Professional Documents

Culture Documents

Cbre

Uploaded by

Anonymous Feglbx5Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cbre

Uploaded by

Anonymous Feglbx5Copyright:

Available Formats

Greater Philadelphia Industrial, Q3 2016

Persistent demand and measured

development stabilize growth

Net Absorption

Vacancy Rate

4.4 Million sq. ft.

Asking Lease Rate (NNN)

6.4 %

$4.19

Sq. ft. (Millions)

Figure 1: Greater Philadelphia Industrial Demand, Supply and Vacancy

Development

13.0 Million sq. ft.

*Arrows indicate change from previous quarter

18

18 (%)

15

15

12

12

3

0

0

2010

2011

2012

2013

2014

Net Absorption

Completions

2015

Vacancy

2016

Source: CBRE Research, Q3 2016.

Vacancy stabilized as the rate of construction

deliveries kept pace with demand growth.

Overall average asking rents continued to climb at a

modest rate while lease comparables reveal more

significant rent growth, specifically for newly

constructed distribution buildings along the 78/81

Corridor.

Speculative construction continues to account for the

majority of development activity. More than 85% of

speculative construction remained available at

quarters end but recent activity suggests that some of

that space will be leased ahead of construction

completion.

Investment sales volume ticked up 25%, quarter-overquarter, with private capital accounting for the

majority of acquisitions during 2016. REIT, crossborder, and institutional investors round out the

remainder of activity as investors of all types

continued to regard industrial product in the

Following a deluge of new product that completed

in early 2016, the subsequent rise in vacancy has

been reversed by recent, robust demand. Given the

new-found balance between supply and demand,

rents persisted in their upward trajectory. And, with

consumer spending rising at a steady pace along

with manufacturers continuing to grow in the

region, demand is poised to maintain its current

growth trajectory. Furthermore, a shrinking supply

of desirable developable land along with holdover

risk-aversion from the Great Recession, current

levels of active construction are lower than their

peak realized at the end of 2015. The confluence of

these factors point toward measured growth across

the industrial market in both inventory and rental

rates. These factors are not lost on investors who

remain focused on acquiring core-stabilized assets

within this market.

Philadelphia region as attractive investment vehicles.

Q3 2016 CBRE Research

2016, CBRE, Inc. |

GREATER PHILADELPHIA INDUSTRIAL

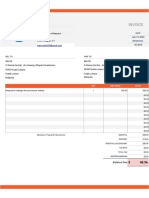

Figure 2: Industrial Market Statistics for All Properties Greater than 100,000 sq. ft.

Inventory

(SF)

Total

Vacancy Rate

(%)

Total

Availability Rate

(%)

Completions

(SF)

Under

Construction

(SF)

