Professional Documents

Culture Documents

LT - 081914

Uploaded by

Jun Guerzon PaneloCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

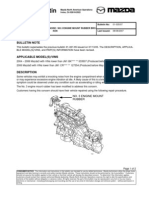

LT - 081914

Uploaded by

Jun Guerzon PaneloCopyright:

Available Formats

B

MANAGEMENT ACCOUNTING

NAME1

LONG TEST 08/19/14

NAME2

PART 1 - MULTIPLE CHOICES: Write only the LETTER of the correct answer. (1-POINT EACH)

1 . If a firm uses variable costing, fixed manufacturing overhead will be included

a. only on the balance sheet.

b. only on the income statement.

c. on both the balance sheet and income statement.

d. on neither the balance sheet nor income statement.

2 . A firm presently has total sales of P100,000. If its sales rise, its

a. net income based on variable costing will go up more than its net

income based on absorption costing.

b. net income based on absorption costing will go up more than its net

income based on variable costing.

c. fixed costs will also rise.

d. per unit variable costs will rise.

3 . The term cost driver refers to

a. any activity that can be used to predict cost changes.

b. the attempt to control expenditures at a reasonable level.

c. the person who gathers and transfers cost data to the management

accountant.

d. any activity that causes costs to be incurred.

4 . Consider the equation X = Sales - [(CM/Sales) * (Sales)]. What is X?

a. net income

b. fixed costs

c. contribution margin

d. variable costs

5 . Which of the following statements is true for a firm that uses

variable (direct) costing?

a. The cost of a unit of product changes because of changes in the

number of units manufactured.

b. Profits fluctuate with sales

c. An idle facility variation is calculated

d. Product costs include direct (variable) administrative costs.

6 . The use of variable costing requires knowing

a. the contribution margin and break-even point for each product.

b. the variable and fixed components of production cost.

c. controllable and noncontrollable components of all costs.

d. the number of units of each product produced during the period.

7 . Advocates of variable costing for internal reporting purposes do NOT rely on which of the ff.

points?

a. The matching concept.

b. Price-volume relationships.

c. Absorption costing does not include selling and administrative expenses as part of

inventoriable cost.

d. Production influences income under absorption costing.

8 . If selling price, per-unit variable cost, and total fixed costs are constant,

a. the break-even point in units remains constant.

b. profit per unit remains constant for all levels of volume within the relevant range.

c. total variable costs equal total fixed costs.

d. total contribution margin equals total fixed costs.

9 . Introducing income taxes into cost-volume-profit analysis

a. raises the break-even point.

b. lowers the break-even point.

c. increases unit sales needed to earn a particular target profit.

d. decreases the contribution margin percentage.

10 . If a company is earning a profit, its fixed costs

a. are less than total contribution margin.

b. are equal to total contribution margin.

c. are greater than total variable costs.

d. can be greater than or less than total contribution margin.

11 . Per-unit variable cost

a. remains constant within the relevant range.

b. increases as volume increases within the relevant range.

c. decreases as volume increases within the relevant range.

d. decreases if volume increases beyond the relevant range.

12 . An increase in the income tax rate

a. raises the break-even point.

b. lowers the break-even point.

c. decreases sales required to earn a particular after-tax profit.

d. increases sales required to earn a particular after-tax profit.

PART 2 - PROBLEM SOLVING: Solve the following independent problems. (2-POINT EACH)

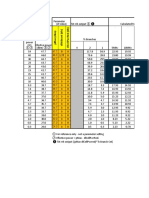

33,333

30.00

16,250.00

300,000.00

0.25

48.30%

1 . Jaime has sales of P200,000, fixed costs of P100,000, and a profit of P20,000. What is

Jaime's margin of safety in Pesos?

2 . George Company desires a profit of P120,000 and expects to sell 20,000 units. Variable cost

per unit is P15 and total fixed costs are P160,000. Compute for the Selling Price.

3 . Selling price is P100, unit variable cost is P68, and fixed costs are P400,000. Unit sales

required to earn a P120,000 profit are?

4 . Fap Enterprises has fixed costs of P120,000. At a sales of P400,000, return on

sales is 10%; at a P600,000 sales, return on sales is 20%. What is the break-even

sales?

