Professional Documents

Culture Documents

Swe1404d - Refineries Deailing Glut of Condensate Oil

Uploaded by

aiabbasi9615Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Swe1404d - Refineries Deailing Glut of Condensate Oil

Uploaded by

aiabbasi9615Copyright:

Available Formats

Producers, Refiners View Strategies to Trim

Texas Glut of Ultralight Condensate Oil

By Jesse Thompson

}

ABSTRACT: Hampered by

the federal oil export ban,

producers are seeking

alternative means to bring to

global markets the burgeoning

supplies of ultralight

condensate oil drawn from the

Eagle Ford Shale region of

South Texas.

he shale revolution has

vastly boosted supplies of the

ultralight crude oil known as

condensate, particularly in

the Eagle Ford Shale region of South

Texas.

Condensate is used to produce a

variety of products, often by combining

it with heavier types of oil. Supplies have

overwhelmed U.S. firms capacity to put

the condensate to use.

A U.S. ban on oil exportsincluding condensateslargely prevents the

sale of condensate to foreign companies. Drilling companies, refiners and

petrochemical producers have employed

various ways to deal with the condensate

surplus, with some producers skirting

the export ban. Regulators have taken

notice, too, allowing limited condensate

exports by two firms.

Still, much uncertainty remains in

the marketplace over what form exports

of condensate will take.

Defining Condensate

Condensate is an ill-defined family of substances, often referred to as

ultralight crude due to its low density.1

Heat and pressure underground keep

the substances gaseous, but when they

come out of the well, they condense into

a liquid, much like water on the outside

of a cold drinking glass.

The American Petroleum Institute

uses an index to indicate how dense various oils are relative to watercalled API

gravity: The higher the API, the lighter

the oil. Generally, condensate API gravity

exceeds 50. By comparison, West Texas

Intermediate crude oil has an API of 39,

while heavier crudes such as Canadian oil can have an API of 25 or lower.

Condensates occupy the border between

what are usually referred to as natural

gas liquids (NGLs), such as ethane and

propane, and crude oil.

10

Increasing Supplies

The Eagle Ford Shale accounted

for 1 percent of the nations oil production in 2008; the share rose to more than

17 percent by mid-2014. One-sixth of

new barrels produced between 2009

and 2013 were an ultralight type called

lease-condensate, according to the most

recent data from the Energy Information

Agency (EIA).2 Over that period, Texas

was responsible for 72 percent of U.S.

condensate production growth.

The Eagle Ford produced 83 million

barrels of condensate27 percent of the

U.S. supply and 52 percent of the Texas

supplyin 2013. The sudden glut of ultralight liquids, which sell at a discount,

drove South Texas producers to focus

their drilling efforts on areas rich with

heavier oils (Chart 1).

Thus, while oil production growth in

the Eagle Ford remains healthy, condensate growth has fallen off, from 70

percent of total Eagle Ford oil production

in 2009 to 20 percent in the first half of

2014. With such an unexpectedly rich

resource of condensate, producers are

seeking any route they can find to deliver

it to customers.

A primary use for condensate is as a

diluent. Heavy crude producers want to

sell their product to refiners for processing but often need to dilute their oil with

something lighter for transport and delivery. A barrel of heavy crude with a low

API can be blended with condensate that

has a high API to create oil with a gravity

somewhere in between.

Refiners convert the diluted barrel

into a variety of products. Some of the

condensate that goes into a barrel of oil

comes through the refining process little

changed and is shipped back to heavy

crude producers to repeat the process.

This creates a loop in which the value of

the condensate is based largely on the

needs of heavy crude producers, as much

Southwest Economy Federal Reserve Bank of Dallas Fourth Quarter 2014

Chart

Texas Eagle Ford Drives Condensate Production

Annual production, index, 1981 = 100

Barrels per day (thousands)

300

430

380

330

Permian Basin

250

Eagle Ford

200

280

150

230

Texas

100

180

130

80

1981

U.S.

1984

50

1987

1990

1993

1996

1999

2002

2005

2008

2011

2014

NOTE: Permian Basin and Eagle Ford production for 2014 is based on JanuarySeptember data.

SOURCES: Energy Information Agency; Texas Railroad Commission.

as the products derived from condensate

itself. U.S. heavy crude production isnt

growing, according to EIA estimates, but

as long as that loop between heavy crude

producers and refineries is expanding

globally, international demand for diluent will grow with it.

Condensate is also used in petrochemical plants. Many use condensate

to make the chemical building blocks

for products such as plastics or car tires.

