Professional Documents

Culture Documents

Chap 6 Problems

Uploaded by

Cecilia Ooi Shu QingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 6 Problems

Uploaded by

Cecilia Ooi Shu QingCopyright:

Available Formats

Chapter 6 International Parity Conditions

FIN3034 Tutorial 4 week 5

13. Interest Rate Parity. Define interest rate parity. What would it say about interest rates if spot rates and forward rates

were the same?

The theory of interest rate parity (IRP) provides the linkage between the foreign exchange markets and the

international money markets. The theory states: The difference in the national interest rates for securities of similar

risk and maturity should be equal to, but opposite in sign to, the forward rate discount or premium for the foreign

currency, except for transaction costs.

If the spot rate and forward rate are the same, IRP says that nominal interest rates are equal.

14. Covered Interest Arbitrage. Ignoring transaction costs, under what conditions will covered interest arbitrage be

plausible?

Covered interest arbitrage (CIA) involves an investment in a currency that is covered by a forward contract to sell that

currency when the investment matures. CIA is plausible when the difference in interest rates is different from the

forward premium.

15. Uncovered Interest Arbitrage. Define uncovered interest arbitrage and explain what expectations an investor or

speculator would need to undertake an uncovered interest arbitrage investment?

A deviation from covered interest arbitrage is uncovered interest arbitrage (UIA), wherein investors borrow in

countries and currencies exhibiting relatively low interest rates and convert the proceeds into currencies that offer

much higher interest rates. The transaction is uncovered because the investor does not sell the higher yielding

currency proceeds forward, choosing to remain uncovered and accept the currency risk of exchanging the higher yield

currency into the lower yielding currency at the end of the period.

Exhibit 6.8 demonstrates the steps an uncovered interest arbitrager takes when undertaking what is termed the yen

carry trade. Borrowing in the Japanese yen market has always been desirable as yen interest rates are frequently very

low, Japanese banks which are largeare frequently interested in lending to multinational companies, and the yen

itself may hold its value for long periods of time.

Arbitrage is making profit. This profit can be because of different interest rate in different markets and different

exchange rates. In order to find if there is an arbitrage opportunity you must first compare if there is a difference in

interest rates. If the answer is yes, then you calculate the forward premium.

After that you compare the difference in the interest rates with the forward premium you can apply the ARBITRAGE

RULE OF THUMB. Arbitrage rule of thumb indicates the final step whether you sell forward the higher interest

proceeds into lower or sell forward the lower interest proceeds in to higher to maximise outcome.

Chapter 6 International Parity Conditions

P6.7

Starts with when you COMPARE TWO Investment choices. One by investing the funds at hand in the US dollar market.

Then selling the dollar proceeds forward. Or two by exchanging the USD dollar funds at hand at spot rate and investing

in the Yen market.

Covered interest arbitrage (CIA) involves an investment in a currency that is covered by a forward contract to sell that

currency when the investment matures. CIA is plausible when the difference in interest rates is different from the

forward premium.

1.4 is greater than 1.358, i.e. Interest rate diff is higher than FORWARD PREMIUM (ARBITRAGE RULE OF THUMB)

FORWARD PREMIUM = Spot Forward * 360 * 100

Forward

n

You invest the 500,000 dollars in the higher interest rate market and then sell the dollar proceeds forward to get final

outcome in Yen to MAXIMISE OUTCOME. This is also indicated in the rule of thumb.

Checklist 1 Sell the invested dollar proceeds FORWARD into yen to maximise the arbitrage profit.

Checklist 2 In other words, he is able to maximise by having outcomes in the opposite currency the lower currency

(Yen) and leverage on the difference in interest rates.

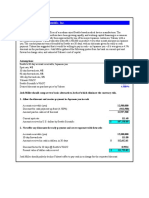

Takeshi Kamada, a foreign exchange trader at Credit Suisse (Tokyo), is exploring covered interest arbitrage

possibilities. He wants to invest $5,000,000 or its yen equivalent, in a covered interest arbitrage between U.S.

dollars and Japanese yen. He faced the following exchange rate and interest rate quotes.

