Professional Documents

Culture Documents

Ib A2 Team

Uploaded by

Hung LeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ib A2 Team

Uploaded by

Hung LeCopyright:

Available Formats

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Table of Contents

1

Executive Summary.............................................................................................. 4

Introduction........................................................................................................ 6

2.1

About Vinamilk Company................................................................................6

2.2

Product Mix.................................................................................................. 6

2.3

Targeted Country............................................................................................ 7

Reasons for Internationalizing..................................................................................8

PEST Analysis..................................................................................................... 9

4.1

4.1.1

Political Situations....................................................................................9

4.1.2

Policies to Attract FDIs.............................................................................. 9

4.1.3

Food Safety Policies............................................................................... 10

4.2

Economic Factors......................................................................................... 11

4.2.1

Economic Situation................................................................................. 11

4.2.2

GDP and Inflation Rate............................................................................12

4.2.3

GNI and Unemployment Rate....................................................................14

4.3

Social Factors.............................................................................................. 15

4.3.1

Demographics....................................................................................... 15

4.3.2

Cultural Differences................................................................................17

4.3.3

Tastes and Preferences.............................................................................18

4.4

Political and Legal factors................................................................................. 9

Technological Factors.................................................................................... 19

4.4.1

Infrastructure........................................................................................ 19

4.4.2

Education and Training............................................................................ 20

4.4.3

Technological Readiness..........................................................................21

Singaporean Dairy Market Analysis.........................................................................21

5.1

Threat of New Entrants: HIGH.........................................................................22

5.2

Power of Buyer: MODERATE.........................................................................22

5.3

Power of Suppliers: LOW............................................................................... 22

5.4

Competitive Rivalry: HIGH............................................................................23

5.5

Threat of Substitutes: LOW.............................................................................23

Entry Mode....................................................................................................... 24

Implementation.................................................................................................. 26

7.1

Internationalization Strategy............................................................................26

7.2

Set-up Cost................................................................................................. 26

SWOT Analysis.................................................................................................. 27

Team: Whatever

2

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

9

Conclusion........................................................................................................ 27

10

Reference Lists............................................................................................... 29

11

Appendix...................................................................................................... 36

Team: Whatever

3

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

1

Executive Summary

Globalization enables firms to expand their operations not only in the home country but also

internationally. Taking this opportunity, Vinamilk (Vietnam Dairy Products Joint Stock

Company) had exported their products to 29 countries in the world. Singapore is a developed

country which highly encourages foreign companies to invest in. This report will analyze

Singaporean environment to reach a conclusion that Singapore is an ideal place for Vinamilk

to expand to.

Market-seeking and efficiency-seeking motives are two reasons why Vinamilk should expand

to Singapore. As an import-reliance country, Singapore is a potential market for exporters.

Moreover, Vietnam and Singapore are members of WTO, ASEAN and APEC. Vinamilk can

take advantages of lower tariffs and easier administrative procedures.

Moreover, PEST analysis, which consists of political, economic, social and technological

factors, is a crucial framework for analyzing macro-environment factors in Singapore. Firstly,

in terms of politics, one party political system brings stability to this country. Singapore also

imposes many encouraging policies to attract FDIs in terms of procedures and tax incentives.

However, strict food safety policy is an issue that Vinamilk has to be aware of. Secondly,

Singapore is a well-developed economy with high GDP and low unemployment rate. Income

of Singaporean people is relatively higher compared to other countries, which creates a

demand for nutritious products. Thirdly, population aging 25-64 constitutes for a large

proportion. Singapore and Vietnam are having the same culture. Furthermore, the level of

price sensitivity of Singaporean customers is significant. Lastly, infrastructure such as port

stations and warehouses in Singapore is extremely modern. On the other hand, employees are

skillful and online shopping is popular in this country. All of these factors indicate that

Singapore is a suitable market for Vinamilk.

For a closer insight about Singaporean dairy market, Porters Five Forces is used in this

report. It is notable that Singaporean dairy market is high in threat of new entrants and

competitive rivalry. Therefore, the dairy market in Singapore is competitive and brutal.

Overall, by applying Uppsala model, Vinamilk can establish sales subsidiary in Singapore.

Team: Whatever

4

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

The company had already had experience and knowledge in building factories and

establishing sales subsidiary in other countries. When setting up sales subsidiary,

transnational strategy is appropriate for Vinamilk. This company should consider sending

PCNs, recruiting Singaporean HCNs and hiring offices and warehouses in Singapore.

Team: Whatever

5

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

2

Introduction

The demand for dairy products in both developed and developing countries is growing along

with rising incomes, urbanization and healthy diets, which creates opportunities for dairy

companies to develop their production. Vinamilk is the largest dairy company in Vietnam,

which creates a sound basis to expand internationally. Taking these advantages, Vinamilk has

headed its products overseas in over 120 countries, such as the U.S., Australia, Canada,

Turkey, Russia and South Korea. However, Singapore is a potential market that Vinamilk has

not expanded to yet (Vinamilk 2014a).

This report will provide detailed analysis of Singaporean market and identify opportunities

and challenges for Vinamilk in expanding to this country.

2.1

About Vinamilk Company

Established in 1976, Vinamilk is mainly engaged in providing dairy products in Vietnam and

internationally (Vinamilk 2014c). They process, manufacture, marketing and distribute their

products regarding milk products, nutrition food and non-alcohol beverages. Vinamilks

managers are wholehearted in providing the best quality product, ensuring food safety and

being innovative in product development to enhance Vietnamese peoples health (Vinamilk

2014a). The strategy of Vinamilk is to gain high customer satisfaction through affordable

prices and the most modern distribution channel in Vietnam (Vinamilk 2014a).

Furthermore, Vinamilk owns intensive physical assets with 13 factories throughout Vietnam

and one milk plant in New Zealand (Vinamilk 2014b). SSI Schaefer (n.d.) states that with

advanced technologies, Vinamilk gains competitive advantage in manufacturing products that

satisfy international standard in nutrients. Moreover, the company engages in raising dairy

cows and developing breeding techniques for stable supply of fresh milk (Vinamilk 2014a).

With all of these capacities, Vinamilk has performed very efficiently in Vietnam and foreign

countries with total revenue of VND 35,704 billion in 2014 (Vinamilk 2014a). It is a solid

base for Vinamilk to expand to Singaporean market.

2.2

Product Mix

Vinamilk has over 10 brands with 200 product lines, which made the company become the

most famous dairy products supplier in Vietnam (Vinamilk 2014c). The fundamental product

Team: Whatever

6

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

line is fresh milk, yogurt, condensed milk, powder milk, beverages, ice cream and soy milk

(figure 1).

Figure 1. Adapted from: Vinamilk n.d.

The company divides its products into groups of ages. They have products for kids, such as

cocoa malt drink which is sweet and have colourful bottle packages and for pregnant women,

like Dielac Mama providing essential nutrients to enhance mothers health and prevent

constipation during pregnancy (Vinamilk 2014a). Furthermore, Vinamilk offers affordable

price that attracts a wide range of customers from low-income class to high-end segment

(Vinamilk n.d.).

2.3

Targeted Country

Singapore is the targeted market which has a strategic location between the South China Sea

and the Indian Ocean (Euromonitor International 2015h). More importantly, Singapore's

geographic location is nearby Vietnam (CIA 2015). Singapore, which is called as the Lion

City, has grown significantly since independence, and become one of the world's most

prosperous countries with the world's busiest port (CIA 2015). Furthermore, Singapore has a

highly development free market economy in which the economy is open and corruption-free

Team: Whatever

7

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

(CIA 2015). The economy depends a lot on imports, which is an advantage for foreign

companies to enter the market (CIA 2015).

Reasons for Internationalizing

With regards to Dunnings four reasons for firms to internationalize (Dunning 2000), marketseeking and efficiency-seeking are the two motives that Vinamilk should think of if the

company intends to approach Singaporean dairy market.

In terms of market-seeking motive, because of the lack of land, Singapore has to import over

90% of its fresh produce, specifically vegetables, fresh meat and dairy products (Euromonitor

International 2014a). Moreover, based on MarketLine (2014), in 2018, it is predicted that

Singaporean dairy market would have a value of $807.7 million (a rise of 27.3% since 2013)

and a volume of 48.1 million kilograms (a rise of 26.9% since 2013). With increases in the

market value and volume forecast, Singapore is an ideal market for Vinamilk to enter.

