Professional Documents

Culture Documents

Declaration of Personnel Costs 2

Uploaded by

othilikOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Declaration of Personnel Costs 2

Uploaded by

othilikCopyright:

Available Formats

Innovation and Networks Executive Agency (INEA)

Documenting Costs of Personnel

1. Guidelines

Background

This declaration aims to provide assurance on the eligibility of staff costs declared by CEF beneficiaries in their

individual financial statement.

In order to simplify the declaration of costs of beneficiaries, the reimbursement of personnel costs declared as unit

costs (so called 'average personnel costs') is authorised under the CEF programme by Commission Decision

C(2016)478. Therefore, CEF beneficiaries may calculate average personnel costs on the basis of usual cost

accounting practices.

In concrete terms, when declaring direct personnel costs, CEF beneficiaries may have two possibilities:

- declare actual personnel costs or,

- declare average personnel cost(s) based on their usual costs accounting practices and in compliance with the

conditions laid down in Commission Decision C(2016)478.

The number of actual working hours declared for a person must be identifiable and verifiable; they must be

necessary for implementing the action and must be actually used during the action. Evidence regarding the actual

hours worked shall be provided by the participant, through a time recording system for which the following

minimum requirements (section 2.3 of Commission Decision C(2016)478) are set out.

The time recording system should record all working time including absences and may be paper or electronically

based. The time records must be approved by the persons working on the action and their supervisors, at least

monthly. The absence of an adequate time recording system is considered to be a serious and systematic

weakness of internal control.

Furthermore, the Decision provides for the use of unit costs for SME owners who do not receive any salary. The

hourly rate is based on a fixed monthly allowance multiplied by a country correction coefficient as defined in the

Appendix of the Decision. Lastly, the Decision also establishes the basic conditions regarding time recording for

personnel costs that should be respected by all CEF beneficiaries.

For further information, see Articles 10 and II.20.5 of the Grant Agreement as well as annex VII on the Certificate

for Financial Statements.

Please do not send this declaration unless specifically requested by INEA upon the ex-ante controls exercise.

Nevertheless, detailed supporting documentation has to remain availaible on site.

How to complete the template

Please fill in all the cells in worksheet "Declaration". Please send by email the Excel file to your Project Manager

together with a scanned version of the signed declaration, in pdf format, as part of the sampling documentation.

Declaration worksheet

Name and position: This concerns the person who has the power to commit the Beneficiary

Sample worksheet

Start date end end date of incurring the costs: these dates correspond to the sample, not to the period of the

Decision or the reporting period.

Components of costs of personnel: If you are reporting costs per person, please provide the name or a

personnel number of each person involved. Alternatively, if you work with categories of personnel, fill in the name

of the category concerned. Then, specify the hourly rate used and the number of hours charged to the Action.

If you have any additional questions related to this template, please contact your Project Manager.

Guidelines

Page 1 of 3

Innovation and Networks

Executive Agency

Documenting Costs of Personnel

2. Declaration by the Beneficiary

Action N

201X-XX-XX-XXXX-X

Grant Agreement N

Action Title

Beneficiary

Name

Position

The Beneficiary declares that:

1. The Costs of personnel declared meet the requirement of article II.19.1 of the Grant agreement, and particularly they they are

incurred in connection with the action as described in Annex I and are necessary for its implementation.

2. The Costs of personnel declared only include the following (compliant to national legislation and according to work contract) :

* Pay (Gross salary, overtime, 13th month (or +), bonus , holiday allowance)

* Employers' contribution ( social insurance charges, pension funding, other insurances)

3. If it includes other items, please specify which ones here below.

4. Are the staff members declared included on your payroll?

YES/NO

If not, please provide further information.

5. Please indicate if the declared staff costs are either actual personnel costs or unit costs

6. Do you have a time recording system, as required by Commission Decision C(2016)478?

ACTUAL/ UNIT COSTS

YES/NO

Briefly describe the system used (eg timesheets, electronic registration)

If not, please describe alternative evidence supporting the number of hours declared to the action (in compliance with the "Use of unit

costs" Commission Decision C(2016)478)

7. Please briefly explain how you calculate the costs of staff working for the action in compliance with Article II.19.1 and Commission

Decision C(2016)478.

The personnel costs declared should be:

- based on the beneficiary's usual cost accounting practices

- applied in a consistent manner, based on objective criteria and

- the hourly rate is calculated using actual personnel costs, excluding any ineligible cost or costs included in other budget categories.

- Please list all components included in the calculation of the gross personnel cost.

