Professional Documents

Culture Documents

Ubi Process Note of Shourya Virat Trading Company

Uploaded by

Tripurari KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ubi Process Note of Shourya Virat Trading Company

Uploaded by

Tripurari KumarCopyright:

Available Formats

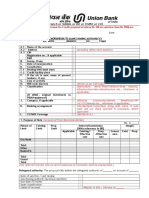

ES-2

(Branch or SARAL or RO or FGMO or CO)

Executive Summary Format for Credit proposal of above Rs.10Lacs and less than Rs.500Lacs

Reference:

Date:

MEMORANDUM TO (SANCTIONING AUTHORITY)

A/C WITH:________BRANCH_______RO______ FGMO

A.1

A.2

Name of the account

Address

: M/s Shourya Virat Trading Company

: C/o Shri Sanjeev Kumar, IOC Road, Sipara, PO-

A.3

: NA as Proprietorship

G.

CIN

Registration no., if applicable

PAN

Group, if any

Date of incorporation

Constitution

Dealing with bank since

Credit facility since

If the a/c is new, name of present

bankers, if any

Line of activity

H.

I.

BSR code (Sector)

Classification

: Trading of Raw Material and Finished Goods of PVC

Pipes and proposed to manufacture the PVC Pipes

: (Sector as per BSR code)

: MSME (Small)

J.

K.

L.

(If MSME, original investment in

P&M/equipment)

Category, if applicable

Banking arrangement

CGTMSE Coverage

61.00 Lakhs

:

: OBC

: Sole

: (Yes)

B.

C.

D.

E.1

E.2

F.

Delwahan, PS-Beur ,District-Patna,PIN-800020

:

: NA

:

: Proprietorship

: New Account

New Account hence no applicable

: Current Account with IDBI Bank

1. Purpose of Note (Synopsis of Final Recommendation)

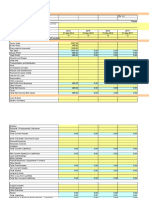

Nature of

Limit

Existing

Limit.

Prop.

Limit

Applicable

Our Bank

CC

Term Loan

Total

Other

Banks/FIs

0.00

0.00

0.00

0.00

Interest/Commission

[With reference to BR]

Existing /

Prop.

Effective

/Effective

rate

rate

(Rs. in _____)

Margin

Conces

sion

46.05

49.87

95.92

0.00

Total

0.00

0.00

Grand

0.00

0.00

Total

(The referred interest rate as well as approval of concession shall be enumerated.)

Exist

Prop

0.00

0.00

0.00

0.00

15.35

16.62

31.97

0.00

0.00

0.00

0.00

0.00

Delegated authority: The proposal falls within the delegated authority of Branch Head on account of the

amount of Limit.

Date of sanction / Last review

: -NA-

Name of the concern

Name of the Branch/RO

Sanctioning authority (previous sanction)

: -NADue date of review

: -NAAsset classification

: -NAStatus of account

: New Account hence not applicable

Credit rating:

Rating Date ABS as of previous year

ABS as of current year

Date:

Date:

Internal Rating

Not applicable

2.

Sr.

No.

1.

Names of Proprietor / Partners / Directors & their means:

Name

Abhishek Kumar

Total

Designation

PAN

(Rs. in ______)

Means

Previou

s

Date:

NA

Proprietor

DIN, if

applicable

Latest

Date:

NA

(PAN & DIN, if applicable should be invariably mentioned / Reason for variation in means to be

commented upon)

3.

4.1

Background

(Including

latest

development in business & present

request in brief.)

3.1 Firm/Company/Concern

: M/s Shourya Virat Trading Company is incorporated in

3.2 Promoters / Directors

Proprietor / Partners

: Mr. Abhishek Kumar is proprietor of M/s Shourya Virat

Capital

Structure,

applicable

Authorised Capital

Issued & Subscribed Capital

Paid Up Capital

Book Value

Market Value (Listed companies)

December 2015 and started the trading of raw material of pvc

pipes and has plan to manufacture of PVC pipes and also

trading of finished goods.

Trading Company and he is Post Graduate in Marketing .He

is of 30 years of age and associated with PVC pipes

business since last 15 years and has the ambitious future

plan related to this industry

wherever

:

:

:

:

:

NA as Proprietorship

NA as Proprietorship

NA as Proprietorship

NA as Proprietorship

Not Applicable

Concern

Concern

Concern

Concern

4.2 Shareholding pattern : Not Applicable as Proprietorship Concern

In case of company indicate following details:

Share Holder

No. of

Face Value

Holding %

Shares

Current

Previous

Date:

Date:

Page 2 of 11

Name of the concern

Name of the Branch/RO

TOTAL

In case of partnership firms indicate capital contributed by each partner separately:

Name of the partner

Current/Date:

Previous/Date:

TOTAL

4.3 Any significant change in share holding pattern : NA

5.