Another potential motive is efficiency-seeking, which is designed to take advantages of free

trade agreements (Dunning & Lundan 2008). According to MarketLine (2015c), Singapore

economy depends on foreign trade to a great extent so that government policies have made

special efforts to reduce trade and investment barriers. Specifically, the country joining WTO,

ASEAN and APEC has removed a large number of import items from its tariff lists

(MarketLine 2015c). For instance, ASEAN Community has effectively lowered intra-national

tariff by Common Effective Preferential Tariff Scheme (ASEAN n.d.). Almost 80% of

products traded between Singapore and Vietnam have been brought down to the 0-5% tariff

range (ASEAN n.d.). Moreover, WTO simplified trade process by standardizing custom

procedures, created transparency by clarifying information related to politics, regulation and

reducing tariffs from 5% to 9% (WTO n.d.). As Vietnam is also a member of WTO, ASEAN

and APEC (Euromonitor International 2015), it could be easier for Vinamilk to enter

Singapore without paying high tariffs.

In terms of psychic distance (Grska 2013), Singapore is an ideal market as the country is

located in the same area, namely South East Asia (SEA) as Vietnam

Team: Whatever

8

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

4

PEST Analysis

4.1

4.1.1

Political and Legal factors

Political Situations

Singapore is a parliamentary republic where the Peoples Action Party (PAP) has dominated

the countrys politics since 1959 (Euromonitor International 2015a). Being the first prime

minister of The Republic of Singapore, Lee Kaun Yew, who was the founder of PAP, engaged

in making Singapore to be an attractive country to invest in by creating transparent

bureaucracy and effective regulatory systems (Hussain 2015).

The one party system brings stability and minimizes political conflicts between parties in

Singapore. Owing to all contributions from the PAP, the Singaporean government is

considered one of the most effective among Asian countries. The score for absence of

corruption is 0.93/1, which indicates the degree of integrity and accountability of the

Singaporean government are tremendously high (World Justice Project 2015).

4.1.2

Policies to Attract FDIs

4.1.2.1 Procedures

Singapore is the worlds easiest place to do business as it bestows many advantages for FDIs

(World Bank 2015d). This country strongly encourages international firms to invest in. The

laws determine different incentives for different sectors (Euromonitor International 2015a).

According to U.S. Department of State (2014), the legal framework and public policies are

advantageous that attract FDIs into Singapore since there is no restriction on reinvestment or

repatriation of earnings or capital. Moreover, foreign investors will be treated as equal as

domestic firms as they are not being required to enter Singapore via joint ventures or gain the

management control in local companies to do business (Euromonitor International 2015a).

4.1.2.2 Corporate Tax Incentives

Singapores corporate tax rate is lowest in Asia which is 17%, whilst the rate in Vietnam is

22% (MarketLine 2014; Deloitte 2015). Moreover, Singapores Goods and Services tax

(GST) is 7% (Euromonitor International 2015a). With the aim of attracting more FDIs, the

government has many tax incentives including tax exemption or tax reduction for all firms in

all industry (KPMG 2013). Specifically, the government organizes the International

Team: Whatever

9

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Headquarter or Regional Headquarter program (IHQ/RHQ) applied for all businesses

incorporated or registered in Singapore (Singapore Economic Development Board n.d.). The

program will reduce the corporate tax rate on incremental income to encourage foreign

entities in considering Singapore as a base to conduct their activities in headquarters

management, control their regional and international operations (Singapore Economic

Development Board n.d.).

Singapore ranks fifth in providing business with friendly tax environment out of 189

countries. It takes only 82 hours per year in Singapore to handle taxation procedures, while

the average amount of the East Asia & Pacific is 204 hours per year (Euromonitor

International 2015a). The total tax payment is equal 18.4% of corporate income, which is a

half of the East Asia & Pacific average rate (34.4%) (Euromonitor International 2015a). This

relatively low level of tax attracts FDI inflows to Singapore.

4.1.2.3 Labor Laws

Singaporean labour market is one of the most flexible markets in the world, which ranked

second out of 144 nations in labour market efficiency of the GCI 2014 (Euromonitor

International 2015g). Labour laws enable businesses to be flexible in labour contracts.

Recruiting and dismissing practices are relatively simple for employers in this country

(Euromonitor International 2015h). Nevertheless, recruitment for foreign labour had been

tightened in 2014 when the Ministry of Manpower required companies to prioritize on hiring

Singaporean labors over foreign ones (Euromonitor International 2015g). Given the fact that

Singaporean workers have a high level of expertise, this is not an issue for Vinamilk in

recruiting employees in this country. Moreover, Singapore does not enforce any minimum

wage regulation and salary can be negotiated between employers and employees

(Euromonitor International 2015g).

4.1.3

Food Safety Policies

Due to an increase in consumer health consciousness, Singaporean place an emphasis on

origin, quality, brands and other factors related to products they will buy (Euromonitor

International 2015c). Being aware of that, the Singaporean government has created stricter

requirements and laws on food safety (MarketLine 2014). Specifically, the importation of

processed food including dairy products, is regulated by the Agri-Food and Veterinary

Team: Whatever

10

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Authority of Singapore (AVA) to make sure the food is safe (AVA (a) n.d.). According to AVA

(b) (n.d.), it is illegal to sell, import, advertise or produce dairy products which have

excessive amounts of antibiotic residues or are degradation products.

Moreover, these products are subjected to Sale Food Act and Food Regulations which

contains packaging regulations and labeling requirements (AVA (a) n.d.). Additionally,

businesses are required to give the proof to ensure its products meet the quality requirements

and standards, such as laboratory analytical reports, food safety standardization and other

supporting documents (Singaporean-German Chamber of Industry and Commerce 2013).

According to AVA (b) n.d.), nutrition claim has to be sufficiently emphasized on dairy

packaging. Hence, these strict regulations will increase compliance costs for businesses

which raise difficulties for foreign investors (MarketLine 2014).

4.2

4.2.1

Economic Factors

Economic Situation

Singapore is an ideal country for foreign investors as it has a free market economy with an

opened and friendly environment as well as second rank in strength of investor protection in

2014 (CIA 2015; Schwab 2014). Imports constitute for a large proportion of Singaporean

GDP (figure 2). Therefore, as being one of the most import-dependent countries, Singapore is

an attractive market for foreign exporters to enter (Euromonitor International 2015h).

Team: Whatever

11

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Figure 2. Reproduced from: World Bank 2015a

Furthermore, economic ideology of the Singaporean government is to boost government

spending on public welfare and developing free trade environment (MarketLine 2015c). A

research by Heritage Foundation (2015) indicated that Singapores Economic Freedom Index

ranking is at 2 out of 178 countries with 89.4 points, which creates freedom for companies as

the intervention level of government on business activities is very low. Moreover, Singapore

has ranked 2nd in Global Competitive Index for four consecutive years. This country ranked

first in goods market efficiency (Schwab 2014).

4.2.2

GDP and Inflation Rate

Figure 3. Reproduced from: MarketLine 2015b

According to MarketLine (2015c), due to economic crisis in 2009, GDP decreased by 0.6%

(figure 3). The rationale is that Singapore is highly dependent on international trade and

finance with other countries. Additionally, based on Euromonitor International (2015f), total

Team: Whatever

12

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

GDP of Singapore increased by 34.1% to reach US$ 307 billion in 2014. However, in 2013,

Singaporean economy recovered marginally to 3.93% and in 2014, GDP growth was more

stable at 2.4% (MarketLine 2015c). GDP growth rate in 2015 is forecasted to be 2 to 2.5%

because the global economy experienced downturns in the first half of 2015 (MTI 2015).

Therefore, income of Singaporean tends to be stably high, which leads to higher purchasing

power and demands for value-added products.

Figure 4. Reproduced from: World Bank 2015b

In contrast, figure 4 shows the inflation rate of Singapore dropped from 5.3% in 2011 to 1%

in 2014. The low inflation rate benefits for businesses as money is more valuable which leads

to an increase in the purchasing power of consumers (Bank of Canada 2013). This generates

opportunities for business investment to enhance productivity and stay competitive in

Singapore (Bank of Canada 2013).

Team: Whatever

13

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Furthermore, according to Harjani (2015), Singapore dollar dropped 5% compared to US

dollar in 2014, and it is forecasted to decrease by 5% at the end of 2015. It will be beneficial

to export to Singapore because the value of VND will increase and revenue for international

firms will accelerate.