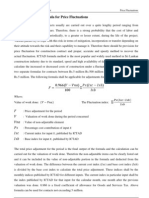

Example:Hourly rate = Annual gross personnel costs

Annual productive hours

Declared cost = hourly rate x CEF project hours

Date

Signature

2 Declaration

Page 2 of 3

Innovation and Networks

Executive Agency

Documenting Costs of Personnel

3. Sample

Action N

201X-XX-XX-XXXX-X

Grant Agreement N

Sampling item

Sampling value (in local currency)

Start date of incurring the costs (DD/MM/YYYY)

End date of incurring the costs (DD/MM/YYYY)

1/1/2015

31/06/2015

Component of costs of personnel

Name or identification N of the

person or category of staff

Person / Category of personnel

Mr X or employee id Y or staff category

engineer junior

Senior engineers

Person / Category of personnel

Person / Category of personnel

Person / Category of personnel

Person / Category of personnel

Person / Category of personnel

Person / Category of personnel

Person / Category of personnel

Person / Category of personnel

Person / Category of personnel

Total (should be equal to the sampling value)

N of staff in the category

Hourly rate

50.00

1,720

86,000.00

80.00

100

8,000.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

94,000.00

The total of costs justified

is not the amount of the

sampling

A. Annual personnel cost

B. Annual productive hours

({annual workable hours of the

person } plus {overtime worked}

minus {absences})

3 Sample & Unit cost

Amount charged to the

project

10

"Unit costs"

C. The 'unit cost': A/B (the hourly

rate)

D. The number of actual hours

worked on the action

E. Personnel cost: CxD

Hours

charged to

the project

#DIV/0!

#DIV/0!

Page 3 of 3

You might also like

- Financial Admin Guidelines 12102015 0Document17 pagesFinancial Admin Guidelines 12102015 0Sugar CaloNo ratings yet

- 2018 Annex X Financial Administrative GuidelinesDocument33 pages2018 Annex X Financial Administrative GuidelinesChatt BoxNo ratings yet

- EU Financial & Administrative Guidelines NGODocument19 pagesEU Financial & Administrative Guidelines NGOFriskaSinurayaNo ratings yet

- Aef 2013 Audit Acc ReqDocument9 pagesAef 2013 Audit Acc Reqvikas_ojha54706No ratings yet

- MBA Cost RecordsDocument8 pagesMBA Cost RecordsGurneet KaurNo ratings yet

- Cost AuditDocument8 pagesCost AuditShaikh SuhailNo ratings yet

- ACT 203 Cost Accounting: 04/05/2023 B Com (Finance/ Accounting), RTC, ThimphuDocument35 pagesACT 203 Cost Accounting: 04/05/2023 B Com (Finance/ Accounting), RTC, ThimphuSonam Peldon (Business) [Cohort2020 RTC]No ratings yet

- Unicef TechnicalDocument7 pagesUnicef TechnicalsimbiroNo ratings yet

- Updated Appendix 2D Updated 31 Mar CleanDocument7 pagesUpdated Appendix 2D Updated 31 Mar CleanAndreiNo ratings yet

- Mechanism For Determination of Prolongation CostsDocument10 pagesMechanism For Determination of Prolongation CostswisnuNo ratings yet

- x220 Lenovo LaptopsDocument20 pagesx220 Lenovo LaptopsEmmanuel MoyoNo ratings yet

- Final Internal Audit Report 12-ICSIL-Ver-DraftDocument29 pagesFinal Internal Audit Report 12-ICSIL-Ver-DraftRamesh ChandraNo ratings yet

- Sap Co Module Implementation AT Tata Bearings: R/3 Client/Server Abap4 R/3 Client/Server Abap4Document48 pagesSap Co Module Implementation AT Tata Bearings: R/3 Client/Server Abap4 R/3 Client/Server Abap4Yugandhar KolliNo ratings yet

- Thesis On Internal Revenue AllotmentDocument5 pagesThesis On Internal Revenue Allotmentafkojbvmz100% (2)

- Project Financial ManagementDocument28 pagesProject Financial ManagementjohnrichardjasmineNo ratings yet

- Other Tax and Investment DevelopmentsDocument21 pagesOther Tax and Investment DevelopmentsShandru MurthyNo ratings yet

- FAQs For ImplementationDocument19 pagesFAQs For ImplementationLasan NicoletaNo ratings yet

- Ict Investment Approval 2nd Pass Business Case TemplateDocument12 pagesIct Investment Approval 2nd Pass Business Case Templatebangun777No ratings yet

- Sop FinanceDocument3 pagesSop FinanceAudia PratiwiNo ratings yet

- Ce110-Ce3A&Ce3B The Civil Engineering Law (Articles Iii &iv)Document42 pagesCe110-Ce3A&Ce3B The Civil Engineering Law (Articles Iii &iv)Tazumi ImnoyaraNo ratings yet

