Professional Documents

Culture Documents

MACROECONOMICS

Uploaded by

simonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MACROECONOMICS

Uploaded by

simonCopyright:

Available Formats

Running head: SECOND SEMINAR MACROECONOMICS

STUDENTS NAME

UNIVERSITY

DATE

Running head: SECOND SEMINAR MACROECONOMICS

CHAPTER XIV-XV-XVI

1. Advantages of having a monetary policy out of the hands of the government

Rather than having the governments deal with the monetary policy, it may be fixed by a currency

board. This helps to control the inflation by creating a tie in the prices of those tradable goods

that are produced locally and that of the marketable products in the anchor country, suppressing

and finally killing the inertial element of inflation. Secondly, it minimizes the component of

currency risk from local interest rates hence reducing the cost of funds for the private sector and

the government and improving the outlook for financial break through, investment and growth.

Masson & Pattillo (2004).

2. The banking transaction that creates money

Most of the money that circulate in the economy is set up in the form of deposits. The money

that the customers deposit is in turn given out in the form of loans at an interest rate. When the

customer checks his balance over the counter, what appears is just an electronic entry, but the

real money is already circulating and earning interest to the banks. Axilrod, (2011).

3. Sources of reserves at the commercial banks.

Banks get their reserves through deposits. When customers take their money to the bank, the

bank uses these funds to retain its stability. Most of the depositors keep their money in their

accounts for extended periods of time while others deposit in fixed deposit accounts.

4. Difference between the real interest rate determined by the invisible hand, and the

discount rate.

The real interest rate is the nominal interest rate corrected for inflation. It is equal to the nominal

interest rate less the inflation. Since inflation diminishes the value of money over time, It is a

Running head: SECOND SEMINAR MACROECONOMICS

reflection of the actual return on savings or the cost of borrowing. The invisible hand coordinates

savings and investment

The discount rate is the interest rate on the loans that the Fed makes to banks. The Fed

can control the supply of money by altering the discount. An increase in the discount rate

discourage banks from borrowing reserves from the Fed, hence when the discount rate reduces, it

also reduces the amount of reserve in the bank system hence limiting the money supply. On the

other hand, when the discount rate is low, it encourages the banks to borrow money from the Fed

hence increasing their reserves

5. Money multiplier and simple multiplier.

Money multiplier

The phrase money multiplier refers to is the amount of money generated for each reserve dollar.

Reserve is the minimum deposits that Fed requires the banks to hold without lending

Simple multiplier implies that the marginal propensity to consume is below 1. This means that an

autonomous increase in government spending will increase income more than the spending

amount

6. Explain why if the price of the bonds goes down, its interest rate will go up. Under what

business cycle will the Fed lower the price of the bonds? Explain your answer.

If Fed sells bonds, and reduces the money supply by drawing cash from the economy in

exchange for bonds. Therefore, this has a direct effect on money supply. If the Fed buys bonds,

prices are pushed higher, and interest rates decrease; if the Fed sells bonds, it drives prices down,

and rates increase.

Running head: SECOND SEMINAR MACROECONOMICS

When altering the economic policy, Fed uses interest rates. When the economic growth is weak,

and the inflation is low, Fed lowers the interest rates, and if the inflationary pressure is

increasing, the interest rates will raise.

Mutual relationship between stabilization instruments and macroeconomic parameters in

the context of the economic situation of the country

1. How to curb inflation if demand-pull inflation creates it.

Demand pull occurs when there is excessive money available to the public where it is only

available to few people. The few people will chase constant supply of goods; hence, the prices

will be skyrocketed.

The remedies include:

The social programs provided by the government to the people should concentrate on the

poor people equitably without bias

The government should create employment opportunities so as the people can join the

market economy.

The unproductive areas within the economy should be eliminated.

2. Curbing inflation caused by cost-pull inflation

The government should introduce a deflationary fiscal policy where there are higher taxes and

reduced spending. This would, in turn, increase the cost of borrowing and minimize the

consumer spending and investment.

3. Explain which type of inflation is harder to curb

Cost pull inflation is also referred to as the wrong inflation since it results in reduced living

standards. It is the hardest to curb since it results in inflation and a falling output

Running head: SECOND SEMINAR MACROECONOMICS

4. If there is a high deficit in the budget and the economy is experiencing a light recession,

the most appropriate policy is the restrictive fiscal policy. When the government has a

high spending and reduced taxes, the government fund will be inclined towards a deficit.

The government will then borrow money to deal with the excess spending about revenue.

The government should reduce its expenditure and increases taxes, which will then shift

the budget toward a surplus. This will then minimize the governments outstanding debt.

The Shifts toward budget surpluses and reduced borrowing are indicative of restrictive

fiscal policy.

