These studies are those where the

researcher tests the hypotheses of causal relationships between variables.

In my study, I have used Exploratory Research Design.

SAMPLING

Sampling may be defined as the selection of some part of an aggregate or totality

on the basis of which a judgment or inference about the aggregate or totality is

made.. In other words, it is the process of obtaining information about an entire

population by examining only a part of it.

41

zzzzzzzzz

42

Types of Sampling

1. Probability Sampling: - Also known as random sampling or chance

sampling. Under this sampling design, every item of the universe has an

equal chance of inclusion in the sample.

2. Non-Probability Sampling: - It is that sampling procedure which does

not afford any basis for estimating the probability that each item in the

population has of being included in the sample.

In my study, I have taken a sample size of 250 and 50 respectively for my two

surveys.

DATA ANALYSIS

Data is mainly of two types:

1. Primary data: - are those, which are collected a fresh and for the first time,

and thus happen to be original in character.

2. Secondary Data: - are those which, have already been collected by

someone else and which have already been passed through statistical

process.

In my study, data has been collected through questionnaires hence it is primary

data.

42

zzzzzzzzz

43

QUESTIONNAIRE FOR INSURANCE SURVEY

NameAddressPhone no.-

Age-

Occupation-

Q.1- Do u know that govt. of india has privatized life insurance industry?

(a)yes

(b)no

Q.2- How many life insurance companies are in india?

(a)17

(b)12

(c) 10

(d)can,t say

Q.3- Do u know abt. BAJAJ ALLIANZ?

(a)yes

(b)no

Q.4- How do u know abt the BAJAJ ALLIANZ ?

(a)through media advertisements

(b)through representative of BAJAJ ALLIANZ

(c)through articles

(d)other channels

Q.5- Which company has the punch line

(a) max new york life insurance

(b)birla sunlife

(c) icici pru

(d)BAJAJ ALLLIANZ

Q.6- Have u taken any life insurance cover for urself or for ur family?

(a)yes

(b)no

Q.7- The no. of policies u have at this time

(a) 1-5

(b)5-10

(c) more than that

Q.8-What is the importance of insurance in your life?

(a) safety

(b)investment

(c)tax saving

(d)others

43

zzzzzzzzz

44

Q.9- How do u rate BAJAJ ALLIANZ vis--vis services offered?

(a) excellent

(b)good

(c)average

(d)poor

Q.10-Do u think BAJAJ ALLIANZ needs more publicity in life insurance sector?

(a)yes

(b)no

Q.11- Which media according to you would put more impact on you?

(a)television

(b)radio

(c)newspaper

(d)BAJAJ ALLIANZ representative

Q.12- Would u like to know more about any products and services of BAJAJ

ALLIANZ?

(a)yes

(b)no

Q.13- Do u know about the CAPITAL UNIT GAIN PLAN ( CUG) of BAJAJ

ALLIANZ?

(a) yes

(b)no

44

zzzzzzzzz

45

DATA ANALYSIS

INSURANCE COAMPANIES

In all there was 10 insurance companies' pension plans were studied,

including BAJAJ ALLIANZ LIFE INSURANCE CO. LTD.

COLLECTION OF DATA

S. No.

INSURANCE COMPANY

1.

BAJAJ ALLIANZ LIFE INSURANCE

2.

ICICI PRUDENTIAL LIFE INSURANCE

3.

HDFC STANDARD LIFE INSURANCE

4.

OM KATAK MAHINDRA LIFE INSURANCE

5.

MAX NEW YORK LIFE INSURANCE

6.

ING VYSYA LIFE INSURANCE

7.

TATA AIG LIFE INSURANCE

8.

LIFE INSURANCE CORPORATION

9.

STATE BANK OF INDIA - LIFE (SBI LIFE)

10.

AVIVA LIFE INSURANCE

45

zzzzzzzzz

46

APPENDICES

PENSION PLANS

BAJAJ ALLIANZ LIFE INSURANCE

BAJAJ ALLIANZ represents pension plans that combine the best of investment

and insurance.

NEW UNIT GAIN EASY PENSION PLAN RP

IN THIS POLICY, THE INVESTMENT RISK IN INVESTMENT PORTFOLIO IS

BORNE BY THE POLICYHOLDER.