- Fund For Innovations and Technological DevelopmentDocument8 pagesFund For Innovations and Technological DevelopmentjasnaNo ratings yet

- Pcs 1Document3 pagesPcs 1Dominic BautistaNo ratings yet

- Compulsory Report Format and Procedures To Be PerformedDocument4 pagesCompulsory Report Format and Procedures To Be PerformedgoranacurgusNo ratings yet

- Ch.7,8 Procurement of Services - 651464Document7 pagesCh.7,8 Procurement of Services - 651464Sumant ChilkotiNo ratings yet

- Section 6 - Technical Proposal FormDocument25 pagesSection 6 - Technical Proposal FormRafael Borromeo IsorenaNo ratings yet

- Subashini U Final ReportDocument39 pagesSubashini U Final ReportPonselviNo ratings yet

- Admas University: Learning GuideDocument13 pagesAdmas University: Learning GuideBekalu TsegayeNo ratings yet

- Payslipmodule Finance3 1Document18 pagesPayslipmodule Finance3 1Aditya SinghNo ratings yet

- Sop 98-5Document14 pagesSop 98-5chanti0999No ratings yet

- Cost Accounting II YearDocument52 pagesCost Accounting II YearAnkit ThakurNo ratings yet

- Cost Audit: Write A Short Note On Cost Audit. (4 Marks, November, 2014)Document6 pagesCost Audit: Write A Short Note On Cost Audit. (4 Marks, November, 2014)casarokarNo ratings yet

- Fund For Innovations and Technology DevelopmentDocument19 pagesFund For Innovations and Technology DevelopmentnecesnikNo ratings yet

- Quiz Group 1Document10 pagesQuiz Group 1Mubarrach MatabalaoNo ratings yet

- 4 Sem Bcom - Cost AccountingDocument54 pages4 Sem Bcom - Cost Accountingraja chatterjeeNo ratings yet

- Opsys Guidelines Siea 2018 V 1 2 - enDocument17 pagesOpsys Guidelines Siea 2018 V 1 2 - enGobitobiNo ratings yet

- Final CBFTEComponentof ICSchemeDocument12 pagesFinal CBFTEComponentof ICSchemeDeepak DeejeNo ratings yet

- Cost Accounting IIDocument62 pagesCost Accounting IIShakti S SarvadeNo ratings yet

- Cost Accounting, Job Costing & Batch CostingDocument10 pagesCost Accounting, Job Costing & Batch Costing✬ SHANZA MALIK ✬No ratings yet

- Paper 5 Cost Management AccountingDocument685 pagesPaper 5 Cost Management AccountingAlson PrasaiNo ratings yet

- Cost CH 3Document20 pagesCost CH 3Yonas AyeleNo ratings yet

- LIFT Financial Reporting Template 2014 06082014Document23 pagesLIFT Financial Reporting Template 2014 06082014liftfundNo ratings yet

- Amrit Notes - PDF Version 1 PDFDocument49 pagesAmrit Notes - PDF Version 1 PDFAmrit GaireNo ratings yet

- Final Examination Cost Accounting 2019 FinalDocument6 pagesFinal Examination Cost Accounting 2019 FinalElias DeusNo ratings yet

- Grant AgreementDocument15 pagesGrant AgreementCAMILO UGARTE CAVERONo ratings yet

- The Statement of Comprehensive Income IfrDocument20 pagesThe Statement of Comprehensive Income IfrBon juric Jr.No ratings yet

- Accounting ModfdDocument42 pagesAccounting Modfdakshit_vijNo ratings yet

- Chapter-Six 6.preparation of Operating Budgets: Financial AccountingDocument6 pagesChapter-Six 6.preparation of Operating Budgets: Financial AccountingWendosen H FitabasaNo ratings yet

- Guide ITProof SubmissionDocument9 pagesGuide ITProof SubmissionSrikanthNo ratings yet

- Chapter 6 11 12Document15 pagesChapter 6 11 12wubeNo ratings yet

- Railway Hand Book On Internal ChecksDocument308 pagesRailway Hand Book On Internal ChecksHiraBallabh82% (34)

- Paper 5 Cost and Management Accounting PDFDocument685 pagesPaper 5 Cost and Management Accounting PDFExcel Champ50% (2)

- Cost AccountingDocument52 pagesCost Accountingd. CNo ratings yet

- Garden Reach Shipbuilders & Engineers LTD.: Invitation To TenderDocument13 pagesGarden Reach Shipbuilders & Engineers LTD.: Invitation To TenderArchie SharmaNo ratings yet