4.2.3

GNI and Unemployment Rate

Figure 5. Reproduced from: Euromonitor International 2015a

Singapores unemployment rate has decreased steadily since 2010 due to steady economic

recovery. In 2015, the unemployment was 2.9% of the economically active population, which

is much lower than the rate of 2009 (4.3%). However, Singapores youth unemployment rate

(aged 15-24) remained tremendously higher at 8.4% in 2015 because experienced workers

are more preferred by employers.

Team: Whatever

14

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Figure 6. Reproduced from: World Bank n.d.

GNI per capita in Purchasing Power Parity is an indicator that effectively measures peoples

living standard by converting into a common currency (UNDP n.d.). Figure 6 illustrates that

income generated domestically and internationally by Singaporean is tremendously higher

than average GNI of the world. Thus, Singaporean has a extremely high living standard.

Figure 7. Reproduced from: Euromonitor International 2014a

Team: Whatever

15

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

The high living standard results in a demand for nutritious products. According to figure 6,

Singaporean expenditure is on upward trend between 2000 and 2013. It is forecasted that this

figure will mount to S$212 per capita in 2016, which creates a potential market for dairy

firms to come to Singapore (figure 7).

4.3

4.3.1

Social Factors

Demographics

According to Euromonitor International (2015h), the population of Singapore was

dramatically increased from 2.4 million in 1980 to 5.6 million in 2014. By 2020, it is

expected that the population will reach 6.1 million (Euromonitor International 2015h). The

increase in the population will become an ideal condition for Vinamilk, since the company

could achieve large sales if it enters Singaporean dairy market.

Figure 8. Reproduced from: CIA 2015

Team: Whatever

16

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Although the population of Singapore rises, the countrys society is ageing (figure 8). The

median age is 36 years old, 10.9 years higher than in 1980 (Euromonitor International

2015h). Moreover, the number of people from 25 to 64 years old is 3,435,768 people which

accounted for nearly 60% of Singapores overall population (CIA 2015). Therefore, as

Vinamilk is a big company that has a variety of dairy products served for different customer

segments from mom and kid, adults to elderly (Vinamilk 2014a), ageing structure of

population is not a threat for the company. Conversely, the ageing population helps the

company in realizing adult segment is very potential and it needs to be mainly concentrated

on when operating in Singapore.

4.3.2

Cultural Differences

Figure 9. Reproduced from: The Hofstede Centre n.d.

Figure 8 indicated Singapore and Vietnam have significant cultural similarities. For instance,

in terms of power distance, both countries accept and expect that power is distributed

unequally within an organization or society meaning that employees expect their bosses to be

Team: Whatever

17

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

told what to do (The Hofstede Centre n.d.). However, there is a minor difference in the level

of uncertainty avoidance between Singapore and Vietnam. Specifically, Vietnamese do not

want to feel threatened by ambiguous or unknown situations and try to avoid them at certain

levels; however, Singaporean seem to have a more relaxed attitude toward ambiguous or

unknown situations and want to take risks with very low score on this dimension (The

Hofstede Centre n.d.). In Singapore, people obey rules and regulations seriously, not because

they need for structure but because of high power distance (The Hofstede Centre n.d.).

Therefore, they call their country a Fine country. You will get a fine for everything (The

Hofstede Centre n.d.). Consequently, from Vinamilks perspective, it is quite easy for the

company to set up its business due to similar cultures. The only issue is that the company

needs to follow regulations and standards if they do not want to get fined when doing

business in Singapore.

4.3.3

Tastes and Preferences

Figure 10. Reproduced from UNDP 2013

Team: Whatever

18

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Human development index (HDI) is a composite index that measures the quality of life in

three dimensions (UNDP 2013). According to UNDP (2013), HDI of Singapore ranked 9th in

the world with 0.901 points which is higher than very high human development level (figure

10). This means Singaporean peoples quality of life is really good with high standard of

living, good knowledge as well as a long and healthy life. In order to have this long and

healthy life, Singaporean consumers value healthy products. Based on Euromonitor

International (2015e), due to the increase in the trend of health-concerns, many Singaporean

consumers start to buy soy milk, free-fat milk, sour milk or reduced fat formats; while full fat

formats like cream are perceived to be unhealthy. Moreover, the consumers prefer drinking

yoghurt as they have a deep knowledge of the health benefits gained from yoghurt including

digestive health and boost immune strength (Euromonitor International 2015j). Thus, milk,

soy products and yogurt become largest segments of the dairy market in Singapore which

account for 40.2%, 24.3% and 11.3% of the markets total value respectively (MarketLine

2014b). Being aware of this trend, Vinamilk can choose to provide specific dairy products

that meet Singaporean consumers demand.

In terms of price sensitivity, Singaporean consumers are highly price sensitive. According to

Euromonitor International (2014b), 52% of Singaporean shoppers thought in shopping

decision, price was outweighed brands reputation and quality. Moreover, approximately 56%

of customers focused on promotions and deals; and 42% of them often used discount coupons

(Euromonitor International 2014b). The reason behind that behaviour is because in

Singapore, the government has created stringent laws and requirements on food safety.

Consequently, Singaporean consumers did not need to concern about the quality of products

and they concentrated on the price to save money. Thus, Vinamilk can enter Singaporean

dairy market without having any fear that local consumers will choose existing competitors

products rather than products of new players like Vinamilk.

Team: Whatever

19

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

4.4

4.4.1

Technological Factors

Infrastructure

Figure 11. Reproduced from: Schwab 2014

The quality of overall infrastructure of Singapore has ranked 5 th in the world with the score of

6.3 out of 7 in 2014 (figure 11). Specifically, qualities of air transport infrastructure, port

infrastructure and roads are extremely high which are in top of the world (figure 11).

Furthermore, based on Euromonitor International (2015a), the Singaporean government will

continue to develop the transport networks and raise residential regions to enhance

infrastructures level due to an increase in the demand of growing population in urban areas.

Additionally, according to World Bank (n.d.), Logistic Performance Index (LPI) is an

international score that utilizes six fundamental dimensions to benchmark the performance of

a country compared to the overall LPI index. In fact, Singapore has an ideal LPI with the

score of 4, which ranked 5th out of 160 in 2014 (World Bank n.d.). This demonstrates that

Singapore has a good performance on trade logistics with the high level of the quality of trade

and transport. Thus, as Singapore has excellent logistics and infrastructure systems

(Euromonitor International 2015a), it is highly easy for Vinamilk to supply its products to

Singaporean customers without having delays that might affect its reputation.

Team: Whatever

20

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

4.4.2

Education and Training

Figure 12. Reproduced from: Schwab 2014

Singapore is in top 2 in terms of having higher education and training (Schwab 2014).

Specifically, figure 12 shows the quality of the education system ranked 4 th. This rank proves

the education system of Singapore is really good that provides valuable knowledge and

information for students to help them in having good educational background. As having

good educational background, they are more confident to work better and harder in future.

Moreover, the extent of staff training is crucial as Singapore Workforce Development Agency

(WDA) arranged a huge number of programs including Productivity Initiatives in Services &

Manufacturing or English Workplace Program to improve workers technical skills (WDA

n.d.). This explains why the extent of staff training of Singapore ranked 7 th in the world

(figure 12). Consequently, with a well-educated workforce and innovative economy,

Singapores labour productivity was high, at US$136,497, which was the worlds third

highest level in 2014 (Euromonitor International 2015a). Overall, the high educational and

technical skills of Singaporeans will benefit Vinamilk as the company will not have to put

lots of time, money and effort in training employees.

Team: Whatever

21

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

4.4.3

Technological Readiness

Figure 13. Reproduced from: Schwab 2014

Singapore is one of the countries that has the highest FDI and technology transfer with the

score of 5.9 out of 7 (figure 13). Moreover, the availability of latest technology is quite high

that ranked 15th in the world (figure 13). These advantages in technology will help Vinamilk

to not only boost the product quantity, but also improve the product quality as the company

can learn technological advances to apply to the production process.

Furthermore, in terms of telecommunications, Singapore is one of Asia Pacifics telecom

leaders with leading telecom network and fixed-broadband, mobile Internet and cable TV

penetration (Euromonitor International 2015i). Additionally, because of convenience, online

shopping becomes a trend among Singaporeans. Thus, there is a booming growth in

transactions for both local e-commerce sites and international online retailers (Euromonitor

International 2015i). Specifically, in 2014, 41.6% of Singapores businesses received order

online, compared to 30.2% in 2009 (Euromonitor International 2015i). Therefore, Vinamilk

can take advantages of online network as a way to reach more Singaporean customers.