Comments on the following:

5.1 Credit Report/s

5.2 Search report/s

5.3 CIBIL Report/s

(CIBIL report of promoters/guarantors should

also be commented upon along with

individual score)

6.1

Comment on due diligence of borrower

: (Along with Date of Report)

6.2

Whether the name of the concern /

directors/group concerns figure in RBI

defaulters / caution list / caution list of

exporters / wilful defaulters /ECGC SAL List.

If yes, furnish details (Date of the list shall

be mentioned)

: Not figuring in the RBI defaulters /

caution list / caution list of exporters /

wilful defaulters /ECGC SAL List

6.3

Whether director / partner / proprietor is a

director in our / other bank or is related to

them. If yes i)

Name of such Director with name of

the Bank

ii)

Type of Relation

: No

6.4

Any litigation in force against the firm /

company or against the partners / director.

If so, mention details and present position

: No

7.

Whether account is taken / to be taken

over. If so norms for takeover are fulfilled

: Not Applicable

8.1

Operational experience of our bank with

regard to sister / allied concerns

Name of

Branch

Conduct

Working

Term

the

of

Capital

Loan

Concern

Account

of

other

Banks

on

sister

:

:

: New Account

Contingent

Investments

8.2

Comments

concerns

8.3

Brief Financials of Sister Concerns, if any

: Not Applicable

9.

Comments on foreign currency exposure

and un-hedged exposure, if any

: Nil

MOR

: Not Applicable

10.1 Nature & value of prime security (Immovable assets):

Nature / Description

Value

Dt. & Value along

of primary Security

Accepted by

with name of

Branch

Valuers

Page 3 of 11

Present

irregularity, if

any

Insurance

[Rs. in ____]

CERSAI

Remarks

Search with

date

Name of the concern

Name of the Branch/RO

Raw Materials

Finished Goods

and

Mkt Value:

Distress Value:

Guideline Value:

Name of Valuer:

Sundry Debtors(Less

than 90 Days)

Amount:

Date

of

Expiry:

Plant and Machinery

TOTAL

(Whether insurance is adequate should be comment upon. Details of valuation of plant & machinery, if

applicable shall also be provided. Comments on latest & previous valuation, wherever available should

be mentioned)

10.2 Nature & value of collateral security:

(Rs. In ____)

Nature / Description

Value

Dt. & Value along

Insurance

CERSAI

Remarks

of collateral

Accepted by

with name of

Search with

Security

Branch

Valuers

date

Mkt Value:

Amount:

Distress Value:

Date

of

Expiry:

Guideline Value:

Name of Valuer:

Total

Our Share

Collateral coverage

(In %)

(Whether insurance is adequate should be comment upon. Comments on latest & previous valuation,

wherever available should be mentioned)

Comments on Due diligence of property: (Primary/Collateral)

Comments on Title Search Report (Date of report/including specific comments on enforceability of

mortgage):

10.3

Personal guarantee / corporate guarantee:

Name of the

PAN

Latest Means

Guarantor

(Credit Report date _____)

1

Abhishek Kumar

2

Sanjeet Prakash

Total

(Reason for variation in means to be commented upon)

11

Financial indicators of borrower

S.

No

.

Year ended /

ending

a.

Paid-Up Capital

b.

Reserves &

Surplus

c.

Intangible assets

: -

(Rs. In ____)

Means as per last sanction

(Credit report date ____)

New Account hence not Applicable (Rs. in ____)

Mar.2022 Mar.2023

Mar.2016

Mar.2017

Mar.2018

Mar.2019

Mar.2020

Mar.2021

(Est.)

16.00

(Proj.)

18.76

(Proj.)

31.02

(Proj.)

36.19

(Proj.)

44.88

(Proj.)

57.15

(Proj.)

73.09

(Proj.)

92.86

3.76

14.27

7.37

11.11

14.93

18.87

22.99

26.78

Page 4 of 11

Name of the concern

Name of the Branch/RO

d.

Tangible Net

Worth (a+b-c)

19.76

33.02

38.39

47.30

59.81

76.02

96.08

119.64

e.

Long Term

Liabilities

42.34

35.28

28.22

21.16

14.10

7.04

5.51

6.51

e(i)

(w/w unsecured

loan i.e. Quasi

Equity)

15.97

22.97

18.00

11.16

0.67

0.00

0.00

0.00

f.

Capital

Employed (d+e)

35.73

55.99

56.39

58.46

60.48

76.02

96.08

119.64

g.

Net Block

0.00

56.95

48.41

41.15

34.97

29.73

25.27

21.48

h.

Investments

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

i.

