Professional Documents

Culture Documents

21 Useful Charts of Tax Compliance

Uploaded by

anon_821432617Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

21 Useful Charts of Tax Compliance

Uploaded by

anon_821432617Copyright:

Available Formats

7th Edition

June, 2016

Gujarat Edition

21

Useful Charts

for Tax Compliance

For Financial Year 2016-17

CA. Amish Khandhar, Ahmedabad

CA. Dinesh Kumar Tejwani, Mumbai

Covering:

Income Tax

Companies Act

Service Tax

GVAT

PF - ESIC

Excise

TDS/TCS Rates

Copyright for Gujarat Edition :

CA. Amish Khandhar, Ahmedabad

CA. Dinesh Kumar Tejwani, Mumbai

Price Rs. 100/Published By :

KMS Advisory Services Pvt. Ltd.

3rd Floor, Devpath Complex, B/h. Lal Bunglow, Off C. G. Road, Ahmedabad - 380 006.

Tel. : 079-2646 1526, 6631 5450/51/52/53

First Edition

: January, 2010

Seventh Edition : June, 2016

Type Setting

Printed by

: Vaishali Printers, Ahmedabad (M) 96240 69110

: Plus Offset, Ahmedabad

Disclaimer :

All efforts have been made to avoid errors or omissions in this book. However, errors may happen. Neither the publishers,

nor the authors or sellers will be responsible for any damage or loss of action to any one, of any kind, in any manner.

No part of this book may be reproduced or copied in any form or by any form or by any means without the written

permission of the publishers.

All disputes are subject to Ahmedabad Jurisdiction only.

Note from Publisher :

With multiple laws and complex compliance requirements, one has to keep referring to several publications and web sites.

This book is an attempt to bring several areas of legal compliance at a single place in a very simple and easy manner.

We are sure our readers will benefit from this useful compilation.

We welcome your comments at amish@kmsindia.in

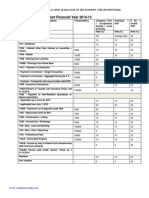

Statistics of Tax Revenue in India (Rs. in Crores)

Source : www.indiabudget.nic.in

Revenue

2012-13

2013-14

2014-15

2015-16

2016-17

(Estimated)

Gross Tax Revenue 10,36,234

11,38,734

12,45,136

14,59,811

16,31,138

Corporation Tax

3,56,326

3,94,678

4,28,925

4,52,970

4,93,923

Income Tax

2,01,486

2,42,857

2,58,326

2,91,653

3,45,776

Customs

1,65,346

1,72,085

1,88,016

2,09,500

2,30,000

Central Excise

1,76,535

1,70,197

1,88,128

2,83,353

3,17,860

Service Tax

1,32,601

1,54,778

1,67,969

2,10,000

2,31,000

INDEX

1.

Income Tax Rates .......................................................4

2.

Securities Transaction Tax Rates (STT) ...............................5

3.

Tax on Distribution of Dividend (DDT) ................................5

4.

TDS Rate Chart...........................................................6

5.

TCS Rate Chart...........................................................8

6.

Carry forward & Set off of Losses.....................................8

7.

Capital Gains Tax Rates.................................................9

8.

Cost Inflation Index ....................................................9

9.

Presumptive Taxation: Income Tax .................................10

10.

Interest Payable: Income Tax ........................................10

11.

Audit Requirements / Advance Tax ..................................11

12.

Penalties under Income Tax Act......................................12

13.

Depreciation Chart - Income Tax & Companies Act ...............13

14.

Registrar of Companies (RoC) Compliance .........................16

15.

VAT - Gujarat............................................................18

16.

PF/ESIC & Payroll Compliance .......................................19

17.

Due Dates Chart ........................................................20

18.

Excise Duty: Periodical Returns .....................................20

19.

Service Tax Compliance ..............................................21

20.

Table of Abatements : Service Tax ..................................22

21.

Penalties : Service Tax ................................................23

Income Tax Rates

For Individuals, HUF, AOP, BOI

Assessment

Year

2017-18

General

Rate

Senior Citizen (Indian Resident)

60 to 79 years

Nil

10%

20%

30%

Upto 2,50,000

2,50,001 to 5,00,000

5,00,001 to 10,00,000

Above 10,00,000

80 years & above

Upto 3,00,000

Upto 5,00,000

3,00,001 to 5,00,000

5,00,001 to 10,00,000 5,00,001 to 10,00,000

Above 10,00,000

Above 10,00,000

Surcharge @ 15% if Total Income exceeds 1 Crore

Assessment

Year

2016-17

General

Rate

Senior Citizen (Indian Resident)

60 to 79 years

Nil

10%

20%

30%

Cess @3%

Upto 2,50,000

2,50,001 to 5,00,000

5,00,001 to 10,00,000

Above 10,00,000

80 years & above

Upto 3,00,000

Upto 5,00,000

3,00,001 to 5,00,000

5,00,001 to 10,00,000 5,00,001 to 10,00,000

Above 10,00,000

Above 10,00,000

Surcharge @ 12% if Total Income exceeds 1 Crore

Cess @3%

Income Tax Rates - Companies/Firms/LLPs/Local Authorities

Assessment Year 2017-18

Total Income

Rate of Income Tax (%)

Rate of MAT/AMT (%)

Tax Rates for Domestic Companies

Upto ` 1 Crore

Exceeding ` 1 Crore but not exceeding 10 Crore

Exceeding ` 10 Crore

30.900*

33.063

34.608

19.055

20.389

21.342

Tax Rates for Foreign Companies

Upto ` 1 Crore

Exceeding ` 1 Crore but not exceeding 10 Crore

Exceeding ` 10 Crore

41.200

42.024

43.260

19.055

19.436

20.008

Tax Rates for Firms / LLPs/Local Authorities

Upto ` 1 Crore

Exceeding 1 Crore

30.900

34.608

19.055

21.342

* In case of Domestic company having turnover of less than ` 5 crore during F.Y. 2014-15, the tax rate will be 29% for A.Y. 2017-18

Income Tax Rates : Co-operative Societies

Assessment Year 2017-18

Net Income Range

Rate of Income Tax

Upto ` 10,000

` 10,001 to ` 20,000

Above ` 20,000

Surcharge

If income upto ` 1 Crore

If income Exceeds ` 1 Crore

Education Cess

Secondary and Higher Education Cess

10%

20%

30%

Nil

12%

2%

1%

19.055

21.342

Securities Transaction Tax Rates (STT)

Transaction

Purchase/Sale of equity shares, units of equity

oriented mutual fund (delivery based)

Sale of equity shares, units of equity oriented

Mutual fund/Units of Business Trust (non-delivery based)

Sale of an option in securities (w.e.f. 01-06-2016 onwards)

Sale of an option in securities, where option is exercised

Sale of futures in securities

01-06-2013 onwards

Sale of unit of an equity oriented fund to the Mutual Fund

01-06-2013 onwards

Sale of unlisted equity shares under an offer for sale to public

Alternative Minimum Tax(AMT)

Rates

Payable By

0.10%

Purchaser / Seller

0.025%

0.05%

0.125%

Seller

Seller

Purchaser

0.01%

Seller

0.001%

0.20%

Seller

Seller

Tax on Distribution of Dividend (DDT) / Buyback of Shares

Payable By

Domestic Company

Domestic Company

Securitisation Trust

Securitisation Trust

Applicable On

Dividend Distribution

Tax on buyback of unlisted shares

Income distribution to investors : Individual/HUF

Income distribution to investors : Other persons

Section

115-O

115QA

115TA

115TA

Rate

20.358

23.072

28.840

34.608

TDS Rate Chart : Resident

4

Assessment Year 2017-18

FINANCIAL YEAR 2016-2017

Nature of payments

made to resident

Sec.

