Professional Documents

Culture Documents

Engineering Economy Reviewer

Uploaded by

Bea AbesamisCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Engineering Economy Reviewer

Uploaded by

Bea AbesamisCopyright:

Available Formats

Beatrice Amistoso Abesamis

Simple Interest

F=P+ I

I =Pin

F=P(1+)

Remember:

- Default interest is per year.

- Value of m if:

Semi - Annually - 2

Quarterly - 4

Monthly - 12

Daily - 360

Ordinary Simple Interest

- 1 year = 360 days

Exact Simple Interest

One year is:

- 365 days if ordinary year.

- 366 days if leap year.

It is leap year if:

- Divisible by 4

- If it is century year, it must be

divisible by 400.

Compound Interest

F=P(1+i)n

F=P(1+

r mt

)

m

F=P ern

Effective Rate

ER=(1+ i)n1

ER=er 1

Cash Flow Diagram

1. Draw the cash flow diagram.

Lender's Side - F up, P down

Borrower's Side - P up, F down

2. Set the focal point.

3. Equate up = down.

Annuity

[

[

(1+i)n 1

F=A

i

P= A

1(1+i)

i

DeferredAnnuity

P= A

1(1+i)

i

(1+i)k

Perpetuity

P=

A

i

VARIABLES

F = Future Amount

P = Present Amount

I = Interest

i = Interest Rate

n = Number of Years

m = No. of Compounding Years

t = Number of Years

ER = Effective Rate

A = Annuity

k =Number of Years Before

Beatrice Amistoso Abesamis

Depreciation

Straight Line Method

- Simplest Method

d=

C oC n

n

C

( ndismantle)

C o

n

d=

D m=d (m)

d

x 100

Co

C oC n

(1+i ) 1

i

D m=d

k=

2

n

m1

2

n

( )

d m=C o 1

2

n

Sinking Fund Method

- Annuity-like

- Fixed cost for every year

- Sinking Fund Deposit Factor (Just

multiply with Co

d=

Double Declining Balance

Method

- Exactly similar as DBM but k is

2/n.

2

Cm =C o (1 )

n

Cm =C oDm

k=

Dm=C oCm

(1+i ) 1

i

Dm=C oCm

Sum of the Year's Digit Method

ReverseYear=nm+1

Years=

2

n C

=1 n

n

Co

Cm =C oDm

d m=C o Cn

d m=C o (1k )m1 k

ReverseYear

Years

Dm=d 1+ d2

D m=

Declining Balance

Method/Matheson Formula

- Fixed percentage

n(n+1)

2

(RY 1 + RY 2 )

(C oC n )

Years

Cm =C oDm

Service-Output Method

Cm =C o (1k )

k =1

k =1

Cm

Co

Cn

Co

a. Working Hours Method

d n=

Co Cn

H year

Ht

b. Output Method

Beatrice Amistoso Abesamis

d n=

Co Cn

Q year

Qt

VARIABLES

Co = First Cost

Cn = Cost After n Years / Trade-in Value

n = Life of the Property

Dm = Total Depreciation After m Years

i = Interest Rate

k = Rate of Depreciation

Ht = Total No. of Hours

Hyear = No. of Hours for a Certain Year

Qt = Total No. of Output

Qyear = No. of Output for a Certain Year

Beatrice Amistoso Abesamis

Bonds

Total Periodic Expense

A=

( 1+i )n1

i

I =Fr

A+I

Bond Value

1(1+i)

V n=Fr

i

+C(1+i )

I =Fr

A = Periodic Deposit to the Sinking Fund

Vn = Value of the Bond in n Periods Before

Redemption

F = Face Value

C = Redemption Price/Selling Price

r = Bond rate

I = Interest on the Bond per Period

F = Accumulated Amount, Amount

Needed to Retire the Bond

Gradient

P= A

] [

1( 1+i )n G 1( 1+i )n

n(1+i)n

i

i

i

P = Present Worth of All Cash

Disbursement

Economic Studies

Rate of Return Method

Net Annual Profit

Capital Invested

*Total Annual Cost

> Expenses + Owner's Salary (If given) +

Depreciation Value (Depreciation is not always

an outcome. It can also be an income.): Use

Sinking Fund and Revenue or Sales.

