Professional Documents

Culture Documents

Online Quiz 1 Final

Uploaded by

MJ YaconCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Online Quiz 1 Final

Uploaded by

MJ YaconCopyright:

Available Formats

On-Line Quiz 1

The following are paths of a typical audit for a company with a fiscal year-end of

July 31.

1. Understand internal control and assess control risk.

2. Perform analytical procedures for accounts payable.

3. Confirm accounts payable.

4. Perform tests of controls and substantive tests of transactions for the

acquisition and payment and payroll and personnel cycles.

5. Perform other tests of details of balances for accounts payable.

6. Perform tests for review of subsequent events.

7. Accept the client.

8. Issue the audit report.

9. Set acceptable audit risk and decide preliminary judgment about materiality

and performance materiality.

Required:

a. Identify the phase of the audit in which each activity occurs.

b. Put parts 1 through 9 of the audit in the sequential order in which you will

expect them to be performed in a typical audit.

c. Identify those parts that will frequently be done before July 31.

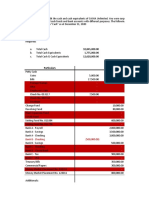

ANSWER:

1. Identify the phase of the audit in which each activity occurs.

a. Understanding client and its environment phase

- Understand internal control and assess control risk

b. Pre-planning phase

- Accept the client.

c. Planning Phase

- Perform analytical procedures for accounts payable

- Set acceptable audit risk and decide preliminary judgment about

materiality and performance materiality.

d. Executing the plan phase

- Confirm accounts payable

- Perform tests of controls and substantive tests of transactions for the

acquisition and payment and payroll and personnel cycles

- Perform other tests of details of balances for accounts payable

e. Completion of Audit Phase

- Perform tests for review of subsequent events

f. Issuance of audit report phase

- Issue the audit report

2. Put parts 1 through 9 of the audit in the sequential order in which you will

expect them to be performed in a typical audit.

1. Accept the client.

2. Understand internal control and assess control risk.

3. Set acceptable audit risk and decide preliminary judgment about

materiality and performance materiality.

4. Perform analytical procedures for accounts payable.

5. Perform tests of controls and substantive tests of transactions for the

acquisition and payment and payroll and personnel cycles.

6. Confirm accounts payable.

7. Perform other tests of details of balances for accounts payable.

8. Perform tests for review of subsequent events.

9. Issue the audit report

3. Identify those parts that will frequently be done before July 31.

- Accepting the client

- Set acceptable audit risk and decide preliminary judgment about

materiality and performance materiality

- Understand internal control and assess control risk

Perform tests of controls and substantive tests of transactions for the

acquisition and payment and payroll and personnel cycles

You might also like

- Math 006B - Module 4 HypothesisDocument4 pagesMath 006B - Module 4 Hypothesisaey de guzmanNo ratings yet

- Chapter 10Document6 pagesChapter 10Melissa Kayla ManiulitNo ratings yet

- Psa 705 Notes and SummaryDocument8 pagesPsa 705 Notes and SummaryEjkNo ratings yet

- Modified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial StatementsDocument29 pagesModified Opinion, Emphasis of Matter Paragraph or Other Matter Paragraph in The Auditor's Report On The Entity's Complete Set of Financial Statementsfaye anneNo ratings yet

- Auditing Theory and Principles Thanks GuysDocument51 pagesAuditing Theory and Principles Thanks GuysrenoNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDocument5 pagesColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNo ratings yet

- Business Combination.: Pfrs 3Document33 pagesBusiness Combination.: Pfrs 3Reginald Valencia100% (1)

- Audit Theory Chapter 7 Overview of FS Audit ProcessDocument13 pagesAudit Theory Chapter 7 Overview of FS Audit ProcessAdam SmithNo ratings yet

- AIS Wk1PostActDocument4 pagesAIS Wk1PostActRose Anne BautistaNo ratings yet

- FC Trans Rem - NotesDocument3 pagesFC Trans Rem - NotesVenz LacreNo ratings yet

- Afar IcpaDocument6 pagesAfar IcpaAndrea Lyn Salonga CacayNo ratings yet

- Afar 3 Government Accounting and Accounting For Non-Profit Organizations Course OutlineDocument2 pagesAfar 3 Government Accounting and Accounting For Non-Profit Organizations Course OutlineJamaica DavidNo ratings yet

- Auditing Theory Ch1-Guide Questions With AnswerDocument8 pagesAuditing Theory Ch1-Guide Questions With AnswerElaineNo ratings yet