Bajaj Allianz New UnitGain Easy Pension Plus RP Plan

With Bajaj Allianz New UnitGain Easy Pension Plus RP you can take control of your

future and ensure a retirement you can look forward to.

Early retirement from work is every ones dream; you want your saving and

investment to grow fast so you dont have to work for money anymore and enjoy

every moment of being with your loved ones.

The New UnitGain Easy Pension Plus RP is a retirement plan that helps you retire

with laughter lines. This unitlinked pension plan gives you the advantage of investing

in securities making your savings grow faster so you can retire earlier.

What are the benefits available?

The plan works in two parts the deferment period and the annuity period. During the

deferment period, the plan builds up the funds. The deferment period ends at the

46

zzzzzzzzz

47

vesting date. You are free to choose your age of retirement (vesting date) between 45

and 70 years. After the vesting date, the annuity payments begin.

The benefits on Vesting Date (the date you choose to retire)

The Fund Value as on the vesting date will be used to purchase an immediate

annuity, at rates prevailing at that point of time.

Option to take lump sum: You have the option to take up to 1/3rd of the Fund

Value as a lump sum. This amount would be tax free in your hand, as per current

tax laws. The balance amount will be used to purchase an immediate annuity.

Open Market Option: You have the option to purchase an immediate annuity

from Bajaj Allianz or from any other life insurer as recognised by IRDA. If the

immediate annuity is purchased from Bajaj Allianz, the amount available for

purchase of the annuity will be marked up by 2%.

Assurance for your family

In the unfortunate event of death during the deferment period, your spouse will have

the option to take the Fund Value as a lump sum or purchase an annuity to get regular

income for life. For the immediate annuity, your spouse will have the Open Market

Option as well. The immediate annuity from Bajaj Allianz will be available only if the

spouse is above 45. If age were below 45, the Fund Value would be paid out.

Annuity options:

Allianz Life insurance at the vesting date. The annuity products currently available

are:

annuity for life

Annuity for life with 5 , 10, 15 or 20years certain payout

Annuity for Life with Return of Capital

Annuity for Life with joint life last survivor option

You also have the open market option to purchase immediate annuity.

The minimum instalment of annuity from Bajaj Allianz is Rs. 1000/-. The annuity

frequency may be changed to make each instalment more than the minimum

requirement. If it still below the minimum, the Fund Value may be paid in a lump

sum, if permissible, subject to applicable tax laws.

47

zzzzzzzzz

48

Full Withdrawals

Full withdrawal/Surrender is allowed (subject to Surrender Charge, if any) anytime

after 3 years from commencement

Important Details of the Bajaj Allianz New UnitGain Easy Pension

Plus RP Plan

Age at Entry

Defement Period

Age at Vesting

Minimum

18 yrs

5 yrs

45 yrs

Minimum Premium

Rs.10000 for yearly, Rs.5000 for halfyearly,

Maximum

65 yrs

40 yrs

70yrs

Rs.2500 for quarterly, and Rs.1000 for

monthly

Tax Benefits

Premiums paid will be eligible for tax deduction under Section 80C of the Income Tax

Act.

Charges under this plan

Policy Administration Charges will be Rs.50 per month per policy (charged

monthly through cancellation of units) escalating at 5% per annum.

Fund Management Charge will be 1.75% p.a. of NAV for Equity Growth Pension

Fund and Accelerator Mid-Cap Pension Fund, 1.25% p.a. of the NAV for Equity

Index Pension Fund II, 0.95% p.a. of the NAV for Bond Pension Fund and 0.95%

p.a. of NAV for Liquid Pension Fund.

Switching Charges: Three free switches would be allowed every year. Subsequent

switches would be charged @ 5% of switch amount or Rs. 100, whichever is

lower.

