Professional Documents

Culture Documents

6.0 Risk Management

Uploaded by

AizuddinHakimBennyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6.0 Risk Management

Uploaded by

AizuddinHakimBennyCopyright:

Available Formats

CHAPTER 6 : Risk Management

6.0

RISK MANAGEMENT

Risk management is the most extensive and indispensable part of project

management. The risk must be perceived by the task project manager

keeping in mind the end goal to distinguish the underlying drivers of risk of

the undertaking as to follow the results towards the achievement of the

venture. Furthermore, risk management is considered as a systematic way

of identifying, analyzing and responding to risks in order to achieve the

project objectives. It is essential from the early stages of a project as major

decisions such as choice of alignment and selection of construction

methods can be influenced. According to Smith (1999), the process of risk

management may be defined as identification of risk, analysis of the

implications, response to minimize risk and allocation to appropriate

contingencies. Risk management is an iterative process in which the

effectiveness of control actions is constantly evaluated, new risks are

discovered, and existing risks are reassessed. This process continues until all

the risks are closed or the project is completed. Risk management process

can give improvement of construction project management processes

and effective use of resources as well as minimizing cost impact, schedule

delays, other issues impact that could delay the project progress. Risk

management process is the basic principle of understanding and

managing risks in a project. It consists of the main phases which are

identification, assessment and analysis, and response (Smith et al. 2006) as

shown in Figure 1 below:

75

CHAPTER 6 : Risk Management

Risk analysis

Risk identification

Risk control

Risk review

Risk response

Figure 6.1 : the process of risks management by Smith etal, 2006

The other idea of risk management in the writing, risk management is described as

a procedure with some predefined methods. The extent of its definition contrasts

among the creators; however the core information is the same. From various

definitions which can be found in the administration writing Cooper et al. (2005)

clarification brings the substance of this idea:

The

risk

management

process

involves

the

systematic

application

of

management policies, processes and procedures to the tasks of establishing the

context, identifying, analyzing, assessing, treating, monitoring and communicating

risks (Cooper et al., 2005).

Therefore, generally risk management process involves four stages which are:

I.

Risk Identification- Risk projects, products and businesses that may be

identified

II.

Risk Analysis- The probability of the assessed

III.

Risk Planning- Plans to mitigate (avoid or reduce)

IV.

Risk Monitoring - Risks are assessed on an on-going basis

76

CHAPTER 6 : Risk Management

Risks

identification

List of potential

risks

Risk

analysis

Prioritized

risks list

Risk

planning

Risk

monitoring

Risk avoidance

& contingency

plans

Risk

assessment

Figure 6.2: the four basic stages in risk management process

These procedures are congruity and rehashed until the project is finished and

decision making from the risk management must be reported in the risk

management plan

Risk Management

Risk is the possibility of loss or injury. Project risk is an uncertain event or

condition that, if it occurs, has an effect on at least one project objective.

Risk management focuses on identifying and assessing the risks to the

project and managing those risks to minimize the impact on the project.

There are no risk-free projects because there are an infinite number of

events that can have a negative effect on the project. Risk management is

not about eliminating risk but about identifying, assessing, and managing

risk.

1. Risk identification that activity should occur throughout the project

management life cycle, but particularly during

a) Creation of the project definition, business case, and scope of work

77

CHAPTER 6 : Risk Management

b) Development of a detailed Work Breakdown Structure (WBS)

c) Preparation of resource, schedule, and cost estimates

d) Establishment of terms and conditions in contracts and subcontracts

e) Selection of subcontractors, vendors, and suppliers

f) Evaluation and execution of contract or technical change requests

2.

Risk quantification should be assigned only when there is reasonable

degree of certainty or confidence in the validity of those metrics.

3.

Risk response strategies applied to reduce or eliminate the

probability of occurrence of a risk event or risk impact.

4.

Risk

Management

Plan

is

prepared

to

document

the

risk

management process such as who is responsible for managing various

areas of project risk, how the initial risk identification, analysis and

prioritization output will be maintained; what the specific response

strategies are, including any contingency plans to be implemented; and

whether a management reserve will be allocated.

6.1

Aim

The purpose of risk management is to identify potential problems before we occur

so that risk-handling activities may be planned and invoked as needed across the

life of the product or project to mitigate adverse impacts on achieving objectives.

6.2

Objective:

Risk management has objectives before and after a loss occurs

1) Pre-loss objectives:

a) Prepare for potential losses in the most economical way

b) Reduce anxiety

c) Meet any legal obligation

2) Post-loss objectives:

a) Ensure survival of the firm

b) Continue operations

c) Stabilize earnings

78

CHAPTER 6 : Risk Management

d) Maintain growth

e) Minimize the effects that a loss will have on other persons and on

society

6.3

Risk Management Process

As said over, this segment will further clarify the Risk Management Process of its

four stages and how it can be utilized as a part of overseeing risks inside of this

project.

6.3.1

Risk Identification

The principal phase of Risk Management Process is fundamentally casual

and can be performed in different routes, contingent upon the association

of the task group. So as to locate the potential risks, an assignment should

be finished. For this situation, the system that has been utilized is to set up

the conceivable risks in this project.

The motivation behind distinguishing risks is to procure a rundown of

potential risks that should be overseen in an undertaking. The risks and

different risks are simpler to take activities and have control over them

once they have been recognized and dispensed before any issues

happened.

From the meeting to generate new ideas with the venture administrator

together with the undertaking group, it was found that under risk

identification method, there are risks that must take into control and

oversaw well. The table #### beneath demonstrates the risks that may

turn out from this project.

Table 6.1: The risks that may come out

Project Risk Aspects

Operational

Significant Risks

Need for making an advertising effort

High staffing costs

Lack of operational and financial

79

CHAPTER 6 : Risk Management

planning

Insufficiently skilled staff

Design

Design not cost effective

Design relies on immature technologies

to achieve performance objectives

Schedule

Schedule does not reflect realistic

acquisition planning

Funding profile not stable from budget

cycle to budget cycle

Schedule objectives not realistic and

attainable

Technology

Design not completed and not feasible

Low

level

of

technological

implementation and training

Technology

has

not

been

demonstrated in required operating

environment.

Cost

Realistic cost objectives not established

early

Fluctuations in cost of raw materials

Funding

profile

does

not

match

acquisition strategy

Supplier Capabilities

Exposure to changes in the price of

goods

Non-determination of the quality of the

service provided

Dispersion in the supply

Increase in power of negotiation

Management

Subordinate strategies and plans are

not developed in a timely manner or

based on the acquisition strategy.

Acquisition strategy does not give

adequate consideration to various

80

CHAPTER 6 : Risk Management

essential elements such as test and

evaluation.

Proper mix (experience, skills, stability)

of people not assigned to the project

Effective

performed

risk

and

assessments

not

the

not

results

understood and acted upon.

Competitors

Lack of operational and financial

planning

Customers

Increase in power of negotiation

Seasonality and decline in the demand

Delays in payment

Environmental

Weather and seasonal implications

Logistical

Availability of sufficient transportation

facilities

Availability

of

resources-particularly

construction equipment spare parts,

fuel and labor

6.3.2

Risk Evaluation

In this stage of risk management, risk evaluation are included the

quantitative and qualitative risks are needed to mention the risks are

involved at the final stages. This is included variety of technique and tool in

analysis of risk evaluation.