Assumptions

Arbitrage funds available

Spot rate (/$)

180-day forward rate (/$)

180-day U.S. dollar interest rate

180-day Japanese yen interest rate

Value

$5,000,000

118.60

117.80

4.800%

3.400%

Yen Equivalent

593,000,000

Arbitrage Rule of Thumb: If the difference in interest rates is greater than the forward premium/discount,

investing in the higher interest market and then selling the proceeds forward will maximise return. If the

difference in interest rates is less than the forward premium, investing in the lower interest mark et and then

selling the proceeds forward will maximise return.

Difference in interest rates ( i$ - i )

Forward premium on the yen

CIA profit potential

1.400%

1.358%

0.042%

In order to lock-in a covered interest arbitrage (CIA) profit, Takeshi Kamada should invest in the higher

yielding interest rate (USD) and simultaneously sell the proceeds forward to Yen.

Chapter 6 International Parity Conditions

START

5,000,000

Spot (/$)

118.60

593,000,000

Japanese yen

U.S. dollar interest rate (180 days)

4.800%

1.0240

---------------> 180 days ---------------->

1.0170

3.400%

Japanese yen interest rate (180 days)

5,120,000

Forward-180 (/$)

117.80

603,136,000

603,081,000

55,000

END

Takeshi Kamada generates a CIA profit by investing the higher interest rate currency, the dollar, and

simultaneously selling the dollar proceeds forward into yen at a forward premium.

P6.8

A deviation from covered interest arbitrage is uncovered interest arbitrage (UIA), wherein investors borrow in countries

and currencies exhibiting relatively low interest rates and convert the proceeds into currencies that offer much higher

interest rates.

The transaction is uncovered because the investor does not sell the higher yielding currency proceeds forward,

choosing to remain uncovered and accept the currency risk of exchanging the higher yield currency into the lower

yielding currency at the end of the period.

1.4 is greater than 1.017, i.e. Interest rate diff is higher than EXPECTED SPOT PREMIUM (ARBITRAGE RULE OF THUMB)

EXPECTED SPOT PREMIUM = Spot Expected Spot * 360 * 100

Expected Spot

n

Checklist 1 Exchange the invested dollar proceeds into yen at the expected spot rate to maximise the arbitrage

profit.

Checklist 2 In other words, he is only able to maximise by having outcomes in the opposite currency the lower

currency (Yen) and leverage on the difference in interest rates.

Chapter 6 International Parity Conditions

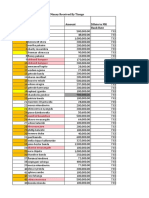

Takeshi Kamada, Credit Suisse (Tokyo), observes that the /$ spot rate has been holding steady, and both

dollar and yen interest rates have remained relatively fixed over the past week. Takeshi wonders if he should try

an uncovered interest arbitrage (UIA) and thereby save the cost of forward cover. Many of Takeshi's research

ass ociates -- and their computer models -- are predicting the s pot rate to remain close to 118.00/$ for the

coming 180 days. Us ing the s ame data as in the previous problem, analyze the UIA potential.

As sumptions

Arbitrage funds available

Spot rate (/$)

180-day forward rate (/$)

Expected s pot rate in 180 days (/$)

180-day U.S. dollar interest rate

180-day Japanese yen interest rate

Value

$5,000,000

118.60

117.80

118.00

4.800%

3.400%

Yen Equivalent

593,000,000

Arbitrage Rule of Thumb: If the difference in interest rates is greater than the expected change in spot rate

investing in the higher interest mark et and then selling the proceeds forward will maximise return. If the

difference in interest rates is less than the expected change in spot rate, investing in the lower interest mark et

and then selling the proceeds forward will maximise return.

Difference in interest rates ( i$ - i )

Expected gain (loss) on the spot rate

UIA profit potential

1.400%

1.017%

0.383%

This tells Takeshi Kamada that he s hould start by borrowing in the lower yeilding currency first. Then in order

to lock-in an uncovered interest arbitrage (UIA) profit, Takeshi Kamada should convert the money into USD.