Non Current

Assets

67.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

j.

Net Working

Capital (f-g-h-i)

or (k-l)

9.79

32.32

34.00

36.05

36.94

50.41

73.10

101.12

k.

Current Assets

64.90

91.38

96.90

103.34

108.76

126.91

155.45

185.36

l.

Current

Liabilities

55.11

59.06

62.90

67.29

71.82

76.50

82.35

84.23

m.

Current Ratio

(k/l)

1.18

1.55

1.54

1.54

1.51

1.66

1.89

2.20

n.

DER (TL/TNW)

(e/d)

2.14

1.07

0.74

0.45

0.24

0.09

0.06

0.05

o.

TOL/TNW Ratio

((e+l)/d)

2.81

1.75

1.68

1.58

1.49

1.14

0.95

0.78

p.

TOL/TNW along

with Contingent

Liabilities

2.81

1.75

1.68

1.58

1.49

1.14

0.95

0.78

q.

Net Sales

106.00

200.00

220.00

242.00

266.20

292.82

322.10

354.31

r.

Cost of Sales

100.70

171.75

194.69

212.15

231.68

253.45

277.64

305.11

s.

Operating

Profit/EBDITA

5.30

36.30

30.86

33.81

37.06

40.62

44.53

48.83

t.

Other Income

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

u.

Interest/Finance

Charges

1.54

11.98

13.11

12.66

12.22

11.78

11.34

10.90

v.

Depreciation

0.00

10.05

8.54

7.26

6.17

5.25

4.46

4.46

w.

Tax

0.00

0.00

1.84

2.78

3.73

4.72

5.75

6.69

Page 5 of 11

Name of the concern

Name of the Branch/RO

x.

Net Profit after

Tax (s+t-u-v-w)

3.76

14.27

7.37

11.11

14.93

18.87

22.99

26.78

y.

Cash Accruals

(v+x)

3.76

24.32

15.91

18.37

21.10

24.12

27.45

31.24

* As per previous sanction, wherever applicable.

11.1

11.2

11.3

12

Comments on Financial Indicators

Audit Notes in Balance Sheet if any, to be

specified

Comments on Restructuring, if any

:

: NA AS NEW CONCERN

Evaluation of the following:

Management Risk

: NA

Proprietor is associated in this business

since last 15 years, hence, he understand

all the business i.e sourcing of raw

materials and marketing of the products.

Industry Risk

PVC pipes are used for a variety of purposes

e.g. water supply schemes, spray irrigation,

deep tube well schemes and land drainage

schemes. PVC slotted and corrugated pipes

are ideal systems for drainages of water from

land where water logging is inevitable. It is

widely used by various utility services now-adays too. The major consumer of PVC pipes

are the Public Health Engineering Department

(PHED) and Irrigation Departments. Besides

these two, it is used by the Municipal

Corporations, Tea estates as well as in N.E.

Region. The usage of PVC pipes also

depends upon the size of these pipes too. It is

manufactured in different sizes having

innumerable usage value.

The World Bank has recently given top priority

in rural water supply in developing and

underdeveloped countries. India has also

received large amounts from World Bank aid

for Rural Water Supply Schemes. However,

due to the acute shortage of appliances

including pipes this money could not be

utilized to a large extent in our country. Thus

PVC/HDPE pipe manufacturing industry has

received higher priority. The requirement of

PVC pipes in Bihar and Jharkhand Region is

around 10,000 MT out of which the

requirement in Bihar is more than 50%.

Business risk

Bihar and Jharkhand has huge potential for

the market for PVC pipes and demand has

accelerated in the recent years due to

govt. Spending on the drinking water

project. In Bihar , Govt of Bihar has

initiated the drinking water project in

mission mode hence demand for the

products likely to be very good. However,

Concern has to develop the nearby market

of Nepal and Bangladesh in for long run.

Page 6 of 11

Name of the concern

Name of the Branch/RO

13.

13.1

13.2

Conduct of the account

Regularity in submission of

Stock/Book Debt Statement

QPR/Half Yearly Statement

Financial Statements

CMA Data

Name of the Statement / Return

13.3

Stock Statement / BD

QPR/Half Yearly Statement

Comments on operations / overdues

(New Account hence not applicable)

13.4

13.5

13.6

Comments on statutory dues

Comments on invocation of BG/Devolvement

of LC, wherever applicable

Any irregular feature observed in the

monitoring report, wherever applicable

: New Account hence not applicable

(If applicable Yes/No)

: Not applicable

Not Applicable

: New Account hence not applicable

: New account hence not applicable

:

No. of Statements /

Last Stat. /

Return recd. During

Return recd.

the year

: (Not applicable)

: Not applicable

(Date)

:

Particulars

Previous Current

Year

Year

Credit Turnover

Sales

% of credit

turnover to sales

Maximum Debit

Balance

Average Debit

Balance

No. of days in

debit

Inward cheque

return (No.)

