Professional Documents

Culture Documents

Palting V San Jose Petroleum Inc

Uploaded by

Aldrin Tang0 ratings0% found this document useful (0 votes)

109 views1 pageCorporation Law Digest

Original Title

Palting v San Jose Petroleum Inc

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCorporation Law Digest

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

109 views1 pagePalting V San Jose Petroleum Inc

Uploaded by

Aldrin TangCorporation Law Digest

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

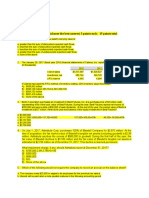

PALTING V SAN JOSE PETROLEUM

FACTS

In September 7, 1956, SAN JOSE PETROLEUM filed with

the Philippine Securities and Exchange Commission a

sworn registration statement, for the registration and

licensing for sale in the Philippines Voting Trust

Certificates representing 2,000,000 shares of its

capital stock of a par value of $0.35 a share, at P1.00

per share. It was alleged that the entire proceeds of

the sale of said securities will be devoted or used

exclusively to finance the operations of San Jose Oil

Company, Inc. (a domestic mining corporation

hereafter to be referred to as SAN JOSE OIL) which has

14 petroleum exploration concessions covering an

area of a little less than 1,000,000 hectares, located in

the provinces of Pangasinan, Tarlac, Nueva Ecija, La

Union, Iloilo, Cotabato, Davao and Agusan.

ISSUE W/N SAN JOSE MAY TIE UP WITH SAN JOSE OIL

RULING NO- FRAUDULENT ARTICLES OF INCORPORATION

of the corporation is a party to or has an interest in, such contract or transaction,

or has in anyway connected with such other person or persons, firm, association

or partnership; and finally, that all and any of the persons who may become

director or officer of the corporation shall be relieved from all responsibility for

which they may otherwise be liable by reason of any contract entered into with

the corporation, whether it be for his benefit or for the benefit of any other

person, firm, association or partnership in which he may be interested.

that any and all persons who may become directors or officers of this

company are hereby relieved of all responsibility which they would

otherwise incur by reason of any contract entered into which this company

either for their own benefit, or for the benefit of any person, firm,

association or corporation in which they may be interested.

The impact of these provisions upon the traditional judiciary relationship

between the directors and the stockholders of a corporation is too obvious to

escape notice by those who are called upon to protect the interest of

investors. The directors and officers of the company can do anything, short

of actual fraud, with the affairs of the corporation even to benefit

themselves directly or other persons or entities in which they are interested,

and with immunity because of the advance condonation or relief from

responsibility by reason of such acts. This and the other provision which

authorizes the election of non-stockholders as directors, completely

disassociate the stockholders from the government and management of the

business in which they have invested.

(1) the directors of the Company need not be shareholders;

(2) that in the meetings of the board of directors, any director may be represented

and may vote through a proxy who also need not be a director or stockholder;

and

(3) that no contract or transaction between the corporation and any other

association or partnership will be affected, except in case of fraud, by the fact

that any of the directors or officers of the corporation is interested in, or is a

director or officer of, such other association or partnership, and that no such

contract or transaction of the corporation with any other person or persons, firm,

association or partnership shall be affected by the fact that any director or officer

To cap it all on April 17, 1957, admittedly to assure continuity of the

management and stability of SAN JOSE PETROLEUM, OIL

INVESTMENTS, as holder of the only subscribed stock of the former

corporation and acting "on behalf of all future holders of voting trust

certificates," entered into a voting trust agreement

And these are the voting trust certificates that are offered to investors as

authorized by Security and Exchange Commissioner. It can not be

doubted that the sale of respondent's securities would, to say the least,

work or tend to work fraud to Philippine investors.

You might also like

- Digest - YASCO V CADocument1 pageDigest - YASCO V CAMaria Anna M LegaspiNo ratings yet

- Tally Assignment AfrozDocument17 pagesTally Assignment AfrozAfrozNo ratings yet

- BSB Group Vs Sally GoDocument2 pagesBSB Group Vs Sally GoAldrin TangNo ratings yet

- Labao v. ComelecDocument3 pagesLabao v. ComelecAldrin TangNo ratings yet

- Need Expectation of Interested Parties According To I So 220002018Document2 pagesNeed Expectation of Interested Parties According To I So 220002018Shivyog SanatanNo ratings yet

- Norse Management Co. v. NSBDocument2 pagesNorse Management Co. v. NSBbenjo2001100% (1)