5 . At its present level of operations, a small manufacturing firm has total variable costs equal to

75% of sales and total fixed costs equal to 15% of sales. Based on variable costing,

if sales change by P1.00, income will be decreased by how much?

6 . Luffy Inc. sells three products with the following results:

X

Y

Z

Sales

P 10,000.00 20,000.00 30,000.00

VC

P 4,000.00 12,000.00 15,000.00

What is the weighted average contribution margin percentage?

500000

193,000.00

8800

7 . The Didang Company has an operating leverage of 2. Sales for 2013 are P2,000,000 with a

contribution margin of P1,000,000. Sales are expected to be P3,000,000 in 2014.

Net income for 2014 can be expected to increase by what amount over 2001?

8 . YYY Company had P200,000 income using absorption costing. YYY has no variable mfg. costs.

Beg. inventory was P15,000 and ending inventory was P22,000. Income under variable costing

would have been?

9 . Babe Company produces a single product. Last year, Babe's net operating income under

absorption costing was P3,600 lower than under variable costing. The company sold

10,000 units during the year, and its variable costs were P9 per unit, of which P1 was

variable selling expense. If production cost was P11 per unit under absoprtion costing,

then how many units did the company produce during the year?

25556

1900000

20%

80000

3000

30%

0.25

7 .

225000

8 .

72000

9 .

432000

10 .

500000

11

If the following data are estimated for next year, what unit sales would be needed to earn P 150,000

after taxes?

Forecast sales (P 30 per unit) P 600,000

Variable costs 240,000

Manufacturing fixed costs 90,000

Administrative fixed costs 120,000

Assumed tax rate 40%

A firm estimates that it will sell 100,000 units of its sole product in the coming period. It

projects the sales price at $40 per unit, the CM ratio at 60 percent, and profit at

$500,000. What is the firm budgeting for fixed costs in the coming period?

Sombrero Company manufactures a western-style hat that sells for $10 per unit. This is

its sole product and it has projected the break-even point at 50,000 units in the coming

period. If fixed costs are projected at $100,000, what is the projected contribution

margin ratio?

The Ship Company is planning to produce two products, Alt and

Tude. Ship is planning to sell 100,000 units of Alt at P4 a unit and

200,000 units of Tude at P3 a unit. Variable costs are 70% of sales

for Alt and 80% of sales for Tude. In order to realize a total profit of

P160,000, what must the total fixed costs be?

A manufacturer produces a product that sells for P10 per unit.

Variable costs per unit are P6 and total fixed costs are P12,000. At

this selling price, the company earns a profit equal to 10% of total

peso sales. By reducing its selling price to P9 per unit, the

manufacturer can increase its unit sales volume by 25%. Assume

that there are no taxes and that total fixed costs and variable costs

per unit remain unchanged. If the selling price were reduced to P9

per unit, the profit would be

Last year, the marginal contribution rate of Lamesa Company was

30%. This year, fixed costs are expected to be P120,000, the same

as last year, and sales are forecasted at P550,000 a 10% increase

over last year. For the company to increase income by P15,000 in

the coming year, the marginal contribution margin rate must be

At its present level of operations, a small manufacturing firm has

total variable costs equal to 75% of sales and total fixed costs equal

to 15% of sales. Based on variable costing, if sales change by

P1.00, income will be decreased by how much?

Scrambled Brain Company has fixed costs of P90,000. At a sales

volume of P300,000, return on sales is 10%; at a P500,000 volume,

return on sales is 22%. What is the break-even volume?

Claremont Company had is a manufacturer of its only one product

line. It had sales of P400,000 for 2002 with a contribution margin

ratio of 20 percent. Its margin of safety ratio was 10 percent. What

are the companys fixed costs?

Lemery Corporation had sales of P120,000 for the month of May. It

has a margin of safety ratio of 25 percent, and after-tax return on

sales of 6 percent. The company assumes its sales constant every

month. If the tax rate is 40 percent, how much is the monthly fixed

costs?

The Didang Company has an operating leverage of 2. Sales for

2001 are P2,000,000 with a contribution margin of P1,000,000.

