Professional Documents

Culture Documents

Monetary Policy: From Hawk To Dove

Uploaded by

umaganOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monetary Policy: From Hawk To Dove

Uploaded by

umaganCopyright:

Available Formats

ECONOMICS UPDATE

5 OCT 2016

Monetary Policy

From hawk to dove

Policy actions initiated

Repo rate was cut to 6.25% due to reduction in

upside risks to the 5% inflation target led by the

fall in food inflation.

Cash reserve ratio (CRR) of scheduled banks

unchanged at 4% of net demand and time

liabilities (NDTL)

Continuation of new liquidity framework (Apr16) which intends to progressively lower the

average ex ante liquidity deficit in the system

from 1% of NDTL to a position closer to

neutrality.

Therefore, the reverse repo rate under the LAF

fell to 5.75%, and the marginal standing facility

(MSF) rate & the Bank Rate to 6.75%

Real Interest rate(1yr bond - CPI) at 152bps

13

Real rates in bps (RHS)

Repo

India 1-Year Bond Yield

CPI Inflation

1000

500

8

0

-500

Apr-12

Aug-12

Nov-12

Feb-13

Jun-13

Sep-13

Dec-13

Apr-14

Jul-14

Oct-14

Feb-15

May-15

Aug-15

Dec-15

Mar-16

Jun-16

Oct-16

The recently constituted MPC delivered its maiden

policy statement with a cut of 25bps in policy rates

with unanimity. This policy meet marks a deviation

from the path of price stability to growth revival.

The quantum of the cut was on expected lines,

however the commentary was in stark contrast

with the hawkish commentary of the former

Governor. There are structural changes underway

in the monetary policy manifested via the

abandonment of the 1.5% to 2% real interest rates

with a more benign 1.25% (upper limit) thereby

creating room for another rate cut in the next

policy meet. The dovish policy stance coupled with

the continued liquidity easing may cause inflation

expectations to get dis-anchored thereby breaking

the virtuous cycle of savings driven disinflation

induced by real positive rates. As per the MPC,

India is on the cusp of growth revival led by agri,

construction and public investments. However

some headwinds are present due to weak global

macros.

Source : RBI

Romit Fernandes

romit.fernandes@hdfcsec.com

+91-99301-24556

HDFC securities Institutional Research is also available on Bloomberg HSLB <GO> & Thomson Reuters

ECONOMICS UPDATE: MONETARY POLICY

Inflation Outlook

Upside risks to the inflation target of 5% for

March 2017 have abated.

The MPC is concerned about the impending rise

by the stimulus to consumption spending that

can be expected from the disbursement of pay,

pension

and

arrears

following

the

implementation of the 7th CPCs award.

in housing due to the 7th CPC, increase in MSP

and rural wages. Its impact on inflation

expectations will have to be carefully monitored

so as to pre-empt a generalisation of inflation

pressures.

However, successive downgrades of global

Inflation excluding food and fuel (including petrol

The decline in remittances and the flattening of

and diesel embedded in transportation) has been

sticky around 5%, mainly in respect to education,

medical and personal care services.

The MPC is quite sanguine on the outlook of food

inflation aided by favourable monsoons. As per

the MPC the strong improvement in sowing,

along with supply management measures, will

improve the food inflation outlook. It notes that

the sharp drop in inflation reflects a downward

shift in the momentum of food inflation which

holds the key to future inflation outcomes

rather than merely the statistical effects of a

favourable base effect.

There isnt any significant observation on the

impact of the recent rise in crude prices on the

CPI. However the same has the potential to

disrupt the applecart via the transportation

channel into food especially perishables.

Key highlights from the policy statement

The RBI has maintained the GVA forecast at 7.6%

as the momentum of growth is expected to be

quickened by the normal monsoon raising

agricultural growth and rural demand, as well as

growth projections by multilateral agencies and

the continuing sluggishness in world trade points

to further slackening of external demand going

forward

software earnings warrants monitoring. While

the pace of foreign direct investment slowed

compared to a year ago, portfolio flows were

stronger after the Brexit vote, galvanised by a

search for returns in an expanding universe of

negative yields. The level of foreign exchange

reserves rose to US$ 372 bn by September 30,

2016 an all-time high.

