Professional Documents

Culture Documents

TVM

Uploaded by

balachmalikCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TVM

Uploaded by

balachmalikCopyright:

Available Formats

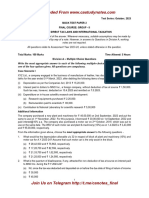

1. Your parents are planning to retire in 18 years.

They currently have 250,000, and they would like

to have 1,000,000 when they retire. What annual rate of interest would they have to earn on their

250,000 in order to reach their goal, assuming they save no more money?

2.

3.

4.

5.

6.

What is the future value of a 5-year ordinary annuity that promises to pay you 300 each year?

The rate of interest is 7 percent.

What is the future value of a 5-year annuity due that promises to pay out 300 each year? Assume

that all payments are reinvested at 7% a year, until year 5.

A company invests 4 million to clear a tract of land and to set out some young pine trees. The

trees will mature in 10 years, at which time the company plans to sell the forest at an expected

price of 8 million. What is company's expected rate of return?

Rachel wants a refrigerator that costs 12000. She has arranged to borrow the total purchase price

of refrigerator from a finance company at a simple interest rate equal to 12 percent. The loan

requires quarterly payments for a period of three years. If the first payment is due three months

after purchasing the refrigerator, what will be the amount of her quarterly payments on the loan?

You are branch manager of town center NatWest Bank, Manchester. A borrower approaches you

for a term loan of 500,000. You agreed to give loan to be fully amortized in a period of 5 year at

10 percent, annual payment. What will be the size of each installment? What fraction of the

payment made at the end of second year represents repayment of interest?

7. It is now January 1, 2007. You plan to make 5 deposits of 100 each, on every 6 months, with the

first payment being made today. If the bank pays a nominal interest rate of 12 percent, but uses

semiannual compounding, how much will be in your account after 10 years?

8. Ten years from today you must make a payment of 1,432.02. To prepare for this payment, you

will make 5 equal deposits, beginning today and for the next 4 quarters, in a bank that pays a

nominal interest rate of 12 percent, quarterly compounding. How large must each of the 5

payments be?

9. Jason has inherited 25,000 and wishes to purchase an annuity that will provide him with a steady

income over the next 12 years. He has heard that the local savings and loan association is currently

paying 6 percent compound interest on an annual basis. If he were to deposit his funds, what yearend equal pound amount (to the nearest pound) would he be able to withdraw annually such that

he would have a zero balance after his last withdrawal 12 years from now?

10. National Lottery has offered you the choice of the following alternative payments.

Alternative 1: 10,000 one year from now

Alternative 2: 20,000 five years from now.

a. Which should you choose if the discount rate is 0 percent? 20 percent?

b. What rate makes the options equally attractive?

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Principles of Management (MBA 1st Sem) MCQsDocument25 pagesPrinciples of Management (MBA 1st Sem) MCQsKhurram Nadeem82% (157)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Short Term Decision Making 56 Practice QuestionsDocument22 pagesShort Term Decision Making 56 Practice Questionsbalachmalik67% (6)

- Microsoft Access Database TemplatesDocument3 pagesMicrosoft Access Database TemplatesFaizan Motiwala0% (2)

- CUEVAS - Maritime Commerce ReviewerDocument8 pagesCUEVAS - Maritime Commerce ReviewerZyra C.100% (2)

- Problem Set Time Value of MoneyDocument5 pagesProblem Set Time Value of MoneyRohit SharmaNo ratings yet

- Time Value of MoneyDocument6 pagesTime Value of MoneyRezzan Joy Camara MejiaNo ratings yet

- Self EsteemDocument7 pagesSelf Esteembalachmalik100% (1)

- Bowne VentureCapital GuidebookDocument152 pagesBowne VentureCapital GuidebookVipul Desai100% (2)

- TVM ProblemsDocument2 pagesTVM Problemsumer_farooqpkNo ratings yet

- Worksheet On AnnuitiesDocument2 pagesWorksheet On AnnuitiesKurt SoNo ratings yet

- ÁdDocument2 pagesÁdtuan phanNo ratings yet

- Business Finance Problems Chapter 7 MixedDocument2 pagesBusiness Finance Problems Chapter 7 MixedjaypdemarcoNo ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- TVM Class QuestionsDocument1 pageTVM Class QuestionskartikNo ratings yet