Outward Cheque

return (No.)

No. of occasions

excesses/ TOD

allowed

Maximum

Excesses/ TOD

allowed

Remarks:

: Not Applicable as new concern

: Not applicable as no credit history

: (Including Date of MMR)

13.7

Value of account (During Financial Year):

i) Advances:

Previous year/Date:

- Interest Income

- Fee Based Income

ii) Third party products:

iii)

Retail / Consumer / Finance[to

No. of Accounts

employees associates]

iv) Deposits:

- Own

- Third Party

Amount

14.

14.1

Compliance to terms of sanction

Completion of Mortgage formalities & vetting

of mortgage by advocate along with date

14.2

Registration of Charges with RoC

Page 7 of 11

(Rs. in _____)

Current year/Date:

Amount

Tenure

:

: (Yes/No

Date of completion of mortgage:

Date of legal vetting of mortgage: )

: (Yes/No

Search ID

Name of the concern

Name of the Branch/RO

Date:______)

14.3

14.4

14.5

14.6

14.7

14.8.1

14.8.2

14.9

14.10

(In case

Whether documents valid and in force

Compliances to CPAO observations along with

date of CPA

Whether all other terms and conditions

complied along with observations/remarks of

sanctioning authority, if any, as per previous

sanction / modification proposals

Whether Consortium meetings held at

prescribed periodic intervals

Compliance of consortium/multiple banking

guidelines of the bank

Compliance on Loan Policy

Compliance of RBI guidelines

Date of last inspection of factory / stock /

assets, etc

Date of Technical Inspection, wherever

applicable

of non-compliance, suitable justification shall be

15.

Audit

observations

(Pending for compliance)

15.1RBI Inspection

15.2 RBIA (Internal Audit)

15.3Concurrent

15.4Statutory

15.5 Stock Audit

Date

: (Yes/No

Date of documents:

Date of DBC:

Date

of

legal

documents:______)

: (Yes/No

Date:______)

(Yes/No)

Vetting

of

: (Yes/No)

Date of last Consortium meeting

Gist of minutes:

: (Yes/No)

: (Yes/No)

(Yes/No)

: (Date:

Comments :)

: (Date:

Gist of inspection :)

provided)

Observations

Branch Replies

including COR

Present status

Exposure details from our bank including investment, if any.:

OUR BANK

Limits

Limits

O/s as on

Value of Prime

Nature of Facility

Existing

Recomm

Securities [Our

ended

share]

(Rs. in _____)

16.1

Irregularities,

if any

TOTAL

Investment

(Date of Stock-Book debt statement should be mentioned in prime securities)

16.2 Exposure details from banking system/FIs (Incl. Our Bank):

Existing Limits : New Concern hence not applicable

Fund Based WC

Non Fund Based

Term Loan

Sl.

No.

Name of

the Bank

% Share

Amt.

% Share

TOTAL

Proposed Limits

Page 8 of 11

Amt.

%

Share

Amt.

(Rs. In _____)

Comments on

Conduct of the

Account and

position of last

sanction / review

Name of the concern

Name of the Branch/RO

Sl.

No.

1

Name of

the Bank

Union Bank

of

India,

Main Branch

TOTAL

16.3

Fund Based WC

% Share

Amt.

100

46.05

Non Fund Based

% Share

Amt.

0%

0.00

Term Loan

% Share

Amt.

100.00%

49.87

46.05

49.87

17.

Other liabilities of directors / partners [In

their individual capacity]

Comments on assessment of limits

17.1

Projected Level of Sales

17.2

Inventory / Receivable holding period

: Nil

: Proposed limit will be on sole banking

basis

: Considering the experience of the

proprietor in this field and sales achieved

in one month, it is likely that projected

sales will be achieved.

: (Applicable for assessment under FBF

method)

[Rs. in _____]

Mar.____

Mar.___

Mar.____

Mar._____

(Aud.)

(Aud.)

(Aud. / Est.)

(Proj.)

Particulars

Finished Goods

(Months Cost of Sales)

Domestic Receivables

(Months domestic Sales)

Sundry Creditors

(Months Purchases)

44

3.67

15

1.70

2

0.17

17.3

: (FBF/Cash Budget/turnover method)

Working Capital Assessment

54

3.59

32

1.94

5

0.37

57

3.47

35

1.89

5

0.33

COMPUTATION OF MAXIMUM PERMISSIBLE BANK FINANCE FOR W/C

Sl

No.