Foreign petrochemical manufacturers dependent on naphthaa mix of

substances resembling condensate that

usually comes from refineriescould

be major buyers of U.S. condensate as

they seek to lower their costs to compete

with U.S. companies whose production

is based on low-cost domestic ethane,

an NGL.3

In the refinery, condensate is also

split or processed into several different products. Some goes directly into

diesel and jet fuel, some is blended into

gasoline and some becomes solvents for

industrial applications.

Even with many petrochemical and

refinery uses, there are limits to how

much condensate the U.S. can process.

Depressed Crude Wellhead Prices

The operating rates of U.S. refineries have climbed since the end of the

recession to as high as 90 percent in 2013

and 95 percent in 2014. Along the Gulf

Coast and in the Midwest, the share of

total operable refining capacity in use

has frequently exceeded 90 percent the

past two years. However, those plants

have limited capacity to refine ultralight

crudes. Particularly along the Gulf Coast,

home to almost half of U.S. refining capacity, operators for most of the past 30

years invested in technologies to process

greater volumes of heavier crudes.

From 1986 to 2008, the API gravity of

oils entering Gulf Coast refineries steadily declined from 35 to 27.8. It nearly

recovered to 30 by early 2013 before falling again through the year. New refinery

units along the Gulf Coast and higher

operating rates at refineries on the East

and West coasts will increase the amount

of ultralight crude the U.S. can process

over the next several years. Still, the

capacity in many parts of the U.S. is near

its limit. In those facilities, processing too

light a mix would diminish profitability

because of inefficient refinery use or sale

of a suboptimal product mix (Chart 2).

Oils with an API gravity of 40 or

more (light crudes and condensate) account for almost all U.S. crude production growth, EIA analysis shows. Thus,

imports of similar crudes have fallen to

zero, practically eliminating shipments

from Nigeria and other light crude producers. Imports of heavy crudes with an

API of 25 degrees or less have declined

somewhat but are little changed as a

refinery units along

}New

the Gulf Coast and

higher operating rates

at refineries on the East

and West coasts will

increase the amount of

ultralight crude the U.S.

can process. Still, the

capacity in many parts of

the U.S. is near its limit.

Southwest Economy Federal Reserve Bank of Dallas Fourth Quarter 2014

11

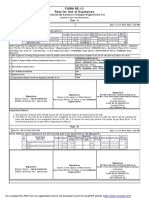

Chart

Refinery Mix Gets Heavier as Crude Supply Gets Lighter

Millions of barrels per day

API gravity (degrees)

16

31.5

14

analysts believe

}Many

its inevitable that

ultralight inventories

will continue to rise as

long as the export ban

remains. The trapped

and growing inventories

could lower domestic

light crude prices

relative to their global

counterparts.

Average refinery API

31

12

10

30.5

API >40

6

4

API <35

29.5

2

0

2011

2012

2013

29

NOTE: Domestic supply calculated as domestic production plus imports.

SOURCES: Energy Information Administration; DrillingInfo; Colorado Department of Natural Resources; Texas Railroad

Commission; authors calculations.

share of refinery input. Heavy crude

imports are down from nearly 24

percent of all oil that went into U.S.

refineries in mid-2009 to 21.4 percent

in late 2013.

Many analysts believe its inevitable

that ultralight inventories will continue

to rise as long as the export ban remains.

The trapped and growing inventories

could reduce domestic light crude prices

relative to their global counterparts. A

further lowering of the price producers

receive at the wellhead would discourage drilling in condensate-rich areas.

However, there is a way around the

export ban.

Export Regulatory Uncertainty

Crude oil cannot be exported, but

refined products can.4 Investing in a

splitter is one way around the ban.

Splitters cut the condensate into lighter

and heavier parts that then qualify as refined products under the law. Split-condensate can be consumed or exported as

light and heavy naphthas, diesel, kerosene and gas oil. Hundreds of millions of

investment dollars have been committed

to this export strategy (Table 1).5

For example, Kinder Morgan Energy Partners is building a $360 million

complex on the Houston Ship Channel

expressly to store, split and export products derived from Eagle Ford condensate

at a rate of 100,000 barrels per day, with

12

30

API 3540

room to grow. The facility is scheduled

to become fully operational in second

quarter 2015.

Even as planned projects make their

way through engineering, permitting

and construction, the rules governing

condensate may be shifting. The Department of Commerces Bureau of Industry

and Security issued a judgment in June

allowing Pioneer Natural Resources and

Enterprise Product Partners to export

condensate.6 The action didnt overturn

the export ban, nor was it a finding that

condensate differs from crude oil under

the law. It stated that a stabilization

process the two companies employed

(in which NGLs and natural gas are

removed) was sufficient to legally qualify

the material they produced as refined.

