Professional Documents

Culture Documents

The Honorable Sweeney Margaret

Uploaded by

Richard_Davet0 ratings0% found this document useful (0 votes)

26 views15 pagesSprawling litigation

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSprawling litigation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

26 views15 pagesThe Honorable Sweeney Margaret

Uploaded by

Richard_DavetSprawling litigation

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 15

Richard F, Davet

PO Box 10092

Cleveland, OH 44110

Phone 216-451-6211

Email: Rfdavev@gmail.com

June 1, 2016

The Honorable Margaret M. Sweeney

United States Court of Federal Claims

Howard T. Markey National Courts Building

717 Madison Place, NW,

Washington, DC 20439

RE: The GSE Business Model’s Sprawling Litigation

Dear Judge Sweeny:

Out of a sense of civie responsibility I must call to your attention the Sham being perpetuated

before you to the detriment of every US Taxpayer.

FYI, Lam a twenty year litigant on the subject (see attached WSJ article). 1 am also attaching a

criminal complaint that | filed, circa 1997 which is self explanatory.

‘The matters before you are a perpetuation of the sham, e.g. GSE Business Model that has been

perpetrated on the US Taxpayers as victims (see attached my 2009 exchange with Jamie Dimon).

The hedge funders spotted a less than noble opportunity in our government's hesitance to pull

the plug on these Frankensteinish entities hoping to capitalize on their discounted pricing to

their own end, I can tell you first hand that FNMA was and is complicit in the fraud perpetrated

on their victims and continue to do so to this day. As a business person, I applaud the quest for

discovery to bring to the light of day the goings on at FNMA/FHFA; however one must hold

their nose knowing that the whole thing is predicated on an elaborate crime. No one should be

able to eat the fruit of the poisonous tree.

From the Government’s perspective their conduct to date is worse. I have been in contact with

Laura Wertheimer, OIG of FHFA who has done nothing with respect to the fraud going on at

FNMA, As you are aware the press is all over the supposedly $50 Billion “profit” which is an

absolute joke when you know the latent liability, unreported fraud going on at the GSEs. FYI,

there is a self serving Report by Mark Cymrot of Baker Hostetler alluding to those exposures

reported by the NY Times. I strongly urge you to read it cover to cover as it will make clear that

all the players are complicit in the crime to this day and in the matters before you

(http://s3.documentcloud.org/documents/289482/lavalle-report-small-printed.pdf ) .

I stand ready to assist you based on my experiences in discharging your duties with respect to the

felonious activities before you. Please do not hesitate to call,

Sincerely yours,

Richard Davet

Rélee

Enclose:

Criminal Complaint

Dimon Exchange 2009

How one Family fought Foreclosure

IN THE COURT OF COMMON FLEAS

CUYAKOGA COUNTY GHID

pag se? 151 P 2 08

HTRTGAAG MORIGAAE GORIORMEN Sage ASHE

co nagp Cout'e

"Gp i

Plaintitt ) JuDeE:

KATHLEEN A, SUTULA

te

V5. AFFIDAVIT

)

)

)

)

RICHARD F, DAVET, etal. )

)

)

Defendants

PREFACE: THE AFFIDAVIT SET FORTH BELOW IS BEING FILED

BY A PRIVATE CITIZEN WITH THE HONORABLE JUDGE

KATHLEEN A, SUTULA PURSUANT TO SECTION 2935.09 OF THE

OHIO REVISED CODE, DEFENDANT RICHARD F, DAVET, A

PRIVATE CITIZEN KNOWLEDGEABLE OF FACTS THAT A FELONY

HAS BEEN COMMITTED BY PERSONS IN THE STATE OF OHIO,

DOES SO CHARGE SAID PERSONS IN THIS AFFIDAVIT AND

EXPECTS, BY THIS FILING, THAT THE HONORABLE JUDGE

SUTJLA SHALL FORTHWITH ISSUE A WARRANT FOR THE

ARREST AND PROSECUTION OF SAID PERSONS PURSUANT TO

SECTION 2935.10 OF THE OHIO REVISED CODE.