Sales are expected to be P3,000,000 in 2002. Net income for 2002

can be expected to increase by what amount over 2001?

uld be needed to earn P 150,000

he coming period. It

and profit at

r $10 per unit. This is

0 units in the coming

ed contribution

s

vc

cn

fc

p

2000

300

99

120

90

30

24.75

90

-65.25

3000

0.5

1000

500

500

2

1000

1

You might also like

- Midterm - Set ADocument8 pagesMidterm - Set ACamille GarciaNo ratings yet

- SEATWORKDocument4 pagesSEATWORKMarc MagbalonNo ratings yet

- (At) 01 - Preface, Framework, EtcDocument8 pages(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodNo ratings yet

- MA2E Relevant Cost ExercisesDocument6 pagesMA2E Relevant Cost ExercisesRolan PalquiranNo ratings yet

- Management Advisory Services Solution to ProblemDocument13 pagesManagement Advisory Services Solution to ProblemMIKKONo ratings yet

- MASDocument46 pagesMASKyll Marcos0% (1)

- GP Variance SmartsDocument6 pagesGP Variance SmartsKarlo D. ReclaNo ratings yet

- CF Quiz AprilDocument5 pagesCF Quiz Aprilsumeet9surana9744100% (1)

- Hansen Aise Im Ch16Document55 pagesHansen Aise Im Ch16Daniel NababanNo ratings yet

- Coma Quiz 6 KeyDocument20 pagesComa Quiz 6 KeyMD TARIQUE NOORNo ratings yet

- Vertical Analysis To Financial StatementsDocument8 pagesVertical Analysis To Financial StatementsumeshNo ratings yet

- Cost-Volume-Profit Analysis: 2,000 Units and $100,000 of RevenuesDocument14 pagesCost-Volume-Profit Analysis: 2,000 Units and $100,000 of RevenuesMa. Alexandra Teddy BuenNo ratings yet

- Chapter 9 Financial Reporing in Hyperinflationary EconomiesDocument28 pagesChapter 9 Financial Reporing in Hyperinflationary EconomiesCatherine AcutimNo ratings yet

- Exam On Strategic ManagementDocument11 pagesExam On Strategic Managementeulhiemae arongNo ratings yet

- JCPenney Strategy DisasterDocument2 pagesJCPenney Strategy DisasterMariya BhavesNo ratings yet

- Math 006B - Module 4 HypothesisDocument4 pagesMath 006B - Module 4 Hypothesisaey de guzmanNo ratings yet

- Activity # 1: Management Advisory Services Part 1Document2 pagesActivity # 1: Management Advisory Services Part 1Vince BesarioNo ratings yet

- Accountancy Refresher Course on Quantitative TechniquesDocument4 pagesAccountancy Refresher Course on Quantitative Techniquesshamel marohom100% (2)

- MA2 04 Relevant Costing Problem 20Document4 pagesMA2 04 Relevant Costing Problem 20Joy Deocaris100% (1)

- Impact of ASEAN Integration on Philippine Accountancy ProfessionDocument8 pagesImpact of ASEAN Integration on Philippine Accountancy ProfessionMark Stanley PangoniloNo ratings yet

- Ma Chapter 5 New Multiple Choice For TestbankDocument4 pagesMa Chapter 5 New Multiple Choice For TestbankJimmy Jamero Jr.100% (1)

- Marion, Danielle Eliza - FINMANDocument1 pageMarion, Danielle Eliza - FINMANelizaNo ratings yet

- TIP Relevant Costing Ex TipDocument10 pagesTIP Relevant Costing Ex TipmaurNo ratings yet

- Conceptual FinalDocument6 pagesConceptual FinalKelsey LorrinNo ratings yet

- MAS Handout CH4 DiffCostAnaDocument2 pagesMAS Handout CH4 DiffCostAnaAbigail TumabaoNo ratings yet

- MAS1Document46 pagesMAS1Frances Bernadette BaylosisNo ratings yet

- Finman Final Exam ProblemDocument10 pagesFinman Final Exam ProblemJayaAntolinAyusteNo ratings yet

- Chapter 2 BLKDocument6 pagesChapter 2 BLKMinoo ShaikhNo ratings yet

- MASDocument2 pagesMASAnnaNo ratings yet

- Exercises For Accounting For Merchandise StoresDocument4 pagesExercises For Accounting For Merchandise StoresAnne Dorene ChuaNo ratings yet