- Chapter15 - Answer PDFDocument14 pagesChapter15 - Answer PDFAvon Jade RamosNo ratings yet

- AGNPO Prelims ReviewerDocument84 pagesAGNPO Prelims ReviewerKurt Morin CantorNo ratings yet

- ACC410 Week 1 AssignmentDocument3 pagesACC410 Week 1 AssignmentbitofpatienceNo ratings yet

- Pineda, Maricar R. CBET-01-502A: Internal FactorsDocument5 pagesPineda, Maricar R. CBET-01-502A: Internal FactorsMaricar PinedaNo ratings yet

- c2 2Document3 pagesc2 2Kath LeynesNo ratings yet

- Existence or Occurrence Completeness Rights and Obligations Valuation or AllocationDocument3 pagesExistence or Occurrence Completeness Rights and Obligations Valuation or AllocationReyes, Jessica R.No ratings yet

- Ap Prob 8Document2 pagesAp Prob 8jhobsNo ratings yet

- ApabkakakaDocument2 pagesApabkakakaDania Sekar WuryandariNo ratings yet

- MAS - Group 5Document7 pagesMAS - Group 5beleky watersNo ratings yet

- P3Document18 pagesP3Rezzan Joy MejiaNo ratings yet

- ACELEC 332 Prelim Quiz 2Document9 pagesACELEC 332 Prelim Quiz 2MontenegroNo ratings yet

- 6 ACCT 2A&B C. OperationDocument10 pages6 ACCT 2A&B C. OperationShannon Mojica100% (1)

- Part 2 PRE2Document3 pagesPart 2 PRE2School FilesNo ratings yet

- Problem 1-5 Multiple Choice (IAA)Document2 pagesProblem 1-5 Multiple Choice (IAA)jayNo ratings yet

- Cost of Capital: By: Judy Ann G. Silva, MBADocument21 pagesCost of Capital: By: Judy Ann G. Silva, MBAAnastasha GreyNo ratings yet

- Franchise AccountingDocument5 pagesFranchise AccountingJose SasNo ratings yet

- AGS CUP 6 Auditing Elimination RoundDocument17 pagesAGS CUP 6 Auditing Elimination RoundKenneth RobledoNo ratings yet

- AP.2903 Intangible-AssetsDocument4 pagesAP.2903 Intangible-AssetsmoNo ratings yet

- You Will Be A CPA in 2019Document12 pagesYou Will Be A CPA in 2019jose amoresNo ratings yet

- CMPC312 QuizDocument19 pagesCMPC312 QuizNicole ViernesNo ratings yet

- PNC Midterm Exam Valuation Ver 2Document55 pagesPNC Midterm Exam Valuation Ver 2Maybelle BernalNo ratings yet

- NPV - HelicopterDocument3 pagesNPV - HelicopterAarti J. Kaushal100% (1)

- 1PB - Ar6Document12 pages1PB - Ar6KimNo ratings yet

- Coursehero 12Document2 pagesCoursehero 12nhbNo ratings yet

- Activity - Chapter 4Document2 pagesActivity - Chapter 4Greta DuqueNo ratings yet

- Chapter 23 28Document104 pagesChapter 23 28Xander Clock50% (2)

- D6Document11 pagesD6lorenceabad07No ratings yet

- An SME Prepared The Following Post Closing Trial Balance at YearDocument1 pageAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuNo ratings yet

- ValuationDocument3 pagesValuationBryan IbarrientosNo ratings yet

- Stock Edited PDFDocument29 pagesStock Edited PDFCzarina PanganibanNo ratings yet

- DLSA AP Intangibles For DistributionDocument7 pagesDLSA AP Intangibles For DistributionJan Renee EpinoNo ratings yet

- 11.11.2017 Audit of PPEDocument9 pages11.11.2017 Audit of PPEPatOcampoNo ratings yet

- Advanced Accounting - Volume 1Document4 pagesAdvanced Accounting - Volume 1Erica CaliuagNo ratings yet

- Chapter 2 Business ProcessesDocument2 pagesChapter 2 Business ProcessesChristlyn Joy BaralNo ratings yet

- AFAR3 QuestionnairesDocument5 pagesAFAR3 QuestionnairesTyrelle Dela CruzNo ratings yet

- Audit of Cash ActivityDocument13 pagesAudit of Cash ActivityIris FenelleNo ratings yet