- Time Value of Money Practice ProblemsDocument5 pagesTime Value of Money Practice ProblemsMarkAntonyA.RosalesNo ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- Chapter 2 Time Value of MoneyDocument2 pagesChapter 2 Time Value of MoneyPik Amornrat SNo ratings yet

- Handout 7.2 - Deferred Annuity QuizDocument5 pagesHandout 7.2 - Deferred Annuity QuizWIIGEENNo ratings yet

- Engineering Economics Problem Set 1 PDFDocument1 pageEngineering Economics Problem Set 1 PDFMelissa Joy de GuzmanNo ratings yet

- Handout2 PDFDocument2 pagesHandout2 PDFTheresiaVickaaNo ratings yet

- Time Value of Money ProblemsDocument2 pagesTime Value of Money ProblemssabyasachibosuNo ratings yet

- Practice Set - TVMDocument2 pagesPractice Set - TVMVignesh KivickyNo ratings yet

- Time Value of Money AssignmentDocument1 pageTime Value of Money AssignmentawaischeemaNo ratings yet

- Name: - 5.1 Problem Set 115Document14 pagesName: - 5.1 Problem Set 115Clair BlushNo ratings yet

- Week1 in Class ExerciseDocument12 pagesWeek1 in Class Exercisemuhammad AdeelNo ratings yet

- Sums Time ValueDocument2 pagesSums Time ValueMavani snehaNo ratings yet

- Extra Ex For Mid TermDocument5 pagesExtra Ex For Mid TermQuân VõNo ratings yet

- Tutorial TVM - S2 - 2021.22Document5 pagesTutorial TVM - S2 - 2021.22Ngoc HuynhNo ratings yet

- Tutorial 1 - TVM and GrowthDocument2 pagesTutorial 1 - TVM and GrowthowenNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- Tutorial 2Document3 pagesTutorial 2jhagantiniNo ratings yet

- TenNhom Lab8Document15 pagesTenNhom Lab8Mẫn ĐứcNo ratings yet

- TenNhom Lab8Document15 pagesTenNhom Lab8Mẫn ĐứcNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- Tutorial 1 Time Value of Money PDFDocument2 pagesTutorial 1 Time Value of Money PDFLâm TÚc NgânNo ratings yet

- Tutorial Time Value of MoneyDocument5 pagesTutorial Time Value of MoneyNgọc Ngô Minh TuyếtNo ratings yet

- TUTORIAL TVM Feb17Document5 pagesTUTORIAL TVM Feb17Thu Uyên Trần ThiNo ratings yet

- Debt and TaxDocument1 pageDebt and TaxChandramani JhaNo ratings yet

- Quiz 2Document1 pageQuiz 2Eric Anthony LorinoNo ratings yet

- Es FOR TIME VALUE OF MONEYDocument6 pagesEs FOR TIME VALUE OF MONEYphuongnhitran26No ratings yet

- Bài Tập ThêmDocument9 pagesBài Tập ThêmK59 Vu Nguyen Viet LinhNo ratings yet

- Exercise - Time Value of MoneyDocument1 pageExercise - Time Value of MoneytleminhchauNo ratings yet

- Compilation For Final Exam 1 Converted 1Document7 pagesCompilation For Final Exam 1 Converted 1Trending News and TechnologyNo ratings yet

- TVM WorksheetsDocument4 pagesTVM WorksheetsRia Pius100% (1)

- TVM WorksheetsDocument4 pagesTVM WorksheetsRia PiusNo ratings yet

- Exercises 1Document4 pagesExercises 1Dilina De SilvaNo ratings yet

- Time Value (Financial Management)Document9 pagesTime Value (Financial Management)Keyur BhojakNo ratings yet

- TVM Practice MathDocument2 pagesTVM Practice MathJunaidNo ratings yet

- Topic 2 Tutorial ProblemsDocument4 pagesTopic 2 Tutorial Problemsda.arts.ttNo ratings yet

- Chapter 03, Math SolutionDocument8 pagesChapter 03, Math SolutionSaith UmairNo ratings yet

- Time Value of Money 1Document5 pagesTime Value of Money 1k61.2211155018No ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- Plates Annuity, Gradient, PerpetuityDocument7 pagesPlates Annuity, Gradient, PerpetuityMarianne Nicole DespiNo ratings yet

- Question BankDocument3 pagesQuestion BankMuhammad HasnainNo ratings yet

- Time Value of Money Problems:: 8. You Invest $10,000. During The First Year The Investment Earned 20%Document3 pagesTime Value of Money Problems:: 8. You Invest $10,000. During The First Year The Investment Earned 20%UmerMajeedNo ratings yet