The resulting product is not subject to

the export ban.

Indeed, some firms have taken it

upon themselves to export stabilized

condensate from Texas without an export permit, both testing regulators will

to enforce the ban and perhaps forcing a

clarification of the rules.7

Following that reasoning, many

firms may rethink the need for a splitter,

while still others continue to review the

decision, hoping to better understand

what exports of condensate might look

like in the near future. The resulting uncertainty may defer some planned Gulf

Coast splitter projects.

Southwest Economy Federal Reserve Bank of Dallas Fourth Quarter 2014

Plant-Condensate Exports

Table

A chemically close substitute for

condensateplant condensate, also

known as pentanes plus, which comes

from natural gasprovides some clues

regarding the potential impact of increased condensate processing. Rather

than being composed of the lightest parts

of oil, like condensate, pentanes plus

is made of the heaviest parts of unprocessed natural gas.

Pentanes plus has never been

considered crude and has never been

subject to the export ban. It is liquid and

has roughly the same potential uses as

condensate. Net exports of pentanes plus

are a dramatic example of what the shale

revolution has done for the U.S. energy

trade balance. After decades of being an

importer of this fuel, the United States is

now a net exporter, principally to Canada

(Chart 3).

The U.S. exported 50 million of

the 127 million barrels of pentanes

plus produced in gas plants in 2013 (40

percent) and 32 million of the 78 million

barrels produced in the first half of 2014

(42 percent).

The Eagle Ford, which produced 83

million barrels of condensate in 2013, is

on track for 91 million barrels in 2014.

Adding only Eagle Ford condensate

production to total pentanes plus output

would result in a nearly two-thirds

increase in the volume of exportable U.S.

energy products in 2014.

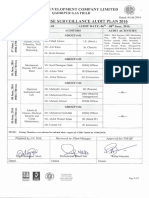

Proposed and Existing Condensate Splitter Projects in Texas

Startup

date

Capacity

(millions of

barrels/day)

Estimated

capacity

(millions of

barrels/day)

Location

2000

75

75

Port Arthur

Kinder Morgan Energy PartnersPhase 1

2014:Q4

50

50

Houston

Kinder Morgan Energy PartnersPhase 2

2015:Q2

50

50

Houston

Company

BASF and Total Petrochem

Trafigura

2015

50

50

Corpus Christi

2016:Q1

& Q2

Up to 100

100

Corpus Christi

Castleton Commodities

TBD

TBD

75

Corpus Christi

Magellan Midstream

TBD

TBD

100

Corpus Christi

Martin Midstream

SOURCE: Turner, Mason and Co.

Chart

Exports of Natural-Gas-Derived Pentanes Plus Soar

U.S. net exports (millions of barrels)

7

6

5

4

3

2

1

0

1

2

3

4

Future Determination

84

86

88

90

92

94

96

98

00

02

04

06

08

10 12 14

SOURCE: Energy Information Agency.

The condensate supply glut has

led to swollen inventories, strained

refinery capacity, and likely diminished

drilling in some parts of the country.

Producers continue to face uncertainty

while the export ban remains in place.

But some combination of reduced light

crude production (due to lower prices),

increased refinery capacity and efforts

to skirt the ban should ultimately alleviate the glut.

Producers in the Eagle Ford Shale,

as in other regions, have been attempting to direct condensates to other uses

and shift production to heavier oils as

they await better pricing and word on

whether the U.S. will liberalize or eliminate the oil export ban.

Regardless of what form new export

rules may take, the Eagle Ford continues

to expand the list of energy products

exported from the Texas Gulf Coast.

Thompson is a business economist

at the Houston branch of the Federal

Reserve Bank of Dallas.

Notes

See Fifty Shades of CondensatesWhich One

Did You Mean? by Rusty Braziel, RBN Energy LLC,

Oct. 22, 2012, https://rbnenergy.com/fifty-shades-ofcondensates%E2%80%93which-one-did-you-mean.

2

For simplicity, lease-condensate is referred to

subsequently as condensate.

3

See Booming Shale Gas Production Drives Texas

Petrochemical Surge, by Jesse Thompson, Federal Reserve

1

Bank of Dallas Southwest Economy, Fourth Quarter, 2012,

and Shale Revolution Feeds Petrochemical Profits as

Production Adapts, by Jesse Thompson, Federal Reserve

Bank of Dallas Southwest Economy, Fourth Quarter, 2013.