- ABC and Standard CostingDocument16 pagesABC and Standard CostingCarlo QuinlogNo ratings yet

- Managerial Accounting Chapter 15 AnalysisDocument175 pagesManagerial Accounting Chapter 15 AnalysismostfaNo ratings yet

- NFJPIA - Mockboard 2011 - MAS PDFDocument7 pagesNFJPIA - Mockboard 2011 - MAS PDFDanica PelenioNo ratings yet

- ACR 107 Management Advisory Services ReviewDocument102 pagesACR 107 Management Advisory Services ReviewPatrick Kyle AgraviadorNo ratings yet

- Relevant Costing Concepts for Short-Term Decision MakingDocument5 pagesRelevant Costing Concepts for Short-Term Decision MakingPATRICIA PEREZ100% (1)

- CH 19Document29 pagesCH 19Emey CalbayNo ratings yet

- Tina and KimDocument3 pagesTina and KimAngelli LamiqueNo ratings yet

- Final Exam in 201Document42 pagesFinal Exam in 201ME ValleserNo ratings yet

- Mas Test Bank QuestionDocument20 pagesMas Test Bank QuestionAsnor RandyNo ratings yet

- 08 - Activity Based Costing and Balance ScorecardDocument4 pages08 - Activity Based Costing and Balance ScorecardMarielle CastañedaNo ratings yet

- AFAR Review Midterm ExamDocument10 pagesAFAR Review Midterm ExamZyrah Mae SaezNo ratings yet

- HP: The Mark Hurd Saga: Case OverviewDocument9 pagesHP: The Mark Hurd Saga: Case OverviewZoo HuangNo ratings yet

- UntitledDocument20 pagesUntitledapriljoyguiawanNo ratings yet

- Accountin 07-07 Cost Acctg 1Document11 pagesAccountin 07-07 Cost Acctg 1Yella Mae Pariña RelosNo ratings yet

- 13 Consolidated Financial StatementDocument5 pages13 Consolidated Financial StatementabcdefgNo ratings yet

- Management Accounting Information For Activity and Process DecisionsDocument30 pagesManagement Accounting Information For Activity and Process DecisionsCarmelie CumigadNo ratings yet

- ACC 349 - Week 5 - Final ExamDocument16 pagesACC 349 - Week 5 - Final ExamShelly ElamNo ratings yet

- Chapter 9 Part 1 Input VatDocument25 pagesChapter 9 Part 1 Input VatChristian PelimcoNo ratings yet

- Tactical DecisionDocument2 pagesTactical DecisionLovely Del MundoNo ratings yet

- AP, AT, MS, TAX Topics for CPA ReviewDocument8 pagesAP, AT, MS, TAX Topics for CPA Reviewmommel53150% (6)

- Study ProbesDocument48 pagesStudy ProbesRose VeeNo ratings yet

- Installment Sales & Long-Term ConsDocument6 pagesInstallment Sales & Long-Term ConsSirr JeyNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisDianne BausaNo ratings yet

- MAS 03 CVP AnalysisDocument4 pagesMAS 03 CVP AnalysisJoelyn Grace MontajesNo ratings yet

- MIDTERM EXAMINATION SET B TRACING NO. MULTIPLE CHOICE QUESTIONSDocument7 pagesMIDTERM EXAMINATION SET B TRACING NO. MULTIPLE CHOICE QUESTIONSCamille Garcia100% (1)

- Correct Answers: 7500: CVP Analysis Chapter QuizDocument30 pagesCorrect Answers: 7500: CVP Analysis Chapter QuizABCNo ratings yet

- Managerial Economics - Midterm Assignment No. 1 (CVP Analysis)Document5 pagesManagerial Economics - Midterm Assignment No. 1 (CVP Analysis)Ronel CaagbayNo ratings yet

- MAS 5 - CVPA ExercisesDocument4 pagesMAS 5 - CVPA ExercisesAngela Miles DizonNo ratings yet

- Cost Volume Profit AnalysisDocument18 pagesCost Volume Profit AnalysisLea GaacNo ratings yet

- Bdocs ManualDocument14 pagesBdocs ManualJun Guerzon PaneloNo ratings yet

- Pet Grooming Salon ServicesDocument18 pagesPet Grooming Salon ServicesJun Guerzon PaneloNo ratings yet