5. If the economy is suffering a deep recession, fiscal policy is the most preferable. Fiscal

policy reduces unemployment by increasing aggregate demand and the economic growth

rate. The government needs to pursue an expansionary fiscal policy which involves

reducing taxes and increasing government spending. Keynes advocated for expansionary

fiscal policy in times of deep recession. He argues that during a recession, resources, i.e.,

both labor and capital remain idle, hence and calls for the intervention of the government

to create demand and reduce the unemployment

6. In your opinion, does the implementation of contractionary fiscal and monetary policies

foster growth? Explain your answer.

Yes. The primary objective of the contractionary fiscal policy is to minimize inflation.

Therefore, a reduction in government spending or an increase in taxes is implemented that

leads to decreasing inflation. However, it can also stimulate the rate of unemployment. In

other words, fiscal policy that leads to increased aggregate demand through increasing the

government spending is typically called expansionary. By contrast, fiscal policy should

always be contractionary if it minimizes the demand through reduced spending.

Running head: SECOND SEMINAR MACROECONOMICS

7. The implementation of expansionary fiscal and monetary policies may be considered to

be austerity measures because they are aimed at extending the supply of money to

promote economic growth and curb inflation. Expansionary fiscal policy supports tax

reduction and increased government spending with the focus of increasing the money

available to the economy

These can be regarded as countercyclical since they aim at reducing spending and increasing

taxes in times of boom and growing spending/cutting taxes during a recession.

8. Conditions where the devaluation of currency will necessarily lead to inflation.

devaluation will probably cause inflationary pressures because of the increased import

prices and high demand for exports. However, the overall impact depends on the state of

the economy and other factors affecting inflation.

Mutual international relationships among countries stabilization instruments and

macroeconomic parameters

1. Economic situations where will a country favor free trade without or very few tariffs?

A state will apparently promote free trade during times of high unemployment level since it is the

best in economic growth and creation of employment

2. Enemy to free trade

WTO while purporting to promote free trade, it is its principal enemy. Just like all other

bureaucracies, WTO mainly deals with advancing its power and hence cannot make international

trade an avenue for the promotion of labor rights. The main idea of the free trade becomes the

victim here

3. The concept of current account

Running head: SECOND SEMINAR MACROECONOMICS

This is given by the difference between the nations savings and its investment. The current

account is a great indicator of the economy's health. When the current account is positive, it

indicates that the nation is a net lender to the other countries. On the other hand, a negative

current account balance shows that the country is a net borrower from other nations.

The main components of current account include; trade in goods, trade in services, Investment

incomes, and net transfers

4. If the country devalues its currency, it may face some negative consequences. Wen the

imports become more expensive, the domestic small industries feel safe. However, higher

exports may increase aggregate demand leading to inflation

5. If a countrys exports are lower than its imports, national saving must, of course, be the

investment. Here, the country is a net borrower since national saving is not enough to

finance all the local investment, and so the extra investment must be financed by

borrowing from other countries. Mishkin & Savastano, M. A. (2001)

6.

According to the data presented in the PowerPoint presentation, which is the most likely

combination of deficits and surpluses between the budget and the current account as

percentages of GDP?

7. How the reduction in the GDP growth in China reduces Brazils and Australias exports.,

I think if the Chinas GDP reduces, the commodity prices and in turn a reduction in the

Running head: SECOND SEMINAR MACROECONOMICS

current account balances of these three countries since they are large exporters. This will

help minimize the worldwide the imbalances

8. Explain how the reduction in the US GDP growth biggest importer in the world

affects exports from China and Europe, and consequently reduces growth in the latter

countries. De la Torre et al (2007)

There exists a close relationship between imports and economic growth. When the

economic growth in the US is stable, China and Europe are able to export their products and

hence their economy also nourishes. The opposite is true, the same nations must suffer a

blow in times of slow growth in the U.S. a slow growth in America implies a reduced

demand for imports hence the countries that export to the U.S also suffer a problem in

economic growth

Running head: SECOND SEMINAR MACROECONOMICS

References

Axilrod, S. H. (2011). Inside the Fed: monetary policy and its management, Martin through

Greenspan to Bernanke. MIT Press.

De la Torre, A., Gozzi, J. C., & Schmukler, S. L. (2007). Financial development: Maturing and

emerging policy issues. The World Bank Research Observer, 22(1), 67-102.

Masson, P. R., & Pattillo, C. A. (2004). The monetary geography of Africa. Brookings Institution

Press.

Mishkin, F. S., & Savastano, M. A. (2001). Monetary policy strategies for Latin

America. Journal of Development Economics, 66(2), 415-444.