6.3.2.1

Qualitative Risk Analysis

This process analyses each risk from the risk register in terms of its probability

and impact on the project if it were to occur. It should be performed as

soon as possible after risks have been identified so that appropriate time

and resources can be allocated to the more serious risks. It uses the

probability and impact matrix (PIM) to rank and prioritize risks, and this

81

CHAPTER 6 : Risk Management

information is placed back on the risk register. Like all the processes within

risk management, this one should be performed regularly because new

risks will be identified and the characteristics of existing risks may change as

the project progresses.

The inputs, tools and techniques, and outputs of this process are

summarized in the table below.

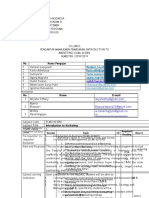

Table 6.2: The inputs, tools and techniques, and outputs of this risk

management process

Inputs

Tools & Techniques

Risk management Plan

Data

gathering

Representation

Outputs

& Project

documents

updates

techniques

Cost management plan

Quantitative risk analysis & modeling techniques

Schedule

management Expert judgment

environment -

plan

Risk register

Enterprise

factors

Organizational

process -

assets

a. Input of Qualitative risk analysis

This process of qualitative risk requires the following inputs:

82

CHAPTER 6 : Risk Management

Risk management plan

This is developed during process and will explain the overall approach that

needs to be taken to risk management on this particular project. It will detail

the amount of risk is acceptable and who should be involved in carrying out

the qualitative analysis of the known risks.

Element of risk

management plan

Budget

Definition of

probability &

Impact

Roles & responsibilities

Risk

management

activities

schedule

Definition risk

categories

Probability &

impact matrix

Stakeholder risk

tolerances

Figure 6.3: Risk management plan

The key elements of this plan used in this process are roles and responsibilities

for conducting risk management, budget, schedule for risk management

activities, definition of risk categories, definition of risk probability and impact,

probability and impact matrix, and stakeholders risk tolerances.

Risk Register

This is the central repository of all of the known risks that are to be analyzed.

Enterprise Environmental Factors

These include industry studies of similar projects by risk specialists and risk

databases from industry or proprietary sources.

Organizational Process Assets

83

CHAPTER 6 : Risk Management

These will include the tools needed to carry out qualitative risk analysis,

policies, procedures and guidelines for risk management, and historical

information including lessons learned from previous projects.

Tool and techniques of Qualitative risk analysis

There are six tools and techniques that can be used:

Risk probability & impact assessment

Probability & impact matrix

Risk data quality assessment

Risk categorization

Risk categorization

Risk urgency assessment

Expert judgment

Risk Probability and Impact Assessment

Risk probability assessment investigates the likelihood that each specific risk will

occur, whereas risk impact assessment investigates the potential effect on a

project objective such as schedule, cost, quality, or performance.

Risk probability= likelihood each risk will occur

Risk impact = looks at potential effect on schedule, cost, quality or performance

Both the likelihood and impact are given a score according to the definitions

given in the risk management plan and these can be considered together to

provide a risk score. Risks with a high score will be given high priority while those

with a low score will be included on a watch list for future monitoring.

Probability and Impact Matrix

Evaluation of each risks importance and, hence, priority for attention can be

done using a probability and impact matrix as shown in table 6.3 below:

84

CHAPTER 6 : Risk Management

Table 6.3: Probability and impact matrix table

Probability and impact matrix

Probability

Threats

Opportunities

0.90

0.05

0.18

0.54

0.72

0.72

0.54

0.18

0.05

0.75

0.04

0.15

0.45

0.60

0.60

0.45

0.15

0.04

0.50

0.03

0.10

0.30

0.40

0.40

0.30

0.10

0.03

0.25

0.01

0.05

0.15

0.20

0.20

0.15

0.05

0.01

0.10

0.01

0.02

0.06

0.08

0.08

0.06

0.02

0.01

Impact

0.05

0.20

0.60

0.80

0.80

0.60

0.20

0.05

This specifies combinations of probability and impact that lead to rating the risks

as low, moderate, or high priority. The type of management response should be:

a)

Threats

I.

High-risk (shown in red boxes) are priority and need a hard line response.

II.

Low-risk (pink boxes) needs to have a contingency made for them & monitored

b)

Opportunities

I.

Red boxes show ones to pursue first as they offer the most benefit & are more easily

achieved.

II.

Pink boxes indicate the ones to be monitored.

It is conceivable to rate a risk independently for expense, time, scope and quality.

Furthermore, it can create approaches to focus one general rating for every risk.

A general rating plan can be produced to mirror the association's inclination for

one target over another and utilizing those inclinations to add to a weighting of

the risk that are evaluated by goal.

85

CHAPTER 6 : Risk Management

Risk Data Quality Assessment

This involves examining how well the risk is understood and the accuracy, quality,

reliability, and integrity of the data regarding it. If data quality is unacceptable, it

may be necessary to gather higher-quality data

Risk Categorization

The risk breakdown structure (RBS) is the normal way to help structure and

organize all identified risks into appropriate categories, and these will assist in

determining which aspects of the project have the highest degree of uncertainty.

Risk Urgency Assessment

Risks that are likely to occur in the immediate future require more urgent attention

than those that may occur later on in the project. Indicators of priority should

include the time required to affect a risk response. In some qualitative analyses

the assessment of risk urgency can be combined with the risk ranking determined

from the probability and impact matrix to give a final risk severity rating.

Expert Judgment

This would relate to experience of the probability and impact of typical risks for

projects of this type and could come from anyone with relevant experience.

Output of Qualitative risk analysis

This process will create the following output:

Qualitative risk

analysis output

Project

document

updates

Project Documents Updates

The risk register can be updated with the following information.

Relative ranking or priority list of project risks - the probability and impact matrix

can be used to classify risks according to their individual significance. Risks may be

listed by priority separately for schedule, cost, and performance since

organizations may value one objective over another. The project manager can

86

CHAPTER 6 : Risk Management

then use the prioritized list of risks to focus attention on those items of high

significance to the most important objectives.

Risks grouped by categories - this can point to common underlying causes of risk,

which may in turn suggest a holistic approach to dealing with them. Discovering

concentrations of risk may also improve the effectiveness of risk responses.

List of risks requiring response in the near-term includes those risks that require an

urgent response and those that can be handled at a later date may be put into

different groups.

List of risks for additional analysis and response - some risks might warrant more

analysis, including Quantitative Risk Analysis, as well as response action.

Watch lists of low-priority risks - those that are not assessed as important in this

process can be placed on a watch list for continued monitoring.

Trends in the analysis results - as this process is iterative, trends for particular types

of risk may become apparent. This information can be fed back into the risk

management process.

6.3.2.2 Quantitative risk analysis

This is the process of analyzing the effect of those risks identified in the previous

process as having the potential to substantially impact the project. It may be used

to assign a numerical rating to those risks individually or to evaluate their

aggregate effect. In some projects it may be possible to develop effective risk

responses without this process. The availability of time and budget, and the need

for qualitative or quantitative statements about risk and impacts, will determine

which method(s) to use.

The inputs, tools and techniques, and outputs of this process are summarized in

the table below.