Then invest in the higher yielding interest rate (USD) and simultaneous ly s ell the proceeds forward to Yen.

P6.9 (PRACTISE SELF)

Heidi Hi Jensen, a foreign exchange trader at J.P. Morgan Chase, can invest $5 million, or the foreign currency

equivalent of the bank's short term funds, in a covered interest arbitrage with Denmark. Using the following

quotes can Heidi make covered interest arbitrage (CIA) profit?

Assumptions

Arbitrage funds available

Spot exchange rate (kr/$)

3-month forward rate (kr/$)

US dollar 3-month interest rate

Danish kroner 3-month interest rate

Value

$5,000,000

6.1720

6.1980

3.000%

5.000%

Arbitrage Rule of Thumb: If the difference in interest rates is greater than the forward premium/discount,

investing in the higher interest market and then selling the proceeds forward will maximise return. If the

difference in interest rates is less than the forward premium, investing in the lower interest mark et and then

selling the proceeds forward will maximise return.

Difference in interest rates ( i$ - i )

Forward discount on the krone

CIA profit potential

2.000%

-1.678%

0.322%

In order to lock-in a covered interest arbitrage (CIA) profit, Heidi Hi Jensen should invest in the higher

yielding interest rate (DKr) and simultaneously sell the proceeds forward to USD.

Thus, 2 is greater than 1.678, i.e. Interest rate diff is higher than FORWARD PREMIUM (ARBITRAGE RULE OF THUMB)

Chapter 6 International Parity Conditions

Step 1. Use the dollar funds at hand (CIA profit uses fund at hand) to invest in the US market.

2. Exchange the USD funds at spot rate to get Danish Krone proceeds

3. Invest the Danish Krone in the Local market to get Krone proceeds which you sell forward as per the ABRITRAGE

RULE OF THUMB (if interest rate is higher than forward premium invest in the higher interest market and then sell

that proceeds forward).

In this problem, the higher interest market is Danish Krone and sell Krone proceeds forward to get USD.

4. Compare the two to outcomes in USD to calculate the profit.

P6.10

Assumptions

Arbitrage funds available

Spot exchange rate (kr/$)

3-month forward rate (kr/$)

US dollar 3-month interest rate

Danish kroner 3-month interest rate

Value

$5,000,000

6.1720

6.1980

4.000%

5.000%

kr Equivalent

kr 30,860,000

Arbitrage Rule of Thumb: If the difference in interest rates is greater than the forward premium/discount, or

expected change in the spot rate for UIA, invest in the higher interest yielding currency. If the difference in

interest rates is less than the forward premium (or expected change in the spot rate), invest in the lower

yielding currency.

Difference in interest rates ( i$ - i )

Forward discount on the krone

CIA profit potential

1.000%

-1.678%

-0.678%

In order to lock-in a covered interest arbitrage (CIA) profit, Heidi Hi Jensen should invest in the lower yielding

interest rate (USD) and simultaneously sell the proceeds forward to DKr.

Here, 1.678 is greater than 1, i.e. Interest rate diff is lower than FORWARD PREMIUM (ARBITRAGE RULE OF THUMB)

Step 1. Use the dollar funds at hand (CIA profit uses fund at hand) to invest in the US market.

2. Exchange the USD funds at spot rate to get Danish Krone proceeds. Which you invest in the in the Local Krone market.

3. Then sell the invested dollar forward to get Danish krone proceeds. (if interest rate is lower than forward premium

invest in the lower interest market and then sell that proceeds forward).

In this problem, the lower interest market is Dollar and sell the dollar proceeds forward to get Danish Krone.