PAGE 2

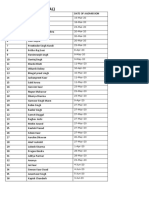

(For reference) NAMES & ADDRESSES

ARE HEREIN PROVIDED OF THOSE

PERSONS CHARGED IN AFFIDAV-T:

NATIONSBANC MORTGAGE CORPORATION

205 PARK CLUB LANE

BUFFALO, NY 14231

H. RANDALL CHESTNUT,

CHIEF EXECUTIVE OFFICER

NATIONSBANC MORTGAGE CORPORATION

205 PARK CLUB LANE

BUFFALO, NY 14231

RICHARD McNELLIE,

MANAGEING PARTNER

McNELLIE & RINI CO., L,P.A.

2520) CHAGRIN BOULEVARD, Suite 240

CLEVELAND, OH 44122

PAGE 3 AFFIDAVIT

The undersigned, being duly sworn, does hereby state that the

persons NATIONSBANC MORTGAGE CORPORATION, H. RANDALL CHESTNUT,

and RICHARD McNELLIE, without standing or privilege for so doing, did

knowingly and complicitly attempt to facilitate a fraud upon Affiant by filing

this foreclosure lawsuit (CASE NO. CY 308224) in Cuyahoga County Common

Pleas Court, State of Ohio.

By so acting, the named persons did complicitly initiate a "Sham legal

process" in violation of Section 2921.52 of the Ohio Revised Code, as defined

in Section 2921.52 (A)(4),

Also, the persons charged violated Section 2921.13(A)(1) of the Ohio

Revised Code by making a false statement when filing the foreclosure lawsuit

on March 1, 1996, in its filing, NATIONSBANC MORTGAGE CORPORATION

falsely stated it had an equity ownership interest in the Affiant's zeal estate

mortgage, and its attendant note, upon which foreclosure action was being

sought. Such falsification is evidenced as a matter of public record.

Consequently, the persons charged herein did also specifically violate Section

2921.52 (Bi(4) of the O2io Revised Code by knowingly committing a felony

by using sham legal process.

PAGE 4

Evidence of the felonious act of the persons charged is set forth in

attached Exhibit "A" which is incorporated herein by reference, Exhibit A

is a copy of the Complaint for foreclosure filed on March 1, 1996 by

RICHARD McNELLIE, Counsel for NATIONSBANC MORTGAGE CORPORATION

(NMC) at the direction of NMC Chief Executive Officer, H. RANDALL

CHESTNUT. In said Complaint, the false statement is made that

NATIONSBANC MORTGAGE CORPORATION is owner of the real estate

mortgage and note upon which foreclosure is sought,

Affant further states that the filing of this Affidavit with Judge Sutula

is not-only being done in good faith but is also being done in the spirit of

civic duty as authorized under Section 2935.09 ORC, AFFIANT SAYETH

NOTHING FURTHER. 1

UA

Richard F. Davet, AFFIANT

Sworn to and acknowledged before

me this Eth Day of September, 1998,

recall howe (all

MILDRED SUE PHILLIPS

NOTARY &SRAL —— wrcomaresorespatin! 2° 509

PAGE §

PROOF OF SERVICE

The undersigned hereby certifies thet a true and exact copy of this

AFFIDAVIT FILED WITH THE HONORABLE JUDGE KATHLEEN SUTULA was

tailed to Ted A. Humbert, Attomey for Defendant, Bank One, Cleveland,

N.A., at 323 Lakeside Avenue, Suite 200, Cleveland, OH 44113; Jeffrey F,

Slavin, Attorney for Defendant, Body, Vickers & Daniels at 75 Public

Square, Suite 1225, Cleveland, OH 44113; Robert J. Olender, Attorney for

Defendant, American National Bank at 925 Euclid Avenue, Suite 1940,

Cleveland, OH 44115; Stephon M. Darlington, Attorney . for-Defendant,

Huntington National Bank at 917 Euclid Avenue, Cleveland, OH 44115; and

Lynn G, Davet at 24800 Community Drive, Beachwood, OHIO; by ordinary

U.S. Mail., this 15th Day of September 15, 1998.