87

CHAPTER 6 : Risk Management

Table 6.4: The inputs, tools and techniques, and outputs of this risk management

process

Inputs

Tools & Techniques

Risk management Plan

Data

gathering

Outputs

& Project

Representation

documents

updates

techniques

Cost management plan

Quantitative risk analysis

& modeling techniques

Schedule

management Expert judgment

plan

Risk register

Enterprise

environment

factors

Organizational

process

assets

This process of quantitative risk requires the following inputs:

Quantitative risk analysis inputs

Risk management plan

Cost management plan

Schedule management plan

Risk register

Enterprise environmental factors

Organisational process assets

88

CHAPTER 6 : Risk Management

Risk Management Plan

This is developed during process and defines the level of risk which is seen as

acceptable, how risks will be managed, who will be responsible for carrying out

risk related activities, the time and cost of each risk activity and how the

communication of risk is to occur.

Cost Management Plan

Costs are also quantifiable and can be used as an input for this process.

Schedule Management Plan

Schedule timings are presented in a quantifiable manner, which means that risks

that will impact time scales can easily be quantified within this process.

Risk Register

This is the central repository of all of the known risks that are to be analyzed. It was

updated in the previous process to include information on relative ranking,

categorization and urgency of responses.

Enterprise Environmental Factors

These include industry studies of similar projects by risk specialists and risk

databases from industry or proprietary sources.

Organizational Process Assets

These will include the tools needed to carry out qualitative risk analysis, policies,

procedures and guidelines for risk management, and historical information

including lessons learned from previous projects

Tool and techniques of Quantitative Risk analysis

There are three tools and techniques that can be used:

Perform quantitative risk analysis tools

Data gathering & representation techniques

Quantitative risk analysis & modeling

techniques

Expert judgment

89

CHAPTER 6 : Risk Management

Data Gathering and Representation Techniques

Structured interviews can be used to determine be probability and impact of risks

from subject matter experts. This information can then be used in the following

modeling techniques.

Quantitative Risk Analysis and Modeling Techniques

Several techniques can be used including:

Sensitivity Analysis - this involves analyzing the project to determine how sensitive

is to particular risks by analyzing the impact and severity of each risk.

Expected Monetary Value (EMV) Analysis - determining the expected monetary

value is to multiply the likelihood by the cost impact to obtain an expected value

for each risk, these are then added up to obtain the expected monetary value for

the project. A typical way of calculating EMV is using decision trees:

Decision Tree Analysis - these are in the form of a flow diagram where each node,

represented by a rectangle, contains a description of the risk aspect and its cost.

These rectangles are linked together via arrows each arrow leading to another

box representing the percentage probability.

Outcome 1

Event

A

Event

C

Decision

1

Outcome 2

Outcome 3

Outcome 4

Event

B

Decision

2

Outcome 5

90

CHAPTER 6 : Risk Management

Figure 6.4: Decision tree analysis

Expert judgment

Experts give a risk probability &

impact value for:

Optimistic view

Pessimistic view

Realistic view

Rather than ask each expert for a single value for each, the project manager

would normally encourage each experts to provide an optimistic, pessimistic and

realistic probability and impact value for each risk.

Output of Quantitative risk analysis

This process will create the following output:

Project document updates

Quantitative risk

report details:

Quantitative

approaches

Quantitative outputs

Quantitative

recommendations

The risk register is further updated to include a quantitative risk report detailing

quantitative approaches, outputs, and recommendations. Updates include the

following:

Probabilistic analysis of the project. Estimates are made of potential project

schedule and cost outcomes listing the possible completion dates and costs with

their associated confidence levels. This output, often expressed as a cumulative

91

CHAPTER 6 : Risk Management

distribution, can be used with stakeholder risk tolerances to permit quantification

of the cost and time contingency reserves.

Probability of achieving cost and time objectives. With the risks facing the project,

the probability of achieving project objectives under the current plan can be

estimated using quantitative risk analysis results.

Prioritized list of quantified risks. This list of risks includes those that pose the

greatest threat or present the greatest opportunity to the project. These include

the risks that may have the greatest effect on cost contingency and those that

are most likely to influence the critical path. These risks may be identified, in some

cases, through a tornado diagram generated as a result of the simulation

analyses.

Trends in the analysis results. As this process is iterative, trends for particular types

of risk may become apparent. This information can be fed back into the risk

management process.

6.4

Analysing and Prioritizing Risks

Risks analysis expands on the danger data produced in the identification step,

changing over it into choice making data. In the analysing step, three more

components are included to the risk's entrance the master risks list, the risk

probability, effect and impact, and also the exposure. These components permit

operations staff to rank risks, which thusly permit them to direct the most vitality

into dealing with the rundown of top risks.

6.4.1 Risk Probability

Risk probability is a measure of the likelihood that the results portrayed in

the risk statement will really happen and is communicated as a numerical

quality. Risk probability must be more noteworthy than zero, or the risk does

not represent a threat. In like manner, the probability must be under 100

percent, or the risk is a conviction as such, it is a known issue.

92

CHAPTER 6 : Risk Management

Table 6.5: Risk Probability Range - an example of a three-value division for

probabilities.

Probability range

Probability value Natural

used

for

Numeric score

language

calculations

expressions

1% through 33%

17%

Low

34% through 67%

50%

Medium

68% through 99%

84%

High

6.4.2

Risk Impact

Risk impact is an estimate of the severity of adverse effects, the magnitude

of a loss, or the potential opportunity cost should a risk be realized. Risk

impact should be a direct measure of the risk consequence as defined in

the risk statement. It can either be measured in financial terms or with a

subjective measurement scale. If all risk impacts can be expressed in

financial terms, use of financial value to quantify the magnitude of loss or

opportunity cost has the advantage of being familiar to business sponsors.

The financial impact might be long-term costs in operations and support,

loss of market share, short-term costs in additional work, or opportunity cost.

93

CHAPTER 6 : Risk Management

Figure 6.5: Risk impact chart

The corners of the chart have these characteristics:

Low impact/low probability Risks in the bottom left corner are low level,

and you can often ignore them.

Low impact/high probability Risks in the top left corner are of moderate

importance if these things happen, you can cope with them and move

on. However, you should try to reduce the likelihood that they'll occur.

High impact/low probability Risks in the bottom right corner are of high

importance if they do occur, but they're very unlikely to happen. For these,

however, you should do what you can to reduce the impact they'll have if

they do occur, and you should have contingency plans in place just in

case they do.

High impact/high probability Risks towards the top right corner are of

critical importance. These are your top priorities, and are risks that you must

pay close attention to.

The most ideal approach to estimate losses is by a numeric scale which the bigger

the number, the more prominent the effect to the business. The length of all risks

94

CHAPTER 6 : Risk Management

inside of an expert risks rundown utilize the same units of estimation, basic

prioritization methods will work. It is useful to make interpretation tables to change

over particular units, for example, time or cash into qualities that can be

contrasted with the subjective units utilized somewhere else as a part of the

investigation, as showed in the accompanying table. This specific table is a

logarithmic change where the score is generally equivalent to the log10 (RM loss)1.