Allocation: A portion of the premium paid will be charged towards expenses in the

initial years. Accordingly, the allocation to your fund will be will be as follows-

Annual premium size Premium payment due in Premium payment due in

48

zzzzzzzzz

49

10,000-24,999

25,000-49,999

50,000- 99,999

100,000-499,999

500,000 and above

Policy Year 1

84%

86%

88%

90%

92%

Policy Year 2

98%

98%

98%

98%

98%

Surrender Charge If first three years regular premiums are not paid and the

policy is lapsed, the Surrender Charge on regular premium unit value would be

100% of the first years annualised Allocated Premium.

If first three years regular premiums have been paid in full, the scale of

Surrender Charge applicable on regular premium unit value would be as follows:

The

after

Policy year

4

5

6 and above

Surrender Charge

5%

2%

No Charge

Surrender Value would be payable

three policy years. Further, if first

three years regular premiums have not been paid and the policy is lapsed, the

Surrender Value, if any, would be payable at the expiry of the revival period or three

policy years, whichever is later.

No surrender charge will be applied in case of complete surrender of units in respect

of Top Up Premium.

Miscellaneous Charge: The miscellaneous charge would be charged at the rate of

Rs.100/- per transaction in respect of reinstatement, alteration of premium mode,

increase in regular premium or issuance of copy of policy document.

Revision of charges

After taking due approval from the Insurance Regulatory and Development Authority,

the Company reserves the right to change the following charges:

Fund Management Charge up to a maximum of 2.75% p.a. of the NAV for the

Equity Growth Pension Fund and Accelerator Mid-Cap Pension Fund, 2.25% p.a.

49

zzzzzzzzz

50

for the Equity Index Pension Fund II and 1.75% p.a. for the Bond Pension Fund

and Liquid Pension Fund.

Switching charge upto a maximum of Rs.200 per switch or 5% of the switching

amount, whichever is lower.

Miscellaneous charge upto a maximum of Rs.200/- per transaction

If the Proposer/Life Assured does not agree with the charges, he/she will be

allowed to exit the plan at the prevailing price of units.

NEW UNIT GAIN EASY PENSION PLAN SP

IN THIS POLICY, THE INVESTMENT RISK IN INVESTMENT PORTFOLIO

IS BORNE BY THE POLICYHOLDER

Bajaj Allianz New UnitGain Easy Pension Plus SP Plan

With Bajaj Allianz New UnitGain Easy Pension Plus SP you can take control of your

future and ensure a retirement you can look forward to. This is a Single Premium

units existing at the valuation date (before any units are redeemed) , gives the unit

linked deferred annuity plan, which will help you plan for your retirement and ensure

price of the fund under consideration. This is applicable when the company is

required Flexibility to manage your investments to sell assets to redeem units at the

valuation date that your investment grows well.

You have been working hard. youre going to retire one day. How do you see your

retirement? Traveling? Golfing? Turning a hobby in to a second career or volunteering

for a noble causeor simply spending more time with your family. Post retirement, how

you choose to spend your time is now up to you. Its also upto you to ensure your

retirement income lasts as long as u do. The decisions u make about your money

today should be flexible enough to accomdate your changing needs. Taking charge of

your retirement begins with Bajaj Allianz New Unit Gain Pension Plus SP, a plan that

ensures that your years ahead are golden years.

KEY FEATURES OF THIS PLAN ARE

Single premium plan

50

zzzzzzzzz

51

Unlimited top-ups

Choice of 5 investment funds

Mortality charges are nil, enabling you to maximize your investment returns

What are the benefits available?

The plan works in two parts the deferment period and the annuity period. During the

deferment period, the plan builds up the funds. The deferment period ends at the

vesting date. You are free to choose your age of retirement (vesting date) between 45

and 70 years. .. After the vesting date, the annuity payments begin.

Benefits on Vesting Date (the date you choose to retire)

The Fund Value as on the vesting date will be used to purchase an immediate

annuity, at rates prevailing at that point of time

Option to take lump sum: You have the option to take upto 1/3rd of the Fund

Value as a lump sum. This amount would be tax free in your hand, as per current

tax laws. The balance amount will be used to purchase an immediate annuity.

Open Market Option: You have the option to purchase an immediate annuity from

Bajaj Allianz or from any other life insurer as recognised by IRDA. If the

immediate annuity is purchased from Bajaj Allianz, the amount available for

purchase of the annuity will be marked up by 2%.