4

See Crude Oil Export Ban Benefits Some but Not

All, by Michael D. Plante, Federal Reserve Bank of Dallas

Economic Letter, vol. 9, no. 7, 2014.

5

See To Split or Not to SplitThat Is the Question, by

Ryan Couture, Turner, Mason and Co., Sept. 8, 2014, www.

turnermason.com/blog/2014/09/08/to-split-or-not-to-split.

6

See With or Without Splitting? Changing Lease

Condensate Export Definitions, by Sandy Fielden, RBN

Energy LLC, June 25, 2014, https://rbnenergy.com/withor-without-splitting-changing-lease-condensate-exportdefinitions.

7

See BHP Billiton to Export Condensate Overseas, by

Jennifer A. Dlouhy, Fuel Fix, Nov. 4, 2014, http://fuelfix.

com/blog/2014/11/04/bhp-billiton-to-export-condensateoverseas.

Southwest Economy Federal Reserve Bank of Dallas Fourth Quarter 2014

13

You might also like

- Variable Area Flow Meter Data Sheet mt3750 enDocument16 pagesVariable Area Flow Meter Data Sheet mt3750 enaiabbasi9615No ratings yet

- Form 29-2012 PDFDocument2 pagesForm 29-2012 PDFaiabbasi9615No ratings yet

- Capacity A&F WorkshopDocument10 pagesCapacity A&F Workshopaiabbasi9615No ratings yet

- 1st In-House HSE Survellance Audit Plan 2016Document4 pages1st In-House HSE Survellance Audit Plan 2016aiabbasi9615No ratings yet

- MarkVie SIS Evaulation ExidaDocument31 pagesMarkVie SIS Evaulation Exidaaiabbasi9615No ratings yet

- 2-27-1370358081-8.investigation of - FullDocument16 pages2-27-1370358081-8.investigation of - Fullaiabbasi9615No ratings yet

- PG Booklet AerospaceDocument24 pagesPG Booklet Aerospaceaiabbasi9615No ratings yet

- CPPA Annual Report - pdf-180305214924155Document96 pagesCPPA Annual Report - pdf-180305214924155aiabbasi9615No ratings yet

- Afghanistan - Alternative Futures and Their Implications: Brigadier Naveed Mukhtar Pakistan ArmyDocument38 pagesAfghanistan - Alternative Futures and Their Implications: Brigadier Naveed Mukhtar Pakistan Armyaiabbasi9615No ratings yet

- Monitor GE 1900 - 65ADocument18 pagesMonitor GE 1900 - 65AJose FloresNo ratings yet

- Fs 9006Document16 pagesFs 9006aiabbasi9615No ratings yet

- HP Rotor UnbalanceDocument3 pagesHP Rotor Unbalanceaiabbasi9615No ratings yet

- Electricity Demand EstimationDocument27 pagesElectricity Demand Estimationaiabbasi9615No ratings yet

- US NGLs Production and Steam Cracker SubstitutionDocument14 pagesUS NGLs Production and Steam Cracker SubstitutionmaitaniNo ratings yet

- 01 G Lube Oil SystemDocument40 pages01 G Lube Oil Systemaiabbasi9615No ratings yet

- 002 - ManualC - G - 47-50 - ING Rev.2 20.10.11Document13 pages002 - ManualC - G - 47-50 - ING Rev.2 20.10.11aiabbasi9615No ratings yet

- Man Turbo THM Gas TurbineDocument51 pagesMan Turbo THM Gas Turbineaiabbasi9615100% (1)

- W1V1 - Energy Scene - Handout PDFDocument8 pagesW1V1 - Energy Scene - Handout PDFDanilson Paulo MelicioNo ratings yet

- Availability Analysis of Gas TurbinesDocument10 pagesAvailability Analysis of Gas TurbinesEman ZabiNo ratings yet

- 9744 EngineeringThermoyoyDocument13 pages9744 EngineeringThermoyoyDavid Gómez de la TorreNo ratings yet

- 173089Document22 pages173089aiabbasi9615100% (1)

- FSLDMDocument5 pagesFSLDMaiabbasi9615No ratings yet

- Scofield Bldg. Addition Project Manual (503-6925), 2011-09-0Document903 pagesScofield Bldg. Addition Project Manual (503-6925), 2011-09-0aiabbasi9615No ratings yet

- 173400Document211 pages173400aiabbasi9615No ratings yet

- 172250Document86 pages172250aiabbasi9615No ratings yet

- RecyclerDocument2 pagesRecycleraiabbasi9615No ratings yet

- 173295Document3 pages173295aiabbasi9615No ratings yet

- SampleCalculationspipingB3132008 PDFDocument13 pagesSampleCalculationspipingB3132008 PDFsosatlantiqueNo ratings yet