> When given is in %, multiply by the

investment

> If two are given like the other one is the cost

after n years, use depreciation. If ever that the

cost becomes higher after n years, it will be an

income.

* Investment is also called first cost and

project cost.

* Net Annual Profit = Revenue or Sales - Total

Annual Profit (also means earnings before

income taxes)

Beatrice Amistoso Abesamis

Annual Worth Method

*

*

*

*

Given Percent x Investment

Product +Total Annual Cost

Given Revenue - Sum

If Negative (Not Justifiable)

Present Worth Method

* Inflow: Revenue (P/A,%,n) + Salvage

Value(P/A,%,n)

^ Do this if the given has salvage value.

* Outflow: Investment + Expenses (Total

Annual Cost without Depreciation) (P/A,%,n)

* Inflow - Outflow

Future Worth Method

* Payroll taxes are deducted from labor cost.

* Annual Savings = Annual Cost A - Annual

Cost B

* Additional Investment = First Cost A - First

Cost B

* ROR less than interest rate: NO

Annual Cost Method

* Given Percent x Investment

* Product +Total Annual Cost

* Pick the lesser one.

Present Worth Method

* Refer to the Present Worth's Cash Flow

Diagram

* Two different years: Get the multiple.

* Depreciation, Final Year, and First Cost must

be aligned.

Payback (Payout) Method

EUAC

Investment Salvage Value

Net Annual Cash Flow

* Net Annual Cash Flow = Revenue - Total

Annual Cost without Depreciation

Comparing Alternatives

Rate of Return on Additional

Investment

Annual Net Savings

Additional Investment

Annual Cost ( Without Depreciation )+

n

1( 1+ i )

i

Capitalized Cost

Co +

C oC n

n

( 1+i) 1

A

i

You might also like

- Simple Interest and Depreciation FormulasDocument5 pagesSimple Interest and Depreciation FormulasBea Abesamis100% (1)

- Engineering Economy Lecture6Document40 pagesEngineering Economy Lecture6Jaed CaraigNo ratings yet

- Engineering EconomyDocument5 pagesEngineering EconomyDayLe Ferrer AbapoNo ratings yet

- Capitalized CostDocument9 pagesCapitalized CostLilibeth ArgamosaNo ratings yet

- Capitalized Cost Eng Econo As1Document8 pagesCapitalized Cost Eng Econo As1Francis Valdez LopezNo ratings yet

- EconomyDocument10 pagesEconomy3 stacksNo ratings yet

- Equation of Value For Ceit-04-501aDocument9 pagesEquation of Value For Ceit-04-501aAngeli Mae SantosNo ratings yet

- Compound Interest FormulaDocument21 pagesCompound Interest FormulaFrancis De GuzmanNo ratings yet

- Engineering Economics Chapter 2Document41 pagesEngineering Economics Chapter 2Jenalyn MacarilayNo ratings yet

- Unit 2 Time and Money D PDFDocument2 pagesUnit 2 Time and Money D PDFCarmelo Janiza LavareyNo ratings yet

- Depreciation, Capital Recovery and Break Even AnalysisDocument6 pagesDepreciation, Capital Recovery and Break Even AnalysisMa. Angeline GlifoneaNo ratings yet

- Engineering Economy 2Document1 pageEngineering Economy 2Matthew DavidNo ratings yet

- Chapter 3Document25 pagesChapter 3abdullah 3mar abou reashaNo ratings yet

- Engineering Economy: Annuities, Capitalized Cost, and AmortizationDocument18 pagesEngineering Economy: Annuities, Capitalized Cost, and AmortizationGayle Ashley GolimlimNo ratings yet

- Engineering Economy: F P F P, I%, NDocument17 pagesEngineering Economy: F P F P, I%, NWigiNo ratings yet

- Additional ExercisesDocument4 pagesAdditional Exerciseschinoi C100% (1)