Particulars

Prov

Estimated

Proj

2016

2017

2018

65

91

97

11

58

83

86

16

23

24

( 45 in Form III )

34

36

37

Item 3 minus item 4

42

60

62

Item 3 minus item 5

24

47

49

Total Current Assets ( 9 in form IV)

Other Current Liabilities (other than

Bank borrowing & AMTL - 14 of Form IV)

3

4

Working Capital Gap (WCG) (1-2)

Min. stipulated net Working Capital ie., 25% of

WCG/25% of total Current Assets as the case

may be depending upon the method of lending

being applied

Actual /projected net working capital

Page 9 of 11

60

3.35

38

1.87

6

0.36

Name of the concern

Name of the Branch/RO

8

17.4

Maximum Bank Finance ( Item 6 or 7

Term Loan

47

49

Particulars

Machinery

Miscellaneous fixed assets

Preliminary and other pre op. expenses

Total

75% of Total is to be financed

Balance will be own contribution

Amount(In Lakhs)

61.00

3.30

2.20

66.50

49.87

17.5 Non-Fund Based Limits

: Not required

17.5.1Nature: (Performance/Financial BG ) (Inland/Import LC)(Domestic/Foreign BG)

17.5.2Amount:

17.5.3Period/Usance: (Period of BG/Usance of LC)

17.5.4Commission:

17.5.5Margin: (By way of Cash/FDR)

17.5.6Assessment: (Including Name of major suppliers/LG beneficiaries/LC beneficiaries

(Buyers))

17.6

Any other matter including Forex

related

concessions

along

with

justification for concession, if any

: Not Applicable

18

INTERNAL CREDIT RATING

:

Marks Obtained

Previous Year

Current Year

ABS as of

ABS as of

Parameters

Borrower Rating

Facility Rating

Risk Mitigators

Business aspects

Total Marks with Grade

Rating Rationale:

(In case of down-gradation of credit rating, justification for the same shall be provided. Comments on

external rating, wherever applicable)

19.

Recommendations

:

We recommend for review/renewal/enhancement/fresh credit facilities as mentioned below on stated

terms and conditions:

(Rs. In _____)

Amount

Int./

Nature of Limit

Margin

Primary Security

Comm.

Existing

Proposed

CC

0.00

46.05

25%

Raw materlals, Finished

Goods

and

Sundary

Debtors

Term Loan

0.00

49.87

25%

Plant and Machinary

TOTAL

95.92

(Present Base Rate @ ________ w.e.f. ______ vide IC No._______ dt._________)

19.1 Collateral Security: 2.58 Kattha of land (3512 Sqft) in the name of Sanjeet Prakash at

Sorampur,PS-Janipur,Patna.

19.2 Personal/Corporate Guarantee: 1. Avinash Kumar

2.Sanjeet Prakash

19.3 Processing charges/Upfront Fees:

19.4 Upfront Contribution (In case of Term Loan)

19.5 Repayment Schedule (In case of Term Loan)

19.6 Other Matters:

Page 10 of 11

Name of the concern

Name of the Branch/RO

20. Terms and conditions:

Annexure-I: Standard terms and conditions

Annexure-II: Undertakings to be obtained from the borrower

Annexure-III: Standard terms for advance under Consortium/Multiple Banking Arrangement

Annexure-IV: Sector Specific additional terms and conditions

Annexure-V: MIS template (As per Instruction Circular 9989 dt.01.07.2014)

Annexure-VI: Flow Chart (As per Instruction Circular 34-2015 dt.01.04.2015)

(In annexure-I/II/III/IV, standard conditions to be appropriately selected during the sanction process

based on nature of advance & constitution of the borrower as per Instruction Circular 9287

dt.16.05.2012. Further, standard terms and conditions should not be repeated in Point No.20 of the

Executive Summary and only reference of the annexure to be made therein.)

Page 11 of 11

You might also like

- Andhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsDocument9 pagesAndhra Bank: Appraisal Format For Advances With Limits Over Rs.10 Lakhs & Below Rs. 50 LakhsSivaramakrishna NeelamNo ratings yet

- Executive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500LacsDocument9 pagesExecutive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500LacsTripurari KumarNo ratings yet

- ES-1 500lacs and AboveDocument15 pagesES-1 500lacs and AboveTripurari KumarNo ratings yet

- Chetna AdhiyaDocument5 pagesChetna AdhiyaVikash MauryaNo ratings yet

- Finova - PD Format Oct 2019Document8 pagesFinova - PD Format Oct 2019Madhusudan ParwalNo ratings yet

- Projections - Civil Contractor Material SupplierDocument16 pagesProjections - Civil Contractor Material SupplierRahul LipareNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationRajkumar NateshanNo ratings yet

