Professional Documents

Culture Documents

Collector v. de Lara

Uploaded by

jehua100%(1)100% found this document useful (1 vote)

785 views3 pagescollector vs. lara

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcollector vs. lara

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

785 views3 pagesCollector v. de Lara

Uploaded by

jehuacollector vs. lara

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

COLLECTOR V.

DE LARA (multiplicity of situs)

FACTS:

Appeal: CTA decision where assessment for estate and

inheritance tax on Hugo H. Miller is modified and Collector is to

pay 2047.22 pesos for estate taxes due. Failure to pay within 30

days will result in 5% surcharge and interest.

Hugo H. Miller from Santa Cruz, California

came to the PH where he was connected to the public

school system as a teacher, later a superintendent.

retiring under Osmeiia Retirement Act, he got a position in

Ginn & Co. book publishers in NY until the start of the

Pacific War.

1922-Dec. 7, 1941: stationed at PH but also covered

JP and CN. sold books for Philippine schools.

stayed at the Manila Hotel (1922) and never in any

residential house in the PH , even when his wife came to

visit. Upon her death (1931), he transferred to Army and

Navy Club until the outbreak of Pacific War.

Jan. 14, 1941: execution of last will and testament in SC,

California.

Dec. 7, 1941: Ginn & Co. closed and he joined Board of

Censors of the US Navy which eventually lead to his

capture by the Japanese forces during the war and

reportedly executed (Mar. 11, 1944)

Ancillary proceedings were filed by executors (BOA, Natl Trust &

Savings Assoc. SFC), as well as estate and inheritance tax return

with Collector, covering only shares of stocks issued by PH

Corps; P269.43 for taxes and P230.27 for inheritance taxes

Collector assessed (made known to executor April 3, 1950),

and De Lara (estate Ancillary Administrator) protested at

the total of 77300.92 pesos (Jan. 16, 1954)

In determining the gross estate of a decedent, under Section

122 in relation to section 88 of our Tax Code, it is first necessary

to decide whether the decedent was a resident or a non-resident

of the Philippines at the time of his death.

CTA: Miller was considered a resident of the PH at the time of his

death due to length of stay, thus imposing taxes on intangible

properties in the US.

residence and domicile used interchangeably by Court, not

affected by actual residence.

despite being a non-resident of the PH, only taxable

properties are PH shares of stocks under the doctrine of

mobilia secuuntur persona.

but his activities are with respect to the intangibles,

lead him to avail of PH laws and benefits; thus

leading taxation to not be limited to California, but

also to the PH. Actual situs of the shares of stock,

corporation itself are in the PH, and rights to

dividends, dispose shares (transmission and

acquisition) enjoy PH protection. PH may, with due

process, impose a tax upon transfer by death of

shares of stock in a domestic corporation owned by a

decedent whose domicile was outside of the state.

DE LARA:

Section 122 of Tax Code: No tax shall be collected in

respect of intangible personal property

(a) if the decedent at the time of his death was a

resident of a foreign country which at the time of his

death did not impose a transfer tax or death tax of

any character in respect of intangible personal

property of citizens of the Philippines not residing in

that country

exemption of non-californians based from

california inheritance tax with respect to

tangibles.

*an exemption was granted to the estate by

virtue of Section 122 of the Tax Code, also to

prevent multiple taxation which otherwise

would subject a decedents intangible personal

property to the inheritance tax, both in his

place of residence and domicile and the place

where those properties are found

(b) if the laws of the foreign country of which the

decedent was resident at the time of his death allow

a similar exemption from transfer taxes or death

taxes of every character in respect of intangible

personal property owned by citizen, of the Philippine

not residing in that foreign country.

exemption by reduction of 4000 pesos from

estates of non residents

*P4,000 based on the reduction under the

Federal Tax Law in the amount of $2,000 is in

the nature of deduction and not of an

exemption

ordered to pay 2047.22 as he used provisions in RA.

1253 which was for those affected by the Japanese

occupation, but was not in time and could not be

invoked.

ISSUE:

W/N the estate is liable to file an estate and inheritance tax

return besides those covering shares of stock issued by

Philippine corporations.