You might also like

- CGN Employment Application FormDocument4 pagesCGN Employment Application FormsimonNo ratings yet

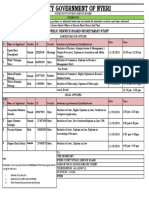

- INTERVIEW SCHEDULE SECRETARIAT 9th FINAL PDFDocument1 pageINTERVIEW SCHEDULE SECRETARIAT 9th FINAL PDFsimonNo ratings yet

- Betting Lotteries and Gaming Act 9 of 1966Document43 pagesBetting Lotteries and Gaming Act 9 of 1966simonNo ratings yet

- INTERVIEW SCHEDULE SECRETARIAT 9th FINAL PDFDocument1 pageINTERVIEW SCHEDULE SECRETARIAT 9th FINAL PDFsimonNo ratings yet

- Betting Lotteries and Gaming Act 9 of 1966Document43 pagesBetting Lotteries and Gaming Act 9 of 1966simonNo ratings yet

- Computer Networking 1Document4 pagesComputer Networking 1simonNo ratings yet

- KSAs-Knowledge, Skills, AbilitiesDocument13 pagesKSAs-Knowledge, Skills, AbilitiesRhoda RazzoukNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Monetary Policy 1Document19 pagesMonetary Policy 1Dhawal RajNo ratings yet

- European Debt CrisisDocument21 pagesEuropean Debt CrisisPrabhat PareekNo ratings yet

- Chapter One:: The Effect of Inflation On Poor People in HargeisaDocument42 pagesChapter One:: The Effect of Inflation On Poor People in Hargeisacankawaab75% (4)

- (ST) 02-Measuring The Cost of LivingDocument55 pages(ST) 02-Measuring The Cost of LivingThanh Ngan DuongNo ratings yet

- Central BankDocument2 pagesCentral BankJestin JohnNo ratings yet

- The Money Supply and FedDocument13 pagesThe Money Supply and FedAbdul HayeeNo ratings yet

- Tenets of Effective Monetary Policy in The Philippines: Jasmin E. DacioDocument14 pagesTenets of Effective Monetary Policy in The Philippines: Jasmin E. DacioEmeldinand Padilla MotasNo ratings yet

- Government Influence On Exchange Rate in BangladeshDocument22 pagesGovernment Influence On Exchange Rate in BangladeshOmar50% (2)

- Working Paper 244Document14 pagesWorking Paper 244pamela heavenNo ratings yet

- Foreign Exchange RateDocument8 pagesForeign Exchange RatePintu RaoNo ratings yet

- Review QuestionsDocument2 pagesReview QuestionsHads LunaNo ratings yet

- Liquidity Preference TheoryDocument34 pagesLiquidity Preference Theorygoldenguy90100% (2)

- MQ7 13 B AnswersDocument14 pagesMQ7 13 B AnswersPatricia CorpuzNo ratings yet

- Man - Solutions - Insights - Inflation RegimeDocument30 pagesMan - Solutions - Insights - Inflation RegimemohammedNo ratings yet

- Loan Calculator - Loan Thru PDFDocument3 pagesLoan Calculator - Loan Thru PDFAzwanAliNo ratings yet

- Total Retail Bond Trading 1511Document307 pagesTotal Retail Bond Trading 1511Sorken75No ratings yet

- Panteion University, Greece: T.panagiotidis@lboro - Ac.ukDocument18 pagesPanteion University, Greece: T.panagiotidis@lboro - Ac.ukHerlan Setiawan SihombingNo ratings yet

- Compress ActivityACCBBP100 (Week 1-3) FinalDocument4 pagesCompress ActivityACCBBP100 (Week 1-3) FinalOiram Ocirol50% (2)

- CPI CalculationDocument5 pagesCPI CalculationAnnu MeerNo ratings yet

- Real vs. Nominal Interest Rates: What's The Difference?Document5 pagesReal vs. Nominal Interest Rates: What's The Difference?Samantha EstilongNo ratings yet

- Amortization - Part 1 PDFDocument28 pagesAmortization - Part 1 PDFWu YueyangNo ratings yet

- Loan Amortisation Schedule FOR 9 YRSDocument4 pagesLoan Amortisation Schedule FOR 9 YRSArul VelanNo ratings yet

- The Impact of Monetary Policy On The Performance of Banking IndustryDocument75 pagesThe Impact of Monetary Policy On The Performance of Banking IndustryGreatman0% (1)

- Parkinmacro12 1300Document18 pagesParkinmacro12 1300Mr. JahirNo ratings yet

- Delhi Public School Sangrur: Multiple Choice QuestionsDocument9 pagesDelhi Public School Sangrur: Multiple Choice Questionsprateek gargNo ratings yet

- Homework #1: Nguyen Xuan Thanh Strategy division-TCBDocument2 pagesHomework #1: Nguyen Xuan Thanh Strategy division-TCBThanh NguyenNo ratings yet

- GL4102-07-Equivalence and Compound Interest-BaruDocument34 pagesGL4102-07-Equivalence and Compound Interest-BaruVicky Faras Barunson PanggabeanNo ratings yet

- Exchange Rate Theories: Prof Mahesh Kumar Amity Business SchoolDocument69 pagesExchange Rate Theories: Prof Mahesh Kumar Amity Business Schoolasifanis100% (2)

- Loan Repayment Template v4Document12 pagesLoan Repayment Template v4136 rNo ratings yet

- Tutorial 5 Chapter 4&5Document3 pagesTutorial 5 Chapter 4&5Renee WongNo ratings yet