Singaporean Dairy Market Analysis

Singaporean dairy market has grown steadily in recent years (MarketLine 2014a). Its total

revenue was $643.7 million in 2013 while milk constituted 40.2% of overall market

Team: Whatever

22

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

(MarketLine 2014a). Specifically, fat-free products are preferred by Singaporean recently as

its value growth is 12% in 2014 (Euromonitor International 2014b).

Fraser And Neave Ltd remains a leading position in Singaporean dairy market which

generates 26.8% of overall market value (MarketLine 2015c), followed by Nestle Singapore

Pte Ltd and Malaysia Dairy Industries Pte Ltd which account for 15.1% and 8.6%

respectively (Euromonitor International 2015b; MarketLine 2015c). Overall, it can be

concluded that Singaporean dairy market is LOW in threat of substitutes and suppliers

power, MODERATE in buyers power but HIGH in threat of new entrants and competitive

rivalry.

5.1

Threat of New Entrants: HIGH

5.2

Power of Buyer: MODERATE

For this force, buyers are not only end consumers but also retailers such as supermarkets or

convenience stores (Johnson, Whittington & Scholes 2014). Firstly, Singaporean consumers

are highly price sensitive. Secondly, as dairy products are crucial in diets, food retailers tend

to stock them, which decrease their buying power (Marketline 2014). Therefore, the power of

buyers is moderate for Singaporean dairy market.

Team: Whatever

23

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

5.3

Power of Suppliers: LOW

Dairy suppliers have limited ability to differentiate raw materials and it is simple to move

from one supplier to another (Marketline 2014). Thus, the power of suppliers is low.

5.4

Competitive Rivalry: HIGH

5.5

Threat of Substitutes: LOW

As milk is considered to be crucial supplies of calcium, therefore, dairy products are not

easily replaced (MarketLine 2014). Thus, the risk of substitutes is low.

In short, Singapore is a potential market for Vinamilk to enter; however, high degree of

competition is a leading issue the company will have to deal with when expanding into this

market.

Team: Whatever

24

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

6

Entry Mode

Figure 14. Adapted from: Burns n.d.

Figure 14 shows different foreign market entry strategies with different level of risks in

which wholly owned subsidiary has the highest risk while the lowest risk belongs to

exporting strategy. Additionally, based on the Uppsala model (figure 15), which distinguishes

four successive stages for firms to expand internationally, exporting is the first step giving no

or little market experience and requiring limited commitment of resources to the market

(Forsgren 2002). He also states that as the firm is more confident and have enough market

knowledge and market commitment, it can expand its business activities, such as establishing

sales subsidiaries or even building its own factories to manufacture.

According to Vinamilk (2014a), exporting is the core strategy that the company has chosen to

enter international markets. Specifically, in 2014, Vinamilk exports to 29 nations and regions

in total (Vinamilk 2014a). The company still maintain exporting strategy to its traditional

markets in Middle East and Southeast Asia (Vinamilk 2014a). Key export products are

sweetened condensed milk and powdered milk (Vinamilk 2014a). Hence, export sales

account for about 10% of the companys total revenue (Vinamilk 2014a). Furthermore, based

on Vinamilk (2014a), it already had one joint venture with Miraka Limited to produce milk in

Team: Whatever

25

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

New Zealand, one production and sales subsidiary in California, USA and one sales

subsidiary in Poland.

As having lots of experiences in internationalization, Vinamilk can choose to take more risks

in order to gain higher profits rather than just playing it safe through utilizing exporting

strategy. Specifically, the company could build its own office and sales subsidiaries when

entering Singaporean dairy market. By using this entry mode, Vinamilk can fully control all

of its business operations including physical distribution, marketing, promotion, and

customer service activities in Singapore instead of depending on independent agents.

Overall, the company should set up its own sales subsidiaries. Although the risks could be

high, it can bring a number of benefits for the company in increasing its brand awareness and

revenue.

Figure 15. Reproduced from: Softducks n.d.

7

7.1

Implementation

Internationalization Strategy

Transnational strategy with ethnocentric staffing approach is suitable for Vinamilk in

Singapore. The headquarters will take control of which products to export, amounts of

Team: Whatever

26

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

products and time to export. Vinamilk can have two PCNs who will control the operation of

Vinamilk and support HCNs. The company can hire ten Singaporean HCNs who are in

charge of managing distribution process as well as marketing and promotional campaigns to

boost sales in this country (Bartlett & Ghoshal 1994).

7.2

Set-up Cost

When setting-up sales subsidiary in Singapore, Vinamilk needs to concern about labour cost,

office rental and warehouse rental expense.

According to Expat Arrivals (n.d.), the salary for an expatriate to Singapore is S$ 250,000

(around 200,000 USD) per year due to high living cost.

Figure 16. Reproduced from: Savills World Report Singapore 2015

Figure 16 shows it will cost S$8 to S$14 per square foot per month to rent an office in

Singapore. Moreover, based on Colliers International (2013), the average monthly gross

rents for warehouse at ground floor and upper floor are $2.62 and $2.15 per square foot per

month respectively. The rents for warehouse are expected to be unchanged (CBRE 2013).

Team: Whatever

27

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

8

SWOT Analysis

Team: Whatever

28

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

9

Conclusion

It is noticeable that Singapore has a transparent bureaucracy and well-developed economy. As

the policy is favorable for FDIs, it is not time consuming and overlapping to establish sales

subsidiary in this country. However, Singaporean dairy market is quite competitive and

undifferentiated. The demand for value-added products is increasing together with concerns

about health. As Vinamilk had experience in expanding to other countries and Singaporean

market is open for FDIs, setting-up sales subsidiary is an appropriate strategy for Vinamilk to

increase market coverage.

Team: Whatever

29

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

10 Reference Lists

Agri-Food & Veterinary Authority of Singapore (a) (AVA) n.d., Import, Export &

Transshipment Of Processed Food, Agri-Food & Veterinary Authority of Singapore, AVA,

viewed

16

August

2015,

<https://www.ifaq.gov.sg/AVA/apps/fcd_faqmain.aspx?

qst=hRhkP9BzcBImsx2TBbssMsxu7lqt6UJK70a1wAEVmyfwSrTLxl24A3EgKVYZmRGH

MzLAysw8NsyCiRSsNcAX2VywnBCdzgIjcuCbrm2kjVYp0p8XtUCg5voDmZYXwgkyEoZ

UMxTFAaHCblufqo3GP0A3n7ILcoKx090hfb1yBkn8Q7j

%2BxW4fY369bwc4A91vrm7IcaghpyT7dVFSm6bjk%2BWBjeWqjk5gz4DbP4%2FEkxo

%3D#FAQ_29842>.

Agri-Food & Veterinary Authority of Singapore (b) n.d., Food Regulations, AVA, viewed 20

August 2015, <http://www.ava.gov.sg/docs/default-source/legislation/sale-of-food-act/foodregulations.pdf?sfvrsn=0>.

Association of Southeast Asian Nations (ASEAN) n.d., Overview, Association of Southeast

Asian Nations, viewed 22 August 2015, <http://www.asean.org/communities/aseaneconomic-community/category/overview-10>.

Bank of Canada 2013, The Benefits of Low Inflation, Bank of Canada, viewed 23 August

2015,

<http://www.bankofcanada.ca/wp-

content/uploads/2010/11/benefits_low_inflation.pdf>.

Bartlett, C. A., & Ghoshal, S. 1994, Changing the role of top management: beyond strategy

to purpose, Harvard Business Review, vol. 72, issue 6, pp. 79-88.

Burns, D n.d., Foreign Market Entry Strategies, image, PowerPoint slides for BUSM3311

International Business, RMIT University, Vietnam, viewed 20 August 2015,

Blackboard@RMIT.

Central Intelligence Agency (CIA) 2015, The World Factbook, graph, CIA, viewed 20

August 2014, <https://www.cia.gov/library/publications/the-world-factbook/geos/sn.html>.

Team: Whatever

30

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Central Intelligence Agency (CIA) 2015, The World Factbook, CIA, Virginia, viewed 18

August 2015, <https://www.cia.gov/library/publications/the-world-factbook/geos/sn.html>.

Collier International 2013, Research & Forecast Report: Singapore Real Estate Market,

Collier

International,

viewed

23

August

2015,

<http://www.colliers.com/-/media/12EDA05D3BDE42FF85C13131AB81843C.ashx?la=enGB>.