HELD: No

The Court agrees with the CTA that residence was synonymous

with domicile, used interchangeabiy. The incidence of estate and

succession has historically been determined by domicile

and situs and not by the fact of actual residence. At the time of

his death, Miller had his residence or domicile in Santa Cruz,

California. During his stay in the PH, Miller never acquired a

residence and the bulk of his savings and properties were in

theUnited States.

Affirmed, with modification.

You might also like

- Collector v. LaraDocument2 pagesCollector v. LaraJaypoll DiazNo ratings yet

- CD - 81. Allied Banking v. Quezon CityDocument2 pagesCD - 81. Allied Banking v. Quezon CityCzarina CidNo ratings yet

- CIR Vs PhilamlifeDocument2 pagesCIR Vs PhilamlifeBreAmberNo ratings yet

- Estate of Vda de Gabriel vs. CIRDocument1 pageEstate of Vda de Gabriel vs. CIRMichelleNo ratings yet

- 05 - Dison vs. PosadasDocument2 pages05 - Dison vs. Posadascool_peach100% (1)

- CIR-vs-Isabela-Cultural-CorpDocument1 pageCIR-vs-Isabela-Cultural-CorpLizzy WayNo ratings yet

- Dizon Vs Posadas JRDocument1 pageDizon Vs Posadas JRArahbells100% (1)

- CIR VS. Sekisui Jushi Philippines, Inc.Document1 pageCIR VS. Sekisui Jushi Philippines, Inc.Abdulateef SahibuddinNo ratings yet

- Cir V Itogon-Suyoc MinESDocument2 pagesCir V Itogon-Suyoc MinESkeloNo ratings yet

- Gonzales V CTADocument2 pagesGonzales V CTAAnonymous 5MiN6I78I0No ratings yet

- Cir Vs Bank of Commerce DigestDocument1 pageCir Vs Bank of Commerce DigestMimmi ShaneNo ratings yet

- Ungab Doctrine and Fortune Tobacco Doctrine TAXDocument2 pagesUngab Doctrine and Fortune Tobacco Doctrine TAXGeorge PandaNo ratings yet

- COMMISSIONER OF INTERNAL REVENUE V Cebu Toyo CorpDocument5 pagesCOMMISSIONER OF INTERNAL REVENUE V Cebu Toyo CorpAustin Viel Lagman MedinaNo ratings yet

- CORAL BAY NICKEL CORPORATION v. COMMISSIONER OF INTERNAL REVENUEDocument2 pagesCORAL BAY NICKEL CORPORATION v. COMMISSIONER OF INTERNAL REVENUELee OhNo ratings yet

- CIR v. Citytrust Investment Phils (2006)Document3 pagesCIR v. Citytrust Investment Phils (2006)Aila Amp100% (1)

- Kepco vs. CIR Case DigestDocument2 pagesKepco vs. CIR Case DigestJeremiah Trinidad100% (2)

- 13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestDocument1 page13.d CIR vs. CA and BPI (G.R. No. 117254 January 21, 1999) - H DigestHarleneNo ratings yet

- Sec of Finance v. LazatinDocument10 pagesSec of Finance v. Lazatinana abayaNo ratings yet

- CIR v. Javier Jr. GR No. 78953 31 July 1991 199 SCRA 825Document2 pagesCIR v. Javier Jr. GR No. 78953 31 July 1991 199 SCRA 825bestie bushNo ratings yet

- Commissioner of Internal Revenue vs. Hambrecht & Quist Philippines, IncDocument1 pageCommissioner of Internal Revenue vs. Hambrecht & Quist Philippines, IncMary AnneNo ratings yet

- DIGITEL v. Pangasinan DigestDocument4 pagesDIGITEL v. Pangasinan DigestAnit EmersonNo ratings yet

- CIR Vs Filinvest DigestDocument3 pagesCIR Vs Filinvest DigestSharon BakerNo ratings yet

- Digest - CIR v. PHIL. HEALTH CAREDocument2 pagesDigest - CIR v. PHIL. HEALTH CAREMyrahNo ratings yet