As per the MPC the industrial sector, by

contrast, suffered a manufacturing-driven

contraction in early fiscal year Q2, after a

sequential deceleration in gross value added in

Q1. Even after trimming the statistical effects of

the lumpy and order-driven contraction of

insulated rubber cables, industrial production as

measured by the index of industrial production

(IIP) turned out to be slower than a year ago..

This indicates that IIP growth have a taken

precedence over the real GDP growth despite

the outdated nature of the IIP series

The FCNR (B) redemptions have continued

without any hiccups aided by copious forex

reserves.

Page | 2

ECONOMICS UPDATE: MONETARY POLICY

GVA forecast maintained at 7.6% as growth is

expected to accelerate due to normal monsoon

As per the MPC, India is on the

cusp of growth revival led by

agri, construction and public

investments. However some

headwinds are present due to

weak global macros

Liquidity conditions in surplus necessitating the RBI

to absorb surplus via reverse repos.

Net injections (US$ bn)

1,300

1,000

Deficit

700

400

100

-200

-500

Surplus

The rise in inflation expectation

doesnt augur well for the

future

Sep-16

Aug-16

Jul-16

Jul-16

Jun-16

May-16

May-16

Apr-16

Mar-16

Mar-16

Feb-16

Jan-16

Jan-16

-800

Source : RBI

Source : RBI

Rise in inflation expectations led by the recent

surge in food inflation doesnt augur well for the

future

Despite the rise in expectations inflation target

maintained at 5% due to impending fall in food

Source : RBI

Source : RBI

The dovish policy stance

coupled with the continued

liquidity easing may cause

inflation expectations to get

dis-anchored thereby breaking

the virtuous cycle of savings

driven disinflation induced by

real positive rates.

Page | 3

ECONOMICS UPDATE: MONETARY POLICY

Disclosure:

I, Romit Fernandes, MBA, author and the name subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the subject

issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Research Analyst or his/her relative or HDFC Securities Ltd. does not have any financial interest in the subject company. Also Research Analyst or his relative or HDFC Securities Ltd. or its

Associate may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. Further

Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or

arrived at, based upon information obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of

warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. This document is for

information purposes only. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be

construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any

locality, state, country or other jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC

Securities Ltd or its affiliates to any registration or licensing requirement within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may

not be reproduced, distributed or published for any purposes without prior written approval of HDFC Securities Ltd .

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived

from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services

for, any company mentioned in this mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies)

mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the

company(ies) discussed herein or act as an advisor or lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and

other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any

action taken on basis of this report, including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the

dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report,

or may make sell or purchase or other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any

other assignment in the past twelve months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or

specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research

report. Accordingly, neither HDFC Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is

not based on any specific merchant banking, investment banking or brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach

different conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served

as an officer, director or employee of the subject company. We have not received any compensation/benefits from the subject company or third party in connection with the Research

Report. HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475

HDFC securities

Institutional Equities

Unit No. 1602, 16th Floor, Tower A, Peninsula Business Park,

Senapati Bapat Marg, Lower Parel, Mumbai - 400 013

Board : +91-22-6171 7330 www.hdfcsec.com

Page | 4

You might also like

- World Credit Card Agreement and DisclosureDocument11 pagesWorld Credit Card Agreement and DisclosureMacrobiM Reklam AjansıNo ratings yet

- Texas Certified Lienholders ListDocument60 pagesTexas Certified Lienholders ListJohn StephensNo ratings yet

- Evidence 6 7Document3 pagesEvidence 6 7Jennifer JohnsonNo ratings yet

- Oracle Accounting in ARDocument28 pagesOracle Accounting in ARMina Sameh100% (6)

- Negotiable Instruments - Meaning, Types & UsesDocument3 pagesNegotiable Instruments - Meaning, Types & UsesQuishNo ratings yet