Cumberland County, PA

48,673,536

5.9%

6.2%

2,345,628

1,145,047

$4.72

Dauphin County, PA

14,240,054

8.9%

11.8%

362,839

$3.58

Franklin County, PA

11,831,160

2.1%

6.3%

$4.60

Lancaster County, PA

34,859,714

1.1%

1.7%

164,337

$4.16

Lebanon County, PA

5,955,793

32.3%

32.3%

398,250

-117,160

$4.37

York County, PA

45,218,299

5.1%

6.3%

754,881

1,372,821

$3.78

Central PA Subtotal

160,778,556

5.6%

6.7%

3,498,759

2,927,884

$4.31

Berks County, PA

17,928,310

2.3%

5.2%

133,232

728,148

$4.47

Lehigh County, PA

36,782,119

2.2%

3.4%

1,200,000

4,830,000

2,010,650

$4.47

Northampton County, PA

15,265,357

2.5%

3.0%

2,349,375

2,914,336

$5.07

Lehigh Valley PA Subtotal 69,975,786

2.3%

3.7%

1,200,000

7,312,607

5,653,134

$4.63

Lackawanna County, PA

12,203,547

17.8%

18.2%

-236,970

$3.60

Luzerne County, PA

28,599,324

4.6%

5.3%

591,356

1,102,559

$3.67

Monroe County, PA

3,539,901

0.4%

1.3%

-2,300

$4.00

Schuylkill County, PA

6,422,272

9.1%

10.6%

455,000

$3.95

Northeast PA Subtotal

50,765,044

8.1%

8.8%

591,356

1318289

$3.71

Bucks County, PA

27,433,847

7.0%

7.4%

137,827

$4.52

Chester County, PA

12,269,153

2.4%

5.4%

14,397

$3.29

Delaware County

10,605,300

8.2%

9.4%

260,797

$4.00

Montgomery County, PA

30,370,845

5.8%

7.3%

305,733

200,000

551,226

$4.56

Philadelphia County, PA

30,273,441

11.4%

13.9%

145,000

23,705

$3.96

Southeast PA Subtotal

110,952,586

7.5%

9.1%

450,733

200,000

987,952

$4.20

Burlington County, NJ

25,123,872

9.4%

11.8%

1,367,640

2,837,213

$4.15

Camden County, NJ

14,753,405

4.5%

6.2%

600,000

-138,965

$3.39

Gloucester County, NJ

16,059,696

10.4%

13.4%

252,681

$4.15

Southern NJ Subtotal

55,936,973

8.4%

10.8%

1,967,640

2,950,929

$4.04

New Castle County, DE

14,306,828

11.9%

15.7%

253,651

$4.38

TOTAL

462,715,773

6.4%

7.8%

2,242,089

12,979,006

14,091,839

$4.19

Submarket

2016 YTD Total

Avg. Asking

Net Absorption

Lease Rate

(SF)

($NNN/PSF/YR)

Source: CBRE Research, Q3 2016.

Q3 2016 CBRE Research

2016, CBRE, Inc. |

GREATER PHILADELPHIA INDUSTRIAL

ABSORPTION

VACANCY

Vacancy stabilized this quarter as a 70 basis point

drop erased vacancy gains posted earlier in the

year as a function of completed construction. The

lowest vacancy rate this quarter came from the

Lehigh Valley, where only 2.3% of industrial space

remained vacant. To date, of the 14.7 million sq.

ft. of new product added during 2016, 10 million

sq. ft. was absorbed leaving just 4.4 million sq. ft.

of this space available. While a significant amount

of new space was added to the market during Q1

2016, the pace of completions since tended lower

than demand growth, pointing toward stabilized

growth within the region, precluding oversupply

during the short term.

Figure 3: Net Absorption

Sq. ft. (Millions)

Another 4.5 million sq. ft. of demand growth

places year-to-date totals at 15.6 million sq. ft.

From a geographic perspective, demand along the

78/81 Corridor is pushing west toward the 78/81

split in Berks County as tenants struggle to find

space within the Lehigh Valley. Demand for space

within the Lehigh Valley is driven largely by

requirements that need access to New York City.

Whichever tenants have more mid-Atlanticfocused requirements, the move westward along I78 allows for more available product at a lower

lease rate. In Philadelphia and the surrounding

counties, manufacturers drive demand. The

availability of skilled labor accounts for this trend.

8

6

4

2

0

Q3 2014

Q1 2015

Q3 2015

Q1 2016

Q3 2016

Q3 2015

Q1 2016

Q3 2016

Source: CBRE Research, Q3 2016.

Figure 4: Vacancy Rate

(%) 10

9

8

7

6

5

Q3 2014

Q1 2015

Source: CBRE Research, Q3 2016.

Figure 5: Completions

The bulk of construction activity in the

Philadelphia market remains concentrated in the

Lehigh Valley, with 11 buildings under

construction totaling 7,312,607 SF. Land scarcity

as well as tightening development regulations

within the Valley may dampen construction

activity within Lehigh and Northampton Counties

as opposed to softening demand. As such,

developers are eying opportunities further west

along I-78. In southern New Jersey, a few projects

are slated for ground-breaking as recently

completed buildings are enjoying leasing activity.

Q3 2016 CBRE Research

Sq. ft. (Millions)

DEVELOPMENT PIPELINE

16

14

12

10

8

6

4

2

0

2011

2012

2013

2014

2015

2016

Source: CBRE Research, Q3 2016.

2016, CBRE, Inc. |

GREATER PHILADELPHIA INDUSTRIAL

LEASE RATES

CAPITAL MARKETS

Investment sales activity remained stable with the

four-quarter average hovering above the $500

million mark where it sat since the end of last year.

The most active buyers, year-to-date, are private

investors who claim 32.4% of acquisitions.

Institutional, cross-border, REIT, and users

account for a near-equal share of the remaining

activity. Users, specifically, were most active in

Philadelphia or its surrounding counties while the

78/81 Corridor portion of the market continued to

attract the attention of institution and crossborder money.

LABOR MARKET

Industrial employment, which includes

manufacturing, trade, transportation and utilities,

continues to post modest gains in the Greater

Philadelphia region. While this points toward a

healthier regional economy, it also creates

challenges for tenants who require an ample labor

supply for running their operations. And while

factors such as location remain paramount when

distributors review market availabilities, access to

labor is becoming a larger aspect of decision

making when tenants decide on where to locate

new facilities.

Q3 2016 CBRE Research

Per Sq. ft. Per Year ($, NNN)

Figure 6: Industrial Lease Rates

4.25

4.20

4.15

4.10

4.05

4.00

3.95

3.90

3.85

Q3 2014

Q1 2015

Q3 2015

Q1 2016

Q3 2016

Source: CBRE Research, Q3 2016.