194A

Description

Threshold

Limit

Amount

Company Firm

If No PAN

Individual

Co-op Soc.

Or

HUF

Local Authority

Invalid PAN

Rate

Rate

Rate

Interest - Payable by Banks

10,000

10

10

20

Interest - Payable by Others

5,000

10

10

20

10,000

30

30

30

194B Winning from Lotteries / Crossword Puzzle

Payment to Contractors - Single Transaction

30,000

20

1,00,000

20

15,000

5/10*

20

1,00,000

20

15,000

20

Rent

1,80,000

10

10

20

Rent-Plant / Machinery

1,80,000

20

30,000

10

10

20

10

10

20

2,500

10

10

20

194BB Winnings from horse race

10,000

30

30

30

194F Repurchase Units by MFs

20

20

20

15,000

20

2,50,000

10

10

20

50,00,000

20

194C

Payment to Contractors - Aggregate during FY

194D Insurance Commission

194DA Non-exempt payments made under a life

insurance policy

194H Commission / Brokerage

194 I

194J

Professional Fees

Director Fees

194

Dividends

194G Commission - Lottery

194LA Immovable Property (Compulsory Acquisition)

194IA Transfer of immovable property, other than

agricultural land

* Tax should be deducted @10% in case the payee is Company assessee.

TDS Rate Chart : Non-Resident

Assessment Year 2017-18

FINANCIAL YEAR 2016-2017

Non-Resident

Section

194B

194BB

194E

194F

194G

194G

194LB

194LC

194LD

196B

196C

196D

195

a

b

(i)

(ii)

c

d

e

(i)

(i)

(ii)

f

(i)

(ii)

g

Nature of Payments

Winning from lotteries / Crossword puzzle

Winning from horse race

Payment to foreign citizen sports person/ entertainer

Repurchases of units by Mutual Funds

Commission on sale of lottery tickets (upto 31-05-2016)

Commission on sale of lottery tickets (from 01-06-2016)

Interest by infrastructure debt fund

Interest on approved long infrastructure bond

Interest on rupee denominated bond

Income from units to an offshore fund

Interest of foreign currency bonds or GDR

Income from security to FII

Other Sum

income of foreign exchange asset to Indian Citizen

Long Term Capital Gains

Under Sec 115E / 112(1)(c)(iii)

Other

Short Term Capital Gains - Sec. 111A

Interest on foreign currency loan by Govt. /Indian company

Royalty

In respect of copyright on books/computer software

Others

Agreement made between 01-04-61 and 31-03-76

Agreement made after 31-03-76

Fees for technical service

Agreement made between 01-03-64 and 31-3-76

Agreement made after 31-3-76

any other income

Non Domestic Company

Upto `

1 Crore

More

than

`1

Crore*

More than

`

More

Upto ` 1 Crore

than

1 Crore but upto ` 10

`

Crore

10 Crore

30.900

30.900

20.600

20.600

10.300

5.150

5.150

5.150

5.150

10.300

10.300

20.600

35.535

35.535

23.690

23.690

11.845

5.923

5.923

5.923

5.923

11.845

11.845

23.690

30.900

30.900

20.600

NA

10.300

5.150

5.150

5.150

5.150

10.300

10.300

20.600

31.518

31.518

21.012

NA

10.506

5.253

5.253

5.253

5.253

10.506

10.506

21.012

32.445

32.445

21.630

NA

10.815

5.408

5.408

5.408

5.408

10.815

10.815

21.630

20.600

23.690

NA

NA

NA

10.300

20.600

15.450

20.600

11.845

23.690

17.768

23.690

10.300

20.600

15.45

20.600

10.506

21.012

15.759

21.012

10.815

21.630

16.223

21.630

10.300

11.845

10.300 10.506 10.815

30.900

10.300

35.535

11.845

51.500 52.530 54.075

10.300 10.506 10.815

30.900

10.300

30.900

35.535

11.845

35.535

51.500 52.530 54.075

10.300 10.506 10.815

41.200 42.024 43.26

* Before 01-06-2016 relevant surcharge was 12%

* In case if recipient is a non resident co-operative society or firm, surcharge will be 12%

TCS Rate Chart

5

Assessment Year 2017-18

Nature of Goods

Resident

Any

Amount

Non-Resident

Upto

`

1 Crore

More

than

`

1 Crore*

Non Domestic Company

More than More

Upto

` 1 Crore than

`

`

but upto

1 Crore

`10 Crore 10 Crore

Alcoholic liquor for human Consumption

1.000

1.030

1.185

1.030

1.051

1.082

Indian made foreign liquor

1.000

1.030

1.185

1.030

1.051

1.082

Tendu leaves

5.000

5.150

5.923

5.150

5.253

5.408

Timber obtained under forest lease

2.500

2.575

2.961

2.575

2.626

2.704

Timber obtained by any mode other than a forest lease

2.500

2.575

2.961

2.575

2.626

2.704

Any other forest produce not being timber or tendu leaves 2.500

2.575

2.961

2.575

2.626

2.704

Scrap

1.000

1.030

1.185

1.030

1.051

1.082

Minerals, being coal or lignite or Iron ore.

1.000

1.030

1.185

1.030

1.051

1.082

Parking lot, Toll Plaza, Mining and quarring

2.000

2.060

2.369

2.060

2.101

2.163

Cash consideration for Bullion exceeding ` 2 lakh &

1.000

1.030

1.154

1.030

1.051

1.082

1.000

1.030

1.154

1.030

1.051

1.082

1.000

1.030

1.154

1.030

1.051

1.082

Jewellery exceeding ` 5 lakh

Cash consideration for any other goods / service

excedding ` 2 lakh

(w.e.f. 01-06-16)

Motor vehicle of value exceeding ` 10 lakh (w.e.f.01-06-16)

* In case of a non resident co-operative society or firm, surcharge will be 12%

Carry forward and Set off of Losses

Sr.

Type of loss

1. House Property

2. Speculation

3. Unabsorbed Depreciation /

Cap Exp on SR / Family Plan

4. Other business losses

5. Short Term Capital Losses

6. Long Term Capital Losses

7. Owning / Maintaining race horses

8. Specified Business u/s 35AD

Set off under/ Against*

Income under head house property

Speculation

Any income

(other than salary)

Normal Business Profit

Short Term / Long Term Capital Gains

Long Term Capital Gains

Owning / Maintaining race horses

Specified Business u/s 35AD

Carried forward for

8 years

4 Years

No Limit

8 Years

8 Years

8 Years

4 Years

No Limit

* No Loss can be set off against winning from lotteries, crossword puzzles, races including horse race, card games and any sort of

receipt from gambling or betting of any form or nature.

* For Loss to be carried forward for future periods, Return of loss must be filed in time.

Capital Gains Tax Rates

7

Assessment Year 2017-18

Particulars

Short-Term Capital

Long-Term Capital

Gains Tax Rates

Gains Tax Rates

Sale transactions of equity shares / unit

of an equity oriented fund which attract STT

15%

Nil

Slab rates

Other than unlisted - 20%

Sale transaction other than mentioned above:

Non-residents Individuals

Unlisted - 10%

Resident Individuals

Slab rates

Firms including LLP (resident and

20% with indexation

non-resident)

30%

10% without indexation

Resident Companies

30%

Overseas financial organisations specified

40% (corporate)

section 115AB

30% (non-corporate)

10%

FIIs

30%

10%

Other Foreign companies

40%

20% / 10%

Local authority

30%

20% with indexation

Co-operative society

Progressive slab rates 10% without indexation

These rates will further increase by applicable surcharge & education cess.

Cost Inflation Index

8

F.Y.

1981-82

1982-83

1983-84

1984-85

1985-86

1986-87

1987-88

1988-89

1989-90

INDEX

100

109

116

125

133

140

150

161

172

F.Y.