- Chapter 3 - Concept Questions and ExercisesDocument3 pagesChapter 3 - Concept Questions and ExercisesAnh TramNo ratings yet

- Workbook1 TimevalueofMoneyDocument2 pagesWorkbook1 TimevalueofMoneyDe BuNo ratings yet

- E120 Fall14 HW3Document2 pagesE120 Fall14 HW3kimball_536238392No ratings yet

- Practice Questions - Time Value of MoneyDocument1 pagePractice Questions - Time Value of MoneySedef ErgülNo ratings yet

- HW3 ProblemDocument1 pageHW3 Problemعبدالله ماجد المطارنه100% (1)

- Time Value of Money Practice ExerciseDocument1 pageTime Value of Money Practice ExercisemaundumiNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMMi ThưNo ratings yet

- Turn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138From EverandTurn a Reverse Mortgage Into an Income-Investing Portfolio: Financial Freedom, #138No ratings yet

- How to Channel the Velocity of Money: And Take Control of Your Financial Outlook: Financial Freedom, #153From EverandHow to Channel the Velocity of Money: And Take Control of Your Financial Outlook: Financial Freedom, #153No ratings yet

- Harvard Business ReviewDocument6 pagesHarvard Business ReviewbalachmalikNo ratings yet

- More Than 2000 Solved MCQsof STA630 Research Method Short Question AnswerDocument337 pagesMore Than 2000 Solved MCQsof STA630 Research Method Short Question AnswerbalachmalikNo ratings yet

- Discriminant Analysis (Student Notes)Document7 pagesDiscriminant Analysis (Student Notes)balachmalikNo ratings yet

- Racing Past The BarriersDocument12 pagesRacing Past The BarriersRaheel KhanNo ratings yet

- Week 2 FIN921 Lecture Slides - WollongongDocument84 pagesWeek 2 FIN921 Lecture Slides - Wollongongbalachmalik100% (1)

- Date: 20-Mar-2013 Position of Re-Issuable/Soiled/Defective/Unsorted Currency Notes, Coins and Cash in Bond With SBPDocument2 pagesDate: 20-Mar-2013 Position of Re-Issuable/Soiled/Defective/Unsorted Currency Notes, Coins and Cash in Bond With SBPbalachmalikNo ratings yet

- Principles of AuditingDocument2 pagesPrinciples of AuditingbalachmalikNo ratings yet

- Part I Ordinance 1961Document49 pagesPart I Ordinance 1961balachmalikNo ratings yet

- Project Selection Models: Nadeem KureshiDocument58 pagesProject Selection Models: Nadeem KureshibalachmalikNo ratings yet

- Lecture 6 - IRR (N)Document24 pagesLecture 6 - IRR (N)Maricar Salvador PenaNo ratings yet

- Principles of AuditingDocument2 pagesPrinciples of AuditingbalachmalikNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisbalachmalikNo ratings yet

- Marginal AbsorptionDocument4 pagesMarginal Absorptionbalachmalik100% (1)

- Elasticities Practice ProblemsDocument3 pagesElasticities Practice Problemsbalachmalik60% (5)

- Manufacturing AccountDocument15 pagesManufacturing Accountbalachmalik50% (2)

- Apple CorporationDocument1 pageApple CorporationbalachmalikNo ratings yet

- Review of Bond & StockDocument3 pagesReview of Bond & StockbalachmalikNo ratings yet

- Princilpes of Management - MGT503 Fall 2006 Quiz 03 SolutionDocument3 pagesPrincilpes of Management - MGT503 Fall 2006 Quiz 03 SolutionAhmadhHussainNo ratings yet

- Example of Investment and Financing DecisionsDocument1 pageExample of Investment and Financing DecisionsbalachmalikNo ratings yet

- Princilpes of Management - MGT503 Fall 2006 Quiz 01 SolutionDocument2 pagesPrincilpes of Management - MGT503 Fall 2006 Quiz 01 SolutionAhmadhHussainNo ratings yet

- 0 CFP Investment Cards (7!22!2007)Document467 pages0 CFP Investment Cards (7!22!2007)Arcely HernandoNo ratings yet

- Estacode ComDocument1,520 pagesEstacode ComKhurram Sheraz100% (1)