Figure 7: Industrial Sales Transactions

($, Millions)

Overall asking rents moved sideways during Q3

2016. On a product-type basis, flex and

manufacturing space posted the largest rent gains,

7.0% and 3.9% respectively, while asking rents for

warehouse space slipped somewhat. For the latter,

recent lease comparables, specifically for Lehigh

Valley warehouse leases, suggest rising rents for

newer distribution space. This trend is not

necessarily seen in asking rent measures as much

of the newer space is leased ahead of delivery,

precluding these prices from the market average

rents of available space. For flex and

manufacturing space, the dearth of development

as well as available modern space is putting

upward pressure on pricing.

700

600

500

400

300

200

100

0

Q1 2009 Q3 2010 Q1 2012 Q3 2013 Q1 2015 Q3 2016

Source: Real Capital Analytics (4-qtr. Average) (Q3 2016 Estimated).

Figure 8: Y-O-Y Industrial Employment Change, Greater

Philadelphia Region

(%) 4

2

0

-2

-4

-6

-8

Jan-07

Apr-09

Jul-11

Oct-13

Jan-16

Source: U.S. Bureau of Labor Statistics.

2016, CBRE, Inc. |

GREATER PHILADELPHIA INDUSTRIAL

CONTACTS

LOCAL OFFICES

Allentown, PA

+1 610 398 6900

Ian Anderson

Director of Research and Analysis

+1 215 561 8997

ian.anderson2@cbre.com

Center City

Philadelphia

Two Liberty Place

+1 215 561 8900

Joseph Gibson

Research Operations Manager

+1 610 727 5922

joseph.gibson@cbre.com

Cira Center

+1 215 921 7400

Mt. Laurel, NJ

+1 856 359 9500

Wayne, PA

+1 610 251 0820

Wilmington, DE

+1 302 661 6700

Greg Dagit

Researcher

+1 610 251 5182

gregory.dagit@cbre.com

Harrisburg, PA

+1 717 540 2700

Conshohocken, PA

+1 610 834 8000

To learn more about CBRE Research,

or to access additional research reports,

please visit the Global Research Gateway at

www.cbre.com/researchgateway.

Disclaimer: Information contained herein, including projections, has been obtained from sources believed to be reliable. While we do not doubt its accuracy, we have not

verified it and make no guarantee, warranty or representation about it. It is your responsibility to confirm independently its accuracy and completeness. This information is

presented exclusively for use by CBRE clients and professionals and all rights to the material are reserved and cannot be reproduced without prior written permission of CBRE.

You might also like

- CIO Bulletin - DiliVer LLC (Final)Document2 pagesCIO Bulletin - DiliVer LLC (Final)Anonymous Feglbx5No ratings yet

- Progress Ventures Newsletter 3Q2018Document18 pagesProgress Ventures Newsletter 3Q2018Anonymous Feglbx5No ratings yet

- Houston's Office Market Is Finally On The MendDocument9 pagesHouston's Office Market Is Finally On The MendAnonymous Feglbx5No ratings yet

- The Woodlands Office Submarket SnapshotDocument4 pagesThe Woodlands Office Submarket SnapshotAnonymous Feglbx5No ratings yet

- 4Q18 Houston Local Apartment ReportDocument4 pages4Q18 Houston Local Apartment ReportAnonymous Feglbx5No ratings yet

- THRealEstate THINK-US Multifamily ResearchDocument10 pagesTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5No ratings yet

- 4Q18 North Carolina Local Apartment ReportDocument8 pages4Q18 North Carolina Local Apartment ReportAnonymous Feglbx5No ratings yet

- ValeportDocument3 pagesValeportAnonymous Feglbx5No ratings yet

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterDocument6 pagesHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5No ratings yet

- 4Q18 Washington, D.C. Local Apartment ReportDocument4 pages4Q18 Washington, D.C. Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Atlanta Local Apartment ReportDocument4 pages4Q18 Atlanta Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Boston Local Apartment ReportDocument4 pages4Q18 Boston Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 South Florida Local Apartment ReportDocument8 pages4Q18 South Florida Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 New York City Local Apartment ReportDocument8 pages4Q18 New York City Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Philadelphia Local Apartment ReportDocument4 pages4Q18 Philadelphia Local Apartment ReportAnonymous Feglbx5No ratings yet

- 4Q18 Dallas Fort Worth Local Apartment ReportDocument4 pages4Q18 Dallas Fort Worth Local Apartment ReportAnonymous Feglbx5No ratings yet

- 3Q18 Philadelphia Office MarketDocument7 pages3Q18 Philadelphia Office MarketAnonymous Feglbx5No ratings yet

- Asl Marine Holdings LTDDocument28 pagesAsl Marine Holdings LTDAnonymous Feglbx5No ratings yet