Assurance for your family

In the unfortunate event of death during the deferment period, your spouse will have

the option to take the Fund Value as a lump sum or purchase an annuity to get regular

income for life. For the immediate annuity, your spouse will have the Open Market

Option as well. The immediate annuity from Bajaj Allianz will beavailable only if the

spouse is above 45. If age were below 45, the Fund Value would be paid out.

51

zzzzzzzzz

52

Full Withdrawals

Full withdrawal/Surrender of Fund Value, net of Surrender Charge, if any, is allowed

anytime after 3 years from commencement.

Annuity options

You will be able to choose from all immediate annuity products offered by Bajaj

Allianz Life insurance at the vesting date. The annuity products currently available

are:

Annuity for Life

Annuity for Life with 5, 10, 15 or 20 years certain payout

Annuity for Life with Return of Capital

Annuity for life with Joint Life Last Survivor Option

You also have the open market option to purchase immediate annuity.

The minimum instalment of annuity from Bajaj Allianz is Rs. 1000/-. The annuity

frequency may be changed to make each instalment more than the minimum

requirement. If it still below the minimum, the Fund Value may be paid in a lump

sum, if permissible, subject to applicable tax laws.

IMPORTANT DETAILS OF THE BAJAJ ALLIANZ NEW UNIT GAIN EASY

PENSION PLAN SP PLAN

Minimum

Maximium

Age at Entry

18 yrs

65yrs

Defement Period

5yrs

40 yrs

Age at Vesting

45 yrs

70yrs

Single Premium

Rs. 50000

No limit

52

zzzzzzzzz

53

Top Up Premium

Rs. 5000

No limit

Tax Benefits

Contributions made will be eligible for tax deduction under Section 80C of the

Income Tax Act.

Charges Under the Plan

Policy Administration charges will be Rs.50 per month per policy (charged monthly

through cancellation of units) escalating at 5% per annum. The Company reserves the

right to change the Policy Administration Charge at any time with prior approval from

the IRDA.

Fund Management charge will be 1.75% p.a. of the NAV for Equity Growth

Pension and Accelerator Mid-Cap Pension Fund, 1.25% p.a. of the NAV for Equity

IndexPension Fund II, 0.95% p.a. of the NAV for Bond Pension Fund and 0.95% p.a.

of NAV for Liquid Pension Fund.

Switching Charges: Three free switches would be allowed every year. Subsequent

switches would be charged @ 5% of switch amount or Rs. 100, whichever is lower.

Allocation: A portion of the premium paid will be charged towards expenses.

Accordingly, the allocation of single premium and top ups would be 98%.

Miscellaneous Charge: The miscellaneous charge would be charged at the rate of

Rs.100/- per transaction in respect of issuance of copy of policy document.

Revision of charges

After taking due approval from the Insurance Regulatory and Development Authority,

the Company reserves the right to change the following charges:

Fund Management Charge up to a maximum of 2.75% p.a. of the NAV for Equity

Growth Pension Fund and Accelerator Mid-Cap Pension Fund, 2.25% p.a. for

53

zzzzzzzzz

54

Equity Index Pension Fund II and 1.75% p.a. for Bond Pension Fund and Liquid

Pension Fund.

Switching charge upto a maximum of Rs.200 per switch or 5% of the switching

amount, whichever is lower.

Miscellaneous charge upto a maximum of Rs.200/- per transaction.

If the Proposer/Life Assured does not agree with the charges, he/she will be

allowed to exit the plan at the prevailing price of units.

54

zzzzzzzzz

55

ICICI PRUDENTIAL LIFE INSURANCE

Lifetime Pension: A regular premium linked deferred pension plan that gives you

the freedom to choose the amount of premium, and invest in market-linked funds, to

generate potentially higher returns.

Secure Plus Pension: A regular premium deferred pension plan that gives you the

flexibility to choose between 3 levels of sum assured for the same level of total annual

contribution.

Life Link Pension: A single premium linked deferred pension plan that gives you

the freedom to choose the amount of premium, and invest in market-linked funds, to

generate potentially higher returns.

Forever Life: A regular premium deferred pension plan that helps you save for your

retirement while providing you with life insurance protection.