1990-91

1991-92

1992-93

1993-94

1994-95

1995-96

1996-97

1997-98

1998-99

INDEX

182

199

223

244

259

281

305

331

351

F.Y

1999-00

2000-01

2001-02

2002-03

2003-04

2004-05

2005-06

2006-07

2007-08

INDEX

389

406

426

447

463

480

497

519

551

F.Y.

2008-09

2009-10

2010-11

2011-12

2012-13

2013-14

2014-15

2015-16

2016-17

INDEX

582

632

711

785

852

939

1024

1081

1125

Presumptive Taxation : Income Tax

All Resident Taxpayers

Rate at which Income is presumed

Business

(i) Small Business [excluding (ii)]

[Section 44AD] (Note : a, b, c, d)

8% of gross turnover/ receipts

(ii) Plying, leasing or hiring of trucks (person should not have

owned over 10 goods carriages at any time during the

previous year) [Section 44AE] (Note : b, b1, c)

` 7,500 per month / part of month

irrespective of vehicle capacity

(from A.Y. 2015-16 onwards)

50% of gross receipts

(iii) Professionals (Section 44ADA) (Note : a, b, c)

Non-Resident Taxpayer

Rate at which Income is presumed

Business

Shipping (b)

Exploration of mineral oil (b)(c)

Operations of Aircraft (b)

Turnkey power projects (b)(c)

7.5% of gross receipts

10% of gross receipts

5% of gross receipts

10% of gross receipts

(a) The assessee is eligible for the option of Presumptive Taxation if the gross receipts of the taxpayer does not

exceed ` 2 Crore in case of business and ` 50 lakh in case of professional

(b) All deductions/expenses (including depreciation) shall be deemed to have been allowed.

(b1) Additional deduction of partners's interest & remuneration in case of firm is allowed.

(c) The taxpayer can claim lower profits, if he keeps and maintains specified books of accounts and gets its

account audited u/s.44AB

(d) Applicable to Individuals, Hindu Undivided Families and Firm - excludes LLP, tax payer availing deduction

under Section 10A/10AA/10B/10BA or Chapter VI-A(C) of the Act.

Interest payable : Income Tax

10

Description

Rate

Period From

Delay in furnishing return of income 1% p.m.

Not furnishing return of income

1% p.m.

Due date

Due date

Failure to pay advance tax, 90% of 1% p.m.

assessed tax as advance tax

Deferring Advance Tax

1% p.m.

Failure to deduct tax at source

1% p.m.

Failure to deposit tax in time

1.5% p.m.

Failure to pay DDT

1%p.m.

Excess Refund Paid

0.5%p.m.

Period To

Section

1st April of AY

Date return furnished

Date of completion of

assessment U/S 144

Date Tax Payment is made

234A

234B

Due date

Date of payment/credit

Date of deduction

Due date

Date of refund

Due date of next instalment

Date of deduction

Date of deposit

Date of Payment

Date of regular assessment

234C

201(1A)

201(1A)

115P

234D

10

234A

Audit Requirements

11

Presumptive Taxation

Audit

Particulars Requirement

Section 44AD / 44ADA

Business

Section 44AE

Other than

Presumptive

Taxation

Section 44AB

Audit is

Turnover is less than

not required ` 2 Crore and profit is 8%

of T/o or more

1) Less than 10 vehicles

2) ` 7,500 per month / part of

month irrespective of vehicle

capacity

Audit is

required

1) 10 or more vehicles OR

Turnover is more

2) Income is less than ` 7,500 than ` 1 Crore

per month / per vehicle

1) Turnover is more than ` 2 Crore

2) Turnover is less than ` 2 Crore

and Profit is less then 8%

Profession Audit is

Gross receipt upto ` 50 lakhs and

not required profit is 50% of gross receipt or more

Audit

required

Turnover is less

than ` 1 Crore

Gross receipt less

than `50 lakhs

Gross receipt

more than ` 50

lakhs

1)Gross receipt more than ` 50 lakhs

2) Gross receipt less than ` 50 lakhs

and profit less than 50%

Advance Tax

Due Date

Corporate & Non-Corporate

*Assessee covered by presumptive Taxation*

15th June

Up to 15%

---

15th Sep

Up to 45%

---

15th Dec

Up to 75%

---

15th Mar

100%

100%

Note : Advance tax is not applicable if tax liability is less than ` 10,000/- or assessees covered U/s 44ADA

* Only for Assessees referred to in Section 44AD

Partner Remuneration

Book Profit

Amount deductible [u/s 40(b) for Business & Profession]

Loss

Maximum ` 1,50,000

Upto ` 3,00,000

` 1,50,000 or 90% of book profit, whichever is more

More than ` 3,00,000

90% of 3,00,000 and 60% of balance book profit

11

Penalties : Income Tax

12

Penalty

Default

Non Payment

Tax Payments including Self Assessment Tax

Failure to Comply

Failure to answer any question put to a person

Failure to sign any statement made by a person in

course of income tax proceeding

Failure to comply summons issued u/s.131(1)

Failure to comply with a notice u/s. 142(1) or 143(2) or

142(2A) [w.e.f. A.Y. 2017-18]

Concealment

Where search has been initiated on or after 1-7-2012

and undisclosed income found for specified previous year:

(a) if assessee admits the undisclosed income during

search subject to conditions;

(b) if assessee admits in the return of income filed after

the search subject to conditions;

(c) if not covered by (a) or (b)

Books, Audit, Loans

Failure to keep, retain books U/S 44AA

Failure to get books audited U/S 44AB

Taking loan in contravention of Sec 269SS

Repayment of loan in contravention of Sec 269T

Failure to furnish return u/s 139(1) before end of AY

TDS

Failure to deduct in part or full

Failure to collect tax in part or full

Quoting false TAN in challan / statements

Failure to apply for TAN

Failure to furnish eTDS statement

Failure to furnish TDS Certificate

International transactions

Failure to keep and maintain any information or

document as required by Sec 92D(1)/(2).

Failure to furnish information document as required

u/s. 92D(4). (w.e.f. A.Y. 2017-18)

Failure to furnish a report from an accountant as

required u/s. 92E.

12

Section

Upto tax in arrear

221(1)

` 10,000 for each failure

` 10,000 for each failure

272A(1)(a)

272A(1)(b)

` 10,000 for each failure

` 10,000 for each failure

272A(1)(c)

272A(1)(d)

271AAB

(a) 10% of undisclosed income

(b) 20% of undisclosed income

(c) 60% of undisclosed income

` 25000

0.5% of gross sales Maximum

` 1.50 Lakh

Equal to amount of loan taken

Equal to amount of loan repaid

` 5000

271A

271B

271D

271E

271F

Equal to tax not deducted

Equal to tax not collected

` 10000

` 10000

` 10000 to 1 lakh

` 100 per day. Limited to

amount of TDS

271C

271CA

272BB(1A)

272BB(1)

271 H

272A(2)(g)

2% of the value

271AA(1)

` 5 lakh

271AA(2)