- Startup Finance-A Entrepreneur ManualDocument37 pagesStartup Finance-A Entrepreneur ManualDhananjay SharmaNo ratings yet

- Uggi Lindamand Therkelsen Vs Republic - FulltextDocument1 pageUggi Lindamand Therkelsen Vs Republic - Fulltextscartoneros_1No ratings yet

- DIGEST Rule 67 4 Robern Devt V Quitain 1999Document4 pagesDIGEST Rule 67 4 Robern Devt V Quitain 1999MarDNo ratings yet

- Option GreeksDocument2 pagesOption GreeksajjupNo ratings yet

- TR Legaltech Startup Report 2019Document23 pagesTR Legaltech Startup Report 2019DaEnigmaticNo ratings yet

- Pecson V MediavilloDocument3 pagesPecson V Mediavillopreciousrain07No ratings yet

- Ra 876Document12 pagesRa 876csncsncsnNo ratings yet

- Will Dispute Over Estate of Tomas RodriguezDocument1 pageWill Dispute Over Estate of Tomas RodriguezReyesJosellereyesNo ratings yet

- Limbona vs. Mangelin case examines jurisdiction over autonomous governmentsDocument1 pageLimbona vs. Mangelin case examines jurisdiction over autonomous governmentsAldrin TangNo ratings yet

- Limbona vs. Mangelin case examines jurisdiction over autonomous governmentsDocument1 pageLimbona vs. Mangelin case examines jurisdiction over autonomous governmentsAldrin TangNo ratings yet

- CAMPOS VS. ORTEGA TITLE DISPUTEDocument4 pagesCAMPOS VS. ORTEGA TITLE DISPUTEKC BarrasNo ratings yet

- Bourns v. Carman, G.R. No. 2800, (December 4, 1906), 7 PHIL 117-120)Document3 pagesBourns v. Carman, G.R. No. 2800, (December 4, 1906), 7 PHIL 117-120)Cristine BilocuraNo ratings yet

- Filipinas Life Assurance CoDocument2 pagesFilipinas Life Assurance CodayneblazeNo ratings yet

- p2 - Guerrero Ch9Document49 pagesp2 - Guerrero Ch9JerichoPedragosa72% (36)

- Neyra Vs Neyra 76 Phil 296Document6 pagesNeyra Vs Neyra 76 Phil 296JohnRouenTorresMarzoNo ratings yet

- Ligot v. MathayDocument2 pagesLigot v. MathayAldrin TangNo ratings yet

- ALEJANDRA MINA, ET AL. vs . RUPERTA PASCUAL, ET AL. Land Ownership DisputeDocument5 pagesALEJANDRA MINA, ET AL. vs . RUPERTA PASCUAL, ET AL. Land Ownership DisputeShivaNo ratings yet

- ABS-CBN vs Court of Appeals on Film Rights DisputeDocument1 pageABS-CBN vs Court of Appeals on Film Rights DisputeAdrianNo ratings yet

- Central Mindanao University Vs DARABDocument1 pageCentral Mindanao University Vs DARABAldrin TangNo ratings yet

- General Insurance v Ng Hua - No Double InsuranceDocument2 pagesGeneral Insurance v Ng Hua - No Double InsuranceJovelan V. Escaño0% (1)

- Plaintiff-Appellant vs. vs. Defendants-Appellees Angeles, Maskariño & Associates Victorio S. AdvinculaDocument3 pagesPlaintiff-Appellant vs. vs. Defendants-Appellees Angeles, Maskariño & Associates Victorio S. AdvinculaSecret SecretNo ratings yet

- Gonzalez La O vs. Yek Tong Lin Fire & Marine Ins. Co.Document2 pagesGonzalez La O vs. Yek Tong Lin Fire & Marine Ins. Co.Minglana KarlNo ratings yet

- Worcester v. OcampoDocument27 pagesWorcester v. OcampoJerickson A. ReyesNo ratings yet

- CRUZ V. CRUZ (G.R. No. 173292 September 1, 2010)Document1 pageCRUZ V. CRUZ (G.R. No. 173292 September 1, 2010)MhareyNo ratings yet

- Union Manufacturing Co., Inc. and Republic Bank v. Philippine Guaranty Co., Inc. DigestDocument1 pageUnion Manufacturing Co., Inc. and Republic Bank v. Philippine Guaranty Co., Inc. DigestNinaNo ratings yet

- Garcia v Bisaya: Action for Reformation of Deed Dismissed for Lack of Cause of ActionDocument1 pageGarcia v Bisaya: Action for Reformation of Deed Dismissed for Lack of Cause of ActionAldrin TangNo ratings yet