- ES 10 - Lec 2Document47 pagesES 10 - Lec 2ebrahim maicomNo ratings yet

- Eeco 111716Document20 pagesEeco 111716Rom HoboiiNo ratings yet

- Continuous vs Discrete CompoundingDocument3 pagesContinuous vs Discrete CompoundingJohnlloyd BarretoNo ratings yet

- Engg. EconomicsDocument2 pagesEngg. EconomicsStevenNo ratings yet

- Econ 6Document7 pagesEcon 6Lyzette LeanderNo ratings yet

- Calculate investment earnings and loan payments over timeDocument1 pageCalculate investment earnings and loan payments over timeYss CastañedaNo ratings yet

- Statics of Rigid Bodies 1: Email AddressDocument15 pagesStatics of Rigid Bodies 1: Email AddressKc Kirsten Kimberly MalbunNo ratings yet

- DepreciationDocument35 pagesDepreciationJames Kevin IgnacioNo ratings yet

- Problem Set 005 Q AnswersDocument5 pagesProblem Set 005 Q AnswersDennis Korir100% (1)

- Engineering Economy AccountingDocument198 pagesEngineering Economy AccountingJericho Dizon TorresNo ratings yet

- Lecture 5 Capitalized CostDocument8 pagesLecture 5 Capitalized CostSealtiel1020No ratings yet

- Regine Mae Yaniza - 2 Year BsceDocument11 pagesRegine Mae Yaniza - 2 Year BsceRegine Mae Lustica YanizaNo ratings yet

- Module 00 Engineering Economics PDFDocument330 pagesModule 00 Engineering Economics PDFJON EDWARD ABAYANo ratings yet

- Cee 109 - First ExamDocument43 pagesCee 109 - First ExamRonald Renon QuiranteNo ratings yet

- Centroids of Composite FiguresDocument21 pagesCentroids of Composite FiguresSamantha CusiNo ratings yet

- Geometric Gradient Series, Finishing Chapter 2Document17 pagesGeometric Gradient Series, Finishing Chapter 2Shaka Shalahuddin Shantika PutraNo ratings yet

- 8 - DepreciationDocument3 pages8 - Depreciationjoyce san joseNo ratings yet

- CEE CpE CEE109 Wata UpdateDocument84 pagesCEE CpE CEE109 Wata UpdateJOYNo ratings yet

- Roofing Materials: Roof ComponentsDocument17 pagesRoofing Materials: Roof ComponentsMero Mero100% (1)

- Students Engineering Economy 2 PDFDocument9 pagesStudents Engineering Economy 2 PDFMark Jake RodriguezNo ratings yet

- Activity 6890Document3 pagesActivity 6890Raymond Gicalde RementillaNo ratings yet

- Engineering-Economy-40 PRE FINALS EXAM PDFDocument4 pagesEngineering-Economy-40 PRE FINALS EXAM PDFroyce542No ratings yet

- ES 33 - Plate No. 1Document10 pagesES 33 - Plate No. 1Maybelline DipasupilNo ratings yet

- Engineering Economy Course Student 4Document27 pagesEngineering Economy Course Student 4Baesl 2000No ratings yet

- Other Annuity TypesDocument7 pagesOther Annuity TypesLevi John Corpin AmadorNo ratings yet

- Engineering Economics - SolutionsDocument11 pagesEngineering Economics - SolutionsIssacus Youssouf100% (1)

- Students Engineering EconomyDocument9 pagesStudents Engineering EconomyAlyssa Apolinario100% (1)

- Chapter 2 Topic 3 Discount Inflation and TaxDocument9 pagesChapter 2 Topic 3 Discount Inflation and TaxJoash Normie DuldulaoNo ratings yet

- Engineering Economy Module 2Document33 pagesEngineering Economy Module 2James ClarkNo ratings yet

- Solns of 5 PointsDocument2 pagesSolns of 5 PointsLorenz BerroyaNo ratings yet

- Collecting Survey Data and Generating Topographic MapsDocument13 pagesCollecting Survey Data and Generating Topographic MapsWendell David ParasNo ratings yet

- BES 221 (PART I - Midterm Module)Document13 pagesBES 221 (PART I - Midterm Module)Maria Victoria IgcasNo ratings yet