LIFETIME PENSION

DEFERRED PENSION PLAN

A Linked Deferred Plan gives you the freedom to choose the amount of premium, and

invest in market-linked funds, to generate potentially higher returns. A part of the

premium paid is used to pay for the death benefit (if any) opted for by you and the rest

would be invested in the plan of your choice. On the retirement date, the accumulated

value of the units will be used to purchase an annuity - to provide you with regular

income for life.

55

zzzzzzzzz

56

LIFE COVER BENEFIT

In the unfortunate event of your death before retirement, your spouse has the option of

receiving either the death benefit or the value of units as a lumpsum (whichever is

higher), or get an annuity that would provide regular income for life.

VESTING AGE

You can choose a vesting date once you are 50 years of age. However, you have the

option of postponing this vesting date till the age of 70 years. With this, you can take

advantage of market movements.

TOP-UPS

Use your surplus funds to top-up your investment (minimum Rs 10,000) during the

deferment period.

LIFE COVER

You choose the amount of life cover you require. You can also opt for a Zero Death

Benefit. The amount, which you pay for the Death Benefit, depends on your chosen

protection level.

LIFE COVER - INCREASE/DECREASE

In case you opt for a Death Benefit, you have the option of increasing or decreasing

the cover during the deferment period.

CHOOSING INVESTMENT PLAN

You can choose between the Maximize (Growth), Protector (Income) or Balancer

(Balanced) plans. You also have the power to switch between the plans, to suit your

investment priorities. You are entitled to one free switch every year during the

deferment period.

56

zzzzzzzzz

57

ELIGIBILITY

You should be between 18 and 60 years of age.

MINIMUM PREMIUM

The minimum annual premium is Rs.10,000; half-yearly premium is Rs. 5,000 and

monthly premium is Rs.834.

TERM

Minimum term is 10 years.

SURRENDER

This plan acquires a surrender value after full premiums for 3 policy years are paid. In

case of complete withdrawal, a surrender value equivalent to the value of the units is

paid.

INITIAL CHARGES

The initial administrative charges in the 1st year would be 20% of the premium, for

premium amounts less than Rs.50,000. For premiums equal to or greater than

Rs.50,000, the charges would be 18% of the premium. In case the Zero Death Benefit

has been opted for, the charges would be 18% and 15% for the same premium bands.

However, in all cases, charges wouldbe 7.5% in the 2nd year and 4% from 3rd year

onwards.

57

zzzzzzzzz

58

ADMINISTRATIVE CHARGES

Other charges would include annual administrative charges of 1.25% per annum of

net assets for Protector (Income) and 1.25% per annum for Maximizer (Growth) and

Balancer (Balanced) options. An annual investment charge of 0.25% per annum of net

assets for Protector and 1% for Maximizer (Growth) and Balancer (Balanced) would

also be charged.

ANNUITY PAYMENT MODE

Your accumulated value would start paying you regular income in the form of an

annuity, at a frequency chosen by you. This income can be received monthly,

quarterly, half-yearly or annually.

SECUREPLUS PENSION

DEFERRED PENSION PLAN

Secure Plus Pension - a flexible regular premium deferred pension plan.

CHOOSE - PROTECTION LEVELS

Secure plus Pension provides you with three levels of sum assured, for the same

amount of total annual contribution. You have the option of choosing between Basic,

Standard and Enhanced levels of cover.

How to calculate your cover as per the term you

have chosen

(Term - 5) x Premium

= Basic cover

(Term) x Premium

= Standard cover

(Term + 5) x Premium

= Enhanced cover

58

zzzzzzzzz

59

ZERO DEATH BENEFIT OPTION

Pension from Secure plus Pension gives you the opportunity to shift from one level of

cover to another as per your changing requirement. Once you have decided to avail of

the Zero Death Benefit option, you do not get the option to alter your cover again. In

the unfortunate event of death, your spouse is protected by a lump sum amount, which

is the sum assured plus the value accumulated in your policy. Additionally, your

spouse can exercise the option to draw an amount.