- HDFC ReportDocument10 pagesHDFC Reportvishal kharvaNo ratings yet

- Appraisal Note For Fresh/renewal /enhancement of MSME Loans of Less Than Rs. 100 Lakhs (Total Limit) - Other Than MUDRA LoansDocument18 pagesAppraisal Note For Fresh/renewal /enhancement of MSME Loans of Less Than Rs. 100 Lakhs (Total Limit) - Other Than MUDRA LoanskiransaradhiNo ratings yet

- Detailed Project Report Proposal For Term Loan of Rs Lakh and Working Capital Limit of Rs .Lakh For Setting Up A New Project For Manufacture of .. I. Introductory, Promoters and ManagementDocument25 pagesDetailed Project Report Proposal For Term Loan of Rs Lakh and Working Capital Limit of Rs .Lakh For Setting Up A New Project For Manufacture of .. I. Introductory, Promoters and ManagementKrishna PrasadNo ratings yet

- The Branch Manager, Bank of Baroda,: Loan Application Form For Baroda AshrayDocument6 pagesThe Branch Manager, Bank of Baroda,: Loan Application Form For Baroda AshrayNitin BhatnagarNo ratings yet

- PKCCDocument6 pagesPKCCKarmbir KumarNo ratings yet

- Form GSTR 2aDocument2 pagesForm GSTR 2aparam.ginniNo ratings yet

- GSTR1 Excel Workbook Template-V1.2Document40 pagesGSTR1 Excel Workbook Template-V1.2vkpamulapatiNo ratings yet

- Company: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 ProjectedDocument68 pagesCompany: IDFC Project Cost Years 2003 2004 2005 2006 2007 2008 2009 2010 Projectedsumit_sagarNo ratings yet

- Profit and Loss AccountDocument9 pagesProfit and Loss AccountAvi HaiNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Yogesh SharmaNo ratings yet

- Commercial Credit Information Report (CCR) - GuideDocument22 pagesCommercial Credit Information Report (CCR) - Guidecyber ageNo ratings yet

- Capsa UnitedDocument12 pagesCapsa Unitedvenkat rajNo ratings yet

- SME Application FormDocument12 pagesSME Application FormSomnath DasGuptaNo ratings yet

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BDocument7 pagesForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1, 3.2, 4 and 5.1 of FORM GSTR-3BAtul VermaNo ratings yet

- Financial Statements of A Sole Proprietorship FirmDocument3 pagesFinancial Statements of A Sole Proprietorship FirmsureshNo ratings yet

- GSTR2B 20CHSPM6149M1ZS 032023 10062023Document7 pagesGSTR2B 20CHSPM6149M1ZS 032023 10062023laxmi handloommdpNo ratings yet

- GSTR 1Document70 pagesGSTR 1vassudevanrNo ratings yet

- Credit Appraisal Process GRP 10Document18 pagesCredit Appraisal Process GRP 10Priya JagtapNo ratings yet

- Chandra Babu Sajja: Page 1 of 3Document3 pagesChandra Babu Sajja: Page 1 of 3Chandra Babu SajjaNo ratings yet

- Form Gstr-2B: 3. ITC Available SummaryDocument8 pagesForm Gstr-2B: 3. ITC Available SummaryNaga DineshNo ratings yet

- GSTR 1Document69 pagesGSTR 1admin bhagirathiNo ratings yet

- Sample Format Form GSTR 2aDocument2 pagesSample Format Form GSTR 2aDeepanshu JaiswalNo ratings yet

- Ram Kripal Nishad - PRAT230728CR689051147Document2 pagesRam Kripal Nishad - PRAT230728CR689051147AmanNo ratings yet

- GSTR3B 07arbpb8459q1z8 112021Document2 pagesGSTR3B 07arbpb8459q1z8 112021Ajit GuptaNo ratings yet

- Consumer Information:: Cibil Transunion ScoreDocument4 pagesConsumer Information:: Cibil Transunion ScoreJyothiKumariNo ratings yet

- GSTR1 33cfhpd2441a1zb 122022Document4 pagesGSTR1 33cfhpd2441a1zb 122022Prabhu SNo ratings yet

- AXIS PD Report FormatDocument7 pagesAXIS PD Report Formatvishal kharva100% (1)

- GSTR1 08CMBPK3397K2ZL 022023Document4 pagesGSTR1 08CMBPK3397K2ZL 022023shiva khandelwalNo ratings yet

- GSTR3B 09aiups9737q1zn 022021Document2 pagesGSTR3B 09aiups9737q1zn 022021AartiNo ratings yet

- Sample Green ReportDocument12 pagesSample Green ReportSyed Abid HussainiNo ratings yet

- Vijay Kumar CrifDocument3 pagesVijay Kumar CrifSajan BokoliaNo ratings yet

- Change of Address FormDocument1 pageChange of Address FormgenesissinghNo ratings yet