- Matalin V Mun. Council of MalabangDocument2 pagesMatalin V Mun. Council of MalabangMath DownloaderNo ratings yet

- Digest Coca Cola Bottlers Vs City of ManilaDocument2 pagesDigest Coca Cola Bottlers Vs City of ManilaRyan Acosta100% (3)

- (Digest) Taganito v. CIRDocument1 page(Digest) Taganito v. CIRHomer SimpsonNo ratings yet

- Bpi Vs ManikanDocument2 pagesBpi Vs ManikanJoshuaLavegaAbrinaNo ratings yet

- Abakada Guro Vs ErmitaDocument1 pageAbakada Guro Vs Ermitaapril75No ratings yet

- Lung Center V QC RosasDocument2 pagesLung Center V QC RosasLloyd David P. VicedoNo ratings yet

- CIR V BurmeisterDocument3 pagesCIR V BurmeisterGenevieve Kristine Manalac100% (1)

- Republic V CA and NielsonDocument1 pageRepublic V CA and Nielsondorian100% (1)

- Mobil Philippines v. City Treasurer of Makati 1.business Tax v. Income TaxDocument4 pagesMobil Philippines v. City Treasurer of Makati 1.business Tax v. Income TaxFloyd MagoNo ratings yet

- Digest Phil Guaranty vs. CirDocument1 pageDigest Phil Guaranty vs. CirAnn SCNo ratings yet

- Mactan Cebu International Airport Authority Vs MarcosDocument3 pagesMactan Cebu International Airport Authority Vs MarcosRaymond RoqueNo ratings yet

- Digested Cases in Taxation2Document5 pagesDigested Cases in Taxation2Dakila Maloy100% (1)

- Cir vs. Isabela Cultural Corporation (Icc) : 1 Taxation Case Digest by Rena Joy C. CastigadorDocument2 pagesCir vs. Isabela Cultural Corporation (Icc) : 1 Taxation Case Digest by Rena Joy C. CastigadorsakuraNo ratings yet

- De Borja V de BorjaDocument3 pagesDe Borja V de BorjaamberspanktowerNo ratings yet

- Bagatsing Vs San Juan (Simbillo)Document3 pagesBagatsing Vs San Juan (Simbillo)Joshua Rizlan SimbilloNo ratings yet

- Kepco Vs CIRDocument3 pagesKepco Vs CIRLizzette Dela PenaNo ratings yet

- Facts:: Philippine Petroleum Corporation Vs Municipality of Pililla, Rizal, GR 90776 (June 03, 1991)Document2 pagesFacts:: Philippine Petroleum Corporation Vs Municipality of Pililla, Rizal, GR 90776 (June 03, 1991)pnp bantayNo ratings yet

- G.R. No. L-19842 December 26, 1969 REPUBLIC OF THE PHILIPPINES, Plaintiff-Appellee, CENTRAL AZUCARERA DEL DANAO, Defendant-Appellant. FactsDocument8 pagesG.R. No. L-19842 December 26, 1969 REPUBLIC OF THE PHILIPPINES, Plaintiff-Appellee, CENTRAL AZUCARERA DEL DANAO, Defendant-Appellant. FactstwIzNo ratings yet

- Hernandez Vs AndalDocument4 pagesHernandez Vs AndalyemyemcNo ratings yet

- Taxation Digest 06.18.12editedDocument5 pagesTaxation Digest 06.18.12editedJason ChanNo ratings yet

- Calasanz Vs CommDocument4 pagesCalasanz Vs CommEANo ratings yet

- CIR V DE LARADocument3 pagesCIR V DE LARAiptrinidad100% (1)

- 13 Vegetable Oil Corp V TrinidadDocument2 pages13 Vegetable Oil Corp V TrinidadRocky GuzmanNo ratings yet

- C - Tang Ho Vs CA CirDocument1 pageC - Tang Ho Vs CA Circeilo coboNo ratings yet

- Gutierrez V Collector 101 Phil 743Document1 pageGutierrez V Collector 101 Phil 743Khian JamerNo ratings yet