- BSc Business Marketing Salon PetsDocument4 pagesBSc Business Marketing Salon PetsJun Guerzon PaneloNo ratings yet

- Bookkeeping Contract - Gamboa CompaniesDocument4 pagesBookkeeping Contract - Gamboa CompaniesJun Guerzon Panelo100% (1)

- KAP Exercise 5 To DoDocument1 pageKAP Exercise 5 To DoJun Guerzon PaneloNo ratings yet

- Abic PosterDocument1 pageAbic PosterJun Guerzon PaneloNo ratings yet

- Sworn Declaration for Inventory SchedulesDocument2 pagesSworn Declaration for Inventory SchedulesPatrick DazaNo ratings yet

- Pet Grooming Salon ServicesDocument18 pagesPet Grooming Salon ServicesJun Guerzon PaneloNo ratings yet

- Schedules of MeetingsDocument1 pageSchedules of MeetingsJun Guerzon PaneloNo ratings yet

- Bookkeeping Contract - Gamboa CompaniesDocument4 pagesBookkeeping Contract - Gamboa CompaniesJun Guerzon Panelo100% (1)

- ShortageDocument1 pageShortageJun Guerzon PaneloNo ratings yet

- Audit Planning ProcessDocument7 pagesAudit Planning ProcessJun Guerzon PaneloNo ratings yet

- Schedules of MeetingsDocument1 pageSchedules of MeetingsJun Guerzon PaneloNo ratings yet

- Audit Report SampleDocument44 pagesAudit Report SampleJun Guerzon PaneloNo ratings yet

- Accounting System WordingsDocument3 pagesAccounting System WordingsJun Guerzon PaneloNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Basic Accounting ModuleDocument4 pagesBasic Accounting ModuleHazel Joy Batocail100% (1)

- AuditDocument30 pagesAuditLeah Dorothy Roque SamboNo ratings yet

- Application Form For Junior Research Fellow (JRF)Document2 pagesApplication Form For Junior Research Fellow (JRF)Dark_loveNo ratings yet

- Accounting Firm Marketing PlanDocument49 pagesAccounting Firm Marketing PlanPalo Alto Software100% (9)

- PORTER Five Forces FrameworkDocument33 pagesPORTER Five Forces FrameworkSIPIROKNo ratings yet

- International Finance ManagementDocument15 pagesInternational Finance ManagementGirish Harsha100% (2)

- Basic Accounting LectureDocument56 pagesBasic Accounting LectureJun Guerzon PaneloNo ratings yet

- PWC Agricultural Assets AccountingDocument24 pagesPWC Agricultural Assets Accountingfaheemshelot100% (1)

- Financial Ratio AnalysisDocument5 pagesFinancial Ratio AnalysisJun Guerzon PaneloNo ratings yet

- Accounting Basics TutorialDocument108 pagesAccounting Basics TutorialSravan WudayagiriNo ratings yet

- From Market Driven To Market DrivingDocument7 pagesFrom Market Driven To Market DrivingJun Guerzon PaneloNo ratings yet

- Chap 4 Social Systems and Organizational CultureDocument11 pagesChap 4 Social Systems and Organizational Cultureflorenzs100% (32)

- Social Responsibility School PDFDocument18 pagesSocial Responsibility School PDFJun Guerzon PaneloNo ratings yet

- CSR Expo 2015 profiles Aboitiz Foundation, EDC projectsDocument20 pagesCSR Expo 2015 profiles Aboitiz Foundation, EDC projectsJun Guerzon PaneloNo ratings yet

- 12soal Uas - K.99 - Raditya - Bahasa Inggris Hukum (1) - 1Document3 pages12soal Uas - K.99 - Raditya - Bahasa Inggris Hukum (1) - 1Brielle LavanyaNo ratings yet

- Writing Patterns NotesDocument2 pagesWriting Patterns NoteslwitsfadontNo ratings yet

- Housekeeping ProcedureDocument3 pagesHousekeeping ProcedureJeda Lyn100% (1)

- Listening & Speaking Test_Unit 6 ReviewDocument4 pagesListening & Speaking Test_Unit 6 ReviewMaii PhươngNo ratings yet