High values indicate serious loss. Medium values show partial loss or reduced

effectiveness. Low values indicate small or trivial losses. The scoring system for

estimating monetary loss should reflect the organization's values and policies. A

RM 10,000 monetary loss that is tolerable for one organization may be

unacceptable for another.

Table 6.6: Score of Monetary Loss

Score

Monetory loss

Under RM 100

RM 100- RM 1,000

RM 1,000- RM 10,000

RM 10,000- RM 100,000

RM 100,000- RM 1,000,000

RM 1,000,000- RM 10 million

95

CHAPTER 6 : Risk Management

RM 10 million- RM 100 million

RM 100 million- RM 1 billion

RM 1 billion- RM 10 billion

10

Over RM 10 billon

When monetary losses cannot be easily calculated, it may be possible to develop

alternative scoring scales for impact that capture the appropriate services

affected. The following table illustrates a simple example.

Table 6.7: simple example of alternative scoring scales for impact that capture the

appropriate services affected

score

criterion

Schedule impact

Technical impact

Low

Slip 1 week

Slight

effect

on

performance

2

Medium

Slip 2 weeks

Moderate

effect

on performance

3

High

Slip 1 month

Severe effect on

performance

100

Critical

catastrophic

Slip more than 1 Mission cannot be

month

accomplish

Unable to deliver

Mission cannot be

accomplish

96

CHAPTER 6 : Risk Management

6.4.3

Risk Exposure

Most risk professionals define risk in terms of an expected deviation of an

occurrence from what they expectalso known as anticipated variability. In

common English language, many people continue to use the word risk as a

noun to describe the enterprise, property, person, or activity that will be exposed

to losses. In contrast, most insurance industry contracts and education and

training materials use the term exposure to describe the enterprise, property,

person, or activity facing a potential loss. So a house built on the coast near

Galveston, Texas, is called an exposure unit for the potentiality of loss due to a

hurricane. Throughout this text, we will use the terms exposure and risk to note

those units that are exposed to losses.

Risk exposure measures the overall threat of the risk, combining the likelihood of

actual loss (probability) with the magnitude of the potential loss (impact) into a

single numeric value. In the simplest form of quantitative risk analysis, risk exposure

is calculated by multiplying risk probability by impact.

Exposure = Probability x Impact

Risk exposure is the same thing as Risk score, so it is also can be calculated this

way:

RE=RP+RI-(RPxRI)

RE=0.5+0.3-0.5x0.3=0.65

Where:

RE= risks exposure

RP = Risk Probability (which is a number from 0 to 1, 0 means that the risk has no

probability of occurring and 1 means that the risk will definitely occur)

RI = Risk Impact (which is the impact of the risk, also from 0 to 1, 0 means that the

risk has no impact on the project whatsoever and 1 means that the risk has the

97

CHAPTER 6 : Risk Management

highest impact on the project. For example, if a risk has a 50% probability of

occurring and has impact of 0.3 over the project, then the risk Exposure will be

note that RE also ranges between 0 and 1. 0 means that the risk is not critical at all

and does not need to be managed, while 1 means that the risk is very critical.

Sometimes a high-probability risk has low impact and can be safely ignored;

sometimes a high-impact risk has low probability and can be safely ignored. The

risks that have high probability and high impact are the ones most worth

managing, and they are the ones that produce the highest exposure values.

At the point when scores are utilized to evaluate probability and effect, it is now

and then advantageous to make a matrix that considers the conceivable mixes

of scores and afterward doles out them to low-risk, medium-risk, and high-risk

categories. For the utilization of a tripartite lprobabilities score where 1 is low and 3

is high, the conceivable results may be communicated as a table where every

cell is a conceivable quality for risk exxposure. In this game plan, it is anything but

difficult to order risks as low, medium, or high relying upon their position inside of

the table. The accompanying table is a sample indicating probabilities and

impact.

Table 6.8: sample indicating probabilities and impact.

Low impact= 1

Medium impact= 2

High

impact= 3

High probability = 3

Medium probabilty= 2

2

Low probability

The advantage of this tabular format is that it is easy to understand through its use

of colours (red for the high-risk zone in the upper-right corner, green for low risk in

the lower-left corner, and yellow for medium risk along the diagonal). It also uses a

well-defined terminology; "High risk" is easier to comprehend than "high exposure."

98

CHAPTER 6 : Risk Management

Risk analysis provides a prioritized risk list to guide IT operations in risk planning

activities. Within the MOF Risk Management Discipline, this is called the master risks

list (described previously in Risk Lists). Detailed risk information including condition,

context, root cause, and the metrics used for prioritization (probability, impact,

exposure) are often recorded for each risk in the risk statement form.

Risk analysis gives an organized risk list to guide IT operations in risk planning

analysis. Inside of the MOF Risk Management Discipline, this is known as the expert

risk list (depicted beforehand in Risk Lists). Itemized risk information including

condition, context, root cause, and the metrics used for prioritization (probability,

impact, exposure) are frequently recorded for every riskr in the risk statement form.

6.4.4 Risk Factor Charts

A risk factor chart helps the group quickly determine the exposure it faces

for all general categories of risk. One line of such a chart might look like the

row in the following table.

Table 6.9 : Risk Factors

Risk Factors

Early

Aggressive

Domain

Protective Factors

Individual

Self-Control

Behaviour

Lack

of

Parental Family

Parental Monitoring

Supervision

Substance Abuse

Peer

Academic Competence

Drug Availability

School

Anti-drug Use Policies

Poverty

Community

Strong

Neighbourhood

Attachment

99

CHAPTER 6 : Risk Management

6.4.5

Measure financial impact

It is often helpful to roughly estimate impact in financial terms and record

this in addition to the impact's numeric estimate. If several risks have the

same exposure value, then the financial estimate can help determine

which one is most important. Also, the financial data helps in the planning

step to ensure that the cost of preventing a risk is lower than the cost of

incurring the consequences.

It might seem that the financial estimate is preferable and could be used in

place of a numeric value. In practice, however, financial impact values

tend to be a much more labor-intensive way to produce the same top risks

list.

If you decide to use a monetary scale for impact, use it for all risks. If a

particular risk's impact uses a numeric scale and another's impact uses a

monetary scale, then the two cannot be compared to each other, so

there is no way to rank one over the other

6.4.6

Site Area Risk Analysis

1)

Known and Predictable Risk Categories

a) Product size risks associated with overall size of the software to be built

b) Business impact risks associated with constraints imposed by

management or the marketplace

c) Customer characteristics risks associated with sophistication of the

customer and the developer's ability to communicate with the customer

in a timely manner

d) Process definition risks associated with the degree to which the

software process has been defined and is followed

e) Development environment risks associated with availability and quality

of the tools to be used to build the project

f) Technology to be built risks associated with complexity of the system to

be built and the "newness" of the technology in the system

100

CHAPTER 6 : Risk Management

g) Staff size and experience risks associated with overall technical and

project experience of the software engineers who will do the work

Social capital development projects, including road projects, are subject to

various risks throughout their life cycle, from the planning and construction stage

to the maintenance stage, due to long construction and maintenance periods

and wide geographical coverage. For the proper execution of such projects, it is

essential to quantify these risks for their appropriate management.