- Garcia v Bisaya: Action for Reformation of Deed Dismissed for Lack of Cause of ActionDocument1 pageGarcia v Bisaya: Action for Reformation of Deed Dismissed for Lack of Cause of ActionAldrin TangNo ratings yet

- Heirs Cannot Claim Estate Properties Before Debts Are PaidDocument1 pageHeirs Cannot Claim Estate Properties Before Debts Are PaidAaliyah AndreaNo ratings yet

- Bautista VS AquinoDocument1 pageBautista VS AquinoJoesil DianneNo ratings yet

- in Re Will of RiosaDocument1 pagein Re Will of Riosajerico kier nonoNo ratings yet

- 03 FABRIGAS V DEL MONTE DigestDocument2 pages03 FABRIGAS V DEL MONTE DigestAldrin TangNo ratings yet

- Investors Perception Towards Real Estate InvestmentDocument38 pagesInvestors Perception Towards Real Estate InvestmentMohd Fahd Kapadia25% (4)

- Agent's land purchase for plaintiffs upheldDocument1 pageAgent's land purchase for plaintiffs upheldOwen BuenaventuraNo ratings yet

- OPRES vs. BuenaobraDocument1 pageOPRES vs. BuenaobraAldrin TangNo ratings yet

- Unido v. ComelecDocument2 pagesUnido v. ComelecAldrin TangNo ratings yet

- Gerona v. De Guzman (CELAJE) - Prescription for Action to Nullify Extrajudicial SettlementDocument2 pagesGerona v. De Guzman (CELAJE) - Prescription for Action to Nullify Extrajudicial SettlementJosh CelajeNo ratings yet

- Visayan Although Residing in San Juan, Rizal at The Time of His Death. The Will Was Executed in The CityDocument1 pageVisayan Although Residing in San Juan, Rizal at The Time of His Death. The Will Was Executed in The CityPraisah Marjorey PicotNo ratings yet

- Probate of Will in Unknown LanguageDocument4 pagesProbate of Will in Unknown LanguageGlen EnterinaNo ratings yet

- UP vs. ReginoDocument1 pageUP vs. ReginoAldrin TangNo ratings yet

- Duran Vs IACDocument2 pagesDuran Vs IACApple ObiasNo ratings yet

- Vizconde Massacre Estate Dispute Decided by Supreme CourtDocument17 pagesVizconde Massacre Estate Dispute Decided by Supreme CourtRB Balanay100% (1)

- Allied Bank Seeks Payment from Guarantors for Unpaid Export BillDocument12 pagesAllied Bank Seeks Payment from Guarantors for Unpaid Export BillRoberto Damian JrNo ratings yet

- Digest - Team Energy Corporation V CirDocument2 pagesDigest - Team Energy Corporation V CirArthur SyNo ratings yet

- BORROMEO-HERRERA V. BORROMEODocument1 pageBORROMEO-HERRERA V. BORROMEODon YcayNo ratings yet

- BRITISH AIRWAYS, Petitioner, vs. COURT OF APPEALS, GOP MAHTANI, and PHILIPPINE AIRLINES, Respondents.Document2 pagesBRITISH AIRWAYS, Petitioner, vs. COURT OF APPEALS, GOP MAHTANI, and PHILIPPINE AIRLINES, Respondents.Charles Roger RayaNo ratings yet

- 34.uy Siuliong vs. Director of Commerce and IndustryDocument7 pages34.uy Siuliong vs. Director of Commerce and Industryvince005No ratings yet

- AFWU v. Maritima Shipping DisputeDocument4 pagesAFWU v. Maritima Shipping Disputetin tinNo ratings yet

- 01 Alvarez V IACDocument2 pages01 Alvarez V IACFranco David BaratetaNo ratings yet

- Gaviola DigestDocument2 pagesGaviola DigestkarlonovNo ratings yet

- 176 - Salafranca v. Philamlife (Pamplona)Document1 page176 - Salafranca v. Philamlife (Pamplona)Janice KimayongNo ratings yet

- Preterition of heirs under Article 814 of the Civil CodeDocument18 pagesPreterition of heirs under Article 814 of the Civil CodeDiane JulianNo ratings yet

- Negotiation Stage and Contract FormationDocument10 pagesNegotiation Stage and Contract FormationGen GrajoNo ratings yet

- Partnerships, Agency, and TrustsDocument3 pagesPartnerships, Agency, and TrustsGloriette Marie AbundoNo ratings yet