4. Compare the two to outcomes in Danish Krone to calculate the profit.

You might also like

- Foreign Exchange Market InsightsDocument12 pagesForeign Exchange Market InsightsRuiting Chen100% (1)

- Problem 8.1 Peregrine Funds - JakartaDocument5 pagesProblem 8.1 Peregrine Funds - JakartaAlexisNo ratings yet

- Chapter 11Document2 pagesChapter 11atuanaini0% (1)

- Bus 322 Tutorial 5-SolutionDocument20 pagesBus 322 Tutorial 5-Solutionbvni50% (2)

- Sample Questions CH 10, FIN 6633Document3 pagesSample Questions CH 10, FIN 6633dragonfire19890% (1)

- Ch8 Practice ProblemsDocument5 pagesCh8 Practice Problemsvandung19No ratings yet

- Summer 2021 FIN 6055 New Test 2Document2 pagesSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- 2Document2 pages2akhil107043No ratings yet

- Chapter 4Document14 pagesChapter 4Selena JungNo ratings yet

- Chapter 4-Exchange Rate DeterminationDocument21 pagesChapter 4-Exchange Rate DeterminationMelva CynthiaNo ratings yet

- IBF - Qeststions For Test 1Document30 pagesIBF - Qeststions For Test 1Pardeep Singh DhaliwalNo ratings yet

- Sallie Schnudel currency option choicesDocument1 pageSallie Schnudel currency option choicesSamer100% (1)

- Companies Swap Rates to Match NeedsDocument4 pagesCompanies Swap Rates to Match NeedsHana LeeNo ratings yet

- Transaction Exposure Chapter 11Document57 pagesTransaction Exposure Chapter 11armando.chappell1005No ratings yet

- MBF14e Chap02 Monetary System PbmsDocument13 pagesMBF14e Chap02 Monetary System PbmsKarlNo ratings yet

- International Financial Markets Chapter 3 SummaryDocument22 pagesInternational Financial Markets Chapter 3 SummaryFeriel El IlmiNo ratings yet

- Vertical Supply Chain of Zara: Suppliers Across World ZARA Manufacturing Unit in SpainDocument1 pageVertical Supply Chain of Zara: Suppliers Across World ZARA Manufacturing Unit in SpainADITYAROOP PATHAKNo ratings yet

- CHAPTER 2 Chapter 1 - Exchange Rate DeterminationDocument48 pagesCHAPTER 2 Chapter 1 - Exchange Rate Determinationupf123100% (2)

- Madura Chapter 6Document13 pagesMadura Chapter 6MasiNo ratings yet

- TB Chapter 20Document14 pagesTB Chapter 20Mon LuffyNo ratings yet

- Inventory Simulation Game Student HandoutDocument3 pagesInventory Simulation Game Student HandoutRhobeMitchAilarieParelNo ratings yet

- Sample MidTerm Multiple Choice Spring 2018Document3 pagesSample MidTerm Multiple Choice Spring 2018Barbie LCNo ratings yet

- Chapter 8 PDFDocument43 pagesChapter 8 PDFCarlosNo ratings yet

- UntitledDocument5 pagesUntitledsuperorbitalNo ratings yet

- Chapter 10 Transaction and Translation Exposure Multiple Choice and True/False Questions 10.1 Types of Foreign Exchange ExposureDocument19 pagesChapter 10 Transaction and Translation Exposure Multiple Choice and True/False Questions 10.1 Types of Foreign Exchange Exposurequeen hassaneenNo ratings yet

- Chapter 3: International Financial MarketsDocument15 pagesChapter 3: International Financial MarketsNam LêNo ratings yet

- Chapter 17Document20 pagesChapter 17Cynthia AdiantiNo ratings yet

- Chapter 09 Management of EcDocument60 pagesChapter 09 Management of EcLiaNo ratings yet

- Pbm7 2Document1 pagePbm7 2jordi92500No ratings yet

- Ch03 ProblemSolutionsDocument6 pagesCh03 ProblemSolutionsordecNo ratings yet

- Foreign Currency Derivatives and Swaps: QuestionsDocument6 pagesForeign Currency Derivatives and Swaps: QuestionsCarl AzizNo ratings yet

- Eun Resnick 8e Chapter 11Document18 pagesEun Resnick 8e Chapter 11Wai Man NgNo ratings yet

- Locational Arbitrage. Assume The Following InformationDocument11 pagesLocational Arbitrage. Assume The Following Informationajim87No ratings yet

- Chapter 5: Currency DerivativesDocument21 pagesChapter 5: Currency DerivativesNotesfreeBookNo ratings yet