The access for the residential project only can be assessed by one road that

passes the road of locals owner. From the analysis, the risks that have been

identified are:

a) During

the

construction

phase,

residents

may

be

disrupted

and

inconvenienced by detours, local road closures, dust, noise, and heavy

equipment traffic on existing roads, changes in the level of service, safety

hazards, and interference with emergency services. Occasionally, there is

vibration damage to near-by structures. However, residents may benefit

from construction employment.

b) When the roadway is operational, changes in traffic patterns may increase

or decrease the clients for some businesses and community services.

c) There may be negative impacts for some residents living near the roadway.

These include increased noise, pollution and aesthetic impacts. Some of

these impacts can be mitigated.

d) Residents displaced for the construction of a road may experience

additional impacts such as: economic impact resulting from acquiring new

housing at a new location; social and psychological impacts due to the

disruption of social relationships and establishing relationships in a new

social environment; and, changes in type and tenure of housing

e) Nature of Business. These risks to the enterprise stem from the nature of

business they conduct, the sector in which they operate, and the business

lines, services, and activities they perform. They could affect the top line in

terms of gross revenues or they could affect bottom line in terms of total

costs of business. Top line performance (i.e., total revenues) could be

affected by new competition, shifting demand, an economic recession,

inflation that erodes purchasing power of customers, changes in regulatory

101

CHAPTER 6 : Risk Management

restrictions, technological innovations that render products or services

obsolete, and rising costs that drive up prices and restrict demand. Bottom

line performance could be eroded by increasing operating costs,

increased taxes, increases in existing fees, creation of new fees, increased

labor costs, increased costs of capital that drive up interest payments.

There are involved the salary of worker in residential and commercial

project. Which is involved of several professional:

a) Project manager

b) Building surveyor

c) Construction management

d) Architect

e) Developer

f) Consultant

g) Interior design

h) Quantity surveying

i)

Estate management

f) Cash Solvency Risks. This is the risk that the revenues generated the business

activities and investments are not adequate to cover fixed operating

expenses of the enterprise. This insolvency may not be permanent if the firm

has adequate operating reserves, the ability to take out property or

portfolio level debt, or the ability to raise capital through secondary stock

offerings, asset dispositions or other means to cover short-term imbalances.

g) Interest Rate Risk. This risk is associated with the use of leverage at the

individual property level, at a division or business line, or at the enterprise

level. Depending on the term structure of debt, this risk might cause erosion

in net earnings, negative cash flows, or a capital crisis if refinancing existing

maturing debt at higher rates is not feasible

h) Static Attribute Risks. Real estate is comprised of a bundle of right which

can be enjoyed as a whole or split into parts and transferred, either

temporarily or permanently. Thus, one of the risks associated with the asset

is the risk of claims on those rights that can cloud the title. In addition to

rights, real estate is a physical asset and as such, it subject to risks ranging

from the quality of construction to the adequacy of maintenance.

102

CHAPTER 6 : Risk Management

i)

Linkages Risks. Similarly, the locational nature of real estate and its

dependence on conditions in its market or trade area as well as

connectivity to ancillary uses as part of a larger urban system exposes the

value proposition to changes affecting commuting and transit patterns.

j)

Management Risk. This risk stems from the fact that high cost housing and

commercial investments must be managed over time. In most cases,

property management activity must be proactive, responding to changing

market dynamics and competitive conditions, operating requirements and

rent rolls. In effect, real estate investments are enterprises which require a

continuous, on-going management and sufficient resource commitment

and expertise to maintain value and capture

k) Exit Risk. Exit risk occurs at the eventual point in time when an investor,

tenant or other party seeks to sell or transfer an asset and there is

insufficient demand to acquire the asset at the desired price. This could

occur for a variety of reason ranging from erosion in net income to an

increase in cost of capital and thus hurdle rates by potential investors

6.5

Risk Planning

6.5.1

Risk Identification

A risk is any occasion that could keep the project from going ahead as

arranged, or from fruitful consummation. Risks can be distinguished from

some distinctive sources. Some may be very clear and will be distinguished

before project kickoff.

Others will be distinguished amid the venture lifecycle, and a risk can be

recognized by anybody associated with the project. Some risk will be

manufactured into the project itself, while others will be the consequence

of outside impacts that are totally outside the control of the project group.

The Project Manager has general obligation regarding overseeing project

risk. Project colleagues may be allocated particular territories of obligation

regarding answering to the project manager. All through all periods of the

project, a particular subject of discourse will be risk identification. The

103

CHAPTER 6 : Risk Management

purpose is to educate the project group in the requirement for risk

awareness, identification, documentation and correspondence.

Risk awareness obliges that each project colleague be aware of what

constitutes a risk to the project, and being delicate to particular occasions

or variables that could conceivably affect the project in a positive or

negative way.

Risk identification comprises of figuring out which risks are liable to influence

the project and documenting the qualities of each. Risk communication

includes conveying risk variables or occasions to the consideration of the

project manager and project team. The project manager will recognize

and report known risk variables amid production of the Risk Register.

It is the manager's obligation to help the project group and different

stakeholders with risk identification, and to record the known and potential

risks in the Risk Register. Overhauls to the risk register will happen as risk

variables change. Risk management will be a theme of discourse amid the

routinely booked task gatherings. The project group will talk about any new

risk components or occasions, and these will be surveyed with the project

manager.

The project manager will figure out whether any of the recently

distinguished risk elements or occasions warrants further assessment. Those

that do will experience risk quantification and risk reaction advancement,

as fitting, and the activity thing will be shut.

Whenever amid the project, any risk components or occasions ought to be

conveyed to the consideration of the project manager utilizing Email or

some other type of composed correspondence to report the thing. The

project manager is in charge of logging the risk to the Risk Register.

Warning of another risk ought to incorporate the accompanying Risk

Register components:

Description of the risk component or occasion, e.g. clashing project or

operational activities that place requests on project assets, unforeseen

study results, delays, and so forth.

104

CHAPTER 6 : Risk Management

Probability that the occasion will happen. For instance, a 50% chance

that the seller won't have a creature state that meets the criteria

accessible.

Schedule Impact. The quantity of hours, days, week, or months that a risk

component could affect the timetable. As a case, the creatures require an

extra 3 months to meet age prerequisites.

Scope Impact. The effect the risk will have on the imagined

achievements of the venture. Postponed creature conveyance may bring

about a diminishment in the quantity of studies that can be finished inside

of the agreement time of execution.

Quality Impact. A risk occasion may bring about a lessening in the nature

of work or items that are created. As an illustration, absence of subsidizing

brought about by expense overwhelms may bring about the diminishment

of the study size and effect factual strengthening

Cost Impact. The effect the risk occasion, on the off chance that it

happens is liable to have on the project budget.

6.5.2

Risk Responsibilities

The obligation regarding overseeing risk is shared amongst all the

stakeholders of the project. Be that as it may, decision authority for

selecting whether to continue with moderation procedures and execute

possibility activities, particularly those that have a related expense or asset

prerequisite rest with the Project Manager who is in charge of illuminating

the subsidizing office to focus the necessity for an agreement alteration.

The accompanying tables subtle elements particular obligations regarding

the diverse parts of risk management.