` 1 lakh

271BA

13

Depreciation Chart : Income Tax

Assessment Year 2017-18

Block

Nature of Asset

Rate of

Depreciation

Block-1

Block-2

Block-3

Building

Residential building other than hotels and boarding houses

Office, factory, godowns or building - not mainly residential purpose

Temporary erections such as wooden structures

5

10

100

Block-4

Furniture

Furniture - Any furniture / fittings including electricals fittings

10

Plant and Machinery

Any plant or machinery (not covered by block 6,7,8,9,10,11 or 12) and motors

cars (other than those used in a business of running them on hire) acquired

or put to use on or after April 1, 1990

Block-6 Ocean-going ships, vessels ordinary operating on inland waters including

speed boats

Block-7 Buses, lorries and taxies used in business of running them on hire,

machinery used in semi-conductor industry, moulds used in rubber and

plastic goods factories

Block-8 Aeroplanes, life saving medical equipment

Block-9 Containers made of glass or plastic used as refills, new commercial vehicle

which is acquired during Jan 1, 2009 and Sept 30, 2009 and is put to use

before Oct 1, 2009 for the purpose of business / profession

Block-10 Computers including computer software. Books (other than annual publication)

owned by a professional; Gas Cylinders, plants used in mineral oil concerns,

fire glass melting furnaces

Block-11 Energy saving devices; renewal energy devices; rollers in flour mills, sugar

works and steel industry; electrical equipment; burners; cogeneration systems

Block-12 Air pollution control equipments; water pollution control equipments; solid waste

control equipments, recycling and resource recovery systems; (being annual

publications) owned by assessees carrying on a profession or books (may or

may not be annual publications) carrying on business in running lending

libraries; Cinematograph films, plants used in mines and quarries, wooden

match frames

100

Intangible Assets

Block-13 Intangible assets (acquired after march 31, 1998) - Know-how, patents,

copyrights, trademarks, licences, franchises and any other business or

commercial rights of similar nature

25

Block-5

13

15

20

30

40

50

60

80

Depreciation Chart : Companies Act, 2013

Assessment Year 2017-18

Nature of Asset

Useful

Life

I. Buildings

(a) Buildings (other than factory buildings) RCC Frame Structure

(b) Buildings (other than factory buildings) other than RCC Frame Structure

(c) Factory buildings

(d) Fences, wells, tube wells

(e) Others (including temporary structure, etc.)

II. Bridges, culverts, bunders, etc

III. Roads

(a) (i) Carpeted Roads-RCC

(ii) Carpeted Roads-other than RCC

(b Non-carpeted roads

IV. Plant and Machinery

(i) General rate applicable to plant and machinery not covered under special

plant and machinery

(a) Plant and Machinery other than continuous process plant

(b) continuous process plant

(ii)Special Plant and Machinery

(a) Production and exhibition of Cinematograph films

(b) Plant and Machinery used in glass manufacturing

Recuperative and regenerative glass melting furnaces

Moulds

Float Glass Melting Furnaces

(c) Portable underground machinery and earth moving machinery used in open cast mining

(d) Plant and Machinery used in Telecommunications

Towers

Telecom transceivers, switching centres, transmission and network equipments

TelecomDucts, Cables and optical fibre

Satellites

(e) Plant and Machinery used in exploration, production and refining oil and gas

Refineries | Oil and gas assets | Petrochmical plants| Storage Tanks

Pipelines | Drilling Rigs

Field operations (above ground) | Loggers

(f) Plant and Machinery used in generation, transmission and distribution of power

Generation Plants :Thermal/ Gas/ Combined Cycle | Hydro | Nuclear | Transmission Lines

Generation Plants : Wind

Distribution Plants : Electric

Distribution and Storage Plants : Gas | Distribution Plants : Water

(g) Plant and Machinery used in manufacture of steel

Sinter Plant | Blast Furnace | Coke ovens | Rolling mill in steel plant

Basic oxygen Furnace Converter

(h) Plant and Machinery used in manufacture of non-ferrous metals

Metal pot line | Bauxite crushing and grinding section | Digester Section | Turbine | Equipments

for Calcination | Copper Smelter | Roll Grinder

Soaking Pit | Annealing Furnace | Rolling Mills | Equipments for Scalping, Slitting , etc.

Surface Miner, Ripper Dozer, etc., used in mines | Copper refining plant

(i) Plant and Machinery used in medical and surgical operations

Electrical Machinery, X-ray and electrotherapeutic apparatus and accessories thereto,

medical, diagnostic equipments, namely, Cat-scan, Ultrasound Machines, ECG Monitors, etc.

Other Equipments

14

Assuming 5%

Salvage Value

SLM(%) WDV(%)

60

30

30

5

3

30

1.58

3.17

3.17

19.00

31.67

3.17

4.87

9.50

9.50

45.07

63.16

9.50

10

5

3

9.50

19.00

31.67

25.89

45.07

63.16

15

25

6.33

3.80

18.10

11.29

13

7.31

20.58

13

8

10

8

7.31

11.88

9.50

11.88

20.58

31.23

25.89

31.23

18

13

18

18

5.28

7.31

5.28

5.28

15.33

20.58

15.33

15.33

25

30

8

3.80

3.17

11.88

11.29

9.50

31.23

40

22

35

30

2.38

4.32

2.71

3.17

7.22

12.73

8.20

9.50

20

25

4.75

3.80

13.91

11.29

40

2.38

7.22

30

25

3.17

3.80

9.50

11.29

13

7.31

20.58

15

6.33

18.10

Depreciation Chart : Companies Act, 2013

Assessment Year 2017-18

Nature of Asset

Useful

Life

(j) Plant and Machinery used in manufacture of pharmaceuticals and chemicals

Reactors | Distillation Columns | Drying equipments/Centrifuges and Decanters | Vessel/

storage tanks

(k) Plant and Machinery used in civil construction

Concreting, Crushing, Piling Equipments and Road Making Equipments

Heavy Lift Equipments Cranes with capacity of more than 100 tons

Heavy Lift Equipments Cranes with capacity of less than 100 tons

Transmission line, Tunneling Equipments

Earth-moving equipments

Others including Material Handling /Pipeline/Welding Equipments

Plant and Machinery used in salt works

V. Furniture and fittings

General furniture and fittings

Furniture and fittings used in hotels, restaurants and boarding houses, schools, colleges and other

educational institutions, libraries; welfare centres; meeting halls, cinema houses; theatres and circuses;

and furniture and fittings let out on hire for use on the occasion of marriages and similar functions

VI. Motor Vehicles

Motor cycles, scooters and other mopeds

Motor buses, motor lorries, motor cars and motor taxies used in a business of running them on hire

Motor buses, motor lorries, motor tractors, harvesting combines and heavy vehicles and motor cars

other than those used in a business of running them on hire, electrically operated vehicles including

battery powered or fuel cell powered vehicles

VII. Ships

1. Ocean-going ships

Bulk Carriers and liner vessels

Crude tankers, product carriers and easy chemical carriers with or without conventional tank coatings

Chemicals and Acid Carriers: With Stainless steel tanks

Chemicals and Acid Carriers: With other tanks

Liquified gas carriers | Conventional large passenger vessels which are used for cruise purpose also |

Coastal service ships of all categories

Offshore supply and support vessels | Catamarans and other high speed passenger for ships or boats

Drill ships

Hovercrafts

Fishing vessels with wooden hull

Dredgers, tugs, barges, survey launches and other similar ships used mainly for dredging purposes

Vessels ordinarily operating on inland waters

Speed boats

Other vessels

VIII. Aircrafts or Helicopters

IX. Railways sidings, locomotives, rolling stocks, tramways and railways used by concerns,

excluding railway concerns

X. Ropeway structures

XI. Office equipment

XII. Computers and data processing units

Servers and networks

End user devices, such as, desktops, laptops, etc.