COMMUTATION

The total accumulated value of the policy, including the declared bonuses, would be

used as a purchase price to give you a pension of your choice. You have the option of

taking up to 33.33% of the accumulated value as a lumpsum and begin a pension from

the rest of the amount.

ACCUMULATION OF FUNDS

The invested premium and the declared bonus interest would be payable on death

(along with the Sum Assured) or would be used as a purchase price at the time of

vesting. However, at the time of payment due to death or at the time of vesting, if the

value of the individual's investment account is more than the invested premium (along

with the declared bonus interests) then the additional amount would also be payable

on death or would be used as a purchase price at the time of vesting. The differential

between declared bonus interest and earned rate would not be greater than 1%.

VESTING AGE

You can choose a vesting age between 50 and 75 years. You have the flexibility to

postpone the vesting date from the originally chosen vesting date up to a maximum of

75 years of age. This option can be exercised only once, 6 months prior to vesting.

ELIGIBILITY

With Life Cover: Any person between 18 and 60 years of age can apply.

Without Life Cover (Zero Death Benefit): Any person between 18 and 65

years of age can apply.

59

zzzzzzzzz

60

TERM

Minimum term is 10 years.

MINIMUM PREMIUM

Minimum annual premium is Rs.10,000; half-yearly premium is Rs.5,000; and

monthly premium is Rs.834.

SURRENDER

Secure plus Pension acquires a surrender value after premiums for three policy years

are fully paid. The surrender value is the accumulated value of your policy, or its

market value at the time of death or maturity, whichever is higher. Surrender value

can be classified under two categories:

a) Guaranteed b) Non-guaranteed.

Guaranteed surrender value will be 35% of all premiums paid - excluding the

first year premium and all extra premiums and premiums for rider benefits.

On request, the company may provide non-guaranteed surrender values as

specified from time-to-time.

The insurance protection ceases on surrender of the policy.

ANNUITY PAYMENT OPTIONS

Your accumulated value would start paying you regular income in the form of an

annuity, at a frequency chosen by you. This income can be received monthly,

quarterly, half-yearly or annually.

GURANTEED ANNUITY PERIOD

You have the option of selecting a guaranteed annuity rate period of either 5 or

7 years.

The amount of annuity is fixed for a guaranteed annuity rate period and will be

recalculated at intervals of every guaranteed period, based on the then

prevailing annuity rates.

On commencement, and at the end of every guaranteed period, the amount of

annuity payable for the next guaranteed number of years and the Residual

60

zzzzzzzzz

61

Purchase Price (which will be available for calculation of the annuity rate at

the end of the guaranteed annuity period), on survival, will be guaranteed

LIFE LINK PENSION

PREMIUM

Life Link Pension - a single premium linked deferred pension plan.

DEFERRED PENSION PLAN

A Linked Deferred Plan gives you the freedom to choose the amount of premium, and

invest in market-linked funds, to generate potentially higher returns. A part of the

premium paid is used to pay for the death benefit (if any) opted for by you and the rest

would be invested in the plan of your choice. On the retirement date, the accumulated

value of the units will be used to purchase an annuity - to provide you with regular

income for life.

LIFE COVER BENEFIT

In the unfortunate event of your death before retirement, your spouse has the option of

receiving either the death benefit or the value of units as a lump sum (whichever is

higher), or get an annuity that would provide regular income for life.

VESTING AGE

You can choose a vesting date once you are 50 years of age. However, you have the

option of postponing this vesting date till the age of 75 years. With this, you can take

advantage of market movements.

TOP-UPS

Use your surplus funds to top-up your investment during the deferment period. The

minimum top-up amount is Rs. 5,000.

PROTECTION LEVEL

61

zzzzzzzzz

62

You choose the amount of life cover you require. In this plan, the Death Benefit is

1.05 times the premium paid. You can also opt for a Zero Death Benefit. The amount,

which you pay for the Death Benefit, depends on your chosen protection level.

CHOOSING INVESTMENT PLAN

You can choose between the Maximize (Growth), Protector (Income) or Balancer

(Balanced) plans. You also have the power to switch between the plans, to suit your

investment priorities. You are entitled to one free switch every year during the

deferment period.

ELIGIBILITY