- (Odd) Acc 101 LT#2B PDFDocument5 pages(Odd) Acc 101 LT#2B PDF有福No ratings yet

- CHPDocument2 pagesCHPHortense JiangNo ratings yet

- CombinepdfDocument39 pagesCombinepdfLeamay LajotNo ratings yet

- Chapter 21: Evaluation of Audit Evidence and Completion of The AuditDocument12 pagesChapter 21: Evaluation of Audit Evidence and Completion of The AuditIrine A. Pedregosa100% (1)

- Completing The AuditDocument5 pagesCompleting The Auditmrs leeNo ratings yet

- Lecture - 9 - Completing The Audit PDFDocument48 pagesLecture - 9 - Completing The Audit PDFShiaab AladeemiNo ratings yet

- Applied AuditingDocument2 pagesApplied Auditingctcasiple50% (2)

- Chapter FourDocument16 pagesChapter FourGebrekiros ArayaNo ratings yet

- Chapter 4Document3 pagesChapter 4Reyza Mikaela AngloNo ratings yet

- Acc 14 FinalDocument7 pagesAcc 14 FinalKiaNo ratings yet

- MAS Risk and Rates of Returns Practice Problems AnswerDocument29 pagesMAS Risk and Rates of Returns Practice Problems AnswerMJ YaconNo ratings yet

- Managerial Skills and Teaching Effectiveness of Elementary School Teachers in Jose Abad SantosDocument19 pagesManagerial Skills and Teaching Effectiveness of Elementary School Teachers in Jose Abad SantosMJ YaconNo ratings yet

- Proficiency - TheoryDocument3 pagesProficiency - TheoryMJ YaconNo ratings yet

- Quantitative MethodsDocument19 pagesQuantitative MethodsSerena Van der WoodsenNo ratings yet

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Document7 pagesPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)rain06021992No ratings yet

- Abs and VarDocument7 pagesAbs and VarChloe Chiong50% (2)

- Anti Money Laundering ActDocument74 pagesAnti Money Laundering ActMJ YaconNo ratings yet

- DocxDocument14 pagesDocxcrispyy turonNo ratings yet

- BudgetingDocument20 pagesBudgetingMJ YaconNo ratings yet

- DocxDocument14 pagesDocxcrispyy turonNo ratings yet

- DocxDocument14 pagesDocxcrispyy turonNo ratings yet

- ALL SubjectsDocument11 pagesALL SubjectsMJ YaconNo ratings yet

- Debt SecurityDocument9 pagesDebt SecurityMJ YaconNo ratings yet

- Ap Solutions 2016Document15 pagesAp Solutions 2016Shariefia MagondacanNo ratings yet

- Edited For Ref C1Document4 pagesEdited For Ref C1MJ YaconNo ratings yet

- ToaDocument18 pagesToaMJ YaconNo ratings yet

- Anti Money Laundering ActDocument74 pagesAnti Money Laundering ActMJ YaconNo ratings yet

- Internship Reflection PaperDocument1 pageInternship Reflection PaperMJ Yacon67% (3)

- Solution - Audit of InvestmentDocument4 pagesSolution - Audit of InvestmentMJ YaconNo ratings yet

- Final Requirement in AdvaccDocument143 pagesFinal Requirement in AdvaccShaina Kaye De Guzman100% (1)

- All Subjects-Prtc AaDocument16 pagesAll Subjects-Prtc AaMJ Yacon100% (2)

- All Subjects-Prtc AaDocument16 pagesAll Subjects-Prtc AaMJ Yacon100% (2)

- All Subjects PicpaDocument16 pagesAll Subjects PicpaMJ YaconNo ratings yet

- BudgetingDocument20 pagesBudgetingMJ YaconNo ratings yet

- The Causes of Hyperthyroidism Include: Graves' Disease - The Most CommonDocument1 pageThe Causes of Hyperthyroidism Include: Graves' Disease - The Most CommonMJ YaconNo ratings yet

- All Subj - Board Exam-Picpa EeDocument9 pagesAll Subj - Board Exam-Picpa EeMJ YaconNo ratings yet

- All Subjects - CCDocument11 pagesAll Subjects - CCMJ YaconNo ratings yet

- Final Preboar1Document17 pagesFinal Preboar1MJ YaconNo ratings yet

- All Subj - Mock Board Exam BBDocument9 pagesAll Subj - Mock Board Exam BBMJ YaconNo ratings yet