Deloitte 2015, Corporate Tax Rates 2015, Deloitte, viewed 21 August 2015,

<http://www2.deloitte.com/content/dam/Deloitte/global/Documents/Tax/dttl-tax-corporatetax-rates-2015.pdf>.

Dunning, JH 2000, The eclectic paradigm as an envelope for economic and business theories

of MNE activity, International business review, vol. 9, no. 2, pp. 163-190, viewed 20 August

2015, ScienceDirect database.

Euromonitor International 2014a, Consumer Expenditure on Milk & Cheese 2000-2016,

graph, Euromonitor International, viewed 22 August 2015, Passport GMID database.

Euromonitor International 2014b, Consumer lifestyles in Singapore, Euromonitor

International, viewed 16 August 2015, Passport GMID database.

Euromonitor International 2015a, Business Environment Singapore, graph, Euromonitor

International, viewed 20 August 2014, Passport GMID database.

Euromonitor

International

2015a,

Business

Environment

Singapore,

Euromonitor

International, viewed 20 August 2014, Passport GMID database.

Euromonitor International 2015b, Drinking Milk Products in Singapore, Euromonitor

International, viewed 16 August 2015, Passport GMID database.

Euromonitor International 2015c, Health and Wellness in Singapore, Euromonitor

International, viewed 20 August 2015, Passport GMID database.

Team: Whatever

31

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Euromonitor International 2015e, Other dairy in Singapore, Euromonitor International,

viewed 16 August 2015, Passport GMID database.

Euromonitor International 2015f, Risks & Vulnerabilities Singapore, Euromonitor

International, viewed 16 August 2015, Passport GMID database.

Euromonitor International 2015g, Singapore in-depth PESTLE insights, Euromonitor

International, viewed 16 August 2015, Passport GMID database.

Euromonitor International 2015h, Singapore: Country Profile, Euromonitor International,

viewed 16 August 2015, Passport GMID database.

Euromonitor International 2015i, Technology, communications and media: Singapore,

Euromonitor International, viewed 16 August 2015, Passport GMID database.

Euromonitor International 2015j, Yoghurt and sour milk products in Singapore, Euromonitor

International, viewed 16 August 2015, Passport GMID database.

Expat Arrivals n.d., Salaries for expats in Singapore, Expat Arrivals, viewed 23 August 2015,

<http://www.expatarrivals.com/singapore/salaries-for-expats-in-singapore>.

Forsgren, M 2002, 'The concept of learning in the Uppsala internationalization process

model: a critical review', International business review, vol. 11, no. 3, pp. 257-77, viewed 20

August 2015, ScienceDirect database.

Grska, M 2013, 'DOES THE UPPSALA INTERNATIONALIZATION MODEL EXPLAIN

THE INTERNATIONALIZATION PROCESS OF PROFESSIONAL BUSINESS SERVICE

FIRMS?', CBU International Conference Proceedings, vol. 1, pp. 1-8, viewed 20 August

2015, <http://ojs.journals.cz/index.php/CBUConference2013/article/viewFile/8/10>.

Harjani, A 2015, Singapore dollars next stop: 1.40?, CNBC, CME Group, viewed 22 August

2015, <http://www.cnbc.com/2015/01/26/singapore-dollar-likely-to-weaken.html>.

Hussain, Z 2015, How Lee Kuan Yew engineered Singapores economic miracle , BBC

News, 24 March, viewed 22 August 2015, <http://www.bbc.com/news/business-32028693>.

Team: Whatever

32

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Johnson, G, Whittington, R & Scholes, K 2011, Industry life cycle, image, in Exploring

strategy: text and cases, image, 9th edn, Financial Times Prentice Hall, Harlow.

Johnson, G, Whittington, R & Scholes, K 2011, Three Generic Strategies, image, in

Exploring strategy: text and cases, image, 9th edn, Financial Times Prentice Hall, Harlow.

Johnson, G, Whittington, R & Scholes, K 2011, Exploring strategy: text and cases, image,

Industry life cycle, 9th edn, Financial Times Prentice Hall, Harlow.

Kotler, P., Amstrong, G., Ang, S., Leong, S., Tan, C. & Hon-Ming, O. 2009, Principles of

Marketing: A global perspective, 12th edn, Pearson Education South Asia, Singapore.

KPMG

2013,

Singapore

Tax

Profile,

KPMG,

viewed

17

August

2015,

<://www.kpmg.com/Global/en/services/Tax/regional-tax-centers/asia-pacific-taxcentre/Documents/CountryProfiles/Singapore.pdf>.

MarketLine 2014, Dairy in Singapore, MarketLine, viewed 17 August 2015, MarketLine

database.

MarketLine 2015a, Singapore Dairy Market share, image, MarketLine, viewed 22 August

2015, MarketLine database,

MarketLine 2015b, GDP and GDP growth rate of Singapore, 2008-18f, graph, MarketLine,

viewed 22 August 2015, MarketLine database.

MarketLine 2015c, Singapore In-depth PESTLE insights, MarketLine, viewed 17 August

2015, MarketLine database.

Ministry of Trade and Industry Singapore (MTI) 2015, MTI Narrows 2015 GDP Growth

Forecast to 2.0 to 2.5 Per Cent, MTI Singapore, viewed 20 August 2015,

<http://www.singstat.gov.sg/docs/default-source/default-documentlibrary/news/press_releases/gdp2q2015.pdf>.

Savills World Report Singapore 2015, Micro-market Grade A office rents and vacancy rates,

Q1/2015, table, Savills World Report Singapore, viewed 23 August 2015,

<http://pdf.savills.asia/asia-pacific-research/singapore-research/singapore-office/singaporeoffice-briefing-q1-2015.pdf>.

Team: Whatever

33

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Schwab, K 2014, The Global Competitiveness Report 20142015, table, World Economic

Forum,

viewed

18

August

2015,

<http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2014-15.pdf>.

Schwab, K, World Economic Forum 2014, The Global Competitiveness Report 20142015,

World

Economic

Forum,

viewed

18

August

2015,

<http://www3.weforum.org/docs/WEF_GlobalCompetitivenessReport_2014-15.pdf>.

Singapore Business Review 2011, What grocery list? Singaporeans rank second most

impulsive shoppers in Southeast Asia, Singapore Business Review, 27 July, viewed 23

August 2015,

<http://sbr.com.sg/retail/news/what-grocery-list-singaporeans-rank-secondmost-impulsive-shoppers-in-southeast-asia>.

Singapore Economic Development Board (EDB) 2015, Incentives for Businesses, EDB

Singapore,

viewed

17

August

2015,

<https://www.edb.gov.sg/content/edb/en/why-

singapore/ready-to-invest/incentives-for-businesses.html>.

Singapore Economic Development Board (EDB) n.d. , Headquarters Award, EDB Singapore,

viewed

17

August

2015,

<https://www.edb.gov.sg/content/dam/edb/en/resources/pdfs/financing-andincentives/International%20or%20Regional%20Headquarters%20(HQ)%20Leaflet.pdf>.

Singapore Workforce Development Agency (WDA) n.d., Information on training for your

employees; funding and assistance schemes, WDA, viewed 22 August 2015,

<http://www.wda.gov.sg/content/wdawebsite/WDARoadMap.html#employers-programmes>.

Singaporean-German Chamber of Industry and Commerce 2013, Singapore-Food Industry,

Singaporean-German Chamber of Industry and Commerce, viewed 16 August 2015,

<http://www.sgc.org.sg/fileadmin/ahk_singapur/DEinternational/IR/diffIR/Food_Industry_20

14.pdf>.

Softducks n.d., Uppsala model, image, Softducks, viewed 17 August 2015,

<http://www.softducks.com/free-download/uppsala-model/>.

SSI Schaefer n.d., High-Tech Distribution Center for Dairy Products in Southeast Asia Vinamilk

Vietnam,

SSI

Schaefer,

viewed

22

August,

<http://www.ssi-

schaefer.de/en/conveying-and-picking/references/food-industry/vinamilk.html>.

Team: Whatever

34

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

The Economist Intelligence Unit 2014, Business Environment Rankings - Which country is

best to do business in?, The Economist Intelligence Unit, viewed 17 August 2015,

<http://pages.eiu.com/rs/eiu2/images/BER_2014.pdf?

mkt_tok=3RkMMJWWfF9wsRogsqrBZKXonjHpfsX67eosWKexlMI

%2F0ER3fOvrPUfGjI4ES8pmI%2BSLDwEYGJlv6SgFTbjGMbht2bgMUhU%3D>.