- Wilmington Office MarketDocument5 pagesWilmington Office MarketWilliam HarrisNo ratings yet

- Fredericksburg Americas Alliance MarketBeat Industrial Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Industrial Q32018Anonymous Feglbx5No ratings yet

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLDocument7 pagesUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5No ratings yet

- 2018 U.S. Retail Holiday Trends Guide - Final PDFDocument9 pages2018 U.S. Retail Holiday Trends Guide - Final PDFAnonymous Feglbx5No ratings yet

- Fredericksburg Americas Alliance MarketBeat Office Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsDocument9 pagesMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Retail Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Retail Q32018 FINALAnonymous Feglbx5No ratings yet

- Fredericksburg Americas Alliance MarketBeat Retail Q32018Document1 pageFredericksburg Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALDocument1 pageRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5No ratings yet

- Hampton Roads Americas Alliance MarketBeat Office Q32018Document2 pagesHampton Roads Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 1 Strategy Udemy Final PDFDocument12 pages1 Strategy Udemy Final PDFRahmat Taufiq SigitNo ratings yet

- Econ DevDocument40 pagesEcon DevLhowella AquinoNo ratings yet

- NetscapeDocument6 pagesNetscapeAnuj BhattNo ratings yet

- Project AppraisalDocument6 pagesProject AppraisalRohan ChauhanNo ratings yet

- Investment Appraisal Techniques SOHO BarDocument6 pagesInvestment Appraisal Techniques SOHO BarvermannieNo ratings yet

- Sekai 09Document1 pageSekai 09Micaela EncinasNo ratings yet

- Submitted By: Sheila Mae M. Mendoza Submitted To: Ezekiel L. Turgo, CPADocument7 pagesSubmitted By: Sheila Mae M. Mendoza Submitted To: Ezekiel L. Turgo, CPAShei MendozaNo ratings yet

- Daqo New Energy CorpDocument154 pagesDaqo New Energy Corpdkdude007No ratings yet

- Foreword by The Presidential CandidateDocument67 pagesForeword by The Presidential Candidatecijoe2006No ratings yet

- #Test Bank - Adv Acctg 2 - PDocument43 pages#Test Bank - Adv Acctg 2 - PJames Louis BarcenasNo ratings yet

- Corporate Finance Homework 3Document4 pagesCorporate Finance Homework 3Thao PhamNo ratings yet

- Shawarma 1Document25 pagesShawarma 1Leonel VidalNo ratings yet

- MBH Reference Materials Catalogue GuideDocument112 pagesMBH Reference Materials Catalogue GuideCristian WalkerNo ratings yet

- Nature and Scope of MarketingDocument61 pagesNature and Scope of MarketingUsman KokabNo ratings yet

- Foreign currency futures and options explainedDocument27 pagesForeign currency futures and options explainedBunyamin JosoephNo ratings yet

- Credit Note On Reliance Power LimitedDocument5 pagesCredit Note On Reliance Power LimitedPenFriendNo ratings yet

- How To Manage Inventory FIFO LIFO AVCO Small Business Guides Xero (.SRT)Document5 pagesHow To Manage Inventory FIFO LIFO AVCO Small Business Guides Xero (.SRT)Nurainin AnsarNo ratings yet

- Invoice 02Document1 pageInvoice 02Frank WalterNo ratings yet

- Value Added TaxDocument6 pagesValue Added Taxarjohnyabut80% (10)

- 1Document5 pages1Absolute ZeroNo ratings yet

- Mountain Man Brewing CompanyDocument1 pageMountain Man Brewing Companynarender sNo ratings yet

- DisneyDocument16 pagesDisneyAnonymous Ht0MIJ100% (1)

- Leverage and Capital StructureDocument50 pagesLeverage and Capital Structurelj gazzinganNo ratings yet

- Software Development Contract Template8Document2 pagesSoftware Development Contract Template8Felix Mokua OsanoNo ratings yet

- Retail LocationDocument26 pagesRetail Locationishajain11No ratings yet

- McDonalds Pricing StrategyDocument5 pagesMcDonalds Pricing StrategyMukul Attri100% (1)

- DRM-CLASSWORK - 11th JuneDocument2 pagesDRM-CLASSWORK - 11th JuneSaransh MishraNo ratings yet

- 11.1 Probabilistic Risk Analysis - Examples - With NotesDocument6 pages11.1 Probabilistic Risk Analysis - Examples - With NotesFlora LinNo ratings yet

- SB I / I B PS CLERK PRELI M S & K DCC CLERK -M ODEL TEST-15Document12 pagesSB I / I B PS CLERK PRELI M S & K DCC CLERK -M ODEL TEST-15Harsha B RNo ratings yet

- Acca Afm (P4)Document36 pagesAcca Afm (P4)SamanMurtazaNo ratings yet