XIII. Laboratory equipment

General laboratory equipment

Laboratory equipments used in educational institutions

XIV. Electrical Installations and Equipment

XV. Hydraulic works, pipelines and sluices

15

Assuming 5%

Salvage Value

SLM(%) WDV(%)

20

4.75

13.91

12

20

15

10

9

12

15

7.92

4.75

6.33

9.50

10.56

7.92

6.33

22.09

13.91

18.10

25.89

28.31

22.09

18.10

10

8

9.50

11.88

25.89

31.23

10

6

8

9.50

15.83

11.88

25.89

39.30

31.23

25

20

25

20

30

3.80

4.75

3.80

4.75

3.17

11.29

13.91

11.29

13.91

9.50

20

25

15

10

14

4.75

3.80

6.33

9.50

6.79

13.91

11.29

18.10

25.89

19.26

13

28

20

7.31

3.39

4.75

20.58

10.15

13.91

15

15

5

6.33

6.33

19.00

18.10

18.10

45.07

6

3

15.83

31.67

39.30

63.16

10

5

10

15

9.50

19.00

9.50

6.33

25.89

45.07

25.89

18.10

14

Registrar of Companies (RoC) Compliance

Compliance By All Companies

Compliance

Date

Last Day for convening AGM

File copies of Annual Accounts with ROC within 30 days of AGM

Filing of Annual Return with ROC within 60 days of AGM

30/09/2016

-

Fees For Filing Various Documents or For Registering any Fact Under Companies Act, 2013

(Except for Form No SH. 7)

Compliance

Fees

Less than ` 1,00,000

1,00,000 less than ` 5,00,000

5,00,000 less than ` 25,00,000

25,00,000 or more less than ` 1 Crore

` 1 Crore or more

`

`

`

`

`

200

300

400

500

600

Fee on Application (including Appeal) made to Central Government

Application made by

(i) A Company having an authorized Share Capital of :

(a) Upto ` 25,00,000

(b) More than ` 25,00,000 and upto ` 50,00,000

(c) More than ` 50,00,000 and upto ` 5 Crores

(d) More than ` 5 Crores and upto ` 10 Crores

(c) More Than ` 10 Crores

(ii) A Company limited by guarantee but not having

share capital

(iii) Section 8 Company

(iv) Foreign Company

(v) Application for Allotment of DIN U/S 153

OPC &

Small Companies

Other than OPC &

Small Companies

1000

2500

N/A

N/A

N/A

2000

5000

10000

15000

20000

2000

2000

5000

500

Additional Fees For Late Filing of Document

Document

Period of Delay

Rate of Additional Fee

Form No. SH 7

from 31st day up to 6 month

(increase in Share Capital) 2.5% pm on normal fee

Other Documents

i) Upto 15 days (Sec. 93, 139 & 157)

ii) More than 15 days and upto 30 days

iii) More than 30 days and upto 60 days

iv) More than 60 days and upto 90 days

v) More than 90 days and upto 180 days

vi) More than 180 days and upto 270 days

16

Beyond 6 Months

3% pm on normal fee

One time of normal filing fee

Two times of normal filing fee

Four times of normal filing fee

Six times of normal filing fee

Ten times of normal filing fee

Twelve times of normal filing fee

Registrar of Companies (RoC) Compliance

Other Fee to be paid

Inspection of File and Charges

File Inspection

Fees for Obtaining Certified Copy

a) Certificate of Incorporation

b) Other Certified Copies

Company

Rs. 100

LLP

Rs. 50

Rs. 100

Rs. 25 per page

Rs. 50

Rs. 5 per page

Important e-forms prescribed under the Companies Act, 2013

Sr.

e-Form

Purpose of Form as per Companies Act, 2013

INC-1

Application for reservation of name

INC-7

Application for Incorporation of Comapny (Other than OPC)

INC-22

Notice of situation or change of situation of registered office

DIR-12

Particulars of appointment of Directors and the key managerial personnel and the changes

among them

DPT-3

Return of deposits

ADT-1

Information to the Registrar by Company for appointment of Auditor

ADT-3

Notice of Resignation by the Auditor

DIR-11

Notice of resignation of a director to the Registrar

MGT-14

Filing of Resolutions and agreements to the Registrar

10

PAS-3

Return of allotment

11

MGT-7

Form for filing annual return by a company

12

AOC-4

Form for filing financial statement and other documents with the Registrar

13 AOC-4(CFS) Form for filing consolidated financial statements and other documents with the Registrar

14 AOC-4 XBRL Form for filing XBRL document in respect of financial statement and other documents with

the Registrar

15

SH-7

Notice to Registrar of any alteration of share capital

17

VAT - Gujarat

15

Due Date for Payment of GVAT and Filing of GVAT Return

Periodicity

Monthly

Quarterly

Annual

Due Dates for

Payment of GVAT

Criteria

GVAT/CST paid more

than ` 60,000 in

previous F.Y. or current F.Y.,

New Registration, Non

Localized dealer, Import,

Export, Sales in SEZ

GVAT/CST paid upto

` 60,000 in previous F.Y.

Dealers liable to

VAT Audit

Dealers not liable to

GVAT Audit

Due Dates for Filing Returns

22nd day after end

of the Month

45th day after the end of the Month

22nd day after end

of the Quarter

N.A.

45th day after the end of the Quarter

N.A.

31st December after

end of the financial year

30th June after

end of the financial year

GVAT / CST Returns and Challan

Description

Form No.

GVAT Return (Monthly / Quarterly)

General

Specific (For a dealer who has opted lump sum permission to pay tax)

201, 201A, 201B, 201C,

202, 202A

Annual Return

General

Specific (For a dealer who has opted lump sum permission to pay tax)

205, 205A

202

CST Return

III-V, Anne, I & II

GVAT / CST Challan

GVAT

CST

207

4B

GVAT Audit

Exceeds ` 1 Crore

31st December

Form No. 217

Mandatory if sale or purchase

Due Date

Form No

Mandatory e-Payment / e-Filing for Dealer under GVAT Act

Mandatory e-Payment

If GVAT / CST payable exceeds ` 50,000 for a month or quarter

Mandatory e-Filing

for all the dealers

18

PF / ESIC & Payroll Compliance

16

Type

PF Share

PF & Pension Share

EDLI

EDLI*

PF Admin Charges

EDLI Admin Charges

EDLI Admin Charges*

PF Admin Charges

EDLI Admin Charges

ESIC

ESIC

Description

Responsibility

12% OF Basic + DA

12% OF Basic + DA

Of which 8.33% or Max Rs.1250/- Pension share &

3.67% or Difference will be PF share

0.50% of ((Basic + DA) upto 15000/-)

0.00% *(IF EDLI Policy taken from Insurance Company)

0.85% of Basic + DA or Min Rs.500/0.01% of ((Basic + DA) upto 15,000/-)or Min Rs.200/0.005% of ((Basic + DA) upto 15,000/-) or Min Rs.200/*(IF EDLI Policy taken from Insurance Company)

Rs.75/- per month - Where no contributory member

Rs.25/- per month - Where no contributory member

1.75% of Gross Wages

4.75% of Gross Wages

EMPLOYEE

EMPLOYER

EMPLOYER

EMPLOYER

EMPLOYER

EMPLOYER

EMPLOYER

EMPLOYER

EMPLOYEE

EMPLOYER

eTDS Form 26Q / 24Q / 27Q filing

Qtr Quarter Ending

Due Date

Q1

June

Jul-31

Q2

Sept

Oct-31

Q3

Dec

Jan-31

Q4

March

May-31

Profession Tax - Gujarat (Employee) w.e.f. 01-04-2013

Form 16 / 16A Issuance Due Dates

Qtr

Quarter Ending Due Date

Form 16 A

Q1

June

Aug-15

Q2

Sept

Nov-15

Q3

Dec

Feb-15

Q4

March

June-15

Form 16 Apr to Mar

May-31

Profession Tax - Gujarat (Firm/Company) w.e.f. 01-04-2013

For Dealers as defined under GVAT Act, 2003

Salary

Upto ` 5,999

6,000 to 8,999

9,000 to 11,999

12,000 and above

Turnover

NIL

80

150

200

Prof. Tax

Upto ` 2,50,000

NIL

2,50,001 to 5,00,000

500

5,00,001 to 10,00,000

1,250

10,00,001 and above

2,400

If a Firm/ Company is not a Dealer as defined under

GVAT Act, 2003 then Professional / Service Provider is

liable to pay Professional Tax as under :

th

15 - Payment of PF

th

15 - Payment of Prof. Tax

st

21 - Payment of ESIC

Prof. Tax

District Panchayat

Municipality

Municipal Corporation

Due

D a te s

500

1,000

2,000

Payment of Professional Tax by Firm / Company should be

made on or before 30th September of current Financial Year.