- Lesson 8 Basic Methods For Making Economic StudiesDocument11 pagesLesson 8 Basic Methods For Making Economic StudiesDaniela CaguioaNo ratings yet

- Money Time LowDocument41 pagesMoney Time LowChristian Sunga0% (2)

- AnnuityDocument23 pagesAnnuityCathleen Ann TorrijosNo ratings yet

- Econ Module 05Document13 pagesEcon Module 05derping lemonNo ratings yet

- Engineering Economy 1stDocument1 pageEngineering Economy 1stMatthew DavidNo ratings yet

- DerivativesDocument42 pagesDerivativesDezalene CierteNo ratings yet

- Sharing Is CaringDocument4 pagesSharing Is CaringChris bongalosaNo ratings yet

- Differential EquationsDocument19 pagesDifferential EquationsDinah Jane MartinezNo ratings yet

- Chapter 3Document20 pagesChapter 3Heart VenturanzaNo ratings yet

- CHAPTER 2 - Presentation - For - TeachersDocument125 pagesCHAPTER 2 - Presentation - For - TeachersReffisa JiruNo ratings yet

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNo ratings yet

- Basics of Engineering EconomyDocument26 pagesBasics of Engineering EconomyHady MagedNo ratings yet

- SF AFDocument1 pageSF AFBea AbesamisNo ratings yet

- Thyristors Are A Broad Classification of Bipolar-Conducting Semiconductor Devices HavingDocument2 pagesThyristors Are A Broad Classification of Bipolar-Conducting Semiconductor Devices HavingBea AbesamisNo ratings yet

- Abesamis and CastilloDocument2 pagesAbesamis and CastilloBea AbesamisNo ratings yet

- ConclusionDocument2 pagesConclusionEdith CastilloNo ratings yet

- InterpretationDocument3 pagesInterpretationEdith CastilloNo ratings yet

- BICTHESDocument2 pagesBICTHESBea AbesamisNo ratings yet

- Dsgms DGKJ AbdjDocument1 pageDsgms DGKJ AbdjBea AbesamisNo ratings yet

- Eqn - For MergeDocument1 pageEqn - For MergeBea AbesamisNo ratings yet

- Ec32fb1 Eval 1410588Document2 pagesEc32fb1 Eval 1410588Bea AbesamisNo ratings yet

- Eqn - For MergeDocument1 pageEqn - For MergeBea AbesamisNo ratings yet

- Types of SphygmomanometerDocument2 pagesTypes of SphygmomanometerBea AbesamisNo ratings yet

- Antenna Experiment Front Page 2Document1 pageAntenna Experiment Front Page 2Bea AbesamisNo ratings yet

- SongDocument28 pagesSongBea AbesamisNo ratings yet

- Vector Analysis ReviewerDocument8 pagesVector Analysis ReviewerBea Abesamis100% (1)

- Safety Management IE 002 (TIP Reviewer)Document5 pagesSafety Management IE 002 (TIP Reviewer)James LindoNo ratings yet

- Statics ScreenDocument1 pageStatics ScreenBea AbesamisNo ratings yet

- Earth Day, Amazon Rainforest, Biology Father & MoreDocument1 pageEarth Day, Amazon Rainforest, Biology Father & MoreBea AbesamisNo ratings yet

- Loque, Mark Ivan Magno, Joseph Emmanuel Mangalino, John Michael Marco, Marc Jayron Miclat, Kenneth Andrian Mintay, Ralph ChristianDocument19 pagesLoque, Mark Ivan Magno, Joseph Emmanuel Mangalino, John Michael Marco, Marc Jayron Miclat, Kenneth Andrian Mintay, Ralph ChristianJericho LindoNo ratings yet

- Chapter 2 Part 3: Financial Planning and Forecasting Financial StatementsDocument10 pagesChapter 2 Part 3: Financial Planning and Forecasting Financial StatementsshafNo ratings yet

- Skorpion Zinc Sustainability Report 2012 2013Document40 pagesSkorpion Zinc Sustainability Report 2012 2013Mac'Ann Ditshego MashaoNo ratings yet

- Course Syllabus-Mgt 111Document6 pagesCourse Syllabus-Mgt 111Austin Jovanee B. GAGNONo ratings yet