Pye

RICHARD F, DAVET, AFFIANT

FAH EBL “A Q-15-98/

F96-96/kai (02-29-96)

ii THE COURT OF COMMON PLEAS

CUYAHOGA COUNTY, OHTO

NationsBanc Mortgage Corporation CASE NO.:

205 Park Club Lane

Buffalo, NY 14231 JUDGE:

Plaintiffé ANID

B04224

vs-

Richard F. Pavet wr CE RI

24800 Community Drive BY THE FAIR DEBT COLLECTION

Beachwood, Ohie 44122 PRACTICES AGT ATTACHED

Jane Doe, Real Name Unknown, Permanent Parcel

The Unknown Spouse, if any, of Nog.: 741-12-009

Richard F. Davet 741-12-010

24800 Community Drive

Beachwood, Ohio 44122

Bank One, Cleveland NA

1288 Euclid avenue

Cleveland, OH 44214

American National Bank

5603 Ridge Road

Parma, Ohio 44129

Body, Vickers, & Daniels,

nka, Vickers, Daniels & Young

50 bublic Square

Terminal Tewer, #2000

Cleveland, Ohio 44113

Buntington National Bank

917 Buclid Avenue

Cleveland, Ohio 44115

Defendants

FIRST COUNT

1. Plaintif€ saya that it is the owner and holder of a certain

promissory note, a copy of which is attached hereto, marked Exhibis

"a", and made a part hereof; that by reason of default in the paymen-

cf the note and mortgage securing same, it has declared said debt due;

and, that there is due and unpaid thereon the sum of $83,162.89, plus

st at the rate of 9.00% per annum from April 1, 1995.

£ CHIBIT A“q4s¢

Pan. 3, "

SECOND COUNT

Plaintiff incorporates herein by reference all of the

allegations contained in its first count, and further says that it is

the owner and holder of a certain mortgage deed, securing the payment

of said promissory note, a copy of which mortgage deed io attached

hereto, marked Exhibit “B", and made a part hereof; and, that said

mortgage is a valid and first lien upon the premises described in said

mortgage deed.

2, Plaintiff says that the conditions of said mortgage deed have

been broken, by reason of default in payment and the same has become

absolute; and, that the defendants named in this complaint have or

claim to have an interest in the premises described in Exhibit *

3, Plaintiff says that pursuant to the covenants and conditions

of said mo:

age deed it may, from time to time during the pendency of

this action, advance sums to.pay realestate taxes, hazard insurance

premiums and property protection and maintenance, which sums so

advanced are a good and valid first lien upor the premises described

in Exhibit "BY, Plaintiff further says that it has performed all of

the conditions precedent required to be performed by it.

WHEREFORE, plaintiff demands judgment against the defendant,

Richard F. Davet, in the sum of $83,162.89, plus interest at the rate

cf 9.00% per annum from April 1, 1995; that the defendants named

herein be required to answer and set up any claim that they may have

in said premises or ba forever barred; that the plaintiff be found to

have a first lien on said premises for this amount so owing, together

with its advances made pursuant to the terms of the mortgage for rea”

estate taxes, insurance premiums and property protection and

maintenance; that upon failure tc pay said amount within three (3)

days thereafter, said premises be ordered appraised, advertised and

EXHIB I A‘. G-ts- 98

PE 3 A

sold according to law; that from the proceeds of said sale, the

plaintiff be paid the amount so found due it; and, that plaintiff be

awarded such other and further reY/ef as equity eptit,

receive.

‘ROW

Mv: RICHARD L. McNELLIE (0032130)

Attorney for Plaintiff

28601 Chagrin Blvd., SUITE 600

Sleveland, CH 44122-4531

(216) 360-7200

Richard Davet

2009 JPM Shareholder’s meeting

Exchange with James Dimon CEO and Chairman

‘As you know, for years, the Bank has been and continues to be major players in its

mortgage business in what has come to be known as the “Government Sponsored

Enterprise (GSE) Business Mode!”

In September of 2008, Treasury Secretary Paulson declared that, and I quote, “these

enterprises pose a systemic risk”. Your mortgage business goes 90%+ to Fannie Mae

on a daily basis.

Much has been written about the GSE flawed business model, including a Wall Street

op-ed by George Soros which calls the models “hopelessly conflicted” and “it simply

doesn’t work”.

? 1, When do you and the Board intend to disclose to shareholders the consequences

of the Bank’s vigorous involvement with this fatally flawed business model?

? 2 Isn't this business a little like your running a house of ill repute while knowing that all

your ladies have aids and what are you doing to your client base?

