Professional Documents

Culture Documents

Institute of Bankers Pakistan: Agriculture Finance

Uploaded by

Muhammad KashifOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Institute of Bankers Pakistan: Agriculture Finance

Uploaded by

Muhammad KashifCopyright:

Available Formats

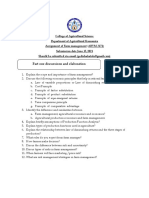

Institute of Bankers Pakistan

Sample Questions

Agriculture Finance

The sample questions are related to the JAIBP Specialization course Agriculture Finance.

The students are advised to thoroughly read the exam guidelines and the syllabus guide for this

course before start studying for the paper. The questions are shared to give an idea to the

student about the paper format and types of questions. For further information visit the IBP

website www.ibp.org.pk

Multiple Choice Questions

Each MCQ carry one and half mark.

Q1. The formal source of agricultural credit is:

A.

B.

C.

D.

Banks (Answer)

Traders

Exporters

Money Lender

Q2. In Pakistan, crop insurance scheme covers farmers against the risks of

A.

B.

C.

D.

low prices of agri. produce.

death of the farmer.

natural calamities. (Answer)

low yield varieties.

Q3. The term collateral in agricultural financing refers to

A.

B.

C.

D.

financial exposure of the farmer against guarantee.

lending by banks against SBP guarantee to farmers.

mortgage of land or property by the banks.

assets offered by farmer to the bank. (Answer)

Agriculture Finance

Page 1 of 3

Institute of Bankers Pakistan

Sample Questions

Constructed Response Question

Each CRQ contains five marks.

Question:

A. List TWO instruments that are used in agriculture value chain financing.

(1 Mark)

B. Under Value Chain Contract Farmer Financing, discuss the role of the bank with respect to

"Grower" and "Processor". (4 Mark)

Answer

Part-A

Instruments:

1. Trader credit

2. Input supplier credit

Part-B.

1. Grower:

Bank will provide loan to farmers as per list of growers provided or guaranteed by

processor/aggregator. Grower will deposit the payment warrant/cheque arrant for settlement of

outstanding loan liability and surplus amount shall be readily available to the growers.

2. Processors:

Bank will provide Marketing loan/seasonal loan/cash finance to processor against stock or any

collateral required by the bank. Processor will repay the loan amount to the bank after sale of

processed goods.

Agriculture Finance

Page 2 of 3

Institute of Bankers Pakistan

Sample Questions

Extended Response Question

Each ERQ contains ten marks.

Question:

A) Discuss TWO cropping seasons of Pakistan by identifying major crops and discussing

their impact on economy. (5 Marks)

B) What is the difference between cash crops and non-cash crops? (2 Marks)

C) Justify with reasons which one (cash crop or non-cash crop) is feasible for the bank?

(3 Marks)

Answer:

Part-A.

Two seasons:

1. Kharif

Season between April and October. Adequate rain water is required and crops may go waste if

it rains more or less.

Major Crops:

Rice

Millet

Maze

Peanut Bean

2. Rabi

Requires irrigation and grown between Mid-November to April.

Major Crops:

Wheat

Barley

Mustard

Peas

Part-B.

Cash crops are non-consumable whereas the non-cash crops or food crops are consumable. It

is not necessary to get earning on food crops but the cash crops are always sold in the market.

Part-C.

The cash crop is feasible for the bank because the farmer will get earning to pay off loans. In

food crops, the investment or lending made by the bank can be consumed by the farmer or

consumers thus giving no money back to the bank.