19

Due Dates Chart

17

For Financial Year 2016-17

Mon

Payment Quarterly Filing of Advance Payment Service

ESIC

of

TDS

Income

Tax

of Service

Tax

Payment

TDS

Return Tax Return Payment

Tax

Return

PF

Payment

April

30

25

21

15

May

31

21

15

June

July

7

7

31

31

15

6

6

21

21

15

15

August

21

15

September

15

21

15

October

31

30

-

25

21

15

November

30*

30

21

15

December

15

21

15

January

31

21

15

February

March

7

7

15

6

6/31

21

21

15

15

*For Companies required to file report u/s 90E.

# Assessees are required to file Service Tax Annual Return and CENVAT Credit Annual return from F.Y. 2016-17.

Excise Duty: Periodical Returns

18

For Financial Year 2016-17

Form

Description

Who is required to file

ER-1 Monthly Return

By Large units#

Time limit

Manufacturers not eligible for SSI

concession

10th of following mth.

EOU units

10th of following mth.

Assessees availing SSI concession

10th of following qtr.

ER-4 Annual Return

Assessees paying duty

of ` 1 crore or more p.a.

through PLA & CENVAT

Annually, by 30th

November of

succeeding year

ER-8 Quarterly Return by first

and second stage dealers

Registered Dealers

15th day of following

quarter

ER-2 Return by EOU#

#

ER-3 Quarterly Return by SSI

@

Quarterly Return

Assessees paying 1%/2% excise duty and Quarterly withing 10 days

not manufacturing any other goods

after close of quarter.

* Form No. ER-5 / ER-6 / ER-7 are Omitted w.e.f. 01-04-2016

# Return can be revised within calendar month in which original return is filed. A return can be revised only

if filed within due date [w.e.f. date to be notified]

@ Annual return can be revised within one month from the date of original return is filed within time limit.

[w.e.f. date to be notified]

20

Service Tax Compliance

19

Basic Exemption Limit Chart

Rate of Service Tax

Period

Basic Exemption Limit

Before 01-04-2005

No Limit

01-04-2005 to 31-03-2007

` 4 Lakhs

01-04-2007 to 31-03-2008

` 8 Lakhs

01-04-2008 onwards

` 10 Lakhs

E-Payment of Service Tax

Individual | Proprietor | Firm | LLP | HUF | OPC#

Period

Due Date

April-June

July 6

July-Sept

Oct 6

Oct-Dec

Jan 6

Jan-March

Mar 31

Period

11-08-2007 to 23-02-2009

24-02-2009 to 31-03-2012

01-04-2012 to 31-05-2015

01-06-2015 to 14-11-2015

15-11-2015 to 31-05-2016

01-06-2016 onwards

Net Rate

12.36%

10.30%

12.36%

14%

14.5%

15%

Corporate | Trust | Society | OPC@

Period

Due Date

March

Mar 31

Other Months

6th of Next Month

# Whose aggregate value of taxable services provided is Rs.50 Lacs or less in Previous F.Y.

@ Whose aggregate value of taxable services provided is more than Rs.50 Lacs in Previous F.Y.

Note : (i) E-Payment of Service Tax is mandatory for ALL assessees w.e.f. 01-10-2014.

(ii) E-Payment will be considered valid up to 8.00 pm of the respective day.

Interest for Delayed Payment

Period

Rate of Interest

01-04-2011 to 30-09-2014

18% p.a. (15% if turnover during previous FY is upto ` 60 Lakhs)

01-10-2014 to 13-05-2016* 18% p.a. (Delay for first 6 months)

24% p.a. (Delay from 7th month to 12 months)

30% p.a. (Delay for the period beyond 1 year)

14-05-2016 onwards*

24% p.a. Service Tax collected but not paid before due date)

15% p.a. (Service Tax not collected and not paid)

* 3% concession in interest rate for assessees having turnover upto Rs.60 Lakhs

Note : Interest shall be for the month or part thereof.

Half-yearly Return in Form ST-3

Period

Due Date

April to September

October to March

25th of October (31st October for Input Service Distributors)

25th of April

(30th April for Input Service Distributors)

Revision of Form ST-3

ST-3 can be revised and submitted again within 90 days from the date of filing of original return.

Annual Return Chart (w.e.f. 01-04-2016)

To be Filed by

30th November

30th November

Annual Return

For Service Tax*

For CENVAT Credit

* Annual Service Tax return can be revised within a period of 1 month from the date of filing of original return.

21

20

Table of Abatements : Service Tax @ 15%

Sr. No.

of Noti.

26/2012

1.

2.

2A.

3.

4.

5.

6.

7.

7A.

(01-06-2016 Onwards)

Name of the Service

Financial leasing including Hire Purchase

Transport of goods by Rail (other than service specified in Sr. No. 2A)

Transport of goods in containers by rail by any person other than Indian Railways

Transport of Passenger by Rail

Bundled service by way of supply of food or any drink, in a premises

(including hotel, convention center, club, pandal, shamiana or any other place,

specially arranged for organizing a function) together with renting of such premises

Transport of Passengers by Air [w.e.f. 01-04-2015]

(i) Economy Class

(ii) Other than Economy Class

Renting of hotels, inns, guest houses, clubs, campsites or other

commercial places meant for residential or lodging purposes

Services of GTA in relation to transportation of goods other than used

household goods [w.e.f. 01-04-2016]

Services of GTA in relation to transportation of used household goods

Abatement

90%

70%

60%

70%

30%

Effective

Rate

**

**

**

*

1.50%

4.50%

6.00%

4.50%

10.50%

60% **

40% **

40% **

6.00%

9.00%

9.00%

70% #

4.50%

60% #

6.00%

#

@

#

#

#

**

10.50%

6.00%

6.00%

6.00%

6.00%

4.50%

90% $

70% $

70% ^

1.50%

4.50%

4.50%

60% ^

30% ^

30% ^

6.00%

10.50%

10.50%

60% *

40% *

6.00%

9.00%

[w.e.f. 01-04-2016]

8.

9.

9A.

10.

11.

Service Tax

(Determination of

Value) Rules, 2006

12.

Services provided by a foreman of Chit fund in relation to chit[w.e.f.01-04-2016]

Renting of a Motor cab [w.e.f. 01-10-2014]

(a) Transport of passengers by a Contract Carriage [w.e.f.11-07-2014]

(b) Transport of passengers by a radio taxi [w.e.f. 01-10-2014]

(c) Transport of passengers by air conditioned stage carriage [w.e.f.01-06-2016]

Transport of goods in a Vessel [w.e.f. 01-04-2015]

Services by a tour operator in relation to,(i) Only arranging, booking, accommodation

(ii) Services other than services specified in (i) above

Construction of Residential and Commercial Complex / Building / Civil Structure

Service portion in the execution of Works Contract

a) Original Works

b) (i) Maintenance/Repair/Reconditioning etc. of any goods

(ii) Maintenance/Repair/Completion & Finishing service in relation to

Immovable property [w.e.f. 01-10-2014]

Service portion in an activity wherein food or any drink is

a) supplied at a Restaurant

b) supplied in Outdoor Catering

*

**

#

^

@

30%

60%

60%

60%

60%

70%

CENVAT credit on any goods classifiable under Chapters 1 to 22 (food articles) of the Central Excise Tariff Act has not been availed.

CENVAT credit on inputs and capital goods has not been availed.

CENVAT credit on inputs, capital goods and input services has not been availed.

CENVAT credit on inputs used for providing the taxable service has not been availed.