- Princilpes of Management - MGT503 Special 2006 Quiz 02 SolutionDocument2 pagesPrincilpes of Management - MGT503 Special 2006 Quiz 02 SolutionbalachmalikNo ratings yet

- Princilpes of Management - MGT503 Spring 2006 Quiz 01 SolutionDocument2 pagesPrincilpes of Management - MGT503 Spring 2006 Quiz 01 SolutionbalachmalikNo ratings yet

- Capital Budgeting TechniquesDocument3 pagesCapital Budgeting TechniquesbalachmalikNo ratings yet

- HDFC PresentationDocument9 pagesHDFC Presentationkaran pahujaNo ratings yet

- Adv CH - 1 PARTNERSHIPSDocument21 pagesAdv CH - 1 PARTNERSHIPSMohammed AwolNo ratings yet

- Ogl 347901676355685668 PDFDocument5 pagesOgl 347901676355685668 PDFBHUSHAN DahaleNo ratings yet

- Surujet Loan FormDocument3 pagesSurujet Loan FormejoghenetaNo ratings yet

- Business and Personal Finance Unit 2 Chapter 6 2007 Glencoe500Document81 pagesBusiness and Personal Finance Unit 2 Chapter 6 2007 Glencoe500Avi ThakurNo ratings yet

- Chapter 16 - The Financial SystemDocument8 pagesChapter 16 - The Financial SystemArsalNo ratings yet

- Text 7-Sem.1 - Banking - Nature of The IndustryDocument2 pagesText 7-Sem.1 - Banking - Nature of The IndustryberndmullerNo ratings yet

- Risk Management 4Document20 pagesRisk Management 4Amin ShafanezhadNo ratings yet

- Fa ProjectDocument16 pagesFa Projecttapas_kbNo ratings yet

- NEW CRG Manual (10/2018) by Bangladesh BankDocument27 pagesNEW CRG Manual (10/2018) by Bangladesh Bankআবদুল্লাহ আল সাকিব100% (1)

- Federico Calero vs. Emilia Carrion Y Santa Marina, Et Al. (1960) FactsDocument41 pagesFederico Calero vs. Emilia Carrion Y Santa Marina, Et Al. (1960) FactsCiara De LeonNo ratings yet

- Shop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountDocument7 pagesShop 75.00 Total: M/S Project Cost & Means of Finance Cost of Project AmountvikramtonseNo ratings yet

- Government of Malaysia V Government of The SDocument13 pagesGovernment of Malaysia V Government of The SSara Azhari100% (1)

- Exam FM FormulaDocument15 pagesExam FM FormulaMim AtchareeNo ratings yet

- Caspro Metal Industries Private - R - 05102020Document6 pagesCaspro Metal Industries Private - R - 05102020Vipul Braj BhartiaNo ratings yet

- Compiled Cases (Article 2 To 13)Document13 pagesCompiled Cases (Article 2 To 13)Terence ValdehuezaNo ratings yet

- Summary of Case Laws of Direct TaxDocument14 pagesSummary of Case Laws of Direct TaxAvaniJainNo ratings yet

- Syndicated LoansDocument18 pagesSyndicated LoansmnlshethNo ratings yet

- CA Final DT Q MTP 2 Nov23 Castudynotes ComDocument10 pagesCA Final DT Q MTP 2 Nov23 Castudynotes ComRajdeep GuptaNo ratings yet

- Banks and Development (2016)Document19 pagesBanks and Development (2016)José Benito RuizNo ratings yet

- Credit Card Lab Math 1050Document2 pagesCredit Card Lab Math 1050api-574894346No ratings yet

- Philippine Private Sector Response Strategies and State Business Relations Toward Economic Recovery and Growth Post Covid 19Document18 pagesPhilippine Private Sector Response Strategies and State Business Relations Toward Economic Recovery and Growth Post Covid 19Carmela AlfonsoNo ratings yet

- Anton Vs OlivaDocument2 pagesAnton Vs Olivaj531823100% (1)

- Re - Estate Settlement ProceduresDocument7 pagesRe - Estate Settlement ProceduresRonadale Zapata-AcostaNo ratings yet

- NirmaDocument89 pagesNirmaAkshay Rathod100% (1)

- US v. IgpuaraDocument2 pagesUS v. IgpuaralumengggNo ratings yet

- Condensed Combined Interim Financial Statements Cpsa and Related Cos September 30 2015Document42 pagesCondensed Combined Interim Financial Statements Cpsa and Related Cos September 30 2015api-307565920No ratings yet