Agriculture Finance

Page 3 of 3

You might also like

- Agriculture Exam PaperDocument23 pagesAgriculture Exam Papermushtaque61No ratings yet

- Agriculture: One Mark QuestionsDocument6 pagesAgriculture: One Mark QuestionsMariyam AfsalNo ratings yet

- EcomomicDocument103 pagesEcomomicZaheer AhmadNo ratings yet

- Module 1 Agricultural Mechanics and MechanizationDocument16 pagesModule 1 Agricultural Mechanics and MechanizationDavie Martinez100% (2)

- Answer To Previous Board Exams Questions PDFDocument964 pagesAnswer To Previous Board Exams Questions PDFDarrick Base AseezNo ratings yet

- BOSTES 2016 HSC Agriculture ExamDocument28 pagesBOSTES 2016 HSC Agriculture ExamOliver LinNo ratings yet

- Cropping Pattern and Cropping SystemDocument14 pagesCropping Pattern and Cropping Systemdsds100% (1)

- Organic Farming Final PDFDocument47 pagesOrganic Farming Final PDFaakumaNo ratings yet

- Lecture Notes of AAG 222 IV SEMDocument66 pagesLecture Notes of AAG 222 IV SEMSachin KumarNo ratings yet

- Agri BusinessDocument132 pagesAgri Businesstedaa0% (1)

- Chapter 1 Introduction Farm MachineryDocument21 pagesChapter 1 Introduction Farm MachinerySiraj Busse0% (1)

- Farm Management Chap 3Document62 pagesFarm Management Chap 3gedisha katolaNo ratings yet

- Agriculture MCQs Practice Test 34Document8 pagesAgriculture MCQs Practice Test 34chenogih kentNo ratings yet

- Agriculture and Rural Development Question BankDocument30 pagesAgriculture and Rural Development Question BankKabya SrivastavaNo ratings yet

- History of Organic FarmingDocument9 pagesHistory of Organic FarmingSanchita KulshresthaNo ratings yet

- Agricultural Economics 2013 PHD Question PaperDocument14 pagesAgricultural Economics 2013 PHD Question PaperdeepakNo ratings yet

- Agricultural Extension and CommunicationDocument26 pagesAgricultural Extension and Communicationskrt skrtNo ratings yet

- Agriculture MCQs Practice Test 46Document10 pagesAgriculture MCQs Practice Test 46VARTIKA SINGHNo ratings yet

- AECO141principle of Agricultural Economics PDFDocument86 pagesAECO141principle of Agricultural Economics PDFpraveenbabu50% (8)

- Farm Management Sample Test QsDocument51 pagesFarm Management Sample Test QsAshish Puranik100% (3)

- Agricultural Innovation SystemDocument16 pagesAgricultural Innovation SystemAnurag Shankar SinghNo ratings yet

- Agricultural Marketing ReviewDocument147 pagesAgricultural Marketing ReviewVanshence neosilverNo ratings yet

- Agricultural Extension 2013Document12 pagesAgricultural Extension 2013deepakNo ratings yet

- Intro Farming SystemDocument50 pagesIntro Farming SystemPaolo Paolo PaoloNo ratings yet

- AgricultureDocument32 pagesAgricultureKapil Kumar Sharma0% (2)

- Agricultural Economics and Marketing Pre TestDocument21 pagesAgricultural Economics and Marketing Pre Testkarla arellano100% (1)

- Elements of Business Plan: Introductory PageDocument4 pagesElements of Business Plan: Introductory PageNishant PatilNo ratings yet

- Marketing of Agricultural InputsDocument34 pagesMarketing of Agricultural Inputsshuklasarvind100% (1)

- Horticulture IntroductionDocument42 pagesHorticulture IntroductionUsama ShahNo ratings yet

- Agribusiness HandoutDocument21 pagesAgribusiness HandoutanatoliNo ratings yet

- Principles and Practices of Water ManagementDocument3 pagesPrinciples and Practices of Water ManagementMahendra paudel PaudelNo ratings yet

- FIELD CROPS RABI With Multiple Choice Questions PDFDocument196 pagesFIELD CROPS RABI With Multiple Choice Questions PDFRaj100% (1)

- Problems of Agricultural Marketing in IndiaDocument5 pagesProblems of Agricultural Marketing in IndiaHariraj SNo ratings yet

- ARS Syllabus Farm MachineryDocument2 pagesARS Syllabus Farm MachineryVijay ChavanNo ratings yet