- Cir V CA Gr117982Document9 pagesCir V CA Gr117982Christopher Joselle MolatoNo ratings yet

- James V USDocument4 pagesJames V USKTNo ratings yet

- Domingo v. GarlitosDocument1 pageDomingo v. GarlitosJazz TraceyNo ratings yet

- Commissioner of Internal Revenue Vs CoaDocument4 pagesCommissioner of Internal Revenue Vs CoaAb Castil100% (1)

- Collector V Goodrich DigestDocument2 pagesCollector V Goodrich DigestmbNo ratings yet

- Republic vs. Salud v. HizonDocument2 pagesRepublic vs. Salud v. HizonGyelamagne EstradaNo ratings yet

- Afisco Insurance Corp V CADocument2 pagesAfisco Insurance Corp V CADon TiansayNo ratings yet

- 25.d Vda. de San Agustin vs. CIR (G.R. No. 138485 September 10, 2001) - H DigestDocument1 page25.d Vda. de San Agustin vs. CIR (G.R. No. 138485 September 10, 2001) - H DigestHarleneNo ratings yet

- Chapter VII - Case NotesDocument23 pagesChapter VII - Case NotesApril Gem BalucanagNo ratings yet

- CIR Vs LedesmaDocument2 pagesCIR Vs LedesmaAnonymous wvx7n36No ratings yet

- Survival Nov 21Document9 pagesSurvival Nov 21JanJan ClarosNo ratings yet

- Wells Fargo Bank V CIR (Situs of Taxation)Document9 pagesWells Fargo Bank V CIR (Situs of Taxation)Vinabie PunoNo ratings yet

- Indemnity Bond 97048184186299Document1 pageIndemnity Bond 97048184186299Khaja NizamuddinNo ratings yet

- Manual of Land Revenue 20200717163931Document68 pagesManual of Land Revenue 20200717163931inexistent4840No ratings yet

- Complinant Smti Rinnu Choudhury Versus Accused Sri Ashok Kr. JakkalDocument14 pagesComplinant Smti Rinnu Choudhury Versus Accused Sri Ashok Kr. JakkalBhawan JindalNo ratings yet

- 06.01 - Matanguihan vs. Court of Appeals, 275 SCRA 380 (1997)Document10 pages06.01 - Matanguihan vs. Court of Appeals, 275 SCRA 380 (1997)JMarc0% (1)

- Courier Service AgreementDocument2 pagesCourier Service AgreementSabu Thomas100% (1)

- Ch5 - Standard Forms of Building ContractDocument5 pagesCh5 - Standard Forms of Building ContracthaNo ratings yet

- Extent or Scope of Actual DamagesDocument4 pagesExtent or Scope of Actual DamagesCamille BritanicoNo ratings yet

- Mint Delhi 13-12-2023Document21 pagesMint Delhi 13-12-2023deeksha vermaNo ratings yet

- Free Consent: Coercion, Undue Influence, Fraud, Misrepresentation and MistakeDocument26 pagesFree Consent: Coercion, Undue Influence, Fraud, Misrepresentation and MistakeVanshdeep Kaur SaranNo ratings yet

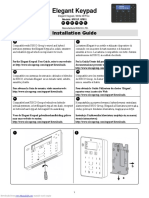

- Elegant Keypad: Installation GuideDocument5 pagesElegant Keypad: Installation GuideSittiphong OUNSAVANHNo ratings yet

- Pah 20705Document6 pagesPah 20705chek86351No ratings yet

- Belgian Vs PH First Insurance With Case DigestDocument9 pagesBelgian Vs PH First Insurance With Case DigestteepeeNo ratings yet

- Al Qaswa Invoice Logo 1Document1 pageAl Qaswa Invoice Logo 1Faizel AsvatNo ratings yet

- Official Form 309A (For Individuals or Joint Debtors) : Order and Notice of Chapter 7 Bankruptcy Case 01/19Document3 pagesOfficial Form 309A (For Individuals or Joint Debtors) : Order and Notice of Chapter 7 Bankruptcy Case 01/19Anonymous Te6DQINo ratings yet