1. Risk Identification: All project stakeholders

2. Risk Registry: Project Manager

3. Risk Assessment: All project stakeholders

4. Risk Response Options Identification: All project stakeholders

5. Risk Response Approval :

105

CHAPTER 6 : Risk Management

Table 6.10 Agencies that involved in project and its function

Agencies involved

Klang Municipal Council (MPK)

Function

Implementing sustainable development

at the local level through local Agenda

21

Klang District Land Office

Manage, plan, and administer the

district and the land and carry out

government

policy

efficiently

and

effectively, systematically according to

the laws in question in line with the

policy of regional development, state

and country.

Public Works Department (JKR)

Serves as a technical advisor in

managing

and

implementing

infrastructure projects in the area.

Planning, design and construction of

infrastructure projects.

Serves as the implementing agency and

technical

consultant

to

the

government.

The main services include technical

consultancy,

project

management

services and maintenance management

services which support the country's

construction

sector,

in

particular

infrastructure works.

Tenaga Nasional Berhad (TNB)

TNBs

core

generation,

activities

are

transmission

the

and

distribution of electricity.

Other activities include repair, test and

maintain the power plants, provide

engineering,

procurement

and

106

CHAPTER 6 : Risk Management

construction of the power plant related

products, installation and manufacture

of high-voltage switches and so on.

SYABAS

To manage, maintain and distribute

clean water around the concession

area.

Urban

and

Regional

Planning

Department (JPBD)

Identifying and ensuring that the

project would be carried out in

accordance with

the development

strategies provided in the RSN or

otherwise.

Monitor developments in the country

through the implementation of Act

172.

National Security Council (MKN)

To defend the country's sovereignty

and strategic interests by monitoring

controls on the zones of invasion.

The

management

disasters

inside

of

and

crises

and

outside

the

country which covers prevention and

mitigation, preparedness for response

and recovery and reconstruction.

Managing land borders, maritime and

air.

6. Risk Contingency Planning; Project Manager(s)

7. Risk Response Management; Project Managers

8. Risk Reporting; Project Manager

107

CHAPTER 6 : Risk Management

6.5.3 RISK ASSESSMENT

Risk assessment is the act of determining the probability that a risk will occur

and the impact that event would have, should it occur. This is basically a

cause and effect analysis. The cause is the event that might occur,

while the effect is the potential impact to a project, should the event

occur.

The last thing that any project will want to face is risks. Projects are

designed to take advantage of resources and opportunities and with

these, come uncertainty, challenges and risk. Hence risk management

becomes a very important key to all project success. The project risk

management plan addresses the process behind risk management and

the risk assessment meeting allows the project team to identify, categorize,

prioritize, and mitigate or avoid these risks ahead of time. Risk assessment is

a step in a risk management procedure. Risk assessment is the

determination of quantitative or qualitative value of risk related to a

concrete situation and a recognized threat. Risk assessment involves

measuring the probability that a risk will become a reality. But in any

project, risk assessment is not a project manager's sole responsibility. A

special meeting has to be conducted to bring in the ideas of the entire

team or at a minimum the following:

Project Manager: Acts as the chairperson and facilitates the risk

assessment meeting

Project Team: The project manager must assign members of the project

team the roles of recorder and timekeeper

Key Stakeholders: Those identified that may bring value in the

identification of project risks or mitigation and avoidance strategies

Subject Matter Experts: Those identified that may specialize in a certain

project activity but are not formally assigned to the project but may add

value

108

CHAPTER 6 : Risk Management

Project Sponsor: May participate depending on the size and scope of the

project

For each of the impact categories the impact assessment should include

consideration of the following areas of impact also:

cost

This impact is usually estimated as a dollar amount that

has a direct impact to the project. However, cost is

sometimes estimated and reported as simply additional

resources, equipment, etc. This is true whenever these

additional resources will not result in a direct financial

impact to the project due to the fact the resources are

loaned or volunteer, the equipment is currently idle and

there is no cost of use, or there are other types of

donations that wont impact the project budget.

Regardless of whether there is a direct cost, the

additional resources should be documented in the risk

statement as part of the mitigation cost

Scope

Whenever there is the potential that the final product

will not be completed as originally envisioned there is a

scope impact. Scope impact could be measured as a

reduction of the number of studies completed, or not

providing a deliverable such as an IND.

Schedule

It is very important to estimate the schedule impact of

a risk event as this often results is the basis for elevating

the

other

impact

categories.

Schedule

delays

frequently result in cost increases and may result in a

reduction of scope or quality. Schedule delays may or

may not impact the critical path of the project and an

associated push out of the final end date.

Performance or Quality

Performance or Quality is frequently overlooked as an

impact category and too often a reduction in quality is

the preferred choice for mitigation of a risk. Short cuts

109

CHAPTER 6 : Risk Management

and low cost replacements are ways of reducing

cost impacts. If not documented appropriately and

approved by the project sponsor, mitigation strategies

that rely upon a reduction in quality can result in

significant disappointment by the stakeholders.

Most risks will be assigned one category, but some might be assigned more than

one, or all.

6.5.4 Phases of Risk Assessment

In many projects, risks are identified and analyzed in a random, brainstorming,

fashion. This is often fatal to the success of the project, as unexpected risks arise,

which have not been assessed or planned for and have to be dealt with on an

emergency basis, rather than be prepared for and defended against in a

planned, measured, manner. It is essential that potential risks are identified,

categorized, evaluated and documented. Rather than look at each risk

independently and randomly, it is much more effective to identify risks and then

group them into categories, or, to draw up a list of categories and then to identify

potential risks within each category. In general, the following are the usually

followed phases in Risk Assessment.

Identifying Risks

The risk assessment process begins with the identification of risk categories. An

organization most likely will have several risk categories to analyze and identify

risks that are specific to the organization. Examples of risk categories include:

Technical or IT risks.

Project management risks.

Organizational risks.

Financial risks.

110

CHAPTER 6 : Risk Management

External risks.

Compliance risks.

For instance, technical risks are associated with the operation of applications or

programs including computers or perimeter security devices (e.g., a computer

that connects directly to the Internet could be at risk if it does not have antivirus

software). An example of a project management risk could be the inadequacy of

the project manager to complete and deliver a project, causing the company to

delay the release of a product to the marketplace. Organizational risks deal with

how the company's infrastructure relates to business operations and the

protection of its assets (e.g., the company does not have clear segregation of

duties between its production and development environments), while financial

risks encompass events that will have a financial impact on the organization (e.g.,

investing the company's cash reserves in a highly speculative investment

scheme). External risks are those events that impactthe organization but occur

outside of its control (e.g., natural disasters such as earthquakes and floods).

Finally, a compliance risk occurs when a company does not comply with

mandated federal regulations, which often results in fines or legal sanctions.

6.5.5

RISK RESPONSE

Risk response is the process of developing strategic options, and

determining actions, to enhance opportunities and reduce threats to the

projects objectives. A project team member is assigned to take

responsibility for each risk response. This process ensures that each risk

requiring a response has an owner monitoring the responses, although the

owner may delegate implementation of a response to someone else.

There are a number of possible responses to risks and as risks can be threats

or opportunities these include responses that are suitable for potential

opportunities. The responses are summarized in the table.