The Heritage Foundation 2015, 2015 Economic Freedom index ranking- Country Rankings,

The Heritage Foundation, viewed 20 August 2015, <http://www.heritage.org/index/ranking>.

The Hofstede Centre 2015, What about Singapore?, graph, The Hofstede Centre, viewed 20

August 2015, <http://geert-hofstede.com/singapore.html>.

The Hofstede Centre 2015, What about Singapore?, The Hofstede Centre, viewed 20 August

2015, <http://geert-hofstede.com/singapore.html>.

Three Generic Strategies 2015, image, course slides for BUSM3309 Strategic Management,

RMIT University, Melbourne, viewed 16 August 2015, Blackboard@RMIT.

U.S Department of State 2014, Investment Climate Statement, U.S Department of State,

viewed 17 August 2015, <http://www.state.gov/documents/organization/227436.pdf >.

United Nations Development Programme (UNDP) n.d., Human development index (HDI),

UNDP, viewed 22 August 2015, <http://hdr.undp.org/en/content/human-development-indexhdi-table>.

United Nations Development Programme (UNDP) n.d., Why is it important to express per

capita GNI in Purchasing Power Parity (PPP) international dollars?, UNDP, viewed 22

August

2015,

<http://hdr.undp.org/en/content/why-it-important-express-capita-gni-

purchasing-power-parity-ppp-international-dollars>.

Vinamilk n.d., Products, image, Vinamilk, viewed 22 August 2015,

<https://www.vinamilk.com.vn/en/nhan-hieu>.

Team: Whatever

35

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Vinamilk

2014a,

Annual

Report

2014,

Vinamilk,

viewed

21

August,

<https://www.vinamilk.com.vn/home/reviewPdf/static/uploads/bc_thuong_nien/14268436837fd7119f0c2d2e9bd538f170cf960824f6fb16f7e94da5af5361b851a598634a-en.pdf>.

Vinamilk 2014b, homepage, Vinamilk, Ho Chi Minh City, viewed 19 August 2015,

<https://www.vinamilk.com.vn/en>.

Vinamilk

2014c,

Vinamilk

Story,

Vinamilk,

viewed

20

August,

<https://www.vinamilk.com.vn/en/lich-su-phat-trien>.

Vinamilk

n.d.,

Products,

Vinamilk,

viewed

20

August,

<https://www.vinamilk.com.vn/en/nhan-hieu>.

World Bank 2013, Economy Rankings, International Finance Corporation, viewed 16 August

2014, <http://www.doingbusiness.org/rankings>.

World Bank 2015a, Imports of goods and services (% of GDP), graph, World Bank, viewed

23 August 2015, <http://data.worldbank.org/indicator/NE.IMP.GNFS.ZS/countries/SG-?

display=graph>.

World Bank 2015b, Inflation of Singapore (annual %), graph, World Bank, viewed 22

August 2015, <http://data.worldbank.org/indicator/FP.CPI.TOTL.ZG>.

World Bank 2015c, Inflation, consumer prices (annual %), World Bank, viewed 17 August

2015, <http://data.worldbank.org/indicator/FP.CPI.TOTL.ZG>.

World Bank 2015d, Ease of doing business index, World Bank, viewed 17 August 2015,

<http://data.worldbank.org/indicator/IC.BUS.EASE.XQ>.

World Bank n.d., GNI per Capital (US Dollar), graph, World Bank, viewed 22 August 2015,

<http://data.worldbank.org/indicator/NY.GNP.PCAP.PP.CD>.

World Bank n.d., Logistic Performance Index: Global Rankings 2014, World Bank, viewed

06 August 2015, <http://lpi.worldbank.org/international/global>.

Team: Whatever

36

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

World Justice Project 2015, Rule of Law Index, World Justice Project, viewed 17 August

2015, <http://data.worldjusticeproject.org/>.

World Trade Organisation (WTO) n.d., Tariffs: more bindings and closer to zero, World Trade

Organisation,

viewed

22

August

<https://www.wto.org/english/thewto_e/whatis_e/tif_e/agrm2_e.htm>.

Team: Whatever

37

2015,

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

11 Appendix

Appendix 1. The industry life cycle

Figure 1. Reproduced from Johnson, Whittington & Scholes 2014

Team: Whatever

38

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

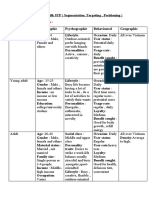

Appendix 2. Marketing plan for Vinamilk in Singapore

As it is the first time that Vinamilk moves to Singapore, promoting brand awareness is a

crucial task. Moreover, marketing campaigns should emphasize on nutritious dairy products

with low level of fat and cholesterol.

1.1. Objectives

2016

In the next 5 years

Introduce fat-free products to

Singaporean market

Get access to Singaporean supermarkets

and convenience stores

Raise brand awareness by Facebook

page

Gain market share of 3%

Increase sale volume by 3% per

year

Rank third for fat-free dairy

distributor in Singapore

1.2. Generic Strategy

According to Euromonitor International (2015c), value-added dairy products such as fat-free,

semi-skimmed and flavoured milk are highly demanded. Customers are seeking for both

nutritious ingredients such as calcium and protein and low fat intake. In Singapore, the

market for value-added milk products is immature as Meiji remains the only key player.

Simultaneously, Singaporean customers are price sensitive. According to Singapore Business

Review (2011), 62% of Singaporean customers are knowledgeable about the price of most

grocery items and noticeable to price change. This figure makes Singapore rank second in

consumers price sensitivity in Southeast Asia.

Therefore, cost focus strategy is appropriate for Vinamilk to apply in Singapore. This

strategy targets price-conscious dairy consumers with differentiation focus on value-added

milk.

1.3. Marketing strategies

a. Segmentation

In Singapore, many international firms have engaged in mass marketing to reach a large

amount of customers. Furthermore, they have gained reputation for providing high quality

dairy products in this country. In order to compete successfully, Vinamilk should concentrate

on niche market with value-added products.

Female constitutes for 50.89% of Singaporean population (CIA 2015). This is the segment

that consumes a large amount of value-added dairy products. Firstly, Vinamilk should focus

on young and middle-aged women whose anti-aging and skin beauty are the leading

concerns. Products with supplement collagen and antioxidant will be attractive to female

segment.

Secondly, young Singaporean customers are seeking for healthy products to maintain their

appearance (Euromonitor International, 2015d). Moreover, 36% of Singaporean population

were overweight in 2014. Therefore, Vinamilk can develop low protein and no sugar added

products which reduce blood pressure and are suitable for dieters.

Team: Whatever

39

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

b. Targeting

Concentrated

Marketing

Company

resources

Finite

Product

Variability

Limited

Products life

cycle stage

Introduction

Market

Variability

Low

Competitors

marketing

strategies

Undifferentiated

Undifferentiated

Marketing

Vast

Differentiated

Marketing

x

x

High

Maturity

High

Differentiated

Vinamilk has compound annual growth rate of 22% in total revenue and in 2014, revenue was

VND 35,704 billion (Vinamilk, 2014). They have launched various products in order to

satisfy different customers with different tastes and preferences. For example, Vinamilk has

value-added products such as pasteurized low-fat milk and probiotic drinking yoghurt. On the

other hand, their products are in maturity stage because the quality of products are confirmed

by customers as Top 10 Vietnamese high quality product (Vinamilk, n.d.). Finally,

competitors such as Nestle and Fraser And Neave Ltd are applying mass marketing to reach a

large number of customers. Therefore, differentiated marketing is suitable for Vinamilk.

c. Positioning

Product: high quality dairy products to meet with strict health regulations and

customers taste

Vinamilk CanxiPro: contain added protein to build bones with low fat and 9%

collagen.

Pasteurized fresh milk low-fat Vinamilk 100%: reduced milk fat which help control

fitness

Vinamilk Kefir Yogurt: contain Kefir which helps reduce blood cholesterol, suitable

for dieters or diabetics.

Probeauty Yogurt: targets at female segment, with collagen and antioxidants to make

skin smooth and flawless.

Price: As the market is highly price-sensitive, Vinamilk should apply marketpenetration pricing strategy. Initially, Vinamilk should set a low price to effectively

attract a large number of buyers quickly and win a large market share. Thus, the high

sales volume will lead to decrease in distribution costs (Kotler et al., 2009).