CENVAT credit on inputs, capital goods, input services has not been availed. [CENVAT credit of input service of Renting of Motor cab

can be availed by service provider in similar line of business subject to a max. of 40% of the service tax of the value of service received].

$ CENVAT credit on inputs, capital goods, input services has not been availed.. [CENVAT credit of input service of Tour Operator can

be availed. by service provider in similar line of business].

Note : (i) To avail abatement in Entry No. 9, value of all goods (including fuel) supplied by S.R. must be included in amount charged.

(ii) To avail abatement in Entry No. 11(i), bill issued should indicate charges for accommodation

(ii) To avail abatement in Entry No. 12, value of land must be included in the amount charged.

22

Penalties

21

Section

70

76

Nature of default

Amount of penalty

Fees for late filing of Return.

- Delay upto 15 days

- Delay of more than 15 and upto 30 days

- Delay of more than 30 days

Failure to pay service tax

77(1)(a) Penalty for default in obtaining Service Tax Registration

77(1)(b) Failure to keep, maintain or retain books of

account and other documents required

77(1)(c) Assessee fails to :

(i) furnish information called by an officer; or

(ii) produce documents called for by a Central

Excise Officer; or

(iii) appear before the Central Excise Officer,

when issued with a summon for appearance to give

evidence or to produce a document in an inquiry.

77(1)(d) Assessee fails to pay service tax electronically

77(1)(e) Assessee issues invoice in accordance with

provisions of the Act or rules made thereunder,

with incorrect or incomplete details or fails to

account for an invoice in his books of account

77(2)

Penalty for contravention of any provision for

which no penalty is provided

78

Penalty for suppressing value of taxable Service*

Rs. 500

Rs. 1000

Rs. 1000 + Rs. 100 for each day but

not exceeding Rs. 20,000

Max. 10% of Service Tax Amt.

Nil if Service Tax + Interest paid

within 30 days of Service of SCN

25% of penalty if Service Tax

+ Interest + Penalty paid within

30 days of receipt of order

Upto Rs. 10,000

Upto Rs. 10,000

Upto Rs. 10,000 or Rs. 200 per day

till failure, whichever is higher.

Upto Rs. 10,000

Upto Rs. 10,000

Not exceeding Rs. 10,000

100% of Service Tax Amt.

15% of Service Tax Amt. if Service

Tax + Interest + Penalty paid within

30 days of Service of SCN

25% of Service Tax Amt. if Service

Tax + Interest + Penalty paid within

78A

Penalty on director, manager, secretary or any other

officer of a company for specified contravention

[w.e.f. 10-05-2013]

30 days of receipt of order

Upto Rs. 1,00,000

* Penalty for offences by director, etc. of company shall be deemed to be closed in cases where the main demand and penalty proceedings

have been closed under section 76 or section 78 of the Act.

23

KMS ADVISORY SERVICES

Indirect Taxation Consultancy

Service Tax

- Opinion Regarding Applicability

- Filing of Returns

- Preventive Matters

- DGCEI Matters

- Service Tax Audit

Excise & Customs

GVAT & CST

Goods & Service Tax (GST)

Impact Analysis of GST

Due Diligence

Sector Specific Structuring

Compliances & Representational Services

Income Tax

ROC Matters including LLPs

Management Consultancy Services

Solutions to Core Management Problems

Financial Advisory

Business Valuation

Management Assurance & Risk Review

Family/ Business Arbitration

Management Transition/ Trust Office

Inbound/ Outbound Investments

Setup of 100% Indian Subsidiary of a

Foreign Corporation

Setting up of Overseas Subsidiary of Indian

Corporation

Audit and Assurance Services

System Audit

Due Diligence Audit

Internal Audit

Compliance Review Report

Forensic Audit

Fraud and Investigation Audit

International Taxation

Compliance with Transfer Pricing Regulations

Filing of Ex-Patriate Returns

DTAA related services

KHANDHAR MEHTA & SHAH

3rd Floor, Devpath Complex, Behind Lal Bunglow, Off C. G. Road, Ahmedabad - 380 006.

Phone: +91 - 79 - 2646 1526, 6631 5450/51/52/53

www.kmsindia.in

In Association with BATGACH - Branches at

Bangalore, Chennai, Guwahati, Hyderabad, Indore, Jaipur, Kochi, Kolkata, Mumbai, New Delhi,

Patna, Raipur, Siliguri, Silchar, Trivandrum

You might also like

- Financial Markets (Chapter 7)Document3 pagesFinancial Markets (Chapter 7)Kyla Dayawon100% (1)

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- 21 Useful Charts For Tax ComplianceDocument24 pages21 Useful Charts For Tax Compliancevrj1091No ratings yet

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- 21 Tax Compliance Charts - Tax Print AY.16-17Document32 pages21 Tax Compliance Charts - Tax Print AY.16-17ImranMamajiwalaNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDocument11 pagesTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86No ratings yet

- 53.income Tax Compliance Check ListDocument5 pages53.income Tax Compliance Check ListmercatuzNo ratings yet

- Highlights of Union Budget 2010 Income Tax ProposalsDocument8 pagesHighlights of Union Budget 2010 Income Tax ProposalsparthsomaiyaNo ratings yet

- Finance Bill 2014Document18 pagesFinance Bill 2014Tanvir Ahmed SyedNo ratings yet

- Sens Ys Compliance HandbookDocument32 pagesSens Ys Compliance HandbookPraful Anil UberoiNo ratings yet

- TDS TRS GST (2) 20211228151919Document38 pagesTDS TRS GST (2) 20211228151919Rishi PriyadarshiNo ratings yet

- Advanced Taxation and Strategic Tax Planning PDFDocument11 pagesAdvanced Taxation and Strategic Tax Planning PDFAnuk PereraNo ratings yet

- TDS RATE CHART FY 2014-15Document26 pagesTDS RATE CHART FY 2014-15shivashankari86No ratings yet

- q6 TaxDocument13 pagesq6 Taxmajidpathan208No ratings yet

- Tata Consultancy Services LTDDocument2 pagesTata Consultancy Services LTDvinay_814585077No ratings yet

- Asifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFDocument21 pagesAsifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFaemanNo ratings yet

- TDS Section Nature of Payment Rate of TDS Threshold LimitDocument3 pagesTDS Section Nature of Payment Rate of TDS Threshold LimitBiswajit GhoshNo ratings yet

- Tax Deducted at SourceDocument29 pagesTax Deducted at SourceChaitany Joshi0% (2)

- Business & Profession Q - A 02.9.2020Document42 pagesBusiness & Profession Q - A 02.9.2020shyamiliNo ratings yet

- Cebbco Spa 030412Document3 pagesCebbco Spa 030412RavenrageNo ratings yet

- Ram Chandra AgarwalDocument4 pagesRam Chandra Agarwalabhishekkumar00No ratings yet

- Tax Rates For MFs And Investors 2012-13Document2 pagesTax Rates For MFs And Investors 2012-13mayankleo_1No ratings yet

- TDS Rates and ReturnsDocument3 pagesTDS Rates and ReturnsKashishKumarNo ratings yet

- Tanzania Tax Guide 2016/2017Document22 pagesTanzania Tax Guide 2016/2017Timothy Rogatus67% (3)

- Compliance Calendar 2013-14Document1 pageCompliance Calendar 2013-14Amitmil MbbsNo ratings yet

- P6mys 2016 Jun QDocument15 pagesP6mys 2016 Jun QAtiqah DalikNo ratings yet

- Tanzania Tax Guide 2012Document14 pagesTanzania Tax Guide 2012Venkatesh GorurNo ratings yet

- VAT Road To GSTDocument19 pagesVAT Road To GSTVarun PuriNo ratings yet

- Income Tax in IndiaDocument19 pagesIncome Tax in IndiaConcepts TreeNo ratings yet

- Income Tax Provisions For FY 2019-20Document26 pagesIncome Tax Provisions For FY 2019-20Mohit SharmaNo ratings yet