Threats

Opportunities

Avoid

Exploit

111

CHAPTER 6 : Risk Management

Risk can be avoided by removing the

The aim is to ensure that the opportunity

cause of the risk or executing the

is realized. This strategy seeks to eliminate

project in a different way while still

the

uncertainty

associated

with

aiming to achieve project objectives. particular upside risk by making the

Not all risks can be avoided or

opportunity definitely happen. Exploit is

eliminated,

this

an aggressive response strategy, best

approach may be too expensive or

reserved for those golden opportunities

timeconsuming

having high probability and impacts

Transfer

Share

Transferring

and

risk

for

others,

involves

finding Allocate risk ownership of an opportunity

another party who is willing to take

to another party who is best able to

responsibility for its management, and

maximize its probability of occurrence

who will bear the liability of the risk

and increase the potential benefits if it

should it occur. The aim is to ensure

does occur. Transferring threats and

that the risk is owned and managed

sharing opportunities are similar in that a

by the party best able to deal with it

third party is used. Those to whom threats

effectively. Risk transfer usually involves

are transferred take on the liability and

payment of a premium, and the

those

costeffectiveness of

this must be

considered when deciding whether to

to

whom

opportunities

are

allocated should be allowed to share in

the potential benefits.

adopt a transfer strategy. Some or all

of the risk is transferred to a third party

for example insurance.

Mitigate

Enhance

Risk mitigation reduces the probability

This response aims to modify the size

or impact of an adverse risk event to an of the positive risk. The opportunity is

acceptable

threshold.

Taking

early enhanced by increasing its probability

action to reduce the probability and/or

and

impact,

thereby

maximizing

impact of a risk is often more effective

benefits realized for the project. If the

112

CHAPTER 6 : Risk Management

than trying to repair the damage after

probability can be increased to 100

the risk has occurred. Risk mitigation percent, this is effectively an exploit

may require resources or time and thus

response.

presents a tradeoff between doing

nothing versus the cost of mitigating the

risk.

6.5.6

RISK MITIGATION

The risk mitigation involves development of mitigation plans designed to manage,

eliminate, or reduce risk to an acceptable level. Once a plan is implemented, it is

continually monitored to assess its efficacy with the intent of revising the course-ofaction if needed. Risk mitigation includes:

1) Assume/Accept: Acknowledge the existence of a particular risk, and make

a deliberate decision to accept it without engaging in special efforts to

control it. Approval of project or program leaders is required.

2) Avoid: Adjust program requirements or constraints to eliminate or reduce

the risk. This adjustment could be accommodated by a change in funding,

schedule, or technical requirements.

3) Control: Implement actions to minimize the impact or likelihood of the risk.

4) Transfer:

Reassign

organizational

accountability,

responsibility,

and

authority to another stakeholder willing to accept the risk.

5) Watch/Monitor: Monitor the environment for changes that affect the

nature and/or the impact of the risk.

After the risk has been identified and evaluated, the project team develops a risk

mitigation plan, which is a plan to reduce the impact of an unexpected event.

The project team mitigates risks in the following ways:

Risk avoidance

Risk sharing

113

CHAPTER 6 : Risk Management

Risk reduction

Risk transfer

Each of these mitigation techniques can be an effective tool in reducing

individual risks and the risk profile of the project. The risk mitigation plan captures

the risk mitigation approach for each identified risk event and the actions the

project management team will take to reduce or eliminate the risk.

Risk avoidance usually involves developing an alternative strategy that has a

higher probability of success but usually at a higher cost associated with

accomplishing a project task. A common risk avoidance technique is to use

proven and existing technologies rather than adopt new techniques, even

though the new techniques may show promise of better performance or lower

costs.

Risk sharing involves partnering with others to share responsibility for the risk

activities. Many organizations that work on international projects will reduce

political, legal, labor, and others risk types associated with international projects

by developing a joint venture with a company located in that country. Partnering

with another company to share the risk associated with a portion of the project is

advantageous when the other company has expertise and experience the

project team does not have. If the risk event does occur, then the partnering

company absorbs some or all of the negative impact of the event.

Risk reduction is an investment of funds to reduce the risk on a project. On

international projects, companies will often purchase the guarantee of a currency

rate to reduce the risk associated with fluctuations in the currency exchange rate.

A project manager may hire an expert to review the technical plans or the cost

estimate on a project to increase the confidence in that plan and reduce the

project risk. Assigning highly skilled project personnel to manage the high risk

activities is another risk reduction method. Experts managing a high risk activity

can often predict problems and find solutions that prevent the activities from

having a negative impact on the project. Risk transfer is a risk reduction method

that shifts the risk from the project to another party. The purchase of insurance on

114

CHAPTER 6 : Risk Management

certain items is a risk transfer method. The risk is transferred from the project to the

insurance company.

6.5.7

RISK CONTINGENCY PLANNING

Contingency planning is a process of developing advance arrangements and

procedures that enable an organization to respond to an event that could occur

by chance or unforeseen circumstances. Contingency plan is a plan used by an

organization or business unit to respond to a specific systems failure or disruption of

operations. A contingency plan may use any number of resources including

workaround procedures, an alternate work area, a reciprocal agreement, or

replacement resources. A contingency plan is a set of procedures that defines

how a business will continue or recover its critical functions in the event of an

unplanned disruption to normal activities. A contingency plan consists of six main

sections:

Executive Summary

Risk Management Goals

Risk Assessment

Business Impact Analysis

Risk Management Strategies

Plan Maintenance

The project risk plan balances the investment of the mitigation against the benefit

for the project. The project team often develops an alternative method for

accomplishing a project goal when a risk event has been identified that may

frustrate the accomplishment of that goal. These plans are called contingency

plans. The risk of a truck drivers strike may be mitigated with a contingency plan

that uses a train to transport the needed equipment for the project. If a critical

piece of equipment is late, the impact on the schedule can be mitigated by

making changes to the schedule to accommodate a late equipment delivery.

115

CHAPTER 6 : Risk Management

Contingency funds are funds set aside by the project team to address unforeseen

events that cause the project costs to increase. Projects with a high risk profile will

typically have a large contingency budget. Although the amount of contingency

allocated in the project budget is a function of the risks identified in the risk

analysis process, contingency is typically managed as one line item in the project

budget.

Some project managers allocate the contingency budget to the items in the

budget that have high risk rather than developing one line item in the budget for

contingencies. This approach allows the project team to track the use of

contingency against the risk plan. This approach also allocates the responsibility to

manage the risk budget to the managers responsible for those line items. The

availability of contingency funds in the line item budget may also increase the use

of contingency funds to solve problems rather than finding alternative less costly

solutions. Most project managers, especially on more complex projects will

manage contingency funds at the project level with approval of the project

manager required before contingency funds can be used.

Contingency may also be reflected in the project budget, as a line item to cover

unexpected expenses. The amount to budget for contingency may be limited to

just the high probability risks. This is normally determined by estimating the cost if a

risk occurs, and multiplying it by the probability.

6.6

RISK MONITORING

According to Winch, 2002 this final step of Risk Management is vital since all

information about the identified risks is collected and monitored. The continuous

supervision over the Risk Management helps to discover new risks, keep track of

identified risks and eliminate past risks from the risk assessment and project.