- Marcos Estate Case Deposition AdmissibilityDocument3 pagesMarcos Estate Case Deposition Admissibilityidmu bcpo100% (1)

- 12 Supreme Court Reports Annotated: Llenares vs. Court of AppealsDocument6 pages12 Supreme Court Reports Annotated: Llenares vs. Court of AppealsKenmar NoganNo ratings yet

- Agency Dispute Over Partnership SaleDocument25 pagesAgency Dispute Over Partnership SalevalkyriorNo ratings yet

- New Succession DigestDocument9 pagesNew Succession DigestAttorneyAngieNo ratings yet

- American Home Assurance vs. Antonio Chua 2Document11 pagesAmerican Home Assurance vs. Antonio Chua 2John CorpuzNo ratings yet

- Insurance Digest 1Document13 pagesInsurance Digest 1joenelNo ratings yet

- Digest Fernandez Vs Dela RosaDocument2 pagesDigest Fernandez Vs Dela RosaXing Keet LuNo ratings yet

- Probate of holographic willDocument21 pagesProbate of holographic willLance KerwinNo ratings yet

- Partnership Dispute Over Fish Business AssetsDocument2 pagesPartnership Dispute Over Fish Business AssetsSRB4No ratings yet

- Busorg1 DigestDocument5 pagesBusorg1 DigestOwie JoeyNo ratings yet

- Sun Insurance Office, Ltd. vs. Court of AppealsDocument6 pagesSun Insurance Office, Ltd. vs. Court of AppealsJaja Ordinario Quiachon-AbarcaNo ratings yet

- Dissolution of fishpond partnership due to illegalityDocument1 pageDissolution of fishpond partnership due to illegalityIsha SorianoNo ratings yet

- Eurotech v. Cuizon: Manager acted within authority signing deedDocument2 pagesEurotech v. Cuizon: Manager acted within authority signing deedDean LozarieNo ratings yet

- SC ruling on usufruct granted to foreignerDocument4 pagesSC ruling on usufruct granted to foreignerIvy PazNo ratings yet

- Intramuros Administration vs. Offshore ConstructionDocument43 pagesIntramuros Administration vs. Offshore ConstructionPreciousNo ratings yet

- Duduaco v Laquindanum judge liability gross ignorance lawDocument1 pageDuduaco v Laquindanum judge liability gross ignorance lawRon DecinNo ratings yet

- Imperial v. CA: Prescription Bars Claim to Reduce Inofficious DonationDocument2 pagesImperial v. CA: Prescription Bars Claim to Reduce Inofficious DonationAlyanna ApacibleNo ratings yet

- PSC Grants Estate CPC to Operate Ice PlantDocument24 pagesPSC Grants Estate CPC to Operate Ice PlantSwitle Mae TamangNo ratings yet

- GUILLERMO-Vda. de Chua vs. IAC (Lease)Document1 pageGUILLERMO-Vda. de Chua vs. IAC (Lease)PATRICIA MAE GUILLERMONo ratings yet

- 122 Palting V San Jose Petroleum (DELFIN)Document3 pages122 Palting V San Jose Petroleum (DELFIN)AlexandraSoledadNo ratings yet

- Callanta v. Carnation Phils. DigestDocument2 pagesCallanta v. Carnation Phils. DigestAldrin TangNo ratings yet

- Prejudicial Question Suspends Estafa CaseDocument9 pagesPrejudicial Question Suspends Estafa CaseJohzzyluck R. Maghuyop0% (1)

- Capuno V Pepsi ColaDocument1 pageCapuno V Pepsi ColaAldrin TangNo ratings yet

- 2019 ICT Syllabus FInalDocument9 pages2019 ICT Syllabus FInalOli ReyesNo ratings yet

- Multi Realty Dev't Corp V Makati Tuscanay CondoDocument2 pagesMulti Realty Dev't Corp V Makati Tuscanay CondoAldrin TangNo ratings yet

- O Written Agreement After Counteroffers and AAC's AppraisalDocument1 pageO Written Agreement After Counteroffers and AAC's AppraisalAldrin TangNo ratings yet

- Provincial Sheriff of Pampanga vs. CADocument1 pageProvincial Sheriff of Pampanga vs. CAAldrin TangNo ratings yet

- Mariano vs. COMELECDocument1 pageMariano vs. COMELECAldrin TangNo ratings yet

- Espanol v. ChairmanDocument1 pageEspanol v. ChairmanAldrin TangNo ratings yet

- Tanguilig v. CA DigestDocument1 pageTanguilig v. CA DigestAldrin TangNo ratings yet