- Back Office SerivceDocument172 pagesBack Office SerivceAbhijith Pai100% (2)

- New World Order PG 10Document1 pageNew World Order PG 10Daniel Paes de SouzaNo ratings yet

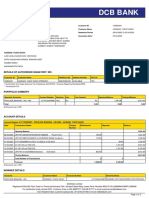

- DCB Bank: Statement of AccountDocument2 pagesDCB Bank: Statement of AccounthasnainNo ratings yet

- Monetary Policy ReviewDocument3 pagesMonetary Policy ReviewNikhil DambalNo ratings yet

- Indian Investors Underinvested in Equities Despite Macro ImprovementsDocument26 pagesIndian Investors Underinvested in Equities Despite Macro ImprovementsWin VitNo ratings yet

- RBIAnnual Monetary Policy ReviewDocument3 pagesRBIAnnual Monetary Policy ReviewtomydaloorNo ratings yet

- FixedIncome January 2012Document3 pagesFixedIncome January 2012jayaram_mca83No ratings yet

- Market Insight Q3FY12 RBI Policy Review Jan12Document3 pagesMarket Insight Q3FY12 RBI Policy Review Jan12poojarajeswariNo ratings yet

- RBI MPC Policy '23Document1 pageRBI MPC Policy '23adithyaNo ratings yet

- Reserve Bank of India - Press ReleasesDocument4 pagesReserve Bank of India - Press ReleasesSarthak AroraNo ratings yet

- Governor's Statement - August 6, 2020: TH TH TH THDocument13 pagesGovernor's Statement - August 6, 2020: TH TH TH THThe QuintNo ratings yet

- MONETARY POLICY 2022-23 KEY HIGHLIGHTSDocument15 pagesMONETARY POLICY 2022-23 KEY HIGHLIGHTSAman GargNo ratings yet

- Q3 RBI Credit Policy ExpectationsDocument3 pagesQ3 RBI Credit Policy ExpectationsRahul SonthaliaNo ratings yet

- IDirect RBIActions Feb16Document4 pagesIDirect RBIActions Feb16umaganNo ratings yet

- Post Budget Impact Analysis - MF & Debt: Retail ResearchDocument2 pagesPost Budget Impact Analysis - MF & Debt: Retail ResearchDinesh ChoudharyNo ratings yet

- Icici Prudential Mutual Fund Rbi Second Quarter Review of Monetary Policy 2010-11Document4 pagesIcici Prudential Mutual Fund Rbi Second Quarter Review of Monetary Policy 2010-11Vinit KumarNo ratings yet

- Thematic Insights - Welcome 2014Document3 pagesThematic Insights - Welcome 2014Jignesh71No ratings yet

- Helios India Rising Portfolio - Performance Update - Oct'23Document2 pagesHelios India Rising Portfolio - Performance Update - Oct'23sandeepjshah19No ratings yet

- RBI Monetary Policy - August 17Document3 pagesRBI Monetary Policy - August 17pappuNo ratings yet

- Monetary Policy StatementDocument3 pagesMonetary Policy Statementvipulpandey005No ratings yet

- C O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficerDocument61 pagesC O M P A N Y P R O F I L E: Achal Gupta Managing Director & Chief Executive OfficervipinkathpalNo ratings yet

- SBP - Analyst Briefing NoteDocument3 pagesSBP - Analyst Briefing Notemuddasir1980No ratings yet

- Bandhan Debt-Market-Monthly-Outlook-Nov-2023Document3 pagesBandhan Debt-Market-Monthly-Outlook-Nov-2023Shivani NirmalNo ratings yet

- Bullish Under The Hood December Policy TakeawaysDocument3 pagesBullish Under The Hood December Policy Takeawaysvishal_lal89No ratings yet

- Demonetization Impact: Banking, Infra BenefitDocument3 pagesDemonetization Impact: Banking, Infra BenefitAngelinaGuptaNo ratings yet

- Economy and Finance deDocument5 pagesEconomy and Finance deNischal SolankiNo ratings yet