6.6.1

The objectives of risk monitoring are to:

1. Systematically track the identified risks

2. Identify any new risks

3. Effectively manage the contingency reserve

116

CHAPTER 6 : Risk Management

4. Capture lessons learned for future risk assessment and allocation efforts

The risk monitoring process occurs after the risk mitigation and planning processes.

It must continue for the life of the project because risks are dynamic. The list of risks

and associated risk management strategies will likely change as the project

matures and new risks develop or anticipated risks disappear.

Occasional project risk reviews repeat the tasks of identification, assessment,

analysis, mitigation and planning. Regularly scheduled project risk reviews can be

used to ensure that project risk is an agenda item at all project development and

construction management meetings. If unanticipated risks emerge or a risk's

impact is greater than expected, the planned response or risk allocation may not

be adequate. At this point, the project team must perform extra reaction wanting

to control the risk.

Risk monitoring and updating tasks can vary depending on unique project goals,

but three tasks should be integrated into design and construction management

plans:

1. Develop consistent and comprehensive reporting procedures.

2. Monitor risk and contingency resolution.

3. Provide feedback of analysis and mitigation for future risk assessment and

allocation.

There are tools and techniques used to risk monitor and control may be:

Risk reassessment identification of new potential risks. This is a constantly

repeated process throughout the whole project.

Monitoring of the overall project status are there any changes in the

project that can effect and cause new possible risks

Status meetings discussions with risks owner, share experience and helping

managing the risks.

Risk register updates

117

You might also like

- Risk Management Plan TemplateDocument17 pagesRisk Management Plan Templaterafael.binder86% (7)

- Risk Management Case StudyDocument3 pagesRisk Management Case StudyVivek WarrierNo ratings yet

- Assignment #3 Risk Assessment 2Document22 pagesAssignment #3 Risk Assessment 2L YagamiNo ratings yet

- Risk Management FrameworkDocument3 pagesRisk Management FrameworkRidawati LimpuNo ratings yet

- Report On EzoneDocument15 pagesReport On EzonehaddinessNo ratings yet

- Formulating, Building, and Running A Monte Carlo Model (Pertmaster)Document18 pagesFormulating, Building, and Running A Monte Carlo Model (Pertmaster)Alexandra- ElenaNo ratings yet

- Risk and Risk ManagementDocument27 pagesRisk and Risk ManagementGürkan SEZEN50% (2)

- Project Risk ManagementDocument77 pagesProject Risk ManagementGishan Sanjeewa100% (4)

- Assignment Project Risk Management - MR Anas Alam FaizliDocument17 pagesAssignment Project Risk Management - MR Anas Alam Faizlisirdukes67% (3)

- Leadership MCQ Questions TBLDocument14 pagesLeadership MCQ Questions TBLsaira tariqNo ratings yet

- Bma5013 Corporate Strategy-Nitin PangarkarDocument4 pagesBma5013 Corporate Strategy-Nitin Pangarkarnedcisa114No ratings yet

- A Practical Approach To Creating A Risk Management PlanDocument4 pagesA Practical Approach To Creating A Risk Management PlanNicoleAbdon0% (1)

- Risk ManagementDocument40 pagesRisk ManagementRajaPal0% (1)

- Risk ManagementDocument26 pagesRisk ManagementRajaPal80% (5)

- Operational Risk ManagementDocument23 pagesOperational Risk Managementmifadzil0% (1)

- Risk ManagementDocument14 pagesRisk ManagementMichelle TNo ratings yet

- Risk Management PolicyDocument1 pageRisk Management PolicyChauhan VineetNo ratings yet

- Risk Management Corporate Quality: 1 - ©2018 ADITYA AUTO PVT LTDDocument21 pagesRisk Management Corporate Quality: 1 - ©2018 ADITYA AUTO PVT LTDSrinivasan VenkatNo ratings yet

- Risk Management Plan Preparation GuidelinesDocument17 pagesRisk Management Plan Preparation Guidelineszenagit123456No ratings yet

- Risk Management ProcessDocument17 pagesRisk Management ProcessUntuk Kegiatan100% (1)

- Risk Assessment Group AssignmentDocument10 pagesRisk Assessment Group AssignmentWinifridaNo ratings yet

- Risk Management in Offshore Construction: Aruna MohanDocument9 pagesRisk Management in Offshore Construction: Aruna Mohanwidayat81No ratings yet

- Risk ManagementDocument10 pagesRisk ManagementShumaila Naz100% (1)

- CH-06 Risk Management: Ayaz Ahmed Shariff K Asst. Professor Dept. of CSE Bitic-Rak-UaeDocument15 pagesCH-06 Risk Management: Ayaz Ahmed Shariff K Asst. Professor Dept. of CSE Bitic-Rak-Uaeayazahmedsk100% (2)

- Risk Management FrameworkDocument20 pagesRisk Management FrameworkArmelAmorNo ratings yet

- Risk ManagementDocument9 pagesRisk ManagementAnabel RubiaNo ratings yet

- Case Study Risk Management: Highland TowerDocument5 pagesCase Study Risk Management: Highland ToweristtNo ratings yet

- Risk ManagementDocument12 pagesRisk ManagementMajor DukeNo ratings yet

- Research Risk App Link ReportDocument57 pagesResearch Risk App Link ReportValerio ScaccoNo ratings yet

- Risk Managment Project ManagmentDocument3 pagesRisk Managment Project ManagmentKamlesh Rampal100% (1)

- Risk Management ProcessDocument27 pagesRisk Management ProcessAnonymous 3H6fFBmNo ratings yet

- PPO TMP RR ProjectRiskRegisterDocument12 pagesPPO TMP RR ProjectRiskRegisterSwadhin PalaiNo ratings yet

- Risk Management PolicyDocument24 pagesRisk Management PolicySHAHEER HASHMINo ratings yet

- Risk ManagementDocument12 pagesRisk ManagementParasYadavNo ratings yet

- 1 Inroduction To Risk ManagementDocument11 pages1 Inroduction To Risk ManagementSuryanarayana DNo ratings yet

- Assignment 1 Project Risk ManagemntDocument21 pagesAssignment 1 Project Risk ManagemntabramNo ratings yet

- Case Study Risk ManagementDocument2 pagesCase Study Risk ManagementJonathanA.RamirezNo ratings yet

- Risk ManagementDocument39 pagesRisk ManagementKaye Salazar100% (1)

- Risk Management ProcessDocument41 pagesRisk Management ProcessRichard Espanola Avena100% (1)

- IOIPG-Enterprise Risk Management Framework PDFDocument56 pagesIOIPG-Enterprise Risk Management Framework PDFpejaaNo ratings yet

- Risk CultureDocument3 pagesRisk Culturevamsi84No ratings yet

- Risk ManagementDocument10 pagesRisk Managementlove0lust100% (2)

- A. N - Bhagat - Risk Officer C.M.Chugh, AGM (Civil) - Resource Person Anand Trivedi, MGR (U&S) - Resource PersonDocument67 pagesA. N - Bhagat - Risk Officer C.M.Chugh, AGM (Civil) - Resource Person Anand Trivedi, MGR (U&S) - Resource PersonAnil100% (1)

- Risk ManagementDocument21 pagesRisk ManagementAndreeaEne100% (2)

- Risk Management in E-BusinessDocument5 pagesRisk Management in E-BusinessTharindu ChathurangaNo ratings yet