- Biala Vs CADocument1 pageBiala Vs CAAldrin TangNo ratings yet

- Paredes v. Espino DigestDocument1 pageParedes v. Espino DigestAldrin TangNo ratings yet

- Osmena Vs PendatunDocument2 pagesOsmena Vs PendatunAldrin TangNo ratings yet

- Shoemaker v. La TondenaDocument1 pageShoemaker v. La TondenaAldrin TangNo ratings yet

- Verendia Vs CADocument1 pageVerendia Vs CAAldrin TangNo ratings yet

- Definition of TermsDocument2 pagesDefinition of TermsAldrin TangNo ratings yet

- Baytan V ComelecDocument2 pagesBaytan V ComelecAldrin TangNo ratings yet

- 160 Pamatong Vs ComelecDocument2 pages160 Pamatong Vs ComelecJulius Geoffrey TangonanNo ratings yet

- BP Investment AppraisalDocument71 pagesBP Investment Appraisalprashanth AtleeNo ratings yet

- Investment Banking ProjectDocument51 pagesInvestment Banking ProjectpbasanagoudaNo ratings yet

- Chapter 1 Securities Operations and Risk ManagementDocument32 pagesChapter 1 Securities Operations and Risk ManagementMRIDUL GOELNo ratings yet

- Summit Bank Final-1Document48 pagesSummit Bank Final-1ABDUL BASIT100% (2)

- Clemente Ronaliza Auditing ProblemsDocument9 pagesClemente Ronaliza Auditing ProblemsEsse ValdezNo ratings yet

- Chapter 05 AnsDocument42 pagesChapter 05 AnsLuisLoNo ratings yet

- (Centre For Central Banking Studies Bank of EnglandDocument54 pages(Centre For Central Banking Studies Bank of Englandmalik naeemNo ratings yet

- AdSurf PonziDocument23 pagesAdSurf PonzibizopNo ratings yet

- ch17 - Modern Auditing - 8e - Boynton - 2006 Auditing The Investing and Financing CyclesDocument27 pagesch17 - Modern Auditing - 8e - Boynton - 2006 Auditing The Investing and Financing CyclesAvon Jade RamosNo ratings yet

- Stand ChartDocument804 pagesStand Chartnagaraj100No ratings yet

- Multiple choice and short problems on accounting topicsDocument7 pagesMultiple choice and short problems on accounting topicsKenny BrownNo ratings yet

- Calculating Equity Risk for Ambuja Cements Ltd Using BetaDocument9 pagesCalculating Equity Risk for Ambuja Cements Ltd Using BetaGouravKumarNo ratings yet

- NI LUH 2021 Company Value Profitability ROADocument11 pagesNI LUH 2021 Company Value Profitability ROAFitra Ramadhana AsfriantoNo ratings yet

- Inv How-To Manual V Erwin OpallaDocument264 pagesInv How-To Manual V Erwin OpallaBudi SafrudinNo ratings yet

- Probable Solution For Questions Asked - Current Batch - March 2015Document30 pagesProbable Solution For Questions Asked - Current Batch - March 2015aditiNo ratings yet

- Chapter 3 Beams 13ed RevisedDocument31 pagesChapter 3 Beams 13ed RevisedEvan AnwariNo ratings yet

- Lecture 1 - Introduction To BankingDocument23 pagesLecture 1 - Introduction To BankingLeyli MelikovaNo ratings yet

- 141 14 513Document53 pages141 14 513Pik PokNo ratings yet

- FIN20014 Assignment 2015 SP2 - Capital Budgeting AssignmentDocument3 pagesFIN20014 Assignment 2015 SP2 - Capital Budgeting AssignmentAssignment Consultancy0% (1)

- Vesuvius India - Result Update-jun-17-EdelDocument11 pagesVesuvius India - Result Update-jun-17-EdelanjugaduNo ratings yet

- Factoring and ForfaitingDocument34 pagesFactoring and ForfaitingAbhishek JhaveriNo ratings yet

- Chapter 16 Budgeting Capital Expenditures Research and Development Expenditures and Cash Pert Cost The Flexible BudgetDocument17 pagesChapter 16 Budgeting Capital Expenditures Research and Development Expenditures and Cash Pert Cost The Flexible BudgetZunaira ButtNo ratings yet

- Project 1 - FCF Intel Example - DirectionsDocument27 pagesProject 1 - FCF Intel Example - Directionsअनुशा प्रसादम्No ratings yet