- Request For Proposal: (Address)Document18 pagesRequest For Proposal: (Address)Shahid NaseerNo ratings yet

- AbstractDocument9 pagesAbstract16july1994No ratings yet

- Cost AccountingDocument24 pagesCost AccountingmugdhaaranaNo ratings yet

- FIDIC & ICTAD Formula DifferencesDocument5 pagesFIDIC & ICTAD Formula DifferencesTharaka Kodippily67% (3)

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Dadar To Nasik Road TrainsDocument1 pageDadar To Nasik Road TrainsAbhishek MojadNo ratings yet

- Project Report of Share KhanDocument117 pagesProject Report of Share KhanbowsmikaNo ratings yet

- Market Visit Ing ReportDocument3 pagesMarket Visit Ing ReportMr. JahirNo ratings yet

- Registration of PropertyDocument13 pagesRegistration of PropertyambonulanNo ratings yet

- Sercu SolutionsDocument155 pagesSercu SolutionsVassil StfnvNo ratings yet

- Statement 20231030161033Document6 pagesStatement 20231030161033kreetika kumariNo ratings yet

- The Evolution of The State Bank of India Is A Comprehensive Book Written by Amiya Kumar Bagchi in FourDocument3 pagesThe Evolution of The State Bank of India Is A Comprehensive Book Written by Amiya Kumar Bagchi in FourZeeshan JessaniNo ratings yet

- Fidelity Bond Form Attachment BDocument9 pagesFidelity Bond Form Attachment BLucelyn Yruma TurtonaNo ratings yet

- Artifact5 Position PaperDocument2 pagesArtifact5 Position Paperapi-377169218No ratings yet

- Special Economic ZoneDocument7 pagesSpecial Economic ZoneAnonymous cRMw8feac8No ratings yet

- Ikhlayel 2018Document41 pagesIkhlayel 2018Biswajit Debnath OffcNo ratings yet

- Heirs of Extremadura v. Extremadura G.R. No. 211065 - June 15, 2016 FACTS: Jose, Now Deceased, Filed A Case For Quieting of Title With Recovery ofDocument1 pageHeirs of Extremadura v. Extremadura G.R. No. 211065 - June 15, 2016 FACTS: Jose, Now Deceased, Filed A Case For Quieting of Title With Recovery ofJed MacaibayNo ratings yet

- CAPE Accounting 2010 U2 P1Document11 pagesCAPE Accounting 2010 U2 P1jsjkdnckdfcNo ratings yet

- Garage Locator PDFDocument134 pagesGarage Locator PDFMCS SBINo ratings yet

- Chapter 8 Unit 1 - UnlockedDocument21 pagesChapter 8 Unit 1 - UnlockedSanay ShahNo ratings yet

- Ayushman Bharat NewDocument21 pagesAyushman Bharat NewburhanNo ratings yet

- Mediclaim Format 1Document1 pageMediclaim Format 1Urvashi JainNo ratings yet

- Voyage Accounting ExampleDocument4 pagesVoyage Accounting Exampledharmawan100% (1)

- Ethiopia Profile Enhanced Final 7th October 2021Document6 pagesEthiopia Profile Enhanced Final 7th October 2021sarra TPINo ratings yet

- DSA 2016 Malaysian ExhibitorsDocument6 pagesDSA 2016 Malaysian ExhibitorsShenie GutierrezNo ratings yet

- PROVA DE INGLÊS Anpad 2009 JunDocument6 pagesPROVA DE INGLÊS Anpad 2009 JunDavi Zorkot100% (1)

- Industrialisation in RajasthanDocument4 pagesIndustrialisation in RajasthanEditor IJTSRDNo ratings yet

- TYS 2007 To 2019 AnswersDocument380 pagesTYS 2007 To 2019 Answersshakthee sivakumarNo ratings yet

- External Query LetterDocument2 pagesExternal Query LetterRohan RedkarNo ratings yet

- 托福阅读功能目的题1 0Document59 pages托福阅读功能目的题1 0jessehuang922No ratings yet

- Credit by Debraj RayDocument35 pagesCredit by Debraj RayRigzin YangdolNo ratings yet

- Chapter 6-Household BehaviorDocument19 pagesChapter 6-Household BehaviorJAGATHESANNo ratings yet

- Five Year PlanDocument5 pagesFive Year PlanrakshaksinghaiNo ratings yet

- LGS MUN SOCHUM Yemen Crisis ResolutionDocument6 pagesLGS MUN SOCHUM Yemen Crisis ResolutionEmaan AhmadNo ratings yet

- Financial AnalysisDocument2 pagesFinancial AnalysisDemi Jamie LaygoNo ratings yet