- Strategic Analysis of SBIMFDocument19 pagesStrategic Analysis of SBIMF26amitNo ratings yet

- Market Outlook Aetoutoo: I-Direct Top PicksDocument5 pagesMarket Outlook Aetoutoo: I-Direct Top PicksAnonymous W7lVR9qs25No ratings yet

- Helping You Spot Opportunities: Investment Update - October, 2012Document56 pagesHelping You Spot Opportunities: Investment Update - October, 2012Carla TateNo ratings yet

- RBI 25bp HIkeDocument1 pageRBI 25bp HIkeadithyaNo ratings yet

- Monetary PolDocument3 pagesMonetary Polst1dNo ratings yet

- Sunrise Research2Document2 pagesSunrise Research2jibranqqNo ratings yet

- Economy: Sep-13 Inflation Clocked in at 7.39% Yoy: He EllDocument2 pagesEconomy: Sep-13 Inflation Clocked in at 7.39% Yoy: He ElljibranqqNo ratings yet

- Monetary Policy Review, 30th January 2013Document5 pagesMonetary Policy Review, 30th January 2013Angel BrokingNo ratings yet

- RBI Credit Policy Analysis November 2010Document8 pagesRBI Credit Policy Analysis November 2010gaurav880No ratings yet

- Brief Report 22-July-2014 - MPSDocument1 pageBrief Report 22-July-2014 - MPSNafees Ul-haqNo ratings yet

- FitchDocument9 pagesFitchTiso Blackstar Group100% (1)

- Country Reports - ChinaDocument26 pagesCountry Reports - ChinapmcardosoNo ratings yet

- Interest Rates InflationDocument3 pagesInterest Rates InflationHans WidjajaNo ratings yet

- Reserve Bank of India Second Quarter Review of Monetary Policy 2013-14 by Dr. Raghuram G. Rajan Governor Monetary PolicyDocument11 pagesReserve Bank of India Second Quarter Review of Monetary Policy 2013-14 by Dr. Raghuram G. Rajan Governor Monetary Policyjohann_747No ratings yet

- FinShiksha - RBI Monetary Policy ReviewDocument5 pagesFinShiksha - RBI Monetary Policy ReviewTheMoneyMitraNo ratings yet

- Key Highlights:: Inflationary Pressures Overrides Downside Risks To GrowthDocument6 pagesKey Highlights:: Inflationary Pressures Overrides Downside Risks To Growthsamyak_jain_8No ratings yet

- RBI Monetary Policy Statement - Must Read For The Class Now and TodayDocument4 pagesRBI Monetary Policy Statement - Must Read For The Class Now and TodayAnanya SharmaNo ratings yet

- RBI Policy June 17Document3 pagesRBI Policy June 17Govind SharmaNo ratings yet

- RBI BulletinDocument118 pagesRBI Bulletintheresa.painter100% (1)

- Debt StrategyDocument10 pagesDebt StrategysnehaaggarwalNo ratings yet

- Macro Economic Impact Apr08Document16 pagesMacro Economic Impact Apr08shekhar somaNo ratings yet

- Governor's StatementDocument11 pagesGovernor's Statementvipulpandey005No ratings yet

- IDirect RBIActions Jun16Document4 pagesIDirect RBIActions Jun16umaganNo ratings yet

- Monetary PolicyDocument6 pagesMonetary PolicyVishalNo ratings yet

- Reserve Bank of India Second Quarter Review of Monetary Policy 2013-14Document12 pagesReserve Bank of India Second Quarter Review of Monetary Policy 2013-14Knowledge GuruNo ratings yet

- Pharmaceuticals: 2QFY17E Results PreviewDocument8 pagesPharmaceuticals: 2QFY17E Results Previewarun_algoNo ratings yet

- Monetary Policy - April 2015Document4 pagesMonetary Policy - April 2015Deepak SharmaNo ratings yet

- RBI monetary policy leaves debt market with safe opportunitiesDocument1 pageRBI monetary policy leaves debt market with safe opportunitiesChandan PreetNo ratings yet