- ADocument4 pagesAaiabbasi9615No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- DMDW Mod3@AzDOCUMENTS - inDocument56 pagesDMDW Mod3@AzDOCUMENTS - inRakesh JainNo ratings yet

- Change Management in British AirwaysDocument18 pagesChange Management in British AirwaysFauzan Azhary WachidNo ratings yet

- Malware Reverse Engineering Part 1 Static AnalysisDocument27 pagesMalware Reverse Engineering Part 1 Static AnalysisBik AshNo ratings yet

- Whisper Flo XF 3 PhaseDocument16 pagesWhisper Flo XF 3 Phasehargote_2No ratings yet

- Customer Perceptions of Service: Mcgraw-Hill/IrwinDocument27 pagesCustomer Perceptions of Service: Mcgraw-Hill/IrwinKoshiha LalNo ratings yet

- John Titor TIME MACHINEDocument21 pagesJohn Titor TIME MACHINEKevin Carey100% (1)

- Experiences from OJT ImmersionDocument3 pagesExperiences from OJT ImmersionTrisha Camille OrtegaNo ratings yet

- FINAL A-ENHANCED MODULES TO IMPROVE LEARNERS - EditedDocument22 pagesFINAL A-ENHANCED MODULES TO IMPROVE LEARNERS - EditedMary Cielo PadilloNo ratings yet

- ABP - IO Implementing - Domain - Driven - DesignDocument109 pagesABP - IO Implementing - Domain - Driven - DesignddoruNo ratings yet

- PESO Online Explosives-Returns SystemDocument1 pagePESO Online Explosives-Returns Systemgirinandini0% (1)

- Last Clean ExceptionDocument24 pagesLast Clean Exceptionbeom choiNo ratings yet

- Built - in BeamsDocument23 pagesBuilt - in BeamsMalingha SamuelNo ratings yet

- Jfif 1.02Document9 pagesJfif 1.02Berry Hoekstra100% (1)

- 2nd Pornhub Awards - WikipediaaDocument13 pages2nd Pornhub Awards - WikipediaaParam SinghNo ratings yet

- Bluetooth TutorialDocument349 pagesBluetooth Tutorialjohn bougsNo ratings yet

- Photographing Shadow and Light by Joey L. - ExcerptDocument9 pagesPhotographing Shadow and Light by Joey L. - ExcerptCrown Publishing Group75% (4)

- "Behind The Times: A Look at America's Favorite Crossword," by Helene HovanecDocument5 pages"Behind The Times: A Look at America's Favorite Crossword," by Helene HovanecpspuzzlesNo ratings yet

- Reflection Homophone 2Document3 pagesReflection Homophone 2api-356065858No ratings yet

- System: Boehringer Mannheim/Hitachi AnalysisDocument20 pagesSystem: Boehringer Mannheim/Hitachi Analysismaran.suguNo ratings yet

- Coffee Table Book Design With Community ParticipationDocument12 pagesCoffee Table Book Design With Community ParticipationAJHSSR JournalNo ratings yet

- PandPofCC (8th Edition)Document629 pagesPandPofCC (8th Edition)Carlos Alberto CaicedoNo ratings yet

- Clark DietrichDocument110 pagesClark Dietrichikirby77No ratings yet

- Water Jet CuttingDocument15 pagesWater Jet CuttingDevendar YadavNo ratings yet

- Quality Management in Digital ImagingDocument71 pagesQuality Management in Digital ImagingKampus Atro Bali0% (1)

- Bank NIFTY Components and WeightageDocument2 pagesBank NIFTY Components and WeightageUptrend0% (2)

- Quantification of Dell S Competitive AdvantageDocument3 pagesQuantification of Dell S Competitive AdvantageSandeep Yadav50% (2)

- 08 Sepam - Understand Sepam Control LogicDocument20 pages08 Sepam - Understand Sepam Control LogicThức Võ100% (1)

- Axe Case Study - Call Me NowDocument6 pagesAxe Case Study - Call Me NowvirgoashishNo ratings yet

- UTP3-SW04-TP60 Datasheet VER2.0Document2 pagesUTP3-SW04-TP60 Datasheet VER2.0Ricardo TitoNo ratings yet

- Bharhut Stupa Toraa Architectural SplenDocument65 pagesBharhut Stupa Toraa Architectural Splenအသွ်င္ ေကသရNo ratings yet