- CH 18Document4 pagesCH 18Ahmed_AbdelkariemNo ratings yet

- Chapter 5: The Market For Foreign ExchangeDocument19 pagesChapter 5: The Market For Foreign ExchangeDang ThanhNo ratings yet

- Blades Case Exposure to International Flow of FundsDocument1 pageBlades Case Exposure to International Flow of FundsWulandari Pramithasari50% (2)

- Global Investments PPT PresentationDocument48 pagesGlobal Investments PPT Presentationgilli1trNo ratings yet

- IFM TB Ch08Document9 pagesIFM TB Ch08isgodNo ratings yet

- FX II PracticeDocument10 pagesFX II PracticeFinanceman4No ratings yet

- Chapter 03 Balance of PaymeDocument50 pagesChapter 03 Balance of PaymeLiaNo ratings yet

- Case Study ch6Document3 pagesCase Study ch6shouqNo ratings yet

- MNC S Exposure To Exchange Rate FluctuationsDocument34 pagesMNC S Exposure To Exchange Rate FluctuationsanshuldceNo ratings yet

- Chapter 2 - Part 2 - Problems - AnswersDocument3 pagesChapter 2 - Part 2 - Problems - Answersyenlth940% (2)

- Mini Case Chapter 8Document8 pagesMini Case Chapter 8William Y. OspinaNo ratings yet

- IfDocument14 pagesIfĐặng Thuỳ HươngNo ratings yet

- Spot Exchange Markets. Quiz QuestionsDocument14 pagesSpot Exchange Markets. Quiz Questionsym5c2324100% (1)

- Sallie Schnudel speculates on Singapore dollar appreciationDocument25 pagesSallie Schnudel speculates on Singapore dollar appreciationveronika100% (1)

- Ch07 SSolDocument7 pagesCh07 SSolvenkeeeee100% (1)

- CH 5Document24 pagesCH 5Rizwan Shahid100% (1)

- Workshop Exercises SolutionsDocument5 pagesWorkshop Exercises SolutionsShar100% (1)

- Chapter Review International Arbitrage and Interest Rate Parity International ArbitrageDocument9 pagesChapter Review International Arbitrage and Interest Rate Parity International ArbitrageWi SilalahiNo ratings yet

- Economic ExposureDocument7 pagesEconomic ExposureChi NguyenNo ratings yet

- Chapter 6Document6 pagesChapter 6TRINHNo ratings yet

- Interest Rate ParityDocument3 pagesInterest Rate ParityPratik PatraNo ratings yet

- Summary MKI Chapter 7Document5 pagesSummary MKI Chapter 7DeviNo ratings yet

- Interest Rate ParityDocument14 pagesInterest Rate ParityParul AsthanaNo ratings yet

- Forward Market: Greg Mackinnon Finance 676 Sobey School of Business Saint Mary'S UniversityDocument9 pagesForward Market: Greg Mackinnon Finance 676 Sobey School of Business Saint Mary'S UniversityMamoon RashidNo ratings yet

- International Financial Management: Assignment # 1Document7 pagesInternational Financial Management: Assignment # 1Sadia JavedNo ratings yet

- IFM Chapter 5&6 - Class PresentationDocument31 pagesIFM Chapter 5&6 - Class PresentationCecilia Ooi Shu QingNo ratings yet

- IFM Chapter 17 - Class PresentationDocument15 pagesIFM Chapter 17 - Class PresentationCecilia Ooi Shu QingNo ratings yet

- FDI in Malaysia and Global Economy (Reading Article)Document3 pagesFDI in Malaysia and Global Economy (Reading Article)Cecilia Ooi Shu QingNo ratings yet

- Measuring the Impact of Operating Exposure on a Multinational CorporationDocument28 pagesMeasuring the Impact of Operating Exposure on a Multinational CorporationCecilia Ooi Shu QingNo ratings yet

- Amadeus Fares Advanced ManualDocument77 pagesAmadeus Fares Advanced ManualAnower ShadatNo ratings yet

- UNIT 5 - Module I 107: Unit Five On FinanceDocument0 pagesUNIT 5 - Module I 107: Unit Five On FinanceLuiza BoleaNo ratings yet