- State Bank of India: Play On Economic Recovery Buy MaintainedDocument4 pagesState Bank of India: Play On Economic Recovery Buy MaintainedPaul GeorgeNo ratings yet

- Jagran Prakashan LTD: EquitiesDocument3 pagesJagran Prakashan LTD: EquitiesAnonymous y3hYf50mTNo ratings yet

- Capital Market Daily: Pakistan EconomyDocument2 pagesCapital Market Daily: Pakistan EconomyImran Khan SharNo ratings yet

- Monetary Policy ReviewDocument4 pagesMonetary Policy ReviewVishal KanojiaNo ratings yet

- Fag 3qcy2012ruDocument6 pagesFag 3qcy2012ruAngel BrokingNo ratings yet

- Overview of Indian Economy & Fixed Income OutlookDocument19 pagesOverview of Indian Economy & Fixed Income OutlookdevkantojhaNo ratings yet

- 036 Sbi Contra FundDocument19 pages036 Sbi Contra Fundashwini shuklaNo ratings yet

- Indian retail industry growth driven by GDP, lower inflationDocument2 pagesIndian retail industry growth driven by GDP, lower inflationRuchika TripathiNo ratings yet

- Asian Development Outlook 2015: Financing Asia’s Future GrowthFrom EverandAsian Development Outlook 2015: Financing Asia’s Future GrowthNo ratings yet

- Hindustan Petroleum Corporation: Strong FootholdDocument9 pagesHindustan Petroleum Corporation: Strong FootholdumaganNo ratings yet

- ReportDocument5 pagesReportumaganNo ratings yet

- Report PDFDocument4 pagesReport PDFshobhaNo ratings yet

- Trident LTD: Retail ResearchDocument18 pagesTrident LTD: Retail ResearchumaganNo ratings yet

- HSL Looking Glass: Retail ResearchDocument4 pagesHSL Looking Glass: Retail ResearchumaganNo ratings yet

- An Exciting Ride Set To Take Off: Wonderla Holidays LTDDocument14 pagesAn Exciting Ride Set To Take Off: Wonderla Holidays LTDumaganNo ratings yet

- 10000 B.C.(Bullish Confirmation for Nifty target of 10000Document6 pages10000 B.C.(Bullish Confirmation for Nifty target of 10000umaganNo ratings yet

- Nifty Weekly Insight 8520 ResistanceDocument4 pagesNifty Weekly Insight 8520 ResistanceumaganNo ratings yet

- Nifty Forecast for February 2017Document6 pagesNifty Forecast for February 2017umaganNo ratings yet

- 10000 B.C.(Bullish Confirmation for Nifty target of 10000Document6 pages10000 B.C.(Bullish Confirmation for Nifty target of 10000umaganNo ratings yet

- Commercial vehicle manufacturer SML Isuzu is a buyDocument9 pagesCommercial vehicle manufacturer SML Isuzu is a buyumaganNo ratings yet

- TRACKING UPCOMING CORPORATE EVENTSDocument2 pagesTRACKING UPCOMING CORPORATE EVENTSumaganNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: February 23, 2017Document2 pagesPossible Nifty Scenario Over 2 - 3 Days: February 23, 2017jaimaaganNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument5 pagesHSL Weekly Insight: Retail ResearchumaganNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: February 23, 2017Document2 pagesPossible Nifty Scenario Over 2 - 3 Days: February 23, 2017jaimaaganNo ratings yet

- ReportDocument5 pagesReportjaimaaganNo ratings yet

- ReportDocument5 pagesReportjaimaaganNo ratings yet

- Nifty sideways as ascending triangle hints at upside breakoutDocument3 pagesNifty sideways as ascending triangle hints at upside breakoutumaganNo ratings yet

- Special Technical Report - Crude Oil: Retail ResearchDocument3 pagesSpecial Technical Report - Crude Oil: Retail ResearchumaganNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: FiverDocument2 pagesPossible Nifty Scenario Over 2 - 3 Days: FiverumaganNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: FiverDocument2 pagesPossible Nifty Scenario Over 2 - 3 Days: FiverDinesh ChoudharyNo ratings yet