- Ao Xam BookDocument205 pagesAo Xam Bookbloomece0% (1)

- Principles of Agricultural MarketingDocument21 pagesPrinciples of Agricultural Marketingagricultural and biosystems engineering100% (1)

- Multiple Choice Questions On Agriculture AdvancesDocument5 pagesMultiple Choice Questions On Agriculture Advancesmushtaque61100% (2)

- Farm Management AssignmentDocument3 pagesFarm Management Assignmentgedisha katola100% (1)

- AG. Econ. 4.3Document135 pagesAG. Econ. 4.3Kaushal VasaniNo ratings yet

- Ag Extn 1-ISO Syllabus-GOCODocument12 pagesAg Extn 1-ISO Syllabus-GOCORosebelle Goco100% (1)

- Board Exam Agricultural MarketingDocument11 pagesBoard Exam Agricultural MarketingHoven Santos IINo ratings yet

- Agricultural EconomicsDocument59 pagesAgricultural EconomicsLaila Ubando100% (1)

- CH 1 Introduction To Agricultural EconomicsDocument34 pagesCH 1 Introduction To Agricultural Economicsdinesh100% (4)

- RB Cagmat Review Center - Aec-History of ExtensionDocument23 pagesRB Cagmat Review Center - Aec-History of ExtensionTeam Agri Cultura100% (1)

- Hitech Horticulture PDFDocument7 pagesHitech Horticulture PDFSofi MehrajNo ratings yet

- Plant Breeding and GeneticsDocument17 pagesPlant Breeding and GeneticsaakumaNo ratings yet

- Postharvest Losses and StrategiesDocument57 pagesPostharvest Losses and Strategiesshii anihs100% (1)

- Farm Machinery IDocument6 pagesFarm Machinery IAnthony ContrerasNo ratings yet

- Introduction To Agricultural MechanizationDocument30 pagesIntroduction To Agricultural MechanizationdegagaNo ratings yet

- Marketing of Agricultural InputsDocument7 pagesMarketing of Agricultural InputsAnurag Singh009No ratings yet

- (Pranav K Desai) Agricultural Economics (BookFi)Document317 pages(Pranav K Desai) Agricultural Economics (BookFi)Arpi JainNo ratings yet

- Organic Production of Some Agronomic Crops: Basmati Rice, Cotton, Red Gram and SugarcaneFrom EverandOrganic Production of Some Agronomic Crops: Basmati Rice, Cotton, Red Gram and SugarcaneNo ratings yet

- Agronomy of Field Crops 1Document122 pagesAgronomy of Field Crops 1mohan92% (39)

- AEC 201 EconomicsDocument6 pagesAEC 201 Economicssudharsan dharshanNo ratings yet

- Farm Crops - With Information on Soil Cultivation, Grain Crops, Forage Crops and PotatoesFrom EverandFarm Crops - With Information on Soil Cultivation, Grain Crops, Forage Crops and PotatoesNo ratings yet

- AGRICULTURAL CREDIT IN PAKISTAN FinalDocument9 pagesAGRICULTURAL CREDIT IN PAKISTAN FinalAbdul QuddoosNo ratings yet

- Poultry Layer FarmingDocument24 pagesPoultry Layer Farmingpmeyyappan95% (19)

- Agricultural Banking - Questions & AnswersDocument9 pagesAgricultural Banking - Questions & AnswersShiva Dubey100% (1)

- Economics Chapter 3 NcertDocument5 pagesEconomics Chapter 3 NcertHarshit GroverNo ratings yet

- COVID-19 and Student PDFDocument60 pagesCOVID-19 and Student PDFMuhammad KashifNo ratings yet

- Acceptance of Mobile Banking Framework in PakistanDocument50 pagesAcceptance of Mobile Banking Framework in PakistanMuhammad KashifNo ratings yet

- Name of Institute: To Whom It May ConcernDocument1 pageName of Institute: To Whom It May ConcernMuhammad KashifNo ratings yet