2.3, What would you say to the skeptics that are out there that think that all players

involved with the GSE Business Model are engaged in a simple criminal scheme, albeit

of a dimension that we have never seen before, that a prosecutor would call “theft by

deception” with the American taxpayer as the victim?

The Court House:

How One Family

Fought Foreclosure

By AMIR EFRATI

December 28, 2007; Page AL

BEACHWOOD, Ohio -- Faced with the threat of foreclosure, many homeowners give up and abandon

their homes.

‘Then there's Richard Davet.

He and his wife, Lynn, lived in a six-bedroom home in this Cleveland suburb for

nearly 20 years when, in 1996, he was served with a foreclosure lawsuit. Rather

than turn over the keys, he hit the law books. Flooding the courts with papers,

Mr. Davet staved off foreclosure for 11 years, until this past January, when a

county sheriff's deputy evicted the couple and changed the locks. They didn't

make a mortgage payment the entire time.

"Our four Scottish terriers are buried there," says the 63-year-old Mr. Davet. "It

was heaven on earth, an/Unbelievable property, and they took it from us like

candy from a baby."

Richard Davet

————_Mr. Davet’s case is believed to be the longest residential foreclosure of its kind in

the history of Cuyahoga County, which is at the epicenter of the foreclosure crisis currently enveloping

Chio and many other parts of the country. Foreclosure actions are generally routine, typically taking

from a few months to a couple of years to get the borrower out of the home. Companies turn the work

over to so-called foreclosure-mill Jaw firms, and generally cases are uncontested.

DISCUSS ON THE LAW BLOG

Za

Mr. Davet's argument -- NationsBanc couldn't bring the suit because it didn't legally own his

mortgage ~ is the same red-hot legal theory now being embraced by judges and regulators in

‘Ohio and elsewhere to help give homeowners a chance against foreclosure. Is this all about a legal

system at work, or not working? Discuss it here.

These days, more homeowners are digging in their heels. They delay foreclosures by filing for

bankruptcy on the eve of a court-ordered sale of the property, or by refusing to answer the door when

the plaintiff tries to "serve" them with a foreclosure lawsuit. They pay lawyers a few hundred dollars to

file a motion that can buy them a little more time.

But few are as dogged as Mr. Davet. And his fight may not be over yet. Though ousted from his home for

nearly a year now, he is trying to get the charming 1940s house back, plus damages. He's relying on the

legal argument -- currently making headlines -- that 2 financial institution can only file a foreclosure

action if it can prove it actually owns and holds the mortgage and promissory note.

"give him credit. He truly believes a banking institution did him a great wrong,” says Daniel Kalk, one of

several lawyers who at various times represented Mr. Davet in the case. "The funny thing is, some of the

things he argued 10 years ago ~ all of a sudden you see a federal court saying the same thing.”

A former jewelry-business owner, Mr. Davet and his wife, a former graphic-arts tutor, bought their

home in 1978 for $150,000. As its value increased they borrowed against it. They made their mortgage

payments, but on one loan, they allegedly made payments late -- 90 times, according to NationsBanc

Mortgage Corp.,. which assessed the couple some $4,000 in late fees.

After the Davets for two years refused demands to pay the late fees, during which NationsBanc began

refusing to accept their regular mortgage payments, the company sued for foreclosure. At the time the

couple still owed $80,000 in principal, plus an additional $160,000 on a second mortgage on the home.

Mr. Davet insists the late fees were erroneous -- he points to a deposition in which a NationsBanc

‘employee conceded that the company couldn't back up its claims for a chunk of the fees. So he began

his full-time crusade in the courts to keep his home.

CASE DOCUMENTS

@

He started with the help of lawyers, but those arrangements didn't last. Dan Dreyfuss, who represented

the couple when the case was filed, called Mr. Davet's strategy "a recipe for how to confound the

courts." He quit after Mr. Davet filed a motion to disqualify a judge against his advice. Mr. Kalk

eventually sued Mr. Davet, successfully, for unpaid legal fees.

lationsBanc’s complaint against Mr. Davet

he Davets' motion for reconsideration

On his own, as a "pro se" litigant, Mr. Davet was undeterred. Four times a week he went to Case

Western Reserve University School of Law to study legal writing and case law in its library. His briefs

were angry and colorful, including football analogies and an aside on Enron Corp.