- Principles of Clinical Chemistry Automation and Point-of-Care TestingDocument27 pagesPrinciples of Clinical Chemistry Automation and Point-of-Care TestingMalliga SundareshanNo ratings yet

- Science and Technology Study Material For UPSC IAS Civil Services and State PCS Examinations - WWW - Dhyeyaias.comDocument28 pagesScience and Technology Study Material For UPSC IAS Civil Services and State PCS Examinations - WWW - Dhyeyaias.comdebjyoti sealNo ratings yet

- Engrase SKF PDFDocument52 pagesEngrase SKF PDFTecnico AnzizarNo ratings yet

- Week Three Lesson Plan Bread and Jam For FrancesDocument2 pagesWeek Three Lesson Plan Bread and Jam For Francesapi-29831576No ratings yet

- Verify File Integrity with MD5 ChecksumDocument4 pagesVerify File Integrity with MD5 ChecksumSandra GilbertNo ratings yet

- Transition Care For ChildrenDocument19 pagesTransition Care For ChildrenapiresourcesNo ratings yet

- Teaching Arts in ElementaryDocument21 pagesTeaching Arts in ElementaryJackaii Waniwan IINo ratings yet

- 01 035 07 1844Document2 pages01 035 07 1844noptunoNo ratings yet

- Parameter ranges and attenuation values for RRH configurationsDocument121 pagesParameter ranges and attenuation values for RRH configurationscharantejaNo ratings yet

- GTN Limited Risk Management PolicyDocument10 pagesGTN Limited Risk Management PolicyHeltonNo ratings yet

- How TikTok Reads Your Mind - The New York TimesDocument8 pagesHow TikTok Reads Your Mind - The New York Timesjoe smithNo ratings yet

- Bluenose Capital Management, LLCDocument2 pagesBluenose Capital Management, LLCIBTRADERSNo ratings yet

- Unit 3 Lesson 2 Video Asa Aas HL NotesDocument2 pagesUnit 3 Lesson 2 Video Asa Aas HL Notesapi-264764674No ratings yet

- Early Christian Reliquaries in The Republic of Macedonia - Snežana FilipovaDocument15 pagesEarly Christian Reliquaries in The Republic of Macedonia - Snežana FilipovaSonjce Marceva50% (2)

- An Adaptive Memoryless Tag Anti-Collision Protocol For RFID NetworksDocument3 pagesAn Adaptive Memoryless Tag Anti-Collision Protocol For RFID Networkskinano123No ratings yet

- Wi-Fi Planning and Design Questionnaire 2.0Document12 pagesWi-Fi Planning and Design Questionnaire 2.0Free Space67% (3)

- The New York Times OppenheimerDocument3 pagesThe New York Times Oppenheimer徐大头No ratings yet

- Journal Pre-Proof: Crop ProtectionDocument34 pagesJournal Pre-Proof: Crop ProtectionKenan YılmazNo ratings yet

- R 449 PDFDocument24 pagesR 449 PDFKhaleel KhanNo ratings yet

- Bulletin 13.9.22Document4 pagesBulletin 13.9.22dbq088sNo ratings yet

- The German Tradition of Psychology in Literature and Thought 1700-1840 PDFDocument316 pagesThe German Tradition of Psychology in Literature and Thought 1700-1840 PDFerhan savasNo ratings yet

- Nipas Act, Ipra, LGC - Atty. Mayo-AndaDocument131 pagesNipas Act, Ipra, LGC - Atty. Mayo-AndaKing Bangngay100% (1)

- Sales & Distribution Management Presentation NewDocument35 pagesSales & Distribution Management Presentation NewVivek Sinha0% (1)

- Health Promotion Throughout The Life Span 8Th Edition Edelman Test Bank Full Chapter PDFDocument30 pagesHealth Promotion Throughout The Life Span 8Th Edition Edelman Test Bank Full Chapter PDFDeborahAndersonmkpy100% (10)

- IIT Ropar Calculus Tutorial Sheet 1Document2 pagesIIT Ropar Calculus Tutorial Sheet 1jagpreetNo ratings yet

- REINFORCED CONCRETE DESIGNDocument22 pagesREINFORCED CONCRETE DESIGNEMIL JOHN P. ANTONIONo ratings yet