- Consumer Base Report GANGANDHARANDocument4 pagesConsumer Base Report GANGANDHARANgangarajathiNo ratings yet

- TXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceDocument22 pagesTXN Date Value Date Description Ref No./Cheque No. Branch Code Debit Credit BalanceMukul DubeyNo ratings yet

- GSTR1 07afmpv0281r1zk 012022Document5 pagesGSTR1 07afmpv0281r1zk 012022company workNo ratings yet

- GSTR3B 06DKXPK3659H1ZH 032021Document2 pagesGSTR3B 06DKXPK3659H1ZH 032021Sahal RizviNo ratings yet

- Allahabad Bank: Appraisal FormatDocument5 pagesAllahabad Bank: Appraisal FormatDEVENDRA BHARDWAJNo ratings yet

- OpMiniStatementUX315 06 2021 PDFDocument1 pageOpMiniStatementUX315 06 2021 PDFsaritaNo ratings yet

- GSTR3B Matha MobilesDocument2 pagesGSTR3B Matha MobilesBRIGHT TAX CENTERNo ratings yet

- GSTR3B 36ablfm5302k1z4 022021Document2 pagesGSTR3B 36ablfm5302k1z4 022021venkyNo ratings yet

- Crif VishalDocument6 pagesCrif VishalKUSHAGRANo ratings yet

- Letter of Credit Appraisal NoteDocument8 pagesLetter of Credit Appraisal NoteNimitt ChoudharyNo ratings yet

- GSTR3B 07arbpb8459q1z8 122021Document2 pagesGSTR3B 07arbpb8459q1z8 122021Ajit GuptaNo ratings yet

- GSTR3B 33mgkps5309e1z4 012022Document3 pagesGSTR3B 33mgkps5309e1z4 012022Suresh KumarNo ratings yet

- GSTR3B 19anapb5865f2z2 062021Document2 pagesGSTR3B 19anapb5865f2z2 062021Bikram PaulNo ratings yet

- FIN AL: Form GSTR-1Document5 pagesFIN AL: Form GSTR-1Aditya TiwaryNo ratings yet

- Annexure - Common Loan Application Form With Formats I, II and III-EnglishDocument12 pagesAnnexure - Common Loan Application Form With Formats I, II and III-EnglishThe LoanWalaNo ratings yet

- Anup Umbarkar 2019Document7 pagesAnup Umbarkar 2019Ramu TangiralaNo ratings yet

- Credit Appraisal of Term Loans and Working Capital LimitsDocument66 pagesCredit Appraisal of Term Loans and Working Capital LimitsmaddyvickyNo ratings yet

- Sample Valuation ReportDocument17 pagesSample Valuation ReportabhidadNo ratings yet

- GSTR3B 24agppp8172k1zp 032021Document2 pagesGSTR3B 24agppp8172k1zp 032021Nanu PatelNo ratings yet

- Executive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500LacsDocument8 pagesExecutive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500LacsTripurari KumarNo ratings yet

- Annexure-A Common Loan ApplDocument7 pagesAnnexure-A Common Loan Applrkp_imsNo ratings yet

- Presentation Camille AlbaneDocument42 pagesPresentation Camille AlbaneTripurari KumarNo ratings yet

- DRUMS Project ReportDocument20 pagesDRUMS Project ReportTripurari Kumar100% (2)

- Presentation Camille Albane PDFDocument42 pagesPresentation Camille Albane PDFTripurari KumarNo ratings yet

- Egg Farming 20000Document14 pagesEgg Farming 20000Tripurari KumarNo ratings yet

- Egg Farming 20000Document14 pagesEgg Farming 20000Tripurari KumarNo ratings yet

- Executive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500LacsDocument8 pagesExecutive Summary Format For Credit Proposal of Above Rs.10Lacs and Less Than Rs.500LacsTripurari KumarNo ratings yet

- Partnership DeedDocument5 pagesPartnership DeedTripurari Kumar75% (4)

- Cost of Project: Smrity Paper Mills Private LimitedDocument17 pagesCost of Project: Smrity Paper Mills Private LimitedTripurari KumarNo ratings yet

- Hospital in PatnaDocument9 pagesHospital in PatnaTripurari KumarNo ratings yet

- Trouble Shooting FilingDocument6 pagesTrouble Shooting FilingTripurari KumarNo ratings yet

- Asm Charitable Super Specialty Hospital and Medical CollegeDocument20 pagesAsm Charitable Super Specialty Hospital and Medical CollegeTripurari KumarNo ratings yet

- Permanual Ferro ScrapDocument421 pagesPermanual Ferro ScrapTripurari KumarNo ratings yet