‘Among his maneuvers: asking a judge to arrest NationsBanc's CEO for initiating a "sham" proceeding

against him because the company claimed in error that it owned his loan. (The judge dismissed the

request.) He later sought to disqualify the judge because she had accepted campaign contributions from

real-estate developers, whose Beachwood developments Mr. Davet had publicly protested before the

foreclosure litigation. When he didn't win that motion, Mr. Davet sought to disqualify the judge who had

dismissed it. He appealed at every chance he could, which bought him extra years in his home.

"Mr. Davet has litigated these same issues over and over again...and in each instance the courts have

dismissed his claims," said Bank of America Corp., Charlotte, N.C., which merged with the owner of

NationsBane.

Several years into the case, Bank of America took the unusual step of bringing in lawyers from a big

corporate law firm, Jones Day. Five years later, in 2005, a judge granted foreclosure in the amount Mr.

Davet owed and set a sale date for the property so that the creditors could take the sale proceeds. But

when the property finally went to sale, Mr. Davet set up a shell company to win the auction, for

$436,000. He couldn't pay more than the required $10,000 deposit, but the move delayed his eviction

by months.

Mr, Davet says it wasn't a delay tactic and that he was trying to line up investors to buy the property.

The house was later sold to another family for $410,000.

The eviction finally happened on a snowy day in January of this year. Don Saunders, who lived three

doors down from Mr. Davet and is a trustee of the neighborhood association, says it came as a shock in

the upscale area,

Mr, Davet continued to try, unsuccessfully, to get the federal court to agree that the state judgment was

invalid. Then, a possible lifeline arrived this past October, when a federal judge in Cleveland, Christopher

A. Boyko, dismissed 14 foreclosure suits because the plaintiffs that brought them couldn't prove they

‘owned the mortgages when the suits were filed,

Such a problem can occur when mortgages are turned into securities and sold to investors. The

companies involved in the transaction may not have checked that each mortgage was legally

transferred, or "assigned," to the new owners. In essence, the originating lender continued to legally

‘own the mortgage -- and would thus need to be the plaintiff in a foreclosure suit. In Mr. Davet's case,

however, the mortgage, which was not securitized, changed hands multiple times and wasn't actually

owned by NationsBanc until three years after the company filed suit.

Other judges have since followed Judge Boyko's lead. The Ohio attorney general has asked numerous

judges to dismiss or delay foreclosures based on similar grounds.

Earlier this month, Mr. Davet filed a second federal appeal, this time citing the Boyko ruling, which he

believes he inspired. It's unclear whether the latest salvo will work. If it doesn't, Mr. Davet says, he will

set his sights on the U.S. Supreme Court.

All the litigation makes the home's new owner, Paul Mikhli, a dentist, "a little nervous." Should Mr.

Davet succeed, he adds, title insurance should cover his expenses.

After spending much of the year living at the homes of friends and family, including their daughter, 2

university student in Indiana, the Davets recently moved into a small, $900-a-month home in a rural

community east of Cleveland. "The money is short,” Mr. Davet said on a recent afternoon, adding that

‘one of his siblings, a pawn-shop owner, has been helping financially.

But hope prevails. From time to time, he drives back to Beachwood, just to see how his old home is

doing,

James R. Hagerty contributed to this article,

Write to Amir Efrati at amir.efrati@wsi.com

You might also like

- Letter To Senators of The Senate Judiciary Committee 10/05/2016Document15 pagesLetter To Senators of The Senate Judiciary Committee 10/05/2016Richard_DavetNo ratings yet

- DePasquale 071816FDocument2 pagesDePasquale 071816FRichard_DavetNo ratings yet

- Depasquale 071816Document6 pagesDepasquale 071816Richard_DavetNo ratings yet

- Monkeys HearDocument1 pageMonkeys HearRichard_DavetNo ratings yet

- Linick 012113Document2 pagesLinick 012113Richard_DavetNo ratings yet

- Bank of America Corporation 2005 Shareholders MeetingDocument2 pagesBank of America Corporation 2005 Shareholders MeetingRichard_DavetNo ratings yet

- Rudman 022706Document3 pagesRudman 022706Richard_DavetNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Ib 71477 SFB10.1B2 GB Ro BG 21Document135 pagesIb 71477 SFB10.1B2 GB Ro BG 21Silviu MotNo ratings yet