- Grepalife V CADocument3 pagesGrepalife V CAMykee NavalNo ratings yet

- Land Law NotesDocument118 pagesLand Law NotesNekiNo ratings yet

- Custodio vs. CADocument2 pagesCustodio vs. CAzenn18100% (1)

- Family Law MCQ 10-01-2022Document5 pagesFamily Law MCQ 10-01-2022Zeel kachhiaNo ratings yet

- AustriaDocument237 pagesAustriaivanov.pravnikNo ratings yet

- Crisis: Clouded at The Core: ForewordDocument22 pagesCrisis: Clouded at The Core: ForewordMildred Wilkins100% (1)

- 10 Son's Pious ObligationDocument13 pages10 Son's Pious ObligationRadhey0% (1)

- Instant Download Becoming A Multicultural Educator Developing Awareness Gaining Skills and Taking Action 2nd Edition Howe Test Bank PDF Full ChapterDocument15 pagesInstant Download Becoming A Multicultural Educator Developing Awareness Gaining Skills and Taking Action 2nd Edition Howe Test Bank PDF Full Chapterstarfishcomposero5cglt100% (9)

- Syllabus For Law of Tort - 2017Document15 pagesSyllabus For Law of Tort - 2017bhupendra barhatNo ratings yet

- Lease Cum Licence Agreement UploDocument2 pagesLease Cum Licence Agreement UploBharath S NadigNo ratings yet

- Andrew Sartori, Intellectual History and Global History, Pp. 201-212Document19 pagesAndrew Sartori, Intellectual History and Global History, Pp. 201-212alekosbeNo ratings yet

- LLP - Forms and Related Sections, Rules: S. No. Form Purpose Section & RulesDocument2 pagesLLP - Forms and Related Sections, Rules: S. No. Form Purpose Section & RulesVipul DesaiNo ratings yet

- Retrospective Operation of Statutes Relating To Succession and Transfer.Document3 pagesRetrospective Operation of Statutes Relating To Succession and Transfer.ramanjeet singhNo ratings yet

- Castillo V EacutinDocument30 pagesCastillo V EacutinRvic CivrNo ratings yet

- FIDIC MDB Harmonised Construction ContraDocument91 pagesFIDIC MDB Harmonised Construction ContraPujan RegmiNo ratings yet

- No-DepositBonus Promotion With Aglobe Investment LTDDocument7 pagesNo-DepositBonus Promotion With Aglobe Investment LTDCédricNo ratings yet

- Broken: The most shocking childhood story ever told. An inspirational author who survived it.From EverandBroken: The most shocking childhood story ever told. An inspirational author who survived it.Rating: 5 out of 5 stars5/5 (45)

- Hell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryFrom EverandHell Put to Shame: The 1921 Murder Farm Massacre and the Horror of America's Second SlaveryRating: 2.5 out of 5 stars2.5/5 (3)

- The Bigamist: The True Story of a Husband's Ultimate BetrayalFrom EverandThe Bigamist: The True Story of a Husband's Ultimate BetrayalRating: 4.5 out of 5 stars4.5/5 (104)

- The Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenFrom EverandThe Girls Are Gone: The True Story of Two Sisters Who Vanished, the Father Who Kept Searching, and the Adults Who Conspired to Keep the Truth HiddenRating: 3.5 out of 5 stars3.5/5 (36)

- Selling the Dream: The Billion-Dollar Industry Bankrupting AmericansFrom EverandSelling the Dream: The Billion-Dollar Industry Bankrupting AmericansRating: 4 out of 5 stars4/5 (17)

- If You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodFrom EverandIf You Tell: A True Story of Murder, Family Secrets, and the Unbreakable Bond of SisterhoodRating: 4.5 out of 5 stars4.5/5 (1798)

- Tinseltown: Murder, Morphine, and Madness at the Dawn of HollywoodFrom EverandTinseltown: Murder, Morphine, and Madness at the Dawn of HollywoodNo ratings yet