- All Subj - Mock Board Exam BBDocument9 pagesAll Subj - Mock Board Exam BBMJ YaconNo ratings yet

- Income Based Valuation - l3Document14 pagesIncome Based Valuation - l3Kristene Romarate DaelNo ratings yet

- 0452 s11 QP 21Document24 pages0452 s11 QP 21Athul TomyNo ratings yet

- Ch03 - Cost-Volume-Profit Analysis OKDocument48 pagesCh03 - Cost-Volume-Profit Analysis OKDwidarNo ratings yet

- FRA Level 2 Question BankDocument244 pagesFRA Level 2 Question Bankamaresh gautam50% (2)

- Standard Costs and Variance Analysis 1236548541Document12 pagesStandard Costs and Variance Analysis 1236548541anon_39534635275% (4)

- Labor Cost Code PDFDocument5 pagesLabor Cost Code PDFkarthikaswiNo ratings yet

- Wk14 Summary Quizzer 2 - Set BDocument5 pagesWk14 Summary Quizzer 2 - Set Bmariesteinsher0No ratings yet

- Solved A Company Reports The Following Income Before Income Tax 4 000 000 Interest Expense PDFDocument2 pagesSolved A Company Reports The Following Income Before Income Tax 4 000 000 Interest Expense PDFAnbu jaromiaNo ratings yet

- SAP Purchase-Order-Accruals-WhitepaperDocument15 pagesSAP Purchase-Order-Accruals-WhitepaperSri Sathya Sai Anugraha GruhamNo ratings yet

- Creative Accounting and Window DressingDocument7 pagesCreative Accounting and Window DressingOnaderu Oluwagbenga Enoch100% (1)

- CPA Study Plan and Tips Simandhar EducationDocument6 pagesCPA Study Plan and Tips Simandhar Educationdaljeet singhNo ratings yet

- Job Order Costing Syste1 PDFDocument19 pagesJob Order Costing Syste1 PDFgosaye desalegn100% (2)

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionCharlene Mae MalaluanNo ratings yet

- 5.1 Income Statements - Non-Recurring Items and Non-Operating Items PDFDocument6 pages5.1 Income Statements - Non-Recurring Items and Non-Operating Items PDFascentcommerceNo ratings yet

- Quiz For 3rd ExamDocument2 pagesQuiz For 3rd ExamSantiago BuladacoNo ratings yet

- Basic Financial StatementsDocument14 pagesBasic Financial StatementssajjadNo ratings yet

- English For The Financial Sector Intermediate Teachers Book FrontmatterDocument10 pagesEnglish For The Financial Sector Intermediate Teachers Book FrontmatterPS Lee0% (3)

- Principles of Accounting Chapter 13Document43 pagesPrinciples of Accounting Chapter 13myrentistoodamnhigh100% (1)

- AASB1021Document31 pagesAASB1021Nicole YvonneNo ratings yet

- BS - M AnixxDocument7 pagesBS - M AnixxmelkamuNo ratings yet

- QUIZ Audit of InventoriesDocument3 pagesQUIZ Audit of Inventoriescrispin leanoNo ratings yet

- The Role of Independent Directors in Corporate Governance - A Critical EvaluationDocument15 pagesThe Role of Independent Directors in Corporate Governance - A Critical EvaluationNaman DadhichNo ratings yet

- Onerous Contracts-Cost of Fulfilling A Contract Amendments To Ias 37Document6 pagesOnerous Contracts-Cost of Fulfilling A Contract Amendments To Ias 37Suzy BaeNo ratings yet

- Financial Results September 30 2021Document9 pagesFinancial Results September 30 2021g_sivakumarNo ratings yet

- Grand Jury Report On Internal Audit DivisionDocument7 pagesGrand Jury Report On Internal Audit DivisionThe Press-Enterprise / pressenterprise.comNo ratings yet

- FM Chapter 3 NotesDocument22 pagesFM Chapter 3 NotesMadesh KuppuswamyNo ratings yet

- KKK Traders Servicing SetDocument17 pagesKKK Traders Servicing SetJeanette KimoNo ratings yet

- Theory Questions 5 PDF FreeDocument5 pagesTheory Questions 5 PDF FreeSamsung AccountNo ratings yet

- Accounts FinalDocument28 pagesAccounts FinalSatyam SinghNo ratings yet

- Afdatil - Jurnal AsingDocument8 pagesAfdatil - Jurnal AsingAfdatilNo ratings yet