- Name of Institute: To Whom It May ConcernDocument1 pageName of Institute: To Whom It May ConcernMuhammad KashifNo ratings yet

- The Impact of Covid 19 On Education Insights Education at A Glance 2020Document31 pagesThe Impact of Covid 19 On Education Insights Education at A Glance 2020Muhammad Kashif100% (1)

- Name of Institute: To Whom It May ConcernDocument1 pageName of Institute: To Whom It May ConcernMuhammad KashifNo ratings yet

- Financial ManagementDocument10 pagesFinancial ManagementMuhammad KashifNo ratings yet

- COVID-19 and Student PDFDocument60 pagesCOVID-19 and Student PDFMuhammad KashifNo ratings yet

- Covid Questions and AnswersDocument9 pagesCovid Questions and AnswersMuhammad KashifNo ratings yet

- Protect Yourself and Others From COVID-19Document3 pagesProtect Yourself and Others From COVID-19Muhammad KashifNo ratings yet

- Covid Questions and AnswersDocument9 pagesCovid Questions and AnswersMuhammad KashifNo ratings yet

- RBFCS V1N1 2010 2Document11 pagesRBFCS V1N1 2010 2Muhammad KashifNo ratings yet

- COVID-19 and Student PDFDocument60 pagesCOVID-19 and Student PDFMuhammad KashifNo ratings yet

- Covid Questions and AnswersDocument9 pagesCovid Questions and AnswersMuhammad KashifNo ratings yet

- List of All CompaniesDocument82 pagesList of All CompaniesMuhammad KashifNo ratings yet

- StateBank of PakistanDocument4 pagesStateBank of PakistanMuhammad KashifNo ratings yet

- Foreign Office Page For Documents AttestationsDocument1 pageForeign Office Page For Documents AttestationsMuhammad KashifNo ratings yet

- Vip Questions For PPSC or NtsDocument6 pagesVip Questions For PPSC or NtsMuhammad KashifNo ratings yet

- Muhammad Kashif CVDocument2 pagesMuhammad Kashif CVMuhammad KashifNo ratings yet

- Muhammad Kashif CVDocument2 pagesMuhammad Kashif CVMuhammad KashifNo ratings yet

- Multiplication Tables From 1 To 30Document3 pagesMultiplication Tables From 1 To 30abhilash149No ratings yet

- CapitalBudgetingAndInvestmentDecisions PDFDocument22 pagesCapitalBudgetingAndInvestmentDecisions PDFMuhammad KashifNo ratings yet

- Como Citar en Estilo APADocument1 pageComo Citar en Estilo APAAbdon Hernan Zavala PerezNo ratings yet

- Muhammad Kashif CVDocument2 pagesMuhammad Kashif CVMuhammad KashifNo ratings yet

- Post-Brexit, Small Businesses in UK Are BullishDocument2 pagesPost-Brexit, Small Businesses in UK Are BullishMuhammad KashifNo ratings yet

- Land Revenue Act 1967Document60 pagesLand Revenue Act 1967Zeeshan Ali Lak100% (1)

- National ToysDocument2 pagesNational ToysMuhammad KashifNo ratings yet

- Cultural Exchange Paper DistDocument3 pagesCultural Exchange Paper DistAbdul HameedNo ratings yet

- 2Document1 page2Muhammad KashifNo ratings yet

- Internship ReprtDocument39 pagesInternship ReprtMuhammad KashifNo ratings yet

- Polymer ProDocument25 pagesPolymer ProJeerisuda KingklangNo ratings yet

- Performantele MTADocument5 pagesPerformantele MTAana aNo ratings yet

- Female Education ThesisDocument48 pagesFemale Education ThesisHashmie Ali73% (11)

- Review Related LiteratureDocument3 pagesReview Related LiteratureHanz EspirituNo ratings yet

- Classroom Readiness ChecklistDocument2 pagesClassroom Readiness ChecklistRoseman Tumaliuan100% (1)