- Restless Souls: The Sharon Tate Family's Account of Stardom, the Manson Murders, and a Crusade for JusticeFrom EverandRestless Souls: The Sharon Tate Family's Account of Stardom, the Manson Murders, and a Crusade for JusticeNo ratings yet

- Perfect Murder, Perfect Town: The Uncensored Story of the JonBenet Murder and the Grand Jury's Search for the TruthFrom EverandPerfect Murder, Perfect Town: The Uncensored Story of the JonBenet Murder and the Grand Jury's Search for the TruthRating: 3.5 out of 5 stars3.5/5 (68)

- Nicole Brown Simpson: The Private Diary of a Life InterruptedFrom EverandNicole Brown Simpson: The Private Diary of a Life InterruptedRating: 3.5 out of 5 stars3.5/5 (16)

- Blood Brother: 33 Reasons My Brother Scott Peterson Is GuiltyFrom EverandBlood Brother: 33 Reasons My Brother Scott Peterson Is GuiltyRating: 3 out of 5 stars3/5 (57)

- Bind, Torture, Kill: The Inside Story of BTK, the Serial Killer Next DoorFrom EverandBind, Torture, Kill: The Inside Story of BTK, the Serial Killer Next DoorRating: 3.5 out of 5 stars3.5/5 (77)

- The Gardner Heist: The True Story of the World's Largest Unsolved Art TheftFrom EverandThe Gardner Heist: The True Story of the World's Largest Unsolved Art TheftNo ratings yet

- Bloodlines: The True Story of a Drug Cartel, the FBI, and the Battle for a Horse-Racing DynastyFrom EverandBloodlines: The True Story of a Drug Cartel, the FBI, and the Battle for a Horse-Racing DynastyRating: 4 out of 5 stars4/5 (8)

- The Rescue Artist: A True Story of Art, Thieves, and the Hunt for a Missing MasterpieceFrom EverandThe Rescue Artist: A True Story of Art, Thieves, and the Hunt for a Missing MasterpieceRating: 4 out of 5 stars4/5 (1)

- Witness: For the Prosecution of Scott PetersonFrom EverandWitness: For the Prosecution of Scott PetersonRating: 3 out of 5 stars3/5 (44)

- Altamont: The Rolling Stones, the Hells Angels, and the Inside Story of Rock's Darkest DayFrom EverandAltamont: The Rolling Stones, the Hells Angels, and the Inside Story of Rock's Darkest DayRating: 4 out of 5 stars4/5 (25)

- Diamond Doris: The True Story of the World's Most Notorious Jewel ThiefFrom EverandDiamond Doris: The True Story of the World's Most Notorious Jewel ThiefRating: 3.5 out of 5 stars3.5/5 (18)

- What the Dead Know: Learning About Life as a New York City Death InvestigatorFrom EverandWhat the Dead Know: Learning About Life as a New York City Death InvestigatorRating: 4.5 out of 5 stars4.5/5 (70)

- Hearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIFrom EverandHearts of Darkness: Serial Killers, The Behavioral Science Unit, and My Life as a Woman in the FBIRating: 4 out of 5 stars4/5 (19)

- A Special Place In Hell: The World's Most Depraved Serial KillersFrom EverandA Special Place In Hell: The World's Most Depraved Serial KillersRating: 4 out of 5 stars4/5 (53)

- Little Shoes: The Sensational Depression-Era Murders That Became My Family's SecretFrom EverandLittle Shoes: The Sensational Depression-Era Murders That Became My Family's SecretRating: 4 out of 5 stars4/5 (75)

- Double Lives: True Tales of the Criminals Next DoorFrom EverandDouble Lives: True Tales of the Criminals Next DoorRating: 4 out of 5 stars4/5 (34)

- To the Bridge: A True Story of Motherhood and MurderFrom EverandTo the Bridge: A True Story of Motherhood and MurderRating: 4 out of 5 stars4/5 (73)

- Unanswered Cries: A True Story of Friends, Neighbors, and Murder in a Small TownFrom EverandUnanswered Cries: A True Story of Friends, Neighbors, and Murder in a Small TownRating: 4.5 out of 5 stars4.5/5 (179)