- Group 6 Tax AssignmentDocument14 pagesGroup 6 Tax Assignmentdianaowani2No ratings yet

- Final J&COTax Card 2015-16Document1 pageFinal J&COTax Card 2015-16Mansoor JanjuaNo ratings yet

- Taxation Management and PlanningDocument10 pagesTaxation Management and PlanningJoel EdauNo ratings yet

- GST Project on TDS and TCSDocument12 pagesGST Project on TDS and TCSAnamika VatsaNo ratings yet

- AINO Communique 105th Edition - July 2022Document13 pagesAINO Communique 105th Edition - July 2022Swathi JainNo ratings yet

- C.H. Padliya & Co.: Chartered AccountantsDocument10 pagesC.H. Padliya & Co.: Chartered AccountantsBhavin ShahNo ratings yet

- IPCC Taxation Guideline Answer Nov 2015 ExamDocument16 pagesIPCC Taxation Guideline Answer Nov 2015 ExamSushant SaxenaNo ratings yet

- 5 6170280447000445052 PDFDocument358 pages5 6170280447000445052 PDFmanoj mohanNo ratings yet

- 01 Revision Salary IncomeDocument24 pages01 Revision Salary IncomeUmer ArabiNo ratings yet

- WNSDocument3 pagesWNSAnonymous f3AnDlikNo ratings yet

- Compliance HandBook FY 2015-16Document32 pagesCompliance HandBook FY 2015-16sunru24No ratings yet

- Tax Reckoner 2012-13: Guide to Indian Income Tax Rates and Mutual Fund TaxationDocument4 pagesTax Reckoner 2012-13: Guide to Indian Income Tax Rates and Mutual Fund TaxationbhaveshNo ratings yet

- Contribution of Corporate Tax On Gross Domestic ProductDocument28 pagesContribution of Corporate Tax On Gross Domestic ProductkushsuranaNo ratings yet

- Central Taxes Replaced by GSTDocument6 pagesCentral Taxes Replaced by GSTBijosh ThomasNo ratings yet

- Cma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsDocument358 pagesCma Inter GR 1 Financial Accounting Ebook June 2021 OnwardsSarath KumarNo ratings yet

- Tamilnadu State Accounting and Taxation Services Co-Operative Society Limited, Xnc-895Document6 pagesTamilnadu State Accounting and Taxation Services Co-Operative Society Limited, Xnc-895Tax Co-operative CBENo ratings yet

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNo ratings yet

- Indirect Tax (7391)Document7 pagesIndirect Tax (7391)1163No ratings yet

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Document14 pagesStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Food Corporation of India - 41202411354277Document9 pagesFood Corporation of India - 41202411354277abhimanyu7004No ratings yet

- ATax - 01 Revision Salary IncomeDocument34 pagesATax - 01 Revision Salary IncomeHaseeb Ahmed ShaikhNo ratings yet

- The Following Information Is Required For Tax Auditaddress Where Books of AccountsDocument3 pagesThe Following Information Is Required For Tax Auditaddress Where Books of AccountsJasmeet DhamijaNo ratings yet

- Taxation of Corporation YogeshDocument4 pagesTaxation of Corporation YogeshyogeshvermastockNo ratings yet

- Digitally Sign and Email Form 16/form 16ADocument1 pageDigitally Sign and Email Form 16/form 16Aparminder211985No ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document9 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Determine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overDocument46 pagesDetermine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overmicaella pasionNo ratings yet

- 27 Useful Charts of Service Tax 2016 17 PDFDocument24 pages27 Useful Charts of Service Tax 2016 17 PDFJosef AnthonyNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Tender NotesDocument25 pagesTender NotesAnushka AnandNo ratings yet

- Assignment 2Document12 pagesAssignment 2Waqar Ali MustafaiNo ratings yet

- Assignment No 2Document6 pagesAssignment No 2Amazing worldNo ratings yet

- Scientific CommunicationDocument4 pagesScientific Communicationsilly GooseNo ratings yet

- CuritibaDocument4 pagesCuritibaLuis PinkmanNo ratings yet

- BARCELOC - Logistics Services Concepts and DefinitionsDocument19 pagesBARCELOC - Logistics Services Concepts and DefinitionsHéctor Federico MuñozNo ratings yet

- The Role of Trade Finance in Promoting Trade and The Implications of Covid-19Document13 pagesThe Role of Trade Finance in Promoting Trade and The Implications of Covid-19comesa cmiNo ratings yet

- Appendix F Preparation of Interim Payment Certificates: GeneralDocument4 pagesAppendix F Preparation of Interim Payment Certificates: GeneralOrebic ViganjNo ratings yet

- Unscoped DCT Report on Maintenance Special RequirementsDocument5 pagesUnscoped DCT Report on Maintenance Special RequirementsshaggipcNo ratings yet

- Group 2 Cost Allocation of Service DeptDocument61 pagesGroup 2 Cost Allocation of Service DeptKim PerezNo ratings yet

- Pharmaceutical Importers and ChainsDocument1 pagePharmaceutical Importers and Chainsmarketing lakshNo ratings yet

- Oil company department responsibilitiesDocument2 pagesOil company department responsibilitiesKristan EstebanNo ratings yet

- Employees As Customers-An Internal Marketing StudyDocument12 pagesEmployees As Customers-An Internal Marketing Studyraad fkNo ratings yet

- Computer Stationary PDFDocument1 pageComputer Stationary PDFPrem KumarNo ratings yet

- MAS Answer KeyDocument18 pagesMAS Answer KeyMitch Regencia100% (1)

- Module 03 Income Tax Concepts RevisedDocument20 pagesModule 03 Income Tax Concepts RevisedArianne Fortuna AugustoNo ratings yet

- Chapters 1-2 Practice Test: Nguyễn Thị Thu Thủy - SAMI - HUSTDocument2 pagesChapters 1-2 Practice Test: Nguyễn Thị Thu Thủy - SAMI - HUSTThanh NgânNo ratings yet

- SBG GLOBAL Reward 01 July v1Document23 pagesSBG GLOBAL Reward 01 July v1LalHmingmawiaNo ratings yet

- 8 PA116 RA7160 LGU Officials in GeneralDocument69 pages8 PA116 RA7160 LGU Officials in GeneralJewel AnggoyNo ratings yet

- V. Guaranty A. Arts. 2047 To 2081, Civil CodeDocument12 pagesV. Guaranty A. Arts. 2047 To 2081, Civil CodeMunchie MichieNo ratings yet

- Unit 1 Introduction Journal Ledger and Trial BalanceDocument51 pagesUnit 1 Introduction Journal Ledger and Trial Balancedivimba87100% (1)

- Accounting For Factory OverheadDocument6 pagesAccounting For Factory OverheadJocel Ann GuerraNo ratings yet

- Service and Customer Satisfaction of Nepal Telecom: A Project Work ReportDocument49 pagesService and Customer Satisfaction of Nepal Telecom: A Project Work ReportMadan DhakalNo ratings yet

- HR Management Inputs, Processes & OutputsDocument3 pagesHR Management Inputs, Processes & OutputsPGDM 20 AYAN TANWEERNo ratings yet

- Income From Business & ProfessionDocument32 pagesIncome From Business & ProfessionauditNo ratings yet

- Course Objective & Outcome-Mba-2022-2023Document9 pagesCourse Objective & Outcome-Mba-2022-2023Vishnu PriyaNo ratings yet

- Asian Insight Sparx - Indonesia Consumption Basket - 8 Dec 2022Document37 pagesAsian Insight Sparx - Indonesia Consumption Basket - 8 Dec 2022Senda SurauNo ratings yet

- Quiz 1 QuestionDocument4 pagesQuiz 1 QuestionNguyễn DatNo ratings yet