- ĐÁP ÁN PHIẾU ÔN TẬP TOÁN CAO CẤPDocument62 pagesĐÁP ÁN PHIẾU ÔN TẬP TOÁN CAO CẤPTrường XuânNo ratings yet

- Nike, Adidas Market Share Analysis in Footwear, Apparel & Equipment IndustriesDocument3 pagesNike, Adidas Market Share Analysis in Footwear, Apparel & Equipment IndustriesAVINASH SINGHNo ratings yet

- MI - 1 (45) So Pyay Aung Win (Life Insurance)Document3 pagesMI - 1 (45) So Pyay Aung Win (Life Insurance)Dr. SNo ratings yet

- Marketing An Introduction Canadian 6th Edition Armstrong Test BankDocument39 pagesMarketing An Introduction Canadian 6th Edition Armstrong Test Bankoleicgrin.k7rih100% (26)

- Concept of Short Run and Long Run in EconomicsDocument8 pagesConcept of Short Run and Long Run in EconomicsSagun P. PokharelNo ratings yet

- Ass4 f10 AnsDocument8 pagesAss4 f10 AnsmustafaNo ratings yet

- m3m Noida 1Document33 pagesm3m Noida 1Nitin AgnihotriNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- Licence Plate NumbersDocument284 pagesLicence Plate NumbersEraldNo ratings yet

- CRED's Plan To Acquire Smallcase Falls ThroughDocument1 pageCRED's Plan To Acquire Smallcase Falls ThroughaxfNo ratings yet

- LUMS MECO111 Principles of Microeconomics Fall CourseDocument3 pagesLUMS MECO111 Principles of Microeconomics Fall CourseAbdul Wasay SiddiquiNo ratings yet

- UNILEVERDocument8 pagesUNILEVERFx ProfessorNo ratings yet

- Hitungan Kuis 7 Bunyan - Lumber - CaseDocument15 pagesHitungan Kuis 7 Bunyan - Lumber - Caserica100% (1)

- Career Compensation Plan IndiaDocument22 pagesCareer Compensation Plan IndiaRaju ReddyNo ratings yet

- Decision Making Using Cost Concept and CVP AnalysisDocument7 pagesDecision Making Using Cost Concept and CVP AnalysisRitesh Kumar DubeyNo ratings yet

- DecisionERCCaseNo2015 055MCDocument16 pagesDecisionERCCaseNo2015 055MCrajgonzNo ratings yet

- Demand New Standards: Alfa Laval Gasketed Plate Heat ExchangersDocument6 pagesDemand New Standards: Alfa Laval Gasketed Plate Heat Exchangersthiagorep17No ratings yet

- COGS Worksheet (Pricing)Document2 pagesCOGS Worksheet (Pricing)Shahbaz AliNo ratings yet

- 2018 Book InequalityDocument391 pages2018 Book InequalityEgyptianNo ratings yet

- Supply FormDocument44 pagesSupply FormCLOUDETTE CLEO CHUANo ratings yet

- Company Compensation ($ Millions) Return in 2013 (%)Document5 pagesCompany Compensation ($ Millions) Return in 2013 (%)JasonNo ratings yet

- Idt AmendmentDocument27 pagesIdt AmendmentNISHA MITTALNo ratings yet

- Assignment 1 - Nur Alia Najwa Binti Mohd Sakri (2020462342)Document25 pagesAssignment 1 - Nur Alia Najwa Binti Mohd Sakri (2020462342)Alia najwaNo ratings yet

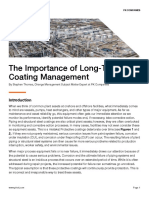

- The Importance of Long Term Coating ManagementDocument8 pagesThe Importance of Long Term Coating ManagementDavid RodriguesNo ratings yet

- IBRD, 1971, Greater Djakarta The Capital City of IndonesiaDocument82 pagesIBRD, 1971, Greater Djakarta The Capital City of IndonesiaBayu WirawanNo ratings yet

- Entrepreneurial DevelopmentDocument1 pageEntrepreneurial Developmentv dheenadhayalanNo ratings yet