- International Arbitrage OpportunitiesDocument26 pagesInternational Arbitrage OpportunitiesAbdallah ClNo ratings yet

- 07bcfc PDFDocument19 pages07bcfc PDFВлад ИвановNo ratings yet

- Origin and Evolution of MoneyDocument8 pagesOrigin and Evolution of MoneyChinthani SooriyamudaliNo ratings yet

- Kelompok 2 - BITCOIN - TemplatesDocument11 pagesKelompok 2 - BITCOIN - TemplatesSofhiaaaNo ratings yet

- AU T2 M 4197 Year 3 Maths Mastery Money Challenge Cards Ver 1Document3 pagesAU T2 M 4197 Year 3 Maths Mastery Money Challenge Cards Ver 1Mostafa EmadNo ratings yet

- The Basics of CryptocurrencyDocument18 pagesThe Basics of CryptocurrencyOwodeha-Ashaka PrapraraNo ratings yet

- Rupee SymbalDocument3 pagesRupee SymbalMeeNu KarthikNo ratings yet

- Copy Ke TableDocument697 pagesCopy Ke TableAnnisa FarhanahNo ratings yet

- Sample Data - Canada Set 1 Form Field Name API NameDocument12 pagesSample Data - Canada Set 1 Form Field Name API NameJuan David GarzonNo ratings yet

- Casino CoinDocument8 pagesCasino Cointore giudiceNo ratings yet

- 43A, 43AA, MAT and DTDocument23 pages43A, 43AA, MAT and DTsaransidharth12No ratings yet

- Case Study Japanese Intervention in Foreign Exchange MarketsDocument6 pagesCase Study Japanese Intervention in Foreign Exchange Marketsnxhong93No ratings yet

- Cryptocurrency As An Alternative Currency in Malaysia: Issues and ChallengesDocument18 pagesCryptocurrency As An Alternative Currency in Malaysia: Issues and ChallengesMyra ChoyyNo ratings yet

- Verified List From MembersDocument24 pagesVerified List From MembersTAWONGA NYIRENDANo ratings yet

- Basel norms and capital requirementsDocument78 pagesBasel norms and capital requirementssouravNo ratings yet

- Damac Project AvailabilityDocument62 pagesDamac Project AvailabilityAnonymous 2rYmgRNo ratings yet

- Bitcoin Profit Updated ReviewDocument8 pagesBitcoin Profit Updated ReviewJahin Binte Junaid100% (1)

- Lecture 10 SudeepDocument44 pagesLecture 10 SudeepJin ShuangNo ratings yet

- Economics Past Papers 2014 - 2016Document22 pagesEconomics Past Papers 2014 - 2016Shane ThomasNo ratings yet

- Treason by DesignDocument2 pagesTreason by DesignAnonymous nYwWYS3ntV100% (1)

- International Money Market GuideDocument2 pagesInternational Money Market GuideKainat TanveerNo ratings yet

- Bank Negara Malaysia Notice on Digital CurrenciesDocument129 pagesBank Negara Malaysia Notice on Digital CurrenciesSamuri Firusi100% (1)

- PSC Re So 722 F Glossary AttaDocument47 pagesPSC Re So 722 F Glossary AttaghhhNo ratings yet

- The Supply and Use of Money in The Roman World 200 B.C. To A.D. 300Document32 pagesThe Supply and Use of Money in The Roman World 200 B.C. To A.D. 300Gonza CordeiroNo ratings yet

- Debt - The First 5000 Years, by David GraeberDocument3 pagesDebt - The First 5000 Years, by David Graebersatria rizki wibisonoNo ratings yet

- GsnubeDocument169 pagesGsnubeAnonymous 4yXWpDNo ratings yet

- Tugas 1 Bahasa Inggris NiagaDocument2 pagesTugas 1 Bahasa Inggris NiagaPNM MEKAAR KEDONDONGNo ratings yet

- Understanding Coinage and the U.S. Minting ProcessDocument2 pagesUnderstanding Coinage and the U.S. Minting ProcessRaluca CiupeNo ratings yet