- Technical Stock PickDocument2 pagesTechnical Stock PickumaganNo ratings yet

- HSL Weekly Insight: Retail ResearchDocument4 pagesHSL Weekly Insight: Retail ResearchumaganNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: FiverDocument2 pagesPossible Nifty Scenario Over 2 - 3 Days: FiverDinesh ChoudharyNo ratings yet

- Possible Nifty Scenario Over 2 - 3 Days: FiverDocument2 pagesPossible Nifty Scenario Over 2 - 3 Days: FiverDinesh ChoudharyNo ratings yet

- HSL Techno Edge: Retail ResearchDocument3 pagesHSL Techno Edge: Retail ResearchumaganNo ratings yet

- Weekly Technical ReportDocument5 pagesWeekly Technical ReportumaganNo ratings yet

- The Indian Cements LTD: Retail ResearchDocument22 pagesThe Indian Cements LTD: Retail ResearchumaganNo ratings yet

- Lending Procedures at Standard BankDocument4 pagesLending Procedures at Standard BankAshraf Uddin AhmedNo ratings yet

- Topic 5 Working Capital and Current Asset ManagementDocument65 pagesTopic 5 Working Capital and Current Asset ManagementbriogeliqueNo ratings yet

- Banking ChicagoDocument2 pagesBanking ChicagoIsrael ZepahuaNo ratings yet

- The development of the short story in Hispanic AmericaDocument401 pagesThe development of the short story in Hispanic Americaramgomser100% (1)

- Customer Relationship Management (CRM) in Banks: Pooja GargDocument29 pagesCustomer Relationship Management (CRM) in Banks: Pooja GargManish SinghNo ratings yet

- Two EcosystemsDocument16 pagesTwo EcosystemsChloeNo ratings yet

- Stat Is e Fek 20161031Document85 pagesStat Is e Fek 20161031pindarwinNo ratings yet

- Accounts Ques BankDocument24 pagesAccounts Ques BankShubhangi GuptaNo ratings yet

- ExxxxxxDocument2 pagesExxxxxxGuiness DeguzmanNo ratings yet

- MSE Pakistan Limited Statement of Financial PositionDocument1 pageMSE Pakistan Limited Statement of Financial Positionmirza fawadNo ratings yet

- Pemberdayaan Usaha Mikro Kecil Dan Menengah (Umkm) Melalui Program Binaan Di Provinsi BaliDocument20 pagesPemberdayaan Usaha Mikro Kecil Dan Menengah (Umkm) Melalui Program Binaan Di Provinsi BaliIsna Aryanti AvanyNo ratings yet

- Chap012 Solution Manual Financial Institutions Management A Risk Management ApprDocument12 pagesChap012 Solution Manual Financial Institutions Management A Risk Management ApprПита ДаминNo ratings yet

- Unit 1 - IFS - Question Bank - 20200717133730Document3 pagesUnit 1 - IFS - Question Bank - 20200717133730Vignesh CNo ratings yet

- Commerce Is The Branch of Production That Deals WiDocument6 pagesCommerce Is The Branch of Production That Deals WiAli SalehNo ratings yet

- Tratado - Cap. 15Document15 pagesTratado - Cap. 15Cinthia de SouzaNo ratings yet

- Course Outline FINA 482 Winter 21 DIARRA - GDocument8 pagesCourse Outline FINA 482 Winter 21 DIARRA - GpopaNo ratings yet

- September StatementDocument4 pagesSeptember Statementdonbabich8No ratings yet

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariNo ratings yet

- Karnataka Bank AR 2020-21 10.08.2021Document255 pagesKarnataka Bank AR 2020-21 10.08.2021Karthik KarthikNo ratings yet

- Statement of Account Summary and Transaction DetailsDocument3 pagesStatement of Account Summary and Transaction Detailsfahad chaudhryNo ratings yet

- Money and CreditDocument7 pagesMoney and CreditSunil Sharma100% (1)