Team: Whatever

40

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Appendix 3. Three Generic Strategies

Figure 3. Reproduced from Johnson, Whittington & Scholes 2014

Appendix 4. Ease of Doing Business Index

Team: Whatever

41

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Figure 4. Reproduced from Worldbank (2013)

Appendix 5. Singapore Dairy Market Category Segmentation

Figure 5. Reproduced from Marketline (2015)

Appendix 6. Singapore Dairy Market share

Team: Whatever

42

VINAMILK INTERNATIONALIZATION STRATEGIES

TO SINGAPORE

Figure 6. Reproduced from Marketline (2015)

Team: Whatever

43

You might also like

- Project VinamilkDocument4 pagesProject VinamilkMinh TâmNo ratings yet

- 5 Forces Model - Vinamilk - K20405CDocument19 pages5 Forces Model - Vinamilk - K20405CNga Nguyễn Thị HảiNo ratings yet

- Group 1 Tài chính doanh nghiệp CLC60Document21 pagesGroup 1 Tài chính doanh nghiệp CLC60diep vuNo ratings yet

- BS A1.1-FinalDocument44 pagesBS A1.1-FinalNaNóngNảyNo ratings yet

- Successful Joint Ventures in TheDocument14 pagesSuccessful Joint Ventures in TheQuỳnh NguyễnNo ratings yet

- Product VinamilkDocument2 pagesProduct VinamilkHoàng NhânNo ratings yet

- SWOT Analysis of VinamilkDocument21 pagesSWOT Analysis of VinamilkNhan Huynh TrongNo ratings yet

- Topic The Supply Chain of Vinamilk Company: Group ProjectDocument13 pagesTopic The Supply Chain of Vinamilk Company: Group ProjectTrúc NhiNo ratings yet

- Vinamilk Yogurt Report 2019: CTCP Sữa Việt Nam (Vinamilk)Document24 pagesVinamilk Yogurt Report 2019: CTCP Sữa Việt Nam (Vinamilk)Nguyễn Hoàng TrườngNo ratings yet

- DENTSU REDDER's Vision for Future Growth in Vietnam's Booming Digital Advertising IndustryDocument7 pagesDENTSU REDDER's Vision for Future Growth in Vietnam's Booming Digital Advertising IndustryTrương Khánh HuyềnNo ratings yet

- Bitis 1. Summery - The Story of Bitis in VietnamDocument3 pagesBitis 1. Summery - The Story of Bitis in VietnamĐinh Quang DũngNo ratings yet

- Vinamilk PESTLE AnalysisDocument2 pagesVinamilk PESTLE AnalysisHiền ThảoNo ratings yet

- (Group 8) International Business of VinamilkDocument55 pages(Group 8) International Business of VinamilkNguyễn Khánh Minh ChâuNo ratings yet

- Assignment 2 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessDocument17 pagesAssignment 2 Front Sheet: Qualification BTEC Level 4 HND Diploma in BusinessNguyễn AnNo ratings yet

- Helping Brands Tap Into Vietnams Changing Eating Habits PDFDocument68 pagesHelping Brands Tap Into Vietnams Changing Eating Habits PDFHoang Nguyen MinhNo ratings yet

- Report For Subjec1Document16 pagesReport For Subjec1Lurine SmithNo ratings yet

- VINAMILK REPORT ANALYSISDocument4 pagesVINAMILK REPORT ANALYSISHà MyNo ratings yet

- Vinamilk's Marketing Environment AnalysisDocument24 pagesVinamilk's Marketing Environment AnalysisKunNguyen HuyNo ratings yet

- Business Strategy of VinamilkDocument31 pagesBusiness Strategy of VinamilkNgọc KhánhNo ratings yet

- Group 14 - Coolmate Case StudyDocument12 pagesGroup 14 - Coolmate Case Studyngan nguyenNo ratings yet

- bài tập nhóm chiến lược số 2Document20 pagesbài tập nhóm chiến lược số 2Anh Thư NguyễnNo ratings yet

- Assignment Cover Sheet: Bachelor of Business (Talented)Document14 pagesAssignment Cover Sheet: Bachelor of Business (Talented)Lâm Tú HânNo ratings yet

- Marketing Plan - 15782988 and 15781144Document21 pagesMarketing Plan - 15782988 and 15781144Khoilinh PhamNo ratings yet

- Operational Management Final Report: National Economics University Business SchoolDocument12 pagesOperational Management Final Report: National Economics University Business SchoolKaren LưuNo ratings yet

- Marketing Vinamilk STPDocument7 pagesMarketing Vinamilk STPĐạt Võ TiếnNo ratings yet

- Nutifood Media Plan: NGUYEN TRONG DUY-HS140698 - MC1403 Lecturer: Ms. Bui Thi Hanh ThaoDocument9 pagesNutifood Media Plan: NGUYEN TRONG DUY-HS140698 - MC1403 Lecturer: Ms. Bui Thi Hanh ThaoDuy Nguyễn TrọngNo ratings yet

- Tr ần Hương Giang - 10160106 - GBE - A1.1Document23 pagesTr ần Hương Giang - 10160106 - GBE - A1.1Hương GiangNo ratings yet

- Vinamilk - Marketing Metrics - Group 6Document34 pagesVinamilk - Marketing Metrics - Group 6Luu Phuong AnhNo ratings yet

- PorterDocument6 pagesPorterHo Bao Yen - K15 FUG CTNo ratings yet

- VINAMILKDocument16 pagesVINAMILKNguyen Viet Duy (FGW HN)No ratings yet

- Banh KeoDocument105 pagesBanh Keobatman12369No ratings yet

- TNC2Document13 pagesTNC2ZhiXian Chin100% (1)

- Research Analysis Report VinamilkDocument20 pagesResearch Analysis Report VinamilkNga LêNo ratings yet

- Final ReportDocument28 pagesFinal ReportLương Vân TrangNo ratings yet

- HN.G06.Team 5.TH True Milk 11Document59 pagesHN.G06.Team 5.TH True Milk 11Linh NguyenNo ratings yet

- Quản Trị MarketingDocument24 pagesQuản Trị MarketingNguyễn Thị Khánh HàNo ratings yet

- Final TBL Group 8 Section ADocument11 pagesFinal TBL Group 8 Section AGaayaatrii BehuraaNo ratings yet

- How P&G Survived Through Continuous InnovationDocument18 pagesHow P&G Survived Through Continuous InnovationPankaj Goyal0% (1)

- MA TRAN SWOT OF SNACK FROM J&J Snack Foods CorpDocument10 pagesMA TRAN SWOT OF SNACK FROM J&J Snack Foods CorpEdutek JohnNo ratings yet

- SCM Individual AssignmentDocument26 pagesSCM Individual AssignmentTiên TrầnNo ratings yet

- REPORT COMM2698 ASN01 NguyenThiNhuQuynh S3880896 03Document27 pagesREPORT COMM2698 ASN01 NguyenThiNhuQuynh S3880896 03Quynh NguyenNo ratings yet

- Marketing and Brand ManagementDocument20 pagesMarketing and Brand ManagementPhương UyênNo ratings yet

- Team 1 Final PaperDocument32 pagesTeam 1 Final PaperNhi TuyếtNo ratings yet

- Shiseido in VN AssignmentDocument4 pagesShiseido in VN AssignmentTáo Mèo0% (1)

- Analyzing Vinamilk's Strategic CapabilitiesDocument14 pagesAnalyzing Vinamilk's Strategic CapabilitiesHiền ThảoNo ratings yet

- Managing A Successful Business ProjectDocument26 pagesManaging A Successful Business ProjectRida FathimaNo ratings yet

- Panasonic CorporationDocument131 pagesPanasonic CorporationssdsNo ratings yet

- Introduction About Big CDocument12 pagesIntroduction About Big Cblackangel707No ratings yet

- Title Case Study About Global Strategic Management of L'OréalDocument97 pagesTitle Case Study About Global Strategic Management of L'Oréalnhanngavida0% (1)

- Phương (4Ps) : 1. ProductDocument3 pagesPhương (4Ps) : 1. ProductPhương VũNo ratings yet

- Marketing Planning A2 Kinh Do To Launch PDFDocument19 pagesMarketing Planning A2 Kinh Do To Launch PDFUyên Lê Nguyễn PhươngNo ratings yet

- Toyota Global Strategy and Specific Strategy in ChinaDocument7 pagesToyota Global Strategy and Specific Strategy in ChinaYK ZhouNo ratings yet