- Dish TVDocument13 pagesDish TVR P100% (1)

- Homi Bhabha Exam Answer - Sheet - Format 1 PDFDocument1 pageHomi Bhabha Exam Answer - Sheet - Format 1 PDFghjfyhjvh100% (1)

- Bowling For ColumbineDocument10 pagesBowling For ColumbineMichael SchmidtNo ratings yet

- Reunion v0.3 WalkthroughDocument15 pagesReunion v0.3 WalkthroughCh Ameen0% (1)

- Govt Order On Bigg BossDocument2 pagesGovt Order On Bigg BossNDTVNo ratings yet

- A Training Report OnDocument35 pagesA Training Report OnKishan KshetrichaNo ratings yet

- Worksheet 1 (Video) PDFDocument2 pagesWorksheet 1 (Video) PDFAndreaBaronNo ratings yet

- The Survivor Episode 5 Youre Awake - Level b1 - ExercisesDocument2 pagesThe Survivor Episode 5 Youre Awake - Level b1 - ExercisesGvantsa mandzulashviliNo ratings yet

- Plan B (2019 Film) - WikipediaDocument10 pagesPlan B (2019 Film) - Wikipediask2vanderNo ratings yet

- Natural English Upper Intermediate TestsDocument48 pagesNatural English Upper Intermediate TestsGERESNo ratings yet

- REP8 Unit 1 Testy Klucz OdpowiedziDocument3 pagesREP8 Unit 1 Testy Klucz OdpowiedziIwona Grzybowska100% (1)

- Jeopardy TemplateDocument33 pagesJeopardy TemplateTea PantskhavaNo ratings yet

- The History of TelevisionDocument3 pagesThe History of TelevisionnadiaNo ratings yet

- EF3e Intplus Filetest 05aDocument4 pagesEF3e Intplus Filetest 05aЕвгения ЛайкомNo ratings yet

- SatHero 230919Document1 pageSatHero 230919david del pradoNo ratings yet

- Class XII Date of AdmissionDocument3 pagesClass XII Date of AdmissionMaanNo ratings yet

- Blue Yellow Colorful Doodle 2023-2024 Years School Cartoon CalendarDocument13 pagesBlue Yellow Colorful Doodle 2023-2024 Years School Cartoon CalendarRaida RaidaNo ratings yet

- The Sister: A Psychological Thriller With A Brilliant Twist You Won't See Coming - Louise JensenDocument6 pagesThe Sister: A Psychological Thriller With A Brilliant Twist You Won't See Coming - Louise Jensenruxahari50% (2)

- Crossing Cultural Barriers With Children's Television Programming: The Case of XuxaDocument9 pagesCrossing Cultural Barriers With Children's Television Programming: The Case of XuxaPDI iProdaNo ratings yet

- Schema Grandin K4117H32HDocument2 pagesSchema Grandin K4117H32Hgft7cx2qw4No ratings yet

- Copy of Media Universe-IMC 2019 - 20th SeptemberDocument125 pagesCopy of Media Universe-IMC 2019 - 20th SeptemberMekhla SinghNo ratings yet

- Lịch Trực Hệ Thống Đồ Án Đa NgànhDocument9 pagesLịch Trực Hệ Thống Đồ Án Đa NgànhNhật NguyễnNo ratings yet

- SAO TitleDocument1 pageSAO TitleJohn Paul Canlas SolonNo ratings yet

- 66 of The Best Netflix Series To Binge Watch Right NowDocument71 pages66 of The Best Netflix Series To Binge Watch Right NowMkNo ratings yet

- Arrow S08E09 iNTERNAL 720p WEB h264-TRUMPDocument117 pagesArrow S08E09 iNTERNAL 720p WEB h264-TRUMPMarwan AffandiNo ratings yet

- Bdix BDTVDocument766 pagesBdix BDTVFerdoushNo ratings yet

- Evaluation of Media: Television and RadioDocument20 pagesEvaluation of Media: Television and RadioAhsan AnikNo ratings yet

- Roland BK-9Document166 pagesRoland BK-9ZoliNo ratings yet

- حل كتاب طالب انكليزي 11 سورياDocument49 pagesحل كتاب طالب انكليزي 11 سورياAndraw AndrawNo ratings yet