- Bihar Medical Services & Infrastructure Corporation LTD.: Performance Appraisal FormDocument10 pagesBihar Medical Services & Infrastructure Corporation LTD.: Performance Appraisal FormTripurari KumarNo ratings yet

- CamHi 4G IP Camera Quick Start GuideDocument11 pagesCamHi 4G IP Camera Quick Start GuiderbokisNo ratings yet

- GPC1-10000-AF™ Gas Pressure Controller: Operation and Maintenance ManualDocument40 pagesGPC1-10000-AF™ Gas Pressure Controller: Operation and Maintenance ManualjlbayonaNo ratings yet

- Hollywood MogulDocument2 pagesHollywood MogulMichelleNo ratings yet

- Sign Language To Text ConverterDocument2 pagesSign Language To Text ConverterAditya RajNo ratings yet

- Assignment 1 - Build A Marketing Funnel For A BrandDocument6 pagesAssignment 1 - Build A Marketing Funnel For A BrandnawalNo ratings yet

- Trees in Data StructuresDocument122 pagesTrees in Data StructuresKarthik PNo ratings yet

- Work Experienxe Sheet CSCDocument1 pageWork Experienxe Sheet CSCLester100% (1)

- Mis in WalmartDocument36 pagesMis in WalmartNupur Vashishta93% (14)

- Companion: Material Safety Data Sheet ® Liquid Biological FungicideDocument2 pagesCompanion: Material Safety Data Sheet ® Liquid Biological FungicideNatalie TorresNo ratings yet

- Personal Business Loan Agreement PDFDocument16 pagesPersonal Business Loan Agreement PDFVijay V RaoNo ratings yet

- Pile Caps Guidance PDFDocument7 pagesPile Caps Guidance PDFDeepak Jain100% (1)

- Room Rental AgreementDocument3 pagesRoom Rental AgreementgrandoverallNo ratings yet

- LinacDocument16 pagesLinacLomombNo ratings yet

- G1312-90010 BinaryPumpSL User EbookDocument168 pagesG1312-90010 BinaryPumpSL User EbookJeff Ong Soon HuatNo ratings yet

- Strategic HumanresourcepdfDocument14 pagesStrategic HumanresourcepdfDanishNo ratings yet

- Audit Project - Statutory AuditDocument2 pagesAudit Project - Statutory AuditWessa7No ratings yet

- Math3 - q2 - Mod3 - Multiplying 2-3 Numbers by 1-2 Numbers With and Without Regrouping - v1Document17 pagesMath3 - q2 - Mod3 - Multiplying 2-3 Numbers by 1-2 Numbers With and Without Regrouping - v1Serena AlmondNo ratings yet

- Tax Invoice: Page 1 of 2Document2 pagesTax Invoice: Page 1 of 2HamzaNo ratings yet

- Corporate Information Security HandbookDocument101 pagesCorporate Information Security HandbookSeenivasagam SeenuNo ratings yet

- JCB Loadall 532: High Performance by DesignDocument4 pagesJCB Loadall 532: High Performance by Designkarijoseph02No ratings yet

- Environmental Clearance For Construction Projects - OptimaDocument11 pagesEnvironmental Clearance For Construction Projects - OptimaSiddharth ChoksiNo ratings yet

- Navigating The Landscape of Higher Engineering EducationDocument120 pagesNavigating The Landscape of Higher Engineering EducationWatchara KhoviNo ratings yet

- 2 CAD Programme and Challenges - PPT NITI Aayog 13.03.2018Document16 pages2 CAD Programme and Challenges - PPT NITI Aayog 13.03.2018AnandNo ratings yet

- He A IgnitorDocument36 pagesHe A IgnitorE.C.MADHUDUDHANA REDDYNo ratings yet

- Olano Alarcon Razuri 2009 Understanding The Relationship Between Planning Reliability and Schedule Performance PresentationDocument17 pagesOlano Alarcon Razuri 2009 Understanding The Relationship Between Planning Reliability and Schedule Performance PresentationRich GamarraNo ratings yet

- Integrative ReviewDocument16 pagesIntegrative Reviewapi-353789245No ratings yet

- Usability in Context: Improving Quality of Use: Miles MacleodDocument7 pagesUsability in Context: Improving Quality of Use: Miles MacleodWarren De Lumen CabunyagNo ratings yet

- My Peace Plan FormDocument2 pagesMy Peace Plan FormStephen PhiriNo ratings yet

- Assignment On Safety and MobilityDocument8 pagesAssignment On Safety and Mobilitysushant.sapkota1710No ratings yet

- Dwnload Full Abnormal Child Psychology 7th Edition Mash Test Bank PDFDocument35 pagesDwnload Full Abnormal Child Psychology 7th Edition Mash Test Bank PDFthrenodyvoxlkio100% (16)