- Job Vacancy Kabil - Batam April 2017 RECARE PDFDocument2 pagesJob Vacancy Kabil - Batam April 2017 RECARE PDFIlham AdeNo ratings yet

- Pia AlgebraDocument12 pagesPia AlgebraCarvajal EdithNo ratings yet

- B 700 FDocument25 pagesB 700 FMohammed HdyliNo ratings yet

- Marine Turtle Survey Along The Sindh CoastDocument106 pagesMarine Turtle Survey Along The Sindh CoastSyed Najam Khurshid100% (1)

- Publication PDFDocument152 pagesPublication PDFAlicia Mary PicconeNo ratings yet

- (Clinical Sociology - Research and Practice) Howard M. Rebach, John G. Bruhn (Auth.), Howard M. Rebach, John G. Bruhn (Eds.) - Handbook of Clinical Sociology-Springer US (2001) PDFDocument441 pages(Clinical Sociology - Research and Practice) Howard M. Rebach, John G. Bruhn (Auth.), Howard M. Rebach, John G. Bruhn (Eds.) - Handbook of Clinical Sociology-Springer US (2001) PDFMuhammad AliNo ratings yet

- QM SyllabusDocument2 pagesQM SyllabusSanthosh Chandran RNo ratings yet

- Rodents and Sectional Title ComplexDocument2 pagesRodents and Sectional Title ComplexFredSmith777No ratings yet

- Oxigen Gen Container CMM 35-21-14Document151 pagesOxigen Gen Container CMM 35-21-14herrisutrisna100% (2)

- NOTIFIER ERCES-Bi-Directional Amplifier Systems (BDA) Webinar 6-4-2019Document50 pagesNOTIFIER ERCES-Bi-Directional Amplifier Systems (BDA) Webinar 6-4-2019culeros1No ratings yet

- Patanjali CHP 1Document31 pagesPatanjali CHP 1Prasad KadamNo ratings yet

- Trophic Levels - 10% RuleDocument5 pagesTrophic Levels - 10% RulerebbiegNo ratings yet

- The Modern Fire Attack - Phil Jose and Dennis LegearDocument7 pagesThe Modern Fire Attack - Phil Jose and Dennis LegearTomNo ratings yet

- Radfet DatasheetDocument6 pagesRadfet DatasheetNicholas EspinozaNo ratings yet

- Make Swiss RollDocument16 pagesMake Swiss RollFelicia LiNo ratings yet

- Chapter 2Document5 pagesChapter 2ERICKA MAE NATONo ratings yet

- Polymer LedDocument14 pagesPolymer LedNaveenNo ratings yet

- 2457-Article Text-14907-2-10-20120724Document6 pages2457-Article Text-14907-2-10-20120724desi meleniaNo ratings yet

- B1 SpeakingDocument5 pagesB1 SpeakingHoàng Nam Thắng100% (2)

- JEE Mains 2024 Question Paper Shift 2 27 JanDocument4 pagesJEE Mains 2024 Question Paper Shift 2 27 JanAnjali SahooNo ratings yet

- Registration of Hindu Marriage: A Project On Family Law-IDocument22 pagesRegistration of Hindu Marriage: A Project On Family Law-Iamit dipankarNo ratings yet

- Topic 10 - The Schooler and The FamilyDocument18 pagesTopic 10 - The Schooler and The FamilyReanne Mae AbreraNo ratings yet

- BS 5422 2001 Method For Specifying Thermal Insulating Materials For Pipes, Tanks, Vessels, DuctDocument60 pagesBS 5422 2001 Method For Specifying Thermal Insulating Materials For Pipes, Tanks, Vessels, DuctRamiAl-fuqahaNo ratings yet

- Commented (JPF1) : - The Latter Accused That Rizal HasDocument3 pagesCommented (JPF1) : - The Latter Accused That Rizal HasLor100% (1)

- Worksheet 2 - TLC - Updated Summer 2021Document4 pagesWorksheet 2 - TLC - Updated Summer 2021Bria PopeNo ratings yet