- B2B Mid Term 2Document5 pagesB2B Mid Term 2Rashmi SuryaNo ratings yet

- Rie NevanDocument8 pagesRie NevanDH KNo ratings yet

- Acecook Hao Hao - Cung Viet Nam Day Lui Covid: University of Finance - Marketing Foreign Language FacultyDocument17 pagesAcecook Hao Hao - Cung Viet Nam Day Lui Covid: University of Finance - Marketing Foreign Language FacultyHoàng Sơn0% (1)

- Vietnam Snack Market Grade BDocument3 pagesVietnam Snack Market Grade BHuỳnh Điệp TrầnNo ratings yet

- Strategic Marketing Project Trung Nguyen Cafe ChainDocument22 pagesStrategic Marketing Project Trung Nguyen Cafe ChainLinh HoangNo ratings yet

- SABECO BEER PRODUCER INTERNET MARKETING REPORTDocument14 pagesSABECO BEER PRODUCER INTERNET MARKETING REPORTPhạm Thùy Trang100% (1)

- Lê Qu NH Anh - 11200144 - Tài Chính Kinh DoanhDocument18 pagesLê Qu NH Anh - 11200144 - Tài Chính Kinh DoanhQuỳnh AnhNo ratings yet

- Tut 5 - Group 2 - VINAMILKDocument33 pagesTut 5 - Group 2 - VINAMILKmai linhNo ratings yet

- PitchDocument17 pagesPitchHung LeNo ratings yet

- Creative Brief: (For Advertising Laws in Vietnam See Ministry of Information and Culture's Website)Document1 pageCreative Brief: (For Advertising Laws in Vietnam See Ministry of Information and Culture's Website)Hung LeNo ratings yet

- TestDocument7 pagesTestHung LeNo ratings yet

- Commonwealth of Australia Warning: RMIT UniversityDocument7 pagesCommonwealth of Australia Warning: RMIT UniversityHung LeNo ratings yet

- TongketDocument9 pagesTongketHung LeNo ratings yet

- Introduction To Advertising: Tutorial 3Document29 pagesIntroduction To Advertising: Tutorial 3Hung LeNo ratings yet

- PR Guide CollectionDocument6 pagesPR Guide CollectionHung LeNo ratings yet

- B2014Document6 pagesB2014Hung LeNo ratings yet

- Specialist PR Writing ScheduleDocument2 pagesSpecialist PR Writing ScheduleHung LeNo ratings yet

- Tute9 MessageAnalysis HandoutDocument1 pageTute9 MessageAnalysis HandoutHung LeNo ratings yet

- Lecture Week 5Document50 pagesLecture Week 5Hung LeNo ratings yet

- Assessment 3Document6 pagesAssessment 3Hung LeNo ratings yet

- Lecture 3Document90 pagesLecture 3Hung LeNo ratings yet

- CB Vaseline-Campaign PDFDocument1 pageCB Vaseline-Campaign PDFHung LeNo ratings yet

- IA Exam Review QuestionsDocument1 pageIA Exam Review QuestionsHung LeNo ratings yet

- Harvard Referencing Guide Jan 2013Document88 pagesHarvard Referencing Guide Jan 2013DANGVIENNo ratings yet

- CDocument2 pagesCHung LeNo ratings yet

- MIT9 00SCF11 Read Kr1Document10 pagesMIT9 00SCF11 Read Kr1mindoflightNo ratings yet

- OutDocument162 pagesOutHung LeNo ratings yet

- ContentServer PDFDocument9 pagesContentServer PDFHung LeNo ratings yet

- (COMM2373) Issues and Crisis ManagementDocument13 pages(COMM2373) Issues and Crisis ManagementHung LeNo ratings yet

- Personality and Individual DifferencesDocument6 pagesPersonality and Individual Differencesnick.accounts4218No ratings yet

- Changing and ImprovingDocument5 pagesChanging and ImprovingHung LeNo ratings yet

- Award-Winning Marketing Communications Pro With 13 Years ExperienceDocument2 pagesAward-Winning Marketing Communications Pro With 13 Years ExperiencegeongeoNo ratings yet

- The Corporate Tax Rate Debate: Lower Taxes On Corporate Profits Not Linked To Job CreationDocument30 pagesThe Corporate Tax Rate Debate: Lower Taxes On Corporate Profits Not Linked To Job CreationNancy AmideiNo ratings yet

- IRS Form SS-4 Guide and InstructionsDocument7 pagesIRS Form SS-4 Guide and InstructionsChristopher WhoKnows100% (3)

- Taxation Impacts on Corporate Decision MakingDocument16 pagesTaxation Impacts on Corporate Decision Makinggetahun asmare100% (1)

- Basic Concepts of Income Tax - Direct vs Indirect TaxesDocument33 pagesBasic Concepts of Income Tax - Direct vs Indirect TaxesDhananjay KumarNo ratings yet

- Tax QuestionsDocument10 pagesTax QuestionsUdit VarshneyNo ratings yet

- Investing in ASEAN 2011 2012Document116 pagesInvesting in ASEAN 2011 2012ASEAN100% (1)

- Business Associations OutlineDocument68 pagesBusiness Associations OutlineEric EricsNo ratings yet

- Form 1065 InstructionsDocument45 pagesForm 1065 InstructionsWilliam BulshtNo ratings yet

- G.R. No. 196596Document23 pagesG.R. No. 196596Ann ChanNo ratings yet

- Key amendments in the Tax Code under the CREATE billDocument2 pagesKey amendments in the Tax Code under the CREATE billJean TomugdanNo ratings yet

- Exam III Practice ProblemsDocument10 pagesExam III Practice ProblemsAbdul SattarNo ratings yet

- Manila Bankers Life Insurance Corp v. CIRDocument16 pagesManila Bankers Life Insurance Corp v. CIRjoselle torrechillaNo ratings yet

- Canadian Tax Principles 2016 2017 Edition Volume I and Volume II 1st Edition Byrd Test BankDocument36 pagesCanadian Tax Principles 2016 2017 Edition Volume I and Volume II 1st Edition Byrd Test Bankturnoutlection80nqy100% (28)

- Chapter 15 PDFDocument14 pagesChapter 15 PDFAvox EverdeenNo ratings yet

- IT Module No. 7: Introduction To Regular Income TaxDocument13 pagesIT Module No. 7: Introduction To Regular Income TaxjakeNo ratings yet

- PKF WWTG 2020 2021 OnlineDocument1,207 pagesPKF WWTG 2020 2021 OnlineHussain MunshiNo ratings yet

- CP575Notice 1605020544606Document2 pagesCP575Notice 1605020544606SMOOVE STOP PLAYIN RECORDSNo ratings yet

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDocument71 pagesIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuNo ratings yet

- Instant Download Ebook PDF Engineering Economic Analysis 14th Edition PDF ScribdDocument51 pagesInstant Download Ebook PDF Engineering Economic Analysis 14th Edition PDF Scribdnathan.prokop316100% (40)

- Act 13 of 2023 Finance Act 2024 FinalDocument62 pagesAct 13 of 2023 Finance Act 2024 FinaladdyNo ratings yet

- PAL vs. CIRDocument29 pagesPAL vs. CIRnathalie velasquezNo ratings yet

- Section 1 30 Marks Determine The Single Most Appropriate Response To The Following QuestionsDocument15 pagesSection 1 30 Marks Determine The Single Most Appropriate Response To The Following QuestionsHelloWorldNowNo ratings yet

- View in Online Reader: Text Size +-RecommendDocument7 pagesView in Online Reader: Text Size +-RecommendRhea Mae AmitNo ratings yet

- Assignment 4.2 Accounting For Income TaxDocument2 pagesAssignment 4.2 Accounting For Income TaxMon RamNo ratings yet

- Vietnam Law On Corporate Income TaxDocument22 pagesVietnam Law On Corporate Income TaxFTU.CS2 Triệu Thạnh KhangNo ratings yet

- Gri 207 Tax 2019Document17 pagesGri 207 Tax 2019Lyra EscosioNo ratings yet

- References: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001Document13 pagesReferences: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001Mark Lawrence YusiNo ratings yet

- 02B Income Taxes: Clwtaxn de La Salle UniversityDocument35 pages02B Income Taxes: Clwtaxn de La Salle UniversityTrisha RuzolNo ratings yet

- RMC No. 62-2021Document4 pagesRMC No. 62-2021Mark Ace SubidoNo ratings yet

- Calculation of Taxable Income: Withholding TaxesDocument2 pagesCalculation of Taxable Income: Withholding TaxesKuveri Kvr TjirasoNo ratings yet